Global Work Zone Detection AI Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud), By Application (Traffic Management, Road Safety Monitoring, Construction Site Management, Incident Detection, Others), By End-User (Government Agencies, Construction Companies, Transportation Authorities, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168278

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

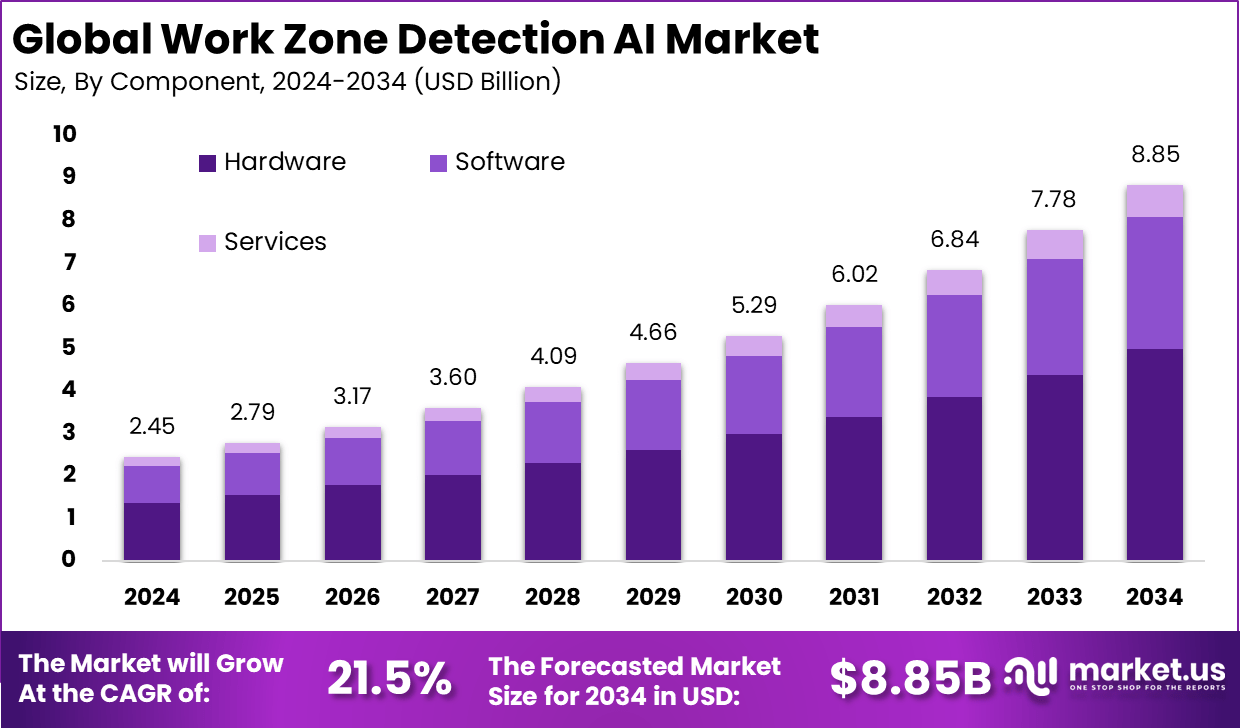

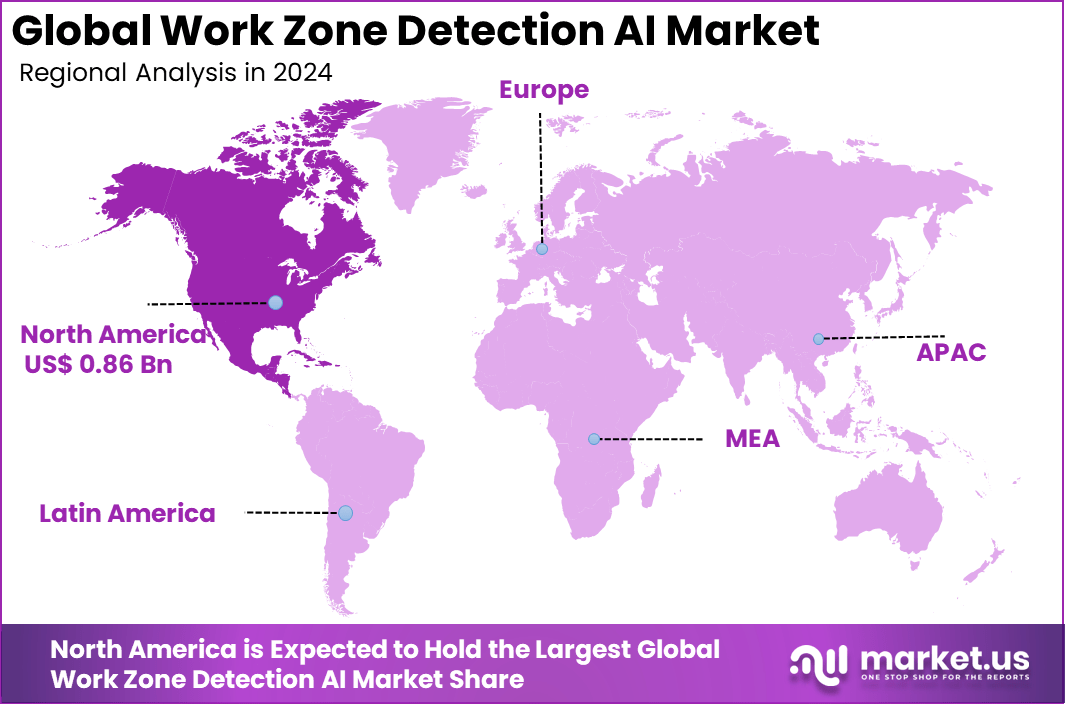

The Global Work Zone Detection AI Market size is expected to be worth around USD 8.85 billion by 2034, from USD 2.45 billion in 2024, growing at a CAGR of 21.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.2% share, holding USD 0.86 billion in revenue.

Work zone detection AI is a computer vision and sensor based system that watches road or construction work areas in real time, flags encroaching vehicles or unsafe worker behaviour, and sends instant alerts to reduce crashes and injuries. It builds on cameras, AI vision models and traffic data that can track vehicles, workers and temporary barriers far more consistently than manual watch alone.

Work zones remain a serious safety problem, with about 898 road users killed and roughly 40,170 people injured in work zone crashes in 2023 in the United States alone. Fatalities in these areas have grown by about 53% since 2010, even as many agencies have added more signs, cones and traditional controls, which keeps pressure on owners to try new digital protection layers.

