Global Zinc Phosphate Market By Type(High Zinc Containing Zinc Phosphate, Low Zinc Containing Phosphate), By Form(Powder, Liquid), By Application(Corrosion Protection, Automotive Coatings, Aerospace Coatings, Marine Coatings, Paints and Coatings, Fertilizers, Others), By End-Use Industry(Automotive, Aerospace, Construction, Marine, Agriculture, Healthcare, Others), and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 17647

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

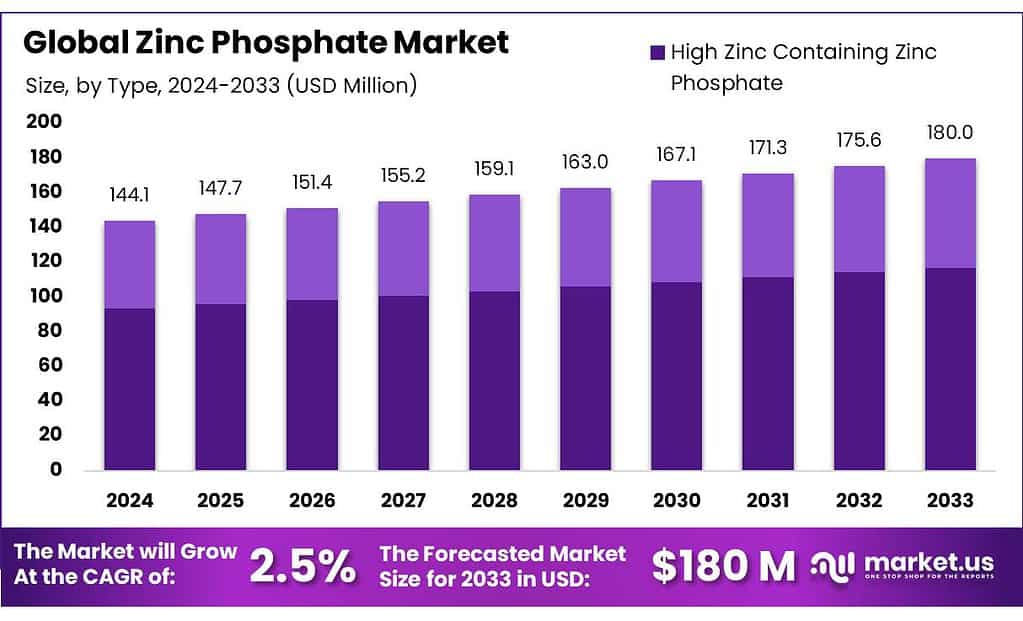

The global Zinc Phosphate Market size is expected to be worth around USD 180.0 billion by 2033, from USD 144.1 billion in 2023, growing at a CAGR of 2.5% during the forecast period from 2023 to 2033.

The Zinc Phosphate Market is a critical sector within the global economy, primarily focused on the production, distribution, and utilization of zinc phosphate. This compound is extensively used as a corrosion-resistant coating on various metal surfaces across multiple industries, including automotive, marine, and construction. The effectiveness of zinc phosphate in enhancing the durability of metal parts and protecting them against rust and corrosion makes it highly valuable.

This market encapsulates the complete supply chain from the initial manufacturing stages to the final applications in various industries. It is significantly influenced by the demand for corrosion-resistant materials, which is driven by the need for longer-lasting metal components in harsh environmental conditions.

Technological advancements play a crucial role in shaping the market dynamics of zinc phosphate. Innovations in coating processes not only improve the efficiency and effectiveness of applications but also help in meeting the stringent environmental regulations imposed globally. These regulations are designed to minimize the environmental impact of chemical processes, including the manufacturing and application of industrial coatings.

Moreover, the zinc phosphate market is sensitive to global economic conditions that influence production and consumption rates across different regions. It also responds dynamically to trends in related industries and movements in global trade, making it a complex sector that requires constant adaptation to maintain competitiveness and compliance with international standards.

In addition to these factors, strategic partnerships and expansions are pivotal for companies within this market. These collaborations often aim to tap into new opportunities and enhance market reach. For instance, companies like B Braun have expanded their portfolio to include medical applications of zinc phosphate, demonstrating the versatility and broad applicability of this compound in enhancing product offerings beyond traditional markets.

