Global Water Purifier Market Size, Share, Growth Analysis By Product Type (Point-of-use Filters, Under The Counter Filters, Counter Top Filters, Pitcher Filters, Faucet-mounted Filters, Point-of-entry Filters, Others), By Category (RO Filters, UV Filters, Gravity Filters, Others), By Application (Residential, Commercial), By Distribution Channel (Retail Stores, Direct Sales, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171321

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

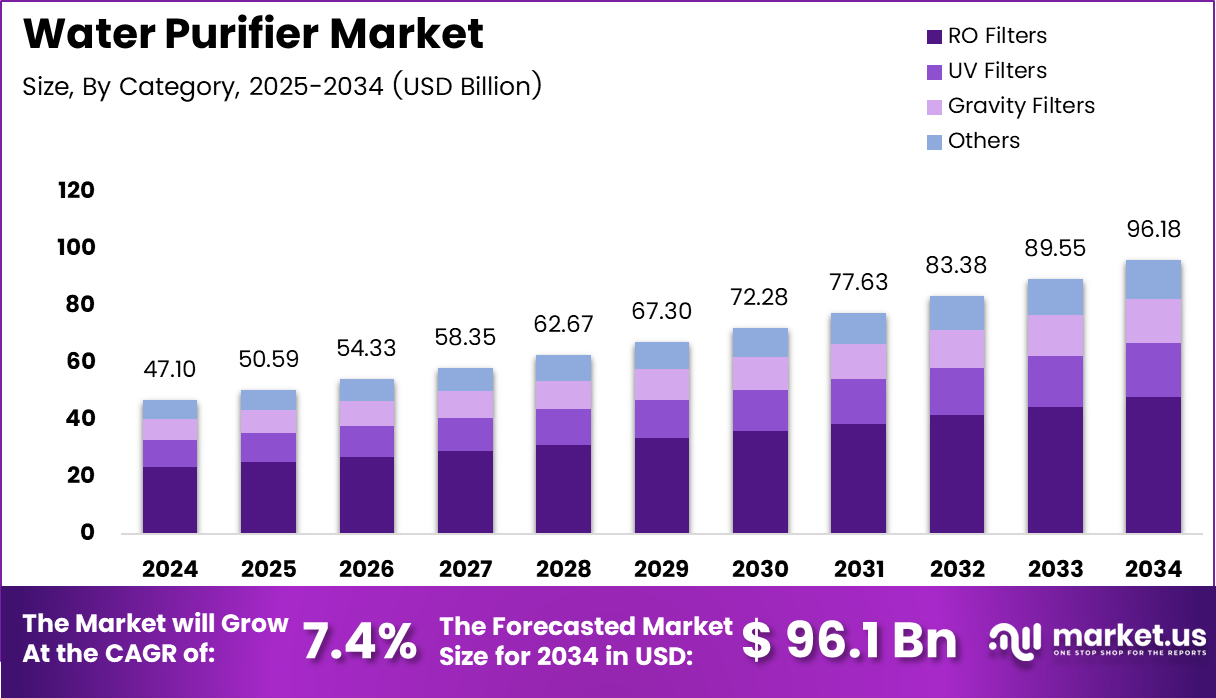

The Global Water Purifier Market size is expected to be worth around USD 96.1 billion by 2034, from USD 47.1 billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Water Purifier Market refers to products and systems designed to remove physical, chemical, and biological contaminants from drinking water. These solutions support residential, commercial, and institutional demand for safe portable water purifier. Increasing urbanization, aging water infrastructure, and rising health awareness steadily expand market relevance across developed and emerging economies.

Water purifiers represent a necessity driven by preventive healthcare behavior rather than discretionary consumption. Consequently, consumers increasingly evaluate purification technologies based on safety assurance, lifecycle cost, and regulatory compliance. Simple business demand centers on reliable filtration, ease of maintenance, and long term household water security.

From a broader market perspective, the Water Purifier Market shows consistent growth as water quality concerns intensify globally. Moreover, population growth and industrial discharge pressure municipal supplies. As a result, point of use purification gains traction in homes, offices, schools, and healthcare facilities, supporting recurring replacement and service driven revenue streams.

