Company Overview

Broadcom Statistics: Broadcom Inc. is a global semiconductor and infrastructure software company that designs, develops, and supplies advanced semiconductor devices and software solutions. The company operates through two main business divisions: Semiconductor Solutions and Infrastructure Software.

Broadcom maintains engineering, design, and software development teams across several countries, including the United States, India, Malaysia, Singapore, Bulgaria, the Czech Republic, the United Kingdom, and Israel. This global presence allows the company to draw on deep technical expertise across multiple regions while focusing its R&D efforts on high-value market opportunities, supported by a strong portfolio of international patents.

Broadcom has a significant worldwide presence, with key locations situated in the United States, India, Malaysia, Singapore, Bulgaria, the Czech Republic, the United Kingdom, and Israel, reinforcing its position as a multinational leader in semiconductor innovation and infrastructure software.

History of Broadcom Inc

1960s

- Introduced the first commercially available LED dot-matrix displays, opening new possibilities for electronic indicators.

- Developed breakthrough gallium-arsenide-phosphide (GaAsP) LEDs, later used in handheld devices, traffic signals, and signage.

1970s

- Launched the first fibre-optic transmitters and receivers, enabling the early generations of high-speed data communication.

1990s

- Formed the Semiconductor Products Group (SPG) to strengthen semiconductor capabilities across new technology standards.

- Released the first optical mouse sensor, eliminating mouse pads and improving precision.

- Delivered the brightest LED of the decade—offering high output, durability, and low power consumption.

- Introduced the first low-cost, high-speed infrared transceiver, enabling wireless data exchange in early phones, cameras, ATMs, and POS systems.

- Created the world’s first single-chip DOCSIS cable modem, driving broadband adoption.

2000

- Shipped more than 4 million fiber-optic transceivers using MT-RJ connectors.

2001

- Shipped the 30 millionth optical mouse sensor, 100 millionth system-on-chip, and 5 millionth small-form-factor fiber-optic transceiver.

2002

- Acquired RedSwitch Inc., adding expertise in InfiniBand® and RapidIO®.

- Shipped the 100 millionth optical mouse sensor.

- Introduced the first 10-Gbps CMOS transceiver.

2003

- Shipped the 200 millionth optical mouse sensor and 20 millionth FBAR duplexer.

- Began mass production of more than 500,000 E-pHEMT power-amplifier modules per month.

2004

- Shipped the 10 millionth lead-free optocoupler.

- Achieved the 100th mobile phone design win for FBAR filters.

- Shipped the 4 millionth Tachyon Fibre Channel controller and 300 millionth optical mouse sensor.

- Crossed 400 million imaging ASICs, 25 million camera modules, 10 million SerDes channels, and 10 million E-pHEMT power amplifiers.

2005

- Established Avago Technologies, becoming the largest privately held semiconductor firm.

- KKR and Silver Lake acquired Agilent’s semiconductor group for $2.66 billion.

- Shipped the 400 millionth optical mouse sensor.

2006

- Shipped the 600 millionth optical mouse sensor, 25 millionth ASIC SerDes channel, and 1 millionth RoHS-compliant fiber-optic transceiver.

- Delivered the first high-speed digital optocouplers for hybrid and electric vehicles.

- Demonstrated 5-Gbps ASIC SerDes in 65-nm CMOS.

2007

- First to support Intel QuickPath Interconnect with advanced SerDes.

- Delivered FBAR-based quintplexers for simultaneous GPS and voice.

- Shipped over 500 million FBAR modules.

- Acquired Infineon’s fiber-optic business.

- Demonstrated 100-Gbps parallel-optical Ethernet links.

- Launched the first Wi-Fi + Bluetooth + FM combo chip.

2008

- Acquired Infineon’s BAW business and Nemicon Encoders.

- Demonstrated 20-Gbps SerDes in 40-nm

- Introduced the world’s smallest RF amplifier using WaferCap.

- Released next-generation 10-Gbps Ethernet SFP

2009

- Unveiled the first DC-to-80-GHz travelling-wave amplifier.

- Introduced high-performance touchscreen technology.

- Demonstrated optical engines for next-gen connectivity.

- Completed IPO on NASDAQ on August 6, 2009, under ticker AVGO.

- Shipped more than 1 billion optical mouse units.

2010

- Achieved $2.1 billion in revenue.

- Cleared outstanding debt obligations.

- Demonstrated 28-Gbps embedded SerDes in 40-nm

- Released the first four-channel QSFP+ optics for 40-GbE.

- Introduced CXP optical transceivers and the first 4G/LTE Band 7 duplexer.

- Delivered an embedded fiber-optic solution for the world’s most powerful supercomputers.

- Developed the world’s first terabit Ethernet switch.

2011

- Recorded $2.3 billion in revenue.

- Announced the first WiMAX coexistence FEM.

- Released optical transceivers with 14-Gbps lane speeds.

- Demonstrated 30-Gbps embedded SerDes.

