Global Wireless Mouse Market By Product Type (Optical Mice and Laser Mice), By Connectivity Type (Radio Frequency (RF) and Bluetooth), By End-Use (Personal Use and Professional Use), By Distribution Channel ( Offline Stores and Online Platforms), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 29837

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Latest Trends

- Product Type Analysis

- Connectivity Type Analysis

- End-Use Analysis

- Distribution Channel Analysis

- Key Market Segments

- Geopolitics and Recession Impact Analysis

- Regional Analysis

- Market Share and Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

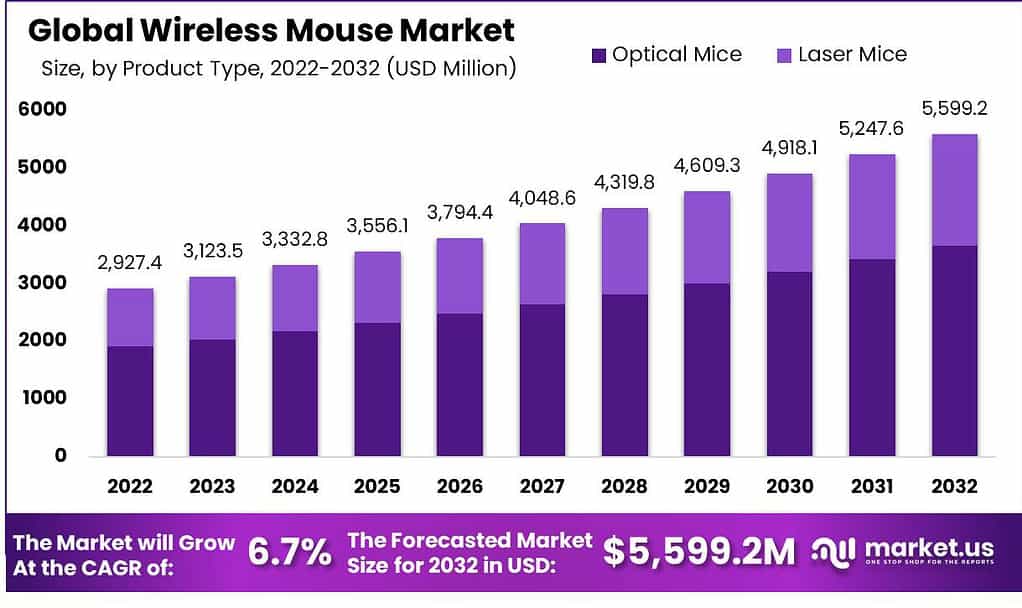

The Global Wireless Mouse Market size is expected to be worth around USD 5,599.2 Million by 2033, from USD 2,927.4 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

The global wireless mouse market has been witnessing remarkable growth recently due to rising demand for convenient and efficient input devices among users. Wireless mice have become preferred choices for both professional and personal use, eliminating cord tangling and offering greater flexibility. Continuous technological advancements have led to improved wireless connectivity, battery life, and ergonomic design, enhancing user experiences.

