Global Water Bus Market Size, Share, Growth Analysis By Vessel Type (Catamaran Vessel, Monohull Vessel, Hydrofoil Vessel), By Propulsion (Fuel Powered, Fully Electric), By Capacity (Less than 50 Passengers, 50–100 Passengers, Above 100 Passengers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171240

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

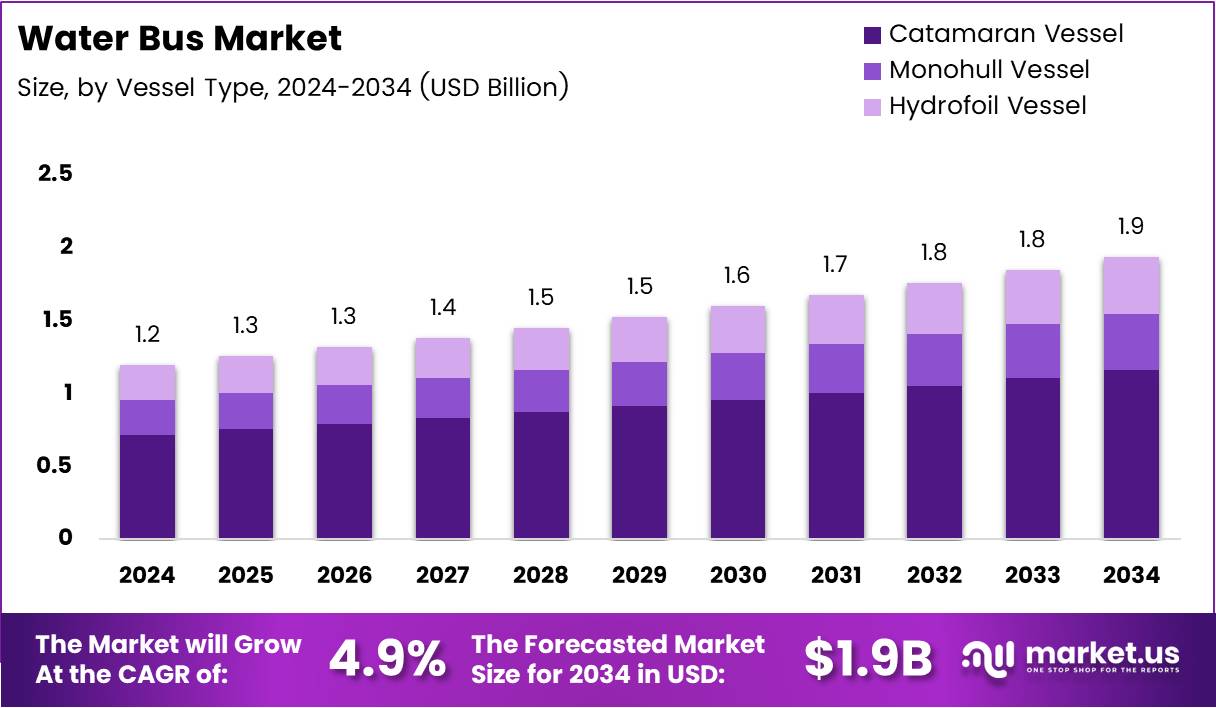

The global Water Bus Market size is expected to reach approximately USD 1.9 Billion by 2034, up from USD 1.2 Billion in 2024, expanding at a CAGR of 4.9% during the forecast period from 2025 to 2034. This growth trajectory reflects increasing urban mobility challenges and the shift toward sustainable transport solutions.

Water buses represent an innovative public transportation mode designed for passenger transport across rivers, harbors, and coastal waterways. These vessels integrate seamlessly into urban transit networks, offering an alternative to congested road-based systems. Modern water buses combine efficiency with environmental responsibility, making them ideal for densely populated cities.

The market benefits significantly from rising urban congestion and the need for multimodal transport integration. Cities worldwide are exploring waterway-based solutions to reduce road traffic and carbon emissions. This shift aligns with global sustainability goals and smart city initiatives gaining momentum across developed and emerging economies.

Government investments play a crucial role in market expansion. Public authorities are allocating substantial budgets toward marine infrastructure development, including terminals, docking facilities, and fleet modernization programs. These initiatives aim to enhance urban connectivity while meeting zero-emission transport targets set by various national and regional policies.

