Global Wage Streaming Platforms Market Size, Share, Industry Analysis Report By Deployment Type (Cloud-Based, On-Premise), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-User Industry (Retail & E-commerce, Healthcare, Hospitality & Restaurants, Manufacturing, BFSI (Banking, Financial Services, and Insurance), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165658

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

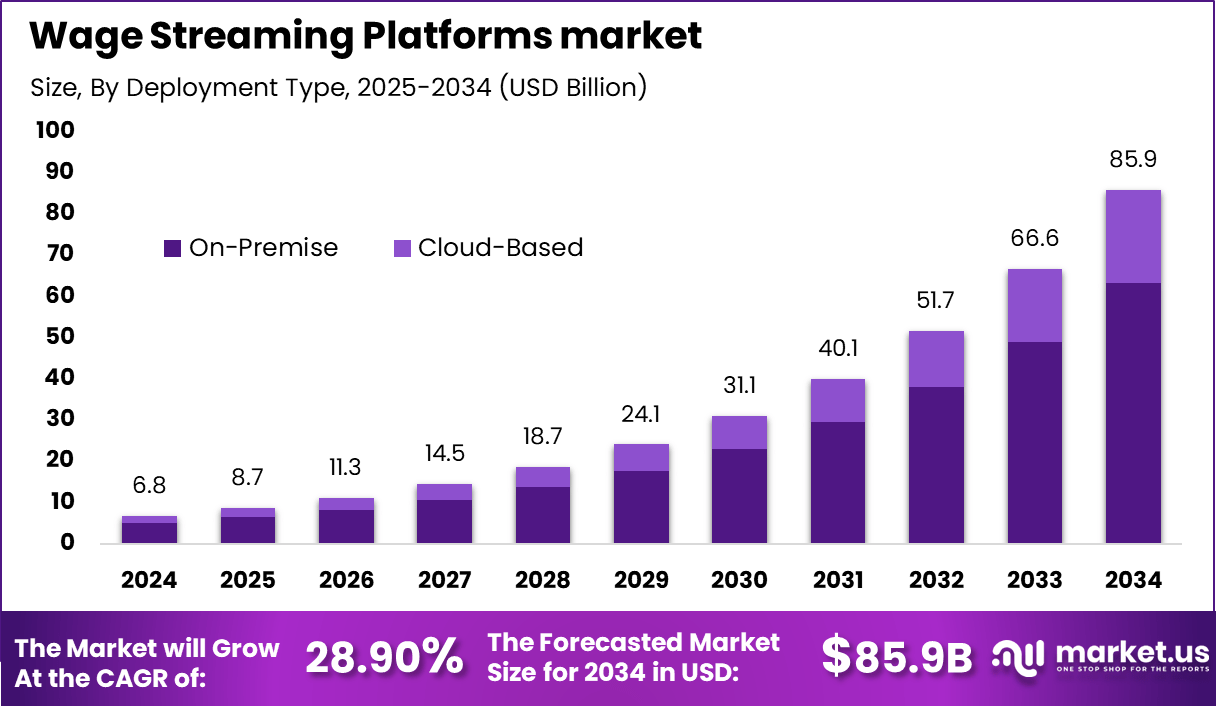

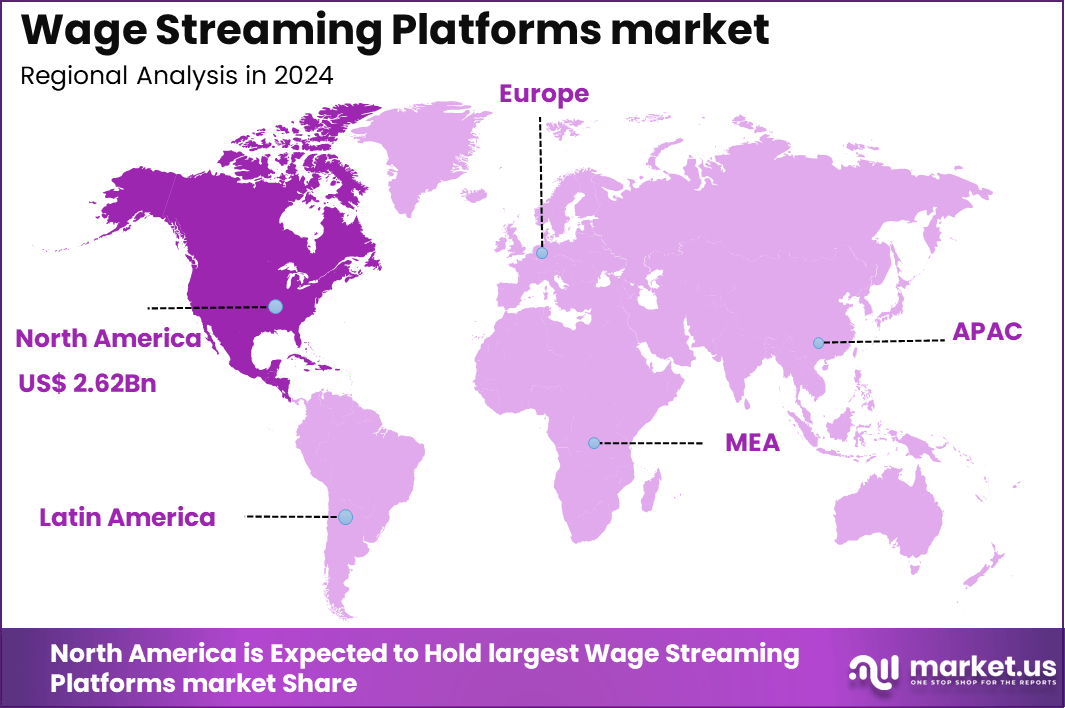

The Global Wage Streaming Platforms market generated USD 6.8 billion in 2024 and is predicted to register growth from USD 8.7 billion in 2025 to about USD 85.9 billion by 2034, recording a CAGR of 28.90% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 2.62 Billion revenue.

The wage-streaming platforms market is gaining momentum as more employers and workers recognise the value of accessing earned wages between traditional paydays. While the segment remains a niche within payroll and financial-wellness offerings, it has been growing steadily. The rise of digital payroll infrastructure and mobile-first payout models is supporting broader deployment of these platforms.

The main drivers behind the growth of wage streaming platforms include increasing financial stress among workers, rising living costs, and the expansion of the gig economy. Many employees now live paycheck to paycheck, making instant access to earned wages a necessity rather than a luxury. Employers are also recognizing the benefits, such as reduced absence and improved workforce retention, which further fuels adoption across industries.

Demand for wage streaming is strongest among hourly, part-time, and gig workers, who represent a growing segment of the workforce. These platforms are also gaining traction in sectors like retail, hospitality, and logistics, where flexible pay options can help attract and retain talent. The convenience of mobile apps and cloud-based payroll systems has made it easier for both employers and employees to integrate wage streaming into daily operations.

Technology is a key enabler of wage streaming adoption. Cloud-based payroll systems, mobile apps, and real-time payment infrastructures allow for seamless transactions and instant access to funds. Nearly 90% of users prefer mobile apps for wage access, highlighting the importance of digital convenience. Integration with broader financial wellness programs is also becoming common, as employers seek to support employee financial health.

Employers adopt wage streaming platforms to improve employee satisfaction, reduce turnover, and support financial wellness. Workers benefit from greater control over their finances, reduced reliance on high-interest loans, and the ability to manage unexpected expenses. The platforms also help employers stay competitive in a tight labor market by offering modern, flexible benefits.

Top Market Takeaways

- By deployment type, on-premise solutions dominate with a 73.7% share, preferred by large enterprises for enhanced data security, customization, and compliance with regulatory requirements.

