Global Warehouse Robotics Market By Type (Mobile Robots, Articulated Robots, and Other Types), By Function (Pick & Place, Palletizing & Depalletizing, and Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023–2032

- Published date: Sep 2023

- Report ID: 18988

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

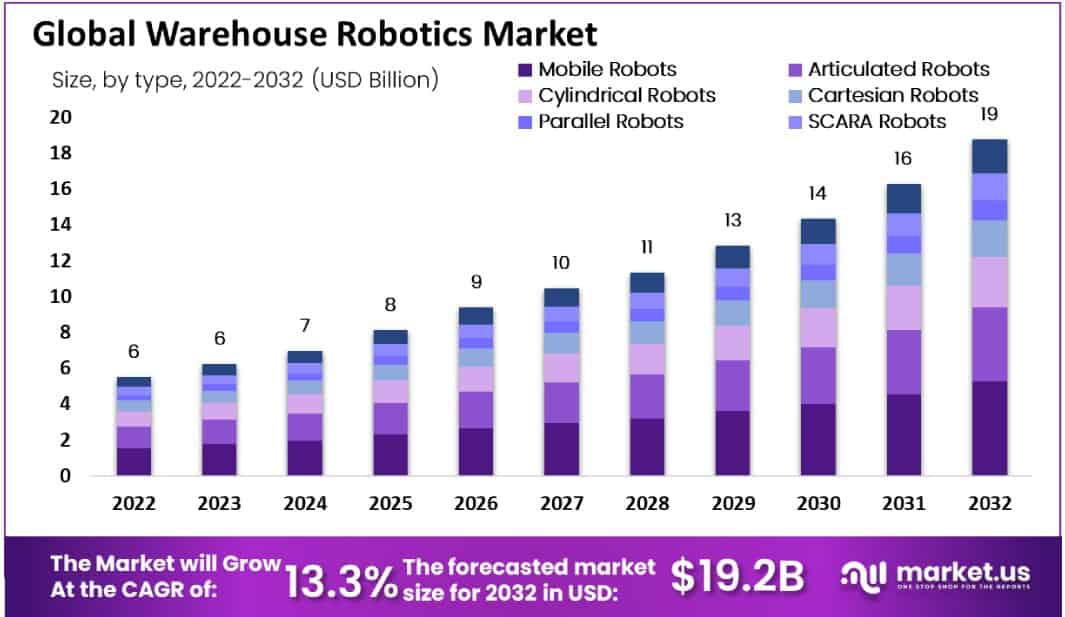

The Global Warehouse Robotics Market size is expected to be worth around USD 19.20 Billion by 2032 from USD 5.5 Billion in 2022, growing at a CAGR of 13.30% during the forecast period from 2023 to 2032.

It is anticipated that there will be a significant demand in the warehousing sector for the implementation of robotic systems to decrease the amount of time and money required for warehouse operations and increase their throughput. It is anticipated that there will be significant growth opportunities for the market as a result of the rising demand for automation as well as increased awareness regarding production quality and safety.

Warehouse robotics can be regarded as one of the most efficient methods to reduce costs and increase the availability of labor. It also helps to improve operational skills. Robots can lift heavy loads, as well as perform picking, transport, packaging, palletizing, and other tasks within the facility.

The market will continue to grow due to the increasing use of artificial intelligence, machine learning, the Internet of Things (IoT), and other technologies that have emerged in the warehousing sector.

Key Takeaways

Rapid Growth: Robotics for warehouses is experiencing exponential growth due to rising demands for efficient logistics and online shopping operations. Speedy order fulfillment as well as improving warehouse management operations are among the main drivers behind this surge.

Automation of Material Handling: Warehouse robots have become an invaluable tool in automating material handling tasks, from materials moving and handling, to ordering pick and inventory management. By decreasing labor costs while simultaneously speeding and improving processes, robots help ensure efficiency for warehouse operations.

Technological Advances: Technological advancements such as robotics, artificial intelligence, and sensor technology are driving improvements in warehouse robots. This includes autonomous mobile robots (AMRs) as well as robotic arms with smart warehouse management systems aimed at increasing efficiency within warehouses.

Retail and E-Commerce: Adoption The rapid expansion of e-commerce coupled with the need for faster, more accurate order fulfillment is driving widespread adoption of warehouse robotics among retailers and e-commerce sites alike. Robots provide them with a cost-effective means of handling online purchases effectively.