- Shipped over 150 million SerDes channels.

- Introduced miniature optical navigation sensors and next-gen Hall-effect encoders.

2012

- Introduced 100-Gbps Vortex Gearbox PHYs.

- Released precision optical isolation amplifiers.

- Announced 25-Gbps long-reach SerDes and full-band digital TV tuners.

2013

- Acquired CyOptics and Javelin Semiconductor.

- Delivered 32-Gbps SerDes in 28-nm CMOS.

- Introduced the world’s first 100-Gbps CFP2 SR10 optical transceiver.

- Shipped over 350 million SerDes channels.

2014

- Shipped over 500,000 QSFP+ MMF modules.

- Acquired PLX Technology and LSI Corp.

- Introduced industry-leading 12-Gbps SAS and 100-Gbps optical

- Delivered next-generation automotive-grade MOSFET drivers.

2015

- Released third-generation PCIe switches.

- Demonstrated 56-G PAM4 SerDes.

- Introduced the first SDARS LNA-filter module.

- Shipped 1 million VCSEL channels.

- Acquired Emulex.

2016

- Delivered the first commercial XGS-PON / NGPON-2 OLT

- Released Tomahawk II 6.4-Tbps switch with 64×100GE

- Demonstrated LTE CA hexaplexer.

- Introduced full optical PAM-4 platforms for 40–400GbE.

- Acquired Broadcom Corp., forming Broadcom Limited.

2017

- Acquired Brocade.

- Expanded server/storage leadership with SFF-TA-1001 platforms.

- Delivered the first dual-frequency centimeter-accuracy GNSS receiver.

- Introduced a complete 11ax ecosystem.

- Shipped first 16-nm Nx56G PAM-4 PHYs.

2018

- Released Gen 6 replication switches and 7th-gen Fibre Channel HBAs.

- Acquired CA Technologies.

- Sampled 7-nm 400G PAM-4 PHYs.

- Shipped xDSL SoCs with Wi-Fi 6.

- Sampled Thor, the first 200-G Ethernet controller.

- Redomiciled to the United States.

- Introduced the first 5G radio switch.

2019

- Introduced ai, an AI-driven enterprise platform.

- Released Tomahawk 4 (25.6 Tbps).

- Acquired Symantec Enterprise Security.

- Delivered leading fast, Wi-Fi 6, MACsec, and testing innovations.

- Shipped world’s first 7-nm Trident 4 (12.8 Tb/s)

2020

- Launched full 800G hyperscale solutions.

- Released Trident SmartToR.

- Expanded Tomahawk 4

- Delivered the first 5-nm ASIC for cloud operators.

- Released automotive IEEE 802.3ch PHYs and Gen 7 Fibre Channel

- Deployed AI-driven network monitoring.

- Delivered complete Wi-Fi 6E product lines.

2021

- Introduced 100G/lane PAM-4 DSP PHYs.

- Launched Broadcom Software Group.

- Released low-power L1/L5 GNSS

- Introduced adaptive endpoint security.

- Launched the first 64G Fibre Channel

- Powered the world’s first Wi-Fi 6E smartphone.

2022

- Shipped Trident 4C.

- Partnered with Tencent on CPO switching.

- Released Tomahawk 5, enabling massive AI/ML scaling.

- Delivered the first 50G Automotive Ethernet

- Launched the world’s first Wi-Fi 7 ecosystem.

- Introduced the highest-density 64G Fibre Channel

2023

- Announced the first 5-nm 100G/lane optical DSP.

- Shipped the first 2-Tbps switch in production.

- Introduced the highest-performance AI networking fabric.

- Released the world’s first Wi-Fi 7 optimized RF FEM (FiFEM).

- Delivered 200G/lane PAM-4 DSP.

- Completed acquisition of VMware.

- Introduced the first switch with an on-chip neural network

2024

- Delivered industry’s first PCIe Gen5/Gen6 retimers for AI scaling.

- Released 2-Tbps CPO Ethernet platform.

- Introduced the leading 200G/lane DSP for AI infrastructure.

- Announced the first 50G PON merchant silicon enhanced with AI/ML.

- Delivered industry-first 5D F2F packaging for AI XPUs.

2025

- Unveiled industry’s lowest-latency, highest-efficiency SAN switch.

- Delivered quantum-safe encryption for ransomware defense.

- Expanded PCIe leadership with Gen 6 AI-ready platforms.

- Announced the first incident-prediction security capability.

- Revealed 3rd-generation CPO with 200G/lane

- Shipped Tomahawk 6, the world’s first 4-Tbps switch.

- Delivered VMware Cloud Foundation 9.0.

