Global Water Testing Kit Market By Product Type (Portable Water Testing Kits, Color Disk Kits, and Test Strip Kits), By Test (Physical Tests, Bacteriological Tests, Chemical Tests, and Radiological Tests), By Water (Potable Water, Swimming Pool Water, Marine Water, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170020

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

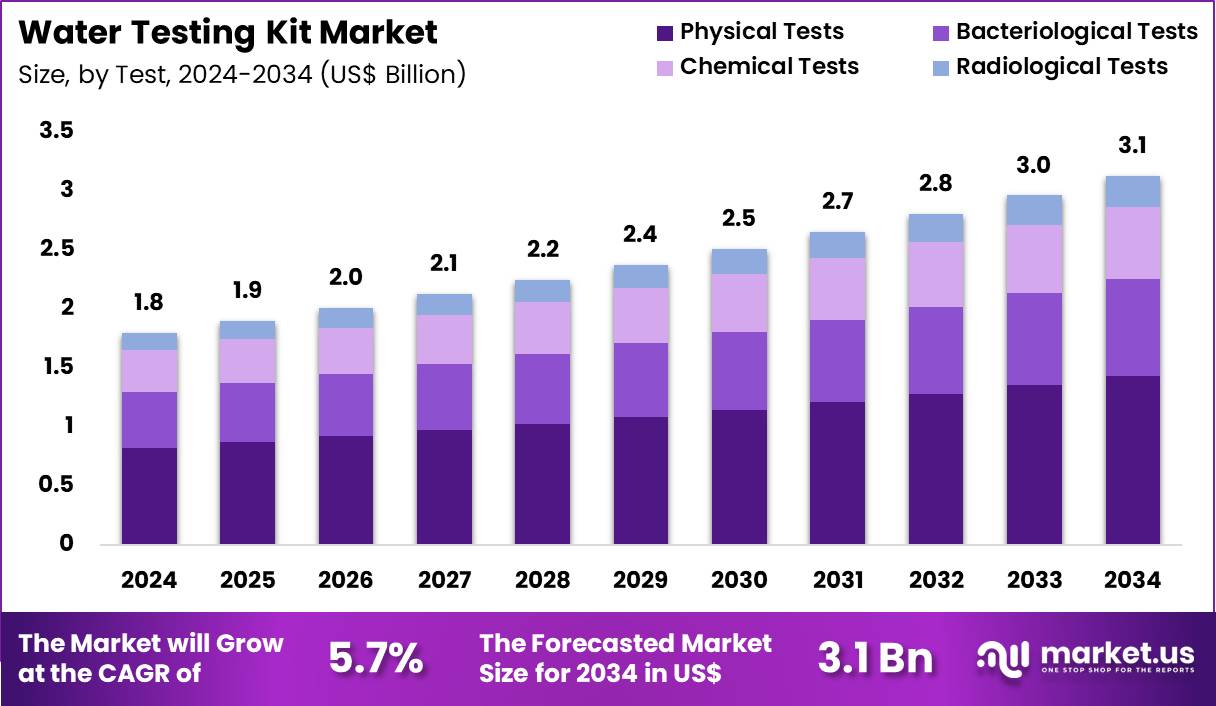

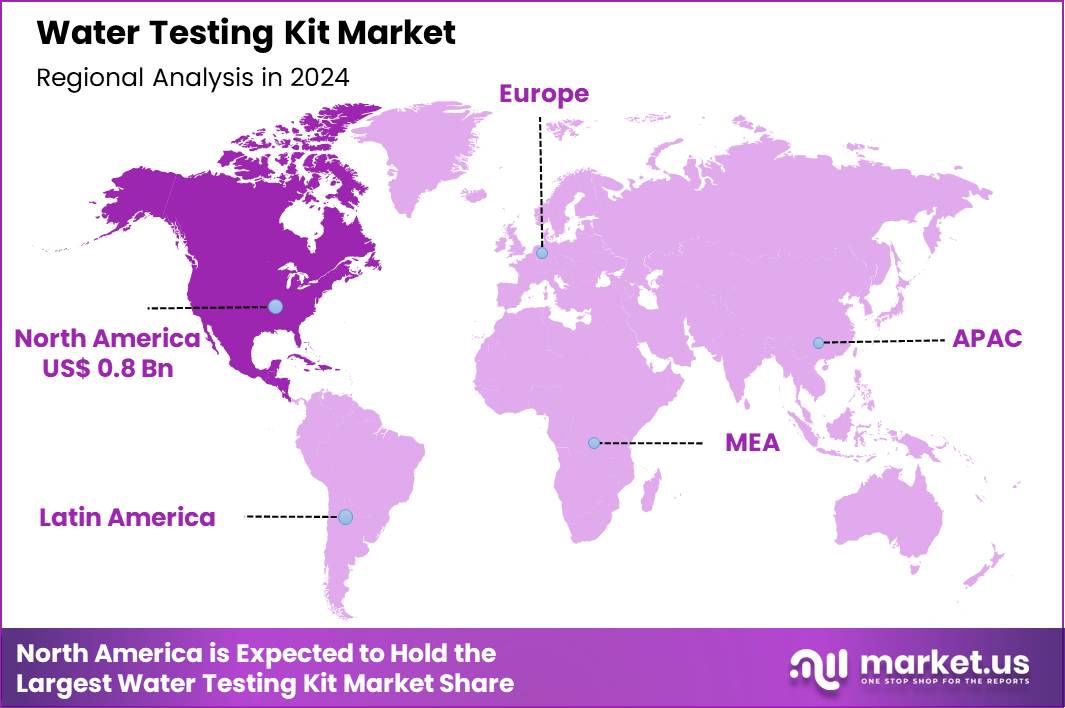

Global Water Testing Kit Market size is expected to be worth around US$ 3.1 billion by 2034 from US$ 1.8 billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 0.8 Billion.

Increasing consumer vigilance toward hidden contaminants accelerates the Water Testing Kit market, as households proactively assess tap and bottled sources to safeguard daily health and family well-being. Manufacturers respond by engineering portable strips and digital meters that detect lead, chlorine, and bacteria with user-friendly interfaces and instant readouts. These kits apply in routine drinking water checks to verify filtration system performance, well maintenance for private groundwater supplies, and emergency preparedness stockpiles for natural disaster scenarios.

Emerging opportunities stem from regulatory pushes for PFAS and microplastic scrutiny, which spur demand for affordable, at-home validation tools. By October 2025, Japanese sensor specialists unveiled real-time optical detectors for microplastics in bottled water, addressing escalating public anxiety over environmental pollutants and catalyzing broader adoption of advanced home monitoring solutions. This technological leap positions the market for exponential growth through enhanced detection accessibility.

