Company Overview

BASF SE Statistics: BASF SE is a global chemical manufacturer engaged in producing, marketing, and supplying a broad portfolio that includes chemicals, plastics, performance products, and crop protection solutions. Its offerings span solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, coatings, food ingredients, fungicides, and herbicides, supporting a wide spectrum of industrial applications.

The company’s operations are structured across six core business segments: Chemicals, Materials, Surface Technologies, Agricultural Solutions, Industrial Solutions, and Nutrition & Care.

In the 2024 business year, BASF employed 111,822 people across 92 countries and operated 235 production sites worldwide. Its global manufacturing footprint includes six large-scale Verbund sites located in Geismar (Louisiana), Freeport (Texas), Ludwigshafen (Germany), Antwerp (Belgium), Kuantan (Malaysia), and Nanjing (China). A seventh Verbund site is currently being built in Zhanjiang, China, with start-up planned for the fourth quarter of 2025.

BASF provides products and services to approximately 74,000 customers across industries such as construction, furniture, agriculture, electronics, automotive, paints and coatings, home care, nutrition, and chemicals, making it one of the most diverse suppliers in the global chemical industry.

History of BASF SE

- 1865: BASF was established in Mannheim as Badische Anilin- & Sodafabrik, beginning its journey with the production of synthetic dyes and foundational chemicals.

- 1865–1866: The company shifted operations to Ludwigshafen, creating the site that would evolve into BASF’s long-term global headquarters.

- Late 1860s: BASF formed one of the earliest dedicated chemical R&D groups under Heinrich Caro, thereby strengthening its innovation capabilities.

- 1870s–1880s: The company expanded its activities into ammonia, fertilizers, and other industrial chemicals, moving beyond its original dye-focused operations.

- 1877: BASF set up its first international manufacturing facility near Moscow, marking the beginning of its global production footprint.

- Early 1900s: BASF researchers contributed to transformative scientific advancements, most notably the Haber-Bosch ammonia synthesis process, which revolutionized modern agriculture.

- 1925: BASF became part of the IG Farben conglomerate, integrating with other German chemical companies under a unified industrial structure.

- 1952: Following the dissolution of IG Farben, BASF regained independence and re-established itself as BASF AG.

- 1960s–1980s: The company diversified into plastics, coatings, crop protection, and petrochemicals, expanding internationally through new plants and acquisitions.

- 2008: BASF adopted the legal form BASF SE (Societas Europaea), reflecting its broadened European and global operating structure.

- 2010s: Global expansion continued, with major investments in Asia-Pacific, North America, and the Middle East, reinforcing BASF’s presence in high-growth markets.

- 2020s: BASF accelerated sustainability commitments and invested in circular economy technologies while initiating construction of its large-scale Verbund site in Zhanjiang, China—one of its most significant projects to date.

(Source: Company Website)

Employee Analysis

- The total workforce reached 111,822 employees as of December 31, 2024, a slight decrease from 111,991 at the end of 2023.

- The reduction primarily stemmed from retirements, exits related to dormant employment, and workforce adjustments driven by the Europe-focused cost savings program.

- Employee additions in Asia Pacific, especially for the new Verbund site in Zhanjiang, China, helped partially offset the overall decline.

- The reported headcount includes employees from joint operations, counted based on BASF’s ownership share.

- As of December 31, 2024, a total of 1,234 employees were working in joint operations, up from 1,210 in the prior year.

