Global Wind Turbine Casting Market Size, Share, And Business Benefits By Type (Horizontal Axis, Vertical Axis), By Material (Ductile Iron, Gray Iron, Steel, Aluminum, Others), By Process (Sand Casting, Investment Casting, Die Casting), By End-Use (On-Shore Wind Turbines, Off-Shore Wind Turbines, Others), By Turbine Size (Small (less than 10 MW), Medium (10-19 MW), Large (20 MW or greater)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153495

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

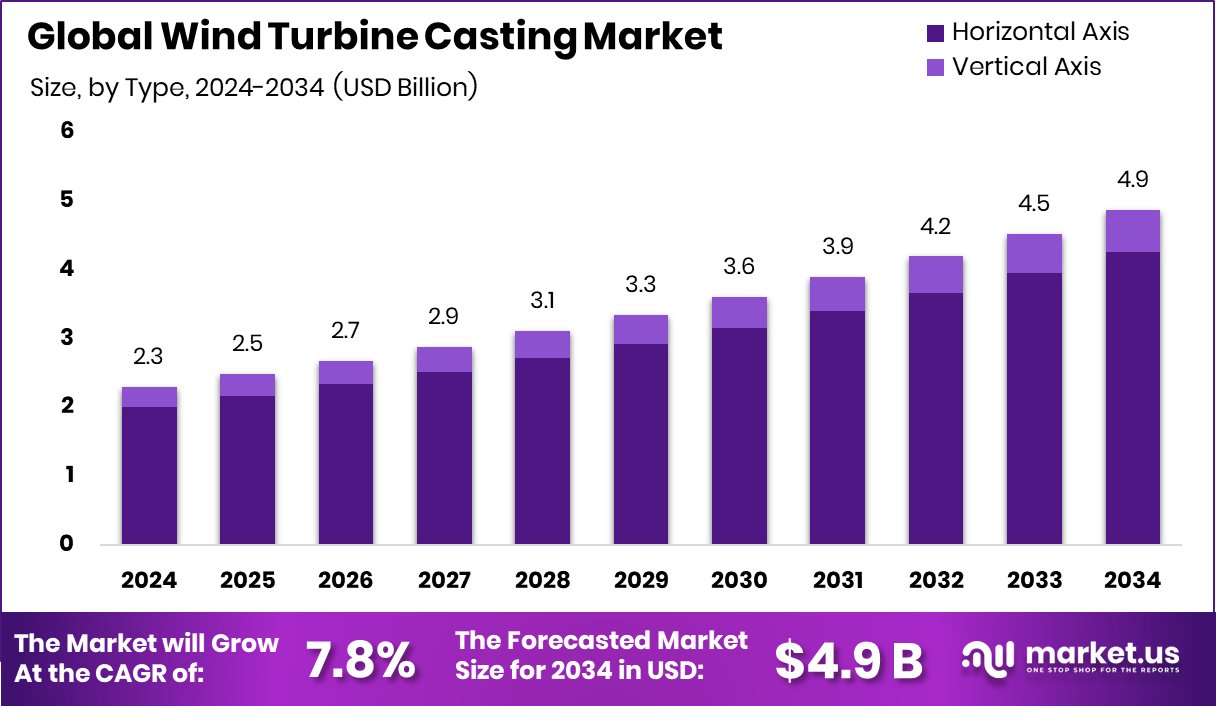

The Global Wind Turbine Casting Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034. Strong investments in wind energy boosted Asia-Pacific’s market share to 38.7%.

Wind turbine casting refers to the manufacturing process in which large and complex metal components for wind turbines—such as hubs, main shafts, gearbox housings, and bearing housings—are produced using casting techniques. These parts are typically made from high-strength iron or steel alloys, designed to withstand mechanical stress and harsh environmental conditions. Precision in casting is crucial because wind turbine components operate under high loads, rotating constantly and facing weather extremes.

The wind turbine casting market involves the production, supply, and integration of cast components used in onshore and offshore wind turbines. This market is closely linked with the overall wind energy sector and plays a vital role in supporting the global shift toward renewable power generation. As countries adopt more wind energy to reduce carbon emissions, the demand for durable and cost-effective turbine parts is growing. For example, Bpifrance provides €17 million to Wysenergy for a 9-MW wind project in Marne, reflecting how government-backed funding supports infrastructure that indirectly boosts casting demand.

