Global Industrial Design Market Infographics Description:

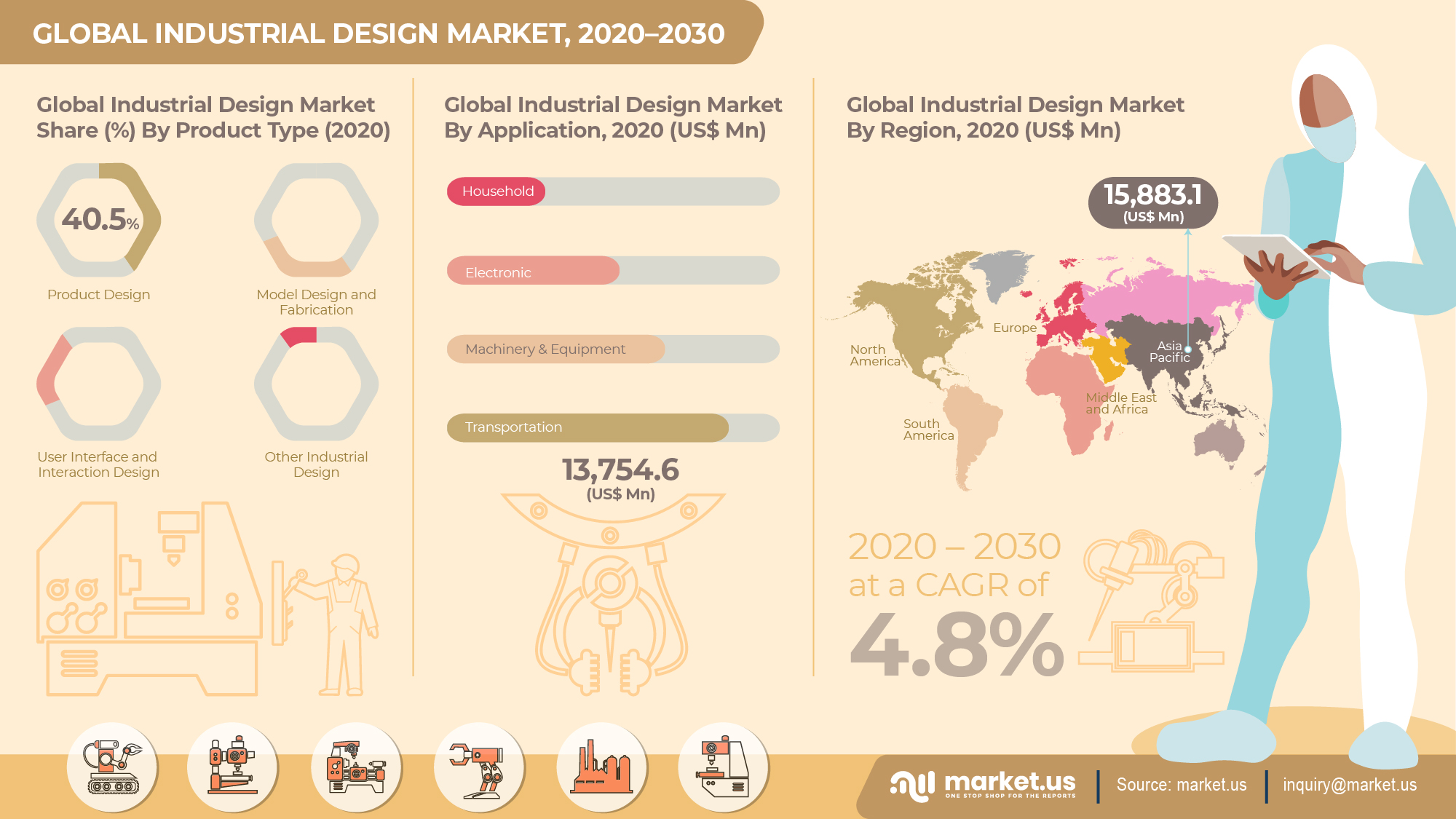

- The global industrial design market is estimated at US$ 37,444.7 Mn in 2020.

- The worldwide industrial design market is projected to reach US$ 59,520.8 Mn in 2030 at a CAGR of 4.8% from 2021 to 2030.