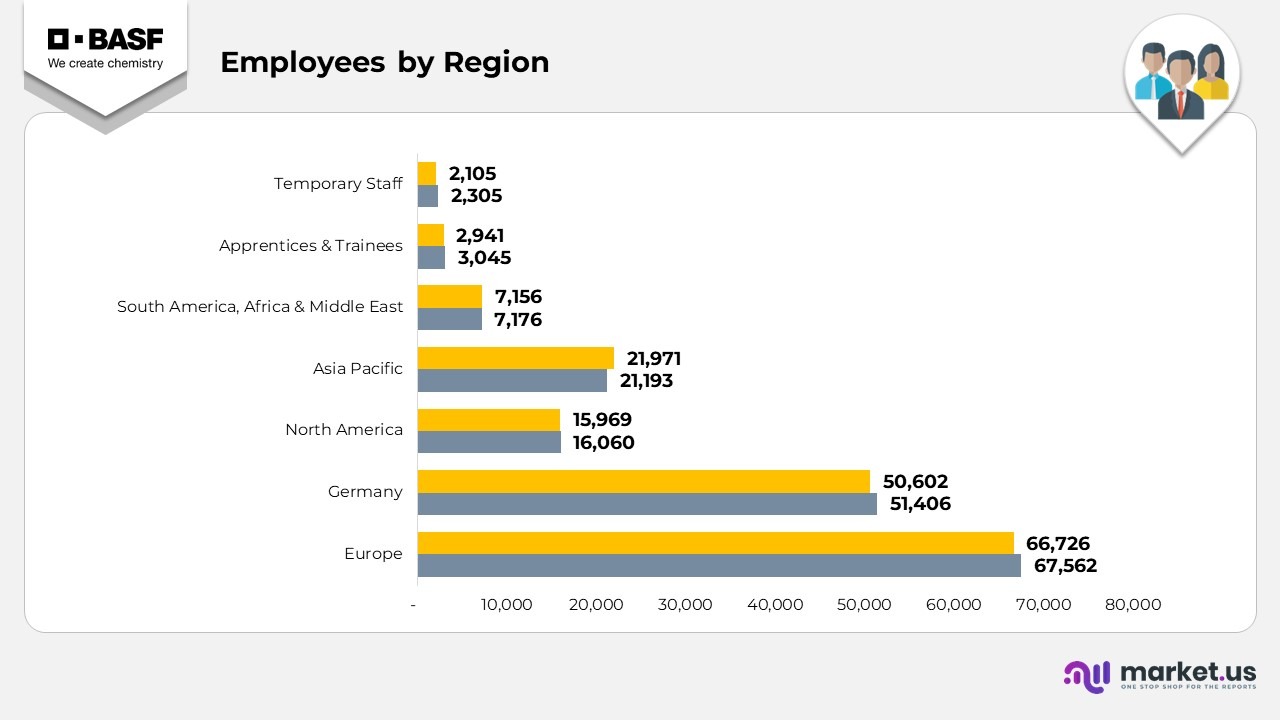

Employees by Region

- Europe recorded 66,726 employees in 2024, slightly lower than 67,562 in 2023.

- Germany had 50,602 employees in 2024, up from 51,406 in 2023.

- North America reported 15,969 employees in 2024, marginally below 16,060 employees in 2023.

- Asia Pacific had 21,971 employees in 2024, up from 21,193 in 2023.

- South America, Africa, and the Middle East employed 7,156 individuals in 2024, almost unchanged from 7,176 in 2023.

- Apprentices and trainees totaled 2,941 in 2024, slightly below 3,045 in 2023.

- Temporary staff accounted for 2,105 employees in 2024, down from 2,305 in 2023.

(Source: BASF SE Annual Report)

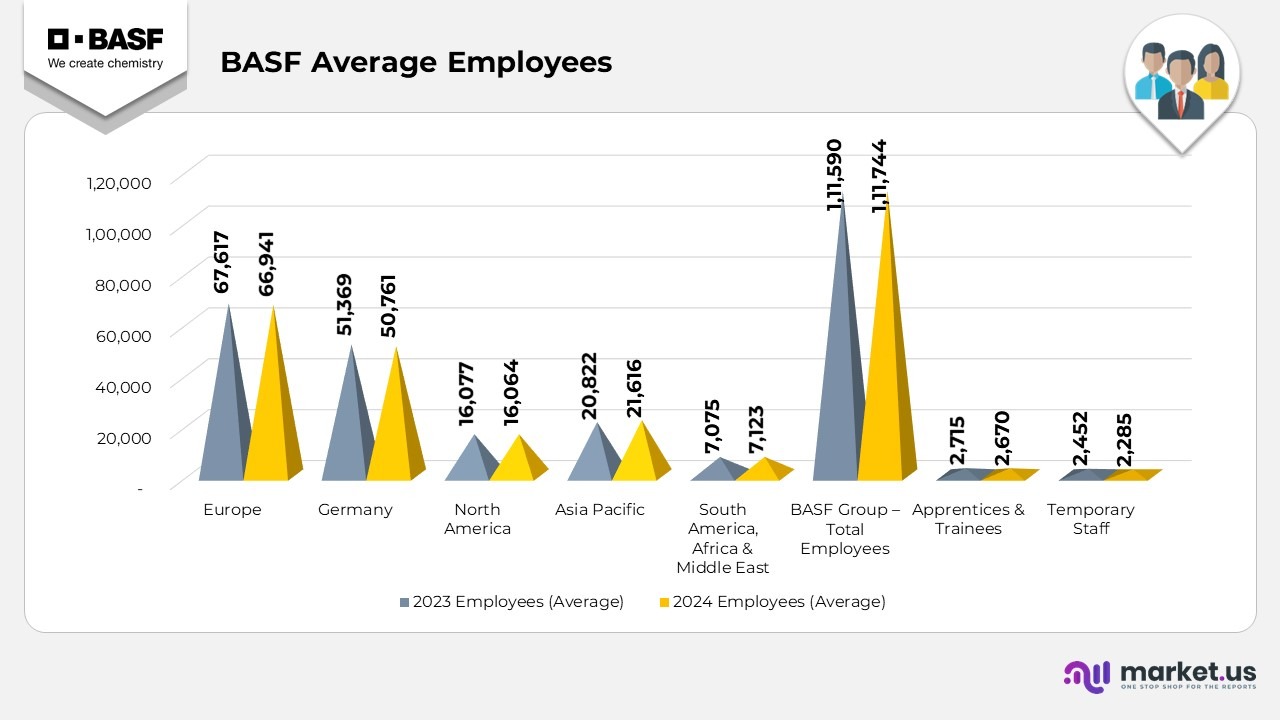

BASF SE Average Employees Statistics

- Europe reported an average workforce of 66,941 employees in 2024, down from 67,617 in 2023, indicating a marginal decline.

- Germany, within Europe, accounted for 50,761 employees in 2024, slightly lower than 51,369 in 2023.

