Global Women Luxury Footwear Market By Product Type (Boots, Heels and Pumps, Sandals and Flats, Casual, Sneakers and Sports Shoes), By Material Type (Rubber, Leather, Polyester, Velvet, Canvas, Textiles, Others), By Sales Channel (Online Sales, Offline Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131232

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

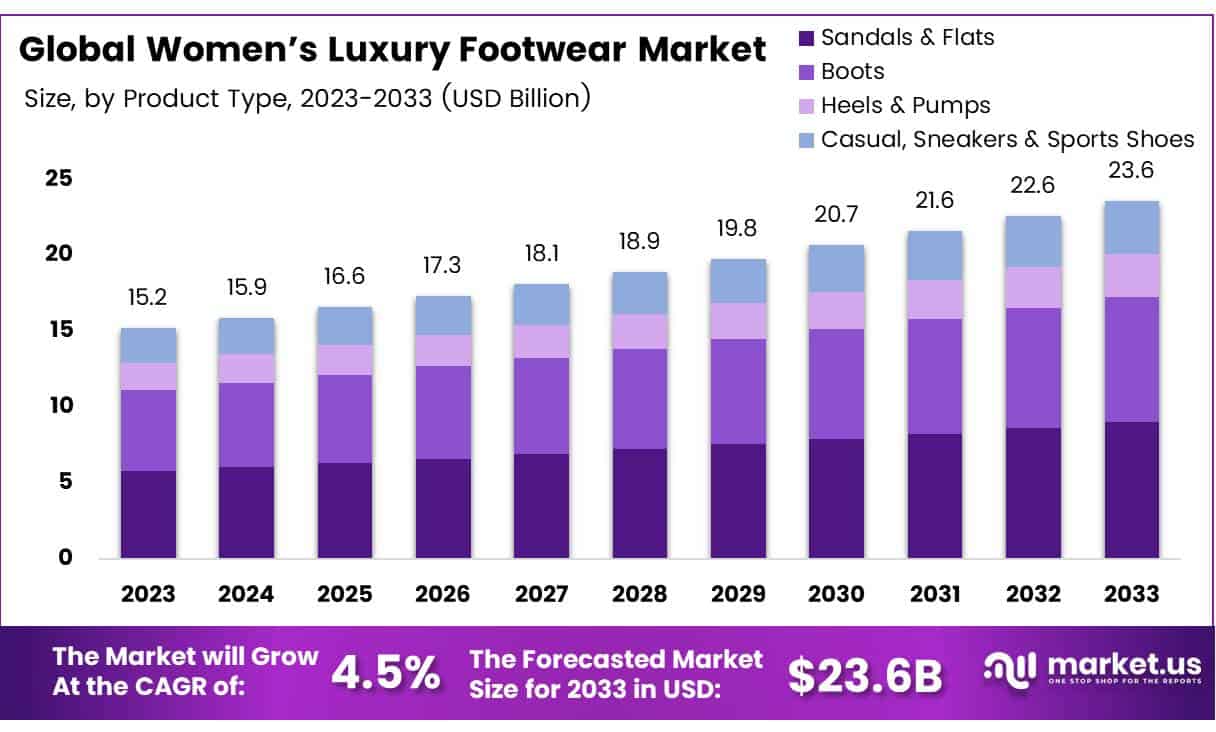

The Global Women’s Luxury Footwear Market size is expected to be worth around USD 23.6 Bn by 2033, from USD 15.2 Bn in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

Women’s luxury footwear transcends traditional boundaries, serving as both a marker of style and a symbol of status. Crafted from the finest materials and distinguished by superior craftsmanship, these pieces often hail from iconic fashion labels. This niche is defined by exclusivity, quality, and a direct link to the evolving dynamics of fashion trends. For discerning consumers, these shoes are not mere accessories but essential elements of a curated lifestyle.

The market for women’s luxury footwear is an intricate tableau of heritage brands and avant-garde designers. It thrives on a unique blend of historical cachet and innovative design, appealing to a clientele that views footwear as a pivotal component of personal identity. The landscape is heavily influenced by economic fluctuations, global consumer trends, and an increasingly digital shopping experience.

