Global Yield Monitoring System Market By Type (Mass Flow Sensor, Moisture Sensor, and GPS Receiver), By Component, By Technology, By Application, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 102886

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

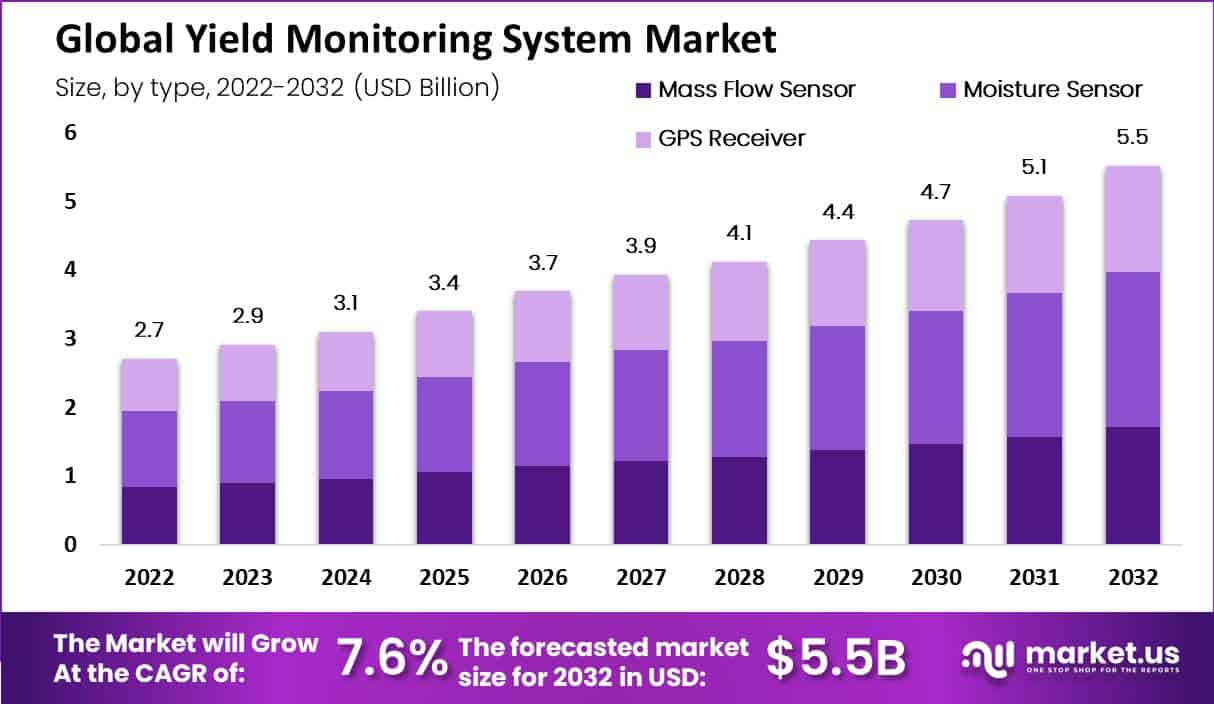

In 2023, the global yield monitoring system market was valued at USD 2.9 billion and will reach USD 5.5 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 7.6%.

A Yield Monitoring System is a technology used in agriculture to measure an also analyze the yield of crops during harvest. The system typically consists of sensors and software that work together to collect data on crop yield, moisture content, or other factors that affect crop performance. The sensors are usually placed on the harvesting equipment, such as a combine or forage harvester and they measure the weight or moisture content of the crop as it is harvested.

This data is then collected and analyzed by software to provide farmers with valuable insights into their crop yield and performance, allowing them to make data-driven decisions to optimize their operations or increase profitability. Yield monitoring systems are widely used in modern agriculture. They can be found in a variety of crops including corn, soybeans, wheat, and more.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The global yield monitoring system market was valued at USD 2.7 billion in 2022 and is projected to reach USD 5.5 billion by 2032, indicating a 7.6% Compound Annual Growth Rate (CAGR) between 2023 and 2032.

