Global Wheel Chocks Market Size, Share, Growth Analysis Product Type (Rubber Wheel Chocks, Plastic Wheel Chocks, Metal Wheel Chocks), End User (Commercial, Residential, Industrial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178312

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

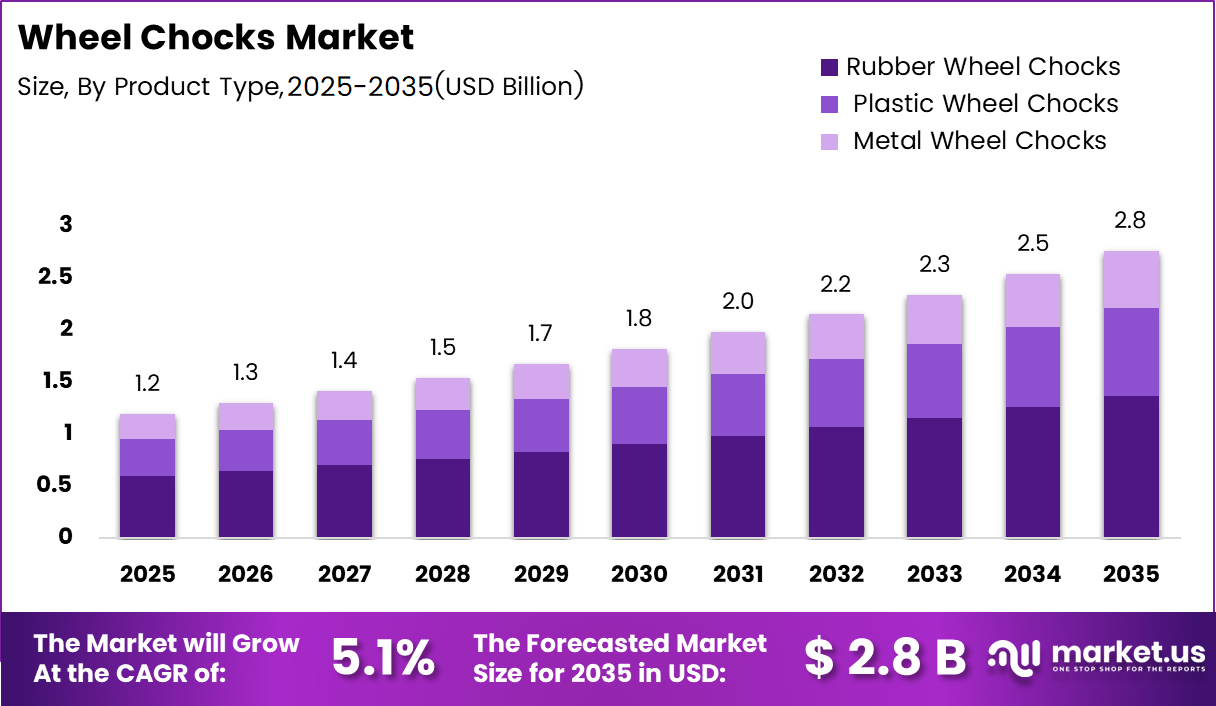

Global Wheel Chocks Market size is expected to be worth around USD 2.8 Billion by 2035 from USD 1.2 Billion in 2025, growing at a CAGR of 5.1% during the forecast period 2026 to 2035.

Wheel chocks are wedge-shaped blocks placed against vehicle wheels to prevent unintended movement. They are widely used across aviation, construction, logistics, and automotive sectors. These safety devices are manufactured from rubber, plastic, and metal, offering varying levels of load-bearing capacity and durability for different industrial applications.

The market is experiencing steady growth driven by rising workplace safety regulations and the rapid expansion of commercial vehicle fleets. Governments across multiple regions are enforcing stricter vehicle immobilization standards. Consequently, industries such as aviation ground handling and heavy logistics are increasing procurement of certified wheel chock equipment.

Moreover, growing awareness around garage and DIY automotive safety has expanded demand beyond traditional industrial buyers. Residential users are now a recognized end-user segment. Additionally, e-commerce platforms are making safety products more accessible, which is contributing to wider market penetration across both developed and developing economies.

Government regulations in North America and Europe mandate the use of wheel chocks in specific industrial and transportation environments. These compliance requirements are creating consistent baseline demand. Therefore, manufacturers are investing in product innovation to meet evolving safety standards and expand their certified product portfolios.

