Global Waterborne Epoxy Resin Market Size, Share Analysis Report By Resin Type (Bisphenol-A Based, Bisphenol-F Based, Novolac, and Bio-based), By Curing Agent Type (Amine-Based, Anhydride, Phenolic, and Others), By Application (Coatings, Adhesives And Sealants, Composites, Textiles, Electrical, and Others), By End-Use (Building And Construction, Automotive And Transportation, Marine, Aerospace, Electronics, Oil And Gas, Energy And Power, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172643

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

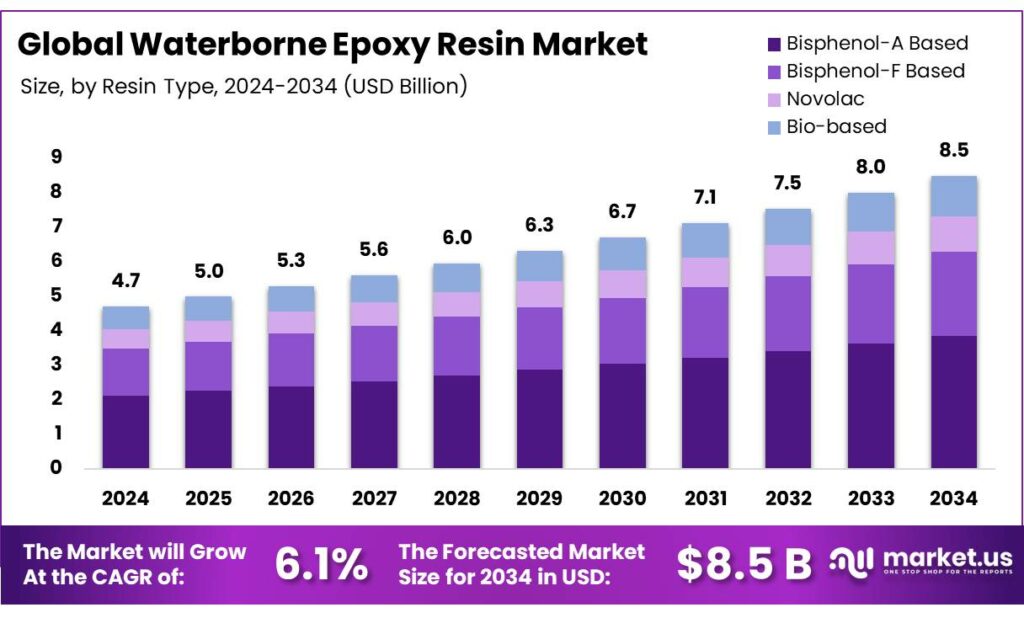

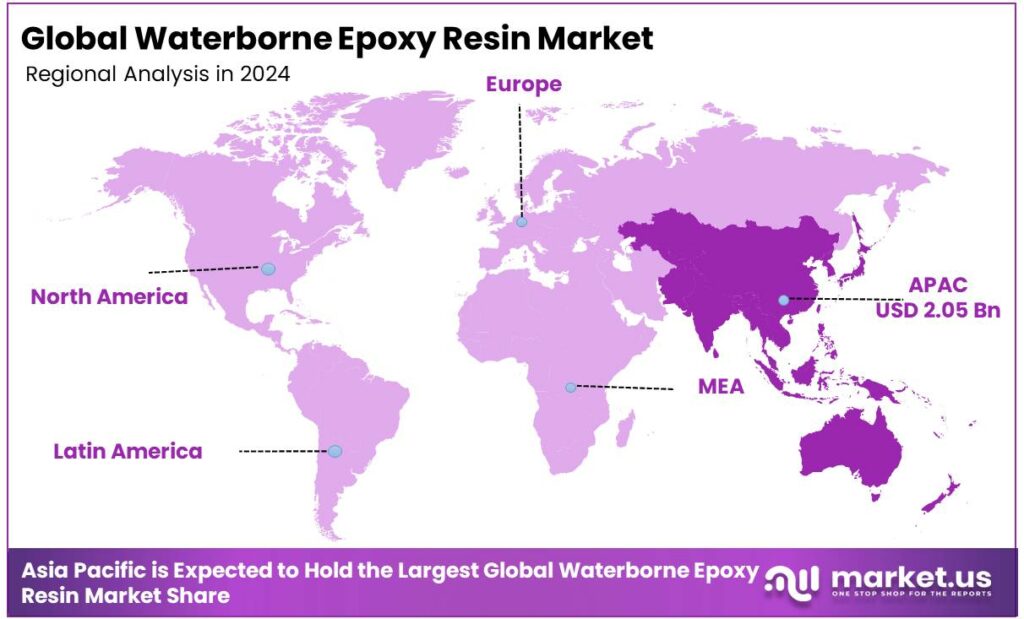

The Global Waterborne Epoxy Resin Market size is expected to be worth around USD 8.5 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 43.4% share, holding USD 2.5 Billion in revenue.