- Driving Factors: Yield Monitoring Systems in agriculture aim to improve crop management and boost profitability by providing precise data for informed decision-making. Factors such as accurate yield measurement, moisture content analysis, and quality assessment contribute to enhanced crop management and increased profitability.

- Technology Analysis: The market segments based on technology include Guidance Systems and Remote Sensing. Remote Sensing holds the largest market share at 54% in 2022, indicating its significance in collecting crucial data on crop growth and health for informed decision-making.

- Application Analysis: Yield Monitoring Systems find application in various sectors such as variable rate application, crop scouting, field mapping, yield mapping, and other applications. Crop Scouting emerges as the most lucrative segment, with a projected CAGR of 7.6%.

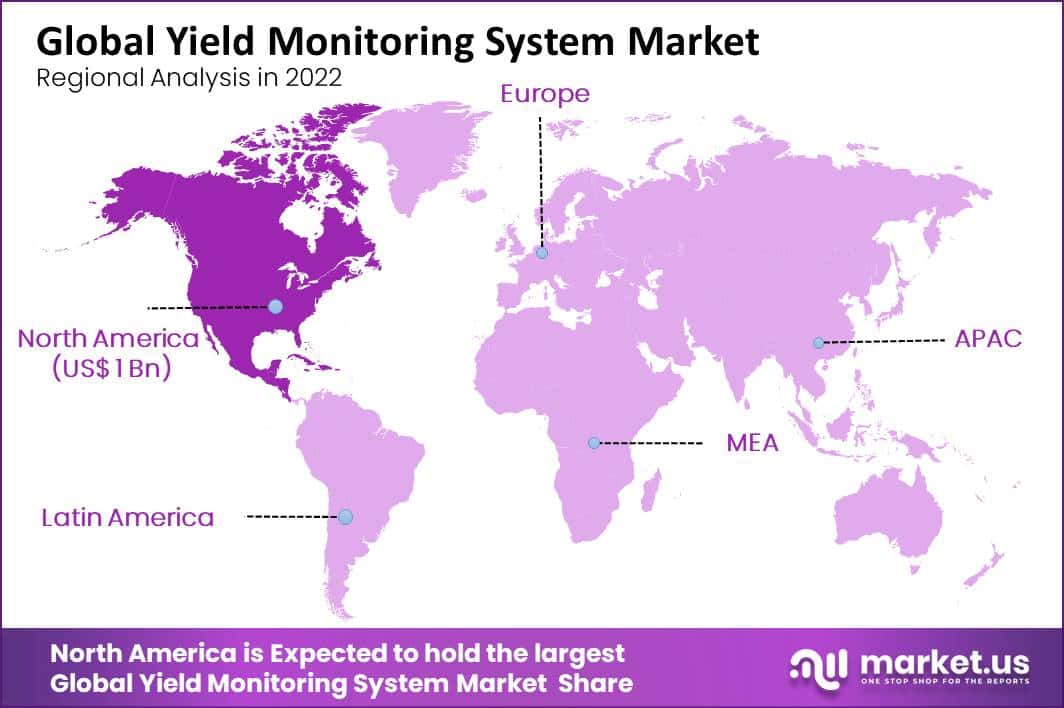

- Regional Analysis: North America is the leading market for yield monitoring systems, with the largest market share of 38% in 2022. However, the adoption of these systems is growing rapidly in regions like Europe, Asia-Pacific, Latin America, and the Middle East & Africa, driven by the increasing demand for precision agriculture tools.

- Key Market Players: Key players dominating the market include Trimble Inc, AGCO Corporation, Raven Industries, Inc., Ag Leader Technology, and others. Their focus on sustainability and improving crop yield and resource use drives the demand for precision agriculture tools, propelling market growth.