- Among all the product type segments, the product design segment in the global industrial design market is expected to register the highest CAGR of over 5.7%, followed by user interface and interaction design.

- Amongst application segments, the transportation segment in the global industrial design market is estimated to account for a majority revenue share of 36.7% in 2020 end, followed by machinery & equipment.

- APAC market is expected to dominate the global industrial design market, followed by the Europe region. It is expected to account for the largest market revenue share as compared to that of markets in other regions.

- Companies profiled in the report are McKinsey & Company Inc. (Lunar Design), BlueFocus Communication Group Co. Ltd. (Fuse Project), Frog Design Inc. (Aricent, Inc.), IDEO, GK design group, PDD Innovation, Ammunition Group, Artop Group, Busse Design, and Designworks.

Industrial Design Market Scoope

- The global industrial design market is projected to grow from USD 48.72 billion in 2023 to approximately USD 77.86 billion by 2033, reflecting a robust CAGR of 4.8% during the forecast period.

- In 2023, the Software segment accounted for a dominant 62% market share in the “By Component” category of the industrial design market.

- The Cloud segment led the “By Deployment” category in 2023, capturing a substantial 56% market share.

- The Automotive sector emerged as the largest application segment in 2023, holding a 31% share of the market.

- North America dominated the global industrial design market in 2023, representing a 36% market share with revenues of USD 17.53 billion.

Key Trends in 2023 Industrial Design Innovations

Enhanced Use of VR/AR in Automotive Manufacturing

- Companies like Ford, GM, and Toyota leveraged virtual reality (VR) and Augmented reality (AR) technologies extensively.

- Resulted in a 25% reduction in prototyping costs by enabling virtual testing and design iterations.

Growth in Cloud-Based Collaborative Design Platforms

- Adoption increased by 30% in 2023, supporting seamless real-time collaboration.

- Bridged physical gaps among designers, engineers, and stakeholders globally.

AI-Powered Design Optimization in Appliance Manufacturing

- Market leaders Samsung and LG implemented advanced AI tools to refine product design.

- Achieved a 20% decrease in design iteration cycles, enhancing efficiency and time-to-market.

Growth Drivers

Industrial design is witnessing robust growth, fueled primarily by the increasing demand for user-centered and innovative product solutions. Businesses across sectors, from consumer electronics to automotive, are prioritizing design as a key differentiator in competitive markets. The proliferation of advanced technologies, such as 3D printing and computer-aided design (CAD) software, has streamlined the design process, reducing time-to-market while enabling greater customization. Furthermore, sustainability trends are driving innovation, as industries seek eco-friendly materials and energy-efficient designs to meet consumer preferences and regulatory requirements.

Another significant growth driver is the rise of the experience economy, where consumers value functionality, aesthetics, and emotional connection in products. This has led to heightened collaboration between industrial designers and interdisciplinary teams, incorporating insights from behavioral psychology, engineering, and branding. Additionally, emerging markets are expanding the global footprint of industrial design, with rising urbanization and disposable incomes fostering demand for thoughtfully designed products. As a result, industrial design is increasingly recognized as a critical enabler of both business growth and customer satisfaction.

Key Developments

- In June 3, 2024 – Ingersoll Rand Inc. (NYSE: IR) finalized its acquisition of ILC Dover, CAPS, Del PD Pumps & Gear Pvt Ltd., and Fruitland Manufacturing. These deals totaled approximately $150 million, strengthening its portfolio in industrial and flow creation solutions.

- In January 16, 2024 – Synopsys (NASDAQ: SNPS) confirmed an agreement to acquire Ansys (NASDAQ: ANSS) for $197 per share in cash and 0.345 Synopsys shares, valuing the deal at $35 billion. The merger combines Synopsys’ EDA technology with Ansys’ simulation tools, creating a leader in end-to-end design solutions.

- In February 15, 2024 – Renesas Electronics Corporation (TSE: 6723) announced plans to acquire Altium Limited (ASX: ALU) for A$68.50 per share, totaling an equity value of A$9.1 billion. This acquisition aims to enhance collaboration in electronics system design and support Renesas’ digitalization strategy.