Company Overview

Cisco Systems Statistics: Cisco Systems, Inc. operates within the global technology and telecommunications industry, designing and delivering a wide portfolio of solutions that power, secure, and extract intelligence from the Internet. The company is embedding artificial intelligence across its networking, security, collaboration, and observability portfolios, while simultaneously enhancing integration across its product ecosystem. Its offerings span advanced networking infrastructure, collaboration tools, comprehensive security solutions, and end-to-end observability technologies.

Cisco enables seamless and meaningful connections across business, education, and social impact domains. Through its hardware, software, and services, the company supports the development of robust networks that provide reliable, real-time access to critical information.

The company operates globally through three primary geographic segments: the Americas, Europe, the Middle East, and Africa (EMEA), and Asia Pacific, Japan, and China (APJC).

(Source: Cisco)

History of Cisco Systems Inc

- 1984: Cisco Systems was established by Leonard Bosack and Sandy Lerner at Stanford University to address the challenge of connecting separate computer networks.

- 1986: The company introduced its first commercial multi-protocol router, allowing different network systems to communicate seamlessly.

- 1990: Cisco went public on Nasdaq, marking the beginning of its accelerated global growth phase.

- 1993–1999: Cisco strengthened its routing, switching, and enterprise networking capabilities through a series of strategic acquisitions.

- 1999–2000: The company rose to become one of the world’s most valuable technology firms during the dot-com boom as internet infrastructure demand surged.

- 1994: Cisco launched the Catalyst switch family, which became a flagship product line in enterprise networking.

- 2000–2010: The company expanded into wireless, security, and collaboration markets with key acquisitions, including Linksys in 2003 and Webex in 2007.

- 2017: Cisco introduced intent-based networking, integrating automation, analytics, and AI to modernize network management.

- 2019–2023: Cisco accelerated its transition toward software-led solutions, subscription models, and hybrid-cloud security offerings.

- 2024–2025: The company continued advancing AI-powered networking, zero-trust security, and multi-cloud connectivity across global enterprises

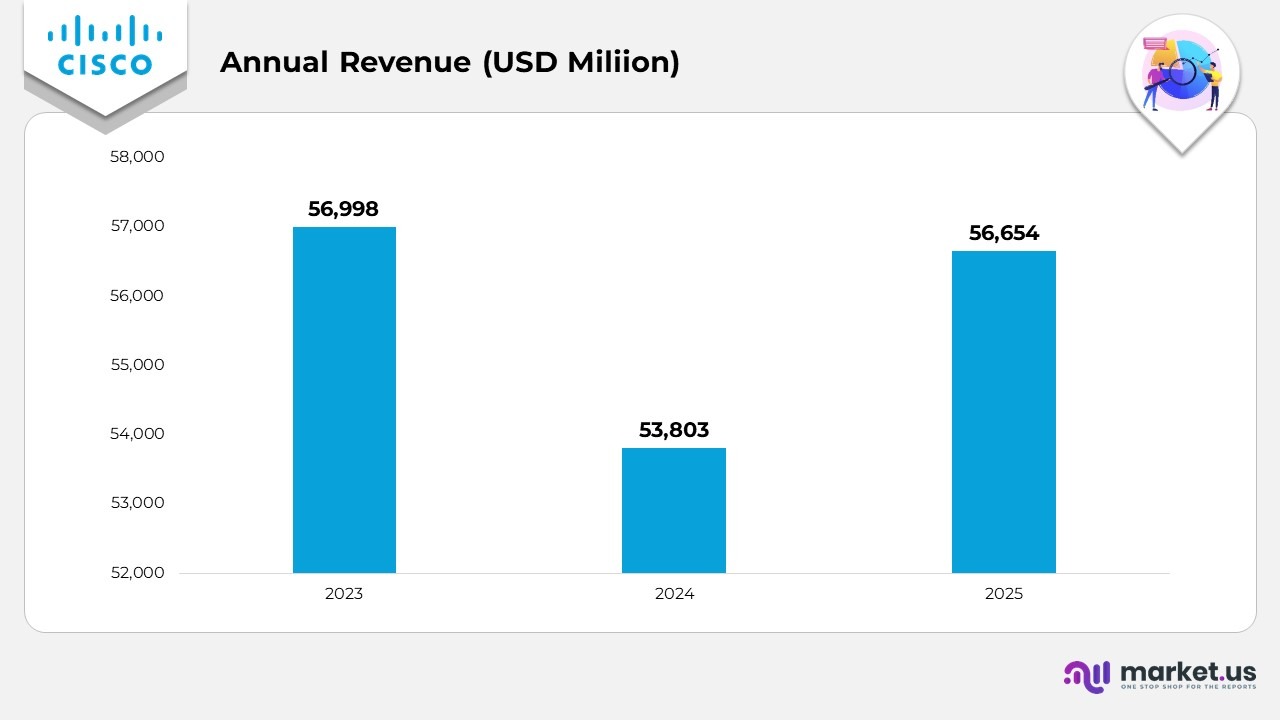

Financial Analysis Cisco Systems Statistics

- Cisco reported USD 56,998 million in revenue in 2023, establishing a strong performance foundation across its core businesses.

