Global Zero-emission Vehicles Market Size, Share, Growth Analysis By Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Application (Passenger Vehicle, Commercial Vehicle, Two Wheelers), By Vehicle Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163350

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

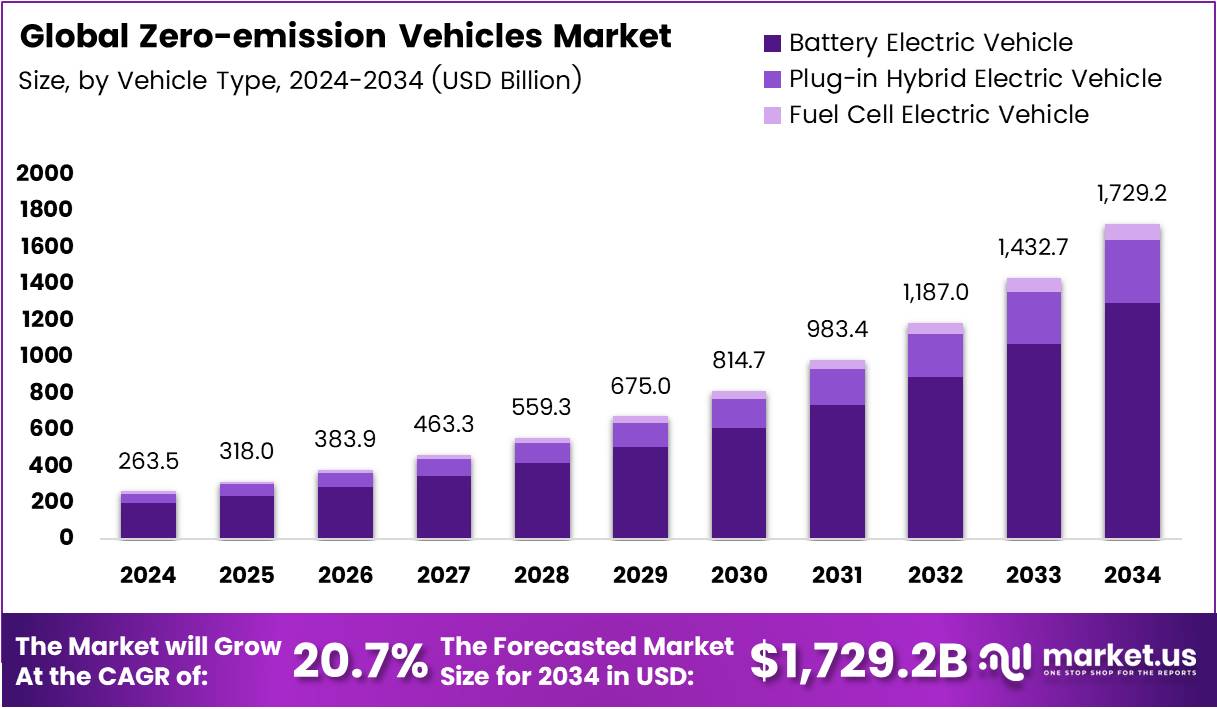

The Global Zero-emission Vehicles Market size is expected to be worth around USD 1,729.2 Billion by 2034, from USD 263.5 Billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034.

The Zero-emission Vehicles (ZEV) market represents a dynamic shift in global mobility trends toward sustainability and clean energy. These vehicles, powered by electricity or hydrogen, emit no exhaust pollutants and support decarbonization goals. Businesses and governments increasingly view ZEVs as a cornerstone for achieving long-term environmental and energy efficiency objectives.

Driven by growing consumer awareness and technological innovation, the Zero-emission Vehicles Market is expanding rapidly. Automakers are integrating advanced battery systems and lightweight materials to enhance performance and reduce costs. Meanwhile, the shift toward electrification is transforming supply chains, creating opportunities across battery manufacturing, energy storage, and charging infrastructure development.