- North America maintained a stable workforce with 16,064 employees in 2024, nearly unchanged from 16,077 in 2023.

- Asia Pacific averaged 21,616 employees in 2024, up from 20,822 in 2023.

- South America, Africa, and the Middle East collectively recorded 7,123 employees in 2024, up from 7,075 in 2023.

- The BASF Group’s overall average employee count reached 111,744 in 2024, slightly higher than 111,590 in 2023.

- The number of apprentices and trainees averaged 2,670 in 2024, compared with 2,715 in 2023.

- Temporary staff averaged 2,285 employees in 2024, declining from 2,452 in 2023.

(Source: BASF SE Annual Report)

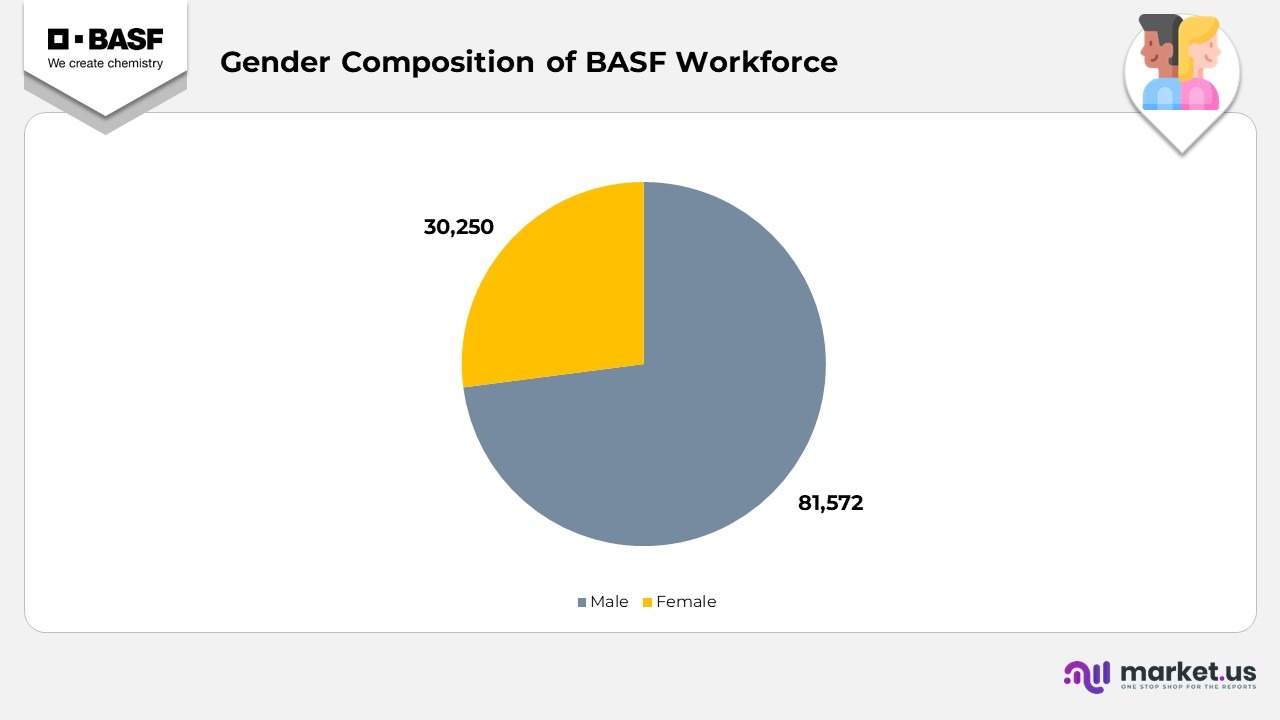

Gender Composition of BASF SE Workforce Statistics

- In 2024, male employees accounted for the largest share of the workforce, totalling 81,572

- Female representation stood at 30,250 employees, representing a significantly smaller share than male staff.

- No employees were listed under the “Not disclosed” gender category.

- Overall, BASF recorded a total workforce of 111,822 employees across all gender categories.

(Source: BASF SE Annual Report)