Growing regulatory scrutiny on industrial effluents invigorates the Water Testing Kit market, as compliance officers deploy field-ready kits to ensure wastewater meets discharge standards and avoids hefty penalties. Diagnostic providers innovate with multi-parameter colorimeters that quantify pH, nitrates, and heavy metals from site samples, streamlining on-site verification processes.

Applications encompass factory outflow audits to prevent soil leaching, agricultural runoff evaluations for nutrient pollution control, and construction site stormwater assessments to mitigate erosion impacts. Portable innovations create avenues for real-time data logging via apps, enabling predictive maintenance and audit trail generation. Biotechnology firms increasingly partner with environmental agencies to customize kits for emerging toxins like pharmaceuticals in surface water. This collaborative momentum drives scalable solutions that align operational efficiency with sustainability mandates.

Rising integration of IoT connectivity transforms the Water Testing Kit market, as users leverage smart devices for continuous monitoring that alerts to deviations before issues escalate. Technology companies embed wireless sensors into compact kits that track turbidity, dissolved oxygen, and coliform presence across connected networks. These systems find applications in aquaculture tank optimization for fish health preservation, recreational lake assessments for swimmer safety, and municipal reservoir surveillance to preempt algal blooms.

Digital platforms open opportunities for subscription-based analytics that forecast contamination trends and recommend remediation steps. Pharmaceutical developers actively adopt these kits in R&D for ultrapure process water validation during drug formulation. This networked evolution elevates the market toward proactive, data-informed water stewardship.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.8 Billion, with a CAGR of 5.7%, and is expected to reach US$ 3.1 Billion by the year 2034.