The growth of the market can be attributed to rising work zone fatalities, higher incidence of distracted driving and the need for more accurate real time alerts. Transportation departments seek advanced tools to improve worker safety and reduce collision risks. The adoption of smart highway technologies and increasing investment in digital traffic management systems further support market expansion.

The market for Work Zone Detection AI is driven by the increasing need to enhance safety in construction and road work zones. AI-powered systems provide real-time monitoring and alert workers and drivers to potential hazards, reducing accidents and improving operational efficiency. Growing infrastructure investments and stricter safety regulations worldwide encourage the adoption of these technologies.

For instance, in June 2025, FLIR Systems launched the PT-Series AI SR camera, with improved thermal and 4K imaging for perimeter and work zone security. The system combines edge AI and proprietary communication protocols for precise detection and tracking, even in adverse conditions, enhancing safety monitoring capabilities.

Key Takeaway

- In 2024, the Hardware segment dominated with a 56.4% share, reflecting strong reliance on sensors, cameras, and roadside detection systems for real-time monitoring.

- The On-Premises segment held a leading 64.7% share, indicating preference for locally managed AI infrastructure due to data sensitivity and operational control requirements.

- The Traffic Management segment accounted for 40.6%, driven by rising adoption of AI systems to reduce accidents, enhance flow, and improve work zone safety.