(Source: Company Website)

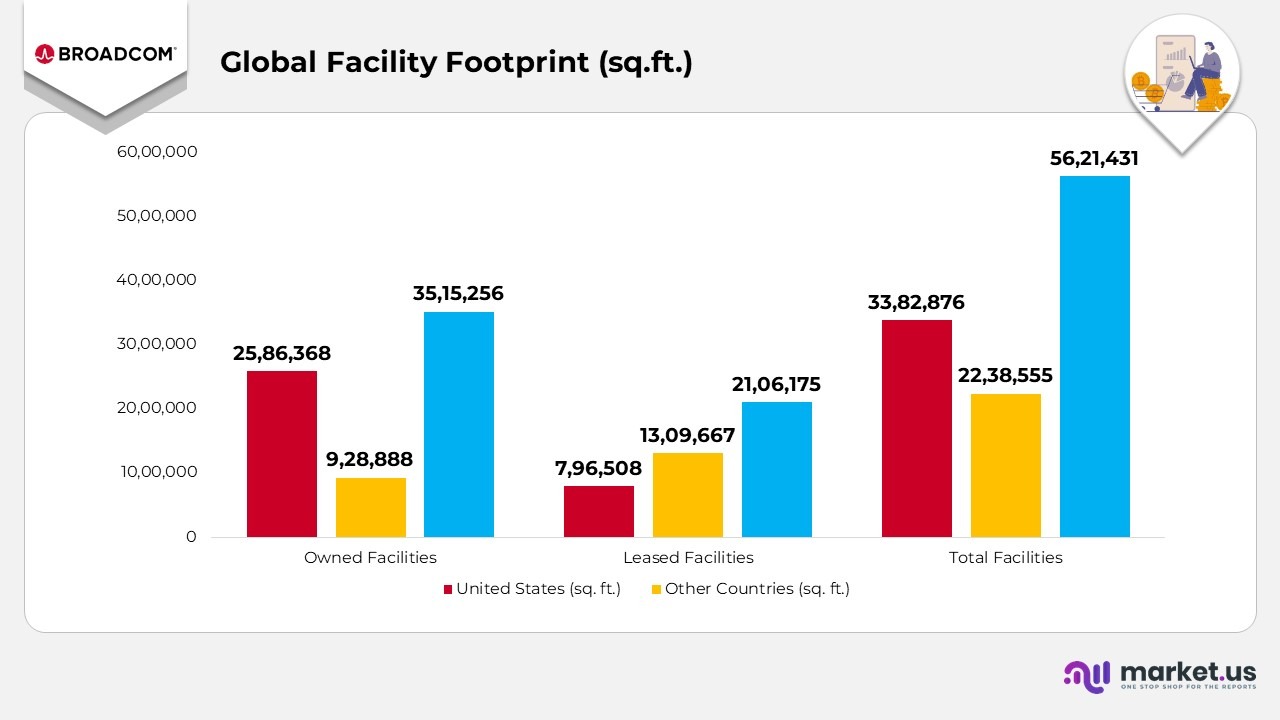

Global Facility Footprint

- As of October 29, 2023, the company operated a significant estate of facilities exceeding 100,000 square feet, covering both owned and leased properties across major regions.

- In the United States, owned facilities totalled 2,586,368 sq. ft., supported by 796,508 sq. ft. of leased space, bringing the US footprint to 3,382,876 sq. ft.

- In other countries, the company owned 928,888 sq. ft. of facilities and leased an additional 1,309,667 sq. ft., for a total of 2,238,555 sq. ft. of international space.

- Across all regions, the organisation managed 3,515,256 sq. ft. of owned facilities and 2,106,175 sq. ft. of leased space, for a total global footprint of 5,621,431 sq. ft.

- International-owned property totals include two Malaysia-based assets (with 318,000 sq. ft. and 153,000 sq. ft.) under long-term land leases expiring in 2051 and 2077, with renewal options available.

- Leased buildings across regions have varying expiry dates extending through February 2046 and generally include renewal provisions.

(Source: Broadcom Inc. SEC Filings)