The development of lightweight composite and polymer-based chocks is also opening new opportunities. According to Polymax, their rubber chocks support loads ranging from 1 tonne to 44 tonnes, demonstrating the broad load-capacity spectrum products must cover. This range highlights the technical demands placed on manufacturers across market segments.

According to Justrite Safety Group, their January 2025 acquisition of Global Spill and Safety reflects growing consolidation in the safety equipment market. Additionally, the February 2025 acquisition of GUNI Products by a leading towing distributor signals increasing strategic interest in vehicle restraint and repositioning product categories globally.

Key Takeaways

- The global Wheel Chocks Market is valued at USD 1.2 Billion in 2025 and is projected to reach USD 2.8 Billion by 2035.

- The market is growing at a CAGR of 5.1% during the forecast period 2026 to 2035.

- By Product Type, Rubber Wheel Chocks dominate with a market share of 49.6%.

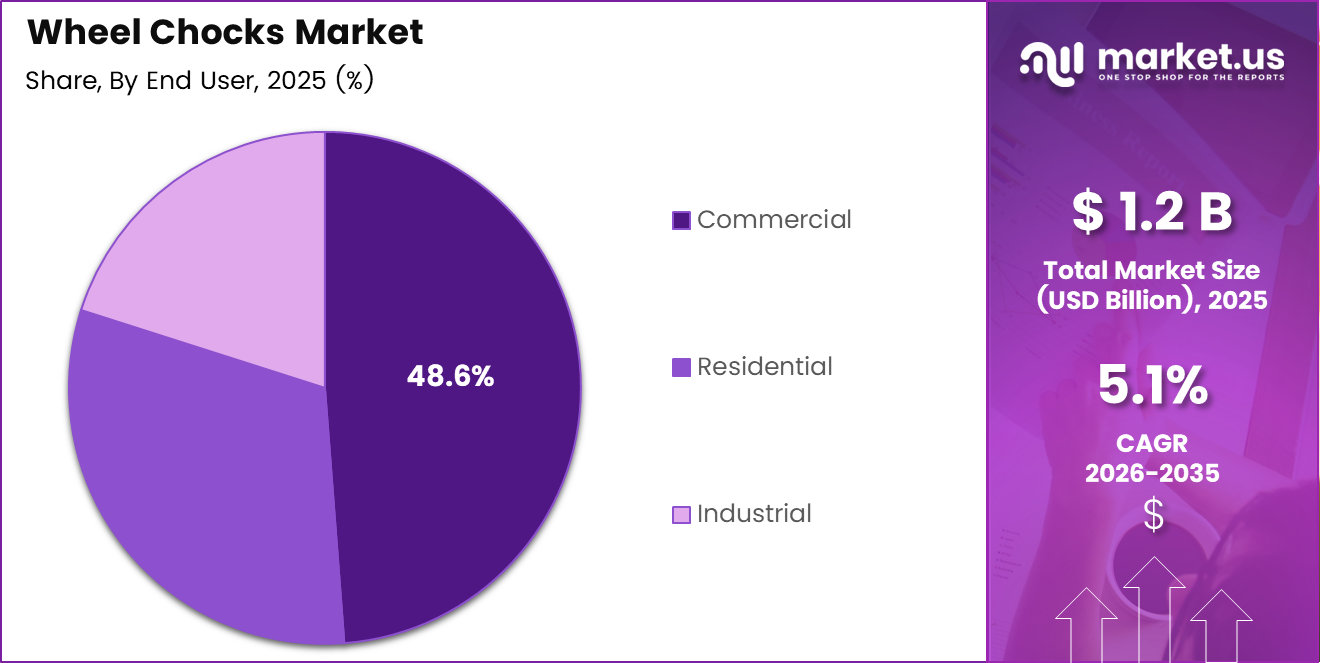

- By End User, the Commercial segment holds the largest share at 48.6%.