Key Takeaways

- Market Growth: The zinc Phosphate market is expected to reach USD 180.0 billion by 2033 from USD 144.1 billion in 2023, growing at 2.5% CAGR.

- Dominant Type: High Zinc Containing Zinc Phosphate holds over 65.3% market share due to superior corrosion resistance properties.

- Preferred Form: Powder form captures more than 77.3% market share in 2023, valued for ease of handling and application.

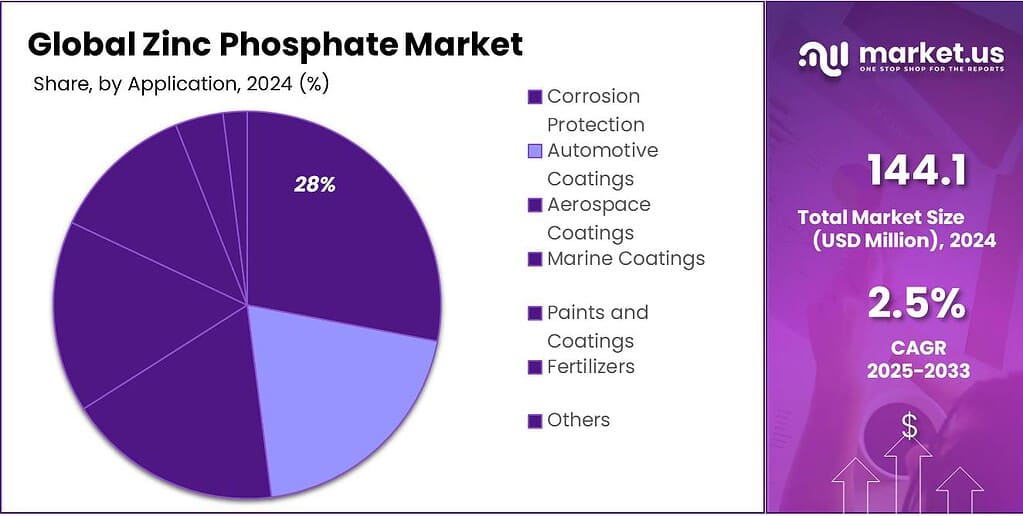

- Key Applications: Used extensively in automotive 28.4% market share, aerospace, and marine sectors for corrosion protection.

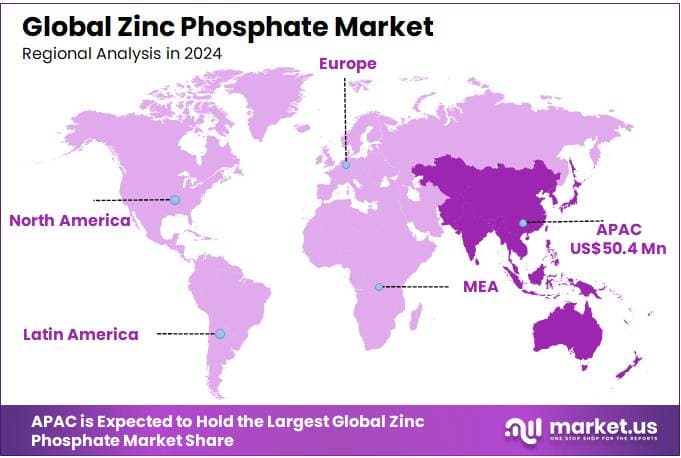

- Regional Leadership: APAC leads with a 35% market share in 2023, valued at USD 50.4 million, driven by rapid industrialization.

By Type

In 2023, High Zinc Containing Zinc Phosphate held a dominant market position, capturing more than a 65.3% share. This type of zinc phosphate is favored for its superior corrosion resistance properties, making it particularly valuable in industries that demand enhanced protection against environmental elements.

Industries such as automotive, marine, and heavy machinery rely on high zinc-containing zinc phosphate for its ability to extend the life and durability of metal components under harsh operational conditions.

On the other hand, Low Zinc low-containing zinc Phosphate, while occupying a smaller portion of the market, is integral in applications where lower levels of zinc are preferred due to environmental concerns or specific performance requirements.

This variant is used in situations where a balance is needed between performance and environmental impact, such as in certain consumer goods and electronics where excessive zinc content could be detrimental.

By Form

In 2023, Powder held a dominant market position in the Zinc Phosphate market, capturing more than a 77.3% share. This form of zinc phosphate is highly preferred due to its ease of handling, storage, and application, making it ideal for a wide range of industrial uses.