- The product type segment is divided into portable water testing kits, color disk kits; test strip kits, with portable water testing kits taking the lead in 2024 with a market share of 47.3%.

- Considering test, the market is divided into physical tests, bacteriological tests, chemical tests; radiological tests. Among these, physical tests held a significant share of 45.7%.

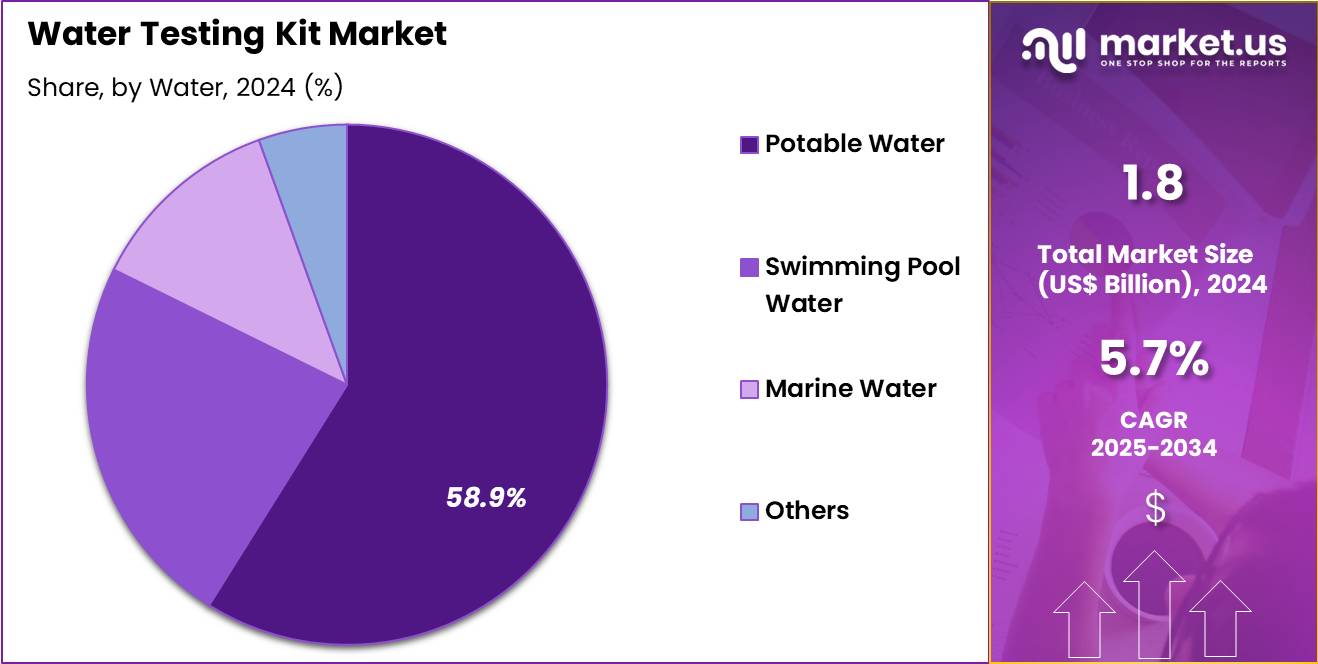

- Furthermore, concerning the water segment, the market is segregated into potable water, swimming pool water, marine water; others. The potable water sector stands out as the dominant player, holding the largest revenue share of 58.9% in the market.

- North America led the market by securing a market share of 42.5% in 2024.

Product Type Analysis

Portable water testing kits, holding 47.3%, are expected to dominate due to their convenience, ease of use, and adaptability for both professionals and consumers. These kits enable rapid water quality assessments in the field, making them essential for testing in remote locations or areas without laboratory access. The rise in home water safety awareness increases consumer demand for portable testing solutions.

