Global Warehouse Automation Market By Component (Hardware, Software, Services), By End-Use Industry (Retail & E-commerce, Food and Beverage, Healthcare & Pharmaceuticals, Automotive, Transportation & Logistics, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 118236

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

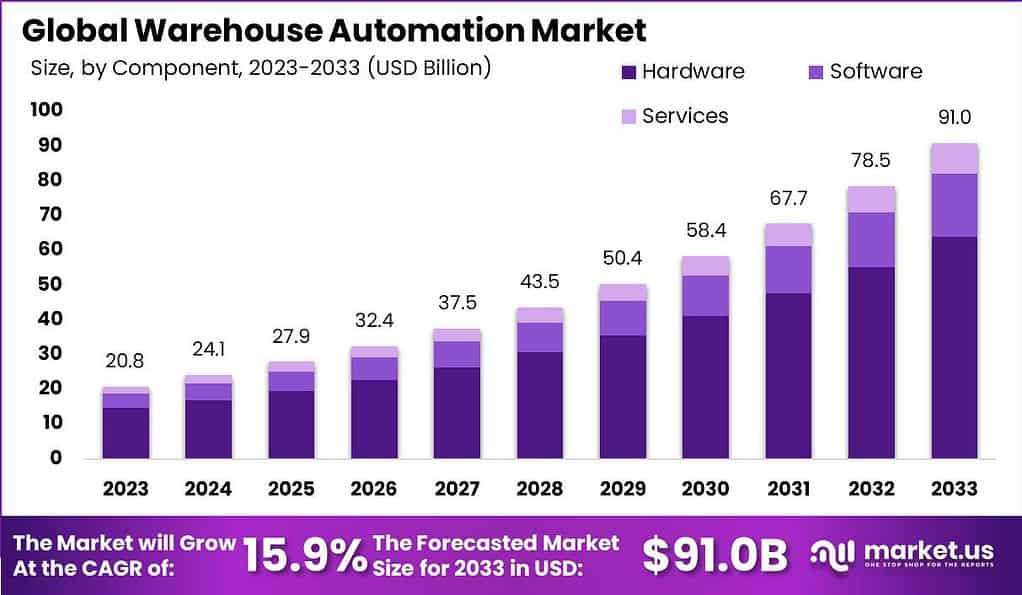

The Global Warehouse Automation Market size is expected to be worth around USD 91.0 Billion by 2033, from USD 20.8 Billion in 2023, growing at a CAGR of 15.9% during the forecast period from 2024 to 2033.

Warehouse automation refers to the use of advanced technologies and systems to streamline and optimize various processes within a warehouse. It involves the implementation of robotic systems, artificial intelligence, machine learning, and other cutting-edge technologies to improve efficiency, accuracy, and productivity in handling inventory, order fulfillment, and logistics operations.

The warehouse automation market has experienced significant growth in recent years as businesses across industries recognize the benefits of automating their supply chain operations. The demand for warehouse automation solutions has been driven by factors such as the need for faster order fulfillment, rising labor costs, increasing customer expectations for quick and accurate deliveries, and the drive to improve overall operational efficiency.

The benefits of warehouse automation are numerous. It enables faster and more accurate order processing, reduces errors and labor costs, optimizes space utilization, enhances inventory management, and improves overall supply chain visibility and control. Additionally, it allows businesses to scale their operations efficiently, adapt to changing market demands, and provide better customer service.

According to G2, The warehousing sector is experiencing significant transformations as evidenced by current trends and future projections. 87% of industry decision-makers are actively engaged in or planning to expand their warehousing capacity by 2024, reflecting a strategic shift towards scaling operations. This expansion correlates with the current landscape where 18,736+ private warehousing establishments exist, and the average warehouse size stands at 181,370 sq ft, a figure that continues to grow annually.

