Company Overview

Hitachi Statistics: Hitachi, Ltd. is a diversified global conglomerate engaged across information technology, electronics, power systems, social infrastructure, industrial solutions, and semiconductor equipment. The company develops and delivers a wide range of offerings, including power and energy systems, information and telecommunications platforms, mobility technologies, industrial and social infrastructure solutions, measurement and analytical instruments, and smart life and environmentally sustainable products.

Its technologies and services support key sectors, including healthcare, manufacturing, aerospace, finance, government, transportation, communications, life sciences, energy, automotive, nuclear engineering, and advanced technology industries. The company operates in 4 business segments, namely Digital Systems & Services, Green Energy & Mobility, Connective Industries, and others. Hitachi operates through a broad network of subsidiaries, affiliates, associates, and joint ventures that span Europe, North America, the Asia-Pacific region, and the Middle East and Africa.

(Source: Company Website)

History of Hitachi, Ltd.

1900’s

- 1910: Company founded; completed a five-horsepower induction motor.

- 1911: Completed a 2-kVA transformer.

- 1914: Began manufacturing AC ammeters and voltmeters.

- 1916: Built a 10,000-hp (7,355-kW) water turbine and started producing fans.

- 1924: Delivered Japan’s first large-scale DC electric locomotive.

- 1930: Began producing pole-top transformers.

- 1931: Completed a 10,000-A hydraulic electrolytic cell.

- 1932: Started elevator production and completed the company’s first electric refrigerator.

- 1933: Manufactured a 23,600-hp Illgner set.

- 1940: Developed a 5,000-line reflex remote branch exchange system.

- 1943: Completed an 85,000-kW Francis turbine and a 70,000-kVA AC generator.

- 1949: Produced the first U05 power excavator.

1950’s

- 1951: Completed a 6,500-kW Kaplan turbine and a 7,000-kVA AC generator—Japan’s first umbrella-type generator.

- 1952: Developed a 21,000-kW two-period pump-turbine.

- 1953: Built a true low-pressure 300-m³/h air parting machine and a 55,000-kW hydrogen-cooled turbine.

- 1954: Produced Japan’s first large-scale cold strip mill.

- 1955: Completed a 100,000-kW Francis turbine and a 93,000-kVA AC generator.

- 1956: Built Japan’s first DF90 diesel-electric engine.

- 1958: Created a six-transistor miniature portable radio; electron microscopes won the Grand Prix at the Brussels World Exposition.

- 1959: Developed transistor-based electronic computers; Hitachi America, Ltd. established.

- 1960: Introduced a cubic refrigerator and completed the MARS-1 railway seat-reservation system.

- 1961: Developed a fully automatic washing machine and built an experimental nuclear reactor.

- 1962: Created exothermic self-hardening mold technology.

- 1963: Built a 265,000-kW desuperheater refiring cross-compound turbine.

- 1964: Produced the first Shinkansen train cars and built the Haneda–Hamamatsu-cho monorail.

- 1965: Completed the HITAC 5020 system and a 19-inch polarized color CRT.

- 1966: Developed LTP processing for silicon transistors.

- 1967: Launched a dry-type room air conditioner.

- 1968: Created hybrid LSI, the HIDIC 100 control computer, and high-speed elevators for skyscrapers.

- 1969: Developed Japan’s first online banking system and mass-produced transistor color TVs.

- 1970: Developed a computer-aided traffic control system for the Shinkansen.

- 1971: Completed a large (1-GB) file storage unit.

- 1973: Built a new-type image pickup tube.

- 1974: Created a numerically controlled ruling engine and supported the launch of Japan’s first 460,000-kW nuclear power station; automated semiconductor assembly processes.

- 1975: Developed Thermoexcell heat-transfer technology and the High Crown Control Mill; built the M-series computer system.

- 1976: Achieved the world’s first optical transmission system trial.

- 1977: Developed a high-speed amino acid analyzer and built the Fugen progressive thermal converter reactor.

- 1978: Created the world’s first field-emission electron microscope and a prototype solid-state color camera.

- 1979: Completed the HITAC M-series 200H.

1980’s

- 1980: Built a 300-MW AC/DC converter linking Hokkaido and Honshu.

- 1982: Hitachi Europe Ltd. was established; it achieved micro-level magnetic field observation via electron beam holography.

- 1983: Developed a scroll-compressor air conditioner.

- 1984: Produced Japan’s first improved standard BWR nuclear reactor; began mass production of 256-kbit DRAMs.

- 1985: Completed the JT-60 Tokamak reactor; developed high-resolution CAD/CAE systems.

- 1986: Released the HITAC M-68X series.

- 1987: Developed predictive fuzzy control systems and large color LCD projection displays.

- 1988: Created a quadrupedal robot; Hitachi Asia Pte. Ltd. established.

- 1989: Developed the world’s fastest superconductive computer and superconductive MRI equipment; opened multiple R&D centers abroad.

- 1990: Released a world-leading large-scale computer and advanced TFT color displays.

- 1991: Developed high-capacity inverter electric locomotives and extremely sensitive image pickup tubes.

- 1992: Built a 500-kV core network substation system and advanced atomic-scale observation technology.

- 1993: Developed a faster Shinkansen (270 km/h), the first room-temperature single-electron memory, and capillary DNA sequencers.

- 1994: Established Hitachi (China) Ltd.; created the SuperH 32-bit RISC processor and prototype 1-Gbit DRAM.

- 1995: Developed Super TFT LCD, 10-Gbit/s fiber-optic transmission, and MULTI 2 encryption.

- 1997: Created 4.7-GB DVD-RAM core technology, cardiac magnetocardiography tech, and a small proton accelerator.

- 1998: Developed a 320-Gbit/s optical transmission system and PAM-controlled home appliances.

- 1999: Commercialized manganese-based lithium secondary batteries.

2000’s

- 2000: Created 52.5-Gbit/in² perpendicular magnetic recording and a record-resolution holographic electron microscope.

- 2001: Launched mobile web gateway and mobile phone processors.

- 2002: Developed a tiny 0.3-mm contactless IC and compact DNA analysis systems.