Waterborne epoxy resin is an eco-friendly coating system using water as the carrier instead of harsh solvents, making it low in VOCs for better air quality and worker safety, yet delivering strong adhesion, durability, and chemical resistance similar to traditional solvent-based epoxy resins. Its market is characterized by its growing adoption across various industries, driven by increasing environmental concerns and stringent regulatory standards.

In particular, the construction industry is a major driver of this shift, with waterborne epoxy resins being used for protective coatings, floorings, and concrete sealing. Despite challenges in formulation, such as the need for multiple additives to overcome issues related to water as a carrier, their superior performance characteristics, such as corrosion resistance and durability, make them highly sought after.

While other industries, such as marine, aerospace, and energy use epoxy resins, the ease of formulation, cost-effectiveness, and eco-friendliness of waterborne versions give them a competitive edge in many large-scale industrial applications, particularly in regions with strict environmental regulations.

- Globally, the number of LEED-certified projects has shown exponential growth, increasing from 5,699 projects in 2014 to 111,397 projects in 2024, creating opportunities for sustainable products such as waterborne epoxy resins.

Key Takeaways

- The global waterborne epoxy resin market was valued at USD 4.7 billion in 2024.

- The global waterborne epoxy resin market is projected to grow at a CAGR of 6.1% and is estimated to reach USD 8.5 billion by 2034.

- On the basis of resin type of waterborne epoxy resin, bisphenol-A-based resins dominated the market, constituting 45.3% of the total market share.

- Based on the curing agent type, amine-based curing agents dominated the market, with a market share of around 39.8%.

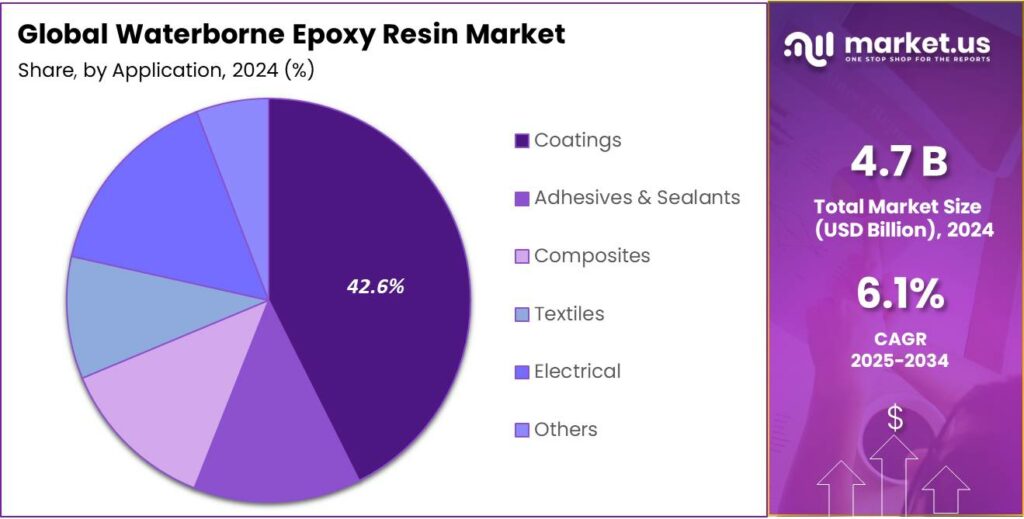

- Based on the application of waterborne epoxy resin, coatings led the market, comprising 42.6% of the total market.

- Among the end-uses, the building & construction sector held a major share in the waterborne epoxy resin market, 50.1% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the waterborne epoxy resin market, accounting for 43.4% of the total global consumption.

Resin Type Analysis

Bisphenol-A-Based Resins Are a Prominent Segment in the Waterborne Epoxy Resin Market.

