Company Overview

Nokia Statistics: Nokia Corporation is a global provider of telecommunications, information technology, and consumer electronics solutions. The company offers a comprehensive portfolio of mobile, cloud network, and fixed network solutions that integrate software, hardware, and services. In addition, Nokia manages and licenses its intellectual property, including patents, proprietary technologies, and the Nokia brand.

The company operates through 4 major business segments: Network Infrastructure, Mobile Networks, Cloud and Network Services, and Nokia Technologies. The Network Infrastructure segment delivers fixed access, IP routing, and optical transport solutions that support business-critical and mission-critical applications for communication service providers, enterprises, and web-scale companies.

Mobile Networks develops products and services across all 3GPP mobile technology generations, including radio access networks (RAN), microwave transport, network management solutions, and technical support and optimization services. Cloud and Network Services provides open, secure, automated, and scalable software solutions that enable service providers and enterprises to transition toward autonomous networks, creating new business value. Nokia Technologies oversees the company’s extensive patent portfolio and drives revenue through intellectual property and technology licensing.

With a global presence spanning 7 key regions: Latin America, North America, Europe, the Middle East and Africa, Asia-Pacific, India, and Greater China. Over 7,000 Nobel Prizes have been awarded to innovators contributing to advancements in technology and science, symbolizing the spirit of innovation that aligns with Nokia’s global vision.

Nokia maintains a robust intellectual property portfolio comprising around 20,000 patent families, reflecting its strong focus on innovation and technological leadership. Over 7,000 of these patents are recognized as essential for 5G, emphasizing Nokia’s significant contribution to global connectivity standards. In 2024, the company reinforced its innovation pipeline by filing patents for more than 3,000 new inventions, spanning advancements in 5G, 6G, cloud infrastructure, and digital technologies.

History of Nokia

1800’s

- 1865: Established as a single paper mill operation, marking the company’s early industrial roots.

1900’s

- 1926: Introduced sound to motion pictures, revolutionizing the entertainment industry.

- 1947: Invented the transistor, a breakthrough that transformed modern electronics.

- 1954: Created the solar cell, converting sunlight into electrical energy for the first time.

- 1958: Developed laser technology, laying the groundwork for fibre-optic communications.

- 1960s: Evolved into a diversified conglomerate with ventures in rubber, cable, forestry, and power generation.

- 1962: Launched Telstar 1, the first communications satellite, enabling live television broadcasts across continents.

- 1969: Created UNIX, the pioneering software system that made multi-user computing and internet connectivity feasible.

- 1982: Introduced Europe’s first fully digital local telephone exchange and the world’s inaugural NMT car phone.

- 1991: Enabled the first-ever GSM call via the Nokia-built Radiorlinja network in Finland.

- 1998: Became a global technology leader and the world’s largest mobile phone manufacturer.

2000’s

- 2001: Invented MIMO technology, a crucial innovation improving the speed and reliability of wireless communications.

- 2006: Developed SoftRouter, a programmable open network architecture to accelerate IP-based service innovation.

- 2007: Formed Nokia Siemens Networks through a joint venture, combining mobile and fixed-line network expertise.

- 2011: Partnered strategically with Microsoft to strengthen competitiveness against iOS and Android ecosystems; acquired Motorola’s wireless network assets.

- 2013: Completed the acquisition of Siemens’ stake in NSN, gaining full ownership.

- 2014: Divested its Devices and Services division to Microsoft, refocusing on network technologies.

- 2016: Acquired Alcatel-Lucent, including Bell Labs, positioning itself as a leader in next-generation communication systems.

- 2017: Introduced Probabilistic Constellation Shaping to maximise fibre capacity; acquired Deepfield and Comptel to enhance software and analytics capabilities.

- 2018: Launched XG-FAST technology to deliver multi-gigabit broadband over existing copper infrastructure; acquired Unium to strengthen home Wi-Fi solutions.

- 2019: Opened the world’s first end-to-end 5G lab, named the Future X Lab, in Murray Hill, New Jersey, US.

- 2020: Partnered with NASA to deploy the first LTE network on the Moon; achieved the first 5G liquid cooling deployment and 5G speed world record.

