Global Water Parks Market Size, Share, Growth Analysis By Attraction Type (Water Slides, Lazy Rivers & Wave Pools, Splash Pads, Cabanas & Relaxation Areas, Others), By Age Group (Up to 18 years, 19-35 years, 36-50 years, 51-65 years, Above 65 years), By Revenue Source (Tickets, Food & Beverage, Merchandise, Hotel & Resorts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157924

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

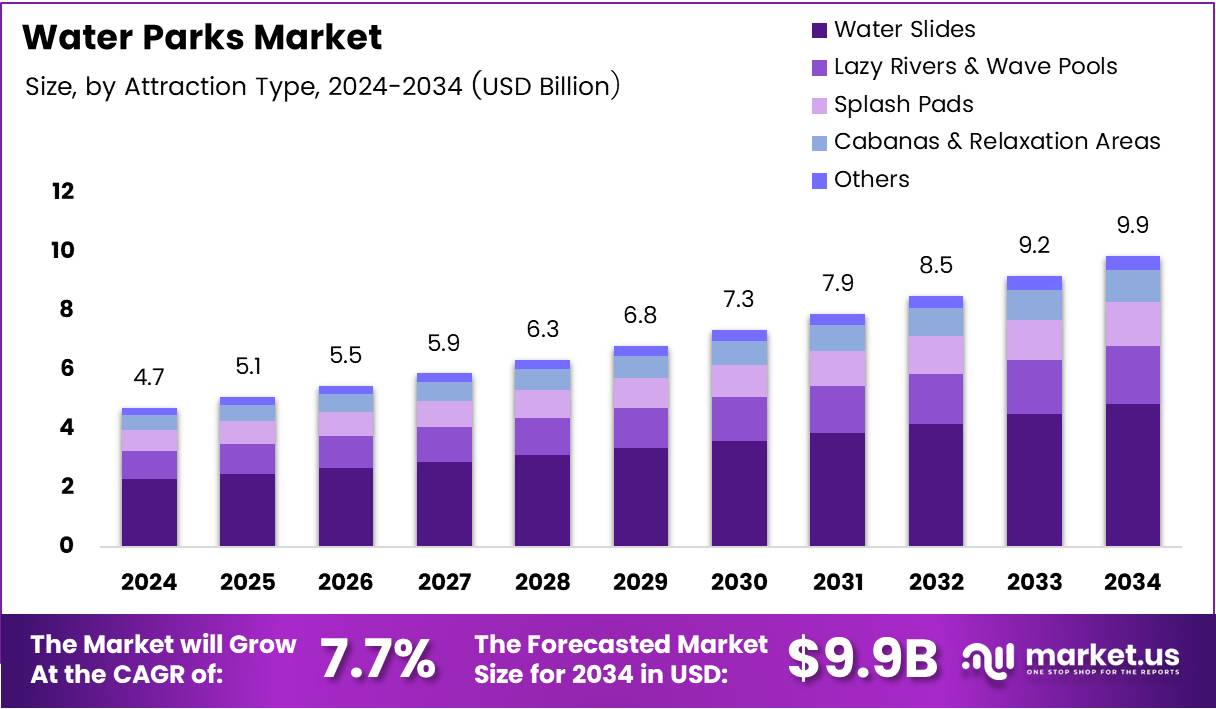

The Global Water Parks Market size is expected to be worth around USD 9.9 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

The water parks market is experiencing steady growth, driven by increasing consumer interest in recreational activities and family-oriented entertainment. This trend is particularly strong in regions with higher disposable incomes, such as North America and parts of Europe. The rising popularity of water parks is fueled by the demand for both outdoor and indoor attractions.

With significant investments from both private players and government initiatives, the water parks market is expected to expand further. Key government regulations focus on safety standards, water conservation, and environmental sustainability. These regulations ensure that water parks not only provide entertainment but also adhere to responsible and sustainable practices.

