Global Well Intervention Market By Intervention Type (Light Intervention, Medium Intervention, and Heavy Intervention), By Location of Deployment (Onshore and Offshore), By Service Type (Logging and Bottom-hole Survey, Stimulation, Artificial Lift, Sand Control, Zonal Isolation, Workover and Fishing, and Others), By Well Depth (Shallow Water, Deep Water, and Ultra-Deep Water), By Well Type (Horizontal wells and Vertical wells), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178776

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

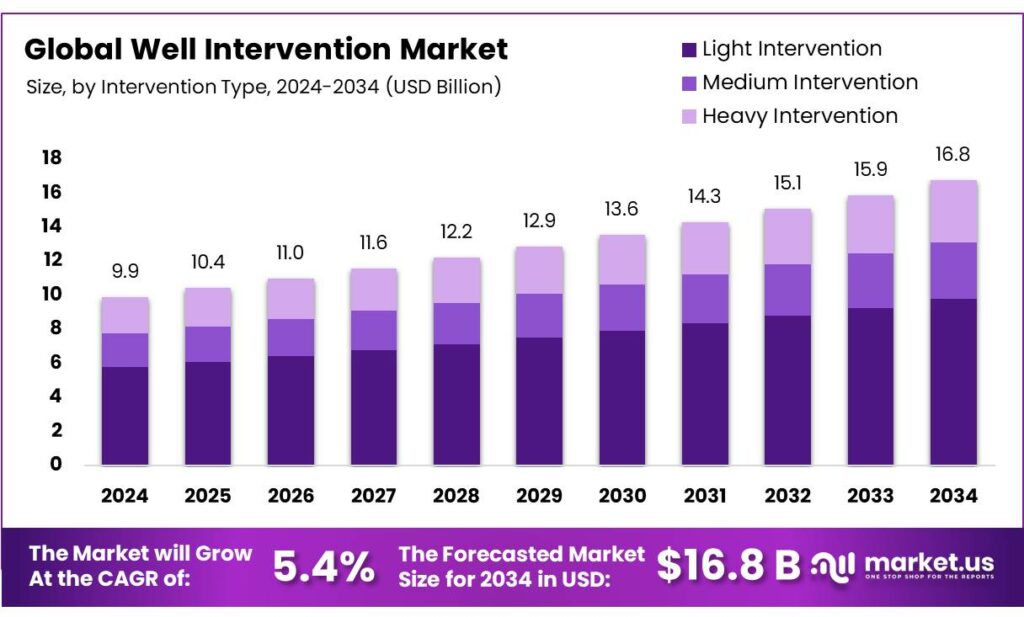

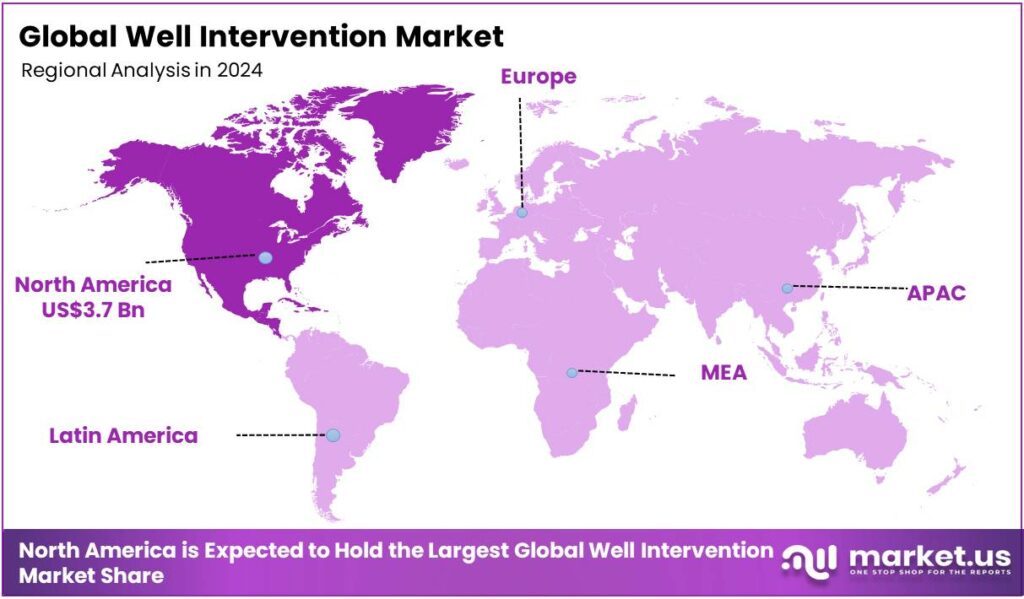

Global Well Intervention Market size is expected to be worth around USD 16.8 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.9% share, holding USD 0.6 Billion in revenue.

In the oil and gas industry, well intervention (known as well work) refers to any operation carried out on a producing well to maintain, restore, or enhance its performance. The well intervention is a cost-effective alternative to drilling new wells.

- According to the SLB (formerly Schlumberger), the proactive intervention can reduce the cost of oil recovery by up to 30% compared to drilling.

The well intervention market is driven by the need to maintain and optimize the performance of oil and gas wells, particularly in mature fields and challenging well conditions. Well intervention services, which include activities such as logging, bottom-hole surveys, stimulation, artificial lift, sand control, and workovers, are essential for extending the life of wells and ensuring continuous production.

- According to the U.S. Energy Information Administration (EIA), the number of producing wells in the United States reached a high of 1,031,161 wells in 2014 but declined to 930,445 wells by 2023 and continued to decline in 2024 to 918,481 wells.