- 2003: Commercialized high-speed finger-vein authentication and demonstrated infant brain function analysis via optical topography.

- 2004: Developed a tiny sensor-network terminal and lead-free solder technology.

- 2005: Hitachi’s explosives trace detection earned TSA certification; introduced the EMIEW robot; established Hitachi China R&D center.

- 2006: Demonstrated electro-luminescence in thin silicon films and advanced brain-machine interface experiments; mass-produced 2.5-inch perpendicular HDDs.

- 2007: Created the world’s smallest noncontact RFID IC, a 2-Mbit SPRAM prototype, and EMIEW 2 robot.

- 2008: Developed hybrid-train lithium-ion batteries and compact high-efficiency motors without rare metals.

- 2009: Created a 3-kV SiC diode prototype, a vehicular lithium-ion battery, and thin-type finger-vein authentication.

- 2010: Developed data-center energy-reduction technology and rare-metal recycling systems; achieved spin-current control.

- 2011: Hitachi Fellow recognized by the Chinese Academy; Japan approved spot-scanning proton therapy system; advanced WAN acceleration tech developed.

- 2012: Field-emission electron microscope named an IEEE Milestone; developed rare-earth-free 11-kW motors and automated human cell-sheet culturing equipment.

- 2013: Built the ROPITS mobility robot, developed strong biometric authentication, and created high-radiation gamma cameras.

- 2014: Developed atomic-resolution electron holography, wearable team-activity sensors, and walk-through finger-vein authentication.

- 2015: Introduced Hitachi AI Technology/H and launched advanced AI solutions.

- 2016: Launched the Lumada IoT Platform.

- 2018: Received major contracts for Italian high-speed rail signaling and launched a digital-payments joint venture with the State Bank of India.

(Source: Company Website

Financial Analysis

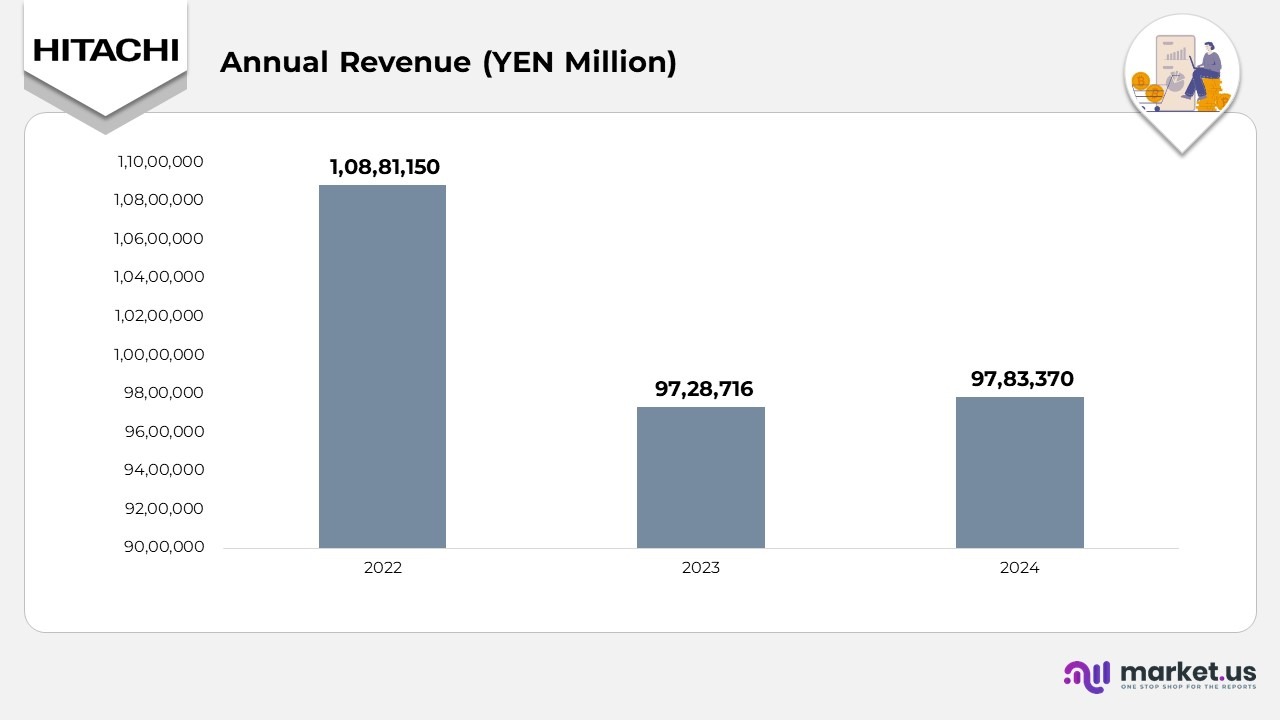

- Hitachi generated 10,881,150 million yen in revenue in 2022, marking the peak revenue point over the past three years.

- Revenue declined to 9,728,716 million yen in 2023, reflecting a YoY decrease of approximately 10.6%, largely influenced by market normalization and shifts in major business segments.

- In 2024, revenue edged up slightly to 9,783,370 million yen, representing a YoY increase of about 0.6% compared to 2023, indicating early signs of stabilization in the company’s top-line performance.

(Source: Hitachi Ltd. Annual Report)

Segmental Analysis

Digital Systems & Services (DSS)

- Hitachi’s Digital Systems & Services segment generated 2,598.6 billion yen in FY2023, supported by strong demand across digital platforms, cloud integration, and IT modernization solutions.

- The Services & Platforms category contributed 5 billion yen, accounting for 32% of segment revenues, driven by digital engineering, cloud services, and expansion of the Lumada business ecosystem.

- Front Business operations recorded 1,111.2 billion yen, representing 36% of revenues, supported by large-scale digital transformation projects spanning financial services, public sector, and enterprise clients.

- IT Services contributed 8 billion yen (32%), driven by system integration, digital workplace solutions, and ongoing customer migration to hybrid and multi-cloud environments.