One of the most notable opportunities in the water parks market lies in the expansion of indoor water parks. With increasing demand for year-round entertainment, the development of indoor water parks has become a focal point. This trend is particularly evident in regions with harsh climates or where outdoor water parks face seasonal limitations.

The market is also seeing significant investments in enhancing visitor experiences through technological advancements. Innovations such as virtual reality attractions, enhanced water filtration systems, and mobile ticketing services are gaining popularity. These investments aim to provide visitors with a unique and seamless experience while also boosting operational efficiency.

According to an industry report, water parks in the U.S. and Canada numbered 1,253 as of February 2025. Notably, 25 new properties were launched in 2024, including both standalone parks and resort-integrated ones. This growth underscores the expanding appeal of water parks as a key segment of the broader entertainment and leisure industry.

Data further indicates that 85 million people attend water parks each year, showcasing the immense popularity of these recreational destinations. In 2024, the opening of 13 indoor water parks added 392,800 square feet of space, with projections for 2025 suggesting that the industry will surpass 526,000 square feet of space. These expansions signal a promising future for the market, especially with increased focus on indoor attractions and year-round operations.

Key Takeaways

- The Global Water Parks Market is expected to reach USD 9.9 Billion by 2034, growing at a CAGR of 7.7% from 2025 to 2034.

- Water Slides dominate the By Attraction Type segment with a 37.2% share in 2024.

- The Up to 18 years age group leads the By Age Group segment with a 31.4% share in 2024.

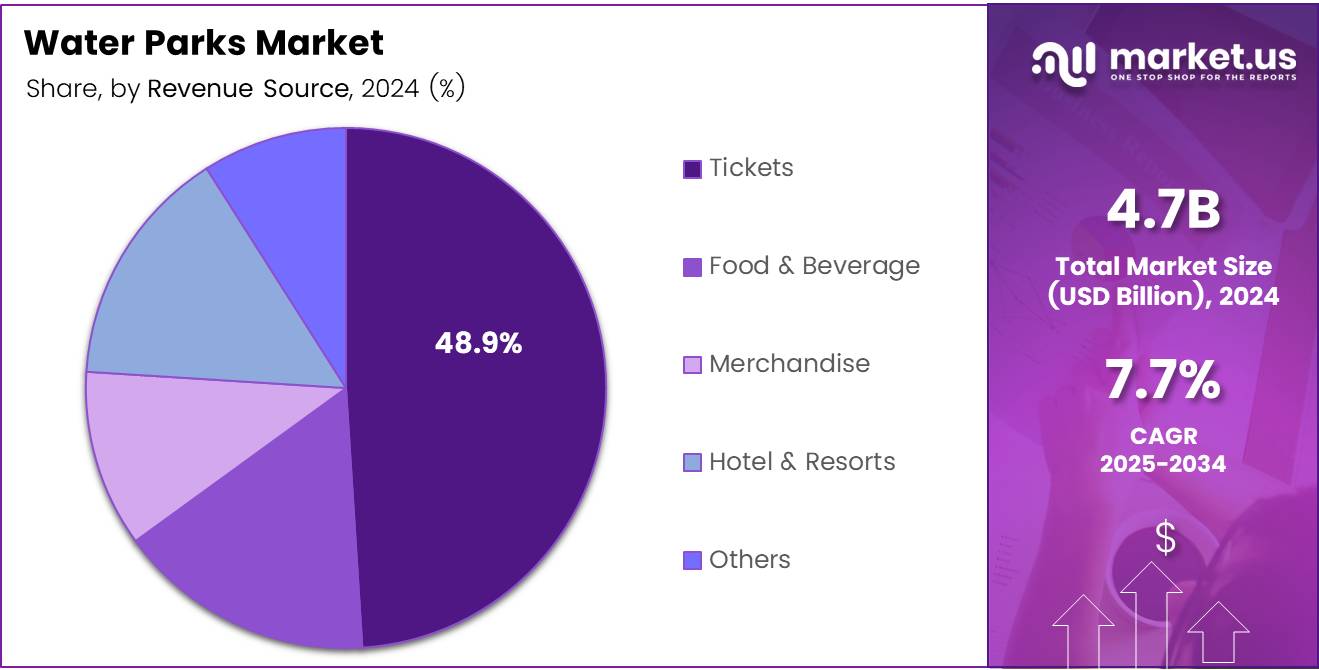

- Tickets account for 48.9% of the revenue in the By Revenue Source segment in 2024.