The waterborne epoxy resin market is segmented based on resin type into bisphenol-A-based, bisphenol-F-based, novolac, and bio-based. The bisphenol-A-based resins led the waterborne epoxy resin market, comprising 45.3% of the market share. These resins are the most widely used due to their superior balance of performance, cost, and ease of production. BPA-based resins offer excellent mechanical properties, chemical resistance, and thermal stability, making them suitable for a broad range of applications, including coatings, adhesives, and electronics.

Contrary to bisphenol-F-based or novolac resins, which tend to be more expensive and have more specialized applications, BPA-based resins provide a more versatile and economical solution. While bio-based epoxy resins are gaining traction due to sustainability concerns, they are often costlier and less developed, limiting their adoption for high-volume industrial applications where performance and cost efficiency remain paramount.

Curing Agent Type Analysis

Amine-Based Curing Agents Dominated the Waterborne Epoxy Resin Market.

On the basis of curing agents, the market is segmented into amine-based, anhydride, phenolic, and others. The amine-based curing agents led the market, comprising 39.8% of the market share, due to their excellent reactivity, versatility, and relatively low cost. Amine curing agents form strong covalent bonds with the epoxy resin, resulting in a durable, highly cross-linked network with superior mechanical properties. Their ease of handling and availability in various forms further contribute to their widespread use.

In contrast to anhydride or phenolic curing agents, amines provide faster curing times, which is essential for many industrial applications that require efficient processing. While anhydride-based curing agents offer better heat resistance and chemical resistance, they tend to require elevated curing temperatures, making them less practical for general use.

Application Analysis

Waterborne Epoxy Resins Are Mostly Utilized for Coatings.

Based on the application of waterborne epoxy resin, the market is divided into coatings, adhesives & sealants, composites, textiles, electrical, and others. The coatings dominated the market, with a notable market share of 42.6%, due to their properties, such as strong adhesion, chemical resistance, and durability, making them ideal for protective and decorative applications. Coatings, such as those used for automotive, industrial, and marine surfaces, benefit from epoxy resins’ ability to create hard, smooth, and long-term finishes that resist wear, corrosion, and harsh environmental conditions.

The versatility of epoxy resins in offering different curing speeds, working times, and mechanical strengths further contributes to their dominance in the coatings industry. While epoxy resins are used in adhesives, sealants, and composites, these applications often require specific additives to optimize performance for particular uses, making coatings the most widespread application due to their broader compatibility and higher demand across various industries.

End-Use Analysis

The Building & Construction Sector Held a Major Share of the Waterborne Epoxy Resin Market.

Among the end-uses, 50.1% of the total global consumption of waterborne epoxy resin is for the building & construction sector. Epoxy resins are predominantly used in the building and construction sector due to their adhesion, durability, and resistance to environmental wear, making them ideal for applications such as flooring, concrete coatings, and adhesives. The construction industry requires materials that can withstand harsh conditions, such as moisture, chemicals, and physical stress.

Additionally, the ease of formulation and cost-effectiveness of epoxy resins allow for wide-ranging applications in construction, including sealants and waterproofing agents. While epoxy resins are used in industries such as automotive, aerospace, and electronics, the rapid growth of the construction industry ensures consistent demand for resins.

Key Market Segments

By Resin Type

- Bisphenol-A Based

- Bisphenol-F Based

- Novolac

- Bio-based

By Curing Agent Type

- Amine-Based

- Anhydride

- Phenolic

- Others

By Application

- Coatings

- Adhesives & Sealants

- Composites

- Textiles

- Electrical

- Others

By End-Use

- Building & Construction

- Automotive & Transportation

- Marine

- Aerospace

- Electronics

- Oil & gas

- Energy & Power

- Others

Drivers

Stringent Regulations Drive the Waterborne Epoxy Resin Market.

The waterborne epoxy resin market has been significantly influenced by stringent environmental regulations, which have driven the demand for eco-friendly alternatives to traditional solvent-based resins. These regulations, particularly those targeting volatile organic compound (VOC) emissions, have prompted industries such as construction, automotive, and coatings to adopt waterborne solutions.

For instance, in the US, the Clean Air Act empowers the EPA to regulate emissions of hazardous air pollutants, including VOCs, and under the National VOC Emission Standards for Consumer Products, the EPA limits the amount of VOCs that can be emitted from products such as household cleaners, personal care items, and automotive products. Similarly, in the EU, Directive 2004/42/EC aims to prevent the negative environmental effects of emissions of VOCs from decorative paints and vehicle refinishing products.