Furthermore, governments worldwide are investing heavily in zero-emission mobility. Policy frameworks promoting subsidies, tax incentives, and infrastructure expansion are strengthening market confidence. Transitioning to ZEVs also aligns with climate commitments, encouraging public-private partnerships. This combination of regulatory support and innovation is enabling market players to scale operations and achieve commercial viability.

In addition, sustainability goals and emission standards continue to accelerate ZEV adoption. Countries are setting ambitious targets to phase out internal combustion engines, pushing automakers to expand electric and hydrogen vehicle portfolios. As green transport becomes mainstream, urban planning and smart mobility systems increasingly incorporate zero-emission strategies for future growth.

According to Industry reports, global electric car sales surpassed 17 million units in 2024, accounting for over 20% of all car sales worldwide. Similarly, in the European Union, 22–23% of new car registrations in 2024 were electric, equal to approximately 2.4 million electric cars, while electric vans reached 7–8% of total sales. These statistics underline accelerating market momentum and expanding consumer acceptance.

Key Takeaways

- The Global Zero-emission Vehicles Market is valued at USD 263.5 Billion in 2024 and projected to reach USD 1,729.2 Billion by 2034, growing at a CAGR of 20.7%.

- Battery Electric Vehicle (BEV) dominates the market with a 74.9% share in 2024 due to strong infrastructure and government incentives.

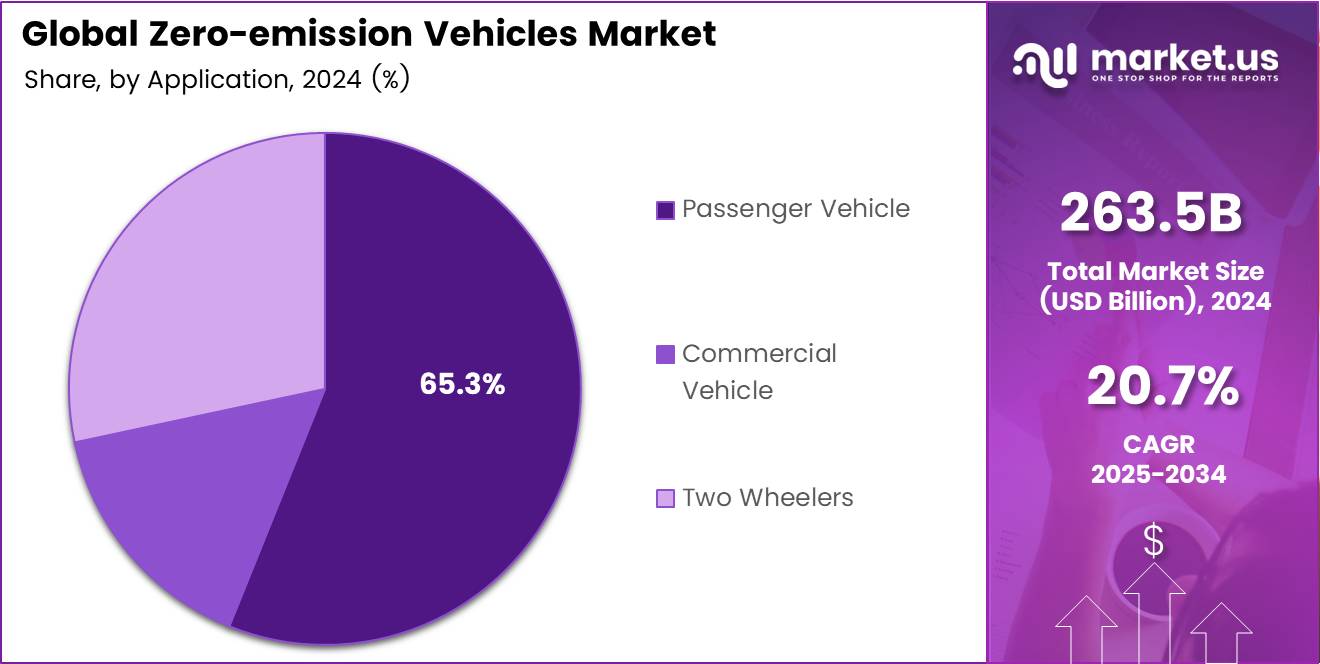

- Passenger Vehicle segment leads with a 65.3% share in 2024, driven by rising affordability and sustainability awareness.