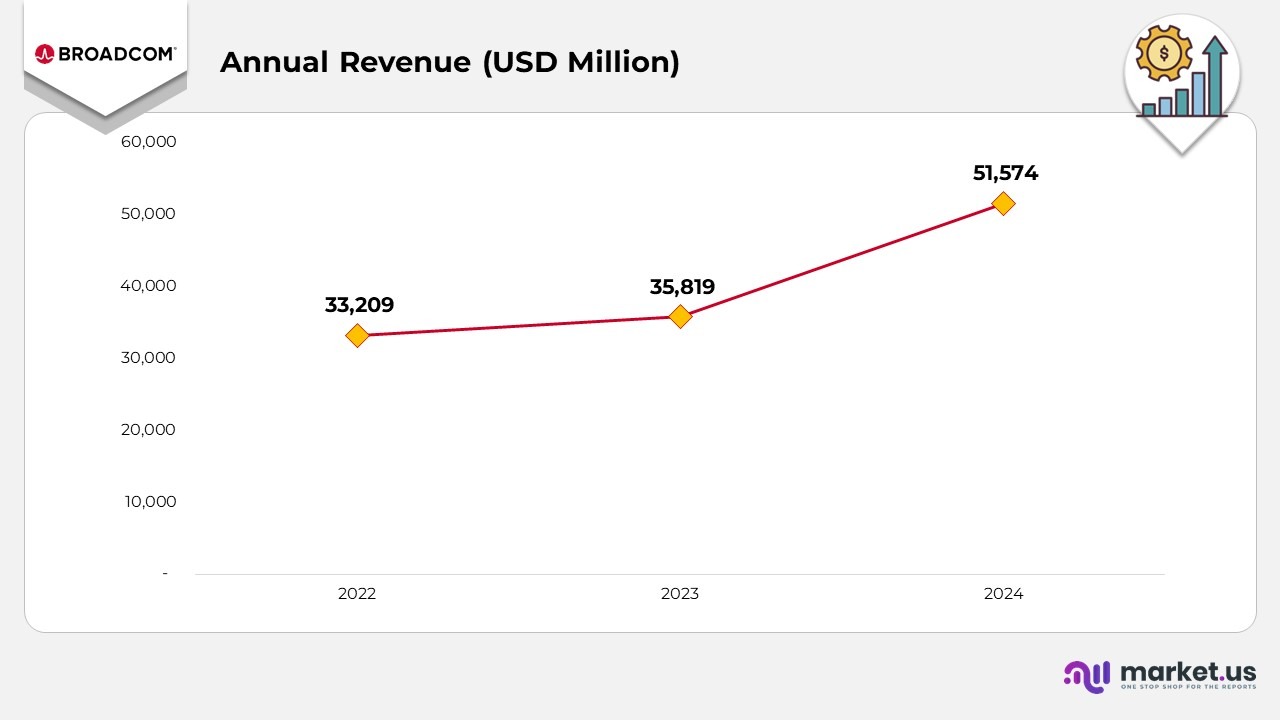

Financial Analysis

- In 2022, the company reported annual revenue of USD 33,209 million, establishing a solid baseline for the growth that followed.

- Revenue increased to USD 35,819 million in 2023, reflecting a YoY growth of USD 2,610 million, driven by expanded market demand and stronger product performance.

- In 2024, annual revenue surged to USD 51,574 million, up USD 15,755 million YoY, supported by major business scale-up, a strengthened product mix, and strategic portfolio expansion.

(Source: Broadcam Inc. Annual Report)

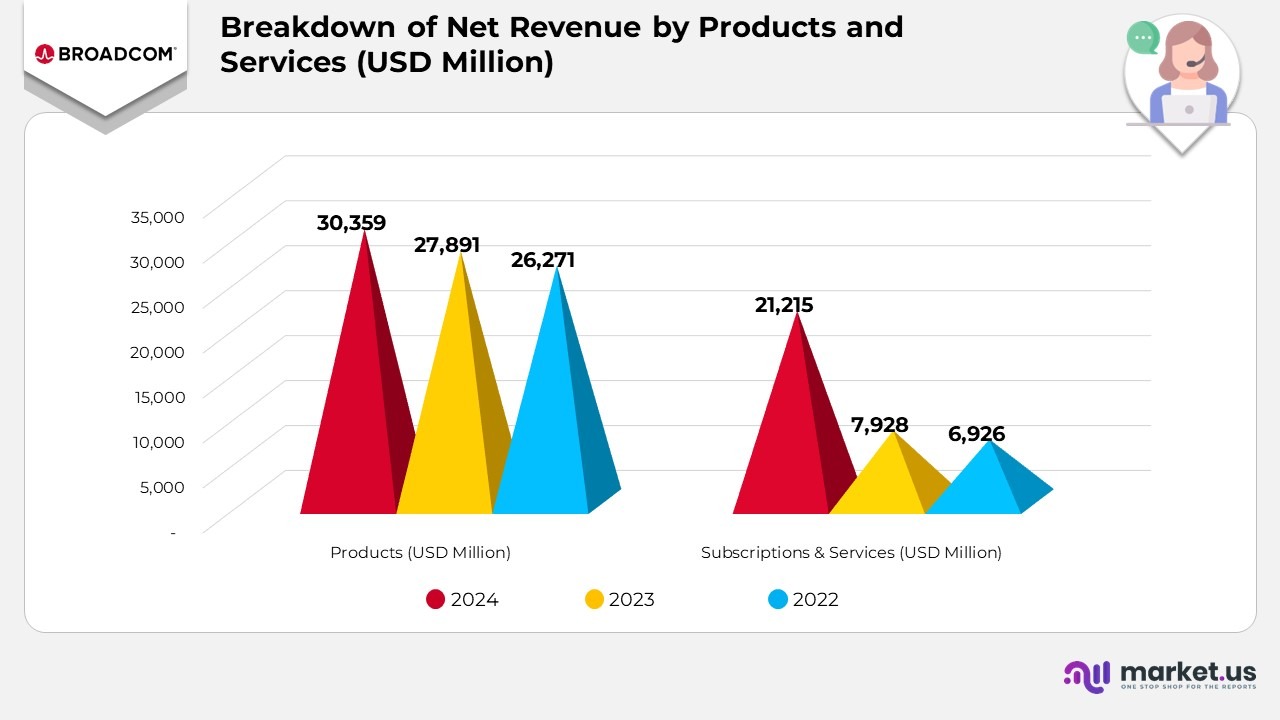

Breakdown of Net Revenue by Products and Services

- In 2024, revenue from products totalled $30,359 million, reflecting strong hardware demand.