In addition, shallow-water wells see more frequent intervention due to lower operational costs and simpler logistics, while horizontal wells demand greater intervention due to their more complex reservoir conditions and rapid production declines. The market is heavily influenced by the global energy landscape, with geopolitical tensions impacting supply chains and operational risks, especially in offshore regions.

- According to the International Energy Agency (IEA), onshore supergiant oil fields in the Middle East decline at less than 2% per year, while smaller offshore fields in Europe average more than 15% per year. Tight oil and shale gas decline even more steeply, without investment, output falls by more than 35% over one year and a further 15% over a second year.

While well intervention is common in onshore fields due to easier access and lower costs, deep and ultra-deepwater interventions remain more resource-intensive due to harsher conditions. Technological advancements, including IoT and AI, are playing an increasingly important role in improving the efficiency and safety of interventions.

- As of 2024, the United States has a vast stock of 918,481 producing oil and natural gas wells.

Key Takeaways

- The global well intervention market was valued at USD 9.9 billion in 2024.

- The global well intervention market is projected to grow at a CAGR of 5.4% and is estimated to reach USD 16.8 billion by 2034.

- On the basis of types of intervention, light intervention dominated the market, constituting 58.9% of the total market share.

- Based on the location of deployment, onshore deployment dominated the well intervention market, with a substantial market share of around 67.8%.