- For commercial coating formulations, the solvent content in waterborne epoxy coatings has dropped from 150 g/L VOC to less than 50 g/L VOC, and in some cases, even approaching zero VOC levels.

Waterborne epoxy resins are considered a safer and more sustainable option due to their low VOC content and reduced environmental impact. Consequently, manufacturers have increasingly focused on developing waterborne products that maintain high performance, durability, and chemical resistance. The shift towards waterborne epoxy resins has been further supported by growing consumer preference for environmentally conscious products and stricter governmental policies in regions such as the European Union and the US.

Restraints

Performance Limitation Might Pose a Challenge to the Waterborne Epoxy Resin Market.

The performance limitations of waterborne epoxy resins pose significant challenges to their widespread adoption, particularly in applications requiring high durability and fast curing times. While waterborne formulations have made substantial advances over the past four decades, issues related to formulation development and application properties persist.

In formulation development, balancing cost, robustness, and component stability remains critical. The requirement for multiple additives to counteract water-related challenges, such as high interfacial tension and potential corrosion, increases the complexity and expense of product development. For instance, wetting agents, dispersing agents, and flash rust inhibitors are often essential; however, their optimal levels must be carefully calibrated to ensure stability and performance.

Furthermore, when applied in colder temperatures and high humidity, the drying and curing process of the epoxy-amine system slows considerably, resulting in extended drying times and potential application defects. These factors can limit the versatility and performance of waterborne coatings in certain industrial environments.

Opportunity

Rapid Expansion of Construction Industry Creates Opportunities in the Waterborne Epoxy Resin Market.

The rapid expansion of the construction industry presents significant opportunities for the waterborne epoxy resin market, particularly in the development of high-performance coatings and adhesives. According to a report by the United Nations, in 2025, approximately 44.8% of the world population resides in cities, and around 80.4% of individuals live in cities and towns combined. As global urbanization accelerates, with construction activity rising across regions such as Asia-Pacific, North America, and Europe, the demand for durable, sustainable, and environmentally friendly materials has increased.

- The construction industry would be required to build 13,000 buildings each day between 2025 and 2050 to support an expected population of 7 billion individuals living in cities.

Waterborne epoxy resins, known for their low VOC content and superior bonding properties, are gaining traction in both commercial and residential construction projects. According to the Global Status Report for Buildings and Construction (Buildings-GSR), the construction sector remains a key driver of the climate crisis, consuming 32% of global energy and contributing to 34% of global carbon dioxide emissions. However, with the construction industry placing increasing emphasis on green building practices in recent years, the adoption of waterborne epoxy coatings aligns with global sustainability trends, offering a viable alternative to solvent-based products.

Trends

Adoption of Waterborne Epoxy Resins in the Electronics Industry.

The adoption of waterborne epoxy resins in the electronics industry is an increasingly prominent trend, driven by the demand for high-performance, environmentally friendly materials. Electronics manufacturers require coatings that offer superior insulation, corrosion resistance, and thermal stability, which is provided by waterborne epoxy resins.

These resins are particularly valued for their ability to form durable protective coatings for circuit boards, semiconductors, and other sensitive electronic components. The shift towards waterborne formulations in the electronics sector is influenced by stringent environmental regulations governing the use of solvents and the growing emphasis on sustainability. With the rising demand for compact and efficient electronic devices, such as smartphones and wearables, the demand for high-quality, non-toxic coatings has intensified, positioning waterborne epoxy resins as a key material in meeting these evolving requirements. For instance, in 2024, the number of smartphones worldwide exceeded 7 billion.

Geopolitical Impact Analysis

Geopolitical Tensions Have Affected Demand Dynamics in the Waterborne Epoxy Resin Market.

The geopolitical tensions, particularly between major economies, have had a notable impact on the waterborne epoxy resin market, influencing supply chains and demand dynamics. Disruptions caused by trade wars, sanctions, and political instability in key manufacturing hubs, such as China, have created volatility in the availability of raw materials used in waterborne epoxy formulations, such as resins, curing agents, and additives. For instance, events such as the Red Sea crisis and the Russia-Ukraine war caused significant disruptions to the global supply chains for key raw materials such as epichlorohydrin (ECH) and bisphenol A (BPA).

