Global Wearable Display Market By Product Type(Smart Bands/Activity Trackers, Smartwatches, Head-Mounted Displays), By Technology(OLED, LCD), By Panel Type(Rigid, Flexible, Microdisplay), By Vertical(Consumer Electronics, Military & Defense, Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129221

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

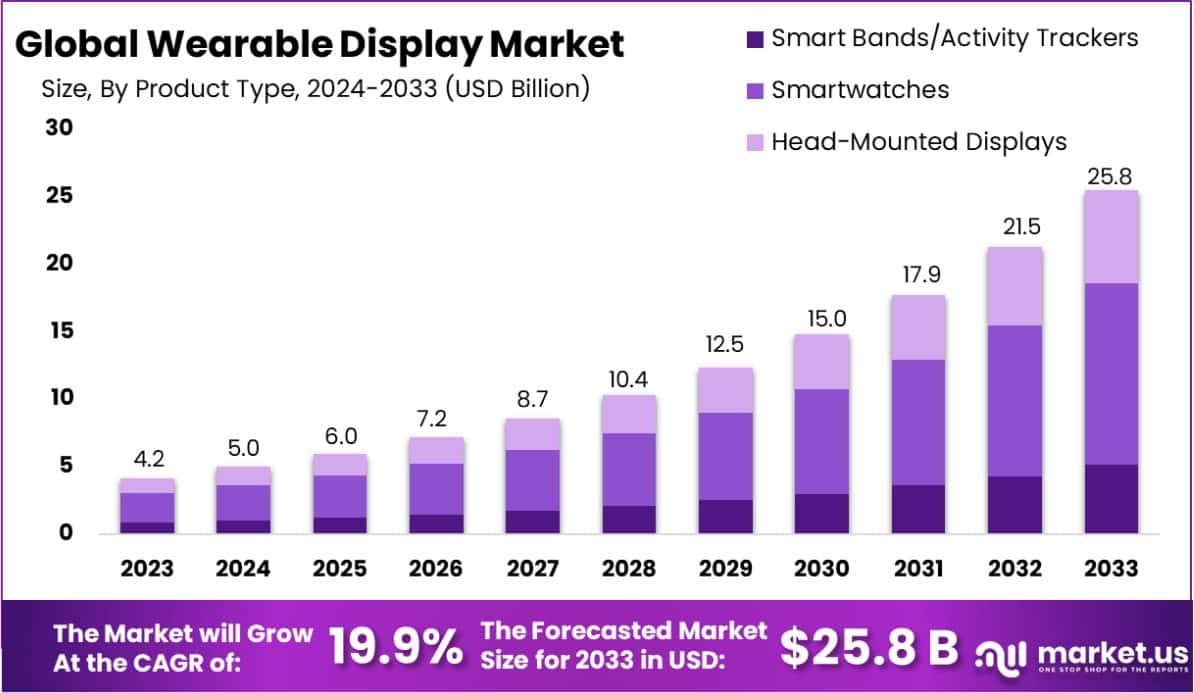

The Global Wearable Display Market size is expected to be worth around USD 25.8 Billion By 2033, from USD 4.2 Billion in 2023, growing at a CAGR of 19.9% during the forecast period from 2024 to 2033. North America dominated a 36.4% market share in 2023 and held USD 1.52 Billion revenue of the Wearable Display Market.

A wearable display refers to an electronic device that can be worn on the body, often integrated into accessories such as watches, glasses, or clothing. These displays provide users with real-time access to information and interactive functionalities through a compact screen.

The wearable display market is experiencing substantial growth, driven by the increasing popularity of smart devices and advancements in display technologies. The demand for lightweight, energy-efficient, and high-resolution displays is contributing significantly to the market expansion. Top opportunities in this sector include the development of augmented reality glasses and fitness tracking bands, which are gaining traction among health-conscious consumers and technology enthusiasts.