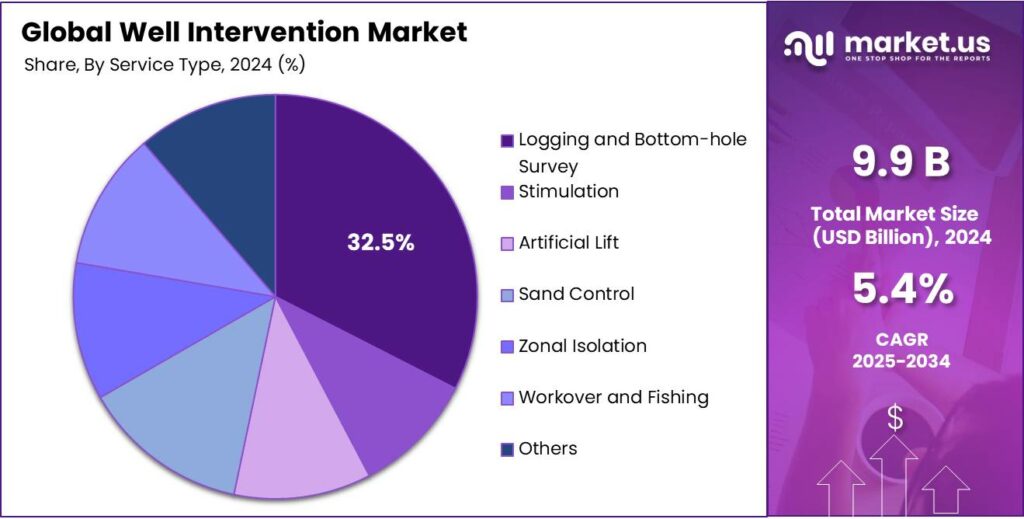

- Based on the service type, logging and bottom-hole survey led the market, comprising 32.5% of the total market.

- Among the well depths, shallow water held a major share in the well intervention market, 53.2% of the market share.

- Among the well types, horizontal wells are the most considerable within the market, accounting for around 61.2% of the revenue.

- In 2024, North America was the most dominant region in the well intervention market, accounting for 37.8% of the total global consumption.

Intervention Type Analysis

Light Intervention is a Prominent Segment in the Market.

The market is segmented based on types of well intervention into light intervention, medium intervention, and heavy intervention. The light intervention led the market, comprising 58.9% of the market share, primarily due to its cost-effectiveness and speed. Light interventions typically require less complex equipment and can be performed with smaller, more mobile rigs, making them ideal for short-duration operations such as monitoring, cleaning, and minor repairs. These interventions are often sufficient for maintaining well integrity in shallow water assets, where production issues are less severe.

In addition, the reduced operational downtime and lower risk of wellbore damage further enhance the appeal of light interventions. In contrast, medium and heavy interventions often involve larger, more expensive rigs and more intensive procedures, which are required only in cases of major repairs or when dealing with complex conditions such as high-pressure or deepwater wells. The light well intervention provides a more efficient solution for many routine maintenance tasks.

Location of Deployment Analysis

Onshore Deployment Dominated the Well Intervention Market.

On the basis of the location of deployment, the well intervention market is segmented into onshore and offshore. The onshore deployment dominated the market, comprising 67.8% of the market share, due to lower operational costs, easier access, and simpler logistics. Onshore operations do not require the expensive infrastructure and specialized rigs that offshore sites demand, such as platforms or subsea equipment. This makes onshore interventions more cost-effective for routine maintenance and smaller-scale operations.

Additionally, onshore sites are more accessible, reducing the complexity and time involved in mobilizing equipment and personnel. Similarly, the environmental and safety risks are lower on land, which translates to fewer regulatory hurdles. In contrast, offshore interventions are more technically challenging and resource-intensive, often involving harsher operating conditions, such as deepwater or subsea environments, which require more specialized technology and expertise.

Service Type Analysis

Logging and Bottom-Hole Survey Are the Most Widely Utilized Well Intervention Services.

The logging and bottom-hole survey well intervention services dominated the market, with a notable market share of 32.5%, as they provide essential data for understanding well conditions and are relatively simple to perform compared to other intervention types. These services offer real-time insights into wellbore integrity, reservoir pressure, fluid properties, and potential production issues, allowing operators to make informed decisions about further interventions or maintenance.

Additionally, the non-invasive nature of logging makes it less risky and quicker to perform, which increases operational efficiency. In contrast, services such as stimulation, artificial lift, sand control, zonal isolation, and workover are more complex, often requiring significant downtime and specialized equipment to address specific well issues, making them costlier and less frequently needed. The broader applicability, lower cost, and quicker turnaround of logging and surveys make them the most commonly used well intervention services.