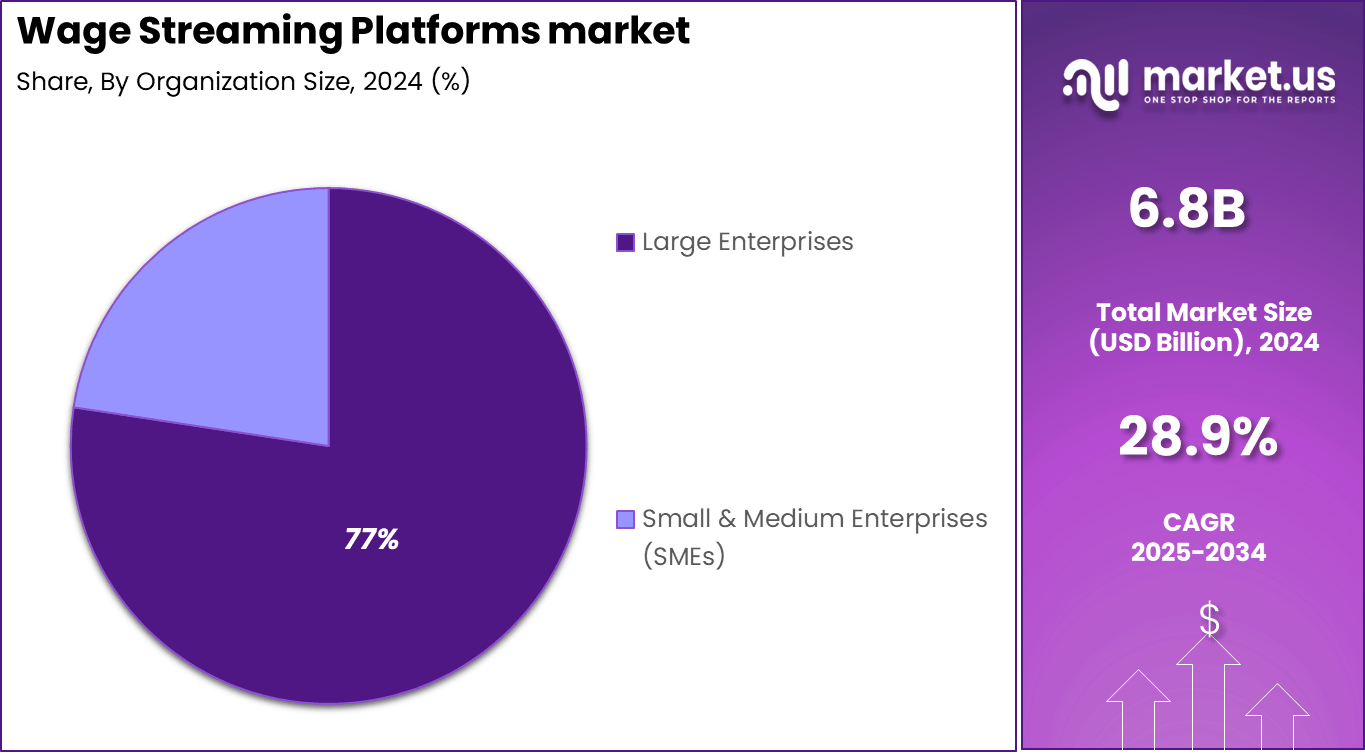

- By organization size, large enterprises represent 77.4% of the market, adopting wage streaming platforms to improve employee financial wellness, retention, and engagement at scale.

- By end-user industry, retail and e-commerce hold the largest share at 38.5%, reflecting high employee turnover and demand for flexible, on-demand wage access to reduce financial stress.

- Regionally, North America accounts for approximately 38.7% of the global wage streaming market.