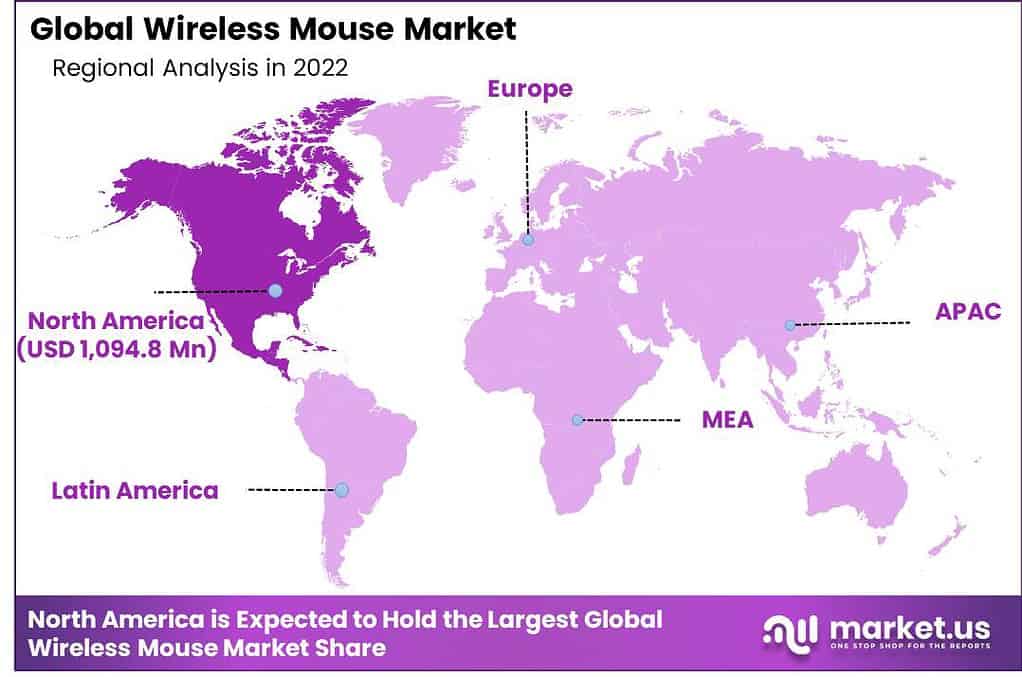

Furthermore, the surge in gaming and the need for precise input devices have further boosted demand for advanced wireless mice. Traditionally, North America and Europe have dominated the wireless mouse market, given their tech-savvy populations and strong manufacturer presence. Nevertheless, Asia-Pacific is emerging as a lucrative market due to its expanding IT sector and increasing wireless technology adoption.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- In 2022, the Global Wireless Mouse Market was valued at US$ 2,927.4 Million.

- By Product Type, the Optical Mice segment held a major market share of 65.3% in 2022.

- By Connectivity Type, the Radio Frequency (RF) segment held a major market share of 67.2% in 2022.

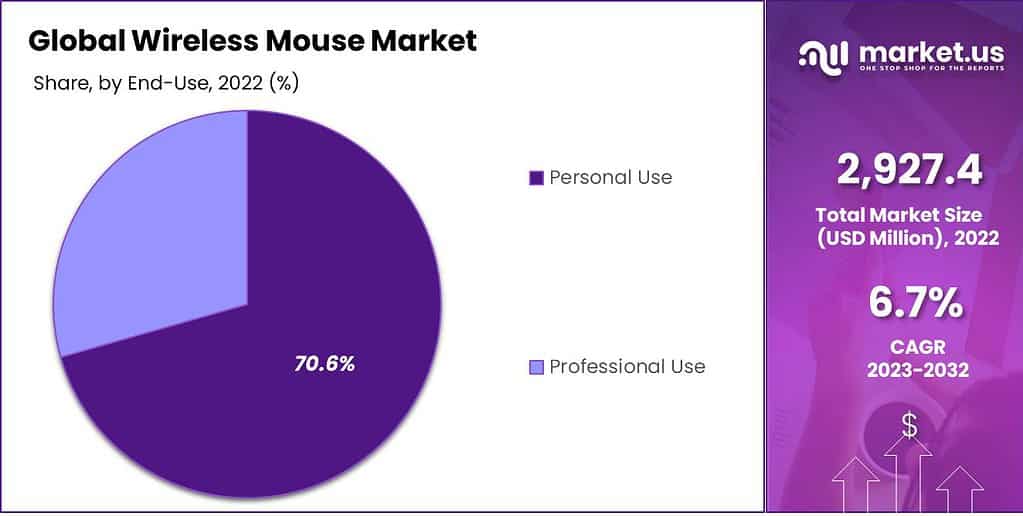

- By End-Use, the Personal Use segment held a major market share of 70.6% in 2022.

- By Distribution Channel, the Offline Stores segment dominated the market

- In 2022, North America dominated the market with the highest revenue share of 37.4%.