Flexibility and Scalability: Modern warehouse robots have been engineered to be flexible, adaptable, and scalable so as to adapt easily to changing layouts of warehouses or load requirements – this adaptability and flexibility are vital in today’s business environment.

Driving Factors

Rising Product Usage in Warehouses for Operational Efficiency to Fulfill the Supply Chain Gap

Investments in the Warehouse Robotics ecosystem have significantly increased over the past few years. New, cost-effective, adaptable, and effective robots for process automation are being installed throughout warehouses as a result of this rising investment. Various warehouse processes like storage and retrieval, palletizing and depalletizing, transportation, and packaging are being automated by these robots.

Numerous advancements have been made in recent years to shorten truck operating times in the logistics corridor and warehouse chain. In the logistics industry, robots are paving the way for in-house operation. In order to improve their manufacturing processes, improve quality, and increase efficiency, a number of industries, including pharmaceuticals, automotive, and others, are primarily implementing robotics for a variety of purposes.

It is thought that articulating robots is a crucial step toward Industry 4.0 because they can carry out intricate tasks in a shorter amount of time and with greater precision. The management of warehouses is becoming easier thanks to mobile robots and warehouse shuttles.

As a result, the demand for these robots is being influenced by a growing preference for end-to-end automation in the warehouse to improve logistical and operational efficiency and alleviate supply chain concerns.

Restraining Factors

High Investment and Data Security Concerns among Stakeholders

In developing nations, the Warehouse Robotics Market is still in its infancy, despite its expansion. The growth will be stifled by issues with the manufacturers’ supply chains and the lack of robotic components because they are expensive. For most of the industry, data privacy is the second most important concern, and stakeholders’ concerns about data security prevent them from working with cobots (human collaboration robots) that are ready for the future.

In developing nations, there is a lack of logistics infrastructure and warehouse chains, as well as a late return on investment (ROI) from the business sector. Additionally, the Warehouse Robotics Market growth is being hampered by additional costs like software upgrades and training that require additional capital. With high investment costs and a slow return on investment, expanding robotics research and development may result in increased growth constraints.

Growth Opportunities

Rise in Adoption of Warehouse Robotics Equipment in the Food & Beverage Industry

Warehouse robotics allows you to store and transport foods efficiently using the right warehouse material handling techniques. Manufacturers are focused on choosing the best equipment to keep food at the correct temperature to ensure cold storage standards. Cold storage facilities use a variety of robots to perform various tasks such as sortation, palletizing, loading, unloading, and sortation.

Customer prospects are rising as a result of the market’s abundance of sellers, and they anticipate receiving goods quickly, creating a lucrative opportunity with more flexibility to set arrival times and avoid delivery fees. In addition, manufacturing and production have become more individualized, which is beneficial to end users but somewhat challenging for the warehouse industry.

Latest Trends

Rising Inclination Toward Minimizing Operation Time and Enhancing Customer Satisfaction to Create New Dimensions for the Market

During the COVID-19 pandemic, the majority of people saw the adoption of a work-from-home culture as an opportunity to save money. This helped the e-commerce industry, which needs better logistical solutions to solve problems with inventory and delivery. The demand for logistic robots is increasing as tech robotics giants like Siemens and ABB develop six-axis and operation-specific robots that solve complex manufacturing and logistics tasks.

The most recent advancement in 3D printing technology has made it easier for start-ups and new techies to create their own robots, lowering the cost of manufacturing for small businesses. To manage internal inventory and its transfer, AI-ML collaborates with logistic robots. For warehouse logistic operations, the majority of stakeholders prefer robots with simple interfaces that are simple to operate and require little upkeep.

Type Analysis

Mobile robots, articulated robots, cylindrical robots, SCARA robots, parallel robots, and cartesian robots are the Product segment. Because they are used to move small payloads across warehouses, robotic systems are essential for the retail and electronic goods industries. They play a significant role in the global warehousing industry. They use sensors and other technologies to detect their surroundings and maneuver.

Mobile robots play an important role in global warehousing because they can be used to transport small payloads around the facility. This segment of machines will grow rapidly due to the potential of Cartesian robotics to perform warehouse operations such as material handling, picking up and placing, loading, and unloading. Because of their thoroughness in performing difficult tasks within the facility, articulated robots accounted for a large share of the Warehouse Robotics Market in 2022.