- Front Wheel Drive (FWD) accounts for 48.7% of the market, supported by compact design and energy efficiency.

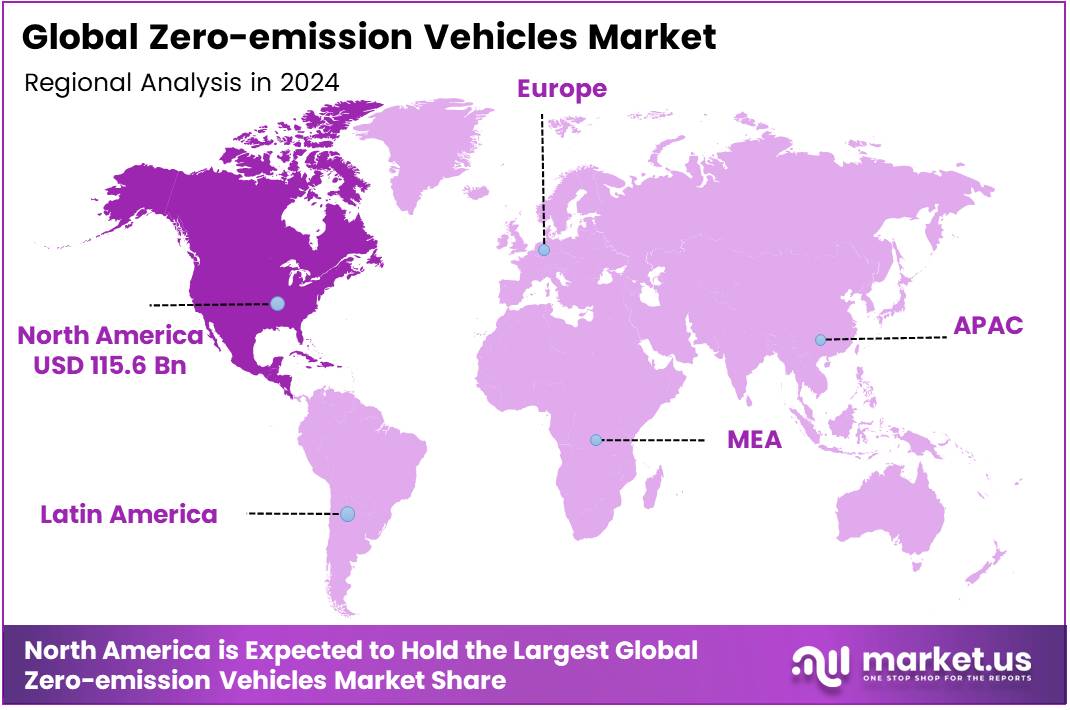

- North America leads regionally with a 43.9% market share valued at USD 115.6 Billion in 2024.

By Vehicle Type Analysis

Battery Electric Vehicle (BEV) dominates with 74.9% due to its widespread adoption and strong charging infrastructure growth.

In 2024, Battery Electric Vehicle (BEV) held a dominant market position in the By Vehicle Type Analysis segment of the Zero-emission Vehicles Market, with a 74.9% share. This dominance is driven by expanding government incentives, reduced battery costs, and increased consumer awareness regarding carbon neutrality. Automakers are increasingly prioritizing BEVs due to their efficiency and zero tailpipe emissions.

The Plug-in Hybrid Electric Vehicle (PHEV) segment continues to grow as a transitional technology, combining conventional fuel engines with electric drivetrains. Consumers favor PHEVs for their extended driving range and flexibility in areas with limited charging infrastructure. This segment benefits from advancements in hybrid power management systems and government initiatives supporting hybrid adoption.