Outsourcing remains a prevalent strategy within the industry, with 80% of warehouse activities managed externally, allowing companies to focus on core operations while expanding geographically. However, 20% of activities are retained in-house, underscoring the importance of direct control over certain operations. This strategic distribution of activities supports the trend where 79% of high-performing supply chain companies outperform their industry peers in revenue growth.

Automation is increasingly viewed as a pivotal factor in warehousing efficiency, with 70% of supply chain professionals affirming its positive impact. This sentiment is projected to drive substantial growth in the warehouse automation market, anticipated to exceed $30 billion by 2026. Concurrently, the adoption of advanced technologies such as Warehouse Execution Systems (WES) is gaining momentum, with the market expected to reach $1.4 billion by the same year.

The logistical backbone of warehousing is also evolving, with transportation management systems leading 56% of warehouse management software usage. In response to efficiency demands, 4 million commercial warehouse robots are projected to be operational in over 50,000 warehouses by 2025, and 38% of U.S. companies plan to enhance their inventory accuracy with additional SKUs and barcode scanners.

Furthermore, more than 2.3 billion square feet of new warehousing space will be needed by 2035 to accommodate the growing demand. This expansion is parallel to the 77% of organizations prioritizing the integration of automated systems to optimize data-driven performance. The transformation extends to traditional retail as well, with the $22 trillion industry increasingly adopting Omni-channel strategies to enhance customer satisfaction.

Overall, the sector shows a strong inclination towards modernization and efficiency, with the installation of Automated Storage and Retrieval Systems (AS/RS) forecasted to surpass 8,000 units by 2024. More than 70% of warehouses are already equipped with some form of automation technology, highlighting the industry’s commitment to embracing technological advancements to meet the evolving demands of the global market.

Key Takeaways

- The warehouse automation market is estimated to grow from USD 20.8 billion in 2023 to a substantial USD 91.0 billion by 2033, showcasing a robust 15.9% Compound Annual Growth Rate (CAGR) throughout the forecast period.

- In 2023, the Hardware segment held a dominant market position within the Warehouse Automation Market, capturing more than a 70.4% share.

- In 2023, the Retail & E-commerce segment held a dominant market position within the Warehouse Automation Market, capturing more than a 33.5% share.

- In 2023, North America held a dominant market position in the warehouse automation sector, capturing more than a 36.7% share.

- Despite the potential benefits, a significant portion of warehouses globally, approximately 80%, still operate manually without any automation support, indicating a vast opportunity for adoption and growth in the warehouse automation sector.

- The exponential growth of the e-commerce industry serves as a primary driver for warehouse automation, with the Retail & E-commerce segment capturing more than a 33.5% share in 2023. This underscores the importance of automation in meeting the demands for speed and accuracy in order fulfillment.

Component Analysis

In 2023, the Hardware segment held a dominant market position within the Warehouse Automation Market, capturing more than a 70.4% share. This significant market share can be attributed to the indispensable role that hardware components – such as robotics, automated storage and retrieval systems (AS/RS), conveyor belts, and sortation systems – play in the automation of warehouse operations.

The demand for these hardware solutions has been driven by the increasing need for efficient, high-speed, and accurate processes in warehouse management to cater to the growing e-commerce sector and the global push for rapid delivery services.

The leading position of the Hardware segment is further reinforced by technological advancements and innovations that enhance the capabilities of automation equipment. Investments in research and development have led to the creation of more sophisticated and adaptable robotics solutions capable of handling a wide range of tasks, from picking and packing to transportation within the warehouse.

Additionally, the integration of IoT (Internet of Things) and AI (Artificial Intelligence) technologies has significantly improved the efficiency and reliability of hardware components, making them even more crucial to the automated warehouse ecosystem. This integration not only optimizes operations but also contributes to reducing errors, lowering operational costs, and improving overall supply chain efficiency.

Moreover, the Hardware segment’s dominance is supported by the scalability of these solutions, allowing businesses of all sizes to incrementally adopt warehouse automation technologies. As organizations strive for competitiveness and operational excellence, the demand for hardware components that can seamlessly integrate with existing systems and scale according to business needs continues to grow.

