Company Overview

General Electric Statistics: The Company operates under the name GE Aerospace, a global leader in aviation with the industry’s largest and expanding commercial propulsion fleet. Its installed base includes roughly 45,000 commercial engines and 25,000 military engines, supporting a robust aftermarket services business that accounts for nearly 70% of total revenue, underscoring sustained customer demand across operations.

On January 3, 2023, GE completed the spinoff of its healthcare division as GE HealthCare Technologies Inc., followed by the April 2, 2024, separation of its energy-focused GE Vernova business into GE Vernova, Inc.

GE Aerospace now operates through 2 primary reportable segments: Defense & Propulsion Technologies and Commercial Engines & Services. The company serves customers in around 120 countries and manages manufacturing and service activities across 67 facilities in 22 U.S. states and Puerto Rico, 24 of which are company-owned, and an additional 67 facilities across 24 countries worldwide, including 34 owned sites.

History of Covestro AG

- 1879: Thomas Edison and his team created a filament that glowed for 1,200 hours after testing more than 6,000 materials, laying the foundation for modern incandescent lighting.

- 1925: GE introduced the first hermetically sealed refrigerator, improving reliability and safety in household cooling.

- 1935: The first major league night baseball game was played at Crosley Field in Cincinnati under GE Lighting Novalux lamps.

- 1944: GE commercialized silicone and developed an efficient manufacturing process that remained standard for decades.

- 1947: GE launched the first fully automatic clothes washer, marking a major advancement in home appliance innovation.

- 1952: The GE Education Fund became the GE Foundation, and in 1954 created the first 1:1 corporate gift-matching program.

- 1955: GE supplied Union Pacific with 8,500-horsepower gas-turbine electric locomotives, the most powerful locomotives ever built.

- 1962: GE researchers demonstrated the first laser diode and the first visible-light semiconductor laser, shaping future manufacturing technologies.

- 1974: Under CEO Reginald Jones, GE expanded minority engineering initiatives, helping lay the groundwork for NACME.

- 1978: GE HealthCare introduced the 7800 CT scanner, the first widely available routine total-body CT system.

- 1986: GE Lighting provided the technology and funding used to relight the Statue of Liberty.

- 2023: GE completed the spinoff of GE HealthCare as an independent publicly traded company.

- 2024: GE completed the separation of GE Vernova, with GE Aerospace becoming an independent publicly traded company on the NYSE.

(Source: Company Website)