- Revenue decreased to USD 53,803 million in 2024, showing a 5.6% year-over-year decline as product demand moderated.

- In 2025, revenue rebounded to USD 56,654 million, reflecting a 5.3% year-over-year increase supported by stronger enterprise investments and AI-enhanced portfolio momentum.

(Source: Cisco Systems, Inc. Annual Reports)

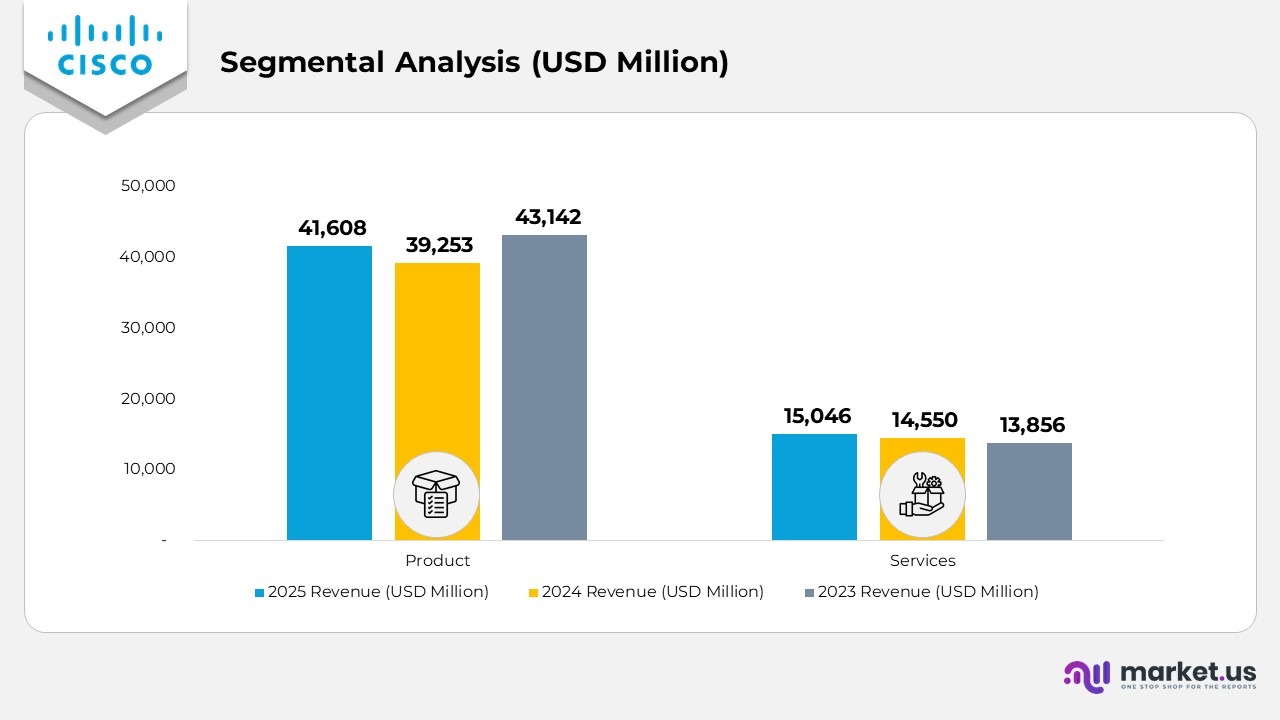

Cisco Systems Statistics By Segmental Analysis

- Product revenue climbed to USD 41,608 million in 2025, improving from USD 39,253 million in 2024, which reflects a 0% YoY rise. Despite this recovery, it remained slightly below the USD 43,142 million posted in 2023, indicating that product demand is rebounding but has not yet fully returned to its earlier peak.

- Services revenue increased to USD 15,046 million in 2025, compared with USD 14,550 million in 2024, marking a 4% YoY increase. This continues the steady momentum seen since 2023, when services generated USD 13,856 million, reinforcing the company’s growing shift toward subscription-based and software-driven revenue streams.