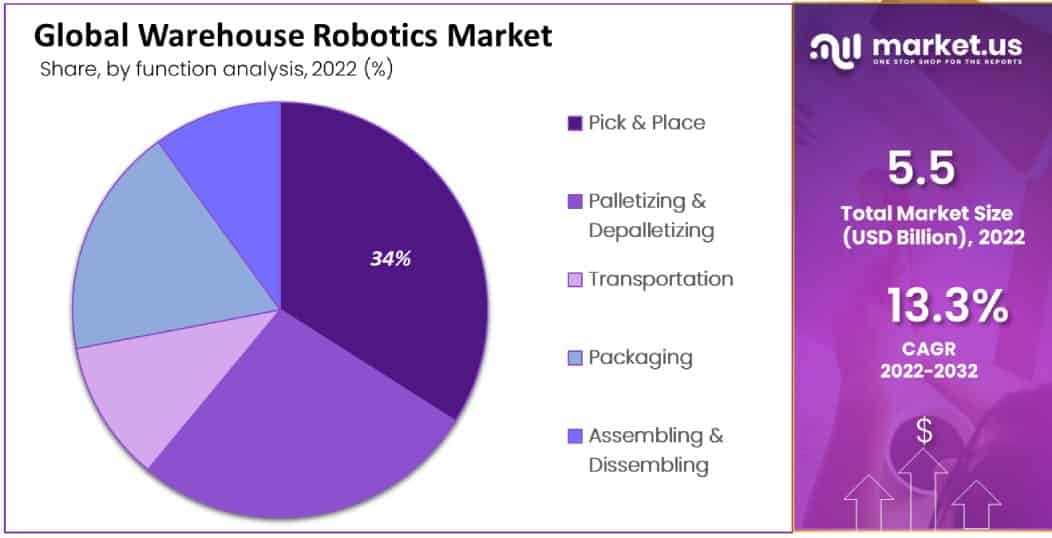

Function Analysis

On the basis of function, the global warehouse robotics market is divided into pick & place, palletizing & depalletizing, transportation, packaging, and assembling & dissembling. The pick & place segment dominated the market in 2022, with a 34% market share.

The packaging segment was the second largest segment, with a 23% market share in 2022, due to robotic systems getting deployed by several enterprises to improve packaging performance by using future-proof and sustainable solutions.

The growth of the market in the transportation industry is driven by the need to reduce transportation expenses and increase the goods unloading & loading proficiency. Due to this, this segment is predicted to have the highest CAGR during the forecast period.

End-User Analysis

E-commerce, healthcare, food & beverage, automotive, textile, metal & machinery, rubber & plastics, and other industries make up the market based on end-use. The Warehouse Robotics Market is expected to be dominated by the e-commerce sector. As online shopping grows in popularity and internet penetration rises, this industry is flourishing, particularly in developing nations.

The utilization of logistics robots, timely delivery, and the enhancement of packaging quality have all been emphasized by businesses in this sector. For instance, Amazon unveiled a new delivery drone in June 2019 that can deliver packages in less than 30 minutes and will begin shipping packages to customers within a range of approximately 15 miles.

Due to rising disposable income, increasing customer demand for real-time delivery, and escalating FMCG product consumption, the automotive, healthcare, and food & beverage industries are expected to expand significantly over the forecast period.

Global Warehouse Robotics Key Market Segments:

Based on Type

- Mobile Robots

- Articulated Robots

- Cylindrical Robots

- Cartesian Robots

- Parallel Robots

- SCARA Robots

- Other Types

Based on Function

- Pick & Place

- Palletizing & Depalletizing

- Transportation

- Packaging

- Assembling & Dissembling

Based on End-User

- E-commerce

- Automotive

- Textile

- Food & Beverage

- Healthcare

- Metal & Machinery

- Rubber & Plastics

- Other End-Use Industries

COVID-19 Impact Analysis

Market Growth Hampered Due to Supply Chain & Manufacturing Disruptions During the Pandemic

The global market was severely affected by the COVID-19 pandemic. The pandemic-related lockdown measures harmed the market’s overall growth potential due to supply restrictions and a decline in end-user adoption. There was tension among the dominant nations as a result of the global slowdown in the manufacturing sector in 2019, and the market is anticipated to decline as a result of the disruption of the economy and supply chain.