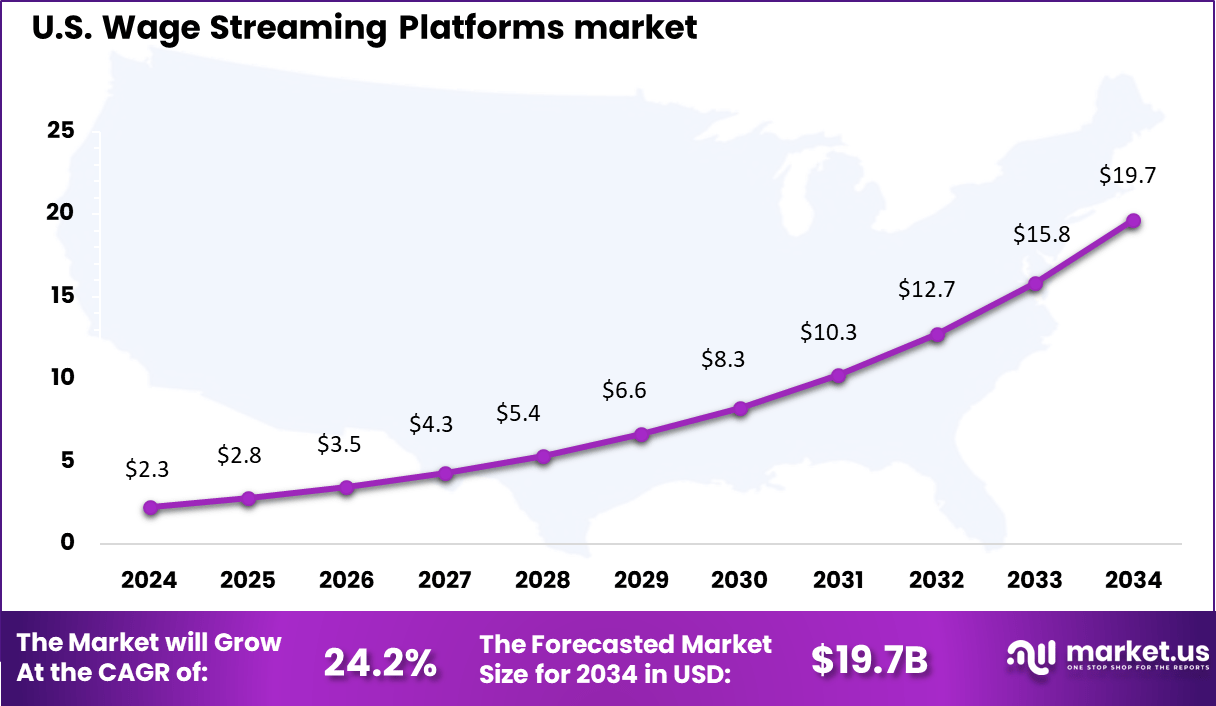

- The U.S. market size is estimated at USD 2.25 billion in 2025.

- The market is expanding at a CAGR of around 24.2%, driven by increasing awareness of financial wellness programs, rising adoption of fintech solutions integrated with payroll systems, and growing demand from hourly and gig economy workers.

- Key players in North America include CloudPay, DailyPay, Earnin, Payactiv, Branch, Rain Technologies, and Wagestream, focusing on AI-driven analytics, seamless payroll integration, and compliance.

- The growth is supported by increasing employee preference for real-time wage access, employer emphasis on reducing turnover costs, and regulatory encouragement for responsible wage streaming solutions.

By Deployment Type

In 2024, On-premise deployment dominates the wage streaming platforms market with a hefty share of 73.7%. This preference is largely due to the enhanced control and security it offers organizations over sensitive payroll data.

On-premise systems allow companies to maintain complete ownership of their data, ensuring stricter compliance with financial and privacy regulations. This is particularly crucial for enterprises handling large volumes of wage transactions and sensitive employee information.

Additionally, on-premise solutions provide predictable performance with minimal latency, offering reliability essential for mission-critical payroll processing. However, they do require higher upfront investments in hardware and dedicated IT staff to manage infrastructure, which some larger companies are well equipped to support.

By Organization Size

Large enterprises form the bulk of the market with 77% share, mainly because of their complex payroll needs and regulatory challenges. These organizations employ wage streaming platforms to boost employee financial wellness by enabling earned wage access, which helps reduce turnover and improve workforce satisfaction.