The powder form is extensively used in paint and coatings industries where it serves as a key ingredient in anti-corrosive formulations. Its ability to mix well with other components and provide consistent protective properties is highly valued.

Conversely, the Liquid form of zinc phosphate, while holding a smaller market share, is notable for its convenience in certain applications where direct mixing or faster application processes are required. It is particularly beneficial in processes that demand quicker integration of zinc phosphate into solutions, such as certain chemical treatments and some specialized coating processes.

The liquid form is appreciated for its ease of use in continuous industrial processes where powder mixing might pose logistical challenges.

By Application

Corrosion Protection: Zinc phosphate is extensively used as a corrosion inhibitor, particularly in environments where metal parts are susceptible to degradation due to exposure to moisture, salt, and other corrosive elements. Its application in this segment is crucial for extending the life of metal structures and components.

Automotive Coatings: In the automotive industry, zinc phosphate serves as a primary ingredient in coatings designed to protect vehicles from rust and corrosion. This application ensures that cars, trucks, and other vehicles can withstand various environmental stresses while maintaining their structural integrity and appearance.

Aerospace Coatings: Similar to automotive applications, zinc phosphate is vital in the aerospace sector for providing protective coatings on aircraft. These coatings are critical for preventing corrosion on aircraft parts, which are often exposed to harsh atmospheric conditions.

Marine Coatings: The marine environment poses unique challenges due to high levels of salt and constant moisture. Zinc phosphate coatings are used extensively in shipbuilding and other marine applications to protect hulls and other components from seawater corrosion.

Paints and Coatings: Beyond specific industrial uses, zinc phosphate is a common additive in general paints and coatings used for residential and commercial buildings. It helps in preventing mold growth and metal degradation, enhancing the longevity of painted surfaces.

Fertilizers: Zinc phosphate is also used in the agriculture sector as a source of zinc in fertilizers. Zinc is an essential nutrient that promotes healthy growth in plants, making zinc phosphate an important component in agricultural applications.

By End-Use Industry

In 2023, the Automotive sector held a dominant position in the Zinc Phosphate market, capturing more than a 28.4% share. This industry heavily relies on zinc phosphate for its corrosion-resistant properties, which are crucial for extending the lifespan and enhancing the durability of automotive components exposed to various environmental conditions. Zinc phosphate coatings are primarily used in underbody coatings, engine parts, and fasteners, ensuring they remain rust-free and functional throughout the vehicle’s life.

The Aerospace industry also significantly utilizes zinc phosphate, primarily for aircraft coatings that protect against corrosion and metal fatigue. This application is critical given the extreme conditions aircraft are subjected to, from temperature fluctuations to moisture exposure.

In the Construction sector, zinc phosphate finds its application in metal structures and fittings, providing essential protection against corrosion that can compromise the structural integrity of buildings and infrastructures.

The Marine industry benefits from zinc phosphate in the production of marine paints and coatings that protect ships and offshore structures from the corrosive marine environment, characterized by high salinity and constant moisture exposure.

Agriculture uses zinc phosphate in a different capacity, mainly as a micronutrient in fertilizers to aid in the healthy growth of plants, highlighting the compound’s versatility beyond industrial applications.

The Healthcare sector employs zinc phosphate in various medical and dental applications, capitalizing on its bioactive properties to create cement and coatings that are safe for medical use.

Key Market Segments

By Type

- High Zinc Containing Zinc Phosphate

- Low Zinc Containing Phosphate.

By Form

- Powder

- Liquid

By Application

- Corrosion Protection

- Automotive Coatings

- Aerospace Coatings

- Marine Coatings

- Paints and Coatings

- Fertilizers

- Others

By End-Use Industry

- Automotive

- Aerospace

- Construction

- Marine

- Agriculture

- Healthcare

- Others

Drivers

Increasing Demand for Corrosion-Resistant Materials in Clean Energy Applications

One of the primary drivers for the Zinc Phosphate market is the escalating demand for corrosion-resistant materials used in various clean energy applications. This trend is particularly evident as global initiatives to transition to clean energy sources intensify, with a notable increase in the deployment of technologies like electric vehicles (EVs) and renewable energy systems such as solar photovoltaic (PV) panels and wind turbines.