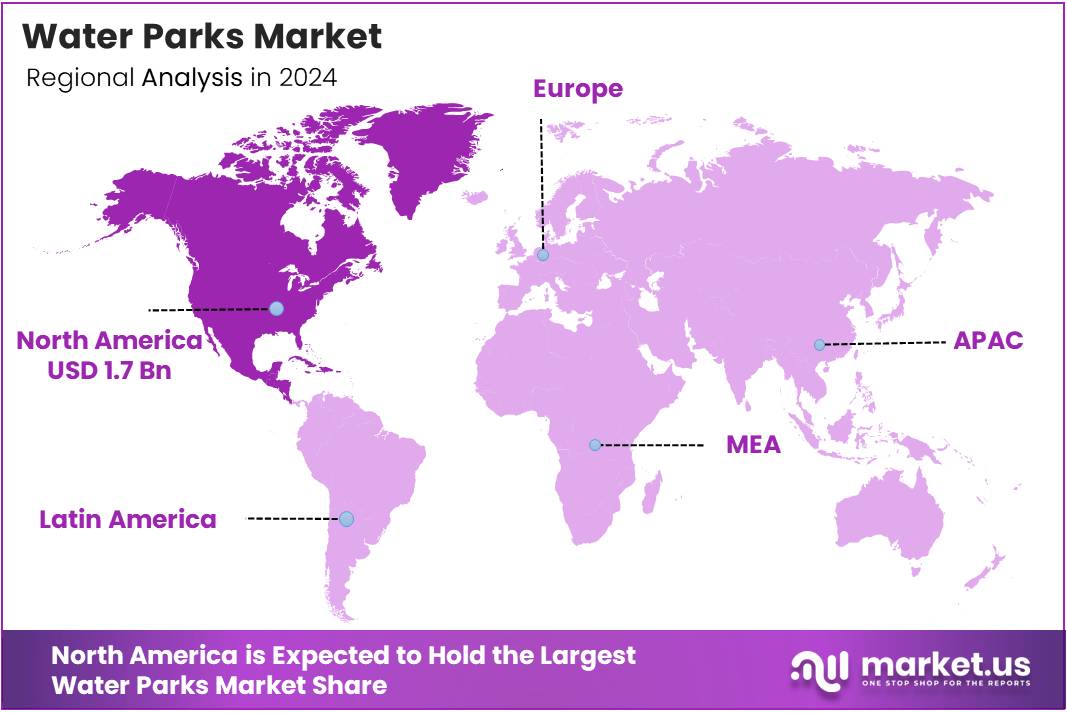

- North America holds 37.4% of the water parks market, valued at USD 1.7 Billion in 2024.

Attraction Type Analysis

Water Slides dominate with 37.2% due to their thrilling appeal and universal popularity among visitors.

In 2024, Water Slides held a dominant market position in By Attraction Type Analysis segment of Water Parks Market, with a 37.2% share. This commanding position reflects the enduring appeal of water slides as the cornerstone attraction that defines the water park experience. Their popularity spans across all age groups, making them essential infrastructure for any successful water park operation.

Lazy Rivers & Wave Pools represent the second-tier attractions, offering relaxation and moderate excitement that complements the high-adrenaline slide experiences. These features cater to families seeking gentler water activities and provide operational diversity.

Splash Pads have gained significant traction, particularly in family-oriented segments, offering safe water play environments for younger children. Their growing popularity reflects the industry’s focus on inclusive entertainment options.