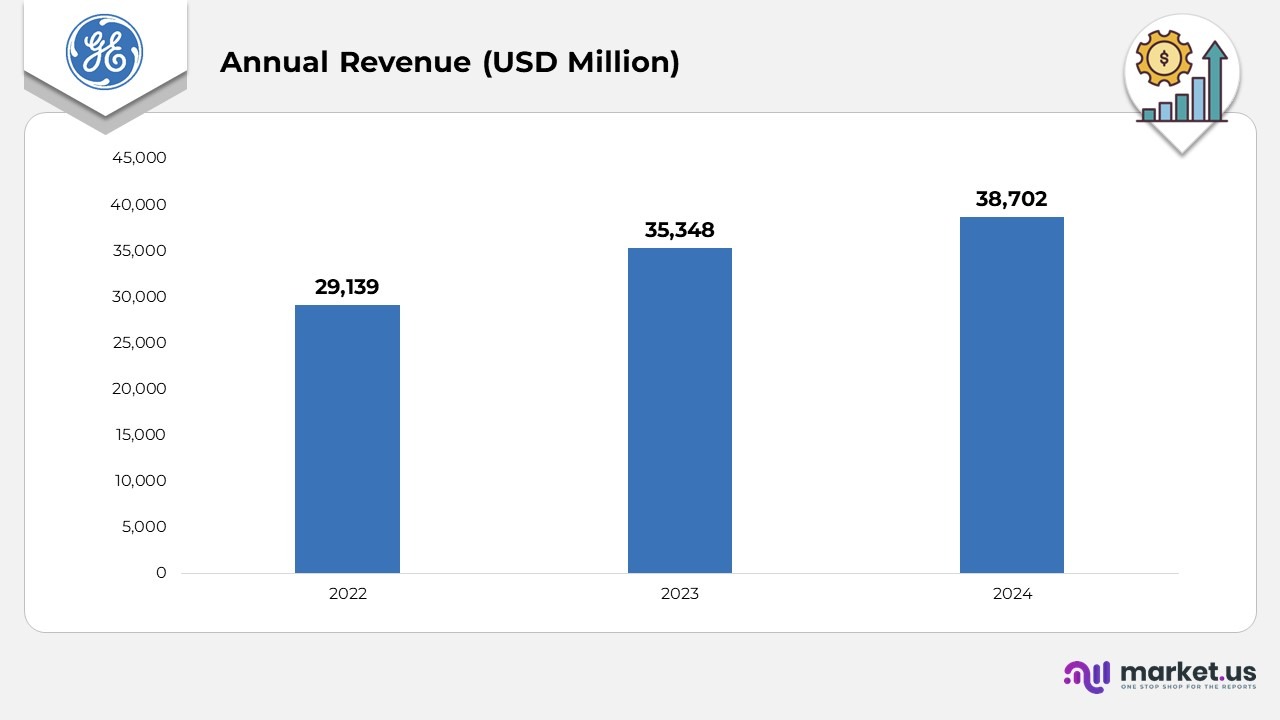

Financial Analysis

- In 2022, Revenue of USD 29,139 million reflects the baseline year before the benefits of stronger pricing strategies and a favourable customer mix began to influence performance materially.

- In 2023, Revenue rose to USD 35,348 million, a notable year-over-year increase driven by improved pricing, a more favorable product and customer mix, and stronger services revenue, supported by higher spare-parts demand and expanded internal shop visit workscope.

- In 2024, revenue further increased to USD 38,702 million, supported by continued pricing strength, growing aftermarket activity, and sustained demand for service packages tied to maturing engine fleets.

(Source: GE Electric Company)