Key growth factors for the wearable display market include technological innovations in OLED and AMOLED displays, which offer superior color accuracy and flexibility for curved screens. Additionally, the integration of IoT and connectivity solutions in wearable devices is expanding their application range, creating new opportunities for market players. The rising trend of personal health monitoring and the increasing adoption of smartwatches are also pivotal in driving market growth.

The wearable display market is poised for significant growth, underscored by robust advancements in technology and an increasing consumer focus on health and fitness. Wearable displays, integral to devices such as fitness trackers, smartwatches, and health monitors, are seeing accelerated adoption due to their ability to seamlessly integrate sophisticated technology with everyday life. This surge is supported by substantial investments in health-related wearable technology, exemplifying a broader trend of digital transformation in healthcare.

For instance, the Australian government’s recent funding allocations are indicative of a growing recognition of wearable technologies’ potential to enhance healthcare delivery. A 1.5 million has been granted to Curtin University to develop wearable sensors aimed at monitoring children with cerebral palsy—an endeavor that not only highlights the sector’s potential for specialized healthcare solutions but also underscores the market’s capability to respond to diverse medical needs.

Similarly, the University of New South Wales has received A$1.9 million to pioneer a cuffless blood pressure monitoring device, reflecting a shift towards more accessible and non-invasive health monitoring technologies. Additionally, Bond University’s receipt of A$1.09 million to support individuals with Type 2 diabetes through wearables further illustrates the critical role these devices play in managing chronic conditions.

Furthermore, the U.S. government’s allocation of $10 million for the Primary Health Care Research Initiative, focusing on wearables and point-of-care testing in rural areas, signifies a strategic investment in expanding healthcare access. This funding not only enhances the development of advanced wearable technologies but also broadens the scope for their application, potentially increasing market reach and penetration in underserved areas.

These investments validate the market’s trajectory towards more integrated, personalized, and preventive healthcare solutions, driven by wearable technology. As these trends continue to evolve, the wearable display market is expected to witness substantial growth, marked by a deeper integration of technology in healthcare and an enhanced focus on improving patient outcomes through innovation.

Key Takeaways

- The Global Wearable Display Market size is expected to be worth around USD 25.8 Billion By 2033, from USD 4.2 Billion in 2023, growing at a CAGR of 19.9% during the forecast period from 2024 to 2033.

- In 2023, Smartwatches held a dominant market position in the By Product Type segment of the Wearable Display Market, capturing more than a 52% share.

- In 2023, OLED held a dominant market position in the By Technology segment of the Wearable Display Market, capturing more than a 62% share.

- In 2023, Flexible held a dominant market position in the By Panel Type segment of the Wearable Display Market, capturing more than a 49% share.

- In 2023, Consumer Electronics held a dominant market position in the vertical segment of the Wearable Display Market, capturing more than a 67% share.

- North America dominated a 36.4% market share in 2023 and held USD 1.52 Billion revenue of the Wearable Display Market.

By Product Type Analysis

In 2023, smartwatches held a dominant market position in the By Product Type segment of the Wearable Display Market, capturing more than a 52% share. This substantial market share is indicative of the widespread consumer preference for smartwatches, driven by their multifunctionality and increasing integration with mobile devices.

Smartwatches have transcended their initial market positioning as niche products to become central in the wearable technology landscape, offering features such as health and fitness tracking, mobile notifications, and even mobile smart payment capabilities.

Following smartwatches, smart bands or activity trackers also commanded a significant portion of the market. These devices, known for their compactness and focused health-tracking features, cater to fitness enthusiasts looking to monitor physical activities and health metrics like heart rate and sleep patterns. Meanwhile, head-mounted displays (HMDs) are emerging as a notable segment of the market.

Although they currently hold a smaller share compared to smartwatches and smart bands, the adoption of HMDs is expected to grow, particularly in the realms of virtual reality (VR) and augmented reality (AR).

This growth is anticipated to be fueled by advancements in display technology and an expanding range of applications in gaming, professional training, and healthcare diagnostics. Each segment underscores a unique facet of consumer demand and technological advancement, shaping the broader trajectory of the wearable display market.