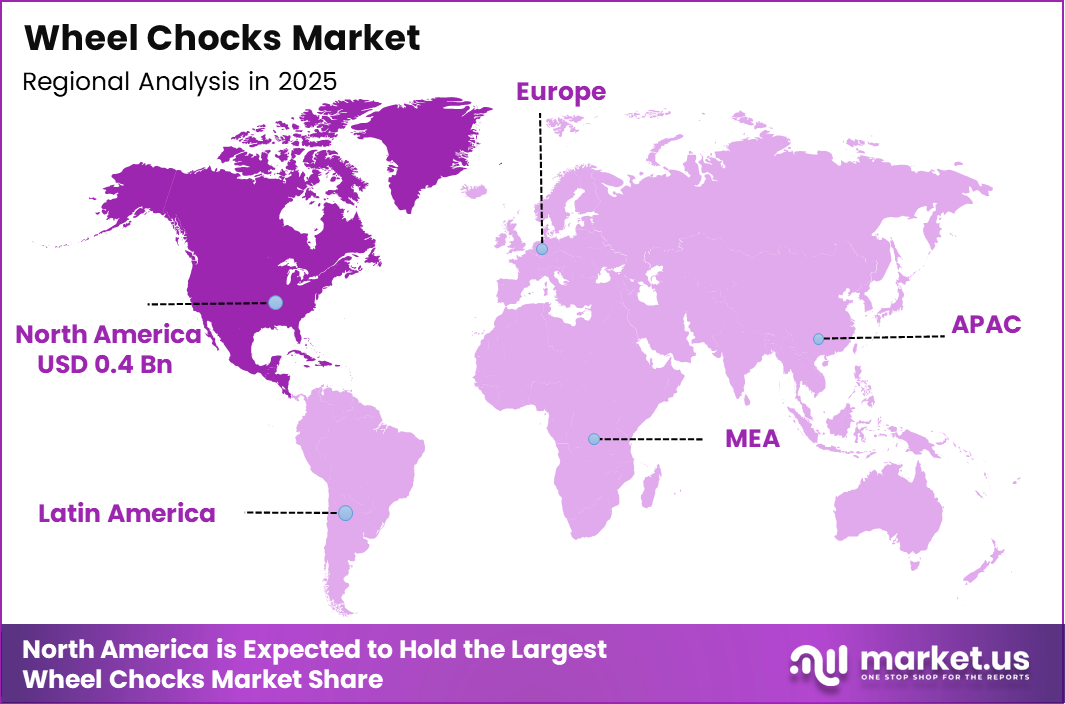

- North America leads all regions with a market share of 36.80%, valued at USD 0.4 Billion.

Product Type Analysis

Rubber Wheel Chocks dominates with 49.6% due to superior grip, durability, and wide industry acceptance.

In 2025, Rubber Wheel Chocks held a dominant market position in the Product Type segment of the Wheel Chocks Market, with a 49.6% share. Rubber chocks offer excellent traction, weather resistance, and load-bearing capacity. They are widely preferred in aviation, logistics, and heavy-vehicle operations due to their proven performance across varied surface conditions and load requirements.

Plastic Wheel Chocks represent a growing sub-segment, particularly valued for their lightweight nature and corrosion resistance. They are increasingly adopted in environments where weight reduction and ease of handling are priorities. However, they are typically suited for lighter vehicle classes and moderate load applications compared to rubber alternatives.

Metal Wheel Chocks are preferred in heavy industrial and military applications where maximum strength and longevity are required. They offer the highest load-bearing capacity among all types. Additionally, their rigid structure makes them suitable for permanent or semi-permanent vehicle restraint setups in demanding operational environments.

End User Analysis

Commercial segment dominates with 48.6% due to high vehicle fleet volumes and strict safety compliance requirements.

In 2025, Commercial held a dominant market position in the End User segment of the Wheel Chocks Market, with a 48.6% share. Commercial operators including logistics companies, airlines, and transport fleets require wheel chocks as a standard safety measure. Regulatory mandates and high vehicle volumes make this segment the primary revenue contributor across the global market.

The Residential sub-segment is gaining traction as DIY automotive maintenance and home garage safety awareness increase. Consumers are purchasing wheel chocks for personal vehicle safety during repairs. Moreover, the availability of affordable plastic and rubber options through e-commerce platforms is making adoption more accessible for everyday residential use.

The Industrial sub-segment covers mining, construction, and manufacturing environments where heavy equipment and oversized vehicles require reliable immobilization. These settings demand high-capacity chocks with strong load ratings. Consequently, manufacturers are developing reinforced rubber and metal variants specifically designed to meet the operational demands of industrial applications.