- Segment revenues rose from 2,389.0 billion yen in FY2022 to 2,598.6 billion yen in FY2023, reflecting a 8% growth rate; the two-year CAGR (FY2021–FY2023) stood at 9%.

- Lumada revenues continued expanding, increasing from 0 billion yen (FY2021) to 1,047.0 billion yen (FY2022) and further to 1,220.0 billion yen (FY2023), highlighting strong momentum in AI-driven and data-centric services.

- The adjusted EBITA margin improved from 3% in FY2022 to 12.8% in FY2023, with future targets set between 15% and 17%, reflecting a strategic focus on high-value digital services and operational efficiency.

- The return on invested capital (ROIC) rose to 9.2%, indicating expanding profitability resulting from digital transformation and platform-based offerings.

Green Energy & Mobility (GEM)

- The GEM segment recorded 3,052.3 billion yen in revenues for FY2023, supported by strong global demand for energy transition solutions, power infrastructure upgrades, and advanced mobility systems.

- Power Grids BU contributed the largest share with 1,869.7 billion yen, accounting for 62% of total segment revenue, driven by substation solutions, transmission systems, and grid modernization projects.

- Railway Systems BU generated 1 billion yen, representing 28%, supported by rolling stock deliveries, rail control systems, and maintenance services for urban and intercity networks.

- Nuclear Energy BU contributed 1 billion yen, or 6%, primarily driven by nuclear power plant engineering, maintenance, and fuel cycle services.

- Hitachi Power Solutions accounted for 9 billion yen, making up 4% of segment revenue, driven by distributed energy, monitoring systems, and maintenance services.

- Total revenue increased from 2,469.9 billion yen in FY2022 to 3,052.3 billion yen in FY2023, reflecting strong 5% growth and supporting a two-year CAGR of 9%, with revenues expected to reach 3,500.0 billion yen next term.

- Lumada revenues for GEM increased steadily from 0 billion yen (FY2021) to 410.0 billion yen (FY2022) and further to 440.0 billion yen (FY2023), indicating rising adoption of digital and data-driven solutions within the energy and mobility domain.

- The segment’s adjusted EBITA margin improved from 6% in FY2022 to 6.8% in FY2023, with a target margin range of 10–12%, reflecting enhanced profitability through operational efficiencies and the delivery of high-value solutions.

- ROIC rose to 4%, highlighting strong capital productivity supported by expanding digital services, grid solutions, and decarbonization programs.

Connective Industries (CI)

- Connective Industries delivered 3,057.9 billion yen in FY2023 revenues, driven by strong industrial, urban, and high-tech solutions across global markets.

- The Building Systems BU contributed 7 billion yen, accounting for 30% of the segment’s revenue, powered by strong demand for elevators, escalators, and smart building technologies.

- Hitachi High-Tech delivered 1 billion yen, representing 23%, supported by semiconductor metrology equipment, analytical instruments, and advanced measurement solutions.

- Hitachi Global Life Solutions generated 8 billion yen (12%), driven by consumer appliances, smart home solutions, and IoT-enabled energy-efficient systems.

- The Industrial Products BU contributed 2 billion yen (16%), supported by motors, drives, power electronics, and engineered components for manufacturing and logistics.

- The Industrial Digital BU recorded 6 billion yen, representing 12%, driven by industrial automation, OT-IT integration, and digital engineering services.

- Water & Environment BU generated 0 billion yen, accounting for 7%, supported by water treatment, environmental monitoring, and smart infrastructure solutions.

- Segment revenues rose from 2,975.2 billion yen (FY2022) to 3,057.9 billion yen (FY2023), reflecting 8% annual growth, with a projected climb to 3,150.0 billion yen next fiscal year.

- Lumada revenues improved from 0 billion yen (FY2021) to 877.0 billion yen (FY2022) and further to 1,000.0 billion yen (FY2023), highlighting the rapid adoption of digital transformation and data-driven industrial solutions.

- The adjusted EBITA margin strengthened from 5% in FY2022 to 11.5% in FY2023, with a future target range of 13–15%, reflecting an emphasis on high-value, digitally enabled solutions.

- ROIC improved to 1%, underscoring strong capital efficiency driven by advanced manufacturing systems, digital platforms, and high-margin industrial technologies.

(Source: Hitachi Ltd. Annual Report)

Geographical Analysis

- Japan records the highest regional contribution with a 41% component ratio, making it Hitachi’s strongest market and placing it far ahead of every other region.

- Europe accounts for 17%, positioning it as the second-largest region but still at less than half of Japan’s share.

- North America contributes 15%, closely trailing Europe, yet remaining well below Japan’s dominant position.

- China holds an 11% component ratio, reflecting a moderate revenue presence, which is smaller than that of Japan, Europe, and North America.

- ASEAN–India represents 9%, indicating an emerging market cluster with a contribution comparable to China but still meaningfully smaller than the major regions.

- Other regions contribute 7%, marking the lowest share among all segments and highlighting limited revenue concentration outside the core markets.