Meanwhile, the Fuel Cell Electric Vehicle (FCEV) segment is emerging gradually, driven by improvements in hydrogen fuel infrastructure. FCEVs appeal to fleet operators and commercial applications seeking longer ranges and quick refueling times. Although infrastructure limitations currently restrict mass adoption, continuous R&D and policy support are expected to enhance their viability in the coming years.

By Application Analysis

Passenger Vehicle dominates with 65.3% due to rising consumer preference and affordable EV models.

In 2024, Passenger Vehicle held a dominant market position in the By Application Analysis segment of the Zero-emission Vehicles Market, with a 65.3% share. The surge in passenger EV sales stems from improved model availability, cost reductions, and urbanization trends promoting sustainable mobility. Governments’ focus on personal electric mobility further strengthens this growth.

The Commercial Vehicle segment is witnessing steady adoption as logistics and fleet operators seek lower operating costs and compliance with emission regulations. Electrification of delivery vans and buses supports emission-free urban transport solutions. Continued infrastructure expansion and subsidies are fostering broader commercial vehicle electrification.

Additionally, the Two Wheelers segment is rapidly evolving, particularly in Asia-Pacific markets. Affordable e-scooters and motorcycles are addressing urban commuting challenges while reducing fuel dependency. Lightweight design and battery-swapping networks are enhancing user convenience, further supporting the shift toward zero-emission personal transport in densely populated regions.

By Vehicle Drive Type Analysis

Front Wheel Drive dominates with 48.7% owing to design simplicity and improved energy efficiency.

In 2024, Front Wheel Drive (FWD) held a dominant market position in the By Vehicle Drive Type Analysis segment of the Zero-emission Vehicles Market, with a 48.7% share. FWD systems are preferred for electric cars due to their compact drivetrain layout, cost-effectiveness, and better traction in standard driving conditions, making them ideal for city use.

The Rear Wheel Drive (RWD) segment is growing among performance-oriented EVs. It offers superior handling dynamics and balanced weight distribution. Manufacturers are adopting RWD for mid-range and premium electric models to enhance driving experience and torque delivery, aligning with consumer demand for sportier EVs.

The All Wheel Drive (AWD) segment is gaining attention for its superior stability and power distribution. AWD systems are increasingly integrated into high-end EVs, supporting off-road and performance applications. As battery and motor technologies improve, AWD EVs are expected to become more energy-efficient and accessible to mainstream buyers.

Key Market Segments

By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Application

- Passenger Vehicle

- Commercial Vehicle

- Two Wheelers

By Vehicle Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

Drivers

Government Subsidies and Tax Incentives Accelerating EV Adoption

Government support through subsidies, tax breaks, and purchase incentives is playing a major role in driving the zero-emission vehicles (ZEV) market. These policies make electric vehicles (EVs) more affordable for consumers and encourage automakers to increase production. Many countries are also setting deadlines to phase out internal combustion engines, further boosting demand for ZEVs.

Another key factor is the rapid expansion of charging infrastructure in urban areas. Cities worldwide are investing in fast-charging networks to reduce range anxiety and make EV ownership more convenient. This development is attracting both private buyers and fleet operators.

Corporate fleet electrification is also gaining momentum, as businesses aim to reduce carbon emissions and meet sustainability goals. Logistics, ride-hailing, and delivery companies are replacing fuel-based fleets with electric ones to cut operational costs and improve their green image.

Furthermore, advancements in battery technology—particularly improvements in energy density and efficiency—are extending vehicle range and reducing charging time. These innovations are making EVs more practical and appealing to a wider audience, driving strong market growth globally.

