Global Weaving Machine Market Size, Share Analysis Report By Machine Type (Shuttle Looms, Shuttle-less Looms), By Category (Automatic, Manual), By Application (Apparel And Fashion, Home Textiles And Upholstery, Industrial Textiles, Automotive Textiles, Medical Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162735

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

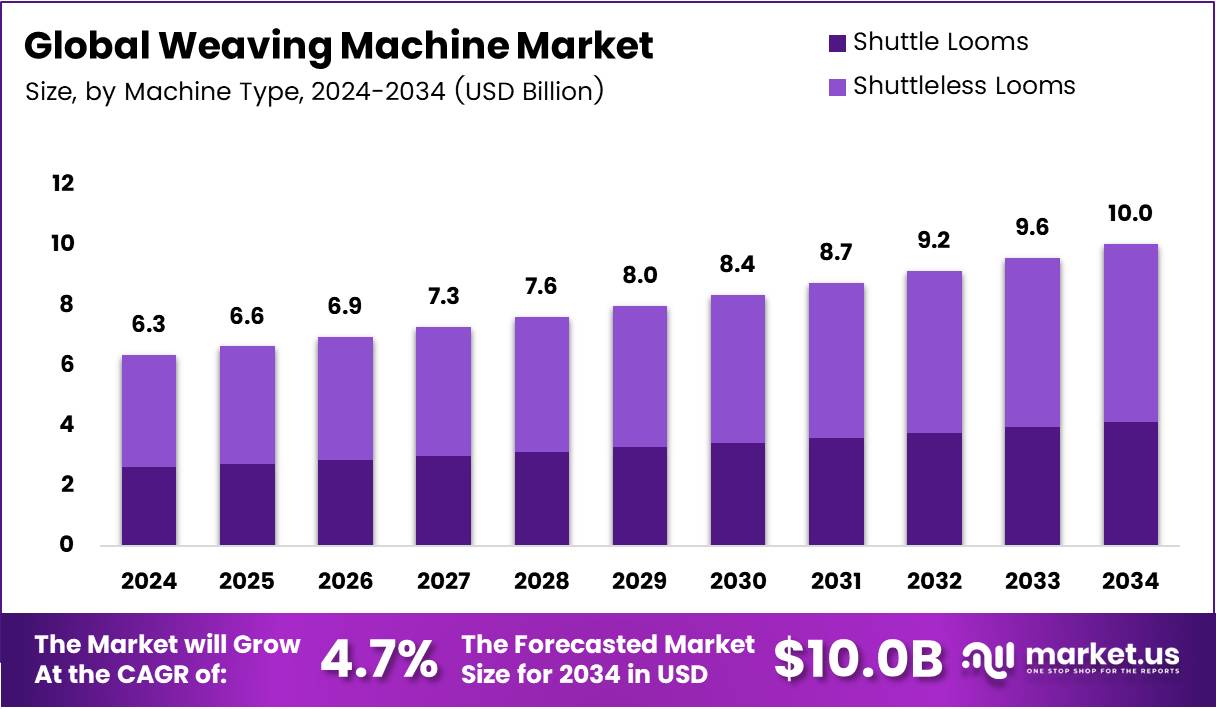

In 2024, the Global Weaving Machine Market was valued at US$6.3 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 4.7%, reaching about US$10.04 billion by 2034.

A weaving machine is a device that interlaces warp and weft threads to create fabric. Its fundamental purpose is to hold the warp threads taut while inserting the weft threads to form a new textile; however, modern versions are highly automated and efficient, unlike traditional hand-operated looms.

Weaving machines use advanced technologies such as shuttle-less systems, air jets, or rapier to achieve high-speed and high-volume fabric production. This adoption of technologies such as automation is an ongoing trend in the market. Most weaving machines are bought by fashion and apparel brands, as the fast-paced nature of the industry creates consistent demand for the textiles.