One of the primary growth drivers for the wind turbine casting market is the global push for cleaner energy. Governments across the world are setting ambitious targets for renewable energy, especially wind, leading to increased installations of wind turbines. Thrive Renewables secures a £10 million funding boost, while Yorkshire receives more than £2.5 million for clean energy projects—both indicative of broader investment trends favoring wind energy development. As turbine sizes increase, the need for large, high-precision cast parts grows significantly.

Demand is particularly strong in regions investing in large-scale wind projects—both onshore and offshore. Emerging economies are also expanding their wind energy capacity, creating opportunities for casting manufacturers to enter new markets. The growing demand for offshore wind, which requires more robust and corrosion-resistant castings, adds further momentum. To support such initiatives, the EU allocates €1.25 billion in grants to strengthen energy infrastructure, promoting a favorable environment for growth in turbine component production.

Significant opportunities exist in developing lightweight, high-strength casting alloys that can reduce turbine weight while maintaining durability. Manufacturers who adopt automation, digital casting simulations, and advanced molding technologies are likely to gain a competitive edge. Furthermore, repowering older wind farms with modern turbines creates a steady aftermarket demand for cast parts.

Key Takeaways

- The Global Wind Turbine Casting Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- In the Wind Turbine Casting Market, horizontal axis turbines accounted for a dominant 87.3% share.

- Ductile iron held the largest material segment in the Wind Turbine Casting Market with 44.8% share.

- Sand casting process led the Wind Turbine Casting Market, contributing to 62.5% of total manufacturing methods.

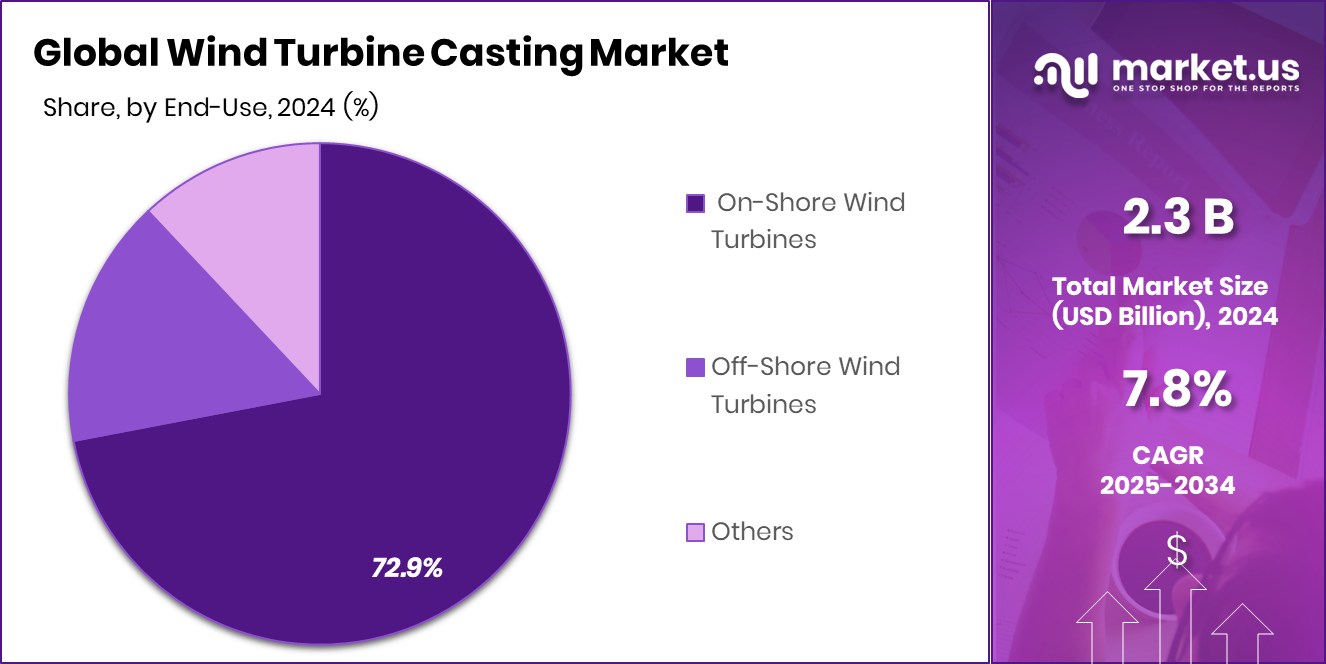

- On-shore wind turbines dominated end-use in the Wind Turbine Casting Market, capturing around 72.9% market share.