Growth in the Electric Vehicle Market: The surge in electric vehicle sales, which neared 14 million in 2023, marking a 35% increase from the previous year, underscores the growing need for durable and efficient materials that can withstand various environmental conditions. Zinc phosphate is extensively used in protective coatings and battery technologies, which are essential for the longevity and performance of these vehicles.

Expansion in Renewable Energy Sector: Similarly, the renewable energy sector’s rapid expansion, with solar PV installations growing by 85% and wind turbines by 60% in the same year, further amplifies the demand for zinc phosphate. These technologies require robust materials that can prevent corrosion, a critical factor in maintaining their efficiency and operational lifespan.

Critical Minerals Demand: The broader market for critical minerals, which includes zinc phosphate, has seen substantial growth, driven by these clean energy technologies. The overall demand for critical minerals like lithium, nickel, and cobalt has risen sharply, with zinc phosphate playing a crucial role in supporting these materials in various applications.

Government Policies and Investments: Government initiatives and investments in clean energy and critical minerals are also pivotal in driving the zinc phosphate market. For instance, countries are enacting significant laws and regulations to ensure an adequate and responsible supply of critical minerals, essential for sustainable and secure energy transitions. This regulatory environment not only supports the market but also stabilizes it by encouraging continuous investment and innovation in efficient and environmentally friendly technologies.

Restraints

Regulatory and Environmental Challenges

A significant restraining factor for the Zinc Phosphate market is the stringent environmental and safety regulations that govern its use and disposal. Zinc phosphate, used primarily as a corrosion inhibitor and in various industrial applications, faces regulatory scrutiny due to its potential environmental impact, particularly on aquatic life and human health if not handled properly.

Environmental regulations are increasingly stringent, focusing on the chemical’s impact during its lifecycle from manufacturing to disposal. These regulations require companies to implement costly safety measures and disposal procedures, which can increase operational costs and limit market growth. The need for compliance with these regulations can deter new entrants and reduce the competitiveness of zinc phosphate products in the market.

Furthermore, the global push towards more environmentally friendly and sustainable products is shaping consumer and industrial preferences. This shift encourages the development and adoption of alternative materials that pose less risk to the environment, thereby potentially reducing the demand for zinc phosphate in traditional applications.

The COVID-19 pandemic also posed significant challenges to the global supply chain and market dynamics, affecting the production, distribution, and consumption patterns of zinc phosphate. Lockdowns and other restrictive measures led to operational disruptions, affecting both supply and demand. While recovery is ongoing as restrictions lift, the long-term impact on market growth remains a consideration.

These regulatory and environmental challenges, combined with the evolving market dynamics post-pandemic, represent a major restraining factor for the Zinc Phosphate market, influencing both current market conditions and future growth prospects.

Opportunity

Expansion in the Construction and Automotive Sectors

A significant growth opportunity for the Zinc Phosphate market lies in its increasing demand within the construction and automotive sectors. This trend is driven by the inherent corrosion resistance properties of zinc phosphate, making it ideal for use in harsh environments commonly encountered in these industries.

Construction Sector Growth: Zinc phosphate is extensively utilized in the construction industry for coatings that prevent metal corrosion, an essential factor in prolonging the lifespan of building structures. The global construction market’s robust expansion, especially in emerging economies, is expected to boost the demand for corrosion-resistant coatings. This growth is supported by increasing urbanization and infrastructure development projects which require durable materials capable of withstanding environmental stresses.

Automotive Industry Expansion: Similarly, the automotive sector presents a substantial growth opportunity for zinc phosphate due to its role in enhancing the durability and longevity of automotive components. The market is benefiting from the rising production of vehicles globally, coupled with stringent regulations regarding vehicle safety and emissions, which necessitate the use of high-quality materials. Zinc phosphate coatings are critical in protecting automotive parts against rust and corrosion, thus ensuring vehicle safety and performance.

Technological Innovations and Advanced Applications: Further amplifying this growth opportunity are technological advancements that improve the application processes of zinc phosphate coatings and their environmental compatibility. Innovations in coating technology not only enhance the protective qualities of zinc phosphate but also align with global environmental standards, reducing the ecological impact of their use.

Government Initiatives and Investments: Governmental policies and investments in infrastructure and automotive sectors, particularly in developing countries, are pivotal in driving the zinc phosphate market. Initiatives that promote the construction of more resilient and sustainable infrastructure contribute directly to the increased demand for zinc phosphate-based products.