By Technology Analysis

In 2023, OLED (Organic Light Emitting Diode) held a dominant market position in the By Technology segment of the Wearable Display Market, capturing more than a 62% share. OLED technology’s superiority in terms of display characteristics such as thinner designs, better color accuracy, and flexibility has significantly contributed to its prevalence in wearable devices. OLED displays are particularly favored in high-end smartwatches and fitness bands due to their ability to provide vibrant visuals and deeper blacks, enhancing user experience in various lighting conditions.

Conversely, LCD (Liquid Crystal Display) technology, while still widely used, holds a smaller market share in the wearable display sector. LCDs are generally appreciated for their cost-effectiveness and availability, making them a popular choice for entry-level and mid-range devices. Despite this, LCDs face limitations in contrast ratios and flexibility compared to OLEDs, which can be a disadvantage in wearable applications that demand high-quality display performance.

The contrasting market shares of OLED and LCD in the wearable display arena reflect ongoing advancements and consumer preferences shifting towards more dynamic, energy-efficient, and aesthetically pleasing display solutions. As technology progresses, OLED is expected to further solidify its dominance, driven by continuous improvements in lifespan, energy efficiency, and production costs.

By Panel Type Analysis

In 2023, Flexible panels held a dominant market position in the Panel Type segment of the Wearable Display Market, capturing more than a 49% share. This significant market share is attributed to the increasing consumer demand for wearable devices that offer both comfort and an aesthetically appealing design.

Flexible displays are integral to the design of devices that conform to various body shapes, such as curved smartwatches and fitness bands, enhancing the ergonomic aspect and overall user experience. The adaptability of flexible displays in innovative product designs has spurred their adoption across multiple wearable categories.

Conversely, rigid panels, though offering durability and cost-effectiveness, are witnessing a slower growth rate in comparison. They remain popular in certain applications where flexibility is less of a priority. Meanwhile, Microdisplays are carving out a niche within the market, particularly favored in applications requiring compact, high-resolution displays such as in augmented reality (AR) systems and advanced head-mounted displays (HMDs).

The market’s inclination toward flexible panels underscores a broader trend toward more personalized and user-friendly technology. As manufacturers continue to innovate in this space, the prevalence of flexible displays is expected to grow, supported by advancements in material science and display technology that further enhance their functionality and appeal.

By Vertical Analysis

In 2023, Consumer Electronics held a dominant market position in the By Vertical segment of the Wearable Display Market, capturing more than a 67% share. This predominant position is driven by the extensive adoption of wearable technologies in everyday consumer products such as smartwatches, fitness bands, and augmented reality glasses. These devices have become integral to the consumer lifestyle, merging functionality with fashion and personal health monitoring, thereby expanding their market reach and acceptance.

On the other hand, the Military & Defense segment also utilizes wearable displays, though to a lesser extent, focusing on tactical head-mounted displays and communication devices that enhance situational awareness and operational efficiency in harsh environments.

Meanwhile, the Healthcare sector is increasingly integrating wearable displays in patient monitoring systems and advanced diagnostic tools, supporting a trend towards more personalized and accessible healthcare solutions. The “Others” category, which includes verticals such as industrial and automotive, is gradually exploring the use of wearables for training, maintenance, and enhanced user interface applications.

The strong foothold of Consumer Electronics in the wearable display market underscores the significant impact of digital and smart technology on consumer habits and preferences, promising continued growth and innovation in this segment.

Key Market Segments

By Product Type

- Smart Bands/Activity Trackers

- Smartwatches

- Head-Mounted Displays

By Technology

- OLED

- LCD

By Panel Type

- Rigid

- Flexible

- Microdisplay

By Vertical

- Consumer Electronics

- Military & Defense

- Healthcare

- Others

Drivers

Wearable Display Market Growth Drivers

First, the growing consumer interest in health and fitness has significantly boosted the adoption of wearable technology, such as smartwatches and fitness trackers, which rely on advanced displays to provide real-time health monitoring and fitness tracking.