Restraints

High Initial Purchase Cost Compared to Conventional Vehicles

One of the main restraints for the zero-emission vehicles market is the high upfront cost compared to traditional vehicles. Despite long-term savings on fuel and maintenance, the initial price remains a major concern for consumers, especially in developing countries. Battery packs are the most expensive component, and their cost directly impacts the affordability of electric cars.

While governments offer incentives, these are often limited or temporary, making it difficult for the market to maintain growth without continued support. This cost barrier is slowing down mass adoption among middle-income buyers who prioritize budget-friendly options.

Another key challenge is the issue of battery disposal and recycling. As EV adoption grows, the number of used or degraded batteries is also increasing. Managing this waste responsibly is crucial to achieving sustainability targets.

Recycling technologies for lithium-ion batteries are still evolving, and improper disposal can harm the environment. The lack of standardized recycling infrastructure and high processing costs make this a pressing issue for the industry.

Growth Factors

Expansion of Hydrogen Fuel Cell Vehicle Segment for Long-Range Transport

The zero-emission vehicles market presents several promising growth opportunities, particularly in hydrogen fuel cell technology. Hydrogen-powered vehicles offer long driving ranges and fast refueling, making them ideal for heavy-duty and long-distance transportation. Governments and energy companies are investing in hydrogen infrastructure to support this expansion.

Integration of Vehicle-to-Grid (V2G) technology is another major opportunity. This system allows EVs to send stored energy back to the grid during peak demand, creating a two-way energy flow. It enhances grid stability and offers consumers financial benefits, transforming EVs into mobile energy assets.

The development of lightweight materials such as carbon fiber and aluminum is also driving innovation. Lighter vehicles require less energy, improving battery performance and range efficiency. This trend is pushing manufacturers to explore advanced materials for future vehicle designs.

Strategic collaborations between automakers and battery producers are further enhancing research and development. These partnerships aim to lower production costs, improve battery life, and speed up technological advancements in the ZEV market.

Emerging Trends

Rise of Solid-State Batteries Offering Enhanced Safety and Longevity

The zero-emission vehicles market is witnessing several important trends, with solid-state batteries emerging as a key focus area. These batteries offer higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. Automakers are investing heavily in this technology to extend vehicle range and reliability.

Another major trend is the growing consumer preference for connected and autonomous electric vehicles. Integration of smart features such as AI-based navigation, remote diagnostics, and self-driving capabilities is increasing the appeal of EVs among tech-savvy buyers.

Investments in solar-powered charging stations are also gaining traction. These systems reduce dependence on fossil-fuel-generated electricity, aligning EV charging with renewable energy goals. This approach supports sustainability while lowering long-term operational costs.

The market is further influenced by a shift toward circular economy models in EV production. Automakers are emphasizing recycling, reusing components, and reducing waste throughout the production cycle. This transition supports environmental responsibility and strengthens brand value among eco-conscious consumers.

Regional Analysis

North America Dominates the Zero-emission Vehicles Market with a Market Share of 43.9%, Valued at USD 115.6 Billion

North America holds the largest share in the global zero-emission vehicles (ZEV) market, accounting for 43.9% of the total market and valued at USD 115.6 Billion. The region’s dominance is driven by strong regulatory frameworks, government incentives for electric mobility, and rapid adoption of advanced automotive technologies. Increasing infrastructure development for charging networks and the rising demand for sustainable transportation further support the market’s expansion across the U.S. and Canada.

Europe Zero-emission Vehicles Market Trends

Europe represents a significant market for zero-emission vehicles, driven by stringent emission reduction targets and aggressive policy initiatives under the European Green Deal. The region is witnessing increasing investments in EV manufacturing and charging infrastructure, especially in countries like Germany, France, and the U.K. Growing consumer awareness regarding sustainability and the shift toward clean mobility continue to propel market growth across the continent.

Asia Pacific Zero-emission Vehicles Market Trends

Asia Pacific is emerging as one of the fastest-growing regions in the zero-emission vehicles market, supported by rapid urbanization, strong government subsidies, and a rising focus on reducing air pollution. China, Japan, and South Korea are leading the regional growth, backed by large-scale production capabilities and expanding EV adoption rates. The region’s growing automotive innovation ecosystem and supportive policy environment are expected to further accelerate market development.