The expansion of the women’s luxury footwear market is propelled by increasing global wealth, particularly in emerging economies where new affluent segments are emerging. The digital sphere amplifies this growth through social media, where influencers and celebrities set aspirational benchmarks. Limited editions and capsule collections further fuel demand, creating a lucrative cycle of desire and acquisition.

Consumer demand in this sector is intricately linked to the emotional resonance of luxury brands, which are perceived as custodians of heritage and innovation. This emotional connection is fortified by personalized experiences and exclusive services that cater to the high expectations of luxury buyers. The trend towards customization and bespoke designs is reshaping demand patterns, making each purchase a personal statement.

Forward-thinking brands are now embracing sustainability as a core component of their value proposition, responding to a market that increasingly equates luxury with responsibility. Moreover, the digital transformation of luxury retail is opening new avenues for engagement, particularly through enhanced online experiences and cutting-edge customer service technologies. These developments represent pivotal opportunities for growth, positioning brands to capitalize on both the enduring allure of luxury and the imperatives of a changing global market.

In the landscape of Women’s Luxury Footwear, discerning market insights pivot on understanding nuanced consumer behaviors and preferences. Data from Viakix reveals a compelling trend within North America spanning the United States, Canada, and Mexico where Size 8 shoes predominate, capturing approximately 29% of market sales.

This particular statistic serves not only as a barometer for consumer demand but also as a strategic anchor for inventory management and marketing campaigns in these regions. Following Size 8, Size 9 maintains a robust presence, constituting between 22% and 26.7% of sales, while Size 11 trails with only 5.6% to 8.0% of orders, signaling a lesser demand that may influence production decisions.

Further enriching our understanding of market dynamics, ShopSmart magazine highlights that the average American woman owns 19 pairs of shoes, with an astonishing 15% possessing over 30 pairs. This data underscores a significant engagement with footwear as both a functional commodity and a fashion statement, presenting an augmented potential for luxury brands to tap into this high-ownership cluster.

Moreover, projections from Foto Shoe magazine estimate a 9.2% rise in global footwear consumption in 2024, suggesting a robust rebound and potential growth opportunities for the luxury segment. This expected increase is indicative of an expanding market where luxury brands can leverage innovative designs and sustainability practices to meet evolving consumer expectations.

Key Takeaways

- The global Women’s Luxury Footwear Market is projected to grow from USD 15.2 billion in 2023 to USD 23.6 billion by 2033, at a CAGR of 4.5%.

- Sandals & Flats lead the market by product type with a 38.1% share in 2023, favored for their comfort and versatility in both casual and formal settings.

- Rubber is the predominant material in luxury footwear in 2023, holding a 32.2% market share due to its durability and flexibility, while leather remains a premium choice.

- Online sales channels dominate the market, reflecting a shift in consumer shopping preferences towards convenience and the use of advanced technologies for a better customer experience.

- North America holds a significant market share of 33%, valued at USD 5 billion, driven by high disposable income and a strong presence of luxury brands and e-commerce.

- Key market drivers include increased global disposable income and a growing interest in fashion trends, influencing women to invest in luxury footwear.

- Social media campaigns using augmented reality and interactive content have become crucial in driving consumer engagement and boosting sales in the luxury footwear sector.

By Product Type

Sandals & Flats Lead at 38.1% in Women’s Luxury Footwear Market

In 2023, Sandals & Flats held a dominant market position in the “By Product Type Analysis” segment of the Women’s Luxury Footwear Market, with a 38.1% share. This segment’s prominence can be attributed to the increasing consumer preference for comfort coupled with style, particularly in warmer climates and during the summer season. The versatility of sandals and flats, suitable for both casual and formal settings, significantly drives their demand.

Following Sandals & Flats, the Boots category emerged as the second most significant, capturing a substantial market portion due to their durability and style versatility, which make them a preferred choice for the autumn and winter seasons.

Heels & Pumps maintained a steady market position, favored for their elegance and the empowerment they offer to the wearer. These styles are particularly popular in professional and formal settings. Meanwhile, Casual, Sneakers, & Sports Shoes are gaining traction, particularly driven by the athleisure trend and an increasing focus on wellness and physical activities among women.

