Global Wearable Gaming Technology Market Size, Share, Industry Analysis Report By Type (VR and AR, Connected Wearables, Motion Sensing Technology Including Wearable 3D, Head Mounted Display, Serious Gaming, Gamification), By Application (Commercial, Household), By User Type (Individual, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155988

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Business Growth and Regulation

- Role of AI

- By Type: VR and AR (40.2%)

- By Application: Commercial Application (59.1%)

- By User Type: Individual User (62.4%)

- Key Market Segments

- Top Growth Factors

- Key Trends and Innovations

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

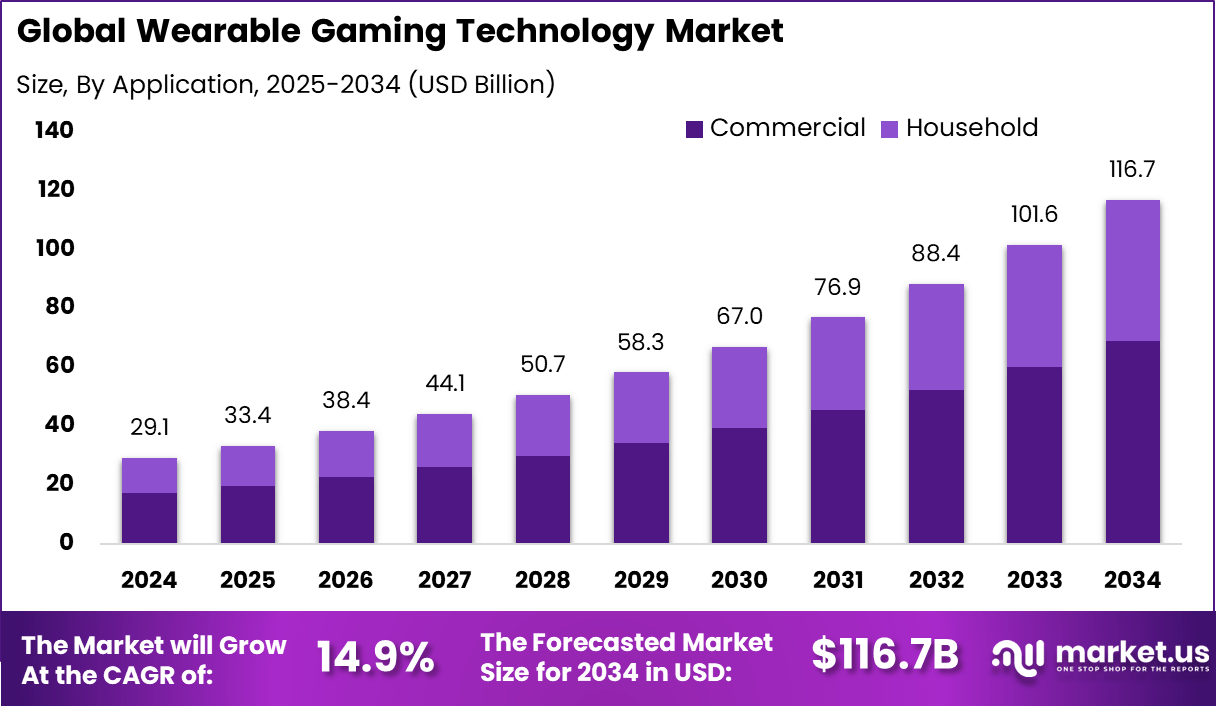

The Global Wearable Gaming Technology Market size is expected to be worth around USD 116.7 Billion By 2034, from USD 29.1 billion in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 30.5% share, holding USD 8.8 Billion revenue.

The wearable gaming technology market refers to devices that are worn on the body and designed to make gaming more interactive. Examples include virtual reality headsets, augmented reality glasses, haptic suits, and motion-sensing controllers. These products create more natural and immersive gaming experiences by combining movement with digital play.

Global wearable devices market is showing strong momentum, with shipments rising by 8.8% year-over-year in Q1 2024 and projected to reach 442.7 mn units in 2023, marking a growth of 6.3% compared to the previous year. Digital fitness and well-being wearables are emerging as a dominant segment, expected to generate USD 68 bn in revenue in 2023, reflecting their growing role in lifestyle management and preventive healthcare.