Tourism demand further accelerates market growth as water buses offer scenic routes and unique travel experiences. Coastal and riverine cities leverage these services to attract visitors while simultaneously serving local commuters. The dual-purpose functionality enhances operational viability and revenue generation potential for service operators.

Technological advancements in vessel design and propulsion systems are reshaping the industry landscape. Electric and hybrid water buses are gaining traction under stringent emission regulations. Lightweight composite materials improve fuel efficiency, while digital ticketing and fleet management systems optimize operational performance and passenger experience.

According to NYC.gov, the Staten Island Ferry operates approximately 117 trips daily, transporting around 45,000 passengers on typical weekdays. The service achieved an impressive on-time performance rate of about 94% in 2023, demonstrating the reliability of water-based urban transport. Meanwhile, Dubai’s marine transport network, including water buses, recorded 17.43 million passengers in 2023, marking a significant 9% increase from 2022, according to the UAE Media Office.

Key Takeaways

- Global Water Bus Market projected to grow from USD 1.2 Billion in 2024 to USD 1.9 Billion by 2034 at a CAGR of 4.9%

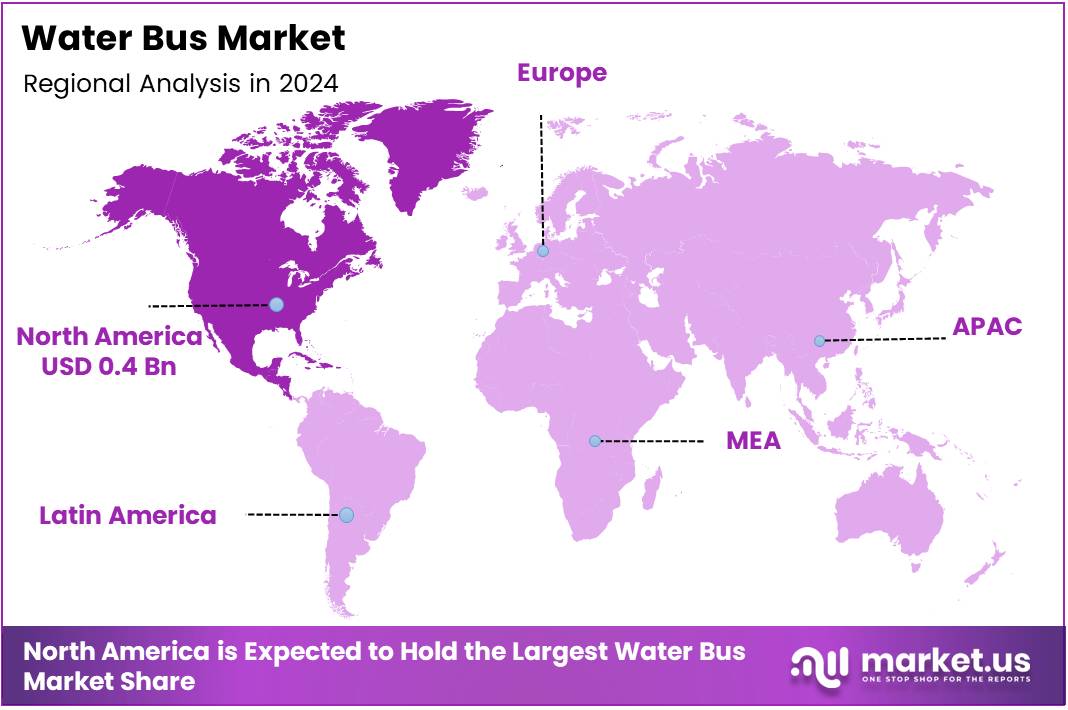

- North America dominates with 38.7% market share, valued at USD 0.4 Billion

- Catamaran vessels lead the vessel type segment with 48.3% market share

- Fuel-powered propulsion holds 69.9% of the market

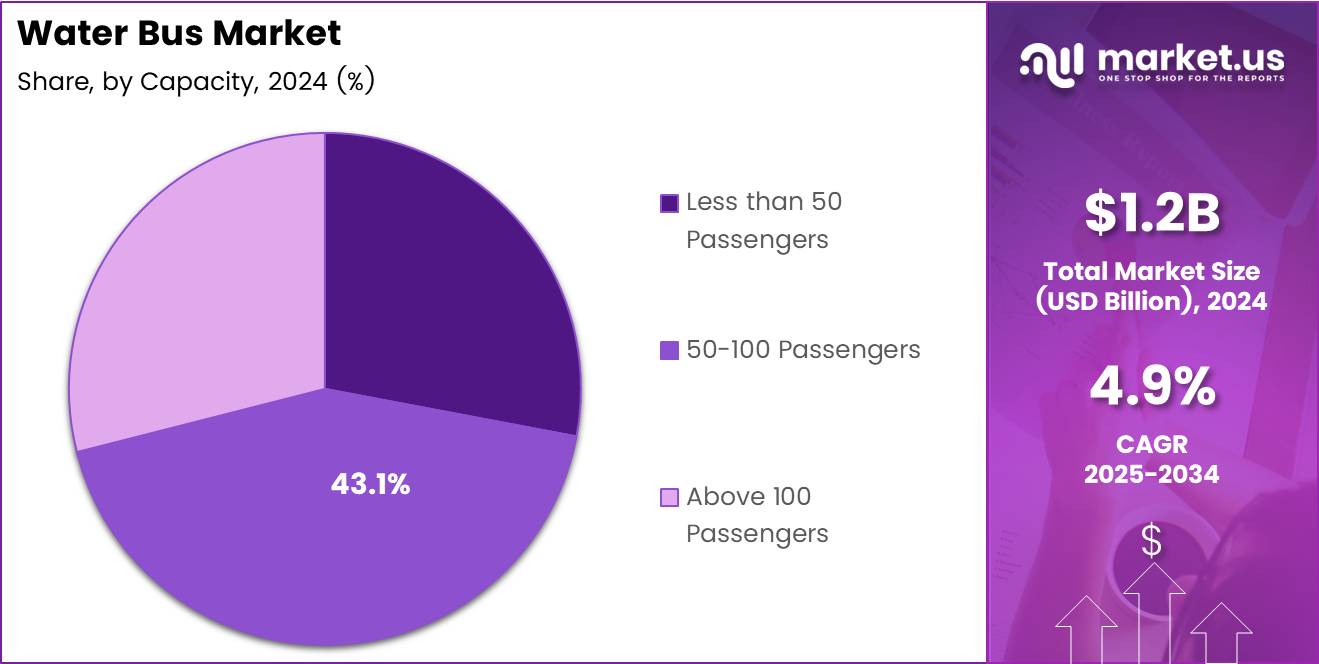

- 50-100 passenger capacity segment accounts for 43.1% market share

By Vessel Type

Catamaran vessels dominate with 48.3% market share due to superior stability and passenger capacity advantages.