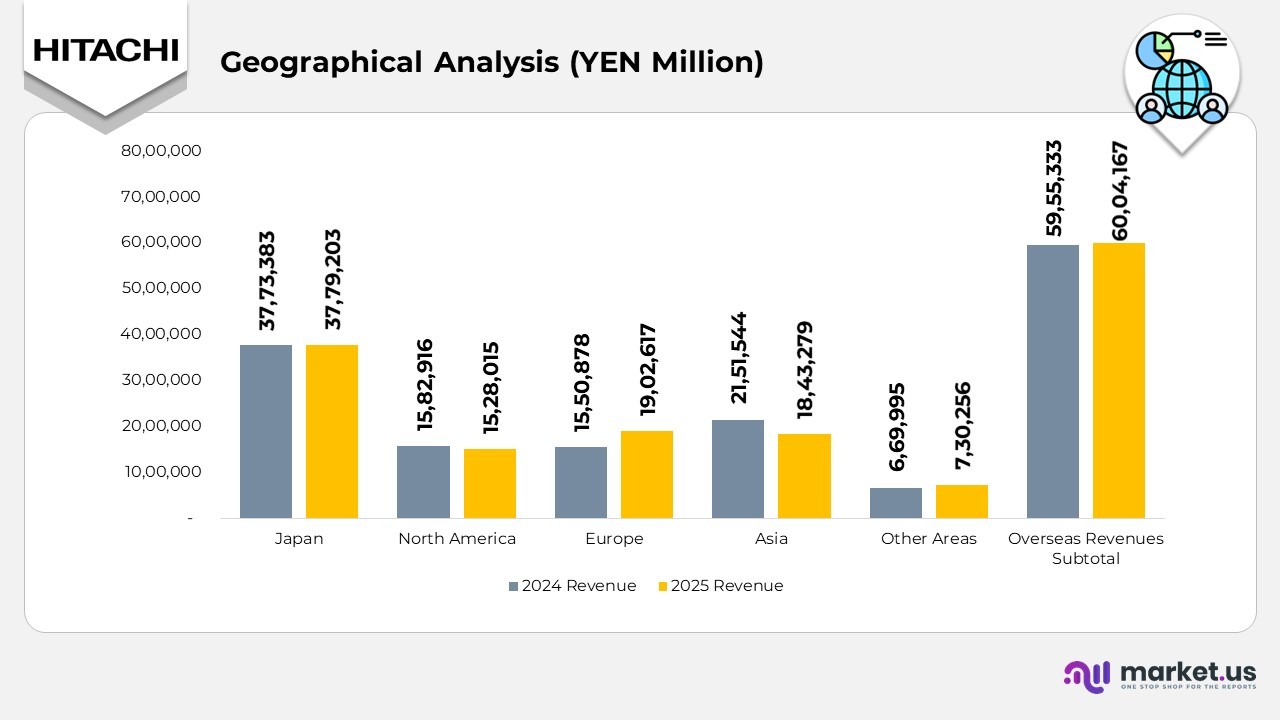

- Revenue from Japan increased from 3,773,383 million yen in fiscal 2024 to 3,779,203 million yen in fiscal 2025, maintaining a 39% share of total revenue and signaling stable domestic performance.

- North America recorded revenues of 1,582,916 million yen in 2024, declining to 1,528,015 million yen in 2025, achieving 97% of the previous year’s level and indicating slight regional softness.

Further,

- Revenue from Europe grew sharply from 1,550,878 million yen in 2024 to 1,902,617 million yen in 2025, reaching 123% of last year’s revenue and highlighting strong market expansion.

- Asia generated 2,151,544 million yen in 2024, which decreased to 1,843,279 million yen in 2025, representing an 86% decrease from the prior year’s level and reflecting weaker performance across major Asian markets.

- Revenues from Other Areas increased from 669,995 million yen in 2024 to 730,256 million yen in 2025, representing a 109% increase over the previous year, indicating growth in emerging and secondary markets.

- Overseas revenue totaled 5,955,333 million yen in 2024 and rose slightly to 6,004,167 million yen in 2025, holding steady at 61% of overall revenue and achieving 101% of the prior year.

- Total revenue increased from 9,728,716 million yen in 2024 to 9,783,370 million yen in 2025, representing a 101% increase over the previous fiscal year and indicating marginal overall growth.

(Source: Hitachi Ltd. Annual Report)

Hitachi Human Capital, Engagement, and Diversity Performance

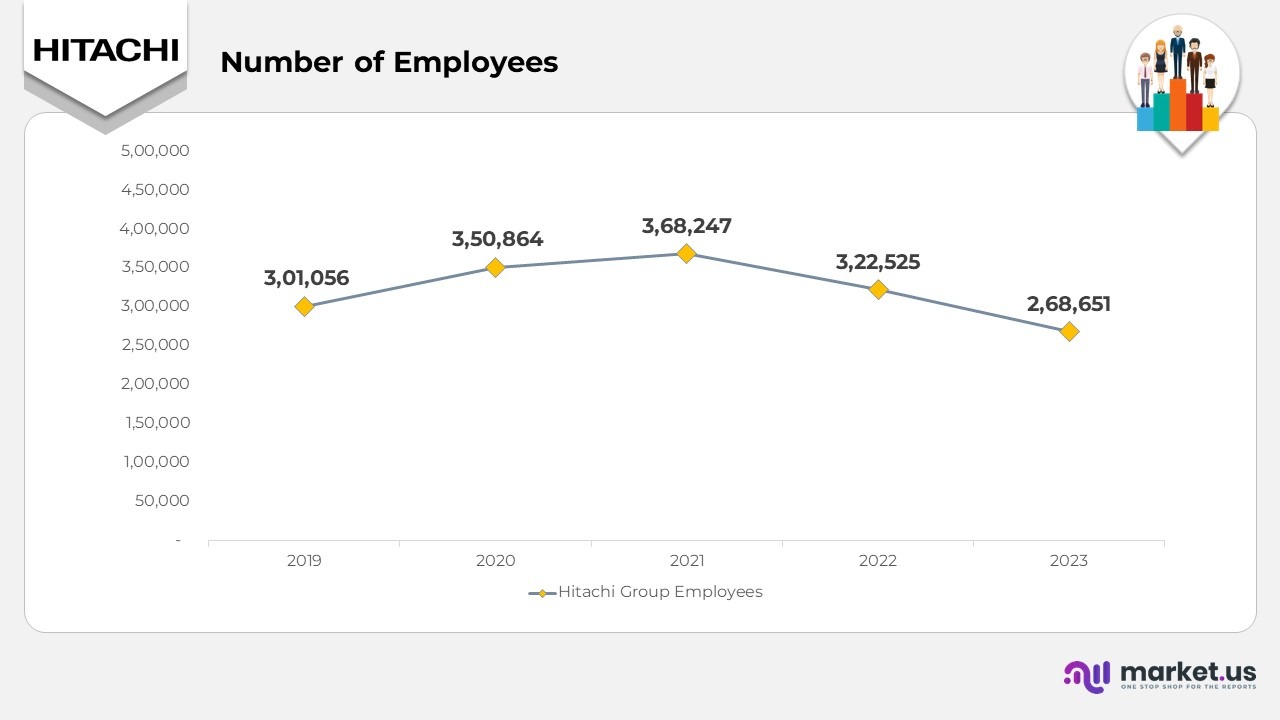

- Hitachi’s workforce totaled 268,651 employees in FY2023, following a consistent trend since FY2019. The average service length for Hitachi Group employees was 15.2 years, while that of Hitachi, Ltd. employees was 5 years, reflecting strong employee tenure. The turnover ratio remained stable at 6.3% for fiscal year 2023.

