Global Woodworking Machinery Market By Product Type (Saws, Planers And Jointers, Routers And CNC Routing Machines, Milling And Drilling Machines, Sanders, Lathes, and Others), By Operating Mode (Manual and Automatic), By Application (Construction, Furniture Manufacturing, and Others), By Sales Channel (OEM and Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172096

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

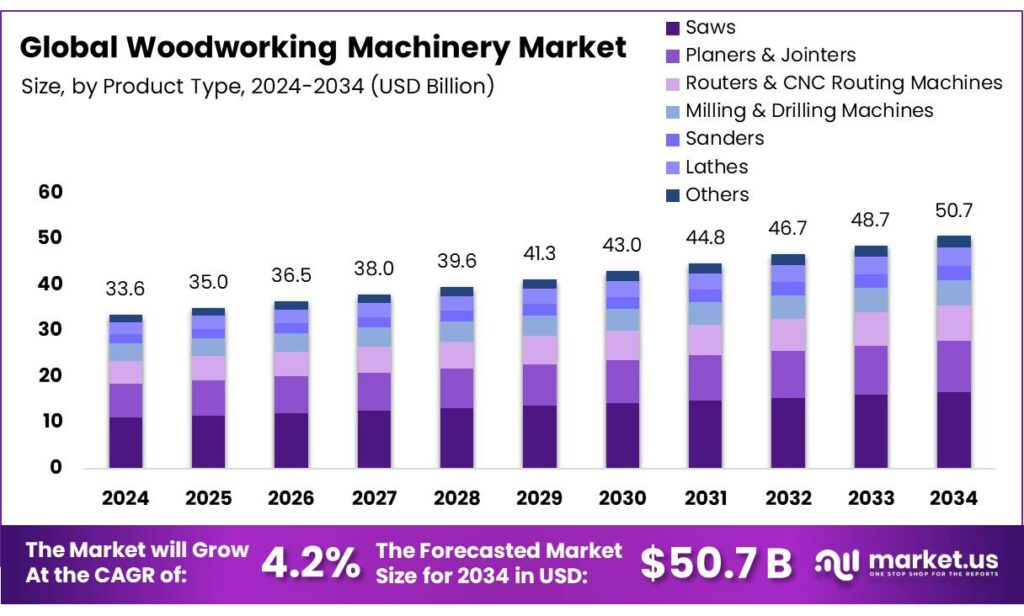

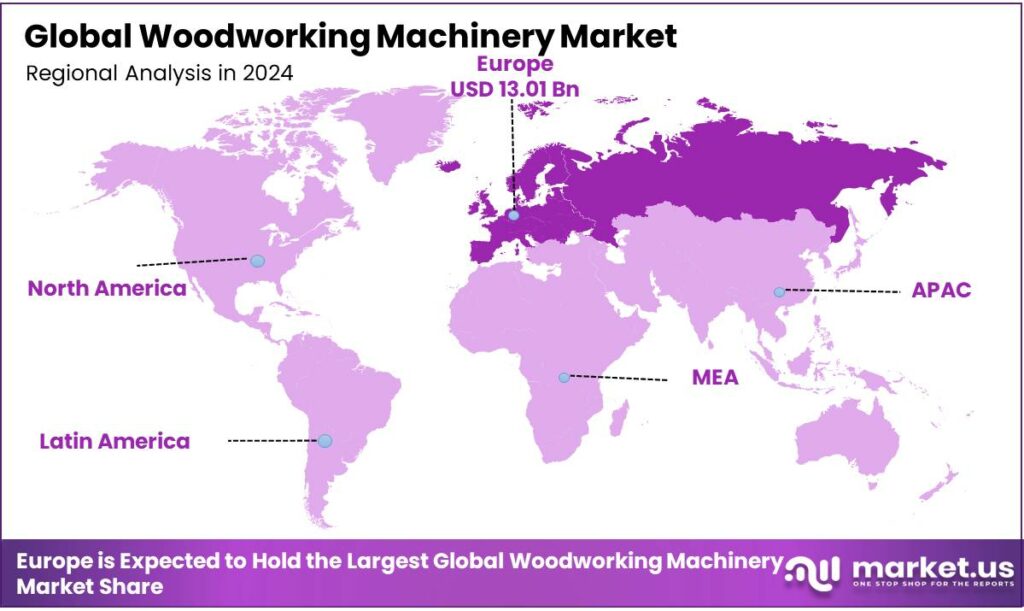

The Global Woodworking Machinery Market size is expected to be worth around USD 50.7 Billion by 2034, from USD 33.6 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 38.7% share, holding USD 1.2 Billion in revenue.