Growth momentum strengthens due to government investments in clean water access and stricter drinking water standards. For instance, public health agencies increasingly mandate contaminant limits, encouraging purifier adoption. Simultaneously, subsidies, rural water missions, and sanitation programs indirectly stimulate household level purification demand, especially across water stressed regions.

Opportunities further emerge through technological innovation and energy efficient purification systems. Transitioning consumers increasingly prefer compact designs, low water wastage, and reduced operating costs. Additionally, digital monitoring, smart filters, and service based maintenance models enhance transactional value while supporting recurring revenue opportunities for solution providers.

According to the World Health Organization and environmental health agencies, reverse osmosis technology removes up to 99% of contaminants from water, offering high purification efficiency. However, these systems retain nearly 95% of mineral salts within membranes and generate approximately 70% wastewater concentrated with pollutants during filtration.

Purchase prices range from a few hundred to several thousand euros, while tank based purifier budgets typically vary between 100 and 500 euros. Furthermore, purified water costs remain 65 times higher than tap water on average.

Key Takeaways

- The global water purifier market is projected to grow from USD 47.1 billion in 2024 to USD 96.1 billion by 2034, registering a CAGR of 7.4%.

- Point-of-use filters represent the leading product type, accounting for 78.3% of total market share in 2024.

- RO filters dominate the category segment with a market share of 49.8%, reflecting strong demand for high-efficiency purification.

- Residential applications remain the largest segment, contributing 81.4% of overall market demand in 2024.

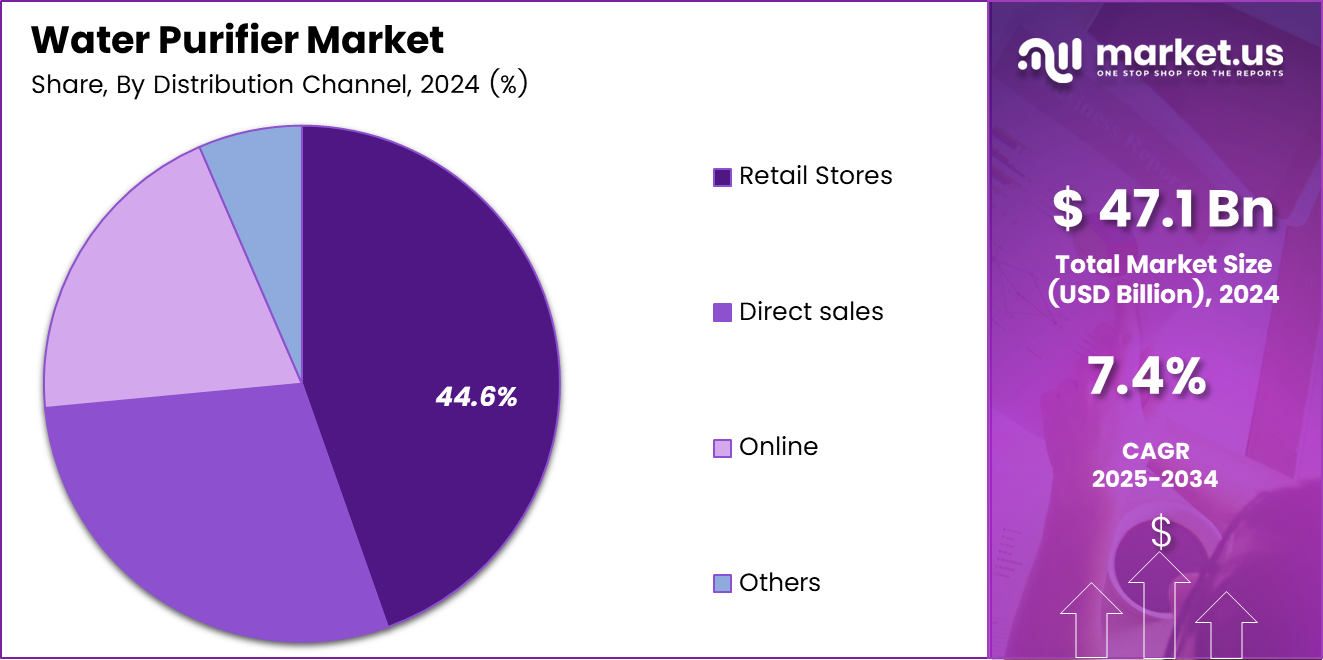

- Retail stores lead the distribution channel segment with a share of 44.6%.