- Positive responses to employee engagement surveys for FY2023 reached 6% globally, improving steadily from the previous years. Engagement levels varied by geography, with Japan at 65.2% and overseas employees at 80.2%, indicating notably higher satisfaction among overseas employees.

- Hitachi’s digital talent pool grew significantly, reaching 95,000 personnel in FY2023, driven by the expansion of digital transformation initiatives. Japan accounted for 50,000 of the total, while overseas regions represented 45,000, highlighting a balanced global distribution of digital competencies.

- The company continued to prioritize diversity and inclusion. Women represented 5% of the Hitachi Group workforce in FY2023, a steady improvement over prior years. The percentage of women managers reached 8.3%, and Hitachi, Ltd. recorded 866 women managers, showing long-term progress toward leadership diversity.

- Across executive leadership roles, the number of women executives increased to 19 as of June 2024, representing 8%, while non-Japanese executives accounted for 25.0% of the leadership team, demonstrating Hitachi’s commitment to global and gender-diverse governance.

(Source: Hitachi Ltd. Annual Report)

Shareholder Analysis

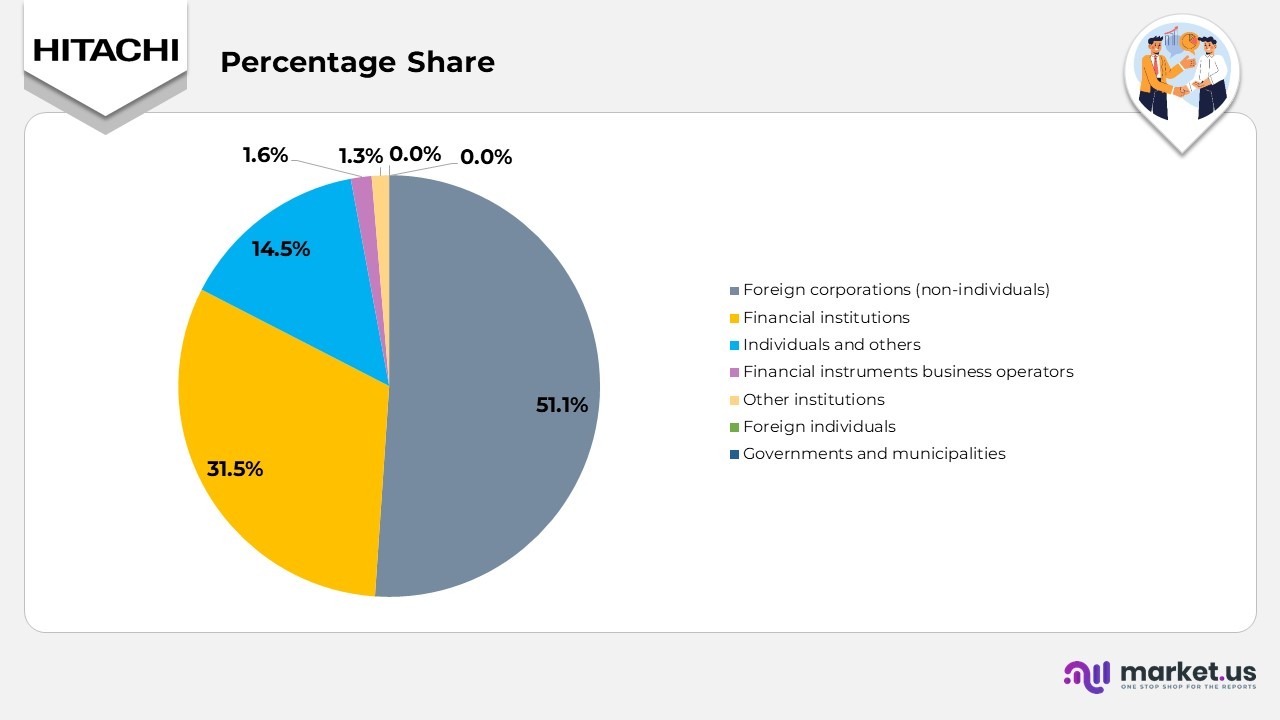

- Hitachi’s total share ownership stands at 9,249,901 units, reflecting a broad mix of domestic and international investors.

- 07% of the shares are held by foreign corporations (non-individuals), making them the largest shareholder group and the primary institutional owners.

- Financial institutions hold 48% of total shares, indicating strong backing from major banking and insurance entities.

- Individuals and others account for 52%, forming the company’s main retail investor base.

- Foreign individuals represent a minimal 01% share of ownership.

- Financial instruments business operators hold 59%, reflecting limited participation from brokerage-related entities.

- Other institutions hold 32%, representing a small but diverse category of organizational shareholders.

- Governments and municipalities hold 00%, confirming no direct public-sector ownership.

