Global Water Sports Market Size, Share, Growth Analysis By Architecture (Multi-Activity, Specialized/Single Activity), By Activities (Boating & Boat Racing, Canoeing, Parasailing, Jet Skiing, Wind Surfing, Kayaking, Rafting, River Trekking, Water Polo, Rowing, Scuba Diving, Snorkeling, Others), By Applications (Under 16, 16-60 Years Old, Over 60 Years Old), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176125

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

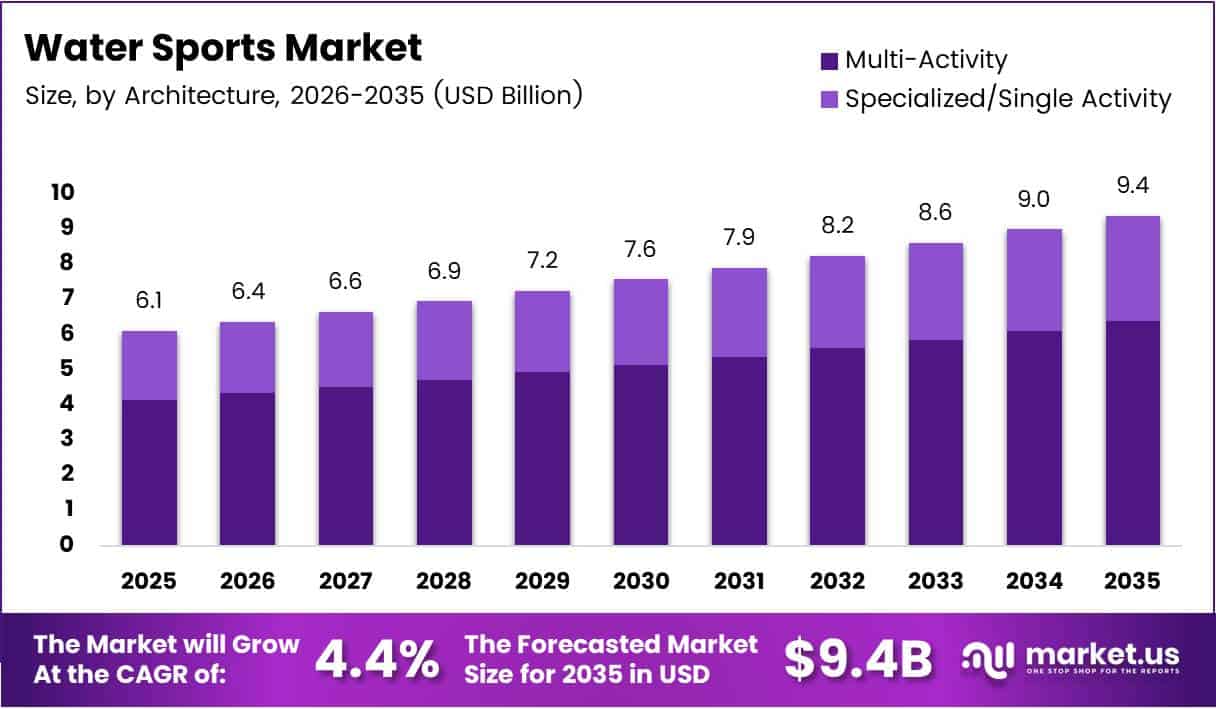

Global Water Sports Market size is expected to be worth around USD 9.4 Billion by 2035 from USD 6.1 Billion in 2025, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Water sports encompass recreational and competitive activities performed on or in water bodies. These activities range from surfing and kayaking to scuba diving and parasailing. Moreover, they attract millions of participants globally seeking adventure, fitness, and leisure experiences.

The market serves diverse consumer segments across coastal regions and inland waterways. Operators provide equipment rentals, training programs, and guided experiences. Additionally, tourism destinations integrate water sports into broader recreational offerings, enhancing visitor engagement and economic value.

Market expansion reflects rising consumer interest in outdoor adventure activities. Tourism infrastructure development supports accessibility to water-based recreation. Furthermore, technological improvements in equipment safety and performance drive adoption rates among new participants.