Driving Factors

The primary driver behind the use of Yield Monitoring Systems in agriculture is to improve crop management and also increase profitability. By accurately measuring & analyzing crop yield, farmers can make data-driven decisions about planting, fertilizing, or harvesting, which can optimize crop production and minimize waste.

Yield Monitoring Systems also provide valuable information on the quality of the harvested crop, such as moisture content, which can affect the storage and sale of the crop. This information can help farmers make decisions about when to sell their crops and to whom, to maximize profitability.

Furthermore, Yield Monitoring Systems can also help farmers identify an also address issues in their crop production process, such as problems with planting, irrigation, or disease control. By identifying these issues early on, farmers can take corrective actions and improve crop yield and quality over time.

Restraining Factors

The technology behind Yield Monitoring Systems can be complex and also require specialized expertise to install and maintain, which can also be a barrier to adoption for some farmers. The large amounts of data generated by Yield Monitoring Systems can be overwhelming and difficult to manage, particularly for farmers without experience in data analysis or management. The use of Yield Monitoring Systems may raise concerns about the privacy and security of data collected from farms, particularly if data is shared with third-party service providers or used for other purposes.

Type Analysis

Based on type, the yield monitoring system market is segmented into Mass Flow Sensors, Moisture Sensors, and GPS Receiver. Among these types, the moisture sensor segment is the most lucrative in the global yield monitoring system market, with a projected CAGR of 7.6% in the forecasted period. The total revenue share of moisture sensor-type yield monitoring systems is 41% in 2022.

A moisture sensor is a type of sensor that measures the moisture content of the material. In the context of yield monitoring, a moisture sensor is used to measure the moisture content of harvested material, which is an important factor in determining the quality and value of the crop.

A mass flow sensor is a type of sensor that measures the flow rate of material passing through it. In the context of yield monitoring, a mass flow sensor is used to measure the volume of grain or other harvested material as it passes through the combined harvester.

A GPS receiver is a device that uses signals from global positioning system satellites to determine its location. In the context of yield monitoring, a GPS receiver is used to record the location of the combine harvester as it moves through the field, which can be used to create yield maps and optimize planting and harvesting operations.

Component Analysis

By component, the market is further divided into hardware, software, and services. The hardware segment is estimated to be the most profitable segment in the global yield monitoring system market, with a market share of 38% in 2022 and a projected CAGR of 7.6%, during the projected period.

The hardware segment includes all physical components of yield monitoring systems, such as mass flow sensors, moisture sensors, and GPS receivers. The software segment includes all computer programs and applications used to analyze, process, and visualize data collected by yield monitoring systems.

The software can be sold as standalone products or as part of a larger agricultural technology platform. The services segment includes all support and maintenance services provided to customers using yield monitoring systems.

Note: Actual Numbers Might Vary In The Final Report

Technology Analysis

By Technology, the market is further divided into Guidance Systems and Remote Sensing. The remote sensing segment is estimated to be the most lucrative segment in the global yield monitoring system market, with a market share of 54% in 2022 and a projected CAGR of 7.6% between 2023 and 2032.

Within the precision agriculture technology market, the yield monitoring system market can be further divided into two categories: guidance systems and remote sensing. Guidance systems use GPS and other technologies to guide farm equipment, such as tractors and harvesters, to ensure precise and efficient operations.

Remote sensing, on the other hand, uses satellite and aerial imagery to collect data on crop growth or health, allowing farmers to make informed decisions about crop management an also yield optimization.

Application Analysis

Based on application, the market yield monitoring system market is segmented into variable rate application, crop scouting, field mapping, yield mapping, and other applications. Among these types, the Crop Scouting segment is the most lucrative in the global yield monitoring system market, with a projected CAGR of 7.6%.

The total revenue share of the Crop Scouting-type yield monitoring system is 22% in 2022. Yield monitoring systems can be used to collect data on crop yields or use that information to optimize the application of fertilizers, pesticides, or other inputs in a process called variable rate application. Field Mapping, Yield monitoring systems can be used to map fields and understand the variability in soil types, drainage, or other factors that can impact crop yields.