The major players’ net revenues and profit margins decreased due to the COVID-19 pandemic’s spread to major economies worldwide. Due to associated international travel restrictions and other protective measures, the COVID-19 pandemic exacerbated these issues.

However, efforts toward economic revival led to increased demand for logistics robots in the automotive, healthcare, and e-commerce industries. In addition, manufacturers are expected to attempt to restructure their operational business models following the COVID-19 pandemic and develop a more disruption-resistant model to cope with future emergencies. On the other hand, the market is driven by investments in modernizing industrial spaces and brand-new car production facilities.

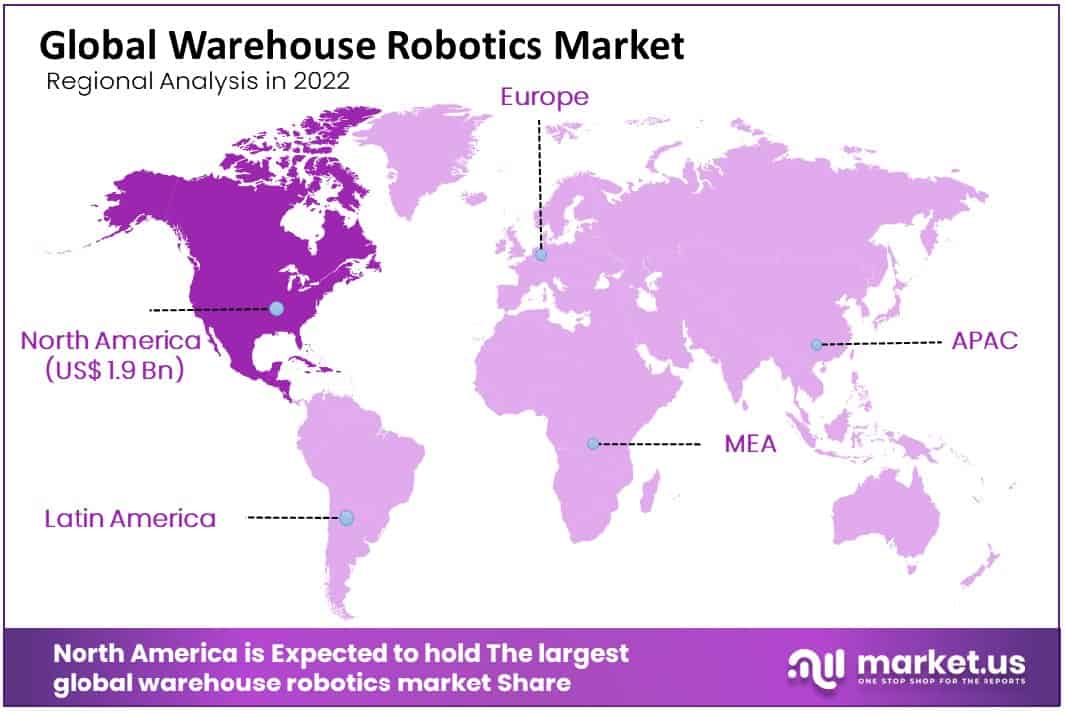

Regional Analysis

Due to the rapid construction of warehouses and distribution centers, North America held the highest market share for logistics robots in 2022, with 34.2%. The product is also seeing an increase in sales as a result of investments in automated warehouses and smart factories. E-commerce, retail, and healthcare expansion will all contribute significantly to the region’s revenue expansion.

The growth of the Warehouse Robotics Market in the region is being driven by rising demand for these robots in logistics operations to cut costs and time. Businesses are turning to logistics robots as a response to the rise in warehouse and storage unit accidents. The logistics robots market will continue to expand in the region as strict safety regulations to avoid hazardous environments containing gases and substances are implemented.

Due to the presence of manufacturing companies, growth in Asia-Pacific is anticipated to be stronger in the upcoming years. One of the region’s largest buyers of logistics robots is China. This nation has a significantly higher robot density than other nations.