(Source: Hitachi Ltd. Annual Report)

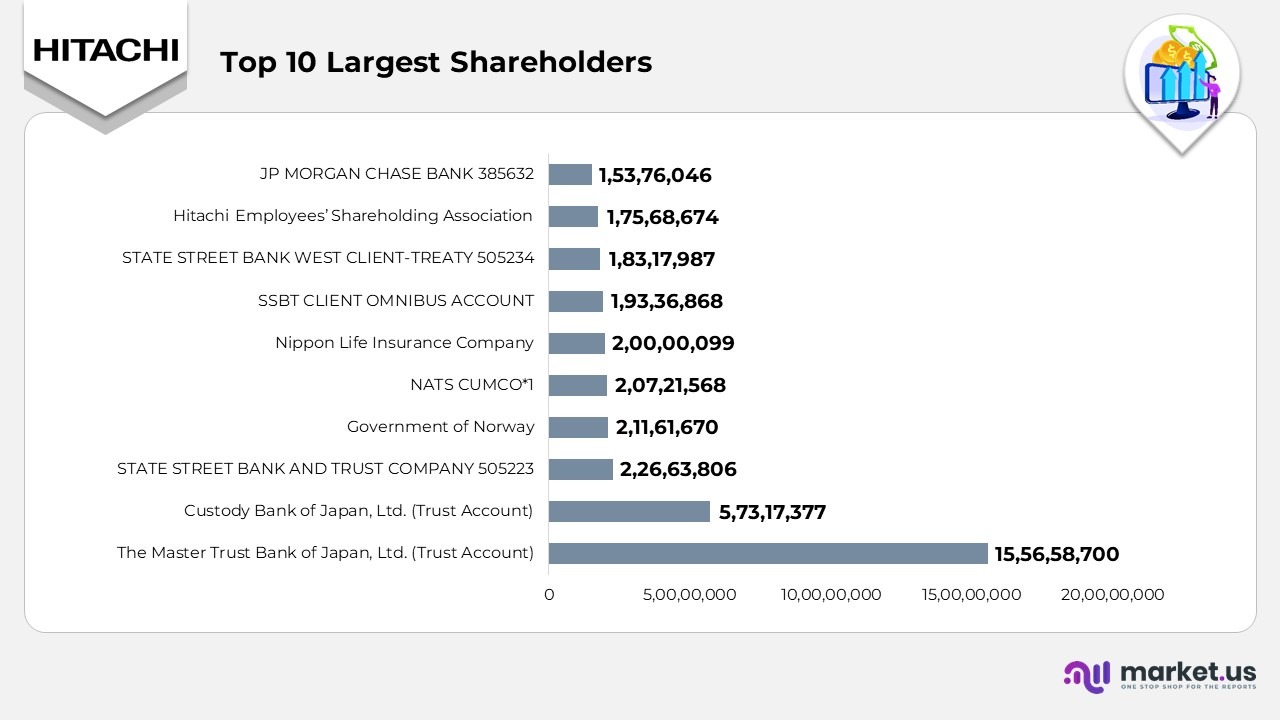

Largest Shareholders of Hitachi

- The Master Trust Bank of Japan, Ltd. (Trust Account) holds the leading position with 155,658,700 shares, representing a 80% ownership ratio, making it the dominant institutional stakeholder.

- The Custody Bank of Japan, Ltd. (Trust Account) follows as the second-largest shareholder, holding 57,317,377 shares and a 6.19% stake, which underscores its significant presence in Hitachi’s ownership structure.

- State Street Bank and Trust Company, with 505223, owns 22,663,806 shares, accounting for a 45% stake, reflecting solid international institutional interest.

- The Government of Norway holds a significant stake with 21,161,670 shares, representing a 28% ownership share.

- NATS CUMCO*1 holds 20,721,568 shares, representing a 24% stake, marking it as another key foreign institutional investor.

- Nippon Life Insurance Company contributes 20,000,099 shares, equivalent to 16%, showing strong participation from domestic insurance institutions.

- The SSBT Client Omnibus Account owns 19,336,868 shares, representing 2.15% of total ownership, and demonstrates diversified client-based holdings.

- State Street Bank West Client-Treaty 505234 controls 18,317,987 shares, holding a 98% stake, reinforcing State Street’s multiple account-level positions.

- The Hitachi Employees’ Shareholding Association holds 17,568,674 shares, representing 1.90%, demonstrating employee-level commitment and internal ownership support.

- JP Morgan Chase Bank, with 385632 shares, rounds out the list, reflecting a 66% ownership ratio and demonstrating continued global financial institution involvement.

(Source: Hitachi Ltd. Annual Report)

Hitachi Strategic Shareholding Trend Analysis

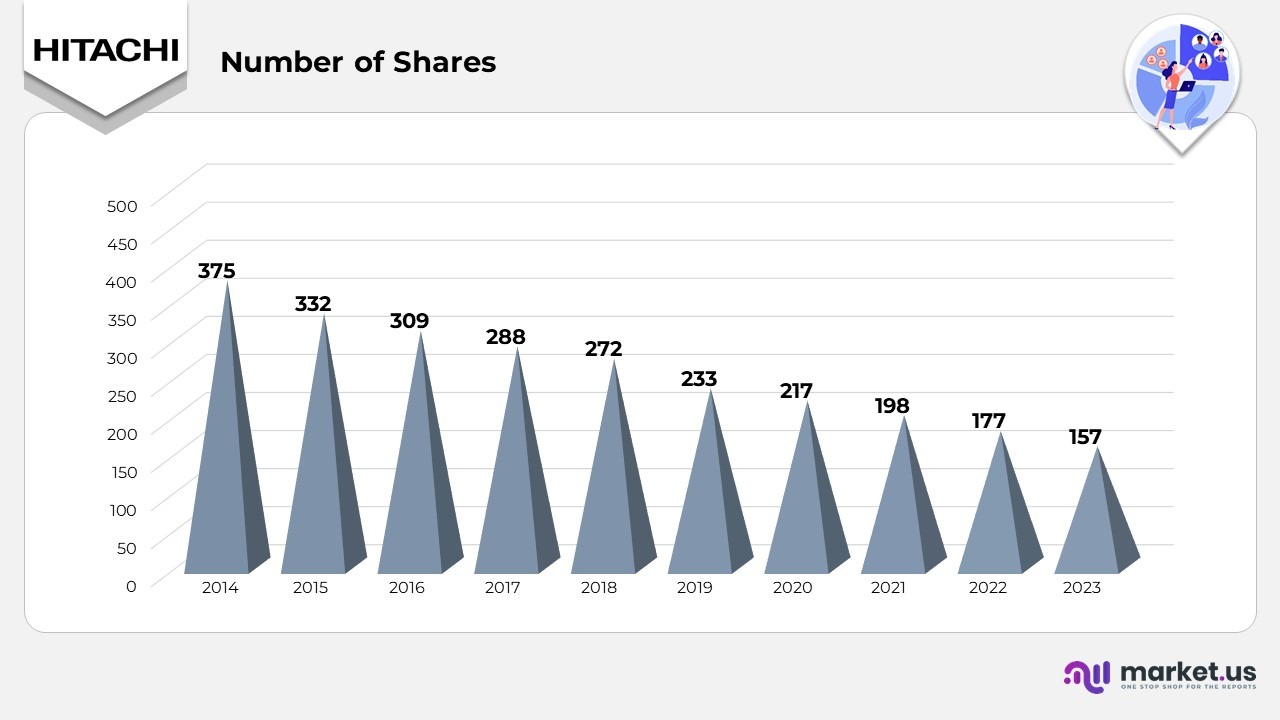

- Hitachi’s strategic shareholdings have steadily declined over the past decade, falling from 375 shares in 2014 to 157 shares in 2023 (FY), reflecting a continued shift toward governance transparency and capital efficiency.