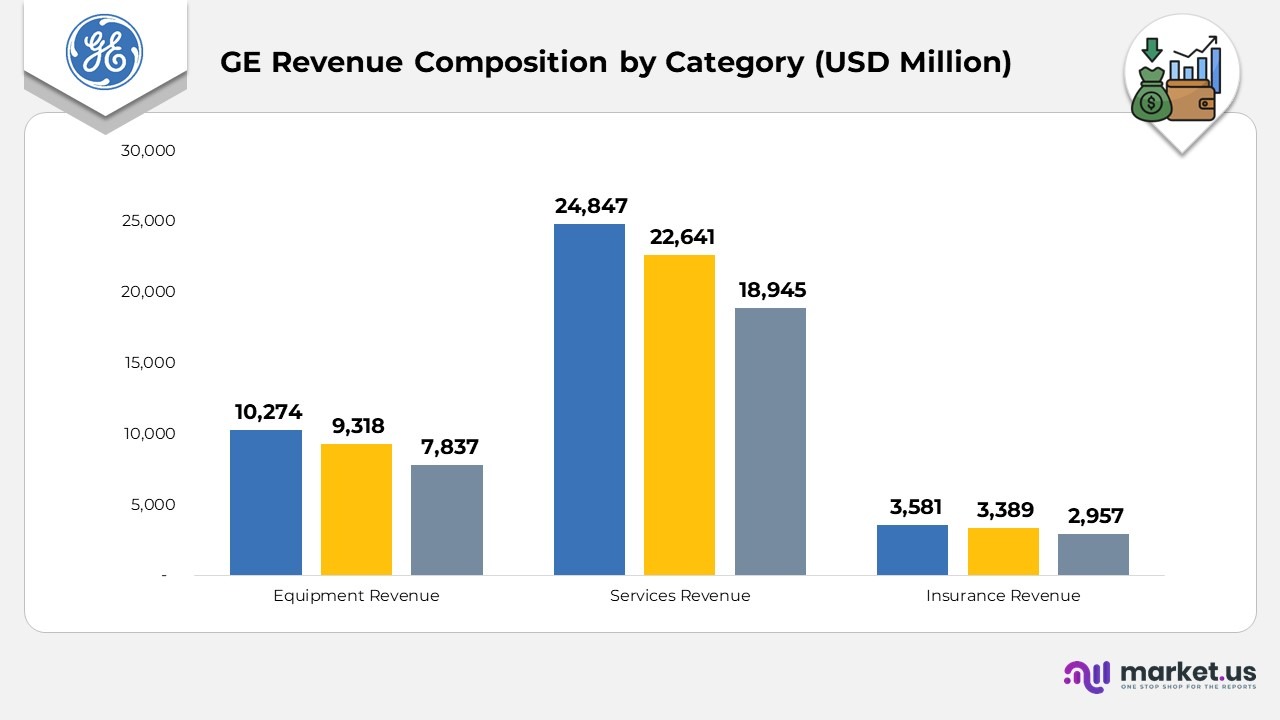

General Electric Revenue Composition by Category Statistics

- Equipment revenue increased from USD 7,837 million in 2022 to USD 9,318 million in 2023, and further to USD 10,274 million in 2024, reflecting steady demand for new engine and system deliveries.

- Services revenue rose from USD 18,945 million in 2022 to USD 22,641 million in 2023. It reached USD 24,847 million in 2024, driven by higher spare-parts volume, expanded internal shop-visit workscope, and an improving customer mix.

- Insurance revenue grew from USD 2,957 million in 2022 to USD 3,389 million in 2023, and then to USD 3,581 million in 2024, supported by stronger policy performance and stable portfolio returns.

(Source: GE Electric Company)