This segment’s growth is enhanced by technological advancements in footwear, which improve comfort and functionality, appealing to a broader demographic seeking both performance and luxury.

By Material Type

Rubber Leads at 32%, Shaping Trends in Women’s Luxury Footwear Materials

In 2023, Rubber held a dominant market position in the “By Material Type Analysis” segment of the Women’s Luxury Footwear Market, with a 32% share. This prevalence is attributed to rubber’s durability and flexibility, which are highly valued in high-end footwear designs.

Following closely, leather claimed a significant portion of the market due to its classic appeal and premium quality, which are synonymous with luxury. Polyester also made a notable impact, favored for its versatility and resistance to wear and tear, making it suitable for both casual and formal luxury footwear.

Velvet and canvas materials, while less dominant, were preferred for their aesthetic appeal and comfort. Velvet, often associated with luxury and elegance, is typically selected for exclusive, fashion-forward designs. Canvas, known for its lightweight and breathable properties, is incorporated into luxury sporty designs, blending comfort with high fashion.

Textiles and other materials, such as synthetic and exotic skins, collectively held a smaller share of the market. These materials are often targeted at niche markets looking for unique textures and patterns. The variety within the “Others” category caters to a segment of consumers seeking distinctiveness in their luxury footwear, highlighting the diverse consumer preferences that luxury footwear brands aim to satisfy.

By Sales Channel Analysis

Online Sales Lead with Major Share in 2023 Women’s Luxury Footwear Market

In 2023, Online Sales held a dominant market position in the “By Sales Channel Analysis” segment of the Women’s Luxury Footwear Market, capturing a significant percentage of the market share. This dominance can be attributed to the increasing consumer preference for shopping convenience, wider selection, and the ability to compare prices and styles efficiently.

E-commerce platforms have enhanced their customer service by incorporating advanced technologies such as virtual try-on and personalized shopping experiences, which have further propelled online sales growth.

Conversely, Offline Sales, while still substantial, have faced challenges in maintaining market share due to changing consumer behaviors and the rising trend of digital migration among shoppers. However, offline channels like boutique stores and luxury retail outlets continue to play a critical role in the luxury footwear market. They offer unique value propositions such as superior customer service, immediate product access, and the tactile experience that luxury consumers value highly.

Both channels are integral to the distribution network of women’s luxury footwear, each offering distinct advantages that appeal to various consumer preferences and shopping behaviors. As the market evolves, integrating these channels to provide a seamless customer experience will be key to sustaining growth and competitiveness in this luxury sector.

Key Market Segments

By Product Type

- Boots

- Heels & Pumps

- Sandals & Flats

- Casual, Sneakers & Sports Shoes

By Material Type

- Rubber

- Leather

- Polyester

- Velvet

- Canvas

- Textiles

- Others

By Sales Channel

- Offline Sales

- Department Stores

- Specialty Stores

- Monobrand Stores

- Off-Price Stores

- Others

- Online Sales

Drivers

Growing Disposable Income Boosts Luxury Footwear Sales

The Women’s Luxury Footwear Market is experiencing substantial growth, primarily driven by increasing global disposable income, which empowers more women to indulge in luxury goods such as high-end footwear. This surge in purchasing power is coupled with a heightened awareness and interest in fashion trends.

Today’s consumer is more fashion-conscious, seeking designer footwear that not only complements their style but also denotes a certain lifestyle or status. Additionally, the expansion of e-commerce has significantly transformed the retail landscape for luxury footwear.

Online platforms offer the convenience of shopping from anywhere, broadening the market reach and making these luxury items more accessible to a global audience. These factors collectively foster a dynamic environment for the sales and demand of women’s luxury footwear, illustrating a promising trajectory for market growth.

Restraints

Luxury Footwear’s High Production Costs

The Women’s Luxury Footwear Market faces significant restraints, primarily driven by the high cost of production. Crafting luxury footwear involves premium materials and meticulous craftsmanship, which inherently drives up the final price for consumers. This high cost can limit the market’s customer base, as only a select group of consumers can or choose to afford such expensive products.