Well Depth Analysis

Shallow Water Held a Major Share of the Well Intervention Market.

Based on well depth, the well intervention market is segmented into shallow water, deep water, and ultra-deep water. Among the well depths, 53.2% of the well intervention services consumed globally are for shallow water, due to lower operational complexity, reduced costs, and easier access. Shallow-water wells typically require less sophisticated equipment and can be serviced with lighter, more mobile rigs, which makes interventions faster and more cost-effective.

Similarly, the environmental and technical challenges in shallow waters are less demanding, which simplifies operations. In contrast, deep and ultra-deepwater wells involve more advanced technology, specialized rigs, and greater safety considerations, all of which drive up costs and time for interventions. Furthermore, the risk of wellbore damage and the need for high-pressure systems make interventions in deeper waters more challenging.

Well Type Analysis

Well Intervention Services Are Mostly Utilized for Horizontal wells.

Among the well types, 61.2% of the total global consumption of well intervention services is utilized for horizontal wells, as horizontal wells typically experience more rapid production declines, requiring more frequent maintenance to sustain output. The extended wellbore length and exposure to larger reservoir areas in horizontal wells can lead to challenges such as uneven pressure distribution, water breakthrough, and increased risk of formation damage, necessitating more intervention.

Additionally, horizontal wells are often drilled in complex reservoirs, such as shale or fractured formations, which require ongoing intervention to optimize production and enhance recovery. The more intricate design and higher production rates of horizontal wells mean that operators must employ well intervention services to address issues such as scaling, blockage, or formation damage, which are less common in vertical wells. The horizontal wells generally demand more frequent intervention activities to maintain well integrity and maximize production.

Key Market Segments

By Intervention Type

- Light Intervention

- Medium Intervention

- Heavy Intervention

By Location of Deployment

- Onshore

- Offshore

By Service Type

- Logging and Bottom-hole Survey

- Stimulation

- Artificial Lift

- Sand Control

- Zonal Isolation

- Workover and Fishing

- Others

By Well Depth

- Shallow Water

- Deep Water

- Ultra-Deep Water

By Well Type

- Horizontal wells

- Vertical wells

Drivers

Aging Wells and Mature Fields Drive the Well Intervention Market.

Aging wells and mature fields are significant drivers of the well intervention market, primarily due to the natural decline in production from older assets. According to the U.S. Energy Information Administration (EIA), nearly 70% of the country’s oil and gas production comes from mature fields, many of which have entered or are approaching a stage requiring increased maintenance, optimization, or well intervention.

These declines are even steeper. If all capital investment in existing sources of oil and gas production were to cease immediately, global oil production would fall by 8% per year on average over the next decade, or around 5.5 million barrels per day (mb/d) each year. This necessitates continuous investment to sustain output levels and enhanced well intervention techniques to manage output and extend field life, with mature offshore basins such as the UK North Sea showing a higher average rate of 9.7%.

Well interventions, which include activities such as reservoir stimulation, pressure management, and workovers, are essential for mitigating production declines and reducing abandonment costs. The maintaining of production from aging fields typically costs less than developing new fields, making well intervention a cost-effective strategy for asset owners.

Restraints

Complex Wellbore Conditions and Technical Risks Pose Challenges to the Well Intervention Market.

Complex wellbore conditions and associated technical risks present significant challenges in the well intervention market. These conditions include issues such as high-pressure/high-temperature (HPHT) environments, deep-water operations, and the presence of challenging formations, including fractured reservoirs or high-salinity brines. Approximately 40% of offshore wells in the Gulf of Mexico operate in HPHT conditions, increasing the risk of equipment failure and operational delays during interventions.