Key Market Segments

By Product Type

- Rubber Wheel Chocks

- Plastic Wheel Chocks

- Metal Wheel Chocks

By End User

- Commercial

- Residential

- Industrial

Drivers

Expansion of Commercial Vehicle Fleets and Rising Safety Regulations Drive Wheel Chocks Market Growth

The rapid expansion of commercial vehicle fleets across logistics, aviation, and construction sectors is a primary market driver. More vehicles in operation directly increases the need for wheel immobilization equipment. Consequently, fleet Management are standardizing wheel chock usage as a core safety protocol across all vehicle handling procedures.

Rising workplace safety regulations are compelling businesses to invest in certified vehicle restraint equipment. Government bodies in North America and Europe mandate wheel chock use in specific operational environments. Therefore, compliance-driven procurement is creating consistent and predictable demand across commercial and industrial end-user segments.

Additionally, increased adoption of wheel chocks in aircraft ground handling operations is boosting market volumes. Aviation safety standards require rigorous vehicle immobilization on tarmacs and in hangars. Moreover, growing DIY automotive maintenance culture is expanding demand into the residential segment, broadening the overall customer base significantly.

Restraints

Alternative Vehicle Restraint Systems and Limited Product Differentiation Restrain Market Expansion

The availability of alternative vehicle restraint systems, such as parking brakes and automated wheel locks, poses a challenge to wheel chock adoption. Many vehicle operators consider these built-in systems sufficient for safety compliance. Consequently, the perceived redundancy of external chocks reduces purchase motivation in certain commercial and residential segments.

Limited product differentiation among standard wheel chock offerings creates intense price-based competition within the market. Most basic rubber and plastic chocks perform similarly, making it difficult for manufacturers to justify premium pricing. Therefore, margins remain under pressure, particularly for smaller producers competing against established global safety equipment brands.

Moreover, lack of universal regulatory enforcement across developing regions further limits consistent market growth. In markets where safety compliance is not strictly monitored, adoption rates remain low. This regulatory inconsistency creates uneven demand distribution and reduces the incentive for businesses to invest in standardized safety equipment procurement programs.

Growth Factors

Composite Materials Innovation and Smart Technology Integration Accelerate Wheel Chocks Market Expansion

The development of lightweight, high-durability composite and polymer wheel chocks is a significant growth driver. These advanced materials offer improved strength-to-weight ratios compared to traditional rubber or metal options. Consequently, they are attracting interest from aviation and logistics operators who prioritize both safety performance and ease of handling.

Growing demand from emerging infrastructure and industrial projects in developing economies is creating new market opportunities. Countries in Asia Pacific, Africa, and Latin America are investing heavily in construction and logistics sectors. Therefore, the need for reliable vehicle immobilization equipment is rising in parallel with industrial activity and fleet expansion in these regions.

Additionally, the integration of smart sensors and IoT features into wheel chocks is enabling real-time safety compliance monitoring. These innovations allow facility managers to verify chock placement digitally. Moreover, expansion of e-commerce distribution channels is improving product accessibility for smaller businesses and individual buyers across global markets.

Emerging Trends

Eco-Friendly Materials and High-Visibility Designs Reshape the Wheel Chocks Market Landscape

A clear shift toward eco-friendly and recyclable wheel chock materials is emerging across the industry. Manufacturers are responding to sustainability mandates from large corporate buyers and government procurement programs. Consequently, products made from recycled rubber and bio-based polymers are gaining traction as environmentally responsible alternatives to conventional options.

Increasing use of customized wheel chocks for heavy-duty and oversized vehicles is another notable trend. Mining, aerospace, and defense sectors require purpose-built solutions for non-standard vehicle dimensions. Moreover, rising preference for foldable and space-saving designs is making wheel chocks more practical for mobile teams and compact storage environments.

Additionally, adoption of bright-color, high-visibility wheel chocks is growing as workplace safety culture strengthens globally. Fluorescent and reflective finishes improve chock visibility in low-light and high-traffic areas. Therefore, safety managers and procurement officers are increasingly specifying high-visibility models as part of standardized hazard prevention and site safety equipment programs.