This includes several industries, such as logistics, chemicals, and electronics. Market players such as ABB and Kion Group AG, Fanuc Corporation, and others are now focusing on mergers and acquisitions to increase penetration in China’s logistics robotics market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Due to advancements in software and automation that enable robots to identify repetitive, time-consuming tasks, reduce errors, and speed up warehouse processes, robotics are increasingly being used in warehouses.

Manufacturers may find it tempting to automate their warehouses as robots become more intelligent and can adapt their work to their surroundings. Concerns about the loss of labor jobs are being raised by the overall market’s rapid expansion.

Numerous e-commerce businesses are automating their facilities in collaboration with robotic system providers to keep up with changing customer preferences for speed. Manufacturers frequently employ collaborative robots in their facilities to assist operators with crucial tasks.

In order to improve the speed and efficiency of the assembly line, a number of businesses are combining the use of human labor with the use of robotic arms to complete tasks involving heavy lifting.

Market Key Players:

Listed below are some of the most prominent Warehouse Robotics industry players.

- ABB Ltd.

- Fanuc Corporation

- Kuka AG.

- Prime Robotics

- Daifuku Co. Ltd.

- Fetch Robotics Inc.

- Yaskawa Electric Corp.

- Toshiba Corporation

- Yamaha Robotics

- Siemens AG

- Mitsubishi Electric Corp.

- Other Key Players

Recent Developments:

- In May 2022, The “ABB Robotic De-palletizer” was introduced by ABB Ltd. as a solution for handling intricate depalletizing tasks in the healthcare, e-commerce, logistics, and consumer packaged goods sectors. This new solution uses machine vision to quickly assess a wide range of box types, allowing customers to process a wide range of loads effectively with minimal engineering effort and a short set-up time.

- In January 2022, The M-1000iA robot from Fanuc America can handle very heavy items like construction materials, automotive parts, and battery packs for electric cars. As of January 2022, Fanuc’s largest serial-link robot is the M-1000iA.

Report Scope:

Report Features Description Market Value (2022) US$ 5.5 Bn Forecast Revenue (2032) US$ 19.2 Bn CAGR (2023-2032) 13.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Mobile Robots, Articulated Robots, Cylindrical Robots, Cartesian Robots, Parallel Robots, SCARA Robots, and Other Types; By Function- Pick & Place, Palletizing & Depalletizing, Transportation, Packaging, and Assembling & Dissembling; and By End-Use Industry- E-commerce, Automotive, Textile, Food & Beverage, Healthcare, Metal & Machinery, Rubber & Plastics, Other End-Use Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd., Fanuc Corporation, Kuka AG., Prime Robotics, Daifuku Co. Ltd., Fetch Robotics Inc., Yaskawa Electric Corp., Toshiba Corporation, Yamaha Robotics, Siemens AG, Mitsubishi Electric Corp., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Warehouse Robotics Market size in 2022?The Warehouse Robotics Market size is USD 5.5 billion for 2022.

What is the CAGR for the Warehouse Robotics Market?The Warehouse Robotics Market expected to grow at a CAGR of 13.3% during 2023-2032.

What are the segments covered in the Warehouse Robotics Market report?Market.US has segmented the Global Warehouse Robotics Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). Based on Type, market is segmented into Mobile Robots, Articulated Robots, Cylindrical Robots, Cartesian, Robots, Parallel Robots, SCARA Robots, Other Types. Based on Function, market is segmented Pick & Place, Palletizing & Depalletizing, Transportation, Packaging, Assembling & Dissembling. Based on End-User, market is segmented into E-commerce Automotive, Textile, Food & Beverage, Healthcare, Metal & Machinery, Rubber & Plastics, Other End-Use Industries.

Who are the key players in the Warehouse Robotics Market?ABB Ltd., Fanuc Corporation, Kuka AG., Prime Robotics, Daifuku Co. Ltd., Fetch Robotics Inc., Yaskawa Electric Corp., Toshiba Corporation, Yamaha RoboticsOther and Other key players are the key vendors in the Warehouse Robotics Market.

-

-

- ABB Ltd.

- Fanuc Corporation

- Kuka AG.

- Prime Robotics

- Daifuku Co. Ltd.

- Fetch Robotics Inc.

- Yaskawa Electric Corp.

- Toshiba Corporation

- Yamaha Robotics

- Siemens AG

- Mitsubishi Electric Corp.

- Other Key Players