- 2021: Created the Resh programming language for network automation and management.

- 2022: Demonstrated the first 100Gb/s fiber broadband; launched the ASTRA lab in the US and introduced six pillars of responsible AI.

- 2023: Rebranded to reinforce Nokia’s B2B technology identity; advanced 6G research; set a world record with a 24 Tb/s optical transmission; and expanded its video, audio, and device management platforms.

- 2024: Divested its Submarine Networks division; partnered with Axiom Space for next-generation lunar connectivity; and deepened collaboration with Infenera to advance optical networking innovations.

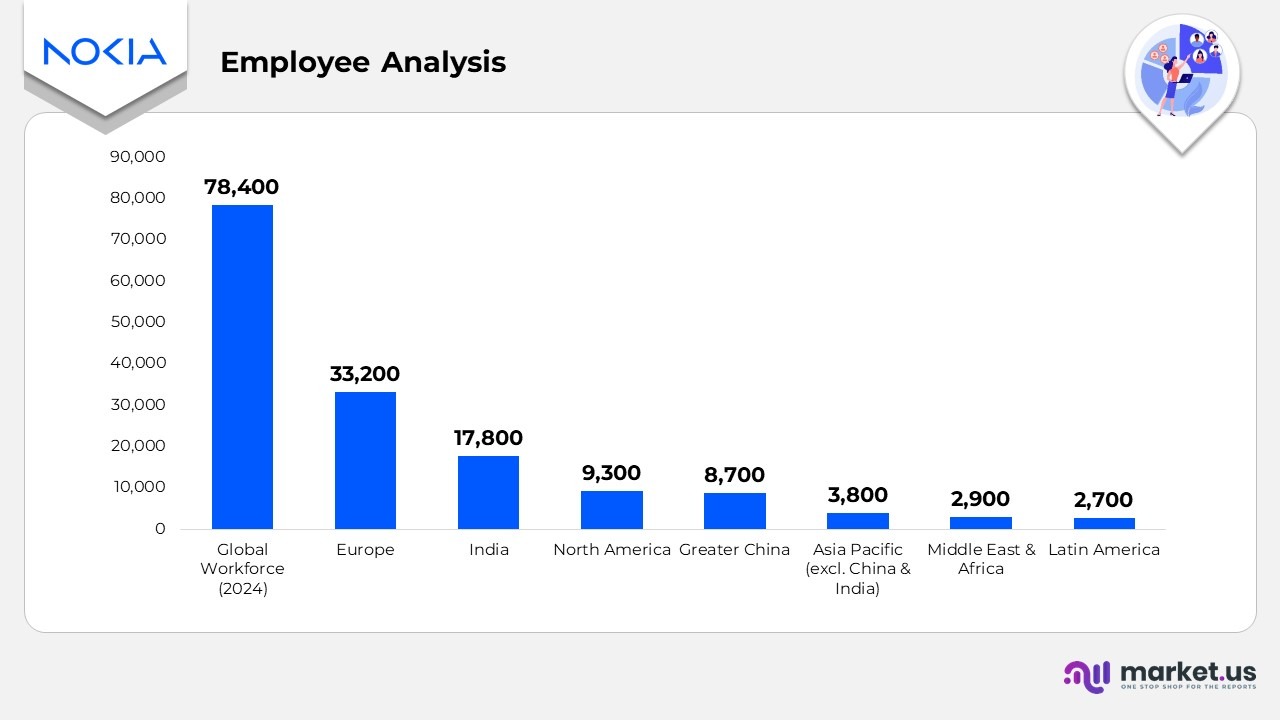

Employee Analysis

- The company has a presence in around 130 countries, highlighting its extensive international operations.

- Nokia’s global workforce averaged 78,400 employees in 2024, reflecting strong human capital support across markets.

- Europe hosts nearly 33,200 employees, representing the largest regional concentration of employees in the world.

- India serves as a major employment center with approximately 17,800 employees driving operational and development activities.

- In North America, the company employs about 9,300 individuals, supporting communication technology and enterprise services.

- Greater China contributes around 8,700 employees, emphasizing its strategic importance in production and technology.