In the medical segment, revenue is forecast to expand further, reaching USD 89.3 million by 2026, driven by demand for remote monitoring and patient-centered care solutions. The U.S. remains a leading market, with forecasts indicating that more than 100 million wearable devices will be connected to the internet by 2026, underlining the rapid integration of these devices into everyday life and healthcare systems.

The growing popularity of these devices highlights the shift in gaming from screen-based interaction to physical engagement. The growth of this market can be attributed to rising interest in immersive experiences and realistic gameplay. Advancements in VR and AR technologies are making it possible to deliver lifelike environments. Another important factor is the link between gaming and fitness.

Key Insight Summary

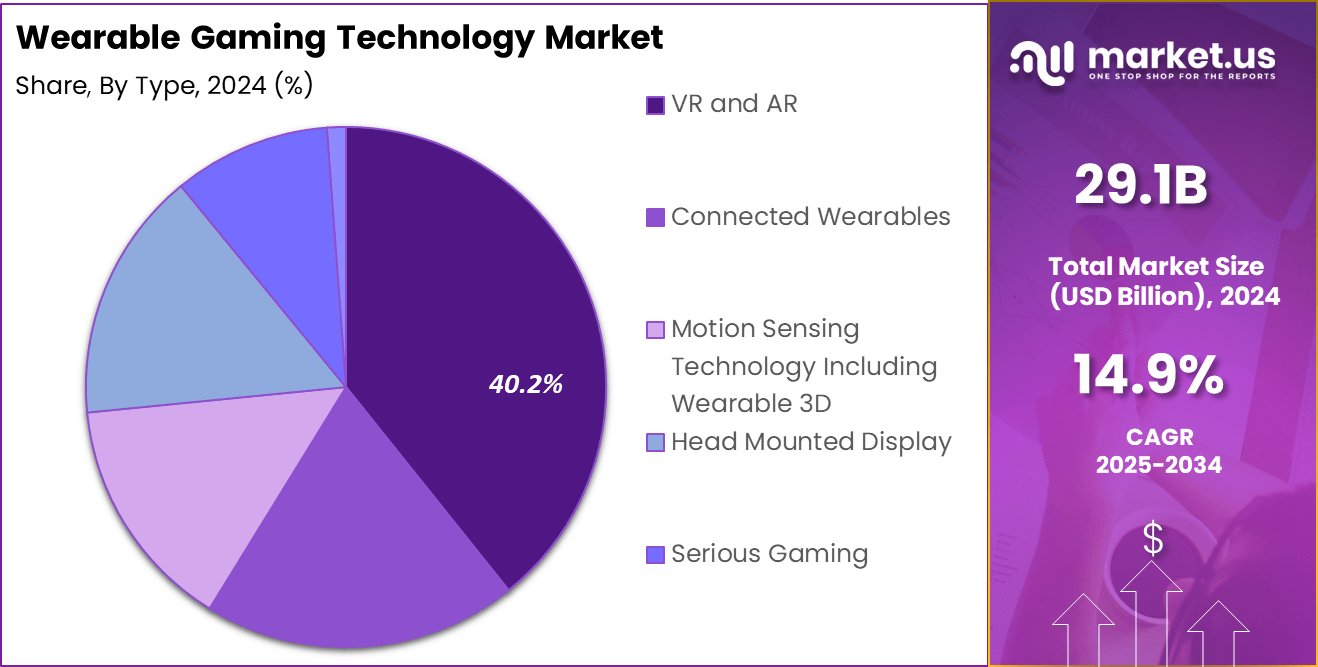

- 40.2% of the market is dominated by VR and AR devices, showing strong demand for immersive gaming experiences.

- 59.1% share comes from commercial applications, highlighting growing adoption in entertainment centers, esports, and gaming arenas.