- Growing Remote Work and E-Learning Trends are expected to positively affect demand for Wireless Mouse.

- Battery Life and Charging Concerns may hamper the adoption of Wireless Mouse among End-Users.

- Growth in E-Sports and Gaming is expected to create lucrative opportunities in the market.

- Wireless mouse with ergonomic designs for enhanced comfort and health are expected to be a trend in the market.

- Key players include Logitech International S.A., HP Inc., Microsoft Corporation, and others.

Driving Factor

Remote Work and E-Learning Trends

The global shift towards remote work and online education, accelerated by the COVID-19 pandemic, has boosted the demand for wireless mice. Professionals and students require efficient, portable input devices that enable productivity and flexibility. Wireless mice provide the mobility and convenience needed for remote work setups and e-learning environments. This trend is not limited to the pandemic era; remote work and online education are expected to remain prevalent in the post-pandemic world, sustaining the demand for wireless mice. As individuals seek reliable and ergonomic peripherals for extended usage, the wireless mouse market is positioned for continued growth, making it a vital driver in the market’s trajectory.

Restraining Factor

Battery Life and Charging Concerns

Battery life and the need for regular charging pose another significant restraint for the wireless mouse market. While manufacturers have made substantial improvements in battery efficiency, wireless mice still require periodic recharging or battery replacement, which can inconvenience users. This issue is particularly relevant for users who rely on wireless mice for extended periods, such as professionals and gamers. The inconvenience of a dead battery during a critical task or gaming session can lead some users to prefer wired mice, which do not have this limitation. Manufacturers must continue developing longer-lasting batteries and innovative charging solutions to address this restraint effectively.

Growth Opportunity

Growth in E-Sports and Gaming

The growing gaming industry is a prime opportunity for wireless mouse manufacturers. Both casual and professional gamers demand high-performance input devices with features like advanced sensors, customization buttons, and low latency. This creates a specialized niche within the wireless mouse market. Companies can capitalize on this by developing gaming-specific wireless mice that cater to the unique needs of gamers.

Additionally, forming strategic partnerships with gaming influencers and e-sports teams can help boost visibility and market penetration in this segment. As gaming continues to gain mainstream popularity, this opportunity is expected to expand further, making it a lucrative avenue for growth.

Latest Trends

Ergonomic Designs for Enhanced Comfort and Health

The focus on ergonomic designs is an increasingly prevalent trend in the global wireless mouse market. With the rise in remote work and extended computer usage, manufacturers prioritize user comfort and well-being.

Ergonomic mice feature designs that reduce wrist strain and promote natural hand positions. Features such as customizable button layouts, adjustable grips, and soft-touch materials are becoming standard. As awareness of ergonomic accessories grows, the demand for these wireless mice is expected to increase.

Product Type Analysis

Cloud-Based Segment Dominates the Market with a Major Revenue Share in Account.

Based on Product Type, the market is further divided into optical mice and laser mice. Among these Product Type segments, the optical mice segment leads the market by covering the major revenue share of 65.3%. The dominance of the optical mice segment can be attributed to its precise and responsive tracking on various surfaces, eliminating the need for mouse pads.

This versatility appeals to a broad consumer base. Also, these mice have no moving parts, reducing wear and tear and extending their lifespan. Optical mice are power-efficient, as they consume less battery compared to their counterparts. Lastly, optical mice align with the trend of sleek and compact designs, enhancing their market appeal. These factors collectively contribute to their market dominance.

Connectivity Type Analysis

Radio Frequency (RF) Connectivity Type Segment Dominates the Global Wireless Mouse Market by Holding Major Revenue Share in Account.

Based on Connectivity Type, the market is classified into radio frequency (RF) and Bluetooth. Among these Connectivity Type segments, the radio frequency (RF) segment dominates the market by holding a major revenue share of 67.2%. This dominance of the radio frequency (RF) segment is due to various factors. RF technology offers exceptional reliability and stable connectivity over considerable distances, which is a vital feature in wireless mice. It operates on a broader frequency spectrum, minimizing interference and providing seamless performance even in crowded wireless environments.