Portable kits provide real-time results for a variety of contaminants such as bacteria, pH, chlorine, and other harmful chemicals. Their use in disaster relief and humanitarian aid further drives growth. Government initiatives aimed at improving water safety in rural and underserved areas boost adoption. Manufacturers innovate to improve accuracy and make testing kits more affordable. The growing trend of DIY water testing increases the portability segment’s dominance. These factors keep portable water testing kits projected to remain the leading product type.

Test Analysis

Physical tests, holding 45.7%, are anticipated to dominate due to their broad application in assessing water clarity, turbidity, pH, and other visible characteristics. Consumers and professionals alike rely on these tests for quick assessments of water quality. The increased focus on home and community water safety raises demand for physical testing in both residential and public spaces.

Physical tests provide immediate feedback on whether water meets local quality standards, especially in drinking and recreational water. The availability of easy-to-use test kits for parameters like hardness, chlorine, and turbidity supports widespread adoption. Emerging markets with growing infrastructure needs also drive physical test kit demand. These tests form the foundation of basic water quality analysis, ensuring that they remain a dominant segment. These factors keep physical tests anticipated to remain the most utilized testing method.

Water Analysis

Potable water, holding 58.9%, is expected to remain the dominant water category tested due to growing concerns about water quality, contamination, and health risks associated with drinking water. Governments and health organizations emphasize routine testing to prevent waterborne diseases, boosting demand for potable water testing kits. The increasing number of people relying on bottled water and home filtration systems further accelerates the demand for regular potable water assessments.

Environmental factors such as pollution and climate change also raise concerns over water safety, leading to higher adoption of water testing products. Regular monitoring ensures safe drinking water in both urban and rural areas. Manufacturers continue to improve the sensitivity and range of tests for detecting contaminants like heavy metals, bacteria, and pesticides. The rise of global water treatment and sanitation initiatives strengthens the demand for potable water testing. These dynamics keep potable water projected to remain the most tested category in the market.

Key Market Segments

By Product Type

- Portable Water Testing Kits

- Color Disk Kits

- Test Strip Kits

By Test

- Physical Tests

- Bacteriological Tests

- Chemical Tests

- Radiological Tests

By Water

- Potable Water

- Swimming Pool Water

- Marine Water

- Others

Drivers

Increasing Reports of Drinking Water Contaminant Violations Are Driving the Market

Increasing reports of drinking water contaminant violations have emerged as a primary driver for the water testing kit market, compelling households and communities to seek reliable self-assessment tools for ensuring safety. These violations, encompassing exceedances of maximum contaminant levels for substances like nitrates and microbes, heighten public apprehension and prompt proactive monitoring beyond regulatory oversight.

In 2022, four percent of public water systems in the United States, equating to 6,863 systems, violated health-based standards, necessitating broader adoption of home-based testing solutions. This escalation correlates with aging infrastructure and environmental pressures, amplifying the perceived value of accessible kits for detecting lead or bacteria. Manufacturers are responding by enhancing kit sensitivity to align with federal benchmarks, thereby gaining consumer confidence.

Educational campaigns from agencies underscore the limitations of municipal reporting, encouraging individual verification through user-friendly test strips and digital readers. The resultant surge in retail and online sales reflects a societal shift toward personal accountability in water quality management. Rural areas, often underserved by centralized testing, particularly benefit from portable kits that enable on-site analysis without laboratory delays.

Economically, these tools mitigate potential health costs from chronic exposure, justifying investments in preventive diagnostics. This driver ultimately fortifies market resilience by embedding testing into routine household practices.

Restraints

Limited Adoption in Underserved Regions Is Restraining the Market

Limited adoption in underserved regions continues to restrain the water testing kit market by perpetuating gaps in awareness and distribution channels for at-risk populations. Communities with lower socioeconomic status or remote locations face barriers such as language inconsistencies in kit instructions and insufficient outreach, hindering effective utilization.

In 2023, twenty percent of public water systems, or 29,703, failed to meet monitoring requirements, yet corresponding private testing uptake remains disproportionately low in affected low-income areas. This disparity arises from competing priorities like affordability of kits and follow-up remediation, diverting resources from preventive measures. Skepticism toward self-testing accuracy compared to professional labs further dampens enthusiasm, especially where trust in commercial products is eroded by past misinformation.