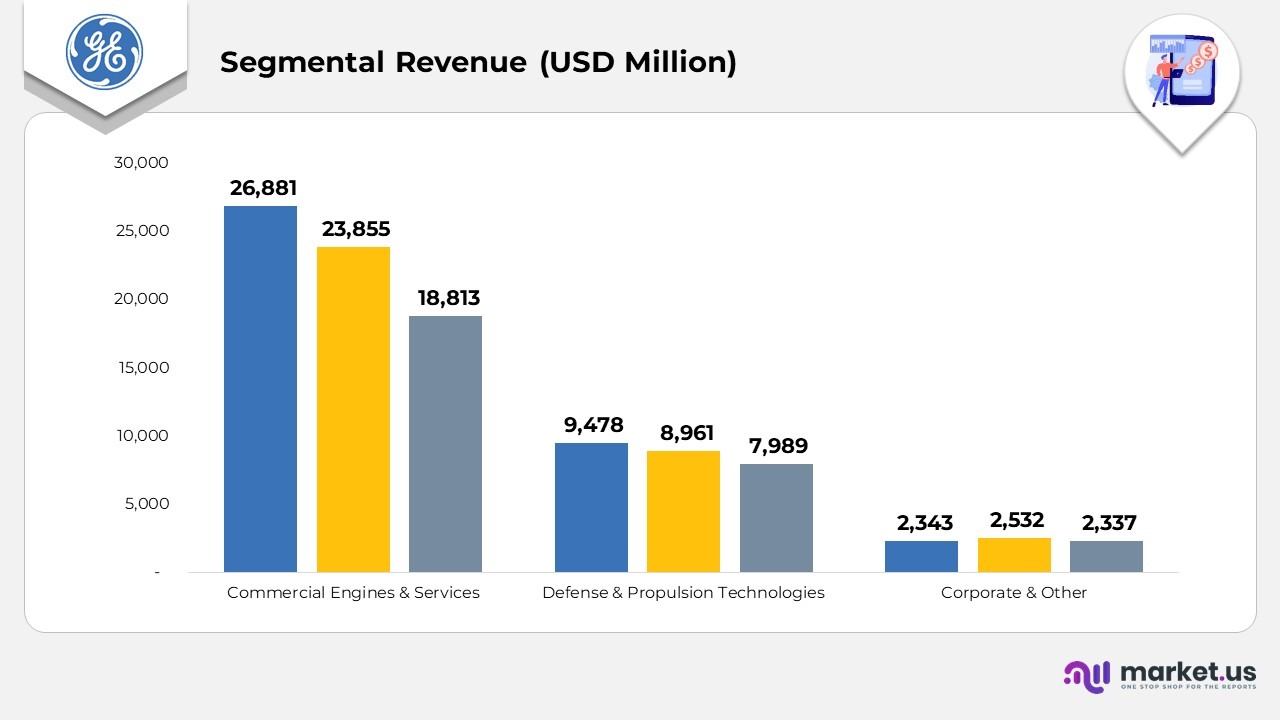

Segmental Analysis

- Commercial Engines & Services generated USD 18,813 million in 2022, rising to USD 23,855 million in 2023, and further to USD 26,881 million in 2024, reflecting strong aftermarket demand, higher shop-visit volumes, and continued growth in service agreements tied to an expanding global engine fleet.

- Defense & Propulsion Technologies reported USD 7,989 million in 2022, increasing to USD 8,961 million in 2023, and reaching USD 9,478 million in 2024, supported by steady defense procurement activity, modernization programs, and sustained demand for propulsion technologies across military platforms.

- Corporate & Other contributed USD 2,337 million in 2022, growing to USD 2,532 million in 2023, and then to USD 2,343 million in 2024, reflecting variations in corporate-level revenue streams and portfolio-related activities across the three years.

(Source: GE Electric Company)

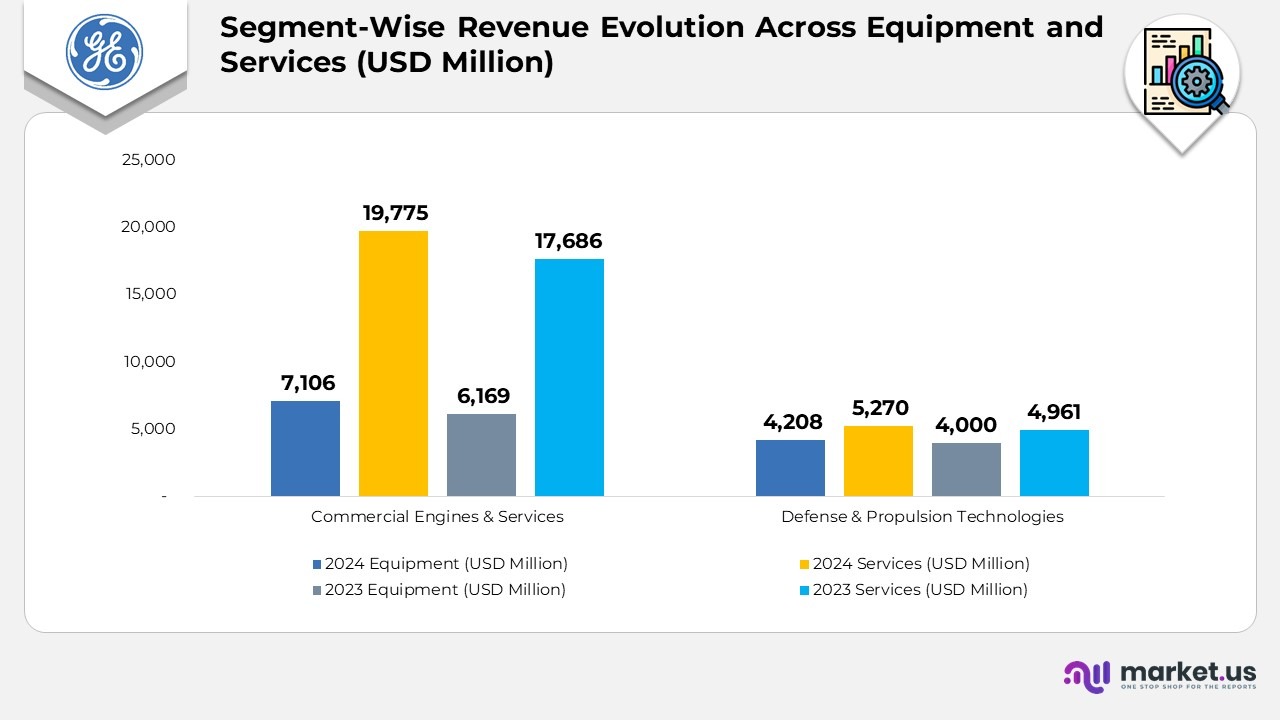

Segment-Wise Revenue Evolution Across Equipment and Services

- In 2024, Commercial Engines & Services generated USD 7,106 million in equipment revenue and USD 19,775 million in services revenue, for a total of USD 26,881 million, demonstrating strong aftermarket demand and continued growth in commercial engine deliveries.