In 2024, Catamaran Vessel held a dominant market position in the By Vessel Type segment of the Water Bus Market, with a 48.3% share. Catamaran designs offer exceptional stability in varying water conditions, making them ideal for urban waterway operations. Their twin-hull configuration provides enhanced passenger comfort and reduces motion sickness, crucial factors for daily commuters. Additionally, catamarans accommodate larger passenger capacities while maintaining fuel efficiency, making them economically viable for high-frequency routes.

Monohull vessels represent the traditional water bus design, favored for their simplicity and lower manufacturing costs. These single-hull vessels perform well in calm waters and narrow channels where maneuverability matters. Their streamlined design reduces drag, potentially improving fuel efficiency on specific routes. However, they typically offer less deck space and stability compared to catamaran alternatives, limiting their application in rough water conditions.

Hydrofoil vessels utilize underwater wings to lift the hull above water at cruising speeds, significantly reducing drag and fuel consumption. This technology enables faster transit times and smoother rides in choppy conditions. Despite these advantages, hydrofoils require specialized maintenance and infrastructure, limiting widespread adoption. Their deployment remains concentrated in routes where speed premium justifies higher operational costs and technical complexity.

By Propulsion

Fuel-powered propulsion dominates with 69.9% market share, reflecting established infrastructure and operational reliability.

In 2024, Fuel Powered held a dominant market position in the By Propulsion segment of the Water Bus Market, with a 69.9% share. Diesel and other conventional fuels remain the primary choice due to proven reliability and extensive refueling infrastructure. Operators prefer fuel-powered systems for their long-range capabilities and minimal downtime between services. The established supply chain and technical expertise further support the dominance of this segment across global markets.