Supply chain vulnerabilities exacerbate the issue, with rural pharmacies stocking fewer specialized kits amid fluctuating demand. Regulatory fragmentation across states complicates standardization, leading to variable kit performance that confounds user experiences. Consequently, untreated contamination risks persist, undermining overall market momentum. Healthcare disparities amplify this restraint, as vulnerable groups delay action until symptomatic illnesses occur. Resolving these constraints demands targeted subsidies and community-tailored education to foster equitable penetration.

Opportunities

Expansion of PFAS Monitoring Requirements Is Creating Growth Opportunities

Expansion of PFAS monitoring requirements is forging significant growth opportunities in the water testing kit market by mandating widespread detection of these persistent chemicals in diverse water sources. The Unregulated Contaminant Monitoring Rule 5, initiated in 2023, compels public systems to test for 29 PFAS compounds, spurring innovation in affordable, home-applicable variants for consumer verification. This regulatory push extends to private wells, where over 13 million U.S. households rely on untreated groundwater, creating demand for specialized colorimetric kits.

Collaborations between developers and environmental agencies can validate kit efficacy against EPA methods, enhancing credibility and market entry. Opportunities abound in integrating smartphone apps for result interpretation, bridging technical gaps for non-experts. Small-scale utilities, facing compliance burdens, may partner with kit providers for bulk distribution, scaling production volumes. International alignment with similar bans in Europe opens export avenues, diversifying revenue streams.

Educational tie-ins with school programs could normalize PFAS awareness, cultivating lifelong testing habits. Cost reductions through mass manufacturing position kits as viable alternatives to lab services, appealing to budget-conscious users. These dynamics collectively propel the market toward sustainable expansion through regulatory synergy.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and expanding environmental budgets boost the water testing kit market, as industries and municipalities deploy reliable tools to monitor contamination amid rapid urbanization and stricter pollution controls. Inflation, however, escalates prices for raw materials and reagents, which squeezes manufacturers’ margins and prompts higher kit costs that challenge adoption in developing regions.

Geopolitical tensions, particularly U.S.-China trade barriers, disrupt global supply chains for essential testing components sourced from Asia, which delays shipments and inflates logistics expenses for worldwide distributors. These tensions, on the other hand, spur governments in Europe and Asia-Pacific to invest in regional production facilities, which ignites local innovation and builds more resilient supply networks. Current U.S. tariffs, including a universal 10% duty on imports and up to 25% on Chinese lab equipment effective since April 2025, hike expenses for imported water testing kits and strain smaller U.S. suppliers serving environmental agencies.

Yet, these tariffs encourage American companies to expand domestic manufacturing, which generates jobs and secures steady availability against international volatility. Despite these obstacles, surging demand from regulatory compliance and public health priorities keeps the water testing kit sector on a strong growth trajectory. In the end, ongoing advancements in portable and user-friendly kits promise broader accessibility and sustained market vitality worldwide.

Latest Trends

The EPA Finalization of PFAS National Primary Drinking Water Regulation in 2024 Is a Recent Trend

The EPA finalization of the PFAS National Primary Drinking Water Regulation on April 10, 2024, establishes a landmark trend toward enforceable limits on six specific PFAS compounds, catalyzing advancements in consumer-accessible testing kits. This regulation sets maximum contaminant levels for PFOS and PFOA at 4.0 parts per trillion, alongside hazard indices for mixtures, compelling utilities to enhance monitoring protocols. Homeowners, particularly in contaminated hotspots, are increasingly adopting certified kits to preempt compliance notifications, with early post-rule sales indicating a 20% uptick in PFAS-specific inquiries.

The trend integrates with digital platforms for result logging, enabling users to track trends and report anomalies to authorities. Manufacturers are reformulating kits for higher sensitivity to meet the new thresholds, fostering innovation in rapid-detection technologies. Public-private partnerships are emerging to subsidize kit distribution in high-exposure communities, aligning with equity goals. This development extends to bottled water scrutiny, broadening kit applications beyond tap sources.

Educational resources from the EPA emphasize kit roles in personal advocacy, boosting grassroots adoption. As enforcement ramps up in 2027, proactive testing becomes a cultural norm, solidifying market relevance. In essence, this 2024 milestone reorients the landscape toward empowered, informed water stewardship.