(Source: Cisco Systems, Inc. Annual Report)

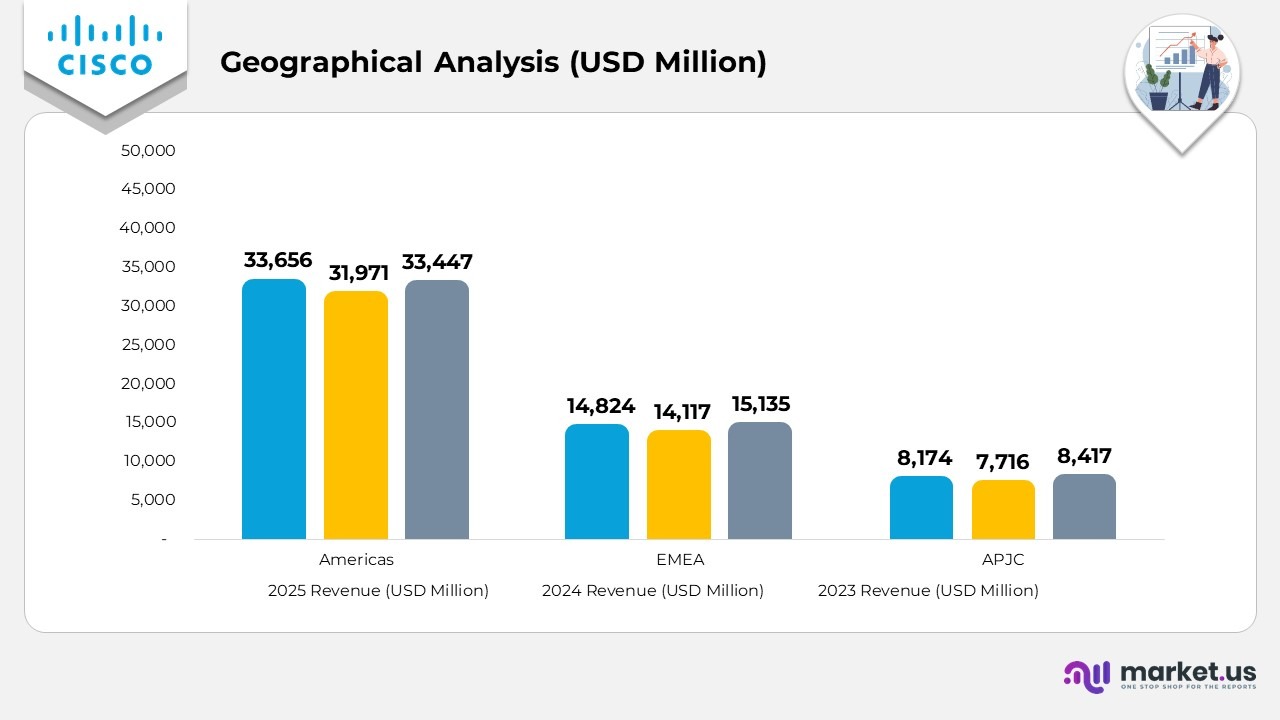

Cisco Systems Statistics By Geographical Analysis

- The Americas region generated USD 33,656 million in 2025, rising from USD 31,971 million in 2024, and nearly matching the USD 33,447 million recorded in 2023. The region consistently contributed 4% of total revenue in both 2025 and 2024, up from 58.7% in 2023, reinforcing its position as Cisco’s strongest revenue base.

- The EMEA region recorded USD 14,824 million in revenue in 2025, slightly above the USD 14,117 million achieved in 2024, although lower than the USD 15,135 million recorded in 2023. Its contribution remained steady at 2% in both 2025 and 2024, compared with 26.6% in 2023, indicating stable performance despite regional macroeconomic pressures.

- The s region delivered USD 8,174 million in 2025, up from USD 7,716 million in 2024, yet slightly below the USD 8,417 million generated in 2023. The segment accounted for 4% of total revenue in 2025, a modest improvement from 14.3% in 2024, although lower than the 14.8% recorded in 2023, highlighting a gradual recovery in Asia-Pacific demand.

(Source: Cisco Systems, Inc. Annual Report)