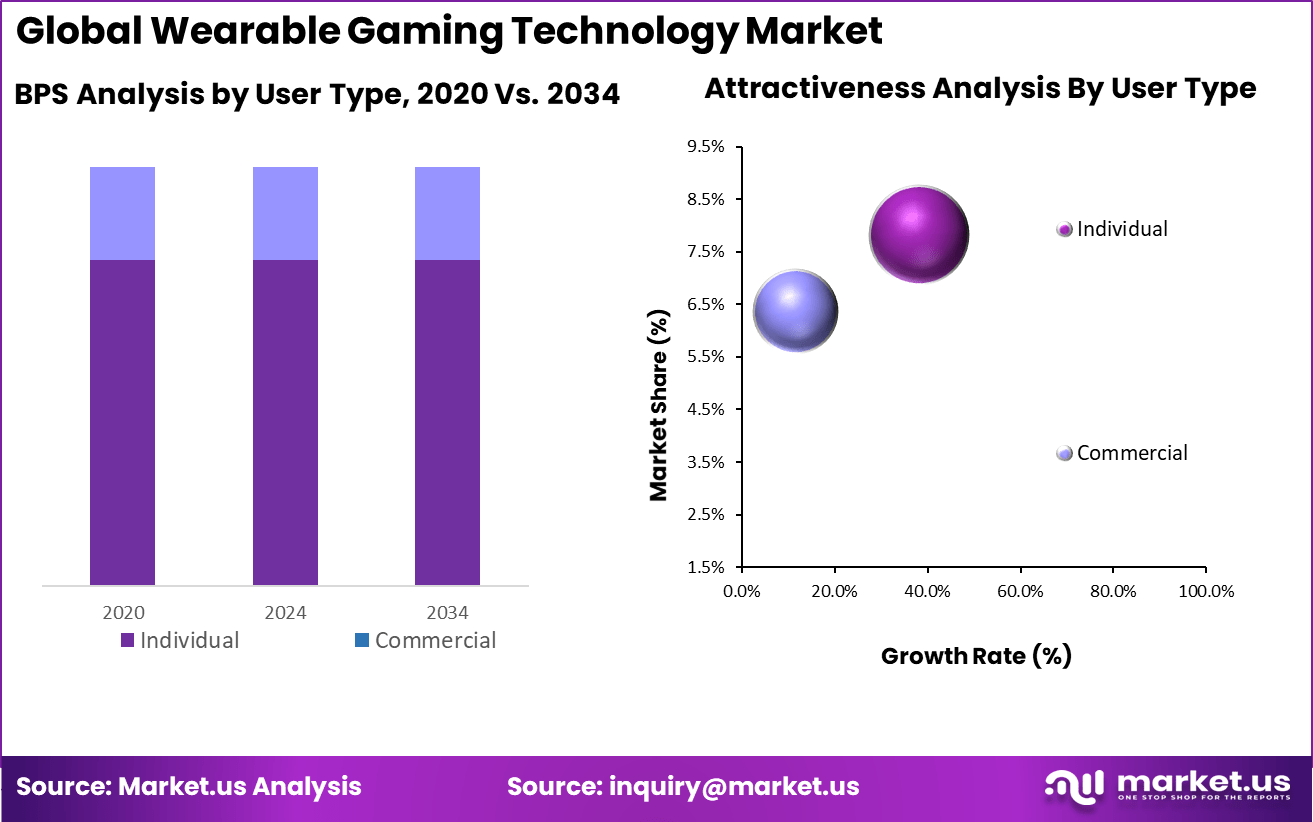

- 62.4% of users are individual consumers, indicating personal gaming remains the largest demand driver.

- 30.5% of revenue is contributed by North America, reflecting its leadership in advanced gaming technologies and consumer adoption.

Business Growth and Regulation

Investment opportunities are growing as interest rises in immersive virtual and augmented reality gaming. Companies that develop devices with advanced feedback, biometric tracking, and personalized gameplay are attracting attention. Entertainment venues and gaming companies are investing heavily in wearable gaming technology, while startups focus on affordable products for home use.

For businesses, wearable gaming technology helps increase user engagement and keeps players interested longer. Commercial venues benefit from offering interactive multiplayer experiences, which create new revenue sources. Wearables are also used for fitness and rehabilitation, expanding their use beyond just gaming. These devices collect data on player behavior, allowing companies to improve game design and marketing.

The regulatory environment focuses on protecting user data, ensuring device safety, and setting product standards. As wearable devices gather more biometric information and support virtual interactions, rules about privacy and ethical use become more important. Companies must follow these regulations to maintain trust and ensure the safety of their users.

Role of AI

AI Role Description Adaptive Gameplay AI analyzes player behavior and skill level to dynamically adjust game difficulty and content Real-Time Motion Tracking AI processes sensor data for accurate, low-latency motion capture enabling immersive controls Biometric Monitoring & Feedback AI interprets heart rate, muscle activity, and other biometrics for personalized gaming experiences Voice & Gesture Recognition AI-powered natural language and gesture controls enhance user interaction within games Predictive Analytics AI predicts player preferences and suggests in-game content or strategies for improved engagement Anti-Cheat & Fair Play Systems AI detects cheating behaviors and ensures fair competition in multiplayer environments Content Generation AI assists in procedural generation of game environments, characters, and scenarios By Type: VR and AR (40.2%)

VR (Virtual Reality) and AR (Augmented Reality) technologies dominate the wearable gaming market, accounting for 40.2% of the total share. These immersive technologies enhance gaming experiences by blending digital content with the real world or creating fully virtual environments.