Cabanas & Relaxation Areas serve the premium market segment, generating higher per-visitor revenue through exclusive comfort offerings. Others category encompasses specialized attractions like water obstacle courses and interactive play structures, representing niche but growing market opportunities that enhance overall park differentiation.

Age Group Analysis

Up to 18 years dominates with 31.4% due to summer vacation periods and family-oriented entertainment preferences.

In 2024, Up to 18 years held a dominant market position in By Age Group Analysis segment of Water Parks Market, with a 31.4% share. This demographic represents the core customer base, driven by school holidays, birthday celebrations, and family outings that prioritize child-friendly entertainment experiences.

The 19-35 years segment forms a substantial portion of visitors, often accompanying younger family members or seeking recreational activities with friends. This group contributes significantly to secondary spending on food, beverages, and premium services.

The 36-50 years demographic typically represents parents and guardians accompanying children, playing a crucial role in purchase decisions and driving family package sales. Their presence often extends visit duration and increases per-capita spending.

The 51-65 years segment, while smaller, represents an important market for relaxation-focused amenities like lazy rivers and spa services. Above 65 years visitors, though the smallest segment, often participate in multi-generational family visits, contributing to the overall family entertainment ecosystem that water parks strive to create.

Revenue Source Analysis

Tickets dominate with 48.9% due to being the primary entry requirement and core business model foundation.

In 2024, Tickets held a dominant market position in By Revenue Source Analysis segment of Water Parks Market, with a 48.9% share. This substantial portion reflects the fundamental business model where admission fees constitute the primary revenue driver, covering operational costs and infrastructure maintenance while ensuring profitability.

Food & Beverage represents a crucial secondary revenue stream, capitalizing on captive audiences spending extended periods within park facilities. This segment benefits from premium pricing strategies and exclusive vendor arrangements that maximize profit margins.

Merchandise sales contribute to brand extension and visitor experience enhancement, offering souvenirs, swimwear, and park-branded items that serve as revenue generators and marketing tools. These products create lasting connections between visitors and park brands.

Hotel & Resorts revenue streams are particularly important for destination water parks, where extended stays significantly increase per-visitor value and encourage repeat visitation. Others category encompasses parking fees, locker rentals, photo services, and special event bookings, representing diverse ancillary revenue opportunities that collectively enhance overall park profitability and operational efficiency.

Key Market Segments

By Attraction Type

- Water Slides

- Lazy Rivers & Wave Pools

- Splash Pads

- Cabanas & Relaxation Areas

- Others

By Age Group

- Up to 18 years

- 19-35 years

- 36-50 years

- 51-65 years

- Above 65 years

By Revenue Source

- Tickets

- Food & Beverage

- Merchandise

- Hotel & Resorts

- Others

Drivers

Growing Consumer Preference for Family Recreation Drives Water Parks Market Expansion

The water parks market is experiencing significant growth due to changing consumer behavior patterns. More families are seeking leisure activities that bring everyone together, making water parks an attractive option for quality time. These destinations offer entertainment for all age groups, from toddler splash areas to thrilling slides for teens and adults.

Rising disposable income levels globally have enabled families to spend more on recreational activities. People now allocate larger portions of their budgets to travel and entertainment experiences. This increased spending power directly benefits water park operators as families can afford admission fees, food, and merchandise.

The shift toward eco-tourism is reshaping the industry. Modern water parks are adopting sustainable practices like solar heating, water recycling systems, and energy-efficient equipment. These green initiatives attract environmentally conscious consumers who prefer businesses that align with their values.

Emerging markets present tremendous growth potential as urbanization increases. Countries in Asia, Latin America, and Africa are witnessing rapid infrastructure development, creating opportunities for new water park construction. These regions have growing middle-class populations eager for entertainment options that were previously unavailable in their areas.

Restraints

Safety Concerns and Seasonal Limitations Create Market Challenges

Safety remains the primary concern affecting water park operations and customer confidence. Accidents involving slides, wave pools, and other attractions can lead to serious injuries and legal complications. These incidents damage brand reputation and result in expensive insurance claims and potential facility shutdowns.