Moreover, technological advancements in display technologies, such as OLED and AMOLED, offer superior image quality and flexibility, making devices more appealing to consumers. The increasing functionality of wearable devices, which now integrate seamlessly with smartphones and other digital devices, also enhances user convenience and connectivity, further propelling market growth.

Additionally, the expansion of the Internet of Things (IoT) ecosystem, where wearable devices play a crucial role in interconnected technology solutions, underscores the market’s potential for continued expansion and innovation.

Restraint

Challenges in Wearable Display Adoption

A primary challenge is the limited battery life of wearable devices, which often discourages prolonged use and can frustrate consumers. Additionally, the cost of advanced display technologies like OLED and flexible screens can make these devices less accessible to a broader audience, potentially limiting market penetration.

Privacy and security concerns also play a crucial role, as the increasing collection of personal data through wearable devices raises questions about data handling and user privacy.

These factors, combined with the technical limitations of smaller display sizes which may affect user experience, represent considerable obstacles that manufacturers must address to sustain market growth and consumer trust.

Opportunities

Expanding Opportunities in Wearable Displays

The ongoing advancements in display technologies, such as the development of more energy-efficient and higher-resolution screens, offer manufacturers the chance to enhance product offerings. There is also a growing interest in integrating wearable devices with healthcare applications, which could open up new markets by assisting in remote patient monitoring and managing chronic conditions.

Additionally, the rising trend of personalization in technology allows companies to tailor devices to individual consumer tastes and needs, potentially increasing their appeal.

Finally, the expansion of 5G technology could improve device connectivity and functionality, enabling more sophisticated applications and seamless user experiences. These factors collectively represent substantial opportunities for the expansion of the wearable display market.

Challenges

Key Challenges Facing Wearable Displays

One major challenge is the design limitations inherent in making compact devices that still offer high functionality and durability. Wearable devices must balance the need for advanced technological features with consumer demands for comfort and style, which is not always straightforward.

Another significant hurdle is the regulatory and privacy concerns associated with wearable technology, particularly as devices become more capable of collecting sensitive personal data. Moreover, market saturation in certain segments like smartwatches can lead to fierce competition and pressure on pricing and innovation.

Finally, global supply chain issues, including the sourcing of raw materials and components, can also pose risks to steady production and market growth rates. These challenges require careful navigation to maintain momentum in the wearable display market.

Growth Factors

Growth Drivers for Wearable Displays

The increasing consumer interest in health and wellness is a significant driver, as more people adopt wearable devices like fitness trackers and smartwatches to monitor their health metrics.

Technological advancements, particularly in OLED and flexible display technologies, enhance the aesthetic and functional appeal of these devices, making them more attractive to consumers. Additionally, the integration of these devices with smartphones and other digital ecosystems is boosting their utility and adoption.

There’s also a growing trend towards personalization and luxury in consumer electronics, which opens up new market segments for premium wearable devices. Furthermore, the expansion of 5G connectivity is expected to enable more features and improve device performance, which could accelerate the adoption and growth of the wearable display.

Emerging Trends

Emerging Trends in Wearable Displays

The shift towards augmented reality (AR) and virtual reality (VR) applications is particularly notable, as these technologies require sophisticated display systems that can handle immersive experiences. Additionally, there’s a growing focus on sustainability within the industry, prompting manufacturers to explore eco-friendly materials and production methods for wearable devices.

Wearables are also becoming increasingly integrated with artificial intelligence (AI) to provide more personalized user experiences and smarter functionality.

Another significant trend is the development of health-centric features, with devices now capable of monitoring a broader range of health parameters, such as stress levels and blood oxygen saturation, which cater to a health-conscious consumer base. These trends are setting the stage for a dynamic evolution of the wearable display market.