- The Government Agencies segment captured 42.9%, highlighting their central role in deploying AI solutions for road safety and public infrastructure management.

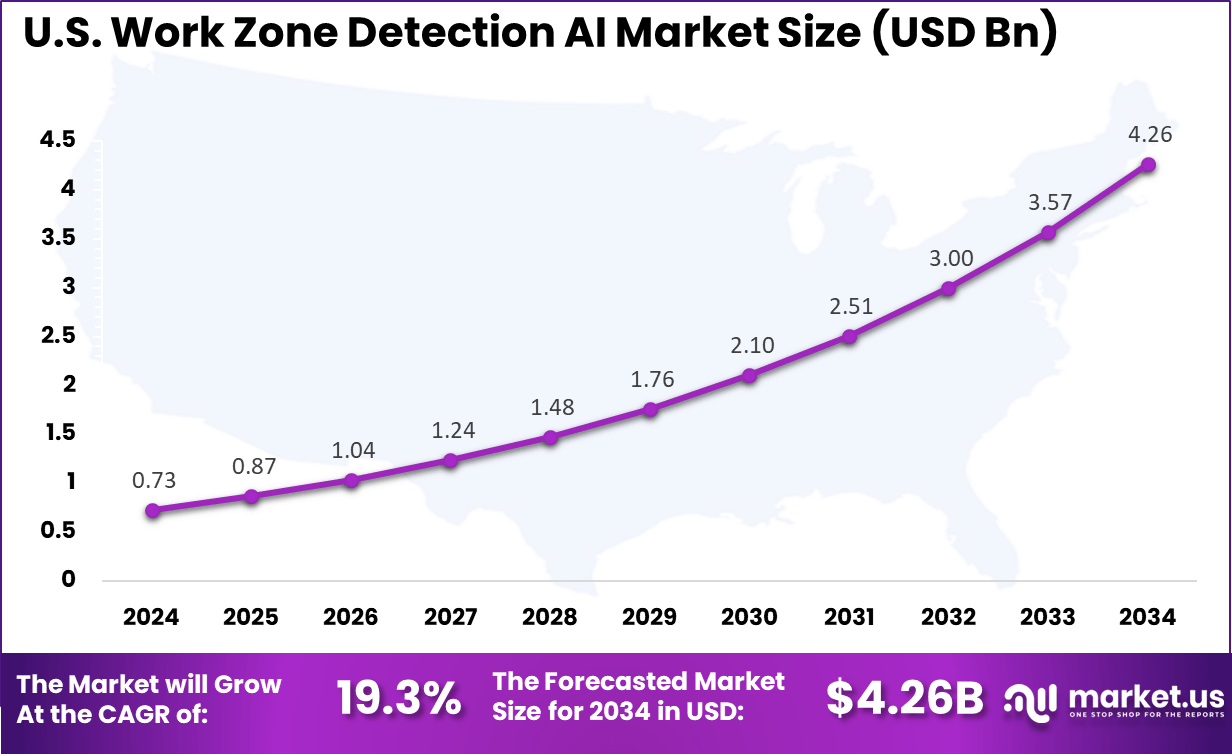

- The US market reached USD 0.73 billion in 2024 and is growing at a strong CAGR of 19.3%, supported by nationwide roadway modernization and safety initiatives.

- North America led globally with over 35.2% share, driven by advanced traffic infrastructure, regulatory mandates, and rising investment in AI-powered safety technologies.

Role of Generative AI

Generative AI is playing a crucial role in enhancing work zone detection by analyzing real-time data from IoT sensors and cameras, which helps identify hazards like equipment malfunction or workers entering danger zones. This technology supports continuous monitoring and proactive alerts, which significantly reduce risks and ensure compliance with safety standards.

Studies indicate that generative AI can streamline safety processes and improve training by creating more dynamic and realistic virtual simulations for worker preparedness, boosting safety awareness by over 40%. Generative AI also facilitates better communication among teams by generating automated safety reports and insights, enhancing decision-making during critical work zone operations.