However, in recent years, there has been a growing demand for textiles from various industries, such as automotive and medical. The major producers of textiles, India and Bangladesh, are largely reliant on imported weaving machines for their garment industry. As the demand for textiles in the region increases, there is an increase in cross-border trade. The shuttle-less looms shipments increased by over 32% to 226,000 units globally in 2024.

- In 2023, the leading exporters of textile fiber machinery were China with sales of US$854 million, Japan with sales of US$839 million, and Germany with sales of US$839 million. The top importers were Turkey with imports of US$697 million, China with US$627 million, and India with imports of US$514 million.

Key Takeaways

- The global weaving machine market was valued at USD 6.3 billion in 2024.

- The global weaving machine market is projected to grow at a CAGR of 4.7% and is estimated to reach USD 10.04 billion by 2034.

- Based on the types of machines, the shuttle-less looms dominated the market, with around 58.9% of the total global market.

- On the basis of the category, the automatic weaving machines dominated the market, with around 68.2% of the total global market.

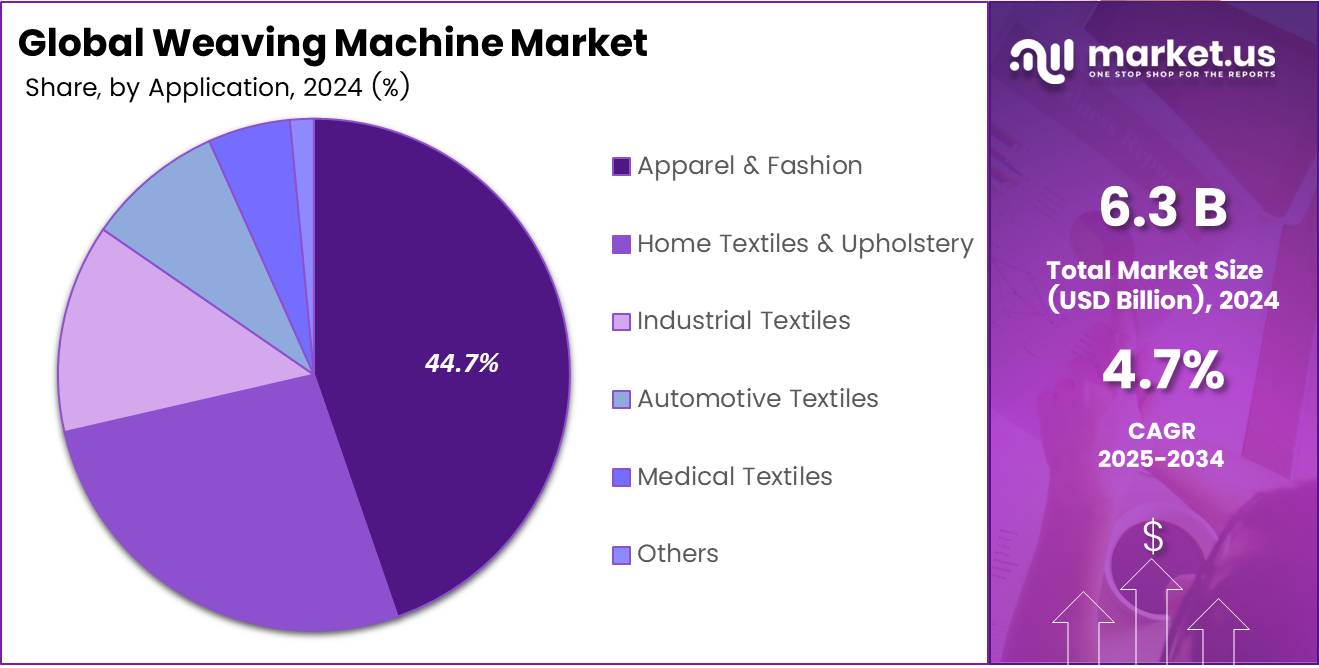

- Among the applications of the weaving machine, fashion and apparel emerged as a major segment in the market, with 44.7% of the market share.