- In 2023, Commercial Engines & Services recorded USD 6,169 million in equipment revenue and USD 17,686 million in services revenue, with total revenue reaching USD 23,855 million, supported by increased shop visits and a stronger spare-parts mix.

- For Defense & Propulsion Technologies in 2024, equipment revenue stood at USD 4,208 million, while services revenue reached USD 5,270 million, bringing total revenue to USD 9,478 million, reflecting consistent support activity across military propulsion programs.

- In 2023, Defense & Propulsion Technologies delivered USD 4,000 million in equipment revenue and USD 4,961 million in services revenue, resulting in USD 8,961 million in total revenue, driven by stable defense procurement cycles and maintenance requirements.

(Source: GE Electric Company)

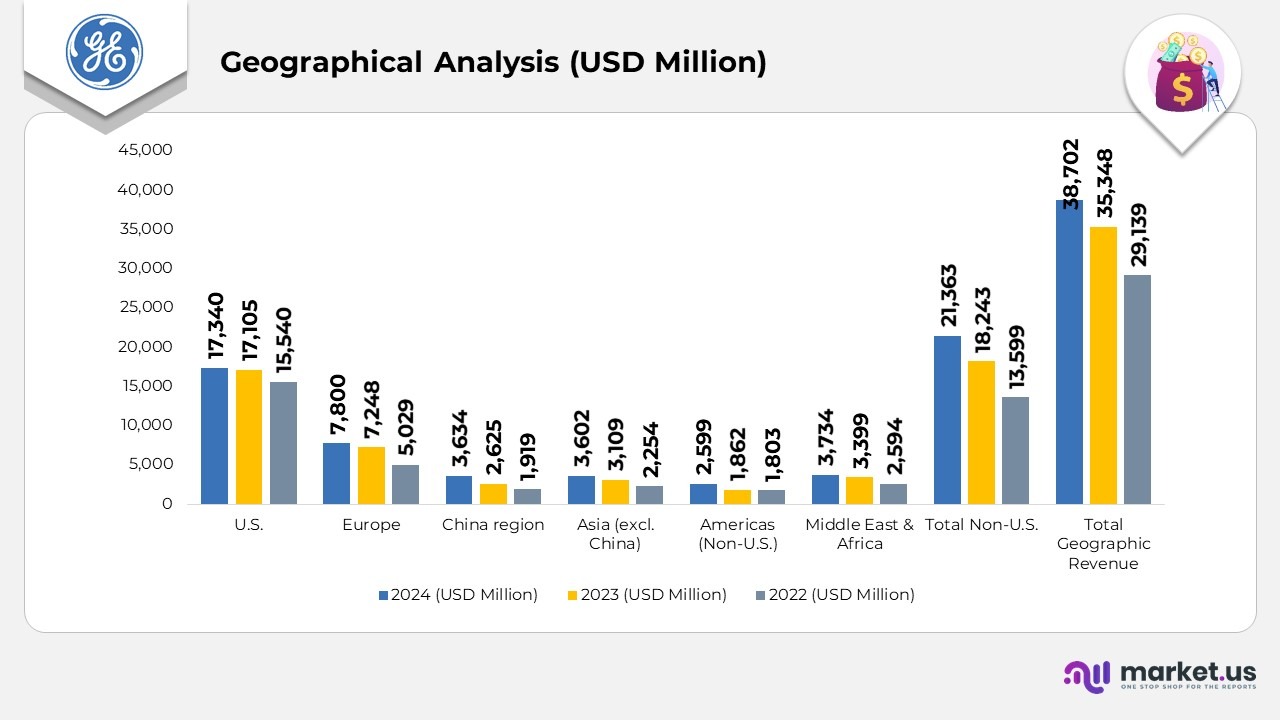

Geographical Analysis

- Revenue from the S. market increased from USD 15,540 million in 2022 to USD 17,105 million in 2023, and further to USD 17,340 million in 2024.