Woodworking machinery refers to power tools and equipment used to cut, shape, smooth, drill, and finish wood for various projects, ranging from simple hand tools such as sanders and routers to complex industrial machines such as CNC routers, table saws, and planers that enhance efficiency in producing furniture, cabinetry, and other wood products. The woodworking machinery market is driven by increasing demand for precision, efficiency, and customization in various industries, particularly furniture manufacturing.

Advanced technologies, such as CNC routers and automated systems, have transformed production processes, enabling manufacturers to produce high-quality, intricate designs with minimal error and reduced labor costs. While automation is on the rise, manual machinery remains prevalent due to its affordability and the control it offers operators, particularly for custom or low-volume production.

However, the market faces challenges, such as high initial costs for advanced machinery and the impact of geopolitical tensions on supply chains. The shift toward sustainability and the ongoing trends of customization and automation continue to shape the landscape, positioning woodworking machinery as a key element in the evolving manufacturing process.

Key Takeaways

- The global woodworking machinery market was valued at USD 33.6 billion in 2024.

- The global woodworking machinery market is projected to grow at a CAGR of 4.2% and is estimated to reach USD 50.7 billion by 2034.

- Among types of products, routers and CNC routing machines dominated the woodworking machinery market, constituting 36.5% of the total market share.

- Based on the operating mode, manual machines dominated the woodworking machinery market, with a substantial market share of around 56.2%.

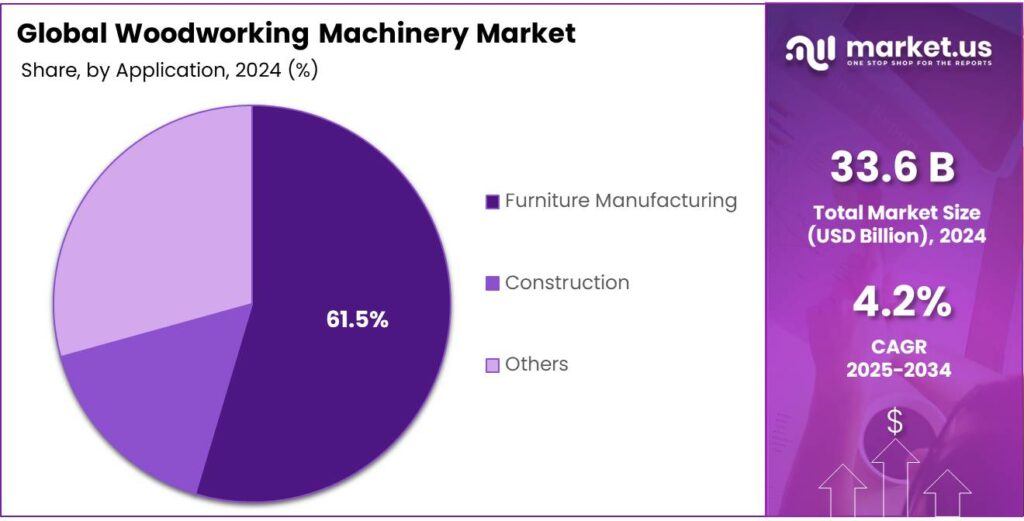

- Among the applications, furniture manufacturing held a major share in the woodworking machinery market, 61.5% of the market share.

- Based on the sales channel, OEM led the woodworking machinery market, comprising 58.6% of the total market.

- In 2024, Europe was the most dominant region in the woodworking machinery market, accounting for 38.7% of the total global consumption.