With increasing adoption, generative AI applications in workplace safety have shown improvements such as a decrease in workplace incidents by nearly 25% in pilot implementations, underscoring their potential for reducing accidents and improving worker protection efficiently.

Investment and Business Benefits

Investment opportunities in Work Zone Detection AI exist in the development of multi-sensor fusion solutions, edge AI computing hardware, and integrated safety management platforms. With increasing government and infrastructure budgets focused on improving road safety, early investment in scalable, reliable AI systems promises strong business potential.

Beyond safety, companies investing in these technologies benefit from reduced accident-related costs, lower insurance premiums, and enhanced reputations for worker protection. The regulatory environment is tightening, with many regions requiring advanced safety protocols that include technological intrusion alerts, which further drives market demand and innovation in this area.

Business benefits of Work Zone Detection AI include improved safety compliance, faster incident response, and reduced worker injury rates. Real-time, actionable alerts help prevent costly accidents and associated downtime. Systems that process data on-site via edge computing avoid network delays, ensuring a timely response. Enhanced monitoring leads to better resource allocation and operational efficiency by identifying unsafe conditions before they escalate.

U.S. Market Size

The market for Work Zone Detection AI within the U.S. is growing tremendously and is currently valued at USD 0.73 billion, the market has a projected CAGR of 19.3%. The market is growing due to the increasing investments in transportation infrastructure and heightened focus on road safety. Growing government regulations around worker and driver protection in construction zones are pushing demand for advanced AI solutions.

These systems enable real-time monitoring, hazard detection, and traffic management, significantly reducing accidents and improving traffic flow near work zones. Continuous innovation in AI-powered hardware and on-premises deployment also supports this growth by enhancing detection accuracy and operational reliability in diverse, challenging environments.

For instance, in June 2025, FLIR introduced the PT-Series AI SR thermal and visible-light surveillance system, featuring Edge AI for early intrusion and threat detection. Their system enhances perimeter and site safety with accurate target detection and tracking, applicable to critical infrastructure and work zone environments.

In 2024, North America held a dominant market position in the Global Work Zone Detection AI Market, capturing more than a 35.2% share, holding USD 0.86 billion in revenue. This leading position is driven primarily by extensive investments in modernizing transportation infrastructure and stringent government regulations focused on enhancing road safety and reducing accidents in work zones.

The region benefits from a well-established technology ecosystem that fosters innovation and rapid adoption of advanced AI hardware and software solutions tailored to meet the safety and operational needs of work zone management. Moreover, the United States plays a significant role within the region due to its advanced technological landscape and strong governmental support for AI initiatives.

Federal funding programs and infrastructure renewal plans further stimulate demand for AI-powered detection systems that improve traffic management and worker safety. The combination of regulatory enforcement, public safety priorities, and innovation dynamics positions North America as a leading force in the global work zone detection AI market.

For instance, in October 2025, Honeywell launched new AI innovations, including an AI assistant and the CT70 mobile computer to boost frontline workforce productivity in logistics and transportation. The AI assistant leverages machine vision and natural language to identify products and faults, enhancing operational efficiency and worker safety in complex environments.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing 56.4% share of the Global Work Zone Detection AI Market. The significance of hardware lies in its foundational role, comprising sensors, cameras, and processing units that form the essential infrastructure for collecting and analyzing real-time data in work zones.

Such physical components are critical to delivering precise detection, facilitating immediate notifications for hazards or unauthorized access in construction and maintenance areas. The ongoing demand for reliable and durable hardware solutions drives innovation focused on enhanced accuracy and responsiveness in the field.

Hardware also underpins advancements in safety by enabling AI systems to monitor complex work zones continuously. This ensures quicker incident identification and timely intervention, which can prevent accidents and reduce risks for workers and drivers. The increasing integration of cutting-edge sensor technologies and edge computing in hardware is elevating the effectiveness of work zone detection solutions, supporting safer traffic environments.