End-Use Industry Analysis

In 2023, the Retail & E-commerce segment held a dominant market position within the Warehouse Automation Market, capturing more than a 33.5% share. This leading position is primarily due to the exponential growth of the e-commerce sector, fueled by changing consumer behaviors that prefer online shopping for its convenience and speed.

The surge in online transactions has necessitated the adoption of advanced warehouse automation technologies to efficiently manage inventory, fulfill orders, and ensure timely delivery. Retail and e-commerce companies are increasingly investing in automation to enhance their logistics and supply chain capabilities, thereby driving the demand for warehouse automation solutions in this segment.

The Retail & E-commerce segment’s prominence in the Warehouse Automation Market is also attributable to the need for scalability and flexibility in operations. Automation technologies such as robotics, automated storage and retrieval systems (AS/RS), and conveyor systems enable these businesses to quickly adjust to fluctuating demand patterns and seasonal peaks, ensuring customer satisfaction and loyalty.

Furthermore, automation helps in minimizing errors, reducing labor costs, and increasing the overall efficiency of warehouse operations. These benefits are particularly valuable in the fast-paced retail and e-commerce environment, where speed and accuracy are crucial to maintaining competitive advantage.

Moreover, the integration of Artificial Intelligence (AI) and machine learning technologies in warehouse automation systems offers predictive analytics and real-time data, enabling retail and e-commerce businesses to make informed decisions regarding inventory management and demand forecasting.

Key Market Segments

By Component

- Hardware

- Software

- Services

End-Use Industry

- Retail & E-commerce

- Food and Beverage

- Healthcare & Pharmaceuticals

- Automotive

- Transportation & Logistics

- Other End-Use Industries

Driver

Exponential Growth of the E-commerce Industry

The explosive growth of the e-commerce industry serves as a primary driver for the warehouse automation market. With the rapid expansion of online shopping, businesses are under pressure to fulfill orders quickly and efficiently. This demand for speed and accuracy in order fulfillment necessitates advanced warehouse automation solutions.

Automation technologies, such as Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS), and robotic picking systems, enable e-commerce companies to enhance operational efficiency, reduce order processing times, and improve customer satisfaction. As consumer expectations for fast delivery continue to rise, the reliance on warehouse automation technologies becomes increasingly crucial for e-commerce businesses to stay competitive and meet market demands.

Restraint

High Capital Investment

A significant restraint to the adoption of warehouse automation is the high capital investment required for implementation. Setting up an automated warehouse involves substantial costs associated with purchasing advanced machinery, software systems, and integrating these technologies into existing operations. Small to medium enterprises (SMEs) especially find it challenging to allocate the necessary financial resources for such large-scale automation projects.

This financial barrier can deter companies from adopting automation technologies, despite the potential long-term benefits of improved efficiency and reduced labor costs. Moreover, the complexity of designing and implementing these systems further escalates initial investments, making it a daunting endeavor for many businesses.

Opportunity

Emergence of Industry 4.0

The emergence of Industry 4.0 presents significant opportunities for the warehouse automation market. Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and big data analytics, offer advanced capabilities for enhancing warehouse operations. These technologies can streamline inventory management, optimize logistics, and facilitate predictive maintenance, thereby reducing downtime and operational costs.

The integration of these smart technologies into warehouse automation systems enables real-time tracking, improved accuracy, and greater flexibility in operations. As businesses increasingly adopt Industry 4.0 principles, the demand for sophisticated warehouse automation solutions is expected to surge, driving innovation and market growth.

Challenge

Skills Gap and Workforce Adaptation

A notable challenge in the warehouse automation market is the skills gap and the need for workforce adaptation. As automation technologies advance, there is a growing demand for skilled professionals capable of operating, maintaining, and troubleshooting these complex systems. However, the current workforce may lack the necessary technical skills, leading to a gap between technological capabilities and human expertise.