- The Asia Pacific (excluding China and India) region employs approximately 3,800 staff, with a focus on customer engagement and service operations.

- The Middle East & Africa employs close to 2,900 people, reinforcing the company’s footprint across emerging markets.

- Latin America employs roughly 2,700 individuals, supporting regional operations and sales expansion.

(Source: Nokia Annual Report)

Financial Analysis

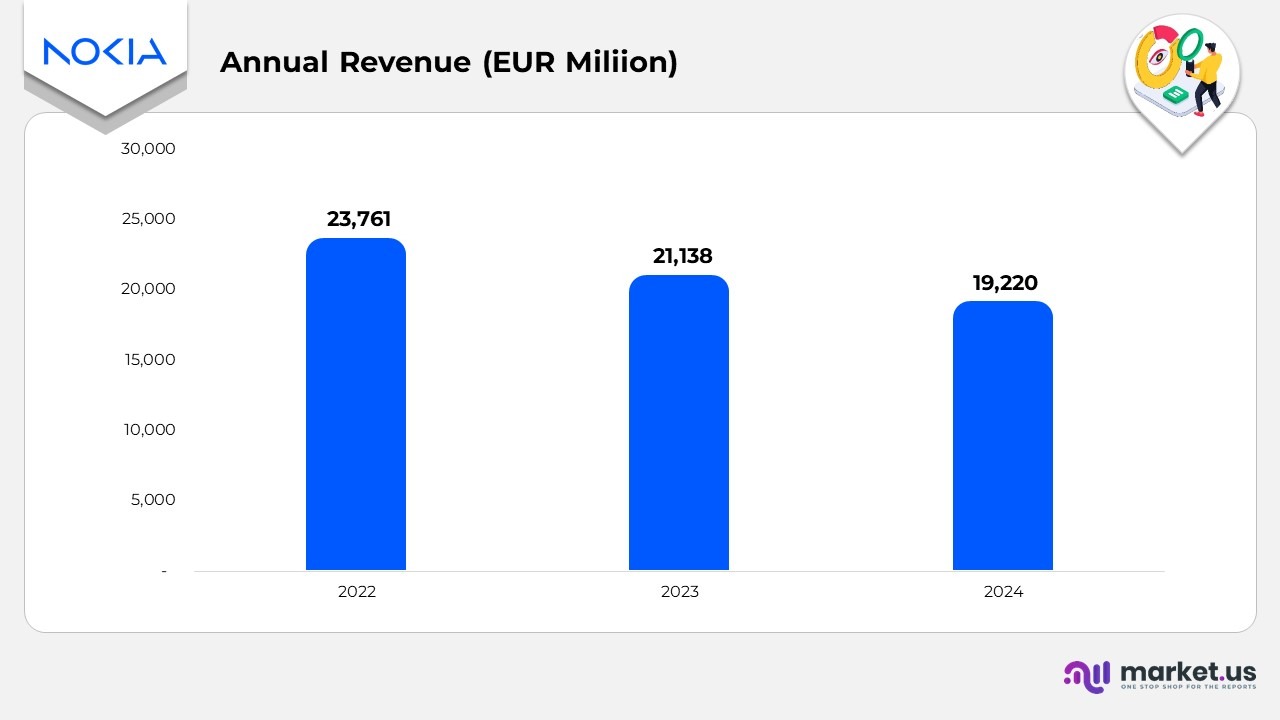

- In 2022, Nokia achieved annual revenue of EUR 23,761 million, supported by robust demand across its network infrastructure and technology divisions. Growth was fueled by continuous investments in 5G infrastructure and enterprise connectivity, reflecting stable global operations.

- In 2023, annual revenue decreased to EUR 21,138 million, a decline of approximately EUR 2,623 million from the previous year. The decline stemmed from challenging global market conditions and reduced capital expenditure by communication service providers. However, Nokia sustained progress in cloud-based solutions and patent licensing, partially balancing the revenue contraction.