End-User Analysis

Based on end-user, the market is segmented into Farmers, agriculture consultants, research bodies, & other end-users. Among these end-users, the farmer’s segment is estimated to be the most lucrative segment in the global yield monitoring system market, with the largest revenue share of 30.5% in 2022 and a projected CAGR of 7.6% during the forecast period.

Farmers are the largest end-users of yield monitoring systems as they are responsible for managing crop yields and ensuring that their operations are profitable. In addition to farmers, agronomists, and crop consultants, other end-users of yield monitoring systems may include agricultural cooperatives, government agencies, and researchers who are looking to study and improve crop yields.

Key Market Segments

Based on Type

- Mass Flow Sensor

- Moisture Sensor

- GPS Receiver

Based on Component

- Hardware

- Software

- Services

Based on Technology

- Guidance System

- Remote Sensing

Based on Application

- Variable Rate Application

- Crop Scouting

- Field Mapping

- Yield Mapping

- Other Applications

Based on End-User

- Farmers

- Agriculture Consultant

- Research Bodies

- Other End-Users

Opportunity

Yield monitoring system market can provide farmers with detailed information about their crop performance, allowing them to identify and address issues that may be limiting crop yield. Yield Monitoring Systems can also provide valuable information about the quality of the harvested crop, such as moisture content, which can affect storage & sale.

By optimizing crop quality, farmers can maximize the value of their crops and also potentially command higher prices. By optimizing crop yield or quality, reducing waste, and improving sustainability, Yield Monitoring Systems can ultimately help farmers increase their profitability and also long-term viability.

Overall, the potential opportunities of Yield Monitoring Systems in agriculture are significant or could have a transformative impact on the industry, particularly as the technology continues to evolve and become more widely available.

Trending Factors

Yield Monitoring Systems are increasingly being integrated with other technologies, such as precision agriculture tools, to provide farmers with a more comprehensive view of their crop performance. The use of big data and analytics is becoming more common in agriculture, as farmers seek to leverage the large amounts of data generated by Yield Monitoring Systems to optimize crop performance.

Cloud-based solutions are becoming growing for storing and analyzing data generated by Yield Monitoring Systems, as they provide a more calculable and cost-effective approach to data management.

Regional Analysis

North America is estimated to be the most lucrative market in the global yield monitoring system market, with the largest market share of 38%, and is expected to register a CAGR of 7.6% during the forecast period.

North America has been an early adopter of Yield Monitoring Systems, particularly in the United States, where large-scale farming operations are common. Europe has also been an early adopter of Yield Monitoring Systems, particularly in countries such as Germany, France as well as the Netherlands.

Adoption of Yield Monitoring Systems in Asia-Pacific is growing rapidly, particularly in countries such as Australia and New Zealand, where large-scale farming operations are common. Adoption of Yield Monitoring Systems in Latin America is increasing, particularly in countries such as Brazil or Argentina, where large-scale soybean & corn production is common.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

As the market for Yield Monitoring Systems continues to grow, these key players are likely to face increased competition from emerging players and startups seeking to enter the market. The focus on sustainability and improving crop yield and resource use is driving demand for precision agriculture tools, including Yield Monitoring Systems, and companies will need to continue innovating and developing new technologies to remain competitive.

John Deere is one of the largest manufacturers of agricultural equipment and also offers a range of Yield Monitoring Systems that can be used in various crops or farming operations. AGCO Corporation offers a range of products under its brand names.

Market Key Players

Listed below are some of the most prominent Yield Monitoring System industry players.

- Trimble Inc

- AGCO Corporation.

- Raven Industries, Inc.

- Ag Leader Technology

- Mouser Electronics, Inc.

- CNH Industrial Group

- Topcon

- Grains Research and Development Corporation

- SPL Technologies Pvt. Ltd.

- AG Leader Technology Inc.

- AGCO Corporation

- AgJunction Inc.

- AgEagle Aerial Systems, Inc.