- Medium-sized turbines (10–19 MW) represented 56.1% of the Wind Turbine Casting Market by turbine size.

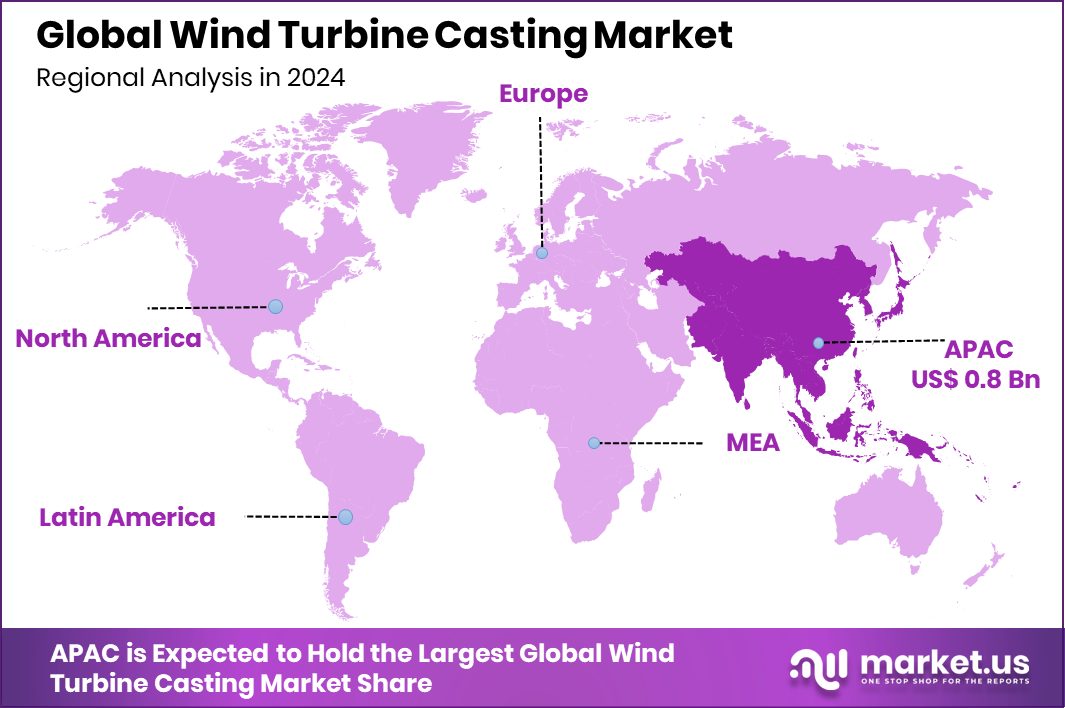

- Wind turbine casting demand in Asia-Pacific reached USD 0.8 billion in 2024.

By Type Analysis

Horizontal axis turbines dominate the Wind Turbine Casting Market, holding 87.3%.

In 2024, Horizontal Axis held a dominant market position in the By Type segment of the Wind Turbine Casting Market, with an 87.3% share. This commanding share reflects the widespread adoption of horizontal axis wind turbines (HAWTs) across both onshore and offshore installations due to their higher efficiency and compatibility with large-scale power generation projects.

The design of HAWTs allows for better aerodynamics and greater energy capture from prevailing wind currents, which has led to their preference in commercial wind farm developments. As turbine sizes continue to scale up for enhanced energy output, the demand for high-strength cast components—such as nacelle housings, hubs, and main shafts—has correspondingly increased, particularly in the horizontal axis configuration.