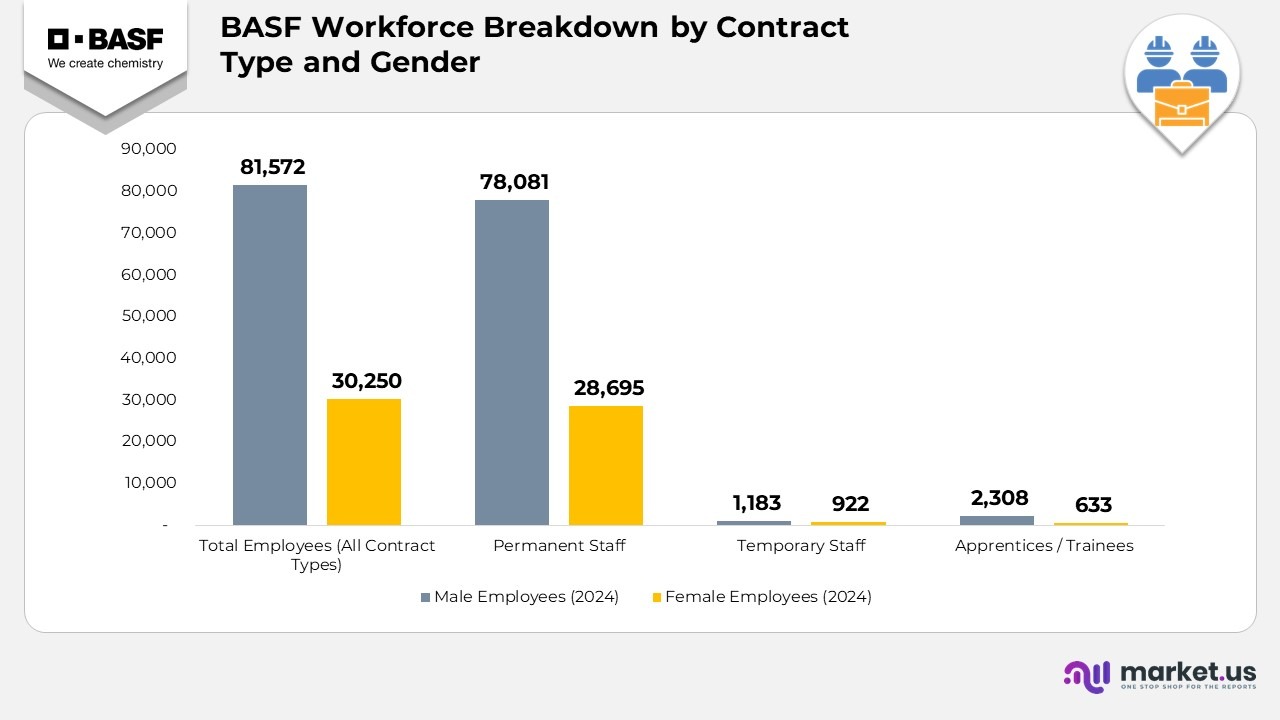

BASF SE Workforce Analysis by Contract Type and Gender Statistics

- In 2024, male employees totalled 81,572, while female employees totalled 30,250 across all contract categories.

- Permanent employment remained the dominant category, comprising 78,081 male and 28,695 female permanent staff members.

- Temporary staffing levels included 1,183 male and 922 female employees, reflecting a relatively small share of the overall workforce.

- Apprenticeship programs engaged 2,308 male apprentices and 633 female apprentices during 2024.

(Source: BASF SE Annual Report)

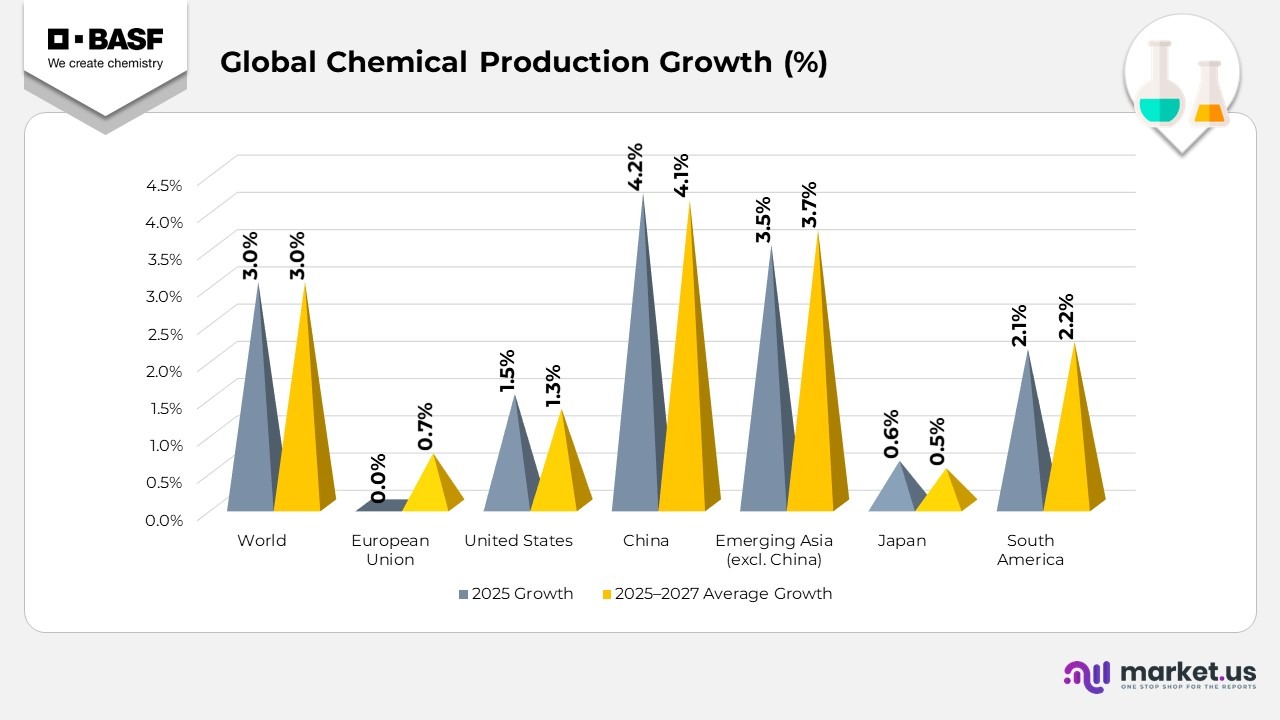

Global Chemical Production Growth

- The global chemical industry is expected to grow by 0% in 2025, with the same 3.0% average annual growth rate projected for 2025–2027.