For Instance, in September 2025, FLIR Systems launched advanced AI-powered security camera technology capable of performing precise object detection and tracking with thermal and visible-light sensors. Their hardware innovations enable superior perimeter security, ideal for complex or low-visibility work zones.

Deployment Mode Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 64.7% share of the Global Work Zone Detection AI Market. These systems are often preferred by government agencies and infrastructure operators who require immediate data processing with minimal latency, essential for time-sensitive work zone safety and traffic operations.

On-premises setups also address data privacy and security concerns by keeping sensitive information within controlled networks rather than exposing it to cloud vulnerabilities. This deployment mode complements the critical need for system reliability in often harsh outdoor work environments. Maintaining AI operations on-premises enables users to customize and manage infrastructure according to specific project requirements, ensuring uptime and responsiveness.

For instance, in June 2025, Siemens Mobility introduced its Industrial Copilot for Operations, which runs AI tasks directly on the shop floor, enabling real-time decision-making and safety monitoring without relying on cloud connectivity, emphasizing the importance of on-premises deployment for time-sensitive environments.

Application Analysis

In 2024, The Traffic Management segment held a dominant market position, capturing a 40.6% share of the Global Work Zone Detection AI Market. Work zone detection AI supports traffic controllers by supplying real-time insights that help reduce congestion around construction zones. By identifying active work areas, flagging changes in lane closures, and alerting drivers to hazards, the technology smooths traffic flow and prevents accidents where roadwork intersects with public roads.

This application also extends overall road safety by facilitating rapid incident detection and response within work zones. By integrating AI-powered detection with traffic signal systems and digital alerts, authorities can optimize traffic routing and protect both workers and commuters. The technology serves a growing need for intelligent traffic solutions amid increasingly complex urban transportation networks.

For Instance, in November 2025, Trimble Inc. revealed AI-powered transportation management systems that automate complex workflows and provide predictive insights, demonstrating AI’s role in traffic management within work zones.

End-User Analysis

In 2024, The Government Agencies segment held a dominant market position, capturing a 42.9% share of the Global Work Zone Detection AI Market. These agencies implement work zone detection AI to protect workers, ensure regulatory compliance, and manage construction schedules more effectively. As primary administrators of public roads, governments leverage AI to reduce traffic accidents and streamline traffic management during roadworks.

Increased adoption by government bodies is supported by public safety mandates and funding initiatives aimed at upgrading infrastructure technologies. These agencies benefit from AI’s capabilities to monitor work zones continuously, predict hazards, and generate actionable insights that improve safety outcomes and operational efficiency in transportation projects.

For Instance, in November 2025, Caterpillar Inc. developed AI-driven predictive maintenance and operational solutions aimed at enhancing infrastructure project safety and efficiency, supporting government agency requirements for work zone safety.

Emerging Trends

A key emerging trend is the deployment of smart work zones using AI combined with sensor fusion technologies like radar, LiDAR, and computer vision to detect unauthorized entries and dynamically manage traffic conditions. This trend has resulted in real-time intrusion alerts and reduced incident rates in experimental zones, showing crash reductions of around 17%, demonstrating real-world impact on worker safety.

Another trend is the integration of AI systems with wearable devices to provide instant alerts to workers when vehicles breach safety zones, creating an active virtual safety net beyond traditional cones and signage. The development of automated flagging devices controlled remotely also minimizes human exposure to live traffic. These innovations are becoming standard in state pilots and show promising safety improvements, with reductions in worker injuries reported up to 30%.

Growth Factors

Growth in work zone detection AI is driven partly by advances in computer vision technology that automate the verification of work zone setups, like the proper placement of cones and barriers. This automation prevents errors in zone preparation, improving safety compliance and reducing accidents by up to 20%.