RF mice are known for their low latency, ensuring swift response times, a crucial factor for gamers and professionals. Furthermore, RF mice are versatile and compatible with various devices and platforms. These attributes collectively make RF connectivity the preferred choice, meeting the diverse needs of consumers and sustaining its dominance in the market.

End-Use Analysis

Personal Use Dominates the End-Use Segment in the Global Wireless Mouse Market.

Based on End-Use, the market is segmented into personal use and professional use. Among these End-user segments, the personal use segment held a major revenue share of 70.6% in 2022. This growth of the personal use segment can be attributed to various reasons. Personal use encompasses a broad spectrum of individuals, from students to professionals and gamers, making it the largest market segment.

Wireless mice have become essential tools for personal computing, offering convenience and flexibility. They cater to various tasks, such as productivity, entertainment, and gaming, ensuring mass-market appeal. Additionally, the personal use segment benefits from repeat purchases, as consumers often upgrade or replace their wireless mice, ensuring sustained demand. This extensive consumer base and adaptability secure its dominance in the market.

Note: Actual Numbers Might Vary In Final Report

Distribution Channel Analysis

Offline Stores Distribution Channel Segment Dominates the Market with a Major Revenue Share in Account.

On the basis of distribution channel, the market is further divided into offline stores and online platforms. Among these distribution channel segments, the offline stores segment leads the market by covering the major revenue share of 61.7%. Offline stores offer a tangible shopping experience, allowing consumers to examine and test products physically, which is particularly important for ergonomic computer peripherals like wireless mice.

Additionally, offline stores provide immediate availability and a level of customer service that online channels struggle to match. Consumers often prefer the convenience of purchasing from local retailers, especially for quick replacements or last-minute needs. Collectively, these advantages keep the offline stores’ distribution channel segment at the forefront of the market.

Key Market Segments

Product Type

- Optical Mice

- Laser Mice

Connectivity Type

- Radio Frequency (RF)

- Bluetooth

End-Use

- Personal Use

- Professional Use

Distribution Channel

- Offline Stores

- Online Platforms

Geopolitics and Recession Impact Analysis

Geopolitics Impact Analysis

Geopolitical factors can significantly influence the Global Wireless Mouse Market. Trade tensions and tariff disputes between major economies can disrupt the supply chain and increase manufacturing costs. Restrictions on technology exports, especially semiconductor components used in wireless mice, can further hinder market growth. Political instability in key manufacturing regions can also lead to production delays and supply chain disruptions. Intellectual property protection and cybersecurity concerns in geopolitically sensitive regions may also impact market dynamics. Companies must navigate these complexities by diversifying supply chains, complying with trade regulations, and closely monitoring geopolitical developments to mitigate potential risks.

Recession Impact Analysis

The Global Wireless Mouse Market may experience challenges and opportunities during economic recessions. On the downside, consumers may reduce discretionary spending, affecting demand for wireless mice. Businesses may cut back on IT equipment budgets, impacting corporate sales. However, there are counterbalancing factors. Remote work trends, often reinforced during economic downturns, can boost demand for wireless mice as more individuals require home office setups. Additionally, cost-conscious consumers may seek affordable wireless mice as cost-effective alternatives to wired counterparts. Companies in the wireless mouse market must adapt to changing consumer behaviors during recessions, focusing on value propositions and cost-effective offerings to weather economic challenges while capitalizing on emerging opportunities.

Regional Analysis

North America Dominates the Global Wireless Mouse Market by Holding the Major Revenue Share in Account.

The North America region dominates the global wireless mouse market by holding a major revenue share of 37.4%. The North American region’s dominance in the global wireless mouse market can be attributed to various factors. North America boasts a highly developed technology infrastructure and a large consumer base with a strong inclination toward adopting innovative tech accessories.