The scale of their operations demands integrated, fully customizable, and secure platforms -qualities typical of on-premise deployments. Large enterprises also have the resources to handle the ongoing support, maintenance, and compliance monitoring required by on-premise solutions, allowing them to safeguard sensitive payroll data effectively while offering flexible wage streaming benefits.

By End-User Industry

The retail and e-commerce sectors account for 38.5% of the market’s end users. These industries, characterized by high employee turnover and hourly wage workers, benefit greatly from wage streaming platforms by improving employee retention and satisfaction. Offering real-time wage access through on-premise systems helps reduce financial stress among employees, leading to better attendance and productivity.

Retail and e-commerce companies prioritize operational continuity and customer experience, which wage streaming solutions support by helping stabilize workforce management and reduce financial distractions among staff.

Emerging Trends

Trends Description Real-Time Payroll Access Wage streaming platforms are enabling employees to access a portion of their earned wages before payday, improving financial flexibility and reducing reliance on payday loans. Integration with Financial Apps Many platforms now connect directly with banking and budgeting apps, allowing users to manage their earnings and expenses in one place for better financial control. Employer Adoption for Retention Companies are increasingly adopting wage streaming to attract and retain talent, especially in sectors with hourly or gig workers who value immediate access to income. Enhanced Security and Compliance Platforms are focusing on robust data protection and regulatory compliance to build trust and ensure safe transactions for both employees and employers. Customizable Withdrawal Options Users can choose when and how much to withdraw, with options for instant or scheduled transfers, making the service more adaptable to individual needs. Growth Factors

Factors Description Rising Demand for Financial Flexibility Workers are seeking more control over their cash flow, especially in uncertain economic times, driving demand for wage streaming solutions. Employer Focus on Employee Wellbeing Organizations recognize that wage streaming can improve employee satisfaction and reduce financial stress, leading to higher productivity and lower turnover. Technological Advancements Improvements in mobile banking, payment processing, and secure authentication are making wage streaming more accessible and reliable for a wider audience. Regulatory Support and Standardization Clearer guidelines and industry standards are helping platforms operate more efficiently and expand into new markets. Expansion into Gig and Freelance Work The growth of the gig economy is creating new opportunities for wage streaming, as freelancers and independent contractors seek flexible payment options. Key Market Segments

By Deployment Type

- Cloud-Based

- On-Premise

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-User Industry

- Retail & E-commerce

- Healthcare

- Hospitality & Restaurants

- Manufacturing

- BFSI (Banking, Financial Services, and Insurance)

- Others

Regional Analysis

In 2024, North America maintained its stronghold in the wage streaming platforms market, capturing a significant 38.7% of the global share. This growth is powered by widespread adoption of real-time payment solutions across various industries, driven by businesses seeking to enhance employee satisfaction and financial wellness.

The region benefits from a robust digital infrastructure, regulatory support, and innovation-friendly ecosystems that facilitate seamless integration of wage streaming technology with existing payroll and HR systems. Increasing awareness about financial inclusion and economic resilience further boosts market traction. Employers across sectors are increasingly leveraging these platforms to provide employees with flexible access to earned wages, positioning North America as a leading market for this rapidly evolving financial service.

In the U.S., which stands as the core market within North America, the wage streaming platforms market is valued at approximately USD 2.25 billion in 2024, with a dynamic CAGR of 24.2%. This impressive growth rate reflects growing demand among workers for on-demand pay solutions, which help reduce financial stress and improve liquidity.

Legislative changes, such as supportive earned wage access laws in various states, are fostering greater adoption. Technology providers in the U.S. continuously innovate platform capabilities, emphasizing security, user experience, and real-time transaction efficiency. The collaboration between fintech companies, employers, and financial institutions enables scalable deployment across industries including retail, healthcare, and manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Flexible Wage Access

A significant driver of the wage streaming platforms market is the growing demand among employees for real-time access to earned wages. Workers want financial flexibility to manage cash flow better and avoid high-interest payday loans or debt. Wage streaming platforms allow employees to access a portion of their earned income before the traditional payday, helping reduce financial stress and improve overall well-being.