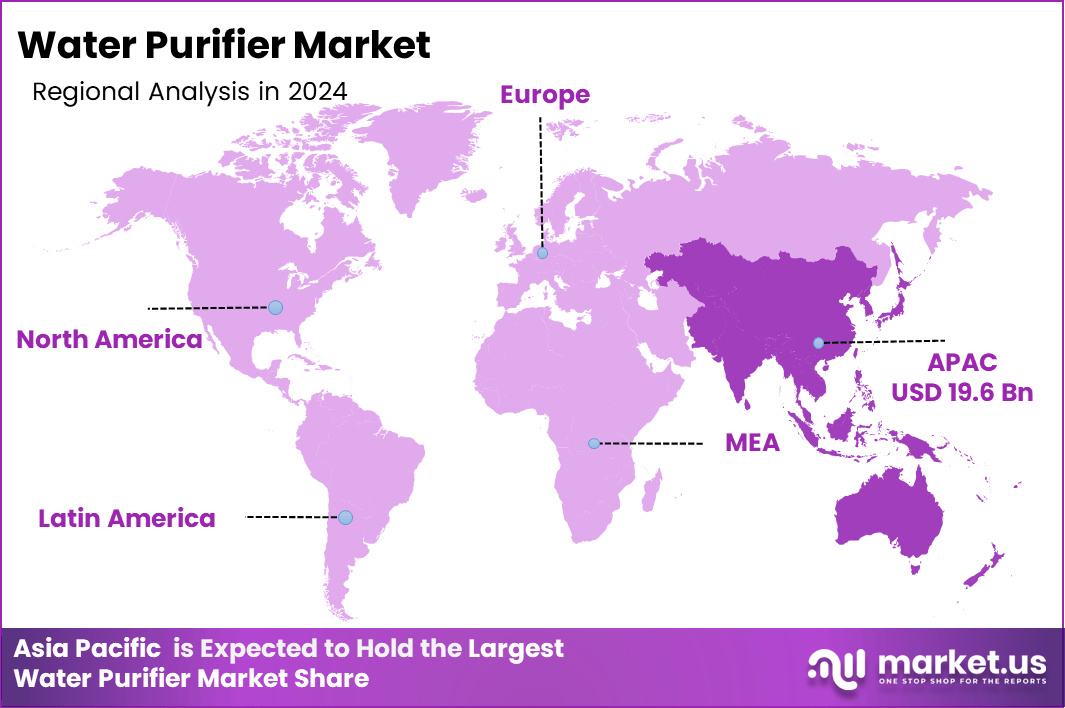

- Asia Pacific is the dominant regional market, holding 41.7% share and reaching a value of USD 19.6 billion.

By Product Type Analysis

Point-of-use Filters dominate with 78.3% due to their affordability, ease of installation, and suitability for household consumption needs.

In 2024, Point-of-use Filters held a dominant market position in the By Product Type Analysis segment of Water Purifier Market, with a 78.3% share. These systems directly treat drinking water at taps, improving safety and taste. Moreover, consumers favor them for low maintenance requirements and compatibility with urban living spaces.

Under The Counter Filters continue to gain traction as they remain concealed and deliver high filtration performance. Additionally, these systems appeal to premium households seeking aesthetics and uninterrupted water flow. As awareness improves, adoption steadily increases across modern kitchens.

Counter Top Filters offer portability and simple installation, supporting flexible usage in rented homes. Consequently, this segment attracts cost conscious consumers seeking efficient purification without plumbing changes. Demand remains stable across urban and semi urban settings.

Pitcher Filters serve entry level users by providing basic purification through gravity based systems. As a result, they maintain relevance among students and small households seeking economical solutions.