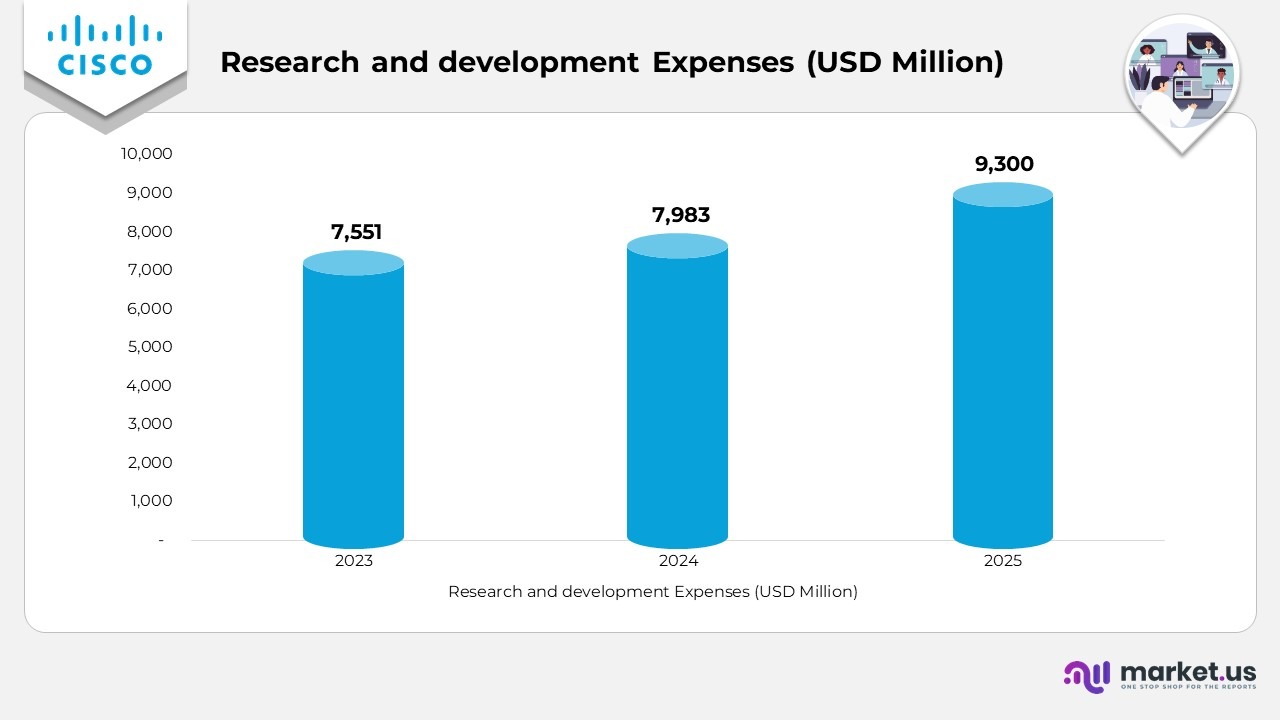

Research and Development Expenses

- Cisco invested USD 7,551 million in research and development in 2023, establishing a strong baseline for innovation across its hardware, software, and networking portfolios.

- R&D spending increased to USD 7,983 million in 2024, reflecting a YoY rise of 5.7% as the company expanded its efforts in AI-driven networking, cloud security, and software automation.

- In 2025, R&D expenditure surged to USD 9,300 million, translating to a YoY growth of 16.5% and highlighting Cisco’s intensified focus on advanced AI integration, next-generation network architectures, and high-value software platforms.

(Source: Cisco Systems, Inc. Annual Report)

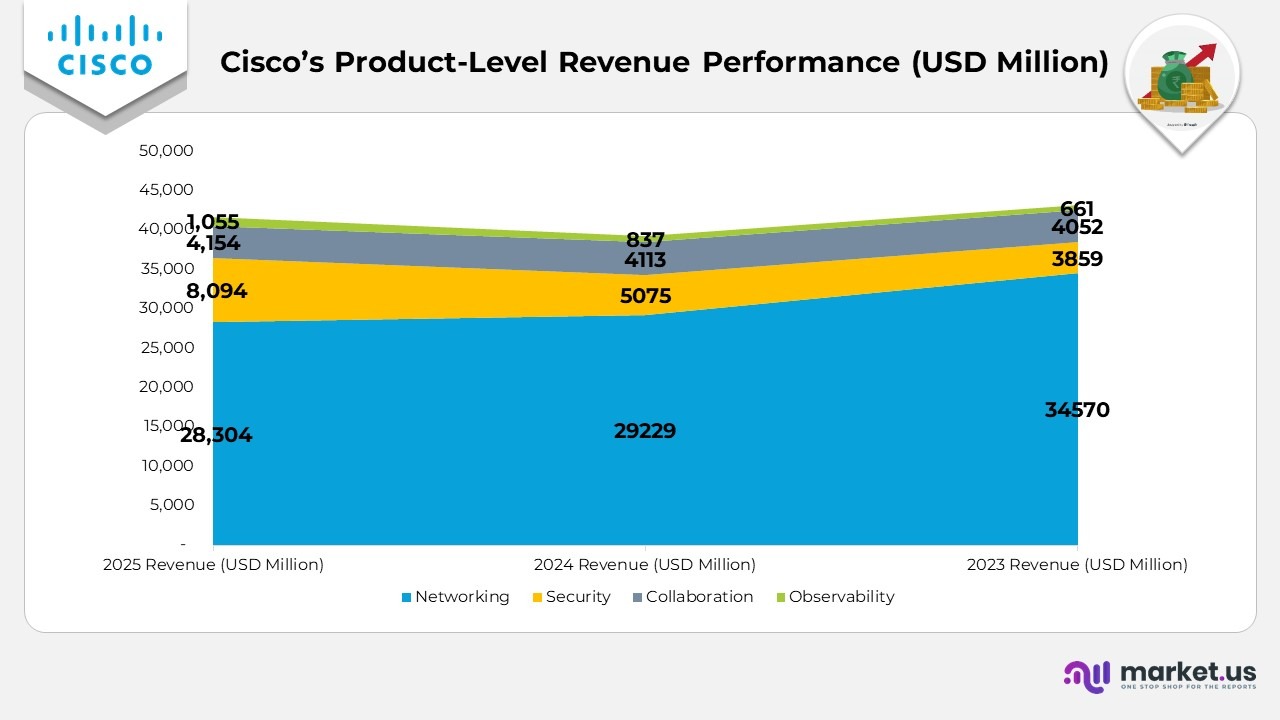

Cisco’s Product-Level Revenue Performance

- Networking revenue reached USD 28,304 million in 2025, down from USD 29,229 million in 2024, marking a YoY decline of 3.2%. Compared to USD 34,570 million in 2023, the segment shows continued normalization, influenced by shifting enterprise hardware spending and longer refresh cycles.