Growth opportunities emerge from expanding middle-class populations in developing regions. Disposable income increases enable spending on premium recreational experiences. Consequently, operators invest in modern facilities and diverse activity portfolios to capture market share.

Government initiatives promote water safety standards and environmental protection measures. Regulatory frameworks ensure sustainable tourism development while protecting aquatic ecosystems. Therefore, compliance requirements shape operational practices and equipment specifications across the industry.

In January 2025, Unleashed Brands acquired Water Wings Swim School, expanding year-round swimming instruction operations. This development demonstrates growing consolidation trends within water-based recreational services and education sectors.

According to Peek Pro, U.S. participation reached approximately 4.13 million in 2023, marking a 9.3% increase from the previous year. This growth indicates strengthening consumer engagement with water-based recreational activities nationwide.

According to Frontiers in Psychology, modern water events attracted around 40% of participants with no prior experience in canoeing or kayaking. This statistic highlights successful entry-point dynamics attracting newcomers to water sports activities.

Key Takeaways

- Global Water Sports Market projected to reach USD 9.4 Billion by 2035 from USD 6.1 Billion in 2025

- Market growing at CAGR of 4.4% during forecast period 2026-2035

- Multi-Activity segment dominates By Architecture with 69.1% market share in 2025

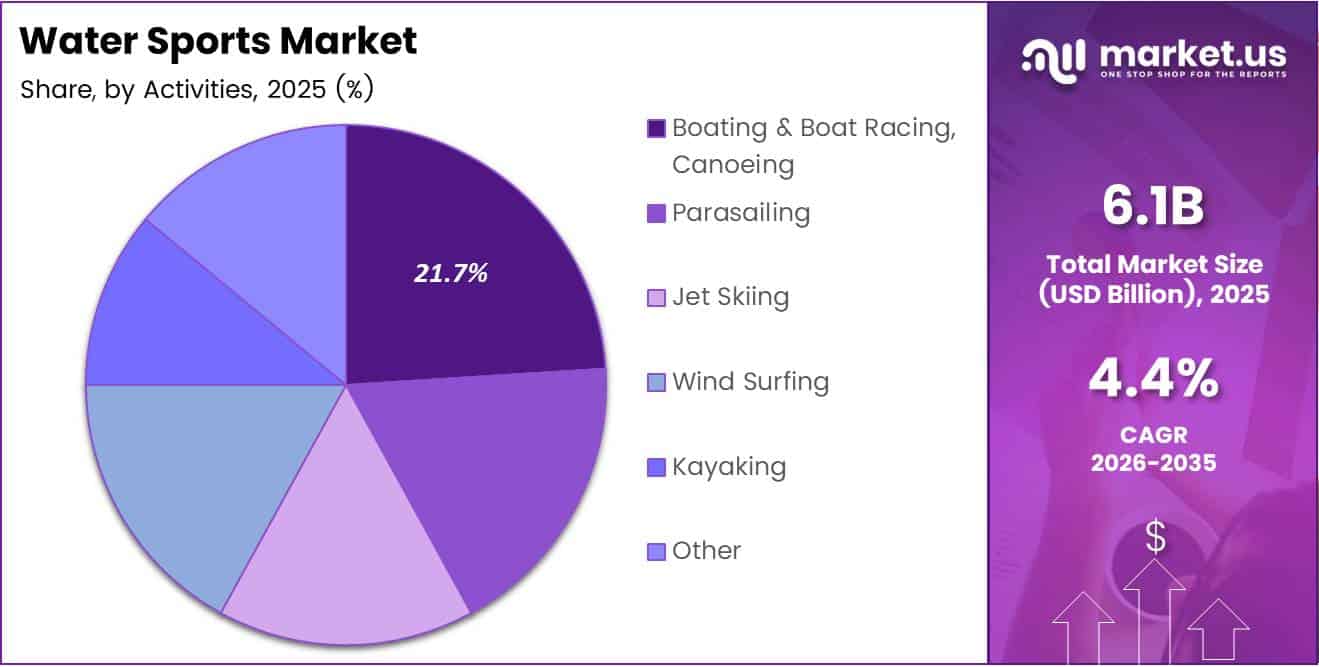

- Canoeing segment leads By Activities with 21.7% market share

- 16-60 Years Old age group holds 67.2% share in By Applications segment