Additionally, AI-enhanced data analytics fuse input from multiple sources, such as driver behavior and road conditions, which helps predict risk hotspots and optimize safety resource deployment. Faster emergency response enabled by AI analytics further limits accident severity by saving critical minutes after incidents.

Another key growth factor is increasing awareness of workplace safety regulations and the need for advanced technology to meet these standards cost-effectively. AI systems provide scalable, continuous monitoring with detailed logging and analysis, supporting compliance efforts while lowering overall risk.

Organizations recognize the value of AI-enabled insight for incident prevention and regulatory reporting. This awareness, combined with better AI performance, is accelerating adoption across infrastructure projects and utilities.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Application

- Traffic Management

- Road Safety Monitoring

- Construction Site Management

- Incident Detection

- Others

By End-User

- Government Agencies

- Construction Companies

- Transportation Authorities

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Enhanced Safety Awareness

The Work Zone Detection AI market is supported by the increasing need to improve occupational safety in high-risk areas. Real-time monitoring through cameras and computer vision helps identify unsafe actions, misplaced barriers, and unauthorized access. These alerts reduce accidents and support safer conditions for workers and motorists as global infrastructure activity continues to grow.

Stricter safety rules and rising investments in modernization further encourage the use of AI systems. Organizations and governments are prioritizing early risk detection to prevent incidents before they occur. This focus on proactive safety improves situational awareness across construction and roadwork sites.

For instance, In June 2025, Bosch expanded its investment in AI to enhance safety and productivity. Their systems provide real-time monitoring and predictive alerts that help avoid hazards and operational downtime. This demonstrates how AI-driven detection supports safer and more efficient work environments.

Restraint

Regulatory and Standardization Challenges

One major restraint facing the Work Zone Detection AI market is regulatory uncertainty and the lack of harmonized safety standards across different regions. Without uniform regulations governing AI deployment in work zones, compliance becomes complex for multinational operators, slowing widespread adoption of these systems.

Moreover, privacy concerns related to surveillance and data collection from AI-based monitoring raise additional legal and ethical questions. This fragmentation of rules, combined with varied digital infrastructure maturity across geography, limits the market’s growth. Companies must navigate different sets of laws and address issues like data privacy, which can delay project approvals and implementation.

For instance, in July 2025, FLIR Systems faces challenges related to regulatory compliance with the EU AI Act, which mandates strict safety, transparency, and accountability measures for AI applications. FLIR has adapted by developing AI systems that operate offline and do not collect personally identifiable information, ensuring GDPR compliance but highlighting how regulatory hurdles can limit deployment complexity and flexibility.

Opportunities

Expansion through Technological Innovation

The Work Zone Detection AI market has a significant opportunity to grow through continuous technology advancement and geographic expansion. Innovations like sensor fusion, edge computing, and AI models that learn from changing work zone conditions allow for more accurate and scalable safety systems. These technologies enable customization to meet diverse requirements across industries and regions, broadening the addressable market.

Emerging markets, especially in the Asia Pacific with rapid urbanization and infrastructure development, represent fertile ground for adoption. There is increasing interest in AI for work zone safety beyond traditional sectors, including utilities and industrial operations, driving new use cases and partnerships. Strategic collaborations and acquisitions further support the penetration of advanced AI detection tools, offering growth prospects beyond current deployments.

For instance, in November 2025, Trimble introduced new AI agents and workflows designed to automate transportation operations, including road and work zone management. These innovations enable better data integration, workflow automation, and efficiency gains, emphasizing the market’s opportunity through technological advancements and expanding AI capabilities in managing complex work zones.

Challenges

Integration and Operational Complexity

A significant challenge for the Work Zone Detection AI market lies in integrating these solutions with existing work site systems and managing operational complexities. Legacy infrastructure often lacks compatibility, making deployment and data synchronization difficult. Additionally, work zones are dynamic environments where AI must handle issues such as occlusion, network latency, false alerts, and evolving site layouts.