VR headsets and AR glasses enable players to interact with games in a more engaging and intuitive way, driving strong demand within the sector. The constant innovation in VR and AR hardware and software, along with improvements in mobility, resolution, and user comfort, continues to propel adoption. Gamers seek these technologies for their ability to deliver realistic and interactive experiences that traditional gaming devices cannot match.

By Application: Commercial Application (59.1%)

Commercial applications lead the wearable gaming market with a 59.1% share, highlighting the increasing use of gaming wearables beyond personal entertainment. Beyond traditional gaming, these technologies are used in esports, virtual sports arenas, gaming cafes, theme parks, and immersive entertainment venues.

The commercial sector capitalizes on wearable gaming to attract consumers seeking novel and shared gaming experiences. The growth in commercial applications is supported by partnerships between gaming developers, hardware manufacturers, and commercial entertainment providers. This segment is expected to continue expanding as experiential gaming gains popularity and technology accessibility improves.

By User Type: Individual User (62.4%)

Individual users represent 62.4% of the wearable gaming technology market, underscoring strong consumer demand for personal gaming experiences. These users adopt wearable devices such as VR headsets, AR glasses, and motion controllers for home entertainment, social gaming, and fitness-oriented games.

The increasing affordability and user-friendliness of wearable gaming devices fuel consumer adoption worldwide. Individual gamers prioritize immersive gameplay, convenience, and portability, which early-generation consoles and PCs cannot fully provide. This segment’s expansion is driven by expanding gaming communities and advancements that enhance solo and multiplayer wearable gaming experiences.

Key Market Segments

By Type

- VR and AR

- Connected Wearables

- Motion Sensing Technology Including Wearable 3D

- Head Mounted Display

- Serious Gaming

- Gamification

By Application

- Commercial

- Household

By User Type

- Individual

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top Growth Factors

Factor Description Advances in VR & AR Driving immersive and interactive gaming experiences Integration of Gaming & Fitness Combined gaming with fitness/wellness applications expanding audience Increasing Individual Gaming Rising demand for engaging, portable, and social gaming experiences Improved Hardware & Software Enhanced comfort, graphics, processing power, and motion tracking Esports Popularity Growing esports market fueling demand for advanced gaming peripherals Key Trends and Innovations

Trend Description Miniaturization of Components Smaller, lighter, and more powerful wearable devices Biometric Sensors Monitoring player vitals like heart rate and muscle activity for adaptive gameplay Gamification & Haptic Feedback Advanced vibration and force feedback for immersive experiences AI Integration Real-time behavioral analysis to personalize gaming Expansion Beyond Gaming Applied in therapeutic, training, and educational scenarios Platform Compatibility Cross-platform integration with AR/VR, consoles, and mobile devices Driver

Rising Consumer Demand for Personal and Fitness-Oriented Gaming

The wearable gaming technology market is driven significantly by growing consumer interest in personalized and fitness-oriented gaming experiences. Devices that track biometric data such as heart rate, motion, and muscle activity enhance gameplay by integrating real-time physiological feedback, making gaming more interactive and health-conscious.

In addition, the increasing convergence of gaming with exercise – via rhythm-based or augmented reality fitness games – has expanded the market. Gamers seek interactive ways to stay active while enjoying entertainment, incentivizing developers to create engaging, gamified fitness experiences. This dual appeal to entertainment and wellness is fueling demand for advanced wearable gaming devices.

Restraint

High Cost and Technical Limitations

One of the major restraints facing the wearable gaming technology market is the high cost of advanced devices. Technologies such as VR headsets and haptic feedback suits often come with premium price tags, limiting accessibility particularly in developing markets. Given that gaming wearables often have short product lifecycles due to rapid technological advances, consumers might hesitate to invest heavily.

Technical limitations also present challenges. Motion sickness, battery life restrictions, limited resolution, and sometimes bulky designs can reduce user comfort and satisfaction. These factors can dissuade first-time users and hinder mass-market adoption until further refinement of hardware and software usability occurs.