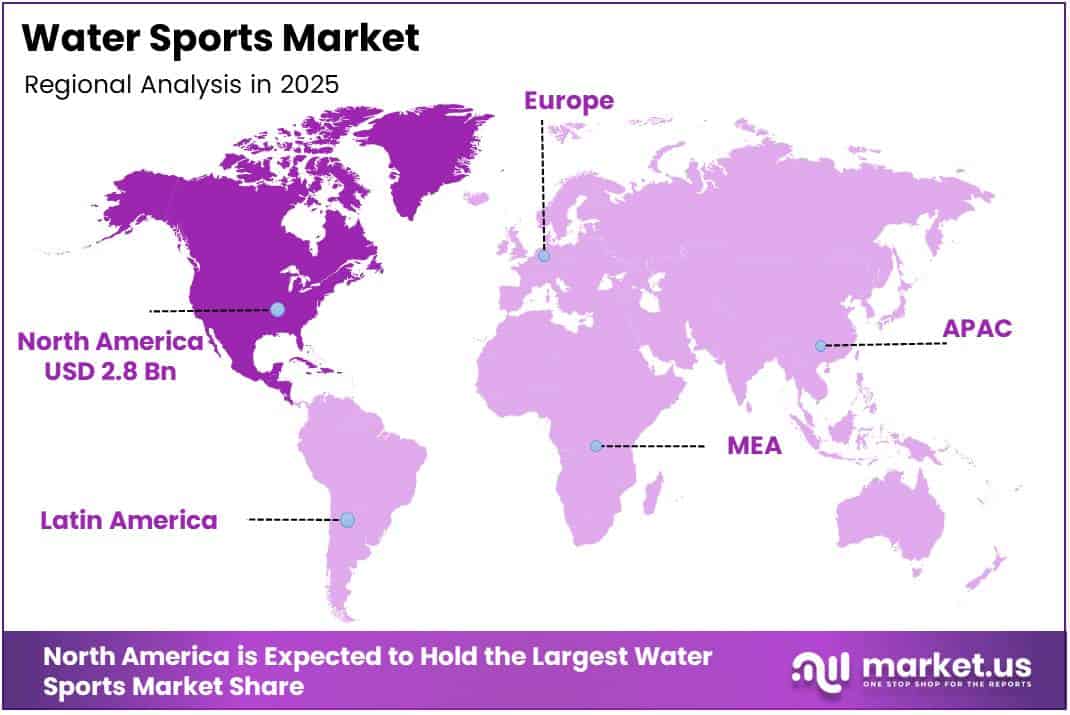

- North America dominates regional market with 46.20% share valued at USD 2.8 Billion

Architecture Analysis

Multi-Activity dominates with 69.1% due to versatile offerings and broader consumer appeal.

In 2025, Multi-Activity held a dominant market position in the By Architecture segment of Water Sports Market, with a 69.1% share. Multi-activity facilities offer diverse water sports experiences within single locations, attracting broader customer bases. Operators benefit from economies of scale through shared infrastructure and equipment utilization. Moreover, customers prefer comprehensive activity portfolios that accommodate varying skill levels and preferences.

Specialized/Single Activity facilities focus on specific water sports disciplines with dedicated equipment and expert instruction. These operations target enthusiasts seeking advanced training and competitive-level experiences. Additionally, specialized centers develop niche market positions through technical expertise and premium service offerings. They maintain loyal customer communities through focused programming and professional coaching standards.

Activities Analysis

Boating & Boat Racing, Canoeing dominates with 21.7% due to widespread accessibility and equipment availability.

In 2025, Boating & Boat Racing, Canoeing held a dominant market position in the By Activities segment of Water Sports Market, with a 21.7% share. Canoeing attracts participants through low entry barriers and minimal equipment requirements. Natural waterways support widespread activity accessibility across diverse geographic regions. Furthermore, organized racing events generate competitive interest and community engagement among practitioners.