Fully electric propulsion is rapidly emerging as the sustainable alternative, driven by stringent emission regulations and environmental commitments. Battery-electric water buses eliminate direct emissions and reduce noise pollution, enhancing urban waterway appeal. Government incentives and declining battery costs are accelerating adoption rates. However, charging infrastructure development and limited range continue to challenge widespread implementation, particularly on longer routes requiring extended operational hours.

By Capacity

50-100 passenger capacity dominates with 43.1% market share, balancing operational efficiency and route demand.

In 2024, 50-100 Passengers held a dominant market position in the By Capacity segment of the Water Bus Market, with a 43.1% share. This capacity range offers optimal flexibility for urban transit networks, accommodating peak-hour demand without excessive operational costs. Vessels in this category strike an ideal balance between passenger volume and fuel efficiency. They remain maneuverable enough for dock operations while providing sufficient revenue potential per trip for service operators.

Less than 50 passenger vessels serve niche markets and low-demand routes, offering personalized service and accessibility to smaller waterways. These compact water buses operate efficiently in areas with limited docking infrastructure or seasonal tourist routes. Their lower acquisition and maintenance costs make them attractive for pilot programs and emerging markets testing water-based transit feasibility.

Above 100 passenger capacity vessels cater to high-volume routes connecting major urban centers and tourist destinations. These larger vessels deliver economies of scale, reducing per-passenger operational costs on established routes. However, they require substantial infrastructure investments, including reinforced docking facilities and wider channels. Their deployment concentrates in mature markets with consistent high-demand patterns and supportive waterway infrastructure.

Key Market Segments

By Vessel Type

- Catamaran Vessel

- Monohull Vessel

- Hydrofoil Vessel

By Propulsion

- Fuel Powered

- Fully Electric

By Capacity

- Less than 50 Passengers

- 50-100 Passengers

- Above 100 Passengers

Drivers

Urban Congestion Mitigation Through Waterway Integration Drives Market Growth

Metropolitan areas worldwide face severe traffic congestion, prompting authorities to explore alternative transportation modes. Water buses utilize underutilized inland and coastal waterways, effectively bypassing gridlocked road networks. This integration reduces commute times and improves overall urban mobility efficiency. Cities with extensive waterway systems benefit most from implementing water bus services as complementary transit options.

Government-led investments in sustainable marine infrastructure accelerate market expansion significantly. Public funding supports terminal construction, fleet acquisition, and operational subsidies during initial implementation phases. These investments align with broader climate action commitments and urban development strategies. Policy frameworks increasingly prioritize low-carbon transport solutions, creating favorable conditions for water bus deployment.

Rising tourism demand for scenic water-based mobility presents substantial growth opportunities. Tourists seek unique travel experiences combining transportation with sightseeing value. Water buses operating on picturesque routes attract both domestic and international visitors. This dual functionality enhances revenue potential while distributing tourist traffic away from congested road-based attractions.

Lower lifecycle emissions compared to diesel buses and private ferries strengthen the environmental case for water buses. Modern vessels incorporate fuel-efficient engines and increasingly electric propulsion systems. These technologies reduce greenhouse gas emissions and local air pollution in waterfront communities. Regulatory pressure on emission reduction continues driving preference toward cleaner marine transport solutions.

Restraints

High Capital Requirements Limit Market Entry and Expansion Pace

High upfront capital expenditure for vessels, terminals, and docking infrastructure presents significant barriers to market entry. Water bus systems require substantial initial investments before generating operational revenue. Procurement costs for modern vessels, particularly electric or hybrid models, remain considerably higher than conventional alternatives. Terminal facilities demand specialized construction to accommodate vessel docking, passenger boarding, and safety requirements.

Operational limitations due to weather variability and seasonal water conditions constrain service reliability and profitability. Adverse weather forces service suspensions, disrupting passenger schedules and reducing revenue consistency. Seasonal variations in water levels affect navigability on rivers and channels, limiting year-round operations. These unpredictability factors complicate financial planning and reduce investor confidence in water bus ventures.

Maintenance requirements for marine vessels exceed those of land-based transport alternatives, increasing operational costs. Saltwater exposure accelerates corrosion, demanding frequent inspections and preventive maintenance. Specialized marine mechanics and dry-dock facilities add to the complexity and expense. These factors particularly challenge operators in developing markets with limited marine service infrastructure and technical expertise.