Trends

Integration of Advanced Technologies in Zinc Phosphate Production

One of the major trends in the Zinc Phosphate market is the integration of advanced manufacturing technologies and practices. This trend is characterized by the adoption of innovative production techniques that enhance efficiency, reduce waste, and improve the quality of the final product. Companies in the zinc phosphate industry are increasingly focusing on optimizing their manufacturing processes to meet stringent environmental regulations and to cater to the evolving needs of end-use industries such as automotive and construction.

Technological Advancements: The use of cutting-edge technologies in zinc phosphate production helps companies achieve higher precision and quality in their products. These advancements are not only enhancing the performance characteristics of zinc phosphate coatings but also their applicability in diverse conditions.

Environmental Compliance: Advanced technologies enable manufacturers to comply with strict environmental regulations by reducing hazardous emissions and waste. This compliance is crucial for maintaining market presence and avoiding penalties.

Market Growth and Efficiency: The implementation of modern manufacturing techniques results in greater production efficiency and lower costs over time, driving market growth. This efficiency also allows for better scaling of operations to meet global demand.

Overall, the trend toward technological innovation in the production of zinc phosphate is shaping the future of the market, offering significant growth opportunities for industry participants. These advancements are crucial for staying competitive in a market that demands high-quality, environmentally friendly, and cost-effective solutions.

Regional Analysis

North America holds a significant share in the Zinc Phosphate market, driven by robust demand across various industrial applications such as corrosion protection coatings, primers, and pigment production. The region benefits from established manufacturing sectors and stringent regulatory frameworks promoting the use of eco-friendly coatings.

In 2023, the market size in North America was valued at approximately USD 40 million. The United States leads the market due to its advanced infrastructure and substantial investments in research and development for innovative coating technologies. Moreover, the presence of major players focusing on product development and expanding their production capacities contributes to the market’s growth in this region.

Europe is a prominent region in the Zinc Phosphate market, characterized by a mature industrial base and stringent environmental regulations promoting sustainable practices. The market in Europe was valued at USD 30 million in 2023, with Germany, France, and the UK leading in terms of consumption.

These countries have well-established automotive and construction sectors, driving the demand for zinc phosphate coatings for corrosion resistance and aesthetic enhancement. Additionally, ongoing advancements in coating technologies and increasing investments in infrastructure projects further bolster market growth in the region.

APAC dominates the global Zinc Phosphate market, accounting for approximately 35% of the market share and valued at USD 50.4 million in 2023. The region’s dominance can be attributed to rapid industrialization, especially in emerging economies like China, India, and Southeast Asian countries. These countries are witnessing extensive growth in automotive production, construction activities, and industrial manufacturing, thereby driving significant demand for zinc phosphate coatings.

Moreover, favorable government initiatives supporting infrastructure development and increasing investments in industrial sectors further propel market expansion in APAC. The presence of a large consumer base and rising disposable incomes also contribute to the region’s robust market growth trajectory.

The Zinc Phosphate market in the Middle East & Africa is experiencing steady growth, supported by infrastructure development initiatives and increasing industrial activities. Countries like Saudi Arabia, UAE, and South Africa are key contributors to market growth in the region. The market size in Middle East & Africa was valued at USD 15 million in 2023, with ongoing investments in the construction and automotive sectors driving demand for protective coatings and anti-corrosion treatments.

Latin America represents a growing market for Zinc Phosphate, driven by expanding automotive production and infrastructure development projects in countries like Brazil, Mexico, and Argentina. The market size in Latin America was valued at USD 10 million in 2023, with increasing investments in manufacturing facilities and rising demand for durable coatings supporting market growth.

Regulatory support for environmental sustainability and growing consumer awareness about the benefits of zinc phosphate coatings are also contributing factors to market expansion in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Zinc Phosphate market features a diverse landscape of key players engaged in manufacturing and supplying zinc phosphate products globally. BASF SE, a leading player in the chemical industry, holds a prominent position in the market, leveraging its extensive research capabilities and robust product portfolio to cater to various industrial applications.

Similarly, Ferro Corporation and Henkel Corporation are notable players known for their advanced coating technologies and innovative solutions in corrosion protection and surface treatment sectors.