Faucet-mounted Filters provide direct filtration at the tap, enabling convenience and space efficiency. Meanwhile, Others and Point-of-entry Filters cater to niche and whole household purification needs, supporting varied consumer preferences.

By Category Analysis

RO Filters dominate with 49.8% due to their ability to remove dissolved solids and chemical contaminants effectively.

In 2024, RO Filters held a dominant market position in the By Category Analysis segment of Water Purifier Market, with a 49.8% share. These systems address high TDS water concerns, making them essential in regions with groundwater dependency.

UV Filters remain relevant for microbial disinfection, especially in areas with biologically contaminated water. Additionally, their chemical free operation supports growing health awareness among consumers.

Gravity Filters appeal to rural and low infrastructure regions due to electricity free operation. Consequently, they maintain steady demand where affordability and accessibility remain critical.

Others include hybrid and advanced purification technologies that address specific water quality issues. As innovation progresses, these systems support specialized applications and evolving regulatory standards.

By Application Analysis

Residential applications dominate with 81.4% due to rising household awareness of drinking water quality and health safety.

In 2024, Residential held a dominant market position in the By Application Analysis segment of Water Purifier Market, with a 81.4% share. Growing urbanization and health consciousness drive consistent household adoption globally.

Commercial applications include offices, hospitality, and institutional facilities that prioritize employee and customer safety. Meanwhile, regulatory compliance and hygiene standards continue to support gradual commercial adoption.

By Distribution Channel Analysis

Retail Stores dominate with 44.6% due to physical product demonstration and consumer trust in offline purchasing.

In 2024, Retail Stores held a dominant market position in the By Distribution Channel Analysis segment of Water Purifier Market, with a 44.6% share. Consumers prefer in store guidance, installation support, and immediate availability.

Direct sales channels enable personalized demonstrations and after sales service. Consequently, brands leverage this model to build long term customer relationships.

Online platforms expand reach through convenience and price transparency. As digital adoption increases, online sales steadily complement traditional channels.

Others include distributors and institutional procurement routes that support bulk and project based installations across regions.

Key Market Segments

By Product Type

- Point-of-use Filters

- Under The Counter Filters

- Counter Top Filters

- Pitcher Filters

- Faucet-mounted Filters

- Point-of-entry Filters

- Others

By Category

- RO Filters

- UV Filters

- Gravity Filters

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Retail Stores

- Direct Sales

- Online

- Others

Drivers

Rising Concerns Over Waterborne Diseases and Contamination Risks Drive Market Growth

Rising concerns over waterborne diseases and contamination risks remain a key driver for the water purifier market. Increasing reports of polluted groundwater, industrial discharge, and aging water infrastructure have raised awareness about unsafe drinking water. As an analyst, this concern is encouraging households to adopt purification solutions to reduce exposure to bacteria, viruses, heavy metals, and chemical pollutants. Consumers increasingly view water purifiers as a basic health safeguard rather than an optional appliance.

The growing urban population relying on treated drinking water further supports market expansion. Rapid urbanization has increased dependence on centralized water supply systems, where quality can vary due to pipeline leakage and inconsistent treatment standards. Urban households are therefore investing in in home purification systems to ensure consistent water quality. This trend is particularly visible in densely populated cities where bottled water is not a sustainable long term option.

Growing awareness of health benefits from purified water consumption also strengthens demand. Consumers now associate purified water with improved digestion, reduced illness, and overall wellness. Health focused messaging, combined with rising lifestyle diseases, is influencing purchasing decisions across middle income groups.

Government initiatives promoting access to safe drinking water add another strong push. Public health campaigns, rural water programs, and urban sanitation missions are reinforcing awareness and indirectly supporting purifier adoption as a complementary solution at the household level.

Restraints

High Upfront Cost of Advanced Purification Systems Limits Market Expansion

High upfront cost of advanced purification systems is a major restraint for the water purifier market. Technologies such as RO, UV, and multi stage systems require higher initial investment, which can discourage price sensitive consumers. As an analyst, this cost barrier is especially visible in developing regions where household budgets are tightly managed and essential spending takes priority.