Seasonal dependency significantly impacts revenue generation for many water parks. Outdoor facilities in temperate climates face months of closure during winter, creating cash flow challenges. Operators must generate sufficient income during peak months to sustain operations year-round, making financial planning difficult.

Government regulations add complexity to water park operations. Health departments enforce strict water quality standards, requiring regular testing and chemical balancing. Environmental agencies monitor water usage and waste disposal, potentially limiting expansion plans or increasing operational costs.

Maintenance costs for water park equipment are substantial and ongoing. Pumps, filtration systems, and ride mechanisms require constant upkeep to ensure safe operation. Weather exposure accelerates wear and tear, necessitating frequent repairs and replacements that strain budgets.

Growth Factors

Themed Attractions and Technology Integration Present Growth Opportunities

Themed water parks represent a major growth opportunity in the entertainment industry. By incorporating popular movie franchises, cartoon characters, or cultural themes, operators can differentiate their facilities and attract specific target audiences. These immersive experiences command premium pricing and encourage repeat visits from loyal fans.

Advanced technology integration is revolutionizing water park experiences. Virtual reality systems on water slides create unique sensory adventures, while augmented reality apps enhance visitor engagement throughout the facility. These innovations appeal to tech-savvy younger generations and justify higher admission prices.

Urban expansion strategies are opening new markets for water park development. Indoor facilities in city centers can operate year-round and serve densely populated areas. These compact designs maximize space efficiency while providing convenient access for urban families who cannot easily travel to traditional suburban locations.

Strategic partnerships with hospitality businesses create mutually beneficial relationships. Hotels and resorts can offer package deals that include water park access, increasing occupancy rates and guest satisfaction. These collaborations provide steady revenue streams for water parks while enhancing the overall tourism experience for visitors.

Emerging Trends

Smart Water Systems and Wellness Programs Shape Industry Trends

Smart water management systems are becoming standard in modern water parks. These technologies monitor usage patterns, detect leaks instantly, and optimize chemical distribution automatically. Energy-efficient pumps and filtration equipment reduce operational costs while supporting environmental sustainability goals that appeal to conscious consumers.

Water-based fitness and wellness programs are expanding beyond traditional swimming. Aqua aerobics classes, therapeutic pools, and spa services attract health-conscious visitors seeking low-impact exercise options. These programs generate additional revenue while serving growing populations of older adults and fitness enthusiasts.

Staycation trends have boosted demand for water park resorts within driving distance of major cities. Families prefer convenient vacation options that minimize travel time and expenses. Resort-style water parks with overnight accommodations capture this market by offering complete entertainment packages for weekend getaways.

Mixed-use development integration is transforming water park business models. Facilities combined with shopping centers, restaurants, and entertainment venues create destination complexes that extend visitor stays and increase spending per guest. These comprehensive entertainment hubs appeal to diverse age groups and provide multiple revenue streams for operators.

Regional Analysis

North America Dominates the Water Parks Market with a Market Share of 37.4%, Valued at USD 1.7 Billion

North America holds a dominant position in the water parks market with a market share of 37.4%, valued at USD 1.7 Billion. The region’s strong growth is driven by high consumer spending, the popularity of family-oriented recreational activities, and a large number of established water parks. The market is further supported by the development of new water park properties and the integration of resort-style offerings.

Europe Water Parks Market Trends

Europe is the second-largest market for water parks, benefiting from a well-established tourism industry and increasing consumer interest in experiential leisure activities. The region’s market is expected to grow due to the rise in disposable income and increasing investments in water park infrastructure. However, the growth rate may be slightly lower compared to North America due to higher saturation.

Asia Pacific Water Parks Market Opportunities

Asia Pacific is projected to experience rapid growth in the water parks market due to the expanding middle class, growing urbanization, and increasing interest in leisure activities. The region is anticipated to witness a rise in water park investments, particularly in countries like China and India, as more consumers seek entertainment options during the holiday seasons.