- The European Union is forecast to see a slight decline of –0.3% in 2025, followed by an average growth of 7% during 2025–2027.

- The United States anticipates expansion of 5% in 2025, easing to an average 1.3% growth rate over 2025–2027.

- China remains the strongest contributor, with production expected to rise 2% in 2025, and average 4.1% growth over 2025–2027.

- The emerging markets of Asia (excluding China) are projected to grow 5% in 2025, increasing to an average of 3.7% during 2025–2027.

- Japan is expected to post modest growth of 6% in 2025, slightly decreasing to 0.5% on average for 2025–2027.

- South America forecasts chemical output growth of 1% in 2025, improving to an average of 2.2% during 2025–2027.

(Source: BASF SE Annual Report)

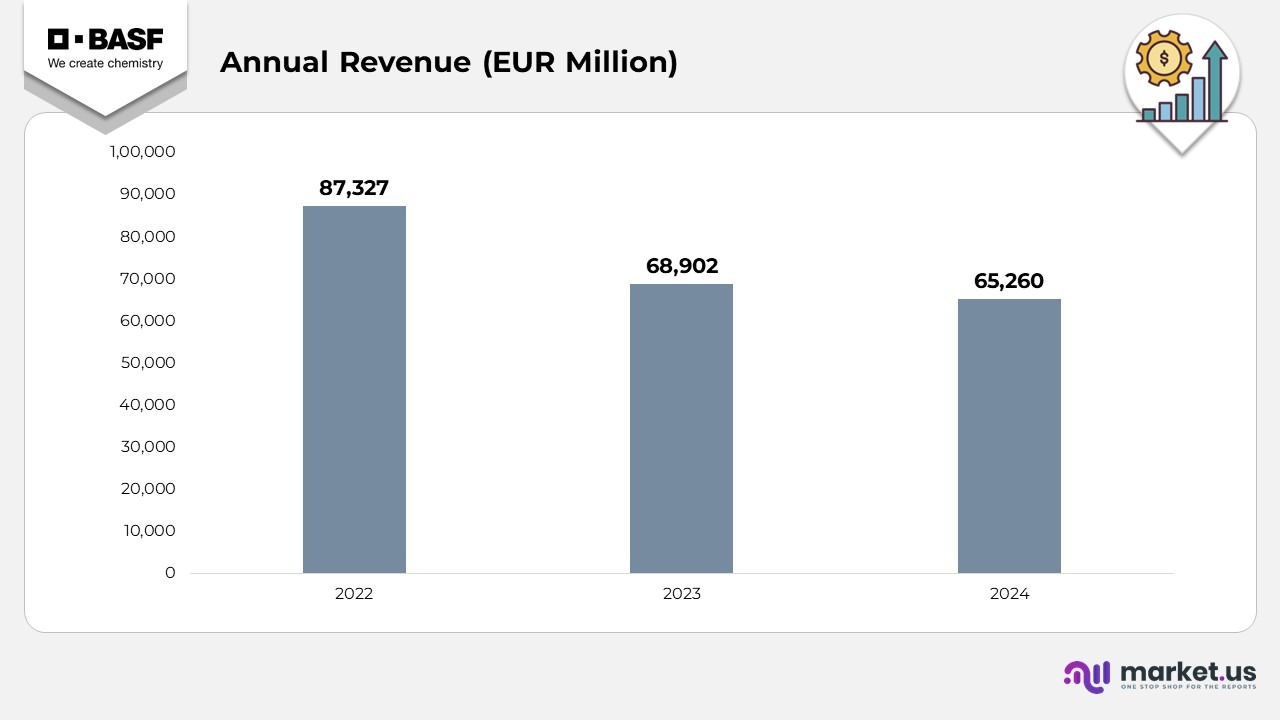

BASF SE Financial Analysis Statistics

- In 2022, revenue reached €87,327 million, marking the highest level within the three years.

- Revenue dropped sharply in 2023 to €68,902 million, a year-on-year decline of €18,425 million from 2022.

- In 2024, revenue further decreased to €65,260 million, reflecting an additional YoY reduction of €3,642 million from 2023.

- Strong volume gains across several core business units, along with moderate growth in Agricultural Solutions, helped offset weaker segments.

- The Surface Technologies division experienced lower sales volumes, largely influenced by sluggish activity in the global automotive sector.

- Overall, improved performance in key segments counterbalanced the downturn in automotive-linked operations.