Regular maintenance and filter replacement expenses further add to ownership costs. Water purifiers require periodic servicing, membrane changes, and cartridge replacements to maintain performance. Many consumers underestimate these recurring expenses at the time of purchase, leading to dissatisfaction or discontinued use. Over time, maintenance costs can approach a significant portion of the original system price.

Limited adoption in low income and rural households continues to restrict broader market penetration. In these areas, access to electricity, awareness of purification benefits, and affordability remain key challenges. Rural consumers often rely on traditional water sources and basic filtration methods, viewing advanced purifiers as unnecessary or financially out of reach.

Additionally, inconsistent after sales service availability in remote areas discourages adoption. Without reliable service networks, consumers hesitate to invest in systems that require technical support. These combined factors slow down mass adoption, despite rising awareness of water quality issues.

Growth Factors

Increasing Penetration of Water Purifiers in Emerging Economies Creates New Opportunities

Increasing penetration of water purifiers in emerging economies presents a strong growth opportunity for the market. Rising disposable incomes, improving living standards, and expanding middle class populations are creating new demand across Asia Pacific, Latin America, and parts of Africa. As an analyst, these regions offer long term volume growth as first time buyers enter the market.

Expanding demand for smart and IoT enabled water purifiers further enhances opportunity. Consumers are showing interest in systems that provide filter life alerts, usage tracking, and real time performance updates. Smart features improve user confidence, reduce maintenance uncertainty, and support premium pricing strategies for manufacturers.

Growing commercial adoption across offices, hospitals, and hospitality settings also opens new revenue streams. Commercial establishments prioritize safe water for employees, patients, and guests, driving demand for high capacity and reliable purification systems. This segment offers repeat business through service contracts and replacement cycles.

Urban infrastructure expansion and new housing developments further support opportunity. Builders and developers increasingly include water purifiers as value added amenities, especially in premium residential projects. Together, these factors position the market for sustained growth beyond traditional household demand.

Emerging Trends

Shift Toward RO UV and Multi Stage Technologies Shapes Market Trends

Shift toward RO, UV, and multi stage purification technologies is a key trending factor in the water purifier market. Consumers prefer systems that address multiple contaminants simultaneously, offering comprehensive protection against biological and chemical impurities. As an analyst, this shift reflects growing knowledge about complex water quality issues rather than single contaminant concerns.

Rising preference for compact and under sink purifier designs is another notable trend. Urban homes with limited space favor sleek, hidden installations that blend with modern kitchen layouts. Compact designs also appeal to renters and apartment dwellers seeking convenience without permanent modifications.

Integration of real time water quality monitoring features is gaining traction. Displays, indicators, and app based alerts help users track water safety and system performance. These features build trust and reduce uncertainty around filter effectiveness and replacement timing.

Increasing demand for eco friendly and low water wastage purifiers is shaping product innovation. Consumers are becoming conscious of water conservation and environmental impact. Manufacturers are responding with improved recovery rates, recyclable components, and energy efficient designs, aligning purification solutions with sustainability expectations.

Regional Analysis

Asia Pacific Dominates the Water Purifier Market with a Market Share of 41.7%, Valued at USD 19.6 Billion

Asia Pacific represents the leading region in the Water Purifier Market, driven by rapid urbanization, rising population density, and growing concerns over water quality. In this region, the market accounted for 41.7% of global share, reaching a value of USD 19.6 billion, supported by increasing household adoption and government-led clean water initiatives. Expanding middle-class income levels and higher awareness of waterborne diseases continue to strengthen demand across residential and small commercial settings.

North America Water Purifier Market Trends

North America demonstrates steady market expansion due to strong consumer awareness regarding health, hygiene, and water safety. The region benefits from advanced water infrastructure combined with increasing concerns over aging pipelines and chemical contaminants. Adoption of point-of-use and under-the-sink systems remains prominent across urban households. Regulatory focus on drinking water standards further supports consistent market demand.