- In 2024, net sales declined further to EUR 19,220 million, representing a decrease of EUR 1,918 million, or approximately 9%, compared to 2023. The downturn was driven by continued market headwinds that began in 2023 and persisted into early 2024, particularly affecting Network Infrastructure, Mobile Networks, and Network and Cloud Services. Nonetheless, Nokia Technologies demonstrated notable resilience, benefiting from new smartphone licensing agreements and catch-up sales that provided a partial offset to the overall decline.

- In 2024, Nokia’s gross profit reached EUR 8,864 million, representing an increase of EUR 318 million, or approximately 4%, compared to EUR 8,546 million in 2023. This growth was primarily driven by higher revenue contributions from Nokia Technologies, supported by new licensing agreements.

- The gross margin improved notably to 1% in 2024, up from 40.4% in 2023, reflecting enhanced profitability and improved operational efficiency.

- Associated and restructuring charges remained largely stable, standing at EUR 155 million in 2024 compared with EUR 151 million in the prior year, indicating disciplined cost management.

(Source: Nokia Annual Report)

Geographical Revenue Analysis

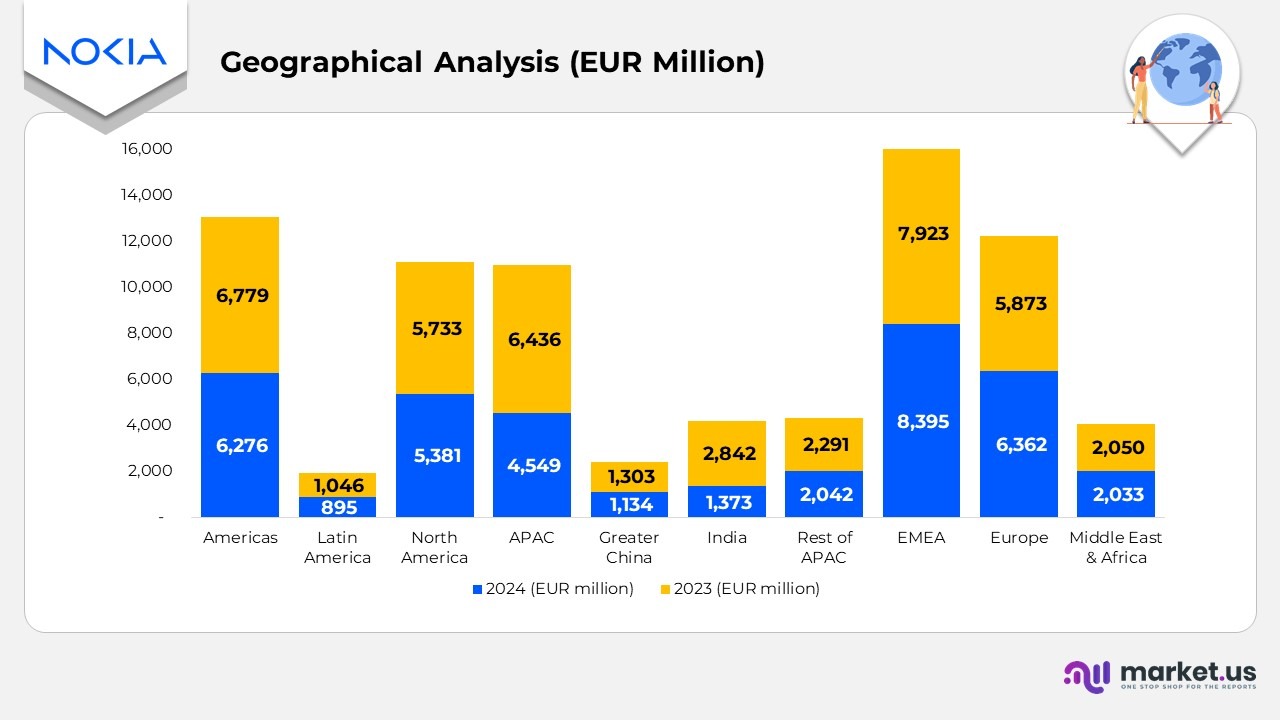

- In 2024, Nokia’s total net sales amounted to EUR 19,220 million, representing a 9% decline from EUR 21,138 million in 2023, reflecting a broad slowdown across several key markets.