Middle East and Africa Water Parks Market Outlook

The Middle East and Africa are emerging markets for water parks, with countries like the UAE leading the way in infrastructure development. The market in this region is driven by high levels of tourism, particularly from affluent visitors seeking premium experiences. Investment in luxury and themed water parks is expected to bolster market growth in the coming years.

Latin America Water Parks Market Trends

Latin America’s water parks market is steadily growing, with increasing demand from the tourism and entertainment sectors. While the market share is smaller compared to other regions, rising disposable incomes and the expansion of urban centers are expected to drive growth. Countries such as Brazil and Mexico show strong potential for future water park development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Water Parks Company Insights

In 2024, several key players are set to drive the global water parks market. Chimelong Group is anticipated to maintain its position as a leader, bolstered by its strong presence in Asia. The company’s innovative attractions and integration with resort amenities have significantly contributed to its market success, particularly in China, where it continues to set new attendance records.

Comcast Corporation, through its ownership of Universal Studios theme parks, has played a pivotal role in the expansion of water park attractions in the US and internationally. Its strategic investments in immersive, high-tech water rides and themed water attractions continue to attract visitors from all over the world, positioning Comcast as a major player in the water parks industry.

Europa-Park stands out as a European leader in both theme and water parks, providing a diversified offering that includes both water-based and traditional amusement park attractions. Its ability to blend entertainment, technology, and water-based attractions has driven sustained visitor growth, enhancing its competitiveness within the European market.

Fantawild Holdings Inc. is making notable strides in the water parks sector, particularly in Asia. The company’s rapid expansion and investment in water-themed parks have positioned it as a formidable competitor, with a focus on combining cultural elements and immersive water experiences to attract local and international tourists.

These companies are expected to continue shaping the market’s evolution with innovative offerings, strategic partnerships, and geographic expansion. Their focus on delivering unique experiences is anticipated to drive future market growth.

Top Key Players in the Market

- Chimelong Group

- Comcast Corporation

- Europa-Park

- Fantawild Holdings Inc.

- SeaWorld Parks & Entertainment

- Therme Erding

- Tropical Islands

- WALT DISNEY WORLD RESORT

- Wet’n’Wild Water Parks

- Wild Wadi Waterpark

Recent Developments

- In August 2025, Lucky Strike Entertainment announced the acquisition of multiple US water parks and Family Entertainment Centers (FECs), expanding its footprint in the recreational sector. The deal is valued at an undisclosed amount but is expected to significantly enhance their market presence.

- In March 2025, Herschend Enterprises revealed plans to acquire Palace Entertainment’s U.S. attractions from Parques Reunidos. This acquisition will include several popular theme parks and water attractions, further solidifying Herschend’s position in the U.S. leisure market.

- In September 2025, SPLASHING OUT UK unveiled a £400 million investment into a new water attraction featuring 20 slides and an indoor beach, set to become one of the largest of its kind. The project promises to offer an exciting update to the UK water park industry.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 9.9 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Attraction Type (Water Slides, Lazy Rivers & Wave Pools, Splash Pads, Cabanas & Relaxation Areas, Others), By Age Group (Up to 18 years, 19-35 years, 36-50 years, 51-65 years, Above 65 years), By Revenue Source (Tickets, Food & Beverage, Merchandise, Hotel & Resorts, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Chimelong Group, Comcast Corporation, Europa-Park, Fantawild Holdings Inc., SeaWorld Parks & Entertainment, Therme Erding, Tropical Islands, WALT DISNEY WORLD RESORT, Wet’n’Wild Water Parks, Wild Wadi Waterpark Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chimelong Group

- Comcast Corporation

- Europa-Park

- Fantawild Holdings Inc.

- SeaWorld Parks & Entertainment

- Therme Erding

- Tropical Islands

- WALT DISNEY WORLD RESORT

- Wet'n'Wild Water Parks

- Wild Wadi Waterpark