Product Type Analysis

Routers & CNC Routing Machines are a Prominent Segment in the Woodworking Machinery Market.

The woodworking machinery market is segmented based on types of machinery into saws, planers & jointers, routers & CNC routing machines, milling & drilling machines, sanders, lathes, and others. The routers & CNC routing machines led the woodworking machinery market, comprising 36.5% of the market share, due to their versatility, precision, and efficiency. Unlike traditional saws or planers, which are primarily used for cutting and smoothing, routers and CNC machines can perform a wide range of tasks, including cutting, engraving, shaping, and drilling, all with high accuracy.

Additionally, the ability to work with intricate designs and complex patterns makes them ideal for custom furniture production and large-scale manufacturing. Similarly, CNC routers offer automation, reducing labor costs and minimizing human error. Their adaptability to various materials, including wood, plastics, and composites, further enhances their appeal. In contrast to other machines such as sanders, lathes, or milling machines, routers and CNC systems provide greater flexibility in terms of precision and the variety of tasks they can accomplish, making them a preferred choice for modern woodworking processes.

Operating Mode Analysis

Manual Machinery Dominated the Woodworking Machinery Market.

On the basis of operating mode, the woodworking machinery market is segmented into manual and automatic. Manual machinery dominated the woodworking machinery market, comprising 56.2% of the market share. Most woodworking machinery remains manual due to factors such as cost, simplicity, and the specific needs of certain operations. Manual machines are significantly less expensive to purchase and maintain compared to their automatic counterparts, making them a more viable option for small to medium-sized businesses with limited capital.

Additionally, manual machines provide a level of control and precision that many craftsmen prefer, particularly in specialized or custom woodworking tasks. They allow operators to make real-time adjustments based on the material’s characteristics or the desired outcome. While automation offers efficiency, the complexity and upfront cost of automated systems may hinder growth, particularly in smaller workshops where custom or low-volume production is common.

Application Analysis

Furniture Manufacturing Held a Major Share of the Woodworking Machinery Market.

The furniture manufacturing industry dominated the woodworking machinery market, with a notable market share of 61.5%, due to the high demand for precision, customization, and aesthetic quality in furniture production. Furniture manufacturing requires intricate designs, detailed craftsmanship, and the ability to work with fine wood finishes, where specialized woodworking machinery, such as CNC routers and planers, excel.

In contrast, the construction sector often involves more standardized wood products such as beams, planks, and panels, which can often be processed with simpler, less specialized equipment. Additionally, furniture makers frequently produce small to medium batches of custom or semi-custom pieces, which require flexible machinery capable of producing unique designs and high-end finishes. The versatility and fine-tuned capabilities of woodworking machinery align more closely with the demands of the furniture industry, where both function and aesthetics are important.

Sales Channel Analysis

Woodworking Machinery Products Are Mostly Sold to OEMs.

Based on the sales channel, the woodworking machinery market is segmented into OEM and aftermarket. Among the sales channels, 58.6% of the woodworking machinery is sold to OEMs, as they require high volumes of machinery for production at scale. These manufacturers often invest in advanced, specialized machinery to meet the precise demands of mass production.

Moreover, OEMs benefit from the latest technology and automation features that enhance efficiency, precision, and output, making them the primary buyers of new equipment. In contrast, aftermarket sales are more focused on maintenance, upgrades, or replacement parts for existing machines, which often involves a smaller, more localized market. The initial investment in machinery by OEMs allows them to maintain a competitive edge in terms of production capabilities, and they account for a larger share of the woodworking machinery market compared to aftermarket sales.

Key Market Segments

By Product Type

- Saws

- Planers & Jointers

- Routers & CNC Routing Machines

- Milling & Drilling Machines

- Sanders

- Lathes

- Others

By Operating Mode

- Manual

- Automatic

By Application

- Construction

- Furniture Manufacturing

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Booming Construction Sector Drives the Woodworking Machinery Market.