- Subscriptions and services generated $21,215 million in 2024, highlighting rapid growth in software and recurring revenue streams.

- In 2023, products contributed $27,891 million, continuing the upward performance trend.

- Subscriptions and services reached $7,928 million in 2023, supported by expanding enterprise software adoption.

- In 2022, products delivered $26,271 million in revenue, forming a strong revenue base.

- Subscriptions and services accounted for $6,926 million in 2022, marking the early phase of Broadcom’s software-led growth.

(Source: Broadcam Inc. Annual Report)

Revenue Breakdown by Region and Revenue Type

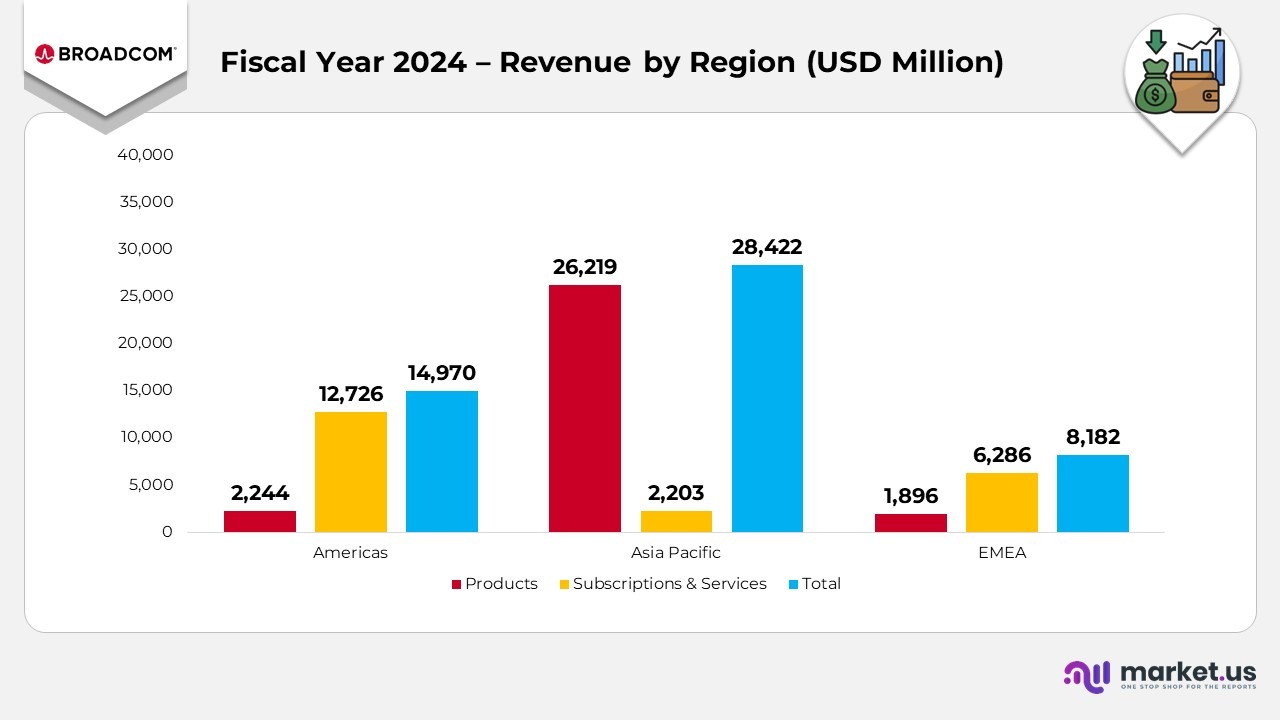

2024

Americas

- Product revenue reached 2,244, reflecting stable hardware demand across the region.

- Subscriptions and services revenue increased to 12,726, highlighting strong software and recurring-service penetration.

- Total regional revenue amounted to 14,970, marking a solid contribution to global performance.

Asia Pacific

- Product revenue totalled 26,219, demonstrating strong demand in key Asian technology markets.

- Subscriptions and services revenue reached 2,203, with growth driven by enterprise and cloud-related engagements.

- Total revenue from this region amounted to 28,422, the highest among all geographical segments.

Europe, Middle East & Africa (EMEA)

- Product revenue totalled 1,896, reflecting ongoing hardware deployments.

- Subscriptions and services revenue came in at 6,286, supported by increasing enterprise software adoption.

- Total EMEA revenue reached 8,182, reinforcing its importance as a developing growth region.