Regional Analysis

North America Dominates the Wheel Chocks Market with a Market Share of 36.80%, Valued at USD 0.4 Billion

North America leads the global Wheel Chocks Market, holding a dominant share of 36.80% and valued at USD 0.4 Billion. The region benefits from stringent workplace safety regulations, a large commercial vehicle fleet, and well-established aviation and logistics industries. Additionally, high awareness of occupational safety standards among businesses drives consistent procurement of certified wheel chock products.

Europe Wheel Chocks Market Trends

Europe represents a mature and compliance-driven market for wheel chocks. Strong regulatory frameworks from bodies such as the EU mandate vehicle immobilization in workplace settings. Moreover, the region’s robust automotive manufacturing base and active logistics sector create steady demand across both commercial and industrial end-user categories.

Asia Pacific Wheel Chocks Market Trends

Asia Pacific is the fastest-growing regional market, driven by rapid industrialization and infrastructure development. Countries such as China, India, and Australia are expanding construction and logistics operations significantly. Consequently, demand for vehicle safety equipment including wheel chocks is rising as safety standards improve and fleet volumes increase across the region.

Middle East and Africa Wheel Chocks Market Trends

The Middle East and Africa market is growing steadily, supported by large-scale infrastructure projects and oil and gas sector activity. Aviation and construction industries in GCC countries are significant consumers of wheel chocks. Additionally, improving workplace safety awareness in South Africa and other markets is contributing to gradual market expansion.

Latin America Wheel Chocks Market Trends

Latin America presents emerging growth opportunities, particularly in Brazil and Mexico where industrial and logistics sectors are expanding. Investment in port infrastructure and commercial transportation is increasing demand for safety equipment. However, inconsistent regulatory enforcement across some countries continues to moderate the overall pace of wheel chock market adoption in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Checkers Safety Group is a well-established player in the global safety equipment industry, with a strong portfolio of wheel chocks and vehicle control products. The company serves aviation, military, construction, and logistics sectors. Its focus on high-visibility and heavy-duty product lines positions it as a preferred supplier for compliance-driven commercial and industrial buyers globally.

Vestil Manufacturing Corp offers a broad range of material handling and safety products, including a comprehensive wheel chock lineup. The company serves warehouse, logistics, and industrial clients across North America. Its competitive pricing strategy and wide distribution network allow it to maintain strong market presence, particularly among small and mid-sized commercial operators seeking reliable vehicle restraint solutions.

Brady Corporation brings strong brand recognition and global distribution capability to the wheel chocks segment. Known primarily for safety signage and identification products, Brady integrates wheel chocks into broader workplace safety solution packages. Consequently, the company benefits from cross-selling opportunities within existing accounts across manufacturing, oil and gas, and transportation industries worldwide.

Pawling Corporation specializes in engineered rubber and polymer products, with wheel chocks forming part of its industrial safety portfolio. The company’s technical expertise in material science allows it to develop high-performance chocks for specialized applications. Moreover, its focus on custom solutions gives it a competitive advantage in segments requiring non-standard vehicle immobilization products.

Key Players

- Checkers Safety Group

- Vestil Manufacturing Corp

- Brady Corporation

- Pawling Corporation

- TireSocks, Inc

- Bramley Safety

- AME International

- The Rubber Company

Recent Developments

- January 2025 – Justrite Safety Group successfully acquired Global Spill and Safety and Kestrel Manufacturing, marking a significant expansion in its safety and spill control product offerings. This strategic move strengthens the group’s position in the industrial safety equipment market and broadens its distribution reach across multiple sectors.

- February 2025 – A leading distributor of trucks, parts, and accessories to the Towing and Recovery market announced the acquisition of Georgia-based GUNI Products, a global manufacturer of universal vehicle repositioning wheels. The deal, made official in November 2024, expands the acquirer’s product portfolio in vehicle restraint and repositioning equipment categories.

Report Scope

Report Features Description Market Value (2025) USD 1.2 Billion Forecast Revenue (2035) USD 2.8 Billion CAGR (2026-2035) 5.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Rubber Wheel Chocks, Plastic Wheel Chocks, Metal Wheel Chocks), End User (Commercial, Residential, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Checkers Safety Group, Vestil Manufacturing Corp, Brady Corporation, Pawling Corporation, TireSocks Inc, Bramley Safety, AME International, The Rubber Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Checkers Safety Group

- Vestil Manufacturing Corp

- Brady Corporation

- Pawling Corporation

- TireSocks, Inc

- Bramley Safety

- AME International

- The Rubber Company