- Security revenue climbed to USD 8,094 million in 2025, rising sharply from USD 5,075 million in 2024, delivering a significant YoY growth of 59.5%. This momentum also reflects strong growth from USD 3,859 million in 2023, driven by heightened global cybersecurity demand and the adoption of AI-powered threat defence.

- Collaboration revenue increased slightly to USD 4,154 million in 2025, compared with USD 4,113 million in 2024, resulting in a modest YoY growth of 1.0%. The segment remained relatively stable, compared to USD 4,052 million in 2023, supported by continued enterprise usage of hybrid work communication tools.

- Observability revenue rose to USD 1,055 million in 2025, up from USD 837 million in 2024, reflecting a strong YoY growth of 26.0%. This also represents a sizable gain from USD 661 million in 2023, underscoring the increasing importance of full-stack visibility solutions in modern cloud environments.

(Source: Cisco Systems, Inc. Annual Report)

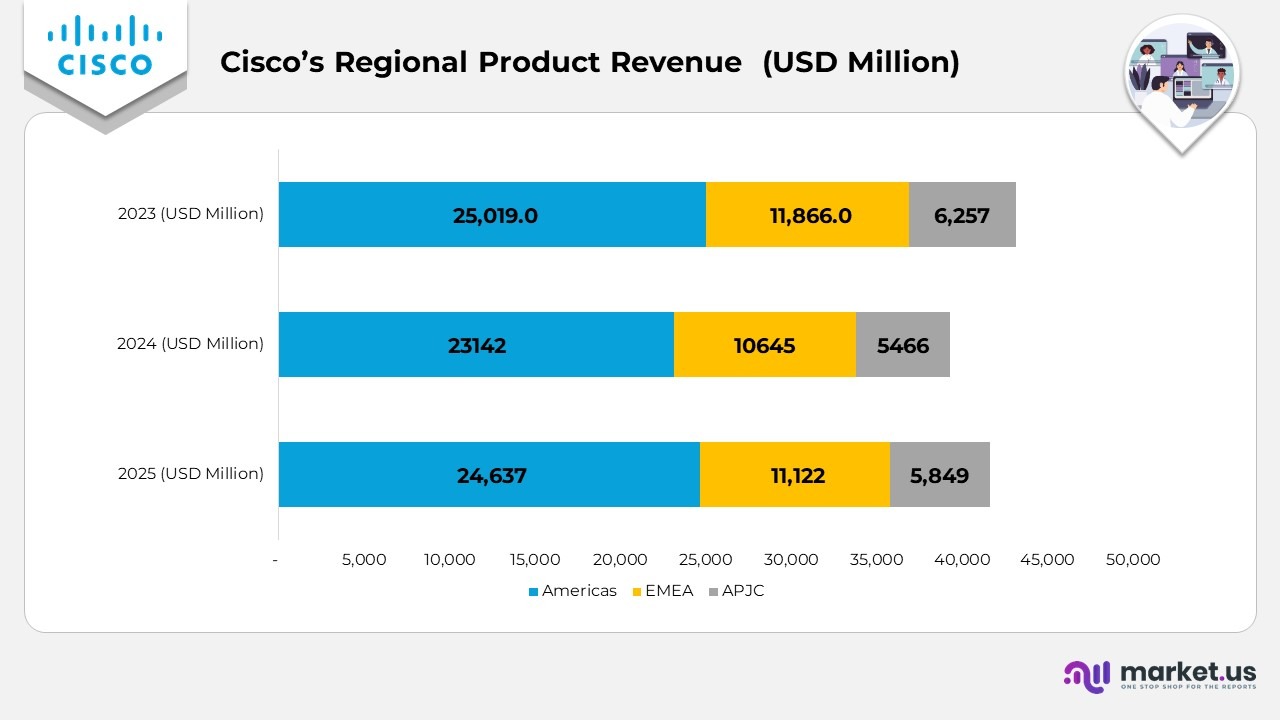

Cisco Regional Product Revenue Systems Statistics

- The Americas region generated USD 24,637 million in product revenue in 2025, rising from USD 23,142 million in 2024, reflecting a 6% year-over-year increase. The segment contributed 2% of total product revenue, supported by stronger enterprise spending and higher AI-infrastructure demand across the United States, Canada, and Brazil.