- Valmont Industries Inc.

- Agsmart Pty Ltd

- BouMatic

- CROPMETRICS

- Trimble Inc.

- CropX Inc.

- Deere & Company

- Farmers Edge Inc.

- GEA Group Aktiengesellschaft

- John Deere

- Other Key Players

Recent Developments

- In 2020, John Deere introduced its Harvest Profitability solution, which combines yield mapping, data analytics as well as machine performance data to provide farmers with real-time insights into their profitability.

- In 2019, AGCO Corporation announced the launch of its FendtONE operating system, which integrates several precision agriculture technologies, including Yield Monitoring Systems, into a single platform.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Bn Forecast Revenue (2032) USD 5.5 Bn CAGR (2023-2032) 7.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Mass Flow Sensor, Moisture Sensor, and GPS Receiver; By Component-Hardware, Software, and Services; By Technology-Guidance System, Global Positioning System, Global Yield Monitoring System Geographic Information, Handheld, and Satellite; By Application-Variable Rate Application, Crop Scouting, Field Mapping, Yield Mapping, and Other Applications; By End-User-Farmers, Agriculture Consultant, Research Bodies, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Trimble Inc, AGCO Corporation., Raven Industries, Inc., Ag Leader Technology, Mouser Electronics, Inc., CNH Industrial Group, Topcon, Grains Research and Development Corporation, SPL Technologies Pvt. Ltd., AG Leader Technology Inc., AGCO Corporation, AgJunction Inc., AgEagle Aerial Systems, Inc., Valmont Industries Inc., Agsmart Pty Ltd, BouMatic, CROPMETRICS, Trimble Inc., CropX Inc., Deere & Company, Farmers Edge Inc., GEA Group Aktiengesellschaft, John Deere, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global yield monitoring system market?The global yield monitoring system market was valued at US$ 2.7 billion in 2022 and will reach US$ 5.5 billion by 2032.

What is yield monitoring system market?A yield monitoring system is a technology used in agriculture to measure and analyze crop yield during harvest.

What are the drivers behind the use of yield monitoring systems in agriculture?Yield monitoring systems help improve crop management, increase profitability, and provide valuable insights into crop quality.

What components make up a yield monitoring system?A yield monitoring system typically consists of sensors, software, and harvesting equipment.

Which type of yield monitoring system is the most lucrative in the market?The moisture sensor segment is the most lucrative type of yield monitoring system in the market.

What is the most profitable segment in the yield monitoring system market?The hardware segment is estimated to be the most profitable segment in the yield monitoring system market.

What are the applications of yield monitoring systems market?Yield monitoring systems can be used for variable rate application, crop scouting, field mapping, yield mapping, and other applications.

What opportunities do yield monitoring systems offer to farmers?Yield monitoring systems provide detailed information on crop performance, allowing farmers to address issues, optimize crop quality, and increase profitability.

What are the key players in the yield monitoring system market?Some of the key players in the yield monitoring system market include Trimble Inc, AGCO Corporation, Raven Industries, Ag Leader Technology, and John Deere, among others.

How can startups enter the yield monitoring system market?Startups can enter the yield monitoring system market by offering innovative technologies, collaborating with key players, or targeting niche markets.

Yield Monitoring System MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Yield Monitoring System MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Trimble Inc

- AGCO Corporation.

- Raven Industries, Inc.

- Ag Leader Technology

- Mouser Electronics, Inc.

- CNH Industrial Group

- Topcon

- Grains Research and Development Corporation

- SPL Technologies Pvt. Ltd.

- AG Leader Technology Inc.

- AGCO Corporation

- AgJunction Inc.

- AgEagle Aerial Systems, Inc.

- Valmont Industries Inc.

- Agsmart Pty Ltd

- BouMatic

- CROPMETRICS

- Trimble Inc.

- CropX Inc.

- Deere & Company

- Farmers Edge Inc.

- GEA Group Aktiengesellschaft

- John Deere