The large market share also indicates that casting manufacturers are primarily geared toward supporting the production and assembly of HAWT components, utilizing advanced metallurgical techniques to meet the size and performance requirements. With this design continuing to dominate wind energy installations, the casting segment aligned with horizontal axis turbines remains a critical supply chain link in the global transition toward renewable energy systems.

By Material Analysis

Ductile iron leads material preference in casting, capturing 44.8%.

In 2024, Ductile Iron held a dominant market position in the By Material segment of the Wind Turbine Casting Market, with a 44.8% share. This significant share highlights the material’s suitability for manufacturing critical wind turbine components that demand a balance of strength, durability, and flexibility. Ductile iron is known for its superior mechanical properties, including high tensile strength and impact resistance, which make it ideal for producing components such as hubs, bearing housings, and gearbox cases.

The material’s ability to withstand heavy mechanical loads and fluctuating stress conditions commonly experienced in wind turbine operations has supported its wide adoption in casting applications. Its machinability and relatively cost-effective production also contribute to its preference among casting manufacturers. With the increasing deployment of large-scale turbines, especially in regions experiencing steady wind power expansion, the demand for reliable and long-lasting materials like ductile iron continues to rise.

The 44.8% market share in 2024 clearly reflects the material’s established role in supporting efficient and robust turbine performance. Manufacturers have consistently relied on ductile iron for casting complex and large-sized components that require high structural integrity, reinforcing its leading position in the material segment of the wind turbine casting market.

By Process Analysis

Sand casting remains the primary process, accounting for 62.5%.

In 2024, Sand Casting held a dominant market position in the By Process segment of the Wind Turbine Casting Market, with a 62.5% share. This leading share indicates the strong preference for sand casting in the production of large and heavy wind turbine components, such as hubs, bases, and main frames.

Sand casting is particularly well-suited for these applications due to its versatility, cost-effectiveness, and ability to accommodate complex geometries and substantial component sizes. The process allows manufacturers to produce components with high structural integrity while maintaining flexibility in mold design and material selection. Its suitability for both low- and high-volume production adds further appeal in a sector where customization and scale are both critical.

The 62.5% market share in 2024 underscores the continued reliance on traditional yet efficient casting methods that can deliver the mechanical strength and durability required for wind turbine applications. Sand casting’s adaptability to various alloys, combined with its economic benefits for large-scale manufacturing, has helped sustain its dominant position in the wind turbine casting process landscape.

By End-Use Analysis

On-shore turbines drive demand, comprising 72.9% market share.

In 2024, On-Shore Wind Turbines held a dominant market position in the By End-Use segment of the Wind Turbine Casting Market, with a 72.9% share. This high share highlights the widespread deployment of onshore wind farms as the preferred method for harnessing wind energy in many regions due to their lower installation costs, easier accessibility, and faster project timelines.

The dominance of onshore projects has directly translated into increased demand for cast components tailored for onshore wind turbines, including hubs, main shafts, and gear housings. These components require robust casting processes and materials that can endure variable terrain, fluctuating wind loads, and seasonal operating conditions typical of onshore environments.

The 72.9% market share in 2024 reflects how the casting industry has aligned its capabilities with the needs of this segment, focusing on delivering large, high-strength parts with reliable mechanical performance. Onshore turbines also allow for easier transport and assembly of cast components, further supporting their widespread use.

As countries continue expanding their onshore wind energy capacity to meet renewable energy goals, the demand for turbine castings tailored to land-based applications remains consistently high, reinforcing the dominant role of this end-use segment in the casting market landscape.

By Turbine Size Analysis

Medium turbines between 10–19 MW hold dominant 56.1% share.

In 2024, Medium (10–19 MW) held a dominant market position in the By Turbine Size segment of the Wind Turbine Casting Market, with a 56.1% share. This substantial share reflects the growing preference for medium-sized turbines, which offer a balance between power generation capacity and cost efficiency.

Turbines in the 10 to 19 MW range are increasingly favored for both large onshore installations and early-stage offshore projects, where scalability and proven performance are key considerations. The demand for cast components suitable for this turbine category—such as large hubs, main shafts, and nacelle frames—has increased in parallel, requiring high-strength materials and precision casting methods to ensure long-term durability.