Europe Water Purifier Market Trends

Europe shows moderate growth in the Water Purifier Market, supported by stringent environmental regulations and rising sustainability awareness. Consumers increasingly prefer filtration systems that reduce plastic bottle and container usage and improve tap water quality. Urban households and small commercial establishments contribute significantly to regional demand. The market also benefits from high penetration of advanced filtration technologies.

Middle East and Africa Water Purifier Market Trends

The Middle East and Africa region is witnessing gradual market development due to water scarcity and limited access to potable water in several areas. Growing urban populations and infrastructure investments are improving adoption rates in residential and institutional segments. Demand is particularly strong in areas facing groundwater salinity and inconsistent municipal water supply. Long-term water security concerns remain a key growth driver.

Latin America Water Purifier Market Trends

Latin America reflects emerging opportunities in the Water Purifier Market, supported by rising urbanization and increasing awareness of water contamination issues. Households are gradually shifting toward affordable purification solutions to address inconsistent water quality. Government programs aimed at improving drinking water access further support market penetration. Economic recovery trends are expected to positively influence future adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Water Purifier Company Insights

A. O. Smith Corporation remains a leading force in the global water purifier market in 2024, driven by its strong emphasis on technological innovation and energy-efficient solutions. The company’s strategic focus on expanding its product portfolio with advanced filtration technologies continues to appeal to environmentally conscious consumers and institutional buyers alike. Its robust distribution network and brand equity position it well to capture growing demand in both developed and emerging markets.

Brita LP continues to leverage its longstanding reputation for high-quality, user-friendly water filtration products that cater primarily to the residential segment. In 2024 the company’s sustained investment in brand marketing and retail partnerships has strengthened its foothold in key regions where consumers prioritize convenience and health. Brita’s emphasis on sustainability, including recyclable filter components, reinforces its appeal among eco-aware households.

Pentair PLC holds a prominent position through its comprehensive range of water purification systems tailored to residential, commercial, and industrial applications. In 2024 Pentair’s focus has been on integrating smart technologies into its product lines to meet the growing demand for connected home solutions. The company’s commitment to innovation, coupled with its global service infrastructure, supports long-term customer retention and competitive differentiation.

Culligan International Company remains a notable player by offering customizable water treatment solutions backed by professional installation and service support. The company’s strength lies in its ability to address complex water quality issues across diverse geographic markets. In 2024 Culligan’s strategic partnerships and loyalty programs have reinforced customer engagement, particularly among commercial clients seeking tailored purification solutions.

Top Key Players in the Market

- A. O. Smith Corporation

- Brita LP

- Pentair PLC

- Culligan International Company

- Unilever PLC

- Panasonic Corporation

- LG Electronics

- Helen of Troy Limited

- Best Water Technology Group

- Kent RO Systems Ltd.

Recent Developments

- In Jul 2024, A. O. Smith Corporation announced that it signed an agreement to acquire Pureit from Unilever, a residential water purification business with annual sales of approximately USD 60 million, primarily in India. This acquisition strengthens A. O. Smith’s presence in the Indian water treatment market and expands its portfolio of household water purification solutions.

- In May 19, 2025, Viomi launched an AI powered mineral water purifier, integrating smart technology to enhance water quality monitoring and user control.The new product reflects Viomi’s focus on intelligent home appliances and advances in connected, data driven water purification systems.

Report Scope

Report Features Description Market Value (2024) USD 47.1 billion Forecast Revenue (2034) USD 96.1 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Point-of-use Filters, Under The Counter Filters, Counter Top Filters, Pitcher Filters, Faucet-mounted Filters, Point-of-entry Filters, Others), By Category (RO Filters, UV Filters, Gravity Filters, Others), By Application (Residential, Commercial), By Distribution Channel (Retail Stores, Direct Sales, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A. O. Smith Corporation, Brita LP, Pentair PLC, Culligan International Company, Unilever PLC, Panasonic Corporation, LG Electronics, Helen of Troy Limited, Best Water Technology Group, Kent RO Systems Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A. O. Smith Corporation

- Brita LP

- Pentair PLC

- Culligan International Company

- Unilever PLC

- Panasonic Corporation

- LG Electronics

- Helen of Troy Limited

- Best Water Technology Group

- Kent RO Systems Ltd.