(Source: BASF SE Annual Report)

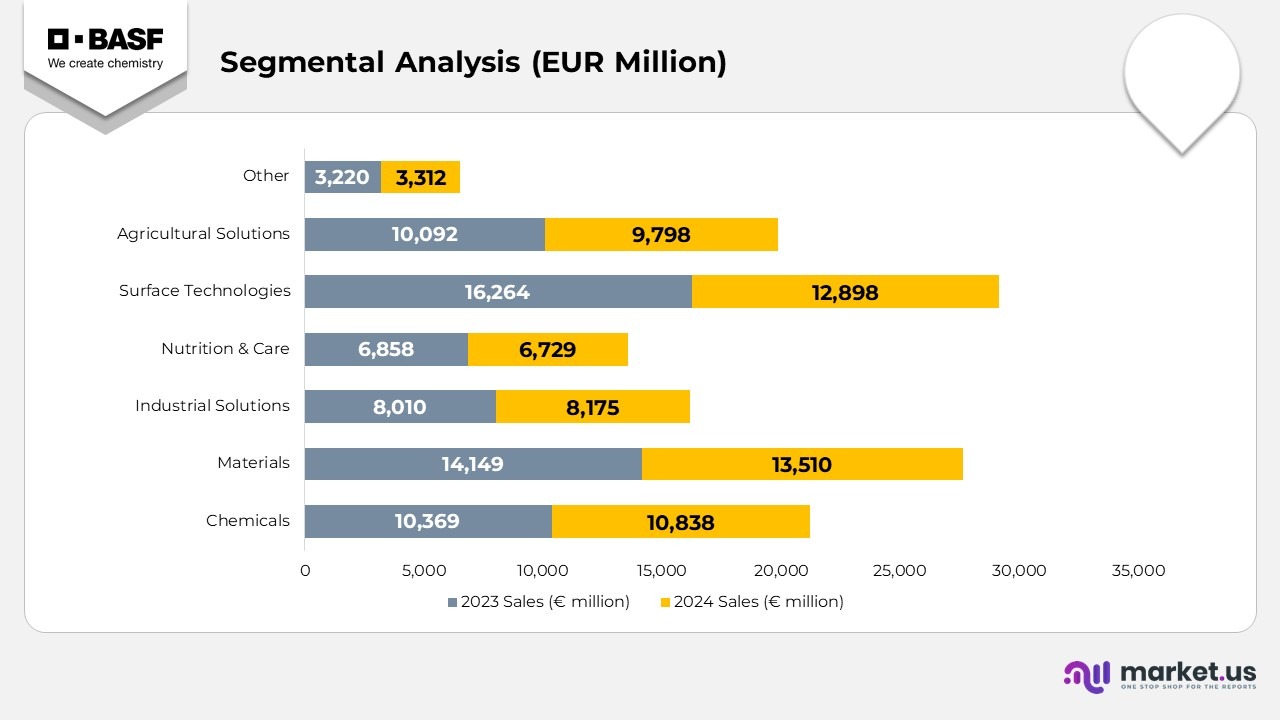

BASF SE Segmental Analysis Statistics

- The Chemicals segment generated €10,838 million in 2024, up from €10,369 million in 2023, supported by strengthening demand for base chemicals and selective price recovery across key intermediates.

- Materials reported €13,510 million in 2024, down from €14,149 million in 2023, mainly due to softer volumes in engineering plastics and continued weakness in construction and automotive applications.

- Industrial Solutions achieved €8,175 million in 2024 versus €8,010 million in 2023, driven by resilient coatings demand and gradual stabilization in industrial manufacturing output.

- Nutrition & Care recorded €6,729 million in 2024, compared with €6,858 million in 2023, reflecting reduced personal care ingredient sales but supported by steady performance in nutrition and home care categories.

- Surface Technologies generated €12,898 million in 2024, significantly lower than €16,264 million in 2023, mainly due to reduced automotive production and lower metal-related revenues, which impacted catalyst businesses.

- Agricultural Solutions posted €9,798 million in 2024, down from €10,092 million in 2023, due to weaker demand for crop protection products and rising price competition across several agricultural markets.

- The Other segment delivered €3,312 million in 2024, up from €3,220 million in 2023, supported by incremental improvements across corporate activities and smaller business units.

Chemicals Division

- The Chemicals division generated €10,838 million in 2024, a slight increase from €10,369 million in 2023, supported by improved demand for base chemicals and the gradual stabilization of feedstock markets.

- Performance Materials recorded €6,843 million in 2024, down from €7,244 million in 2023, due to weaker demand from the automotive and construction sectors.

- Monomers delivered €6,661 million in 2024, down from €6,905 million in 2023, reflecting lower price levels for key intermediates and subdued global industrial activity.

Materials Division

- The Materials division posted €13,510 million in 2024, a decline from €14,149 million in 2023, driven by reduced volumes in engineering plastics due to ongoing softness in consumer goods and mobility applications.

- Dispersions & Resins achieved €5,110 million in 2024, up from €4,921 million in 2023, supported by recovering demand for coatings and adhesives in select end markets.

- Performance Chemicals delivered €3,065 million in 2024, nearly matching €3,088million in 2023, as steady demand for specialty additives helped offset pricing pressure.

Industrial Solutions Division

- Industrial Solutions reported €8,175 million in 2024, slightly higher than €8,010 million in 2023, reflecting resilient demand for industrial chemicals despite volatile manufacturing output.

- Care Chemicals generated €4,751 million in 2024, roughly in line with €4,721 million in 2023, supported by stable consumption in the home and personal care sectors.