Bureau of Safety and Environmental Enforcement (BSEE) records that approximately 69.3% of safety-critical pressure equipment (SPPE) failures in 2020 occurred on producing wells, with 84.2% of these failures involving low-producing marginal wells. In addition, the U.K. Oil & Gas Authority highlights that over 25% of wells in the North Sea face complexities such as long horizontal sections or extensive cementing challenges, further complicating intervention efforts.

The failure rates of intervention tools, particularly in deep-water environments, can rise due to mechanical issues or operational limitations. Addressing these technical risks is crucial to ensuring the safety, efficiency, and cost-effectiveness of well interventions in complex wellbore conditions.

Opportunity

Subsea & Riserless Intervention Creates Opportunities in the Well Intervention Market.

Subsea and riserless well intervention represent a growing opportunity in the well intervention market, driven by the need to reduce operational costs and enhance safety in deepwater fields. It provides a high-efficiency alternative to traditional rig-based operations, specifically targeting the lower recovery rates historically associated with subsea wells. While surface platforms typically achieve higher recovery, subsea wells often lag due to the complexity and cost of intervention.

Riserless intervention, which eliminates the need for a riser system, is particularly effective in ultra-deepwater fields, offering cost-effective solutions for maintenance and well integrity. The North Sea Transition Authority (NSTA) 2024 report highlights that interventions in the UKCS generate production at less than EUR12 per barrel of oil equivalent, well below greenfield exploration break-even points.

Additionally, modern RLWI systems are designed for extreme environments, with some units capable of operating at depths up to 10,000 feet (3,000 m) and pressures reaching 10,000 to 15,000 psi. Petrobras has integrated subsea intervention into its 2024-2028 Strategic Plan, contracting dedicated vessels for long-term services to support its pre-salt assets, which account for 81% of its total production.

Trends

Adoption of Advanced Technologies such as IoT and AI.

The adoption of advanced technologies, including the Internet of Things (IoT) and Artificial Intelligence (AI), is becoming increasingly prevalent in the well intervention market as operators seek to enhance operational efficiency, safety, and predictive maintenance. The integration of IoT in well interventions allows for real-time data monitoring, enabling more precise decision-making and faster response times to potential issues.

For instance, real-time downhole monitoring tools, such as those used in the North Sea, provide critical data on pressure, temperature, and fluid levels, improving the effectiveness of interventions. Similarly, AI technologies are being employed to optimize well intervention operations by analyzing large datasets for predictive maintenance and fault detection.

Equinor reported using AI to monitor over 700 rotating machines via 24,000 sensors, realizing US$120 million in value in 2025 alone by preventing sudden shutdowns. Similarly, BP utilized AI and real-time monitoring to achieve a 97% upstream plant reliability rate in Q3 2025, protecting approximately 10% of total production from going offline.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Increased Prices of Well Intervention.

The geopolitical tensions are significantly impacting the well intervention market, particularly in regions heavily reliant on oil and gas production. For instance, following the permanent cessation of Russian gas imports in December 2025, the European Union accelerated its REPowerEU initiatives. Intervention on existing wells became a primary lever to sustain domestic output, with the North Sea Transition Authority reporting that 56 successful interventions contributed over 8 million barrels of oil equivalent annually to offset supply fragilities.

The disruptions caused by the conflicts have led to volatility in energy prices and, consequently, in the demand for well intervention services. For instance, escalations in the Middle East, a region accounting for 25% of global oil production, have introduced high risk for subsea infrastructure. A hypothetical closure of the Strait of Hormuz is estimated to halt 20% of global oil supply, potentially driving prices to US$100 per barrel, which incentivizes rapid light interventions in non-conflict zones to fill supply gaps.

To protect production against sudden geopolitical or technical shocks, major operators such as BP and Equinor have deployed AI-driven monitoring on hundreds of wells, achieving reliability rates as high as 97% to prevent unplanned downtime. Similarly, the focus on energy security in Europe and Asia has prompted countries to invest more in existing fields, raising the need for intervention technologies to extend the life of older wells and ensure stable production amidst geopolitical uncertainties.