- EMEA recorded USD 11,122 million in product revenue in 2025, up from USD 10,645 million in 2024, marking a 4% YoY increase. The region accounted for 7% of total product revenue, driven by continued momentum in the public sector and enterprise markets across the United Kingdom, Germany, and France.

- The APJC region delivered USD 5,849 million in 2025, compared with USD 5,466 million in 2024, resulting in a 7% YoY growth. The region represented 1% of total product revenue, supported by rising customer demand in Japan, Australia, India, and China, which grew by 7%, 11%, 10%, and 10%, respectively.

(Source: Cisco Systems, Inc. Annual Report)

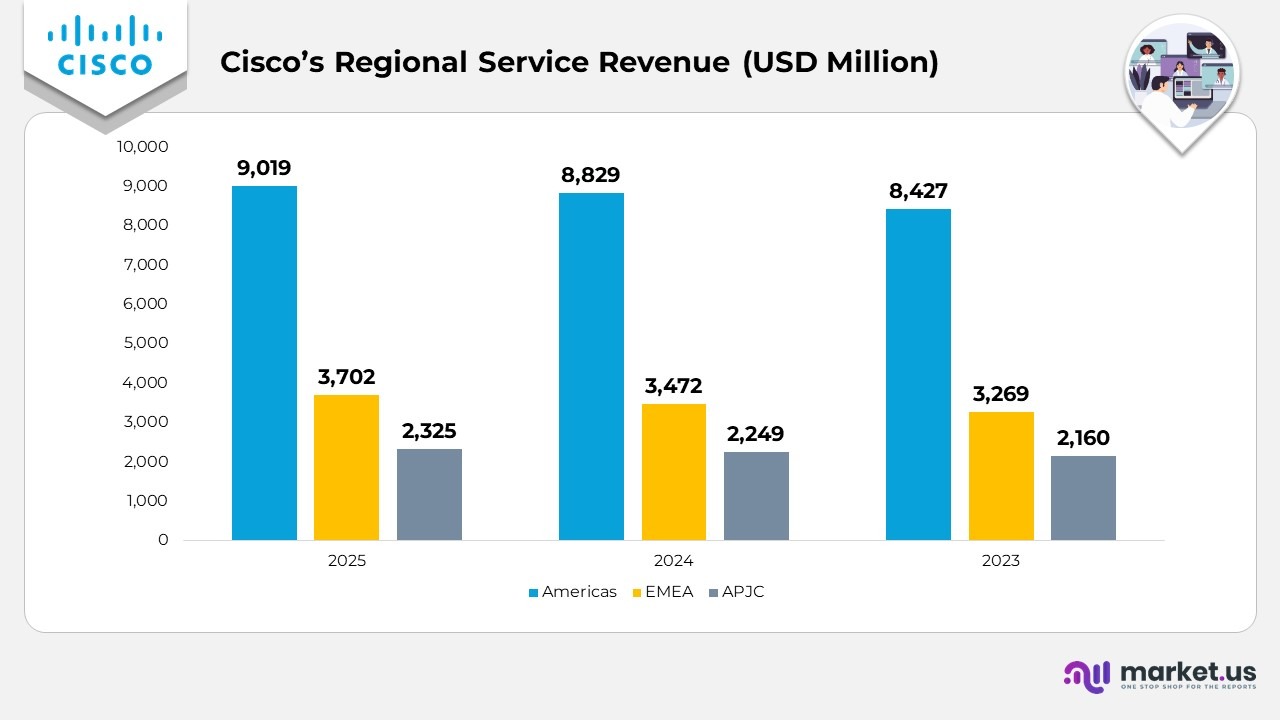

Cisco’s Regional Service Revenue

- The Americas generated USD 9,019 million in services revenue in 2025, up from USD 8,829 million in 2024 and USD 8,427 million in 2023. This reflects a 2% year-over-year increase, supported by strong demand for software, Cloud, and virtualization-related services.

- EMEA recorded services revenue of USD 3,702 million in 2025, compared with USD 3,472 million in 2024 and USD 3,269 million in 2023. The region posted a solid 7% YoY growth, driven by rising enterprise adoption of managed and subscription-based service offerings.

- The APJC region delivered USD 2,325 million in services revenue in 2025, up from USD 2,249 million in 2024 and USD 2,160 million in 2023, resulting in a 3% YoY increase. Growth was supported by expanding service engagements in Asia-Pacific markets and higher uptake of support programs across emerging economies.

- Overall, total services revenue rose to USD 15,046 million in 2025, compared with USD 14,550 million in 2024 and USD 13,856 million in 2023, marking a steady 3% YoY growth fueled by software-centric and recurring service streams.