Additionally, shifting consumer preferences pose another challenge. Modern trends indicate a movement toward more casual and practical footwear options, which can diminish demand for traditional luxury styles, such as high-heeled shoes.

These changes in consumer behavior suggest that the market must adapt to maintain relevance, possibly by integrating elements of comfort and practicality into luxury designs to broaden their appeal. This scenario highlights the need for strategic adjustments in product offerings to meet evolving consumer demands while managing production costs to remain competitive in the high-end market.

Growth Factors

Luxury Footwear Taps New Markets

The Women’s Luxury Footwear Market is poised for significant growth by venturing into new geographic regions that have yet to fully exploit the luxury goods sector. This strategic expansion taps into a ready consumer base eager for premium products.

Furthermore, the market can gain substantial momentum through cross-industry collaborations, enhancing brand visibility and injecting fresh appeal into established names. These partnerships not only broaden the consumer demographic but also invigorate the brand image with innovative design and marketing approaches.

Additionally, there’s a remarkable opportunity to captivate the Millennial and Gen Z demographics by aligning marketing efforts with the values of sustainability and ethical fashion, which are increasingly influential in consumer purchase decisions.

By integrating these strategies, geographic expansion, creative collaborations, and targeted marketing, the Women’s Luxury Footwear Market can attract a diverse customer base and set new benchmarks in luxury retail.

Emerging Trends

Interactive Social Media Campaigns Boost Luxury Footwear

In the women’s luxury footwear market, three key trends are shaping consumer behavior and driving sales. Firstly, interactive social media campaigns are increasingly vital. Brands are engaging consumers through creative and interactive content on platforms like Instagram and TikTok, making use of augmented reality filters, live launches, and interactive polls to draw attention and enhance customer interaction.

Secondly, celebrity endorsements and influencer marketing play a crucial role. When celebrities or social media influencers wear luxury footwear, it significantly influences their followers’ preferences and boosts brand visibility and sales.

Lastly, the athleisure trend continues to influence luxury footwear designs. This trend integrates athletic and leisure elements, making luxury footwear not only stylish but also more comfortable and versatile. These factors together are steering the market dynamics by appealing to a broader audience, encouraging more frequent purchases, and ultimately leading to market growth.

Regional Analysis

North America Leads Women’s Luxury Footwear Market with 33% Share, Valued at $5 Billion

The Women’s Luxury Footwear Market exhibits distinct characteristics and trends across various regions, reflecting consumer preferences, economic conditions, and cultural influences.

In North America, the market is robust, holding a commanding 33% share with a valuation of USD 5 billion. This dominance can be attributed to high disposable income levels and a strong preference for luxury brands, which fuel demand for high-quality, stylish footwear. The region’s market is bolstered by the presence of numerous flagship stores and a well-established e-commerce network that facilitates accessibility and variety for consumers.

Regional Mentions:

Europe follows closely, renowned for its rich fashion heritage and the presence of several leading luxury footwear designers and manufacturers. The region benefits from its reputation as a global fashion hub, with cities like Milan and Paris leading in luxury fashion trends. This market is characterized by high consumer loyalty to luxury brands, sophisticated retail landscapes, and an increasing focus on sustainable and artisanal footwear.

The Asia Pacific region is witnessing rapid growth in the luxury footwear market, driven by increasing affluence, particularly in China and India. The expanding middle class, coupled with a growing inclination towards Western fashion trends, is significantly boosting demand. Retail expansions and digital marketing strategies are effectively tapping into this burgeoning consumer base, which shows a keen interest in luxury products as symbols of status and fashion.

The Middle East & Africa and Latin America regions, though smaller in market share, are emerging as potential growth areas. In the Middle East, luxury consumption is propelled by high per capita income and a strong retail sector. Latin America is gradually evolving with rising fashion awareness and increasing economic stability, which are opening new avenues for luxury footwear brands.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Kering has consistently positioned itself as a leader in the luxury fashion sector, and its impact on the Women’s Luxury Footwear Market remains substantial. In 2023, Kering has leveraged its robust portfolio of iconic brands, including Gucci and Saint Laurent, to innovate and expand its footwear offerings.