Middle East and Africa Zero-emission Vehicles Market Trends

The Middle East and Africa are gradually embracing the zero-emission vehicle trend, with governments introducing initiatives to diversify their economies and reduce carbon footprints. Countries such as the UAE and Saudi Arabia are investing in electric vehicle infrastructure and clean energy programs. While the market is still developing, increasing awareness and policy support are expected to foster long-term growth in the coming years.

Latin America Zero-emission Vehicles Market Trends

Latin America’s zero-emission vehicles market is witnessing steady progress, driven by supportive government policies and rising environmental concerns. Nations such as Brazil, Mexico, and Chile are taking proactive steps to promote EV adoption through tax incentives and infrastructure projects. Although the market is in its early stages, improving economic stability and technological advancements are expected to contribute to sustained market growth across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Zero-emission Vehicles Company Insights

The global Zero-emission Vehicles (ZEV) market in 2024 continues to experience strong competition as major automakers intensify their focus on sustainable mobility and advanced electric technologies.

Fiat has been expanding its electric portfolio with compact and affordable EVs, targeting urban consumers and small families. The brand’s strategy focuses on accessibility and practicality, helping strengthen its market share in Europe and emerging economies where demand for city-friendly zero-emission cars is rising.

Hyundai maintains a leadership position through its IONIQ and Kona Electric series, emphasizing innovation in battery efficiency and hydrogen fuel cell technology. Its diversified clean mobility strategy positions the company as a major global contender, particularly in Asia and North America, where government incentives continue to boost EV adoption.

BMW leverages its premium positioning with the expansion of the “i” series, combining luxury with advanced electrification. The brand’s commitment to integrating sustainable materials and digital connectivity enhances its competitiveness among environmentally conscious high-end consumers, consolidating its strong presence in the European ZEV market.

Kia, building on its successful EV6 model, is aggressively investing in next-generation platforms to expand its electric lineup. With a clear roadmap toward full electrification, the company’s strategy centers on affordability, fast charging infrastructure, and cross-market penetration across Europe and North America.

Overall, these leading automakers are shaping the 2024 ZEV landscape through innovation, strategic investments, and a shared commitment to achieving carbon neutrality, reinforcing the market’s steady global growth trajectory.

Top Key Players in the Market

- Fiat

- Hyundai

- BMW

- Kia

- Chevrolet

- Toyota

- BYD

- Tesla

- Nissan

- Volkswagen

Recent Developments

- In March 2025: Rivian Automotive, Inc. spun off a new company named Also Inc., which successfully secured US$ 105 million in funding to enhance its electric mobility initiatives.

- In October 2025: Toyota partnered with the UK Government in a £30 million initiative aimed at accelerating the development and production of zero-emission vehicles in the country.

- In September 2024: The UK Government awarded £88 million in funding to support research and manufacturing of next-generation zero-emission vehicles and advanced clean transport systems.

- In December 2024: The U.S. Environmental Protection Agency (EPA) announced over $735 million in grants to replace older heavy-duty vehicles with clean, zero-emission models under its Clean Heavy-Duty Vehicles program.

Report Scope

Report Features Description Market Value (2024) USD 263.5 Billion Forecast Revenue (2034) USD 1,729.2 Billion CAGR (2025-2034) 20.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Application (Passenger Vehicle, Commercial Vehicle, Two Wheelers), By Vehicle Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fiat, Hyundai, BMW, Kia, Chevrolet, Toyota, BYD, Tesla, Nissan, Volkswagen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Zero-emission Vehicles MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Zero-emission Vehicles MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiat

- Hyundai

- BMW

- Kia

- Chevrolet

- Toyota

- BYD

- Tesla

- Nissan

- Volkswagen