Parasailing delivers aerial water sport experiences combining parachute flight with boat towing. This activity appeals to adventure seekers desiring unique perspectives and adrenaline-focused recreation. Moreover, coastal tourism destinations integrate parasailing into premium activity packages, enhancing revenue generation opportunities.

Jet Skiing provides high-speed water recreation through personal watercraft operation. Participants enjoy motorized experiences requiring minimal training and offering immediate satisfaction. Additionally, rental operators maintain substantial jet ski fleets serving tourist markets and recreational enthusiasts.

Wind Surfing combines sailing principles with surfboard techniques for wind-powered water navigation. This activity requires skill development and specialized equipment investment. Consequently, windsurfing communities establish dedicated locations with optimal wind conditions and supportive infrastructure.

Kayaking offers versatile paddling experiences across calm waters and challenging rapids. Equipment portability enables access to remote waterways and diverse environmental settings. Therefore, kayaking attracts outdoor enthusiasts seeking exploration and physical fitness benefits.

Rafting delivers group-based white-water adventures through inflatable boat navigation. Commercial operators provide guided trips combining safety protocols with thrilling river experiences. Moreover, rafting destinations develop regional tourism economies around seasonal water flow patterns.

River Trekking involves navigating river courses through swimming, climbing, and walking techniques. Participants engage with natural water environments while developing technical skills and physical endurance. Additionally, this activity supports eco-tourism initiatives in mountainous and forested regions.

Water Polo represents competitive team sport conducted in swimming pools and open water venues. Organized leagues and tournaments maintain structured participation pathways from youth to professional levels. Furthermore, water polo programs integrate with aquatic facilities and educational institutions.

Rowing encompasses recreational and competitive boat propulsion through synchronized oar strokes. This activity supports fitness objectives while building team coordination and competitive skills. Consequently, rowing clubs maintain dedicated training facilities along suitable waterways worldwide.

Scuba Diving enables underwater exploration through self-contained breathing apparatus and specialized training certification. Participants access marine ecosystems for recreational observation and scientific study. Moreover, diving tourism generates substantial economic value in coastal regions with rich aquatic biodiversity.

Snorkeling provides surface-level underwater viewing through mask and breathing tube equipment. This accessible activity requires minimal training and appeals to broad tourist demographics. Additionally, snorkeling experiences complement beach resort offerings and marine conservation education programs.

Others category includes emerging and niche water sports activities beyond primary classification segments. These activities range from stand-up paddle boarding to underwater hockey and aquatic fitness programs. Therefore, operators continuously introduce innovative offerings responding to evolving consumer preferences and technological developments.

Applications Analysis

16-60 Years Old dominates with 67.2% due to prime physical capability and disposable income levels.

In 2025, 16-60 Years Old held a dominant market position in the By Applications segment of Water Sports Market, with a 67.2% share. This demographic possesses physical fitness levels supporting diverse water sports participation requirements. Income stability enables equipment purchases, facility memberships, and travel expenses for water-based recreation. Moreover, lifestyle preferences increasingly prioritize health, adventure, and experiential consumption among working-age populations.

Under 16 segment represents youth participants engaging through family activities, educational programs, and competitive training pathways. Parental involvement drives enrollment in swimming lessons, summer camps, and junior sports leagues. Additionally, schools integrate water safety education and recreational swimming into physical education curricula.

Over 60 Years Old segment includes senior participants pursuing low-impact water activities for fitness and social engagement. Aquatic exercises provide joint-friendly physical activity options supporting mobility and cardiovascular health. Furthermore, retirement lifestyles enable increased leisure time for recreational water sports participation and travel to coastal destinations.

Key Market Segments

By Architecture

- Multi-Activity

- Specialized/Single Activity

By Activities

- Boating & Boat Racing, Canoeing

- Parasailing

- Jet Skiing

- Wind Surfing

- Kayaking

- Rafting

- River Trekking

- Water Polo

- Rowing

- Scuba Diving

- Snorkeling

- Others

By Applications

- Under 16

- 16-60 Years Old

- Over 60 Years Old

Drivers

Rising Global Participation in Adventure and Recreational Water-Based Activities Drives Market Growth

Consumer preferences shift toward experience-based recreation over material consumption patterns. Water sports deliver adventure, physical challenge, and social engagement opportunities. Consequently, participants allocate increasing leisure budgets to water-based activities across diverse geographic markets and demographic segments.