The region is home to several key players in the tech industry, including major wireless mouse manufacturers, facilitating easy access to cutting-edge technology and trends. These factors positively affect the demand for wireless mice in the region. However, the Asia-Pacific region is also expected to grow at a higher CAGR in the forecasted period.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The global wireless mouse market encompasses various companies offering optical and laser mice to a broad range of customers. Key players in the market are focusing on enhancing their market presence via strategic acquisitions and mergers. Companies in the market are constantly developing new and advanced wireless mice to strengthen their market position. Some major players in the market include Logitech International S.A., HP Inc., Microsoft Corporation, Apple Inc., Dell Inc., Lenovo Group Limited, Razer Inc., Corsair Gaming, Inc., Acer Inc., Samsung Electronics Co., Ltd., SteelSeries, ACCO Brands Corporation, Anker Innovations Co., Ltd, IOGEAR, GIGABYTE Technology Co., Ltd., as well as other key players.

Top Key Players in the Wireless Mouse Market

- Logitech International S.A.

- HP Inc.

- Microsoft Corporation

- Apple Inc.

- Dell Inc.

- Lenovo Group Limited

- Razer Inc.

- Corsair Gaming, Inc.

- Acer Inc.

- Samsung Electronics Co., Ltd.

- SteelSeries

- ACCO Brands Corporation

- Anker Innovations Co., Ltd

- IOGEAR

- GIGABYTE Technology Co., Ltd.

- Other Key Players

Recent Developments

- In September 2023, Logitech International S.A. announced the launch of its Logitech G Pro X Superlight 2 Gaming Mouse.

- In June 2023, Razer Inc. launched a new Razer Cobra Pro Wireless Mouse product.

Report Scope

Report Features Description Market Value (2023) US$ 3,123.5 Bn Forecast Revenue (2032) US$ 5,599.2 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Optical Mice and Laser Mice), By Connectivity Type (Radio Frequency (RF) and Bluetooth), By End-Use (Personal Use and Professional Use), By Distribution Channel ( Offline Stores and Online Platforms) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Logitech International S.A., HP Inc., Microsoft Corporation, Apple Inc., Dell Inc., Lenovo Group Limited, Razer Inc., Corsair Gaming, Inc., Acer Inc., Samsung Electronics Co., Ltd., SteelSeries, ACCO Brands Corporation, Anker Innovations Co., Ltd, IOGEAR, GIGABYTE Technology Co., Ltd. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a wireless mouse?Wireless mice are computer input devices that operate wirelessly without physically connecting to a computer or laptop, typically via Bluetooth or radio frequency (RF) technology.

How does a wireless mouse work?Wireless mice communicate with the computer via a wireless receiver or Bluetooth connection. They use batteries or rechargeable cells to power their operation.

How big is the market for Wireless Mouse Market?The Global Wireless Mouse Market is anticipated to create a lucrative growth opportunity in the global landscape by registering a CAGR of 6.7% from 2023 to 2032. The market is expected to reach a valuation of USD 2,927.4 Million by the end of 2022 and is predicted to reach USD 5,599.2 Million by 2032.

What is future of wireless mouse market?Future predictions for wireless mouse markets hold promise of advanced sensor technology, extended battery life, ergonomic designs that provide enhanced comfort, wireless charging capabilities and multi-device connectivity options. Customizability options and sustainability also remain key trends - gamers in particular can look forward to receiving tailored upgrades while smart features and durability improvements will further expand wireless mouse versatility. As technology develops and costs decrease further expansion is expected within this market.

Who is leader in Wireless Mouse Market ?Logitech is the leader in the wireless mouse market. Logitech has a wide range of wireless mice to choose from, including mice for gaming, business, and general use. Logitech mice are known for their high quality, reliability, and performance.

-

-

- Logitech International S.A.

- Microsoft Corp.

- Razer Inc.

- Hewlett-Packard

- Lenovo Group Ltd.

- Dell Technologies Inc.

- Samsung Group

- Apple Inc.

- Other Key Players