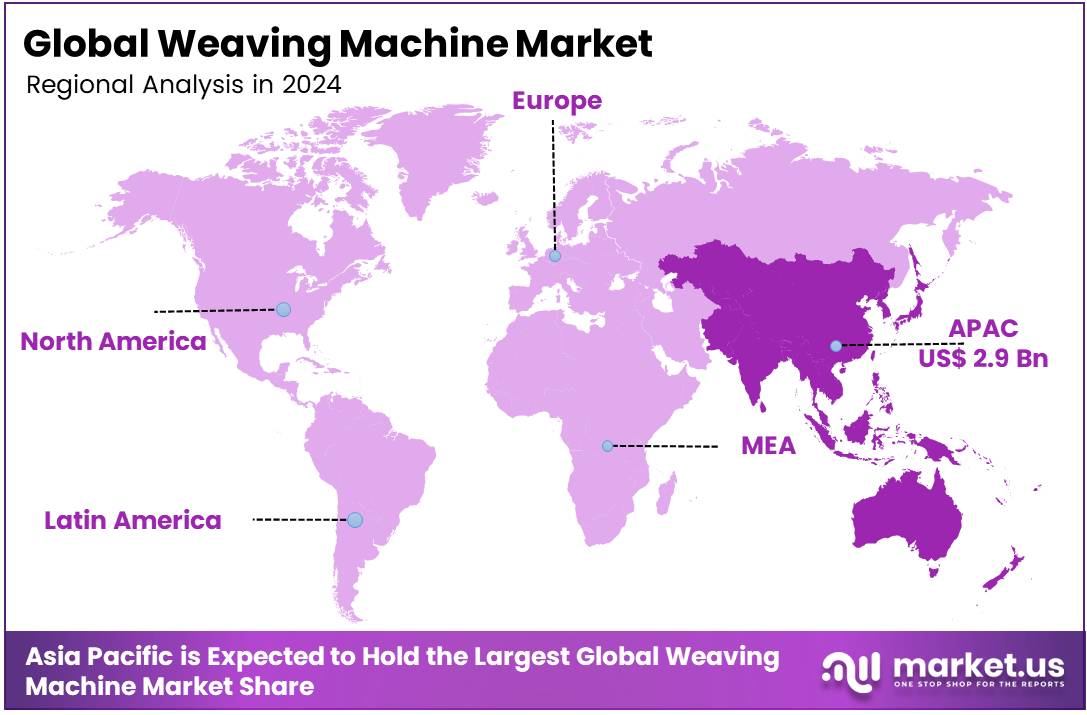

- In 2024, the Asia Pacific was the most dominant region in the weaving machine market, accounting for around 46.3% of the total global consumption.

Machine Type Analysis

Shuttle-less Looms Dominated the Market in 2024.

The weaving machine market is segmented based on machine type into shuttle looms and shuttle-less looms. The shuttle-less looms dominated the market, comprising around 58.9% of the market share.

The use of a shuttle-less weaving machine is of great significance for increasing fabric varieties, adjusting fabric structure, reducing fabric defects, improving fabric quality, reducing noise, and improving working conditions. Shuttle-less looms are more widely utilized than shuttle looms in the weaving machine market, primarily because they improve labor productivity.

Unlike traditional shuttle looms, which have slower production rates and higher maintenance needs, shuttle-less variants, such as rapier, air-jet, and projectile looms, can operate at significantly higher speeds, often exceeding 1000 picks per minute, 4-8 times higher than that of shuttle looms. In addition, they produce less vibration and noise, which enhances operator comfort and reduces wear on machine components.

Similarly, shuttle-less looms minimize fabric defects and are better suited for weaving finer, more intricate textiles with minimal yarn waste. Their adaptability to various types of yarn and designs makes them ideal for modern, high-volume textile production.

Category Analysis

Automatic Weaving Machines Represent a Significant Portion of the Market.

The weaving machine market is segmented based on category into automatic and manual. The automatic weaving machines dominated the market, comprising around 68.2% of the market share.

They are more widely utilized than manual weaving machines as they offer higher productivity, consistency, and cost-efficiency in large-scale textile production. Unlike manual looms, which require constant human operation and produce limited output, automatic machines can run continuously with minimal supervision, dramatically increasing fabric yield.