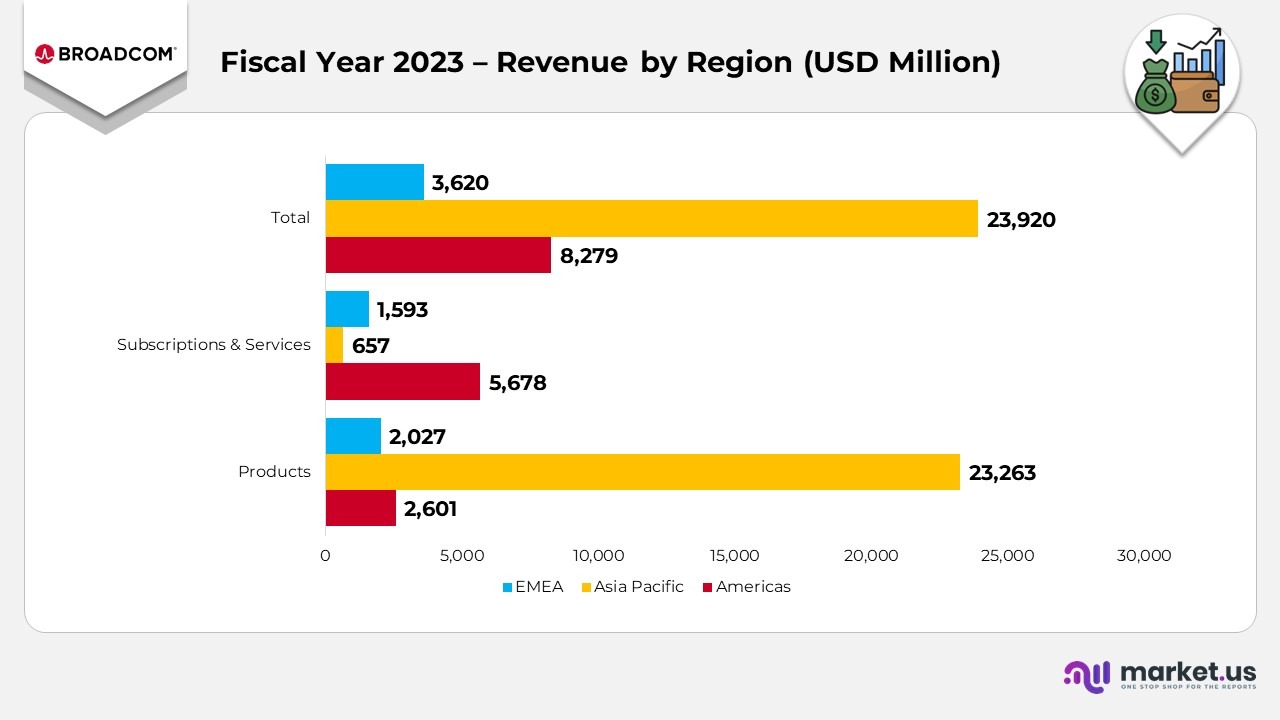

2023

Americas

- Product revenue was 2,601, showing an improvement over the prior year’s product momentum.

- Subscriptions and services revenue amounted to 5,678, supported by better software and services uptake.

- Total revenue for the Americas was 8,279.

Asia Pacific

- Products revenue reached 23,263, maintaining the region’s strong position in technology consumption.

- Subscriptions and services revenue was 657, primarily driven by infrastructure-related offerings.

- Total Asia Pacific revenue reached 23,920.

Europe, Middle East & Africa (EMEA)

- Product revenue came in at 2,027, reflecting continued demand for hardware solutions.

- Subscriptions and services revenue reached 1,593, supported by expansion in enterprise software.

- Total EMEA revenue amounted to 3,620.