Opportunity

Expansion in eSports and Haptic Feedback Accessories

The expanding eSports industry offers lucrative growth opportunities for wearable gaming technology. Competitive gamers are increasingly adopting wearables embedded with biometric sensors and performance analytics, enhancing training and in-game performance through data-driven insights. This niche fosters specialized products and services, including wearable telemetry and stress-level monitoring.

Furthermore, advancements in haptic feedback accessories, such as gloves and full-body suits, create more immersive and realistic gaming experiences by simulating touch, pressure, and environmental effects. These innovations boost user engagement and open new markets in virtual reality gaming, both recreational and professional, as well as in training simulations.

Challenge

Integration Complexity and Data Privacy Concerns

A significant challenge within the wearable gaming market is ensuring seamless integration across diverse gaming platforms and devices. Consumers expect interoperability between wearables and games, yet technical barriers require close collaboration among hardware manufacturers, game developers, and software providers. Standardizing communication protocols is essential for delivering smooth user experiences.

Additionally, wearable devices collect extensive personal and biometric data, raising privacy and cybersecurity concerns. Companies must implement robust protections and transparent data policies to gain consumer trust, especially in light of regulations such as GDPR. Managing data responsibly while maintaining user engagement involves a delicate balance critical for sustainable growth.

Competitive Analysis

The Wearable Gaming Technology Market is shaped by strong participation from both hardware innovators and immersive solution providers. Companies such as ICAROS GmbH and Cyberith GmbH have developed motion-based gaming systems that blend physical activity with virtual environments. Their platforms focus on full-body engagement and are positioned as fitness-driven gaming experiences.

Technology giants have also established a commanding presence in this market. HTC Corporation, Microsoft Corporation, ASUSTeK Computer Inc., and Sony Corp dominate through head-mounted displays, VR consoles, and cross-platform ecosystems. Their continuous investment in hardware performance and gaming content integration has reinforced user adoption.

Innovation is also driven by companies such as Avegant Corp, Razer Inc., and Teslasuit. Avegant focuses on near-eye display technology to deliver enhanced visual fidelity. Razer leverages its brand strength in gaming peripherals to expand into wearable experiences. Teslasuit adds haptic feedback and biometric tracking, enabling realistic and immersive simulations beyond entertainment.

Top Key Players in the Market

- ICAROS GmbH

- Cyberith GmbH

- Zero Latency PTY LTD

- Avegant Corp

- HTC Corporation

- Microsoft Corporation

- ASUSTeK Computer Inc.

- Sony Corp

- Razer Inc.

- Teslasuit.

- Others

Recent Developments

- Zero Latency PTY LTD celebrated its 10th anniversary in 2025, marking a decade of pioneering free-roam VR experiences. The company expanded its licensing model recently to scale immersive multiplayer VR entertainment globally, emphasizing high-end graphic experiences and wide audience appeal in location-based VR gaming. Their growth strategy is focused on delivering exceptional, socially engaging VR attractions.

- Avegant Corp formed a strategic partnership with Vuzix in June 2024 to develop full-color optical waveguide modules for AI-enabled smart glasses. This collaboration aims to push AR smart glasses technology forward, with commercial OEM-ready versions expected in 2025. This partnership combines Avegant’s optical tech with Vuzix’s AR capabilities to target consumer smart eyewear markets.

- Microsoft Corporation hinted at a future focus on wearable AI technology under its Surface brand. Executives highlighted the growing value of AI-integrated wearable devices such as smart glasses, suggesting ongoing exploration of this market in 2024.

Report Scope

Report Features Description Market Value (2024) USD 29.1 Bn Forecast Revenue (2034) USD 116.7 Bn CAGR(2025-2034) 14.9% Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (VR and AR, Connected Wearables, Motion Sensing Technology Including Wearable 3D, Head Mounted Display, Serious Gaming, Gamification), By Application (Commercial, Household), By User Type (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ICAROS GmbH, Cyberith GmbH, Zero Latency PTY LTD, Avegant Corp, HTC Corporation, Microsoft Corporation, ASUSTeK Computer Inc., Sony Corp, Razer Inc., and Teslasuit. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wearable Gaming Technology MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Wearable Gaming Technology MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ICAROS GmbH

- Cyberith GmbH

- Zero Latency PTY LTD

- Avegant Corp

- HTC Corporation

- Microsoft Corporation

- ASUSTeK Computer Inc.

- Sony Corp

- Razer Inc.

- Teslasuit.

- Others