Additionally, they ensure uniform weaving quality by reducing human error and maintaining precise control over yarn tension and pattern execution. In industries where speed and scalability are crucial, such as fashion, home textiles, and technical fabrics, automatic looms enable manufacturers to meet tight deadlines and mass production demands. Additionally, they reduce labor dependency, making them more viable in regions facing skilled labor shortages or rising labor costs.

Application Analysis

The Apparel & Fashion Application Emerged as a Leading Segment in the Weaving Machine Market.

On the basis of applications of the weaving machine, the market is segmented into apparel & fashion, home textiles & upholstery, industrial textiles, automotive textiles, medical textiles, and others. Approximately 44.7% of the revenue in the weaving machine market is generated by the apparel & fashion applications.

Most weaving machines are used in the fashion and apparel industry, as this sector demands high volumes of varied and rapidly changing fabric styles, driving the need for efficient and flexible weaving technology. Fashion textiles often require intricate patterns, fine yarns, and a wide range of materials, which modern weaving machines are designed to handle.

In contrast, industrial, automotive, and medical textiles typically involve more specialized or heavier fabrics produced in smaller volumes or with specific technical requirements, often using different manufacturing processes. Furthermore, the apparel industry’s constant innovation and fast fashion cycles push for faster production speeds and quick changeovers, making weaving machines particularly essential and prevalent in this field.

Key Market Segments

By Machine Type

- Shuttle Looms

- Shuttle-less Looms

- Rapier

- Air-Jet

- Water Jet Loom

- Others

By Category

- Automatic

- Manual

By Application

- Apparel & Fashion

- Home Textiles & Upholstery

- Industrial Textiles

- Automotive Textiles

- Medical Textiles

- Others

Drivers

Rising Demand from the Fashion and Apparel Industries Drives the Weaving Machine Market.

The fashion and apparel industry is significantly fueling demand for weaving machines as manufacturers seek to keep pace with fast‑fashion timelines and shifting consumer preferences.

- For instance, 36% of the Gen Z population buys new fast fashion clothing at least once a month, and the age group average US$767 a year on fast fashion clothing. As consumers buy more garments and expect shorter style cycles, textile producers are investing in high‑speed, automated looms and systems that enable rapid change‑overs between styles and reduce labor reliance.

In addition, fabrics for apparel frequently involve innovative blends, such as cotton‑polyester mixes or performance materials, that require advanced weaving equipment capable of handling versatile yarns and complex patterns. Across major manufacturing hubs in Asia, the urgency to upgrade older power‑loom setups to modern shuttle‑less, air‑jet, or rapier looms is higher, particularly as brands are pushing for woven fabrics with higher quality finishes and differentiations.

For instance, the development of jacquards and micro‑textures, and the marketing of premium blended fabrics. This alignment of consumer demand, apparel trends, and production capability is driving a clear uptick in the acquisition of sophisticated weaving machines.

Restraints

Slow Adoption of Technology Might Pose a Challenge in the Weaving Machine Market.

The shift towards adopting advanced technologies in the weaving machine market faces notable hurdles that could slow broader uptake. A key issue is the high upfront cost of modern looms equipped with automation, IoT connectivity, and smart sensors.

The small and mid‑sized mills often struggle to justify such capital investments. Furthermore, the lack of skilled labor deters several factories from upgradation. For instance, around 30% of textile producers cited insufficient technical experience as a reason for not opting for newer weaving technologies.

In addition, organizational resistance and inertia play a key role. The operators are reluctant to change longstanding production routines, and some workers fear job loss when automation is introduced. Furthermore, many established production facilities operate on older infrastructure that does not support modern machinery.

The upgradation of machines may require significant re‑engineering of ancillary systems, adding further cost and disruption risk. While demand for smart looms is clear, the pace at which they are being adopted remains uneven and regionally dependent.

Opportunity

Demand for Industrial and Technical Textiles Creates Opportunities in the Weaving Machine Market.