Coastal and inland tourism destinations expand water sports infrastructure to attract visitors. Governments invest in marina development, safety facilities, and environmental protection systems. Moreover, private operators establish rental services, training academies, and guided experience programs supporting accessibility for novice participants.

According to Business of Diving, water sports comprise about 16% of overall sports participation among Americans aged 6+, reflecting substantial integration within broader physical engagement patterns. This participation rate demonstrates significant market penetration and ongoing growth potential across recreational sports categories.

Restraints

High Initial Equipment and Maintenance Costs Limit Market Adoption

Water sports equipment requires substantial upfront investment deterring casual participants from ownership. Specialized gear such as boats, diving apparatus, and surfboards involves significant purchase costs. Additionally, ongoing maintenance expenses including storage, repairs, and safety equipment replacement create financial barriers to sustained participation.

Regulatory compliance mandates proper training, certification, and insurance coverage for water sports activities. Safety requirements increase operational costs for commercial providers and individual participants. Furthermore, liability concerns necessitate comprehensive risk management protocols affecting service pricing and accessibility.

According to WiFi Talents, white-water rafting maintains an average fatality rate of approximately 1 per 100,000 participants. This measurable risk statistic influences insurance premiums and regulatory oversight, subsequently impacting operational costs and consumer perceptions regarding adventure water sports safety.

Growth Factors

Technological Advancements and Tourism Integration Accelerate Market Expansion

Emerging tourism destinations integrate water sports into regional development strategies attracting international visitors. Governments promote coastal and lakeside recreation through infrastructure investments and marketing campaigns. Consequently, previously underdeveloped regions establish competitive market positions through natural resource advantages and cost-effective service offerings.

Rental and subscription-based business models reduce entry barriers for occasional participants and tourists. Operators develop flexible pricing structures accommodating varying usage frequencies and experience levels. Moreover, digital platforms streamline booking processes and equipment availability management improving operational efficiency.

According to Business of Diving, U.S. scuba diving participation involved approximately 3 million participants in 2023, with engagement primarily driven by casual divers participating 1-7 times per year. In November 2025, Bass Pro Shops and White River Marine Group acquired Hobie, bringing the California-based watercraft brand into a broader marine portfolio and planning manufacturing relocation to Missouri.

Emerging Trends

Sustainability and Digital Influence Transform Market Dynamics

Eco-friendly equipment manufacturing responds to environmental consciousness among consumers and regulatory pressures. Manufacturers develop sustainable materials and production processes reducing ecological impacts. Additionally, operators implement conservation practices protecting aquatic ecosystems while maintaining recreational access and commercial viability.

Electric and motor-assisted water sports gear expands accessibility for diverse skill levels and physical capabilities. Battery-powered watercraft reduce noise pollution and operational costs compared to traditional fuel engines. Furthermore, technological integration enhances safety features through GPS tracking and automated emergency response systems.

According to Business of Diving, casual participation in scuba diving demonstrated stronger growth than core participation, averaging 2.7% versus -0.7% over five years. Social media platforms amplify water sports lifestyle trends through visual content sharing and influencer marketing, driving aspiration-based consumption and destination tourism demand.

Regional Analysis

North America Dominates the Water Sports Market with a Market Share of 46.20%, Valued at USD 2.8 Billion

North America commands market leadership through established recreational infrastructure and high consumer participation rates. The region benefits from extensive coastlines, lakes, and river systems supporting diverse water sports activities. Moreover, strong economic conditions enable substantial household spending on recreational equipment and tourism experiences. The market share of 46.20% valued at USD 2.8 Billion reflects mature industry development and continued growth momentum.

Europe Water Sports Market Trends

Europe maintains significant market presence through Mediterranean tourism and Northern European sailing traditions. Coastal nations develop comprehensive water sports facilities attracting domestic and international participants. Additionally, regulatory frameworks emphasize safety standards and environmental protection supporting sustainable industry development and consumer confidence.