- In Europe, revenue rose from USD 5,029 million in 2022 to USD 7,248 million in 2023, reaching USD 7,800 million in 2024.

- The China region recorded USD 1,919 million in 2022, rising to USD 2,625 million in 2023 and further to USD 3,634 million in 2024.

- Revenue from Asia (excluding China) grew from USD 2,254 million in 2022 to USD 3,109 million in 2023, advancing to USD 3,602 million in 2024.

- In the Americas (excluding the U.S.), revenue rose from USD 1,803 million in 2022 to USD 1,862 million in 2023 and to USD 2,599 million in 2024.

- The Middle East and Africa generated USD 2,594 million in 2022, rising to USD 3,399 million in 2023, and reaching USD 3,734 million in 2024.

- Overall, Non-U.S. revenue expanded from USD 13,599 million in 2022 to USD 18,243 million in 2023, and climbed to USD 21,363 million in 2024.

- Total geographic revenue increased from USD 29,139 million in 2022 to USD 35,348 million in 2023, and further to USD 38,702 million in 2024.

(Source: GE Electric Company)

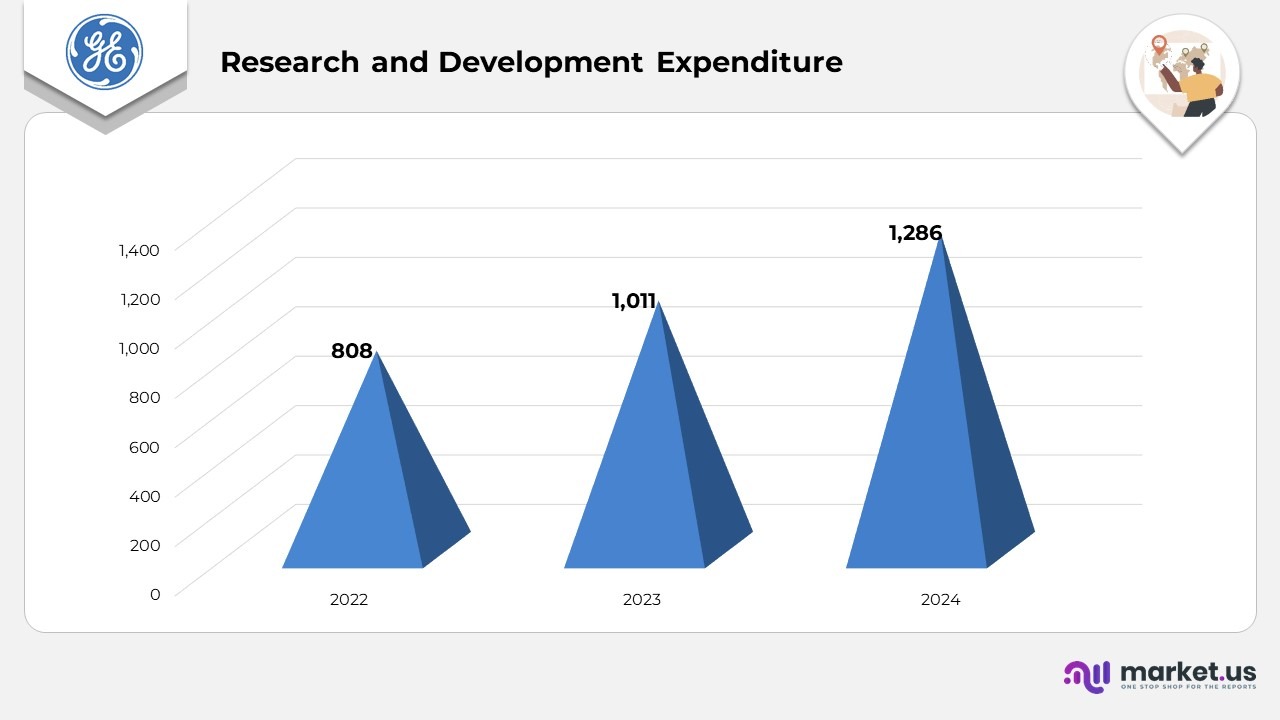

General Electric Research and Development Expenditure Statistics

- Research and development expenditure amounted to USD 808 million in 2022, marking the baseline year before planned innovation-driven investments began to scale upward.