- The Americas recorded net sales of EUR 6,276 million, down 7% from EUR 6,779 million in 2023, as weaker demand in North and Latin America weighed on overall performance.

- North America saw a 6% decline, reaching EUR 5,381 million, due to reduced spending by communication service providers.

- Latin America registered a sharper drop of 14%, with net sales of EUR 895 million, indicating continued macroeconomic challenges in the region.

- The Asia-Pacific (APAC) region reported EUR 4,549 million, a significant 29% decrease from EUR 6,436 million in 2023.

- Within the APAC region, India experienced the steepest decline of 52%, falling to EUR 1,373 million, primarily due to a reduction in 5G deployment activity.

- The Rest of APAC contributed EUR 2,042 million, down 11%, reflecting lower investment cycles in several markets.

- Greater China also recorded a 13% decrease to EUR 1,134 million, primarily due to weaker demand and market saturation.

- The Europe, Middle East, and Africa (EMEA) region demonstrated relative resilience, with EUR 8,395 million in 2024, representing a 6% year-over-year increase from EUR 7,923 million in 2023.

- Europe led the gains, with sales rising 8% to EUR 6,362 million, driven by strong demand from enterprises and broadband.

- The Middle East & Africa segment declined slightly by 1% to EUR 2,033 million, maintaining stability despite regional economic pressures.

(Source: Nokia Annual Report)

Nokia Net Sales Distribution by Customer Type Statistics

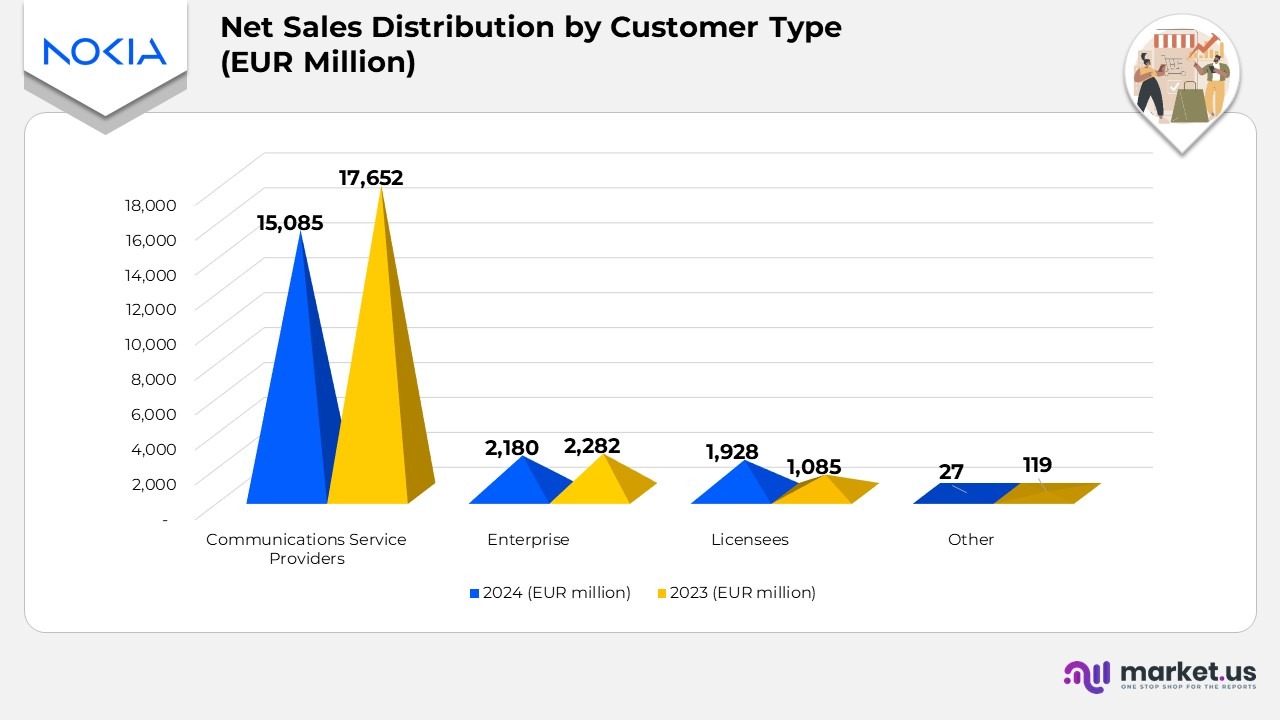

- Communications Service Providers generated 15,085 million EUR in 2024, representing a 15% decline from 17,652 million EUR in 2023. The reduction was largely due to slower network investments and the postponement of modernization initiatives among major telecom operators.