Growth Factors

Electric Propulsion Adoption Under Zero-Emission Policies Accelerates Market Expansion

Deployment of electric and hybrid water buses under zero-emission transport policies represents the primary growth catalyst. Governments worldwide mandate emission reductions from public transportation, creating regulatory pull for clean propulsion technologies. Battery technology improvements enhance operational range and reduce charging downtime. Subsidies and incentives offset higher acquisition costs, making electric vessels increasingly financially viable for operators.

Expansion of water bus networks in rapidly urbanizing coastal and riverine cities opens new market opportunities. Emerging economies with extensive waterways recognize water-based transit potential for managing urban growth. These cities can implement water bus systems at lower cost than subway or light rail alternatives. Population concentration along waterfronts makes water buses particularly effective in serving dense residential and commercial districts.

Public-private partnerships for smart port and multimodal transit integration enhance system efficiency and financial sustainability. Private sector participation brings operational expertise and capital while sharing commercial risk. Integrated ticketing systems connecting water buses with metro, bus, and rail networks improve passenger convenience. Smart technologies optimize routing, scheduling, and fleet management, reducing operational costs and improving service quality.

Adoption of water buses for last-mile connectivity in metro and ferry systems extends their market application. Water buses efficiently bridge gaps between major transit hubs and final destinations unreachable by other modes. This integration enhances overall public transport network utility and ridership. Last-mile connectivity solutions address critical urban mobility challenges, positioning water buses as essential components of comprehensive transit systems.

Emerging Trends

Battery-Electric Vessels Lead Industry Transformation Toward Sustainable Operations

Increasing adoption of battery-electric and solar-assisted water bus vessels reshapes propulsion technology standards across the industry. Manufacturers prioritize zero-emission designs meeting stringent environmental regulations in major markets. Solar panels integrated into vessel superstructures supplement battery power, extending operational range. These innovations reduce dependence on conventional fuels while demonstrating technological leadership in sustainable marine transport.

Integration of digital ticketing and real-time fleet management systems enhances operational efficiency and passenger experience. Mobile applications enable contactless payment, route planning, and live vessel tracking. Operators utilize data analytics to optimize scheduling based on demand patterns and reduce empty runs. These digital solutions lower transaction costs while providing valuable insights for service improvement and strategic planning.

Growing use of lightweight composite materials for fuel-efficient hull design advances vessel performance capabilities. Carbon fiber and advanced polymers reduce vessel weight without compromising structural integrity. Lighter hulls decrease fuel consumption and enable higher speeds with equivalent power. Material innovations also improve corrosion resistance, extending vessel lifespan and reducing maintenance frequency and costs.

Rising focus on accessibility-compliant vessel designs addresses urban commuter needs and regulatory requirements. Modern water buses incorporate wheelchair ramps, dedicated accessible seating, and visual-audio passenger information systems. Universal design principles ensure water-based transit serves all population segments effectively. Accessibility improvements expand potential ridership while fulfilling social equity objectives within public transportation mandates.

Regional Analysis

North America Dominates the Water Bus Market with 38.7% Market Share, Valued at USD 0.4 Billion

North America leads the global Water Bus Market with a commanding 38.7% market share, valued at approximately USD 0.4 Billion. The region benefits from established ferry networks in major cities and significant government investment in sustainable urban transport. Strong regulatory frameworks supporting emission reduction drive electric vessel adoption. Mature infrastructure and technical expertise facilitate rapid deployment of advanced water bus technologies.

Europe Water Bus Market Trends

Europe demonstrates strong market potential driven by extensive inland waterways and environmental leadership. Cities like Amsterdam, Venice, and London operate established water bus networks serving commuters and tourists. Stringent EU emission standards accelerate electric propulsion adoption across the region. Public-private partnerships support infrastructure modernization and service expansion in emerging markets.

Asia Pacific Water Bus Market Trends

Asia Pacific exhibits the fastest growth potential owing to rapid urbanization and coastal city development. Countries like China, Japan, and India invest heavily in waterway transport to alleviate road congestion. Tourist destinations throughout Southeast Asia increasingly deploy water buses for sustainable tourism management. Government initiatives promoting multimodal transport integration create favorable conditions for market expansion.