Employers also benefit from offering wage streaming as a perk that boosts employee satisfaction and retention while enhancing productivity. The rise of gig workers and freelancers, who often face irregular pay schedules, further fuels adoption of these platforms, expanding their market footprint.

Restraint

Regulatory and Compliance Challenges

Despite rapid growth, the wage streaming platforms market faces restraints due to evolving regulatory and compliance complexities. Different countries and states have varying laws regulating wage disbursement, lending, and financial services, creating a challenging environment for platform operators to navigate.

Ensuring compliance with data privacy, anti-money laundering, and labor laws demands continuous legal oversight and investment, raising operational costs. Regulatory uncertainty can slow expansions and delay partnerships with employers and financial institutions, limiting market reach and scalability.

Opportunity

Expansion through Employer Partnerships and Financial Wellness Programs

Wage streaming platforms have strong opportunities to expand through partnerships with employers and integrations into broader financial wellness programs. By embedding streaming services within payroll systems and benefit packages, platforms can provide seamless user experiences and increase adoption.

Additionally, growing awareness of financial health drives employers to offer wage streaming alongside budgeting tools, emergency savings, and financial education. This holistic approach strengthens employee engagement and loyalty, unlocking new B2B revenue streams and fostering long-term market growth.

Challenge

Balancing User Experience with Risk Management

A major challenge for wage streaming platforms is balancing a smooth user experience with effective risk and fraud management. Real-time access to wages demands robust authentication and transaction monitoring to prevent misuse and ensure fund availability.

Platforms must also design responsible payout limits and manage credit risk without complicating the process or discouraging users. Achieving this balance requires advanced technology, data analytics, and continuous refinement to maintain trust while delivering flexible financial solutions.

Competitive Analysis

The Wage Streaming Platforms Market is led by established providers such as DailyPay, EarnIn, Payactiv, Inc., and Refyne. Their platforms enable workers to access earned wages before payday through secure, compliant, and real-time systems. These companies support large employers with scalable infrastructures, strong data protection measures, and integrations that help reduce employee financial stress and improve retention.

Mid-sized and specialised providers including Stream Platforms Ltd., Flexwage Solutions, ZayZoon, and Instant Financial strengthen the market through differentiated features. Their offerings include budgeting tools, automated withdrawals, employer dashboards, and configurable access rules. Adoption is rising across retail, logistics, and service sectors as organizations seek solutions that support workforce stability and productivity.

Additional participants such as Hastee Technologies Ltd., Branch, and other market players continue to expand access models, cross-border capabilities, and mobile-first experiences. Their platforms emphasise instant disbursement, low transaction costs, and financial wellness tools. Continued growth is supported by rising demand for flexible pay, real-time financial services, and employer-focused digital payroll ecosystems.

Top Key Players in the Market

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- June, 2025, Refyne secured about $4 million debt funding to enhance its platform that allows employees to draw their wages on demand with AI-driven real-time salary tracking and underwriting technologies.

- January, 2025, DailyPay began preparations for a potential IPO in the U.S., aiming for a valuation between $3 billion and $4 billion. The company added new financial wellness features and hired a former Uber executive as COO in early 2025. It remains a top choice for early wage access for large employers in retail and hospitality.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 85.9 Bn CAGR(2025-2034) 28.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Type (Cloud-Based, On-Premise), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-User Industry (Retail & E-commerce, Healthcare, Hospitality & Restaurants, Manufacturing, BFSI (Banking, Financial Services, and Insurance), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Refyne, DailyPay, EarnIn, Payactiv, Inc., Stream Platforms Ltd., Flexwage Solutions, Hastee Technologies Ltd., ZayZoon, Instant Financial, Branch, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wage Streaming Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Wage Streaming Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others