- Enterprise revenue totalled 2,180 million EUR in 2024, a 4% decrease from 2,282 million EUR in 2023. The decrease stemmed from conservative IT spending patterns and delayed digital transformation projects across enterprise clients.

- Licensees contributed 1,928 million EUR in 2024, representing a substantial 78% increase from 1,085 million EUR in 2023. This sharp growth was fueled by new patent licensing agreements and additional catch-up payments recognized during the year.

- The Other category recorded 27 million EUR in 2024, a 77% decrease from 119 million EUR in 2023, reflecting reduced revenue from smaller non-core operations and the completion of legacy contracts.

(Source: Nokia Annual Report)

Nokia Segment-Wise Net Sales Performance by Region Statistics

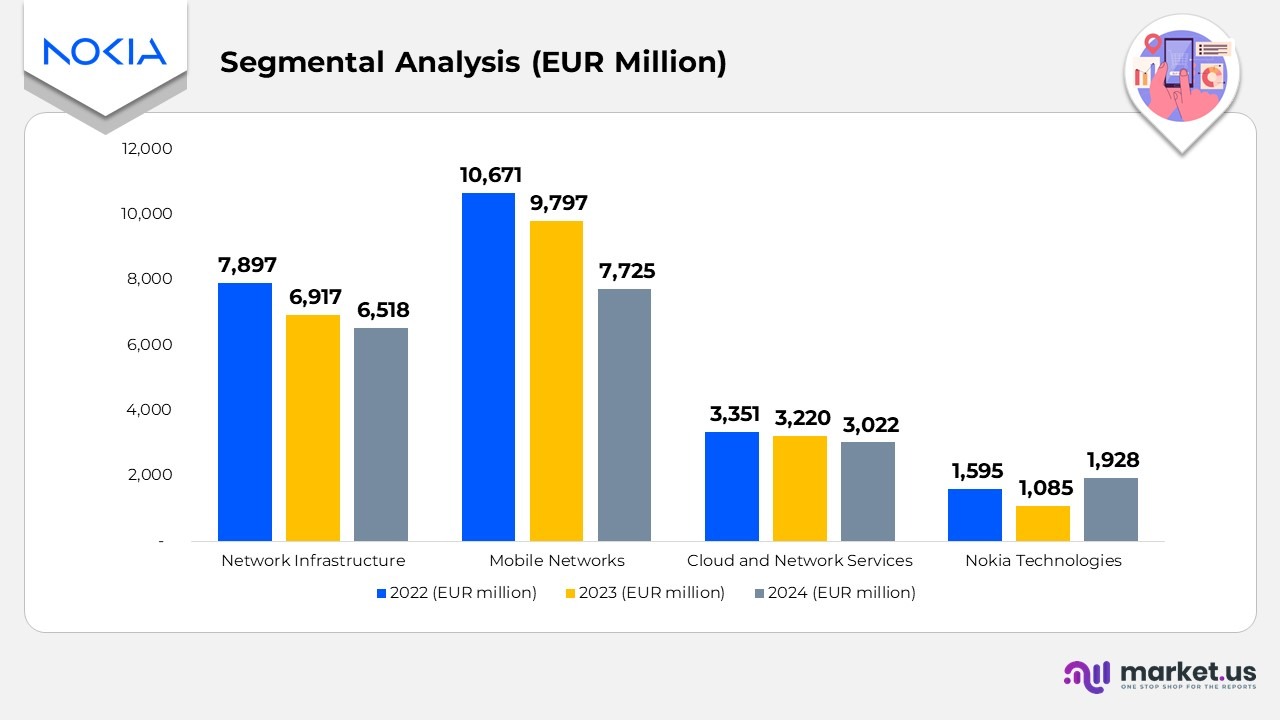

- Network Infrastructure reported EUR 6,518 million in 2024, down from EUR 6,917 million in 2023 and EUR 7,897 million in 2022. The decline was mainly due to slower demand across the Americas and APAC regions, partially offset by stable performance in EMEA.