Middle East and Africa Water Bus Market Trends

The Middle East and Africa region shows promising development concentrated in Gulf cities and major African ports. Dubai’s extensive marine transport network exemplifies successful water bus integration in modern urban planning. Limited road infrastructure in some coastal African cities makes water-based transit economically attractive. Government investments in tourism infrastructure support water bus deployment in resort destinations.

Latin America Water Bus Market Trends

Latin America presents emerging opportunities in coastal and riverine cities with underutilized waterway potential. Cities like Rio de Janeiro and Buenos Aires explore water buses for congestion relief and tourism enhancement. Regional governments prioritize sustainable transport solutions under climate commitments. Cross-border river services between neighboring countries create unique market development possibilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Water Bus Company Insights

The global Water Bus Market in 2024 features several established maritime manufacturers and emerging technology providers driving innovation and market growth.

Damen Shipyards Group maintains a leading position through its comprehensive portfolio of passenger vessels and proven track record in delivering customized water bus solutions for diverse operational environments. Icarus Marine specializes in high-performance catamaran designs, offering fuel-efficient vessels optimized for urban waterway operations and tourist services.

Mavi Deniz Cevre Hiz A.S. focuses on environmental marine services and sustainable vessel operations, particularly in the Mediterranean and Middle Eastern markets where regulatory standards increasingly favor eco-friendly solutions. Incat Crowther delivers innovative naval architecture and vessel design services, supporting operators worldwide with efficient hull configurations that reduce operational costs and environmental impact.

Austal contributes advanced aluminum shipbuilding expertise, producing lightweight high-speed vessels suitable for urban transit and tourism applications across multiple continents. Ares Shipyard Inc. offers competitive manufacturing capabilities with focus on emerging markets seeking cost-effective water bus solutions. Artemis Technologies pushes technological boundaries through electric and hydrofoil vessel development, positioning itself at the forefront of zero-emission marine transport innovation.

Willard Marine Inc. provides specialized vessel manufacturing for various maritime applications including passenger transport in challenging operational conditions. Hyke operates smart city ferry services leveraging electric propulsion and digital integration, demonstrating practical implementation of next-generation water bus concepts. Swimbus develops compact electric water bus solutions targeting smaller waterways and niche urban mobility applications where conventional vessels face operational constraints.

Key Companies in Water Bus Market

- Damen Shipyards Group

- Icarus Marine

- Mavi Deniz Cevre Hiz A.S.

- Incat Crowther

- Austal

- Ares Shipyard Inc.

- Artemis Technologies

- Willard Marine Inc.

- Hyke (Hydrolift Smart City Ferries AS)

- Swimbus

Recent Developments

- In January 2024, Yamaha Motor Co., Ltd. completed the acquisition of Torqeedo GmbH from DEUTZ AG, strategically positioning itself to strengthen electric marine propulsion capabilities and accelerate its marine electrification strategy across global markets.

- In May 2025, Incat Tasmania successfully launched China Zorrilla, recognized as the world’s largest battery-electric ferry, specifically designed for zero-emission passenger transport operations between Argentina and Uruguay, demonstrating significant advancement in large-scale electric vessel technology.

- In July 2025, Uber Boats by Thames Clippers secured substantial funding totaling £59 million from NatWest and Santander to support fleet expansion initiatives and comprehensive upgrades to river transport infrastructure throughout London’s Thames waterway network.

- In December 2025, Uber Boat by Thames Clippers introduced Orbit Clipper, marking the launch of the UK’s first fully electric passenger ferry into commercial operation on the River Thames, representing a milestone in sustainable urban water transport development.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 1.9 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vessel Type (Catamaran Vessel, Monohull Vessel, Hydrofoil Vessel), By Propulsion (Fuel Powered, Fully Electric), By Capacity (Less than 50 Passengers, 50–100 Passengers, Above 100 Passengers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Damen Shipyards Group, Icarus Marine, Mavi Deniz Cevre Hiz A.S., Incat Crowther, Austal, Ares Shipyard Inc., Artemis Technologies, Willard Marine Inc., Hyke (Hydrolift Smart City Ferries AS), Swimbus Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Damen Shipyards Group

- Icarus Marine

- Mavi Deniz Cevre Hiz A.S.

- Incat Crowther

- Austal

- Ares Shipyard Inc.

- Artemis Technologies

- Willard Marine Inc.

- Hyke (Hydrolift Smart City Ferries AS)

- Swimbus