- Nutrition & Health posted €1,978 million in 2024, down from €2,137 million in 2023, due to lower demand for food ingredients and API-related materials.

Nutrition & Care Division

- The Nutrition & Care division registered €6,729 million in 2024, down from €6,858 million in 2023, due to softer performance in personal care ingredients and slower-than-expected recovery in premium consumer categories.

- Catalysts reported €6,617 million in 2024, down from €11,818 million in 2023, reflecting a sharp correction driven by lower precious metal prices and structural shifts in catalyst-related revenue reporting.

- Coatings delivered €4,280 million in 2024, slightly below €4,387 million in 2023, with demand impacted by lower construction activity and muted automotive refinishing volumes.

Surface Technologies Division

- Surface Technologies generated €12,898 million in 2024, down significantly from €16,264 million in 2023, driven by reduced global automotive production and lower metal market valuations.

- Fungicide sales reached €3,014 million in 2024, a minor decrease from €3,047 million in 2023, driven by lower disease pressure and reduced application intensity in certain regions.

- Herbicides posted €2,965 million in 2024, compared with €3,380 million in 2023, reflecting strong competition and inventory adjustments by farmers.

- Insecticides delivered €1,102 million in 2024, up slightly from €1,041 million in 2023, supported by stable pest pressure in key agricultural belts.

- Seed Treatment contributed €598 million in 2024, down from €662 million in 2023, due to softer planting activity and a shifting crop mix.

- Seeds & Traits recorded €2,119 million in 2024, improving from €1,962 million in 2023, driven by stronger demand for modern seed technologies.

Agricultural Solutions Division

- Agricultural Solutions posted €9,798 million in 2024, down from €10,092 million in 2023, driven by weaker global crop protection spending and increased pricing pressure in competitive markets.

Other Segment

- The Other segment reached €3,312 million in 2024, up from €3,220 million in 2023, supported by improved operational efficiencies and better performance in miscellaneous portfolio businesses.

(Source: BASF SE Annual Report)

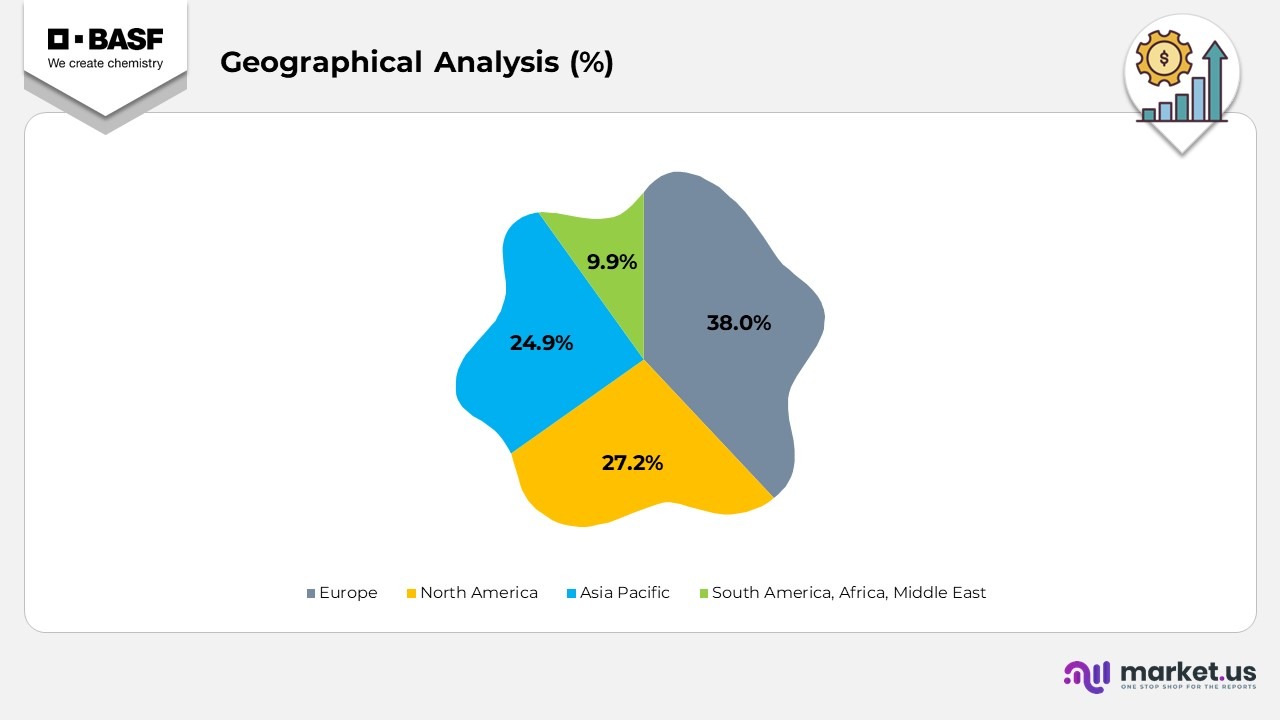

Geographical Analysis

- Europe accounted for the largest share of BASF’s 2024 sales, representing 0% of total customer-based revenue.

- North America accounted for 27.2% of overall sales, reflecting its position as the company’s second-largest regional market.