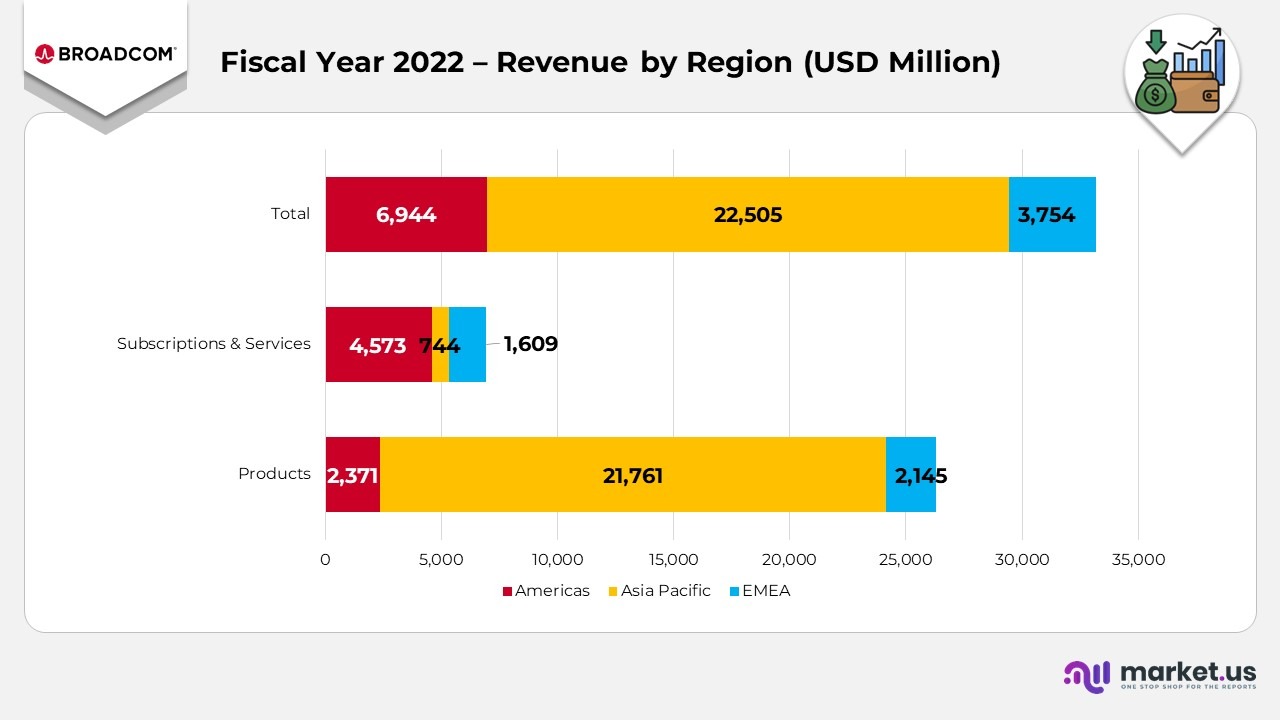

2022

Americas

- Product revenue totalled 2,371, maintaining steady hardware performance.

- Subscriptions and services revenue reached 4,573, reflecting the ongoing adoption of enterprise service offerings.

- Total regional revenue was 6,944.

Asia Pacific

- Product revenue totalled 21,761, reflecting strong demand across technology-driven markets.

- Subscriptions and services revenue amounted to 744, supported by early-stage enterprise adoption.

- Total Asia Pacific revenue reached 22,505.

Europe, Middle East & Africa (EMEA)

- Product revenue reached 2,145, driven by hardware deployments.

- Subscriptions and services revenue totalled 1,609, reflecting steady software and services traction.

- Total EMEA revenue amounted to 3,754.

(Source: Broadcam Inc. Annual Report)

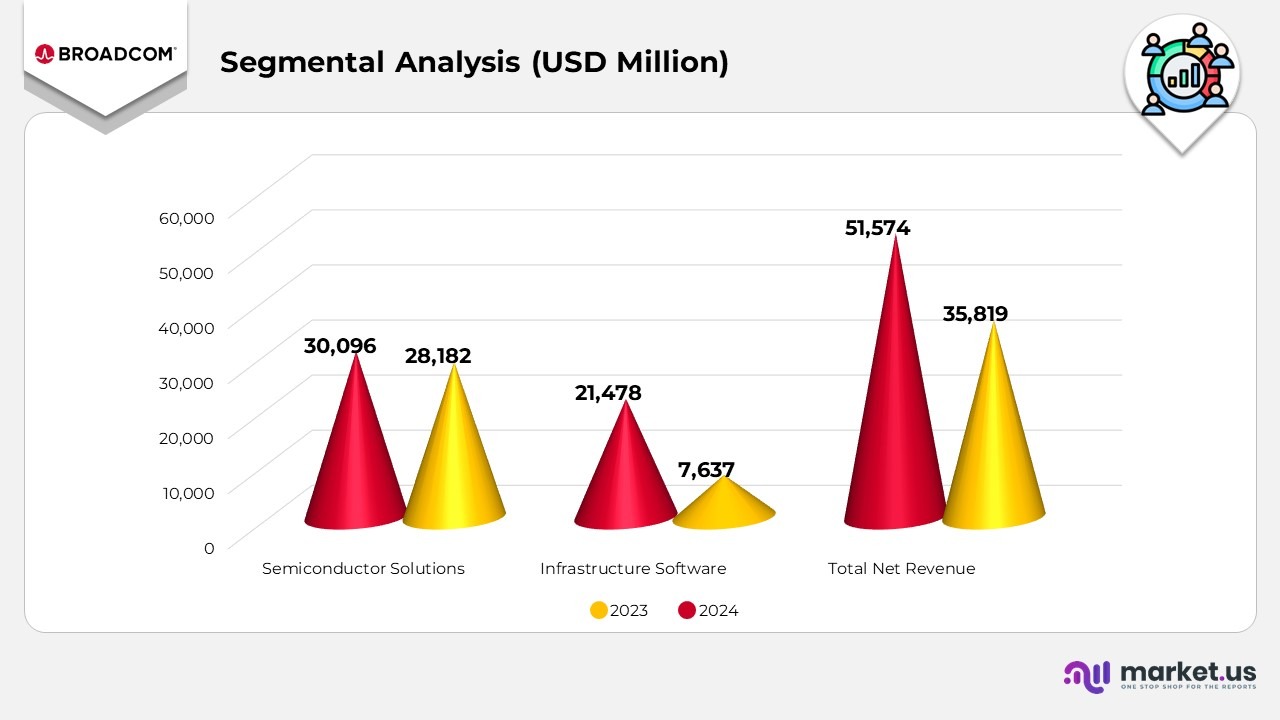

Segmental Analysis

- In 2024, semiconductor solutions generated USD 30,096 million, supported by strong demand for AI networking and core infrastructure products.