- The reduction accelerated between 2014 and 2018, as shareholdings dropped from 375 to 272, indicating a focused effort to streamline cross-shareholding practices and strengthen balance sheet flexibility.

- From 2019 onward, the pace of reduction continued, with strategic shareholdings decreasing from 233 in 2019 to 157 in 2023 (FY), aligning with global best practices and Hitachi’s portfolio transformation.

- The total amount recorded on the balance sheet also followed a downward trajectory, decreasing from 334,617 million yen in 2014 to 68,336 million yen in 2023, demonstrating a substantial reduction in tied capital and improved strategic asset allocation.

(Source: Hitachi Ltd. Annual Report)

Sustainability Management Indicator

- Hitachi achieved 142 million metric tons of CO₂ avoided emissions (three-year average from FY2022 to FY2024), demonstrating strong progress in supporting global decarbonization efforts.

- The company recorded an 81% reduction in total CO₂ emissions compared to FY2010 levels, reflecting long-term structural improvements in energy efficiency and the integration of renewable sources.

- Hitachi’s digital talent base expanded to 107,000 people, reinforcing the company’s commitment to digital transformation and advanced technology capabilities.

- The employee engagement score reached 5 points, indicating a consistently strong organizational culture and high levels of workforce involvement.

- Women officers accounted for 9% of leadership roles as of June 2025, showing steady progress toward gender-balanced executive representation.

- Non-Japanese executives represented 1% of senior leadership as of June 2025, indicating an increase in global diversity in decision-making positions.

(Source: Hitachi Ltd. Annual Report)

Hitachi Patent Portfolio

Automotive Patents

| Patent No. | Patent Title | Inventor Names |

|---|---|---|

| 9562504 | Fuel pump for an internal combustion engine | Yosuke Tanabe, Jason Abbas, George Saikalis |

| 9836330 | Virtual Resource Management Tool for Cloud Computing Service | Heming Chen, Donald J. McCune, Sujit S. Pharak, Can Wang |

| 9593655 | Fuel delivery system | Donald J. McCune, Harsha Badarinarayan, Pilar Hernandez Mesa, George Saikalis |

| 9618480 | Contact Impedance Measurement Method and Apparatus | Isao Hoda, Hua Zeng, Masayoshi Takahashi, Hiroki Funato |

| 9671033 | Method & apparatus for controlling a solenoid actuated inlet valve | Yosuke Tanabe, Donald J. McCune |

| 9694765 | Control system for an automotive vehicle | Heming Chen, Donald J. McCune, Sujit Phatak, Yuan Xiao |

| 9697321 | Identifying the value of an unknown circuit component in an analog circuit | Yuan Xiao, Donald J. McCune, Can Wang, Heming Chen, Sujit Phatak, Yasuhiro Ito |

| 8823389 | Identifying EMI sources in an electrical system | M. Takahashi, H. Zeng |

| 8698571 | Circuit improving the immunity performance of a vehicle network | M. Takahashi, H. Zeng |

| 8049369 | Power inverter controller and method | H. Funato, L. Shao, K. Maki, G. Saikalis |

| 7911806 | Reducing EMI emissions from a power inverter | H. Funato, L. Shao, M. Torigoe |

| 8594952 | Measuring mechanical power dissipation in a vibratory system | Akira Inoue |

| 8789513 | Fuel delivery system | Donald J. McCune, Harsha Badarinarayan, Pilar Hernandez Mesa, George Saikalis |

| 7980226 | Fuel system for a direct injection engine | Frank Hunt, Harsha Badarinarayan, Takashi Yoshizawa |

| 7406946 | Attenuating fuel pump noise in direct injection engines | Atsushi Watanabe, Harsha Badarinarayan, Jonathan Borg, Donald J. McCune, etc. |

| 7866531 | Multi-sheet structures & manufacturing method | Qi Yang, Harsha Badarinarayan, Frank Hunt, Kazutaka Okamoto |

| 7508682 | Housing for an electronic circuit | Harsha Badarinarayan, Kazutaka Okamoto, Frank Hunt |

| 7778806 | Simulating microcomputer-based systems | Makoto Ishikawa, Shigeru Oho, George Saikalis, Donald J. McCune, Jonathan Borg |

| 8700379 | Simulating microcomputer-based systems | Makoto Ishikawa, Shigeru Oho, George Saikalis, Donald J. McCune, Jonathan Borg |

| 7987075 | Developing multi-core microcomputer-based systems | Yasuo Sugure, Donald J. McCune, Sujit Phatak, George Saikalis |

| 10443595 | Automotive fuel pump | Prashanth Avireddi, Nikhil Seera, Akira Inoue |

| 10281903 | Cavitation erosion-resistant components | Lili Zheng, Wei Yuan, Harsha Badarinarayan |

| 10169928 | Providing data to the hardware-in-the-loop simulator | Heming Chen, Sujit Phatak, Yuan Xiao |

| 10360540 | Fuel measurement for fleet vehicles | Sanketh Dinakara Shetty, Sujit Phatak, Heming Chen |

| 10202663 | Shot treatment for cavitation erosion resistance | Lili Zheng, Wei Yuan |

| 10424132 | Vehicle component failure prevention | Heming Chen, Nikhil Seera, Yuan Xiao, Sujit Phatak |

| 10308257 | Monitoring the respiration of the vehicle operator | Subrata Kumar Kundu |

| 10259468 | Active vehicle performance tuning based on driver behavior | Prashanth Avireddi, Heming Chen |