- The Americas generated EUR 2,726 million in 2024, a slight dip from EUR 2,813 million in 2023.

- APAC posted EUR 1,426 million, down from EUR 1,580 million in the prior year.

- The EMEA region recorded EUR 2,366 million, a marginal decrease compared with EUR 2,524 million in 2023.

- Mobile Networks generated EUR 7,725 million in 2024, compared to EUR 9,797 million in 2023 and EUR 10,671 million in 2022, reflecting a year-over-year decline due to reduced 5G rollout momentum in key markets.

- The Americas contributed EUR 2,365 million, which is slightly below the EUR 2,618 million recorded in 2023.

- APAC generated EUR 2,461 million, declining from EUR 3,148 million the previous year.

- EMEA reached EUR 2,899 million, a modest drop from EUR 3,995 million in 2023.

Further

- Cloud and Network Services achieved EUR 3,022 million in 2024, down slightly from EUR 3,220 million in 2023 and EUR 3,351 million in 2022. The decline reflected cautious enterprise spending but continued demand for automation and software-based solutions.

- The Americas accounted for EUR 1,184 million, compared with EUR 1,306 million in 2023.

- APAC posted EUR 649 million, slightly below the EUR 752 million reported in the prior year.

- EMEA generated EUR 1,189 million, a marginally higher figure than EUR 1,165 million in 2023.

- Nokia Technologies delivered EUR 1,928 million in 2024, representing a significant increase from EUR 1,085 million in 2023 and EUR 1,595 million in 2022. New patent licensing agreements and recognition of catch-up sales during the year primarily drove this strong growth.

- Group Common and Other reported EUR 27 million in 2024, down from EUR 119 million in 2023 and EUR 248 million in 2022, reflecting the phasing out of non-core operations and completion of legacy contracts.

Statistics of Nokia Segmental Analysis

- Network Infrastructure net sales reached € 6,518 million in 2024, a decrease of € 399 million or 6% compared to € 6,917 million in 2023. The overall decline reflected weaker performance across all business lines. Although market demand began showing improvement during the latter part of the year.

- Mobile Networks reported net sales of 7,725 million EUR in 2024, down 2,072 million EUR or 21% from 9,797 million EUR in 2023. The decline was primarily attributed to weaker demand in India within the APAC region, as the pace of 5G deployments slowed following heavy investments made during 2023. The Americas region also experienced a downturn, particularly in North America. Where deployment activity remained subdued and market share decreased due to the loss of one major customer.

- Cloud and Network Services generated 3,022 million EUR in 2024, a decrease of 198 million EUR or 6% compared to 3,220 million EUR in 2023. The reduction stemmed from the divestment of the Device Management and Service Management Platform businesses, along with declines in Cloud and Cognitive Services and Core Networks. A slight positive contribution came from growth in Enterprise Campus Edge. While foreign exchange rate fluctuations had a minor negative impact of less than 1% on overall sales.

- Nokia Technologies recorded net sales of 1,928 million EUR in 2024, reflecting a strong increase of 843 million EUR or 78% over 1,085 million EUR in 2023. The growth was mainly driven by new smartphone licensing agreements with OPPO, vivo, and other manufacturers, some of which resulted in catch-up sales recognized during the year. Additionally, Nokia Technologies expanded its footprint into emerging innovation areas such as automotive, consumer electronics, IoT, and multimedia, further diversifying its revenue base.

(Source: Nokia Annual Report)

Research and Development (R&D) Expenditure

- Research and development (R&D) expenses totalled 4,512 million EUR in 2024. Representing an increase of 235 million EUR, or 5%, compared with 4,277 million EUR in 2023.

- R&D expenses accounted for 23.5% of net sales in 2024, up from 20.2% in 2023. Demonstrating the company’s continued focus on innovation and advanced technology development.