This approach has enabled Kering to maintain a strong connection with luxury consumers who value both tradition and contemporary style in their footwear. Kering’s strategic focus on sustainability and exclusive designs continues to enhance its market position, catering to a growing segment of environmentally conscious consumers.

Burberry, renowned for its British heritage and distinctive check pattern, has effectively utilized its brand legacy to fortify its presence in the luxury footwear market. In 2023, Burberry emphasized digital innovation and integrated marketing campaigns that align with its high fashion aesthetic.

The company’s investments in digital platforms have particularly strengthened its direct-to-consumer channels, making its luxury footwear more accessible to global audiences. Burberry’s commitment to British craftsmanship and personalized customer experiences remains a significant draw for consumers seeking exclusivity and heritage in their purchases.

Caleres stands as a notable player with a diverse brand portfolio that includes both luxury and accessible lines. In 2023, Caleres successfully capitalized on market trends by expanding its offerings in both high-end and premium casual footwear.

Its strategic acquisitions and collaborations have broadened its reach and resonated well with a wide demographic, from millennials to older luxury buyers. Caleres’ ability to blend style, comfort, and innovation keeps it competitive in a market that values both aesthetic appeal and functionality.

Top Key Players in the Market

- Kering

- Burberry

- Caleres

- NIKE, Inc.

- Capri Holdings Limited

- Jimmy Choo PLC

- Christian Dior

- Skechers

- Under Armour, Inc.

- Ariat International, Inc.

- Catwalk Worldwide Pvt. Ltd.

- Wolverine World Wide, Inc.

- JGGR S.R.L

- Manolo Blahnik International Limited

- Adidas Group

Recent Developments

- In June 2024, MGCU made its first significant investment by acquiring a stake in RG Barry Brands, a prominent player in the footwear industry. This strategic move by MGCU aims to leverage RG Barry Brands’ established market presence and expertise to enhance its portfolio and expand its market reach.

- In August 2023, a Massachusetts-based company secured approximately $7.7 million in funding through a financing round in March. The round was notably led by professional football quarterbacks Derek Carr and Alex Smith, highlighting a growing interest from sports figures in business investments.

- In January 2023, American Exchange Group successfully completed the acquisition of White Mountain Footwear, a well-known women’s footwear brand. This acquisition is part of American Exchange Group’s strategy to diversify its product offerings and strengthen its position in the footwear market.

- Brazilian footwear giant Arezzo acquired a 65% stake in the luxury brand Paris Texas for 130 million Brazilian reais (25 million euros). The deal involved ARZZ Italia, a subsidiary of Arezzo, purchasing a 26% stake via a 10 million euros capital increase and buying the remaining 39% from Baltimora Studio, which represents the founders, for 15 million euros. This acquisition is a strategic expansion of Arezzo’s luxury footwear segment.

Report Scope

Report Features Description Market Value (2023) USD 15.2 Bn Forecast Revenue (2033) USD 23.6 Bn CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Boots, Heels & Pumps, Sandals & Flats, Casual, Sneakers & Sports Shoes), By Material Type(Rubber, Leather, Polyester, Velvet, Canvas, Textiles, Others), By Sales Channel(Online Sales, Offline Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kering, Burberry, Caleres, NIKE, Inc., Capri Holdings Limited, Jimmy Choo PLC, Christian Dior, Skechers, Under Armour, Inc., Ariat International, Inc., Catwalk Worldwide Pvt. Ltd., Wolverine World Wide, Inc., JGGR S.R.L, Manolo Blahnik International Limited, Adidas Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Women Luxury Footwear MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Women Luxury Footwear MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kering

- Burberry

- Caleres

- NIKE, Inc.

- Capri Holdings Limited

- Jimmy Choo PLC

- Christian Dior

- Skechers

- Under Armour, Inc.

- Ariat International, Inc.

- Catwalk Worldwide Pvt. Ltd.

- Wolverine World Wide, Inc.

- JGGR S.R.L

- Manolo Blahnik International Limited

- Adidas Group