Regional Analysis

North America Held the Largest Share of the Global Well Intervention Market.

In 2024, North America dominated the global well intervention market, holding about 37.8% of the total global consumption, due to its extensive oil and gas production, particularly from mature fields and unconventional resources. Most of the U.S. oil production comes from shale formations, which require frequent well interventions for maintenance and optimization. Similarly, the Gulf of Mexico plays a critical role, with its offshore oil production coming from mature fields in need of continuous intervention to maintain output.

- Horizontal wells, which typically exhibit steep initial decline rates of up to 70-80% in their first year, in 2024 account for 22% of the total U.S. well count, up from 10% in 2014.

In Canada, the Alberta oil sands represent a key sector for well intervention, with production from these fields requiring ongoing wellbore integrity maintenance and optimization to combat steep production declines. North America’s large number of mature assets, complex well conditions, and high-pressure systems necessitate advanced well intervention techniques, reinforcing the region’s dominance in this market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of well intervention services focus on continuous development of advanced technologies, such as real-time monitoring systems and automation, which improve the efficiency and safety of interventions. Additionally, companies emphasize expanding their service portfolios to cover diverse well types, including subsea, deepwater, and mature field interventions, thereby catering to a broader range of customer needs.

Strengthening global presence and building strategic partnerships with oil and gas operators, particularly in key regions like North America and the Middle East, plays a critical role. Furthermore, manufacturers invest in research and development to address technical challenges, such as high-pressure/high-temperature (HPHT) conditions and wellbore complexities, thus providing solutions that reduce operational risks and downtime.

The Major Players in The Industry

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Expro Group Holdings NV

- National Oilwell Varco Inc.

- Vallourec SA

- Scientific Drilling International

- China Oilfield Services Ltd (COSL)

- Helix Energy Solutions Group Inc.

- Archer Ltd.

- Welltec A/S

- Superior Energy Services Inc.

- Trican Well Service Ltd.

- Aker Solutions ASA

- Altus Intervention AS

- Hunting PLC

- Other Key Players

Key Development

- In January 2026, Halliburton and the Agency for Science, Technology & Research, Singapore’s principal public sector research and development agency, jointly announced the establishment of the Next-Generation Energy Xccelerator Joint Lab (NEX Lab). This collaboration is designed to expedite the development and commercialization of cutting-edge well completion technologies within the energy sector.

- In August 2025, global energy technology firm SLB acquired Stimline Digital AS, a prominent cloud-based software provider focused on the energy industry, particularly in well intervention services.

Report Scope

Report Features Description Market Value (2024) US$9.9 Bn Forecast Revenue (2034) US$16.8 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Intervention Type (Light Intervention, Medium Intervention, and Heavy Intervention), By Location of Deployment (Onshore and Offshore), By Service Type (Logging and Bottom-hole Survey, Stimulation, Artificial Lift, Sand Control, Zonal Isolation, Workover and Fishing, and Others), By Well Depth (Shallow Water, Deep Water, and Ultra-Deep Water), By Well Type (Horizontal wells and Vertical wells) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Expro Group Holdings NV, National, Oilwell Varco Inc., Vallourec SA, Scientific Drilling International, China Oilfield Services Ltd (COSL), Helix Energy Solutions Group Inc., Archer Ltd., Welltec A/S, Superior Energy Services Inc., Trican Well Service Ltd., Aker Solutions ASA, Altus Intervention AS, Hunting PLC, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Expro Group Holdings NV

- National Oilwell Varco Inc.

- Vallourec SA

- Scientific Drilling International

- China Oilfield Services Ltd (COSL)

- Helix Energy Solutions Group Inc.

- Archer Ltd.

- Welltec A/S

- Superior Energy Services Inc.

- Trican Well Service Ltd.

- Aker Solutions ASA

- Altus Intervention AS

- Hunting PLC

- Other Key Players