The woodworking machinery market has experienced significant growth, driven largely by the booming construction sector. As construction activities ramp up globally, the demand for precision and high-efficiency machinery in woodworking has surged. For instance, as the construction of residential and commercial buildings increases, the need for high-quality wood products, such as flooring, paneling, and cabinetry, has risen. This trend correlates with a growing adoption of advanced woodworking machinery, which offers improved productivity and precision.

- According to the Government of India, the country’s total infrastructure spending has grown exponentially, with budget allocations rising to INR 10 lakh crore in 2023-24. Similarly, according to the National Bureau of Statistics of China, infrastructure investment reached approximately US$2.4 trillion in 2023, marking a 6% increase from 2022.

Additionally, the push for sustainability in construction encourages the use of optimized machinery that minimizes material waste, further boosting the demand for innovative woodworking equipment.

Restraints

High Initial Costs Might Pose a Challenge to the Woodworking Machinery Market.

High initial costs represent a significant challenge in the woodworking machinery market, particularly for small and medium-sized enterprises (SMEs) looking to invest in advanced technologies. For instance, CNC machines and automated systems, while offering superior precision and efficiency, can require substantial capital outlay for purchase and installation.

- For instance, high-end woodworking CNC routers, designed for industrial use, typically cost US$20,000 to over US$120,000, with features such as 5-axis capability, Automatic Tool Changers (ATC), larger work areas, and higher precision for complex furniture or musical instruments, while prosumer models start around US$10,000-US$25,000 for advanced 3-axis machines.

This upfront investment can be a barrier for businesses that operate on thin profit margins or those that are entering the market. Furthermore, the need for specialized training to operate these machines adds another layer of expense. While these machines offer long-term cost savings through increased productivity and reduced labor costs, the financial hurdle remains a significant obstacle for many companies, particularly in developing regions where access to capital may be more limited.

Opportunity

Consumer Demand for Custom Furniture Creates Opportunities in the Woodworking Machinery Market.

The increasing consumer demand for custom furniture is presenting significant opportunities in the woodworking machinery market. For instance, according to a report, 71% of customers prefer personalized furniture and decorations designed for their bathrooms. As preferences shift toward personalized and unique designs, woodworking businesses are adapting by investing in advanced machinery capable of producing bespoke furniture pieces with high precision. CNC routers and 3D printers have become essential tools, enabling manufacturers to create intricate and customized designs that meet specific customer requirements.

Additionally, the growing trend of e-commerce and online furniture sales has fueled this demand, with consumers seeking tailored products that reflect their individual tastes. This shift is particularly evident in regions such as North America and Europe, where the preference for custom-made furniture is more. Moreover, as sustainability becomes a key consideration, consumers are increasingly opting for locally sourced, custom-made products, which further drives demand for innovative woodworking machinery that can handle smaller batch sizes without compromising on quality or efficiency.

Trends

Shift Towards Automation and CNC.

The shift towards automation and the adoption of CNC (Computer Numerical Control) technology is a dominant trend in the woodworking machinery market. Automation allows for faster production cycles, reduced labor costs, and enhanced precision, making it increasingly attractive to manufacturers aiming to meet the rising demand for high-quality wood products. In particular, CNC machines are central to this transformation, as they enable manufacturers to produce intricate designs with unparalleled accuracy and consistency. For instance, CNC routers are widely used for cutting, drilling, and engraving, streamlining operations while offering versatility for different materials.

In addition, the technology facilitates the production of customized furniture and complex architectural elements, a crucial factor as consumer preferences shift toward personalized designs. Similarly, automation reduces human error and material waste, contributing to more sustainable practices in woodworking. The ongoing integration of AI and robotics in CNC systems is further optimizing efficiency and operational flexibility, setting the stage for the future of the woodworking industry.

Geopolitical Impact Analysis

Geopolitical Tensions Have Affected the Dynamics of the Woodworking Machinery Market.