Training and educating employees on new automation technologies require time and investment, posing challenges for companies transitioning to automated operations. Moreover, workforce adaptation involves managing changes in job roles and addressing concerns about job displacement due to automation, further complicating the implementation process.

Emerging Trends

- Generative AI and Advanced Robotics: Generative AI is revolutionizing warehouse operations by offering capabilities like risk management, demand forecasting, and customer service automation. Coupled with advanced robotics, these technologies are set to significantly boost operational efficiency and decision-making processes. Robotics in warehouses are becoming more versatile, with collaborative robots (cobots) working alongside humans for tasks requiring precision and consistency.

- Mobile Robots and Drones: The shift from traditional conveyors to mobile robots for goods transportation within warehouses signifies a move towards more flexible, space-efficient automation solutions. Drones, too, are gaining traction for their ability to perform inventory counts, enhance security, and support various logistical operations, marking a leap in operational efficiency and safety.

- RFID and Wearable Technology: RFID technology is increasingly adopted for its ability to improve inventory tracking and management, reducing errors and enhancing efficiency. Similarly, wearable technologies like wrist-worn scanners and exoskeletons are enhancing worker efficiency and safety, showcasing the industry’s focus on integrating technology to support human labor.

- Sustainability Initiatives: A growing emphasis on sustainability within warehouse operations highlights the industry’s response to environmental concerns. Efforts to reduce energy consumption, utilize sustainable materials, and optimize transportation routes are among the measures being adopted to ensure eco-efficient operations.

- The Impact of 5G Technology: The integration of 5G technology into warehouse operations is poised to revolutionize real-time data processing and connectivity, promising significant improvements in speed, efficiency, and responsiveness. This technology enables scalable solutions that can adapt to changing business needs without substantial downtime or investment.

Regional Analysis

In 2023, North America held a dominant market position in the warehouse automation sector, capturing more than a 36.7% share. This leadership can be attributed to several key factors, including the presence of major e-commerce giants, a highly developed retail sector, and significant investments in research and development of automation technologies.

The demand for Warehouse Automation in North America was valued at US$ 7.6 billion in 2023 and is anticipated to grow significantly in the forecast period. The region’s rapid adoption of advanced technologies such as robotics, artificial intelligence, and machine learning to streamline warehouse operations and enhance efficiency has been pivotal.

Furthermore, the growing demand for faster delivery times, coupled with the push for more efficient supply chain operations from companies looking to reduce operational costs, has significantly driven the market’s expansion.

Europe follows closely, leveraging its strong manufacturing base and stringent regulations regarding worker safety and operational efficiency. The region’s focus on sustainability and the integration of green technologies in warehouse operations have also played a critical role. Investments in smart warehouses equipped with IoT and AI technologies are on the rise, aimed at increasing operational efficiency and reducing environmental impact.

The Asia-Pacific (APAC) region is witnessing rapid growth in warehouse automation, fueled by the expanding e-commerce sector, increasing labor costs, and the push for faster delivery services. Countries like China, Japan, and South Korea are leading the charge, implementing robotics and smart systems to enhance productivity and manage the growing consumer demand efficiently.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The analysis of key players in the warehouse automation market reveals a dynamic and competitive landscape, characterized by innovation and strategic partnerships. Companies such as Daifuku Co., Ltd., Honeywell International Inc., and Swisslog Holding AG lead the sector, underpinned by robust product portfolios that include robotics, automated storage and retrieval systems (AS/RS), conveyor systems, and software solutions.

These entities are distinguished by their relentless pursuit of technological advancements, extensive global presence, and comprehensive service offerings, ranging from system design and integration to post-installation support. The growth of these market leaders can be attributed to their ability to cater to the evolving needs of industries such as e-commerce, retail, and manufacturing, where efficiency, speed, and scalability are paramount.