The growing demand for industrial and technical textiles is opening new opportunities for the weaving-machine sector. Technical textiles, used in areas such as filtration, geotextiles, automotive interiors, conveyor belts, and protective gear, must often be produced on machines with higher precision, wider widths, or tougher yarns than conventional apparel fabric looms. For instance, fabrics used for conveyors in mining or cement plants require high tensile strength, abrasion resistance, and often extra-wide weaving capability.

In addition, fabric developments such as ripstop weaves used in parachutes and other lightweight, high‑strength applications rely on weaving machines that are able to handle thicker reinforcement yarns and complex patterns. As sectors such as automotive, construction, and infrastructure expand, fabric producers are upgrading from standard looms to specialized weaving machines, with features like rapier, projectile, or air‑jet weaving, to meet the tougher requirements of technical fabrics. Thus, the push from industrial and technical-textile end‑markets is becoming a key driver for weaving‑machine demand.

Trends

Shift Towards Automation and Smart Solutions in the Market.

The weaving‑machine sector is undergoing a pronounced shift toward automation and smart technology. The advanced looms are increasingly equipped with the Internet of Things (IoT) and Artificial Intelligence (AI). This enables real-time monitoring of machine performance and output, predictive maintenance to reduce downtime, energy consumption optimization, and automated adjustments to compensate for yarn irregularities.

- Automation mitigates the dependency on skilled manpower for weaving applications, thus allowing an increase in scalability and cost-effectiveness. The intelligent looms have claimed labor‑cost savings of around 20–30% and efficiency gains in the same range due to automated cloth‑inspection and servo‑driven take‑up and let‑off mechanisms.

Similarly, weaving machines are becoming more user-friendly with the introduction of touchless controls. Operators can manage and monitor machines with reduced contact, adding an extra dimension of hygiene and efficiency to the production environment.

Furthermore, with adaptive configurations, fabric-weaving machines are manufactured to work on technical textiles, blended yarns, carbon fibers, and others, enabling these industries in aerospace, automotive, healthcare, and defense. Programmable electronic controllers allow design changes to be uploaded digitally, enabling fast transitions between fabric styles without lengthy manual setup.

Geopolitical Impact Analysis

Geopolitical Tensions Are Adversely Affecting The Weaving Machine Market By Causing Significant Disruptions Across Global Supply Chains.

The current landscape of geopolitical tensions is having a marked effect on the market for weaving machines, and several interconnected dynamics illustrate the nature of this impact. The trade restrictions and shifting policies, such as imposed tariffs or export bans, are raising costs and disrupting the flow of key components and machines.

For instance, the broader machinery sector has experienced U.S. tariffs on Chinese‑made machine imports contribute to higher equipment costs and delayed investment decisions, as China is the largest exporter of textile fiber machinery.

For manufacturers, this dynamic has led to higher procurement costs and more complicated supply chains. Similarly, transport‑ and logistics‐related disruptions, particularly along major maritime routes such as the Red Sea corridor and the Suez Canal, are affecting the arrival of machines and parts, particularly for textile hubs in Asia and the Middle East.

- For instance, shipping rates from India to Europe increased by about 40 % under the Red Sea disruptions, which led textile fabric producers who are buying new weaving equipment to factor in additional time and expense. The knock‑on effect of these tensions on the broader textile value chain, such as raw materials, fabrics, and end‑consumer demand, is noticeable.

As the textile industry has reported weakening demand, order cancellations, and margin squeeze in part due to geopolitical uncertainty, weaving machine makers face slower equipment purchases and idle capacity. For example, in January 2023, 53% of textile companies across the globe recorded 58% order cancellations.

Similarly, in 2025, the 40% tariffs imposed on Myanmar by the United States administration took a heavy toll on the country’s garment industry, with several factories forced to shut down, leading to job losses for workers, when over 700,000 workers are directly employed in Myanmar’s garment industry.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Weaving Machine Market.