- Infrastructure software delivered USD 21,478 million in 2024, showing a major uplift largely driven by VMware’s contribution.

- Total net revenue reached USD 51,574 million, up sharply from last year.

- Year over year, semiconductor solutions rose by USD 1,914 million (7% growth), reflecting stable hardware demand despite softness in broadband and storage lines.

- Infrastructure software increased by USD 13,841 million, a significant 181% jump, highlighting the impact of the VMware acquisition.

- Combined net revenue grew by USD 15,755 million, representing a strong 44% annual improvement.

- The revenue mix in 2024 shifted to 58% from semiconductor solutions and 42% from infrastructure software, compared with 79% and 21%, respectively, in 2023, illustrating Broadcom’s rapid move toward a more software-balanced business.

(Source: Broadcam Inc. Annual Report)

Broadcom Patents

| Patent / Publication Title | Number | Type | Filed |

|---|---|---|---|

| Methods for Applying Microlenses to Small-Aperture Photodetectors & VCSELs | 12272921 | Grant | October 25, 2021 |

| Copper-Bonded Glass Module Architecture on Glass Substrates | 12199007 | Grant | July 28, 2022 |

| Diamond-Based Spot Size Converter for Fiber Edge Coupling | 20240036263 | Application | July 29, 2022 |

| Macrochip Architecture Using Interconnect Stacks for Power & Signal Routing | 20230352415 | Application | April 27, 2022 |

| Extended HBM Routing Offsets with 2.5D Interposers | 11538790 | Grant | September 30, 2021 |

| Microlens Techniques for Compact Photodetectors & VCSEL High-Rate Systems | 20220209496 | Application | October 25, 2021 |

| Configurable Multi-Mode Storage Media Interface | 10990307 | Grant | July 27, 2018 |

| Optical Power Transfer Device with Active Cooling Chip | 10901161 | Grant | September 14, 2018 |

| Active-Cooled Optical Power Transfer Device | 20200091677 | Application | September 14, 2018 |

| Detection & Mitigation of Sleep-Deprivation Attacks | 10178110 | Grant | May 25, 2016 |

| Overclocked NRZ Line-Rate PHY Interface Communication | 10069620 | Grant | March 28, 2016 |

| FDSOI-Based LDMOS Semiconductor Structure | 20180122942 | Application | December 19, 2016 |

| Transmit-Signal Distortion Reduction Using Replica Amplifier Feedback | 20180123622 | Application | November 29, 2016 |

| Wireless Power Inverter Control System | 20180097400 | Application | October 31, 2016 |

| Harmonic-Selective Receiver with Digital Calibration | 20180048339 | Application | August 18, 2016 |

| Backchannel-Based Link Training & Adaptation Protocol | 20180041305 | Application | August 2, 2016 |

| Adaptive Control for Bluetooth Low-Energy Advertising | 20170374629 | Application | June 27, 2016 |

| Fully-Depleted SOI Programmable Cell Fabrication Method | 20170373074 | Application | July 12, 2016 |

| High-Density RDL Bridge via Reconstituted Wafer | 20170365565 | Application | June 30, 2016 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company formed a collaboration with NEC Corporation to support the rollout of modern private cloud environments powered by VMware Cloud Foundation (VCF). By applying NEC’s internal VCF implementation expertise, the partnership aims to help customers strengthen security and accelerate digital innovation.

- In November 2025, the company introduced a newly expanded ecosystem for VMware Cloud Foundation (VCF), giving enterprises broader capabilities to build, integrate, secure, and scale their modern private cloud environments.

- In October 2025, the company teamed up with Broadcom Inc. to jointly develop advanced accelerator and networking systems designed to support the next generation of high-performance AI cluster architectures.

- In September 2025, the company partnered with Lloyds Banking Group to enhance the speed, reliability, and overall performance of digital services delivered to more than 28 million customers across the UK.

- In August 2025, the company began collaborating with Canonical to optimise VMware Cloud Foundation for modern container platforms and AI-driven workloads, improving efficiency and deployment flexibility.

- In March 2025, the company worked with Audi to enable next-generation factory automation systems using VMware cloud technologies, supporting more intelligent, IT-driven industrial operations.

(Source: Broadcam Inc. Press Release)