- Asia Pacific represented 9% of BASF’s 2024 sales, supported by continued industrial growth and expanding customer demand in key Asian economies.

- South America, Africa, and the Middle East accounted for 9% of sales, marking the smallest regional share but still offering growth potential in select emerging markets.

(Source: BASF SE Annual Report)

BASF Shareholder Structure

- BASF has over 900,000 shareholders, making it one of the largest publicly listed companies with a significant free-float structure.

- As of September 2025, institutional investors from Canada and the United States accounted for the largest regional group, holding approximately 23% of BASF’s share capital.

- Institutional investors based in Germany accounted for 4% of the outstanding shares.

- Investors from Ireland and the United Kingdom held 7% of BASF’s capital.

- Institutional shareholders from the rest of Europe made up an additional 10% of total shareholdings.

- Institutional investors from the rest of the world, including Asia Pacific, accounted for 3% of the company’s shares.

- Private investors represent the largest single category, holding approximately 46% of BASF’s share capital, with almost all of them residing in Germany.

- Due to this strong retail investor presence, BASF remains one of the DAX 40 companies with the highest proportion of private shareholders.

(Source: Company Website)

BASF SE Patents

| Patent / Application No. | Title | Type | Filing Date | Grant / Publication Date |

|---|---|---|---|---|

| 12472506 | Jet mill | Grant | November 18, 2021 | November 18, 2025 |

| 12476276 | Lithium-ion conducting haloboro-oxysulfides | Grant | June 16, 2020 | November 18, 2025 |

| 20250346794 | Antifreeze concentrate with corrosion protection | Application | November 29, 2022 | November 13, 2025 |

| 12467014 | Dodecandien-1-ol and dodecen-1-ol aroma chemicals | Grant | December 16, 2020 | November 11, 2025 |

| 20250342442 | Augmented reality–based automation system with a task manager | Application | April 28, 2023 | November 6, 2025 |

| 12459934 | Pesticidal compounds | Grant | November 18, 2019 | November 4, 2025 |

| 12462132 | Ecological mining using a printing device for proof-of-work | Grant | March 15, 2022 | November 4, 2025 |

| 12454486 | Process for producing calcium silicate hydrate | Grant | October 5, 2021 | October 28, 2025 |

| 12454503 | Process for producing superabsorbents | Grant | November 4, 2019 | October 28, 2025 |

| 12454657 | Viscosity index improver for lubricants | Grant | November 29, 2022 | October 28, 2025 |

| 20250326911 | Storage-stable coated particles | Application | October 17, 2023 | October 23, 2025 |

| 20250326993 | Biodegradable graft polymers as dye-transfer inhibitors | Application | June 12, 2025 | October 23, 2025 |

| 12450862 | Quantifying biotic leaf damage using CNNs | Grant | March 15, 2021 | October 21, 2025 |

| 12448296 | Oxidic material with AEI-type zeolite | Grant | January 21, 2020 | October 21, 2025 |

| 12448342 | Process for obtaining isobutene from C4 mixtures | Grant | March 1, 2022 | October 21, 2025 |

| 12450247 | Data extraction system for tabular files | Grant | April 9, 2020 | October 21, 2025 |

| 20250320027 | Laminated board & pallet manufacturing | Application | May 30, 2023 | October 16, 2025 |

| 20250319641 | Co-extruded HDPE and TPU films | Application | May 12, 2023 | October 16, 2025 |

| 12441905 | Coatings with improved adhesion | Grant | September 16, 2020 | October 14, 2025 |

| 12441038 | Injection molding tool for marbled molded parts | Grant | October 13, 2020 | October 14, 2025 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company expanded its high-performance dispersant production line in Nanjing, China, enabling local output of advanced dispersants using Controlled Free Radical Polymerization (CFRP) technology and improving global supply flexibility alongside the Heerenveen site in the Netherlands.

- In November 2025, the company introduced xarvio FIELD MANAGER for Grapes, giving wine-grape growers in France, Spain, and Türkiye access to advanced digital models for plant health, pests, diseases, fertilization, and irrigation to support more sustainable viticulture.

- In November 2025, the company broadened its Alkyl Polyglucosides footprint in Asia with a new production unit at the Bangpakong location in Thailand, strengthening its position in a high-growth region and enabling faster, more flexible customer support.

- In November 2025, the company entered into a collaboration with ExxonMobil to accelerate the development of methane pyrolysis technology, targeting efficient, lower-emission hydrogen production through a jointly planned demonstration plant.

- In October 2025, the company signed an agreement to deploy its OASE blue gas treatment technology for a carbon-capture project in Aarhus, Denmark, designed to capture about 435,000 tons of CO₂ annually from a waste-to-energy facility, subject to Danish CCS funding.

- In October 2025, the company partnered with International Flavors & Fragrances (IFF) to advance Designed Enzymatic Biomaterials™ technologies, enabling next-generation enzyme solutions for home, personal, dish, and industrial care applications.

- In October 2025, the company collaborated with Xiaomi to jointly develop 100 new automotive color shades, introducing fresh aesthetics to vehicle design.

- In October 2025, the company launched Isobionics, a natural lime-flavoured ingredient derived from renewable resources and produced through high-purity fermentation.

(Source: BASF SE Press Release)