Additionally, shipping delays, particularly due to conflicts around major shipping routes, such as the Suez and Panama canals, forced rerouting, adding 7 to 15 days to transit times and straining logistics. Furthermore, tensions between the United States and China have led to fluctuations in the costs of petrochemical products, which are vital for producing certain types of resins. Moreover, the geopolitical uncertainty has resulted in slower economic growth in some regions, dampening industrial activity and affecting demand for waterborne epoxy resins in sectors such as automotive and construction.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Waterborne Epoxy Resin Market.

In 2024, the Asia Pacific dominated the global waterborne epoxy resin market, holding about 43.4% of the total global consumption. The region holds the largest share of the global waterborne epoxy resin market, largely due to its robust industrial sectors and rapid urbanization. For instance, in 2025, roughly 36% of India’s population is estimated to be living in cities, and UN DESA projects that this proportion will approach 50% by 2050.

Similarly, in 2024, approximately 67% of the total population in China lived in cities. Countries such as China, India, and Japan have witnessed substantial growth in the construction, automotive, and electronics industries, which are significant consumers of waterborne epoxy resins. For instance, according to the National Bureau of Statistics of China, in 2024, the investment in real estate development was 10,028.0 billion yuan in China.

Furthermore, the region benefits from a growing demand for eco-friendly coatings in response to stringent environmental regulations and a shift toward sustainable materials. China, as the largest manufacturing hub in the world, drives a considerable portion of the demand, particularly in automotive coatings, protective coatings for infrastructure, and electronics. This trend is expected to continue as the region pursues more stringent environmental and sustainability goals, along with rapidly growing industries in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the waterborne epoxy resin market focus on several strategic activities, such as product innovation, investments, geographic expansions, and acquisitions. These players majorly focus on product innovation by investing in research and development to improve resin performance, such as developing high-performance formulations that offer better adhesion, durability, and chemical resistance while maintaining eco-friendly characteristics such as low VOC content.

Additionally, companies often expand their market reach by forming strategic partnerships with key players in related industries, such as coatings manufacturers or construction firms, and by collaborating with players in the industry to jointly develop products. Furthermore, enhancing production capabilities, reducing costs, and streamlining supply chains are the key strategic moves by the companies to gain a competitive edge.

The Major Players in The Industry

- BASF SE

- Dow Inc.

- Aditya Birla Chemicals

- Allnex Netherlands B.V.

- Arkema

- Eastman Chemical Company

- Evonik Industries AG

- Kukdo Chemical Co., Ltd.

- Huntsman International LLC

- Hexion Inc.

- Olin Corporation

- Solvay S.A.

- Westlake Corporation

- Momentive Performance Materials

- Nan Ya Plastics Corporation

- Other Key Players

Key Development

- In March 2025, BASF developed and launched a new amine building block for curing epoxy resins under BASF’s Baxxodur EC 151 brand in collaboration with Sika.

- In June 2025, Aditya Birla Group announced the acquisition of a 17-acre specialty chemicals manufacturing facility from Cargill Incorporated in Dalton, Georgia. The Dalton facility manufactures a range of products, including epoxy resins, curing agents, reactive diluents, and polyaspartic resins for use in marine, industrial coatings, and flooring applications.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Bn Forecast Revenue (2034) USD 8.5 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Bisphenol-A Based, Bisphenol-F Based, Novolac, and Bio-based), By Curing Agent Type (Amine-Based, Anhydride, Phenolic, and Others), By Application (Coatings, Adhesives & Sealants, Composites, Textiles, Electrical, and Others), By End-Use (Building & Construction, Automotive & Transportation, Marine, Aerospace, Electronics, Oil & Gas, Energy & Power, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Dow Inc., Aditya Birla Chemicals, Allnex Netherlands B.V., Arkema, Eastman Chemical Company, Evonik Industries AG, Kukdo Chemical Co., Ltd., Huntsman International LLC, Hexion Inc., Olin Corporation, Solvay S.A., Westlake Corporation, Momentive Performance Materials, Nan Ya Plastics Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Waterborne Epoxy Resin MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Waterborne Epoxy Resin MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Dow Inc.

- Aditya Birla Chemicals

- Allnex Netherlands B.V.

- Arkema

- Eastman Chemical Company

- Evonik Industries AG

- Kukdo Chemical Co., Ltd.

- Huntsman International LLC

- Hexion Inc.

- Olin Corporation

- Solvay S.A.

- Westlake Corporation

- Momentive Performance Materials

- Nan Ya Plastics Corporation

- Other Key Players