The 56.1% share in 2024 underscores the alignment between manufacturing capabilities and the specific structural needs of this turbine size. Casting manufacturers have focused their production lines and design expertise to meet the mechanical demands associated with this segment, especially as developers seek to maximize energy yield per installation while maintaining operational reliability.

The prominence of this turbine size also reflects its compatibility with evolving grid infrastructure and land use regulations, making it a practical and scalable choice for energy developers. As such, medium turbines have become the central driver of casting activity within the wind energy sector.

Key Market Segments

By Type

- Horizontal Axis

- Vertical Axis

By Material

- Ductile Iron

- Gray Iron

- Steel

- Aluminum

- Others

By Process

- Sand Casting

- Investment Casting

- Die Casting

By End-Use

- On-Shore Wind Turbines

- Off-Shore Wind Turbines

- Others

By Turbine Size

- Small (less than 10 MW)

- Medium (10-19 MW)

- Large (20 MW or greater)

Driving Factors

Global Shift Toward Renewable Energy Boosts Demand

One of the main driving factors for the wind turbine casting market is the worldwide push toward clean and renewable energy. As countries try to reduce carbon emissions and rely less on fossil fuels, wind energy is becoming one of the most preferred choices. Governments are setting strict climate goals and investing in wind power projects—both onshore and offshore.

This growing demand for wind energy means more wind turbines need to be built, which directly increases the need for strong and durable cast parts like hubs, shafts, and bearing housings. Since castings are essential to building and operating turbines safely and efficiently, the move toward greener energy continues to strongly support growth in this market.

Restraining Factors

High Production Costs Limit Market Growth Potential

One of the key restraining factors for the wind turbine casting market is the high cost of production. Manufacturing large and complex cast parts requires advanced machinery, skilled labor, high-grade raw materials, and energy-intensive processes. Foundries also need to maintain strict quality and safety standards, especially for offshore wind components, which further adds to the cost.

These expenses can become a challenge for both new and existing manufacturers, particularly in regions with limited infrastructure or financial support. As a result, some wind energy developers may seek alternative solutions or delay investments. The overall market growth may slow down if casting costs continue to rise faster than the demand, making affordability a critical concern for long-term expansion.

Growth Opportunity

Rising Offshore Wind Projects Create New Demand

A major growth opportunity for the wind turbine casting market lies in the rapid development of offshore wind energy projects. Offshore wind farms are expanding globally due to their ability to produce higher energy output with stronger and more consistent winds. These projects require larger turbines, often above 10 MW, which need heavy-duty and corrosion-resistant cast components like nacelle frames, main shafts, and housings.

As offshore turbines grow in size and number, the need for high-quality casting solutions will rise significantly. This trend opens new doors for foundries and manufacturers to invest in specialized production techniques and materials tailored for harsh marine environments. The offshore segment’s strong future makes it a promising area for long-term casting market expansion.

Latest Trends

Use of Advanced Alloys Improves Casting Strength

One of the latest trends in the wind turbine casting market is the growing use of advanced alloys to produce stronger, lighter, and more durable components. As turbine sizes increase, especially in offshore projects, cast parts must handle higher loads and extreme weather conditions. Traditional materials like gray iron are being replaced or enhanced with high-performance alloys that offer better strength, fatigue resistance, and corrosion protection.

These advanced alloys also help reduce the overall weight of the turbine, improving efficiency and making transportation easier. Manufacturers are investing in metallurgical research and adopting new casting technologies to support this shift. This trend reflects the industry’s focus on improving the quality and performance of turbine parts for longer, more reliable service life.

Regional Analysis

In 2024, Asia-Pacific led the market with a 38.7% regional share.

In 2024, the Asia-Pacific region held a dominant position in the global Wind Turbine Casting Market, accounting for 38.7% of the total share, valued at approximately USD 0.8 billion. This strong regional performance is largely driven by continued investments in wind energy infrastructure across major economies in the region, particularly focusing on expanding onshore wind installations and accelerating offshore project developments.

The region’s manufacturing capabilities and supply chain advantages also support large-scale production of cast components such as hubs, nacelle housings, and main shafts. North America and Europe followed as key markets, supported by their ongoing renewable energy targets and favorable government policies promoting clean energy technologies.