Maintaining system accuracy with limited connectivity and ensuring real-time alerts without delay requires robust edge computing hardware and software. Adoption hurdles include the need for training personnel and fine-tuning AI parameters for specific sites. These operational issues can hinder user acceptance and complicate large-scale implementation, requiring ongoing innovation in AI algorithms and platform design to overcome.

For instance, In April 2025, Caterpillar invested 100 million USD to upskill employees in AI and machine learning, addressing the difficulty of aligning new technologies with existing worker capabilities and legacy infrastructure. The initiative highlighted how human factors and older systems continue to slow smooth AI adoption in industrial environments.

Key Players Analysis

Bosch, Siemens Mobility, Honeywell, Topcon, and Trimble lead the work zone detection AI market with advanced sensing systems, machine-vision platforms, and real-time safety analytics. Their technologies support roadway monitoring, automated hazard detection, and improved worker protection. These companies focus on accurate object recognition, rapid alerting, and seamless integration with traffic-management systems.

FLIR Systems, Caterpillar, Hexagon, Conduent, Iteris, and Miovision strengthen the competitive landscape with AI-enabled cameras, thermal imaging, and cloud-based traffic intelligence. Their solutions monitor lane closures, equipment movement, and vehicle flow inside work zones. These providers help agencies reduce collisions and improve situational awareness.

RoadBotics, RoboSense, Waycare, Derq, LeddarTech, Sensys Networks, Kapsch TrafficCom, SWARCO, Allied Vision, and others broaden the market with specialized perception systems and sensor fusion technologies. Their offerings include LiDAR-based detection, computer-vision hazard analysis, and AI-driven predictive safety tools. These companies prioritize fast deployment, high accuracy, and compatibility with smart-city ecosystems.

Top Key Players in the Market

- Bosch

- Siemens Mobility

- Honeywell International

- Topcon Corporation

- Trimble Inc.

- FLIR Systems

- Caterpillar Inc.

- Hexagon AB

- Conduent Incorporated

- Iteris Inc.

- Miovision Technologies

- RoadBotics

- RoboSense

- Waycare Technologies

- Derq

- LeddarTech

- Sensys Networks

- Kapsch TrafficCom

- SWARCO AG

- Allied Vision Technologies

- Others

Recent Developments

- In February 2025, Bosch announced advancements in AI interior sensing technology, including camera systems capable of occupant monitoring and driver attention detection, which are integral to enhancing safety features in work zones and vehicles alike. This AI development supports automated alerts for distracted or fatigued operators, contributing to safer work zone environments.

- In January 2024, FLIR expanded its thermal imaging camera range with models featuring enhanced thermal sensitivity and AI-ready dual camera modules. These assist in night and low-visibility work zones by detecting heat signatures and objects, improving overall site safety monitoring.

Report Scope

Report Features Description Market Value (2024) USD 2.45 Bn Forecast Revenue (2034) USD 8.85 Bn CAGR(2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud), By Application (Traffic Management, Road Safety Monitoring, Construction Site Management, Incident Detection, Others), By End-User (Government Agencies, Construction Companies, Transportation Authorities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch, Siemens Mobility, Honeywell International, Topcon Corporation, Trimble Inc., FLIR Systems, Caterpillar Inc., Hexagon AB, Conduent Incorporated, Iteris Inc., Miovision Technologies, RoadBotics, RoboSense, Waycare Technologies, Derq, LeddarTech, Sensys Networks, Kapsch TrafficCom, SWARCO AG, Allied Vision Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Work Zone Detection AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Work Zone Detection AI MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch

- Siemens Mobility

- Honeywell International

- Topcon Corporation

- Trimble Inc.

- FLIR Systems

- Caterpillar Inc.

- Hexagon AB

- Conduent Incorporated

- Iteris Inc.

- Miovision Technologies

- RoadBotics

- RoboSense

- Waycare Technologies

- Derq

- LeddarTech

- Sensys Networks

- Kapsch TrafficCom

- SWARCO AG

- Allied Vision Technologies

- Others