(Source: Cisco Systems, Inc. Annual Report)

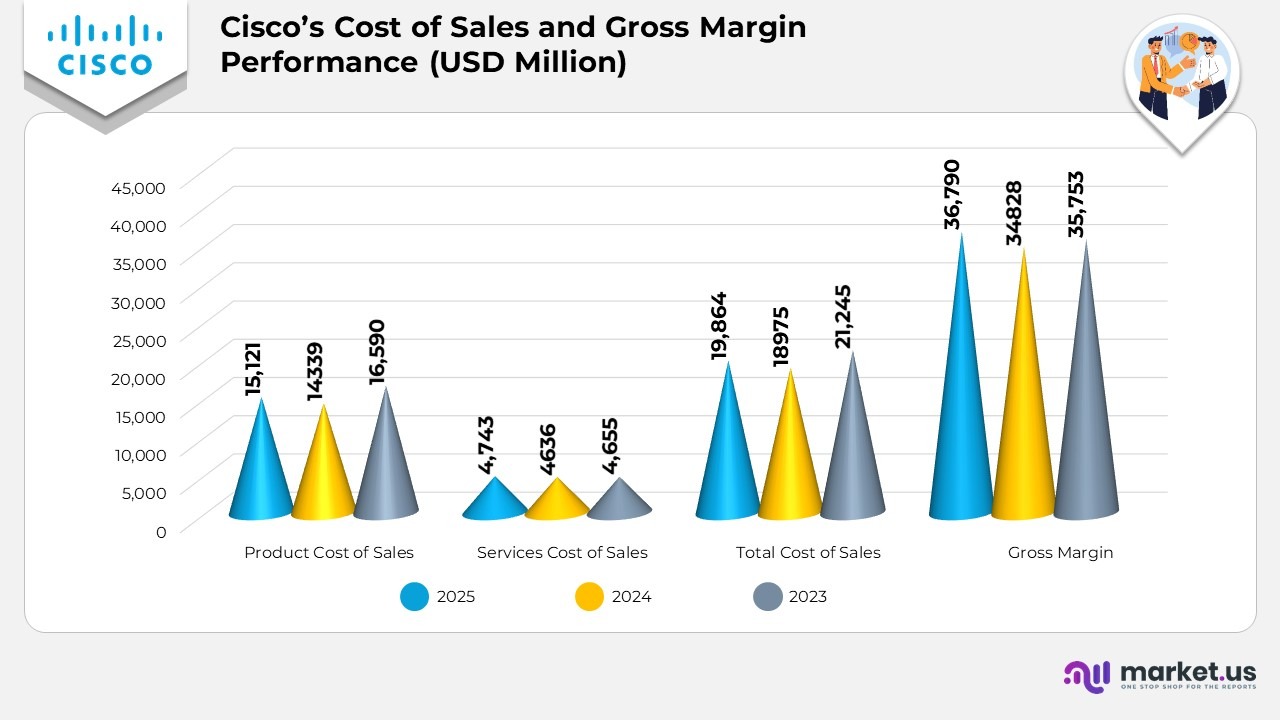

Cisco’s Cost of Sales and Gross Margin Performance

- The cost of product sales reached USD 15,121 million in 2025, compared with USD 14,339 million in 2024 and USD 16,590 million in 2023, exhibiting moderate fluctuations attributed to component pricing, supply-chain normalisation, and changes in product mix.

- Service-related cost of sales totalled USD 4,743 million in 2025, a slight increase from USD 4,636 million in 2024 and USD 4,655 million in 2023, reflecting stable operational expenses associated with software subscriptions, support services, and maintenance contracts.

- The total cost of sales amounted to USD 19,864 million in 2025, up from USD 18,975 million in 2024, but lower than USD 21,245 million in 2023, indicating improved efficiency and stronger cost discipline year over year.

- Cisco recorded a gross margin of USD 36,790 million in 2025, an increase from USD 34,828 million in 2024 and slightly above USD 35,753 million in 2023, indicating enhanced profitability supported by a higher mix of software and recurring revenue offerings.

(Source: Cisco Systems, Inc. Annual Report)

Cisco’s Patents and Applications

| Rephrased Title | Publication / Patent No. | Type | Filed | Publication / Patent Date |

|---|---|---|---|---|

| Cache Optimization Using Semantic Diversity for Text Queries | 20250328566 | Application | April 22, 2024 | October 23, 2025 |

| Adaptive Similarity Thresholding for Language Model Query Caches | 20250328554 | Application | April 22, 2024 | October 23, 2025 |

| Automated Neighbor Discovery in Mixed-Radio Wireless Environments | 12452778 | Grant | March 28, 2024 | October 21, 2025 |

| Physical Network Orchestration for Data Centers | 12452128 | Grant | June 16, 2021 | October 21, 2025 |

| Energy-Aware Network Topology Management | 12452131 | Grant | March 31, 2023 | October 21, 2025 |

| Seasonal Forecasting Parameters for Ultra-Short-Term Resource Predictions | 12452141 | Grant | October 24, 2023 | October 21, 2025 |

| Resource-Efficient Telemetry for Constrained Devices | 12452712 | Grant | May 15, 2023 | October 21, 2025 |

| Dual-Mode Wi-Fi Access Point Operation in Shared & Non-Shared Channels | 12452701 | Grant | June 9, 2022 | October 21, 2025 |