While North America benefits from established wind power projects and technical expertise, Europe continues to advance in offshore wind capacity expansion. Meanwhile, the Middle East & Africa and Latin America represent emerging regions in the wind turbine casting landscape, where gradual adoption of wind energy solutions is creating localized demand for essential cast components. However, their market shares remain comparatively smaller at this stage.

With Asia-Pacific leading the global wind turbine casting market, the region is expected to maintain its influence through continued capacity additions and its role as a central hub for turbine component manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, DHI DCW Group Co., Ltd. continued to reinforce its stature through consistent investment in high-capacity casting facilities. The company has advanced its production capabilities to manufacture large-scale castings like hubs and bearing housings designed for both onshore and offshore turbines. Its focus on metallurgical refinement and precision molding has supported increased demand from utility-scale turbine projects, particularly in markets favoring medium and large turbine sizes.

Dongfang Electric sustained its competitive edge through strategic enhancements in its foundry operations. The company’s vertical integration facilitates tighter coordination between casting and downstream turbine assembly, which improves delivery timelines. In 2024, Dongfang Electric’s emphasis on capacity expansion aligned with suppliers of advanced materials, enabling it to meet growing orders for medium‑capacity turbine components.

Doosan Heavy Industries focused on advanced casting technologies, investing in digital mold simulation and automation. These efforts enabled higher consistency and reduced production lead times for large structural components such as main frames and shafts. Doosan’s improved cycle efficiency and quality assurance protocols helped bolster its standing among turbine manufacturers seeking customized and heavy-duty cast components.

Finally, Elyria Foundry Company, LLC leveraged its niche capabilities in specialized cast iron alloys to address specific turbine requirements. With expertise in ductile iron variants, Elyria Foundry has been able to supply smaller batches with heightened metallurgical precision. In 2024, its agility in meeting custom alloy specifications and support for rapid prototyping differentiated its offerings amid rising demand for tailored casting solutions.

Top Key Players in the Market

- DHI DCW Group Co., Ltd.

- Dongfang Electric

- Doosan Heavy Industries

- Elyria Foundry Company, LLC

- Enercon

- GE Renewable Energy

- Hyundai Heavy Industries

- Riyue Heavy Industry Corporation Ltd.

- SAKANA Group

- SEFORGE

- Siemens Gamesa

- Suzlon

- Vestas

Recent Developments

- In January 2025, GE Vernova committed USD 90 million to expand its Schenectady, New York, plant. This facility—capable of producing 150 onshore wind turbines annually—will ramp up casting and assembly of key structural components like hubs, nacelles, and shafts. This investment also supports the creation of 100 local jobs and enhances U.S.-based manufacturing resilience.

- In September 2024, Siemens Gamesa restarted sales of its 4.X onshore turbine series, following a 13-month suspension due to component issues. The company had previously paused sales to address defects in key parts—likely including cast elements within nacelles and gearbox housings—and provided EUR 1.6 billion in compensation.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Horizontal Axis, Vertical Axis), By Material (Ductile Iron, Gray Iron, Steel, Aluminum, Others), By Process (Sand Casting, Investment Casting, Die Casting), By End-Use (On-Shore Wind Turbines, Off-Shore Wind Turbines, Others), By Turbine Size (Small (less than 10 MW), Medium (10-19 MW), Large (20 MW or greater)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DHI DCW Group Co., Ltd., Dongfang Electric, Doosan Heavy Industries, Elyria Foundry Company, LLC, Enercon, GE Renewable Energy, Hyundai Heavy Industries, Riyue Heavy Industry Corporation Ltd., SAKANA Group, SEFORGE, Siemens Gamesa, Suzlon, Vestas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Turbine Casting MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Casting MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DHI DCW Group Co., Ltd.

- Dongfang Electric

- Doosan Heavy Industries

- Elyria Foundry Company, LLC

- Enercon

- GE Renewable Energy

- Hyundai Heavy Industries

- Riyue Heavy Industry Corporation Ltd.

- SAKANA Group

- SEFORGE

- Siemens Gamesa

- Suzlon

- Vestas