- Spending increased to USD 1,011 million in 2023, reflecting stronger commitments toward advanced aerospace technologies, engine efficiency programs, and next-generation platform development.

- By 2024, R&D expenditure rose further to USD 1,286 million, highlighting expanded project pipelines, deeper investments in materials science, digital engineering, and propulsion advancements.

(Source: GE Electric Company)

Company Share Repurchase Activity

- In October 2024, the company repurchased 1,836 shares at an average price of 89 per share, all under the share repurchase authorization.

- In November 2024, a total of 5,411 shares were bought back at an average price of 84 per share, reflecting the highest purchase volume in the period.

- In December 2024, the company purchased 1,924 shares at an average price of 48 per share, marking a decline in monthly repurchase activity.

- Overall, during 2024, the company repurchased 9,172 shares at a consolidated average price of 02 per share, fully utilized under the authorized buyback program.

(Source: GE Electric Company)

GE Electric Company Patents

| Patent Title | Patent / Pub. No. | Type | Filed Date |

|---|---|---|---|

| Multi-Layer Stage Modulation Acoustic Lens | 20250118284 | Application | October 4, 2023 |

| Combustor gathering for a turbine engine | 12270544 | Grant | February 5, 2024 |

| DV/DT controlled ramp-on for SSPCs | 12272945 | Grant | August 29, 2022 |

| Airfoils for gas turbine engines | 12270317 | Grant | March 15, 2023 |

| Dispatch advisor for power plant operation | 12271846 | Grant | November 14, 2023 |

| Automatically tunable mass damper | 12270449 | Grant | March 3, 2022 |

| Combustion system for a boiler | 12270541 | Grant | April 13, 2021 |

| Seal assembly for a turbomachine | 12270303 | Grant | May 12, 2023 |

| Suspension device & X-ray imaging | 12268540 | Grant | June 20, 2022 |

| System & method for cleaning turbine components | 12269074 | Grant | December 19, 2022 |

| Imaging system & method | 12270882 | Grant | May 24, 2022 |

| Gas turbine engine oil flow control | 12270337 | Grant | November 3, 2023 |

| Integrated condition monitoring | 12271171 | Grant | February 7, 2022 |

| Severe weather outage management | 12272951 | Grant | April 19, 2022 |

| Bipole power transmission schemes | 12272955 | Grant | May 21, 2021 |

| Turbine engine with floating seal assembly | 12270304 | Grant | July 26, 2021 |

| Boride-reinforced alloy composition | 12270091 | Grant | April 22, 2022 |

| Energy management system for aircraft fleet | 12269368 | Grant | December 9, 2022 |

| Engine component with/ abradable material | 12270306 | Grant | December 15, 2021 |

| Thermal management system | 12270342 | Grant | October 10, 2023 |

| Thermal management system | 12270342 | Grant | October 10, 2023 |

| Dome-deflector assembly | 12270546 | Grant | May 26, 2023 |

| Background-aware image reconstruction | 12272034 | Grant | March 24, 2021 |

| MRI vascular imaging | 12272028 | Grant | June 20, 2022 |

| Additive manufacturing control | 12269090 | Grant | August 10, 2021 |

| Variable flowpath casings | 12270308 | Grant | October 24, 2023 |

| Seal assembly for rotary machine | 12270305 | Grant | March 30, 2020 |

| Gas turbine + fuel cell assembly | 12270340 | Grant | January 4, 2024 |

| Deep learning multi-planar imaging | 12272023 | Grant | March 15, 2022 |

| MRI noise reduction system | 12270879 | Grant | December 1, 2022 |

| Voltage balance systems | 12267012 | Grant | June 17, 2019 |

| Synchrophasing propulsion system | 12264631 | Grant | June 15, 2023 |

| Damping device for shaft vibration | 12264690 | Grant | March 27, 2024 |

| Optical monitoring for additive manufacturing | 12263636 | Grant | November 2, 2020 |