Strategic acquisitions and collaborations form a core part of their expansion strategies, enabling them to enhance their technological capabilities and market reach. Moreover, the focus on research and development initiatives is evident, as these companies aim to address the growing demand for flexible, scalable, and intelligent warehouse automation solutions. This competitive environment is conducive to innovation, driving the overall advancement of the warehouse automation market

Top Market Leaders

- Honeywell International Inc.

- Oracle Corporation

- Daifuku Co. Ltd.

- Dematic

- Swisslog Holding AG

- KNAPP AG

- BEUMER Group

- ABB Ltd.

- Fanuc Corporation

- Vanderlande

- SSI Schaefer

- KION Group

- Softeon

- Manhattan Associates

- Other Key Players

Recent Developments

- March 2023: Maersk and BionicHIVE commenced a pilot program in Mira Loma, California, United States, to evaluate automation processes at a Maersk warehouse. The pilot involved sorting, selecting, and storing packages using automated systems equipped with cameras and sensors.

- April 2023: SVT Robotics introduced the SOFTBOT Platform Connector for Tecsys Inc., enabling a seamless integration between SVT’s SOFTBOT Platform and Tecsys WMS. This pre-built connector facilitates faster deployment and reduces complexity for Tecsys Elite clients, eliminating the need for custom code in robotics deployments and multi-system automation.

- January 2023: AutoStore launched Pio, a plug-and-play version of their renowned cube storage technology, specifically designed for small and medium-sized businesses (SMBs). Pio offers an affordable automation solution for SMBs in various industries like sporting goods, crafts, cosmetics, and apparel, enabling them to access advanced automation technology.

Report Scope

Report Features Description Market Value (2023) USD 20.8 Bn Forecast Revenue (2033) USD 91.0 Bn CAGR (2024-2033) 15.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By End-Use Industry (Retail & E-commerce, Food and Beverage, Healthcare & Pharmaceuticals, Automotive, Transportation & Logistics, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Honeywell International Inc., Oracle Corporation, Daifuku Co. Ltd., Dematic, Swisslog Holding AG, KNAPP AG, BEUMER Group, ABB Ltd., Fanuc Corporation, Vanderlande, SSI Schaefer, KION Group, Softeon, Manhattan Associates, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is warehouse automation?Warehouse automation involves the use of technology and machinery to automate various tasks and processes within a warehouse or distribution center. This can include tasks such as inventory management, picking, packing, sorting, and shipping.

How big is Warehouse Automation Market?The Global Warehouse Automation Market size is expected to be worth around USD 91.0 Billion by 2033, from USD 20.8 Billion in 2023, growing at a CAGR of 15.9% during the forecast period from 2024 to 2033.

Who are the key players in Warehouse Automation Market?Honeywell International Inc., Oracle Corporation, Daifuku Co. Ltd., Dematic, Swisslog Holding AG, KNAPP AG, BEUMER Group, ABB Ltd., Fanuc Corporation, Vanderlande, SSI Schaefer, KION Group, Softeon, Manhattan Associates, Other Key Players are the major companies operating in the Warehouse Automation Market

Which region has the biggest share in Warehouse Automation Market?In 2023, North America held a dominant market position in the warehouse automation sector, capturing more than a 36.7% share.

What are the key factors driving the growth of the warehouse automation market?Factors driving the growth of the warehouse automation market include increasing demand for faster order fulfillment, rising labor costs, advancements in robotics and artificial intelligence (AI) technology, growing e-commerce industry, and the need for improved operational efficiency and accuracy.

What are the challenges associated with warehouse automation implementation?Challenges may include high initial investment costs, integration complexities with existing systems, workforce training requirements, concerns about job displacement, maintenance and reliability issues, as well as regulatory and safety considerations.

Warehouse Automation MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Warehouse Automation MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Oracle Corporation

- Daifuku Co. Ltd.

- Dematic

- Swisslog Holding AG

- KNAPP AG

- BEUMER Group

- ABB Ltd.

- Fanuc Corporation

- Vanderlande

- SSI Schaefer

- KION Group

- Softeon

- Manhattan Associates

- Other Key Players