Jiangsu Shenlong Zinc Industry Co. Ltd. and Shenlong Zinc Industry are key players from China, contributing significantly to the market with their large-scale production capabilities and extensive distribution networks across Asia Pacific and other regions. These companies specialize in zinc phosphate manufacturing for diverse applications ranging from paints and coatings to metal treatments.

Other prominent players like Delaphos, Heubach GmbH, and Nubiola bring specialized expertise in pigment production and high-performance coatings, catering to specific industrial needs across Europe and other global markets. Their emphasis on product innovation, quality control, and sustainable manufacturing practices reinforces their competitive edge in the zinc phosphate sector.

In addition, emerging players such as Mamta Industries and Kunyuan Chemical are making inroads into the market, focusing on expanding their market presence through strategic partnerships, technological advancements, and regional expansions.

The competitive dynamics within the Zinc Phosphate market are characterized by continuous product development efforts, strategic acquisitions, and collaborations aimed at enhancing market penetration and meeting evolving customer demands for advanced coating solutions globally.

Market Key Players

- BASF SE

- Delaphos

- Ferro Corporation

- Hanchang Industries

- Henkel Corporation

- Heubach GmbH

- Jiangsu Shenlong Zinc Industry Co. Ltd.

- Kunyuan Chemical

- Mamta Industries

- Noelson Chemicals

- Nubiola

- Numinor

- Shenlong Zinc Industry

- SNCZ

- Societe Nouvelle Des Couleurs Zinciques (SNCZ)

- Vanchem Performance Chemicals

- VB Technochemicals

- WPC Technology

- Xinsheng Chemicals

Recent Development

By April 2023, BASF’s zinc phosphate segment showed significant growth, aligning with rising demand from sectors such as coatings, paints, and corrosion protection.

By June 2023, Delaphos reported a notable increase in sales, bolstered by strong performance in North America and Europe, where industrial activities drive zinc phosphate consumption.

Report Scope

Report Features Description Market Value (2023) US$ 144.1 Bn Forecast Revenue (2033) US$ 180.0 Bn CAGR (2024-2033) 2.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(High Zinc Containing Zinc Phosphate, Low Zinc Containing Phosphate), By Form(Powder, Liquid), By Application(Corrosion Protection, Automotive Coatings, Aerospace Coatings, Marine Coatings, Paints and Coatings, Fertilizers, Others), By End-Use Industry(Automotive, Aerospace, Construction, Marine, Agriculture, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Delaphos, Ferro Corporation, Hanchang Industries, Henkel Corporation, Heubach GmbH, Jiangsu Shenlong Zinc Industry Co. Ltd., Kunyuan Chemical, Mamta Industries, Noelson Chemicals, Nubiola, Numinor, Shenlong Zinc Industry, SNCZ, Societe Nouvelle Des Couleurs Zinciques (SNCZ), Vanchem Performance Chemicals, VB Technochemicals, WPC Technology, Xinsheng Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Zinc Phosphate Market?Zinc Phosphate Market size is expected to be worth around USD 180.0 billion by 2033, from USD 144.1 billion in 2023

What CAGR is projected for the Zinc Phosphate Market?The Zinc Phosphate Market is expected to grow at 2.5% CAGR (2024-2033).

List the key industry players of the Global Zinc Phosphate Market?BASF SE, Delaphos, Ferro Corporation, Hanchang Industries , Henkel Corporation, Heubach GmbH, Jiangsu Shenlong Zinc Industry Co. Ltd., Kunyuan Chemical , Mamta Industries, Noelson Chemicals, Nubiola, Numinor , Shenlong Zinc Industry, SNCZ, Societe Nouvelle Des Couleurs Zinciques (SNCZ), Vanchem Performance Chemicals , VB Technochemicals, WPC Technology, Xinsheng Chemicals

-

-

- BASF SE

- Delaphos

- Ferro Corporation

- Hanchang Industries

- Henkel Corporation

- Heubach GmbH

- Jiangsu Shenlong Zinc Industry Co. Ltd.

- Kunyuan Chemical

- Mamta Industries

- Noelson Chemicals

- Nubiola

- Numinor

- Shenlong Zinc Industry

- SNCZ

- Societe Nouvelle Des Couleurs Zinciques (SNCZ)

- Vanchem Performance Chemicals

- VB Technochemicals

- WPC Technology

- Xinsheng Chemicals