| Component repair system | 12264591 | Grant | June 2, 2023 |

| Auto-generation of test scripts | 12265465 | Grant | April 29, 2022 |

| Plane selection using localizer images | 12263017 | Grant | August 1, 2018 |

| Monolithic composite blade | 12264597 | Grant | November 29, 2022 |

| Unducted propulsion system | 12264619 | Grant | February 6, 2023 |

| Liquid fuel phase detection system | 12264588 | Grant | March 7, 2022 |

| CT scatter & crosstalk correction | 12266036 | Grant | March 2, 2022 |

| Ultrasonic fuel flow measurement | 12264952 | Grant | April 29, 2022 |

| CT + LiDAR imaging system | 12263024 | Grant | August 16, 2022 |

| Heat exchanger for a gas turbine | 12264627 | Grant | March 2, 2022 |

| Fan assembly for the engine | 12264590 | Grant | August 8, 2023 |

| Tower structure manufacturing | 12264490 | Grant | November 16, 2022 |

| Ceramic fiber coating system | 12264110 | Grant | July 21, 2021 |

| Ultrasonic fuel flow (excitation signals) | 12264951 | Grant | April 29, 2022 |

| Testing protection circuits (Rogowski coil) | 20250102576 | Application | September 25, 2024 |

| Passive auxiliary lubrication system | 12258904 | Grant | April 29, 2022 |

| Lubrication system for a wind turbine | 12258943 | Grant | January 12, 2023 |

| CT + LiDAR imaging system | 12263024 | Grant | August 16, 2022 |

| Heat exchanger for a gas turbine | 12264627 | Grant | March 2, 2022 |

| Fan assembly for the engine | 12264590 | Grant | August 8, 2023 |

| Tower structure manufacturing | 12264490 | Grant | November 16, 2022 |

| Ceramic fiber coating system | 12264110 | Grant | July 21, 2021 |

| Ultrasonic fuel flow (excitation signals) | 12264951 | Grant | April 29, 2022 |

| Testing protection circuits (Rogowski coil) | 20250102576 | Application | September 25, 2024 |

| Passive auxiliary lubrication system | 12258904 | Grant | April 29, 2022 |

| Lubrication system for a wind turbine | 12258943 | Grant | January 12, 2023 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company acquired Intelerad, strengthening GE HealthCare’s strategy to scale cloud-enabled, AI-driven solutions and supporting its goal to triple its cloud-based offerings by 2028.

- In November 2025, the company announced a USD 14 million investment to expand capacity at its Pune facility, building on the USD 30 million committed last year, with upgrades focused on advanced engine component production and automation.

- In November 2025, the company signed an agreement with Gulf Helicopters Company for MRO support on six CT7-2E1 engines powering three AW189 helicopters, including access to a spare-engine pool to minimize downtime.

- In November 2025, the company partnered with Shield AI, selecting the F110-GE-129 engine featuring the AVEN nozzle to power the X-BAT, with GE Aerospace providing propulsion integration and testing support.

- In October 2025, the company signed an agreement to explore MRO and depot-level maintenance capabilities for the F110-GE-129 engine used in the Boeing F-15EX fighter jet.

- In October 2025, the company signed an agreement with Hanwha Aerospace to support Korea Aerospace Industries’ programs with 88 T700 and 40 F404 engine kits, with GE manufacturing the hardware and Hanwha assembling and testing the engines.

- In October 2025, the company agreed with IT Science Co., Ltd. to explore local manufacturing of HUMS systems in South Korea, including repair support for KUH Surion multi-role helicopters operated by the ROK Army and the ROK Marine Corps.

- In October 2025, the company expanded its partnership with Hanwha Aerospace to jointly develop marine gas turbine packages, advancing U.S.–Korea collaboration in naval propulsion.

(Source: General Electric Company Press Release)