Asia Pacific Water Sports Market Trends

Asia Pacific demonstrates rapid growth driven by expanding middle-class populations and tourism infrastructure development. Tropical destinations integrate water sports into resort offerings and adventure tourism packages. Furthermore, increasing disposable incomes enable recreational spending among young urban consumers seeking lifestyle experiences and physical fitness activities.

Middle East & Africa Water Sports Market Trends

Middle East & Africa regions develop water sports markets through luxury tourism positioning and natural resource advantages. Gulf states invest in marina infrastructure and international sporting events enhancing destination appeal. Moreover, African coastal nations promote eco-tourism and adventure recreation creating economic opportunities through sustainable resource management.

Latin America Water Sports Market Trends

Latin America attracts participants through diverse coastal environments and favorable climate conditions year-round. Regional operators offer competitive pricing and authentic cultural experiences complementing water-based activities. Additionally, governments promote tourism development supporting local economic growth and infrastructure improvements benefiting recreational service providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Bali Jetpacks and Water Sports operates comprehensive water sports facilities in premier Indonesian tourist destinations. The company provides jet ski rentals, parasailing experiences, and emerging flyboard technologies attracting international visitors. Moreover, strategic positioning in Bali’s tourism infrastructure enables access to high-volume customer flows and premium pricing opportunities through luxury resort partnerships.

Fury Water Adventures delivers guided water sports experiences across Caribbean and Florida locations. The operator maintains modern equipment fleets and certified instruction programs ensuring safety and customer satisfaction. Additionally, integrated booking systems and multi-location presence support operational efficiency and market reach among vacation travelers seeking professionally managed water activities.

Gold Coast Watersports serves Australian markets through diverse activity offerings and coastal facility locations. The company combines equipment rentals with training programs and competitive event organization. Furthermore, strong regional brand recognition and environmental stewardship initiatives enhance market positioning among domestic participants and international tourists.

Cruz Bay Watersports specializes in Caribbean water sports experiences emphasizing customer service and equipment quality. Operations focus on snorkeling, diving, and boat-based activities suited to tropical marine environments. In September 2025, Hobie acquisition by White River Marine Group brought production back to Missouri, strengthening distribution and dealer support worldwide among key industry players.

Key players

- Bali Jetpacks and Water Sports

- Fury Water Adventures

- Gold Coast Watersports

- Cruz Bay Watersports

- Rockley Watersports

- Athens Watersports School

- H&S Watersports Academy – Jordan

- Amorgos Diving Center

Recent Developments

- June 2025 – The HEAD Group formally acquired the Aqualung Group, expanding its portfolio in diving equipment and underwater sports technology. This strategic acquisition strengthens HEAD’s position in specialized water sports equipment manufacturing and global distribution networks.

- January 2025 – Sea Ray premiered the SDX 270 Surf at boot Düsseldorf International Boat Show (18-26 January 2025), marking the European launch of its redesigned surf boat. The vessel features advanced surf-wave technology enhancing recreational boating experiences for water sports enthusiasts.

- November 2024 – Boat retailer Action Water Sports acquired the former Tommy’s Boats dealership, expanding regional market presence and service capabilities. This acquisition strengthens retail distribution channels for water sports equipment and marine vessels in competitive markets.

Report Scope

Report Features Description Market Value (2025) USD 6.1 Billion Forecast Revenue (2035) USD 9.4 Billion CAGR (2026-2035) 4.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Architecture (Multi-Activity, Specialized/Single Activity), By Activities (Boating & Boat Racing, Canoeing, Parasailing, Jet Skiing, Wind Surfing, Kayaking, Rafting, River Trekking, Water Polo, Rowing, Scuba Diving, Snorkeling, Others), By Applications (Under 16, 16-60 Years Old, Over 60 Years Old) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bali Jetpacks and Water Sports, Fury Water Adventures, Gold Coast Watersports, Cruz Bay Watersports, Rockley Watersports, Athens Watersports School, H&S Watersports Academy – Jordan, Amorgos Diving Center Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bali Jetpacks and Water Sports

- Fury Water Adventures

- Gold Coast Watersports

- Cruz Bay Watersports

- Rockley Watersports

- Athens Watersports School

- H&S Watersports Academy – Jordan

- Amorgos Diving Center