In 2024, the Asia Pacific dominated the global weaving machine market, holding about 46.3% of the total global consumption. The market in the region is fueled by the textile manufacturing powerhouses of China, India, Bangladesh, and Vietnam. The region accounts for more than half of global weaving‑machine revenue and an overwhelming share of shuttle‑less loom shipments.

- For instance, in 2023, the Asia Pacific region received about 96% of all shuttle‑less looms shipped worldwide. Similarly, in 2024, the region received 97% of all shuttle-less loom deliveries, with China leading growth across all loom categories. The dominance of the region is reinforced by low labor costs, large export‑oriented textile ecosystems, and strong in‑region demand for modern weaving solutions.

In China alone, consumption of weaving and knitting machinery reached around 11 million units in recent years, making up roughly 43 % of the region’s volume. As textile manufacturers upgrade equipment to meet faster fashion cycles, higher precision, and technical textile applications, Asia‑Pacific remains the leader in units consumed and sets the pace for innovation, capacity expansion, and market share.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the weaving machine market are Picanol Group, Toyota Industries, Tsudakoma Corporation, ITEMA, Dornier, Jiangsu Yingyang Nonwoven Machinery, RIFA Textile Machinery, Tongda Group, Saurer Group, Lakshmi Machine Works, Taya Machinery, Staubli Group, Hanma Machinery, and SMIT Textile Machinery. Many of these companies primarily invest in research and development for the advancement of the machines. In recent years, participants have been trying to integrate IoT, automation, and AI into weaving machines to make them more user-friendly.

In addition, companies seek to collaborate with retailers for seamless distribution of their products. For instance, in May 2023, Qingdao Tianyi Group, a comprehensive large-scale joint stock group in China, announced a partnership with Toyota Industries Corporation, a leading global manufacturer of automotive, textile, and material handling equipment. The partnership is to focus on the distribution and support of the JAT910 air-jet loom.

The major players in the industry

- Picanol Group

- Toyota Industries Corporation

- Tsudakoma Corporation

- ITEMA S.p.A.

- Dornier GmbH

- Jiangsu Yingyang Nonwoven Machinery Co., Ltd.

- RIFA Textile Machinery Co., Ltd.

- Tongda Group

- Saurer Group

- Lakshmi Machine Works

- TAYA Machinery Co., Ltd.

- Staubli Group

- Hanma Machinery Co., Ltd.

- SMIT Textile Machinery

- Other Key Players

Key Development

- In January 2025, Picanol launched the Supermax rapier weaving machine in the Indian subcontinent at SITEX. The Supermax is setting the benchmark for digitalization, especially when it is operated in combination with Picanol’s digital platform, PicConnect.

- In June 2023, Itema Group, a leading manufacturer of weaving solutions, unveiled at ITMA 2023, the world’s main exhibition for the textile machinery industry, a preview of its plans to launch an innovative as-a-service solution, developed in partnership with SECO, aimed at introducing a set of value-added services based on artificial intelligence and dedicated to the textile industry.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 10.0 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Shuttle Looms, Shuttle-less Looms), By Category (Automatic, Manual), By Application (Apparel & Fashion, Home Textiles & Upholstery, Industrial Textiles, Automotive Textiles, Medical Textiles, & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Picanol Group, Toyota Industries, Tsudakoma Corporation, ITEMA, Dornier, Jiangsu Yingyang Nonwoven Machinery, RIFA Textile Machinery, Tongda Group, Saurer Group, Lakshmi Machine Works, Taya Machinery, Staubli Group, Hanma Machinery, SMIT Textile Machinery, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Picanol Group

- Toyota Industries Corporation

- Tsudakoma Corporation

- ITEMA S.p.A.

- Dornier GmbH

- Jiangsu Yingyang Nonwoven Machinery Co., Ltd.

- RIFA Textile Machinery Co., Ltd.

- Tongda Group

- Saurer Group

- Lakshmi Machine Works

- TAYA Machinery Co., Ltd.

- Staubli Group

- Hanma Machinery Co., Ltd.

- SMIT Textile Machinery

- Other Key Players