Data Analytics Patents

| Patent No. | Patent Title | Inventor Names |

|---|---|---|

| 10109122 | Maintenance recommendation based on effectiveness estimation | Ahmed K. Farahat, Chetan Gupta, Hsiu-Khuern Tang |

| 9957781 | Oil & gas rig data aggregation & modeling | Vennelakanti, Sahu, Dayal |

| 9990588 | Predicting production output | Tanuma, Peng, Yoshikawa, Yamasaki, Dayal, Vennelakanti, Sahu |

| 9836449 | Information analysis system | Bin Tong, Hiroaki Ozaki, Makoto Iwayama, etc. |

| 10202826 | Automatic decision cube generation | Ravigopal Vennelakanti, Anshuman Sahu, Umeshwar Dayal |

| 10432477 | Performance monitoring at the network edge | Anshuman Sahu, Chetan Gupta, Song Wang, Umeshwar Dayal |

| 10402511 | Maintenance recommendation via degradation modeling | Ahmed K. Farahat, Chetan Gupta |

| 10340039 | Detecting outlying ICU patients using waveform data | Shuang Feng, Abhay Mehta, Hsiu-Khuern Tang, etc. |

| 10313422 | Prediction & estimation using log and sensor data | Ozaki, Mehta, Tang, Feng, Wang |

| 10466142 | Failure mode & severity analysis | Tomoaki Hiruta, Chetan Gupta |

| 10309372 | Adaptive power generation management | NamQuan Huyn, Chandrasekar Venkatraman |

| 10510167 | Geological formation visualization | Ravigopal Vennelakanti, Christophe Loth, Iwao Tanuma, Anshuman Sahu |

| 10346728 | Nodule detection with false positive reduction | Maojing Fu, Hsiu-Khuern Tang, Abhay Mehta |

| 10453454 | Dialog system with self-learning NLU | Takeshi Homma, Masahito Togami |

| 10579042 | Defect rate analysis in manufacturing | Qiyao Wang, Susumu Serita, Chetan Gupta |

IoT Edge / Network Patents

| Patent No. | Patent Title | Inventor Names |

|---|---|---|

| 8020065 | Packet encoding with unequal error protection | Sudhanshu Gaur |

| 9713009 | Dual connectivity to macro & small cells | Joydeep Acharya, Long Gao, Sudhanshu Gaur |

| 10063405 | Real-time transmission monitoring & anomaly detection | Takeshi Shibata, Miyuki Hanaoka, Hiroaki Shikano, Prasad V. Rallapalli |

| 9801014 | Predictive analytics for idle UE location | Joydeep Acharya, Salam Akoum |

| 10111033 | GIS compression & GPS data reconstruction | Joydeep Acharya, Sudhanshu Gaur |

| 10158534 | Edge processing for data transmission | Joydeep Acharya |

| 10375094 | Wireless sensor network security | Takeshi Shibata, Sudhanshu Gaur |

| 10382466 | Cooperative cloud-edge vehicle anomaly detection | Jeremy Ostergaard |

Platform Patents

| Patent No. | Patent Title | Inventor Names |

|---|---|---|

| — (500+) | Patent applications in storage, IT platform, cloud mgmt, stream analytics | — |

| 10055133 | Automated page-based tier management | Hiroshi Arakawa |

| 10515016 | Caching in software-defined storage | Hideo Saito, Keisuke Hatasaki |

| 10447570 | Caching in software-defined storage | Miyuki Hanaoka |

| 10341703 | Audience interaction measurement for videos | Qifeng Shen |

| 10452299 | Storage system with thin provisioning | Yoshiki Kano, Akira Yamamoto |

| 10331672 | Stream data processing with time adjustment | Toshihiko Kashiyama |

| 10275411 | Management system for a computer system | Kura, Ban, Washio, Fujii, Nogami, Sasanabe, Nakanishi, Uchiyama |

| 10254989 | Data de-duplication storage system | Akio Nakajima |

| 10185636 | Virtualizing the remote copy pair in 3DC configuration | Akira Deguchi, Azusa Jin, Toru Suzuki |

| 10303570 | Data recovery in distributed storage | Akio Nakajima |

| 10180798 | Configure IT infrastructure | Yasutaka Kono |

| 10176098 | Data cache in converged systems | Akira Deguchi |

(Source: Company Website)

Recent Developments

- In November 2025, the company and leading railway operators introduced a joint co-creation program aimed at deploying HMAX technologies across Japan’s rail network to enhance operational efficiency and passenger services.

- In October 2025, the company partnered with Blackstone Energy Transition Partners to enhance its power-infrastructure Service portfolio across North America. As part of the collaboration, Hitachi Energy acquires an equity stake in Shermco, a major provider of maintenance, testing, commissioning, and electrical engineering services, which Blackstone-affiliated funds recently purchased.

- In October 2025, the company formed a strategic partnership with OpenAI, aligning its efforts to design next-generation. Sustainable data centre solutions accelerate the rollout of advanced AI systems aimed at solving large-scale societal and industrial challenges.

- In September 2025, the company announced a CAD 270 million (USD 195 million) investment to expand its large power-transformer manufacturing plant near Montreal, Canada. This expansion will nearly triple the facility’s annual output, solidifying Canada’s position as a global hub for clean energy manufacturing.

- In September 2025, the company entered a collaboration with ELITechGroup S.p.A. to advance molecular diagnostic testing technologies for infectious diseases.

- In September 2025, the company reached an agreement to acquire Synvert, a German AI and data services provider. To accelerate development in Agentic AI and Physical AI, thereby supporting the worldwide growth of the HMAX

- In September 2025, the company unveiled a landmark USD 1 billion manufacturing investment dedicated to boosting the United States’ clean energy future through the large-scale production of essential grid infrastructure components.

(Source: Hitachi Ltd. Press Release)