The geopolitical tensions have introduced significant volatility in the woodworking machinery market, affecting supply chains and market dynamics. Trade disruptions, particularly due to tariff impositions and export restrictions, have impacted the availability of key raw materials, such as steel and electronics, which are essential in manufacturing advanced woodworking machinery. For instance, tariffs on Chinese imports in the US have led to increased costs for components such as motors and control systems, which are critical in CNC machines. These price hikes have forced several manufacturers to absorb the additional costs or pass them on to customers, potentially reducing demand.

Furthermore, geopolitical instability in regions of Eastern Europe has led to uncertainty in production and distribution channels, creating delays and uncertainties in lead times for machinery delivery. In addition, companies have been prompted to reconsider their sourcing strategies, with many seeking to diversify suppliers or relocate production to more stable regions. The volatility affects investment decisions, with companies adopting a more cautious approach to expansion and capital investment in advanced machinery.

Regional Analysis

Europe Held the Largest Share of the Global Woodworking Machinery Market.

In 2024, Europe dominated the global woodworking machinery market, holding about 38.7% of the total global consumption. The region has consistently held the largest share of the global woodworking machinery market, driven by the region’s advanced manufacturing capabilities and strong demand for high-quality woodworking products. Countries such as Germany, Italy, and Sweden are at the forefront, with robust industrial bases and a history of woodworking craftsmanship.

For instance, Germany is a key player due to its emphasis on precision engineering and technological innovation in machinery. Additionally, the European Union’s commitment to sustainability encourages investments in energy-efficient and eco-friendly woodworking technologies, boosting demand for modern machinery. Moreover, mature construction and furniture industries in the region, particularly in countries such as Italy and France, drive the demand for high-end, custom-made wood products, further pushing the demand for sophisticated machinery.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies focus on product innovation, particularly through the integration of advanced technologies such as CNC automation, robotics, and AI, which enhance precision, efficiency, and customization capabilities. Additionally, many companies enhance their global presence by expanding distribution networks and forming strategic partnerships with regional distributors, ensuring better access to diverse markets.

Similarly, large companies make efforts to invest in manufacturing facilities to expand their market reach and to cater to the broader consumer base. Furthermore, the companies focus on strategic mergers and buyouts for market expansion and to innovate their product portfolios.

The following are some of the major players in the industry

- Holytek Industrial Corp.

- SCM Group

- Gongyou Group Co., Ltd.

- Dürr Group

- Socomec S.R.L.

- Oliver Machinery Company

- RS Wood S.R.L.

- Biesse Group

- A L Dalton Ltd.

- Solidea Srl

- Cantek America Inc.

- Homag Group

- Michael Weinig AG

- Felder Group

- Other Key Players

Key Development

- In November 2025, SCM Canada announced its new partnership with Titan Equipment, appointing the company as the official SCM machinery distributor for British Columbia and Alberta.

- In October 2024, Oliver Machinery introduced the model 10045 benchtop planer with a single-phase, 2-hp, 115-volt motor, Wixey digital readout, and four-post design for cutterhead alignment.

Report Scope

Report Features Description Market Value (2024) US$33.6 Bn Forecast Revenue (2034) US$50.7 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Saws, Planers & Jointers, Routers & CNC Routing Machines, Milling & Drilling Machines, Sanders, Lathes, and Others), By Operating Mode (Manual and Automatic), By Application (Construction, Furniture Manufacturing, and Others), By Sales Channel (OEM and Aftermarket) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Holytek Industrial Corp., SCM Group, Gongyou Group Co., Ltd., Dürr Group, Socomec S.R.L., Oliver Machinery Company, RS Wood S.R.L., Biesse Group, A L Dalton Ltd., Solidea Srl, Cantek America Inc., Homag Group, Michael Weinig AG, Felder Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Woodworking Machinery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Woodworking Machinery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample- Holytek Industrial Corp.

- SCM Group

- Gongyou Group Co., Ltd.

- Dürr Group

- Socomec S.R.L.

- Oliver Machinery Company

- RS Wood S.R.L.

- Biesse Group

- A L Dalton Ltd.

- Solidea Srl

- Cantek America Inc.

- Homag Group

- Michael Weinig AG

- Felder Group

- Other Key Players