- The rise in R&D expenditure was primarily driven by higher variable pay accruals in 2024. Reflecting stronger performance-based payouts compared to the prior year.

- R&D expenses also included restructuring and associated charges of 135 million EUR in 2024. Compared to 61 million EUR in 2023, the highlights greater investment in operational and strategic transformation initiatives.

(Source: Nokia Annual Report)

Recent Developments

- In November 2025, Nokia entered a collaboration with Latvijas Mobilais Telefons (LMT) to integrate its advanced 5G radio technology into LMT’s defense communication systems. The project focuses on developing a secure, high-capacity tactical network to support mission-critical defense applications.

- In November 2025, Nokia strengthened its partnership with SoftBank Corp. in Japan to supply 4G and 5G radio access equipment. The initiative aims to modernise existing networks and expand 5G standalone coverage across Western Japan using Nokia’s AirScale portfolio.

- In November 2025, Nokia partnered with Rohde & Schwarz to address coverage challenges in future 6G networks by advancing testing and network optimization solutions for high-frequency spectrum bands.

- In November 2025, Nokia partnered with OneLayer to accelerate the adoption of secure private 5G and LTE in the utilities sector. With a focus on enhancing operational safety and data integrity.

- In October 2025, Nokia and Corporación Nacional de Telecomunicaciones (CNT E.P.) launched Ecuador’s viable 5G network. The network achieves speeds of up to 1.5 Gbps, 10 times faster than 4G. Offering ultra-low potential and seamless nationwide connectivity.

- In October 2025, Nokia collaborated with NVIDIA to accelerate AI-RAN innovation and drive the transition from 5G to 6G by combining AI capabilities with advanced network automation.

- In October 2025, NVIDIA invested USD 1.0 billion (EUR 0.86 billion) in new Nokia shares for USD 6.01 (EUR 5.16) per share. This investment deepens the strategic partnership to lead AI-driven RAN development and enhance global data center networking capabilities.

- In October 2025, Nokia teamed up with E.ON SE to modernize telecommunications infrastructure for distribution system operators. Improving network reliability and efficiency in energy communication.

- In October 2025, Nokia and Ericsson, along with Berlin’s Fraunhofer Heinrich Hertz Institute (HHI). Began collaboration to define next-generation video coding standards for immersive and efficient media experiences in the 6G era.

Moreover

- In October 2025, Nokia partnered with Vietnam Posts and Telecommunications Group (VNPT) to enhance network capacity and digital connectivity, advancing Vietnam’s digital transformation and socio-economic growth.

- In September 2025, Nokia partnered with Nscale to accelerate the deployment of AI infrastructure for enterprises and cloud service providers, enabling scalable and high-performance computing environments.

- In September 2025, Nokia signed an agreement with Kongsberg Defence & Aerospace to co-develop tactical communications systems that combine military-grade security with Nokia’s expertise in 4G and 5G private wireless solutions.

- In September 2025, Nokia expanded its defence technology portfolio by introducing the Mission-Safe Phone and an upgraded Banshee 5G Tactical Radio, thereby strengthening secure and reliable communications for defence operations.

- In September 2025, Nokia partnered with Supermicro to deliver AI-optimized data center networking solutions by integrating Supermicro’s high-performance hardware with Nokia’s network automation systems for AI, HPC, and cloud applications.

- In September 2025, Nokia collaborated with Extreme Broadband (EBB) to enhance data center security and implement next-generation network solutions in Malaysia.

- In July 2025, Nokia partnered with Optus to enhance voice reliability through a cloud-native architecture supporting the rollout of advanced 5G voice services.

- In June 2025, Nokia partnered with Leonardo to deliver mission-critical private wireless networks. Designed for public safety and critical infrastructure, ensuring secure and resilient connectivity.

- In June 2025, Nokia partnered with Andorix to expand private 5G and edge computing solutions within the North American real estate sector. Accelerating the region’s adoption of smart and connected buildings.

- In June 2025, Nokia collaborated with a technology innovator to develop smart enterprise applications and integrate AI-driven automation into advanced industrial use cases.

(Source: Nokia Annual Report)