Regional Analysis

The Wearable Display Market is segmented across key regions including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America dominates the market with a 36.4% share, valued at USD 1.52 billion, driven by high consumer adoption rates of smart technologies and significant investments in health and fitness monitoring devices. The presence of major technology firms and startups focusing on wearable innovation significantly contributes to this growth.

In Europe, the market is propelled by increasing health awareness and rising disposable incomes, which enable consumers to invest in advanced wearable devices. The region also benefits from strong regulatory support for digital health technologies.

Asia Pacific is witnessing rapid growth due to the expanding middle class and the enhancement of mobile connectivity in the region. Countries like China, Japan, and South Korea are at the forefront of manufacturing and exporting wearable technologies, which supports regional growth.

The markets in the Middle East & Africa and Latin America are still developing but show potential due to increasing urbanization and growing interest in connected devices. These regions are expected to experience faster growth rates in the coming years as technology penetration increases and local companies enter the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Wearable Display Market in 2023, three key players—Samsung Electronics Co., Ltd., LG Display Co., Ltd., and Japan Display Inc.—stand out due to their technological advancements and strategic market positioning.

Samsung Electronics Co., Ltd. plays a pivotal role in the wearable display market. As a leading innovator in OLED technology, Samsung has capitalized on its expertise to produce high-resolution, energy-efficient displays that are ideal for wearable devices. The company’s strong patent portfolio and massive scale of operations enable it to maintain a competitive edge. Samsung’s ability to integrate its displays with a broad ecosystem of consumer electronics, particularly in its range of products from smartphones to smartwatches, underpins its dominant market position.

LG Display Co., Ltd. is another significant contributor, renowned for its investments in flexible and transparent OLED panels. LG Display’s focus on developing ultra-thin screens that provide exceptional color accuracy and flexibility has made it a preferred supplier for various wearable manufacturers. The company’s commitment to innovation and sustainable manufacturing practices also enhances its brand reputation and appeal in the wearable display sector.

Japan Display Inc., although smaller in scale compared to Samsung and LG, has made notable strides in developing LCD and low-power displays tailored for wearables. Specializing in small to medium-sized displays, Japan Display Inc. has leveraged its technological prowess to secure collaborations and supply agreements with various wearable device manufacturers, focusing on markets that demand high performance at lower power consumption.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Japan Display Inc.

- Kopin Corporation

- Emagin Corporation

- AUO Corporation

- BOE Technology Group Co., Ltd.

- Au Optronics Corporation

- Tianma Microelectronics Co. Ltd.

- eMagin Inc.

- HannStar Display Corporation

- Other Key Players

Recent Developments

- In May 2023, AUO introduced a series of flexible OLED screens aimed at revolutionizing the design and functionality of next-generation wearable devices.

- In March 2023, Secured a $10 million contract to supply military-grade displays for helmet-mounted systems used by defense personnel.

- In January 2023, Kopin launched a new high-resolution display specifically designed for VR headsets, aiming to enhance user immersion and comfort.

Report Scope

Report Features Description Market Value (2023) USD 4.2 Billion Forecast Revenue (2033) USD 25.8 Billion CAGR (2024-2033) 19.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Smart Bands/Activity Trackers, Smartwatches, Head-Mounted Displays), By Technology(OLED, LCD), By Panel Type(Rigid, Flexible, Microdisplay), By Vertical(Consumer Electronics, Military & Defense, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Display Co., Ltd., Japan Display Inc., Kopin Corporation, Emagin Corporation, AUO Corporation, BOE Technology Group Co., Ltd., Au Optronics Corporation, Tianma Microelectronics Co. Ltd., eMagin Inc., HannStar Display Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wearable Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Wearable Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Japan Display Inc.

- Kopin Corporation

- Emagin Corporation

- AUO Corporation

- BOE Technology Group Co., Ltd.

- Au Optronics Corporation

- Tianma Microelectronics Co. Ltd.

- eMagin Inc.

- HannStar Display Corporation

- Other Key Players