| Cloud-Based L2/L3 Gateway Integration via Enhanced Service Nodes | 12452171 | Grant | April 10, 2024 | October 21, 2025 |

| Intelligent API Endpoint Redirection via DNS Analysis | 12452283 | Grant | June 2, 2023 | October 21, 2025 |

| Model Selection for AI Tasks Using Prompt Processing Units | 20250321852 | Application | October 30, 2024 | October 16, 2025 |

| Network Device Cluster Emulation for Simulating Network Behavior | 20250323830 | Application | April 15, 2024 | October 16, 2025 |

| Chunk-Level Access Control for Retrieval-Augmented Generation | 20250322087 | Application | October 30, 2024 | October 16, 2025 |

| Task Authorization Framework for Generative AI Using Prompt Processing Units | 20250322092 | Application | October 30, 2024 | October 16, 2025 |

| ROI Estimation for AI Tasks Using Prompt Processing Units | 20250321798 | Application | October 30, 2024 | October 16, 2025 |

| Dual-Lens Optical Coupling System for Multicore Fibers | 12442991 | Grant | February 2, 2023 | October 14, 2025 |

| Client IP Anonymization via Address Translation Mechanisms | 12445407 | Grant | August 24, 2023 | October 14, 2025 |

| Preview-Based Index Configuration Before Index Store Integration | 12443656 | Grant | December 19, 2023 | October 14, 2025 |

| Dynamic WLAN Access Point Configuration for Optimized Performance | 12446056 | Grant | February 6, 2023 | October 14, 2025 |

| Dual-Layer Antisymmetric Bragg Gratings for Optical Bandpass Filtering | 12442981 | Grant | February 13, 2023 | October 14, 2025 |

(Source: Justia Patents)

Recent Developments

- In November 2025, Cisco unveiled the core components of its upcoming Cisco 360 Partner Program, scheduled for launch on January 25, 2026. Co-created with partners, the program aims to boost partner profitability and strengthen customer outcomes. With AI expected to account for most partner revenue within five years, the refreshed framework encourages partners to innovate in overcoming infrastructure limitations, data challenges, and talent shortages. It also deepens ecosystem-wide collaboration and empowers partners to build AI-ready data centers, resilient workplaces, and secure digital environments.

- In November 2025, the company introduced Cisco IQ, an AI-driven digital interface designed to unify real-time insights, automated assessments, troubleshooting tools, and personalized learning into a single, integrated professional services and support experience.

- In October 2025, Cisco expanded its collaboration with King Abdullah University of Science and Technology (KAUST) by establishing a next-generation AI Institute. The initiative merges Cisco’s global leadership in networking, cybersecurity, and AI-scale infrastructure with KAUST’s advanced research capabilities and strategic influence in education. The participation of His Royal Highness highlights the national importance of advancing Saudi Arabia’s research and innovation agenda.

- In October 2025, Cisco partnered with NVIDIA and other collaborators to introduce the world’s first AI-native wireless stack for 6G, setting a foundation for next-generation telecom connectivity. The solution offers enterprises, telecom operators, and cloud providers the flexibility and interoperability needed to deploy, manage, and secure AI infrastructure at massive scale.

- In October 2025, Cisco expanded its strategic initiatives to strengthen secure AI infrastructure across various regions, reinforcing its long-term vision of building trusted, high-performance digital ecosystems for the AI era.

Moreover

- In October 2025, Cisco worked with the City of Los Angeles and local nonprofits to deliver free public internet access throughout major streets, parks, and community hubs across LA’s historic Crenshaw Corridor.

- In September 2025, the company introduced new workplace solutions that enhance collaboration between humans and AI agents. These include upgraded agentic capabilities in Cisco AI Assistant, RoomOS 26 for Cisco Devices, and deeper integrations with the Webex Suite, all designed to simplify digital agent management and improve hybrid teamwork.

- In May 2025, Cisco agreed to join the Stargate UAE Consortium as a preferred technology partner, providing advanced networking, observability, and security solutions to speed up the rollout of next-generation AI compute clusters.

- In May 2025, the company strengthened its engagement in France by launching new strategic initiatives, including a Global AI Hub to support innovation, training, and digital transformation.

- In May 2025, Cisco expanded its partnership with Saudi Arabia, aligning with national initiatives to accelerate AI adoption, build secure infrastructure, and cultivate digital talent.

- In May 2023, Cisco collaborated with the AI Infrastructure Partnership to promote investment in modern data centers and AI-enabling infrastructure across priority markets.

- In May 2025, Cisco partnered with G42 to advance AI innovation and infrastructure development, supporting the creation of scalable, secure, and energy-efficient AI ecosystems.

- In April 2025, the company partnered with ServiceNow to simplify enterprise AI adoption through secure, automated, and operationally streamlined workflows, enabling organizations to integrate AI at scale.

(Source: Cisco Systems, Inc. Press Release)