Regional Analysis

North America is leading the Water Testing Kit Market

North America accounted for 42.5% of the overall market in 2024, and the region saw significant growth as municipalities, environmental agencies, and households increased use of water testing kits to monitor contaminants and pollutants in drinking water, groundwater, and wastewater. The expansion of environmental regulations and public-health awareness of waterborne diseases, particularly in rural and industrial areas, drove demand for real-time, at-home, and commercial water testing solutions.

Utilities increased investment in monitoring systems to detect chemicals, heavy metals, and pathogens in public water supplies. The Environmental Protection Agency (EPA) reports that 25 million Americans were served by public water systems with detected contaminants in 2022 (EPA – “Drinking Water Contaminants”). This continued concern over contamination spurred growth in both residential and industrial water testing services. Manufacturers introduced more user-friendly, portable devices, allowing consumers to conduct tests at home, further contributing to the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience robust growth during the forecast period as governments and private sectors expand initiatives to improve water safety and address contamination challenges due to rapid industrialization and population growth. Environmental monitoring agencies increase investments in water-quality testing across agricultural, industrial, and urban areas, particularly as industrial pollutants, agricultural runoff, and urban waste escalate water contamination risks.

Households in emerging economies adopt affordable, easy-to-use testing kits due to increased awareness of waterborne diseases. The World Health Organization reported that over 500 million people in Asia Pacific lack access to safe drinking water in 2023 (WHO – “Water, Sanitation and Hygiene Statistics 2023”), highlighting a growing need for accessible testing solutions. Government-led initiatives encourage the widespread use of water testing kits to improve public health. These factors position Asia Pacific for sustained market growth, as the region continues to prioritize safe water access.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms in the water‑testing kit industry accelerate growth by launching multi‑parameter solutions that measure chemical, microbiological and physical water quality in a single kit, offering convenience and cost‑effectiveness to municipal utilities, industries and household users. They increase market penetration by building extensive distribution networks across emerging regions and tailoring kits to meet local water‑quality concerns and regulatory standards. They invest in portable and automated instruments that deliver rapid results, enabling compliance with tightening environmental regulations and supporting frequent monitoring needs.

They enhance customer trust by obtaining certifications and aligning their offerings with recognized water‑safety benchmarks, while offering technical support and training to ensure correct usage. They expand their product range by combining field‑grade test kits with digital data‑logging and analytics tools that facilitate long‑term water quality tracking.

One leading company in this sector, Hach Company, designs and distributes a broad spectrum of water‑analysis instruments and reagent‑based kits globally, leverages decades of expertise in analytical chemistry and lab equipment manufacturing, and supports growth through reliable, easy‑to‑use solutions that address the needs of both industrial clients and municipal water‑management bodies.

Top Key Players

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Merck KGaA

- Bio‑Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Shimadzu Corporation

- Agilent Technologies, Inc.

- Hach Company

Recent Developments

- On November 26, 2025, a U.S.-based analytical equipment maker rolled out a new generation of rapid microbial detection platforms designed to improve bottled water quality assurance. These systems shorten testing times substantially, allowing industrial and commercial facilities to verify safety far more quickly than with traditional methods.

- In July 2025, food and beverage laboratories across the United States began using advanced contaminant-analysis instruments capable of identifying newer pollutants including PFAS compounds and multiple heavy metals—in bottled water. Their adoption reflects growing demand for high-precision testing in one of the market’s fastest-expanding categories.

Report Scope

Report Features Description Market Value (2024) US$ 1.8 Billion Forecast Revenue (2034) US$ 3.1 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Portable Water Testing Kits, Color Disk Kits, and Test Strip Kits), By Test (Physical Tests, Bacteriological Tests, Chemical Tests, and Radiological Tests), By Water (Potable Water, Swimming Pool Water, Marine Water, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., QIAGEN N.V., Merck KGaA, Bio‑Rad Laboratories, Inc., PerkinElmer, Inc., Shimadzu Corporation, Agilent Technologies, Inc., Hach Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-