Global Voice-based AI Companion Product Market Size, Share and Analysis Report By Product Type (Standalone AI Companion Apps, Embedded AI Companions (smartphones, wearables, smart speakers), Dedicated Companion Devices/Robots) By End User (Individual Consumers, Enterprises/Organizations, Healthcare & Care Providers, Education Institutions), By Application (Companionship & Social Interaction, Mental Health & Emotional Support, Productivity & Personal Assistance, Learning & Tutoring, Elderly Care & Assisted Living), By Deployment Model (Cloud-based, On-device (Edge AI), Hybrid (Cloud + On-device)), By Business Model (Subscription-based, Freemium with In-app Purchases, Enterprise Licensing/Contracts, Advertising/Sponsored Models), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176191

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Usage and Demographic Insights

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Product Type

- By End User

- By Application

- By Deployment Model

- By Business Model

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trend Analysis

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

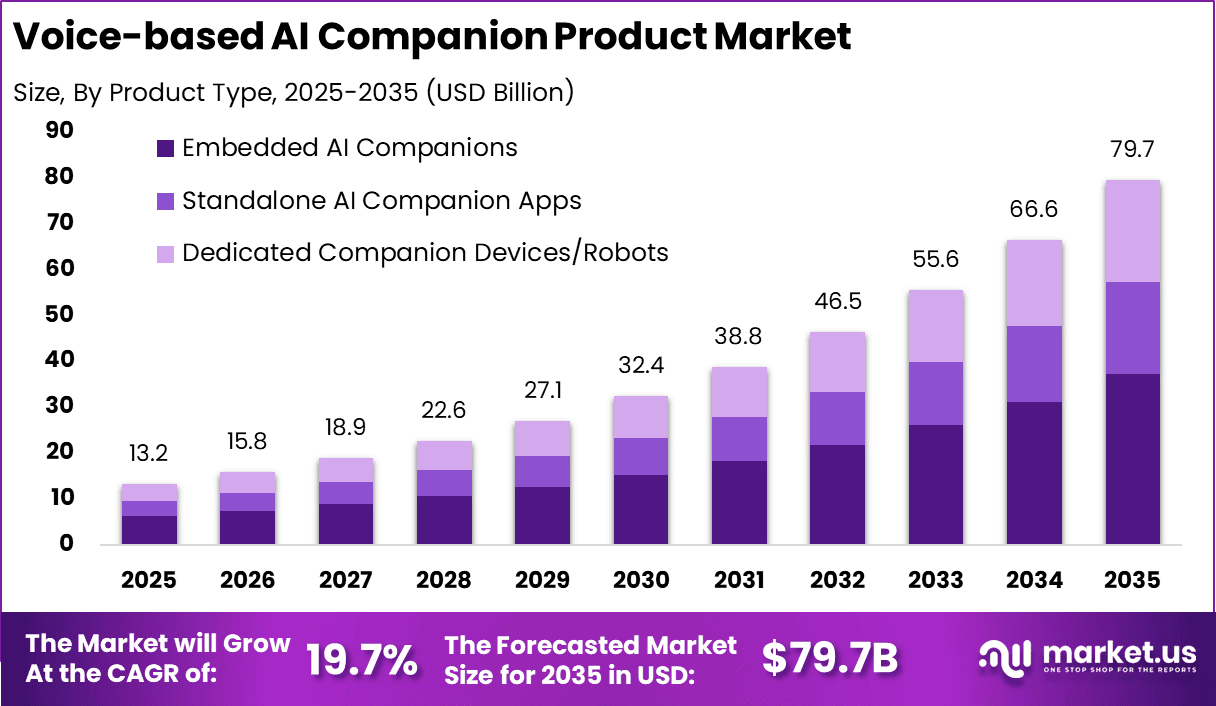

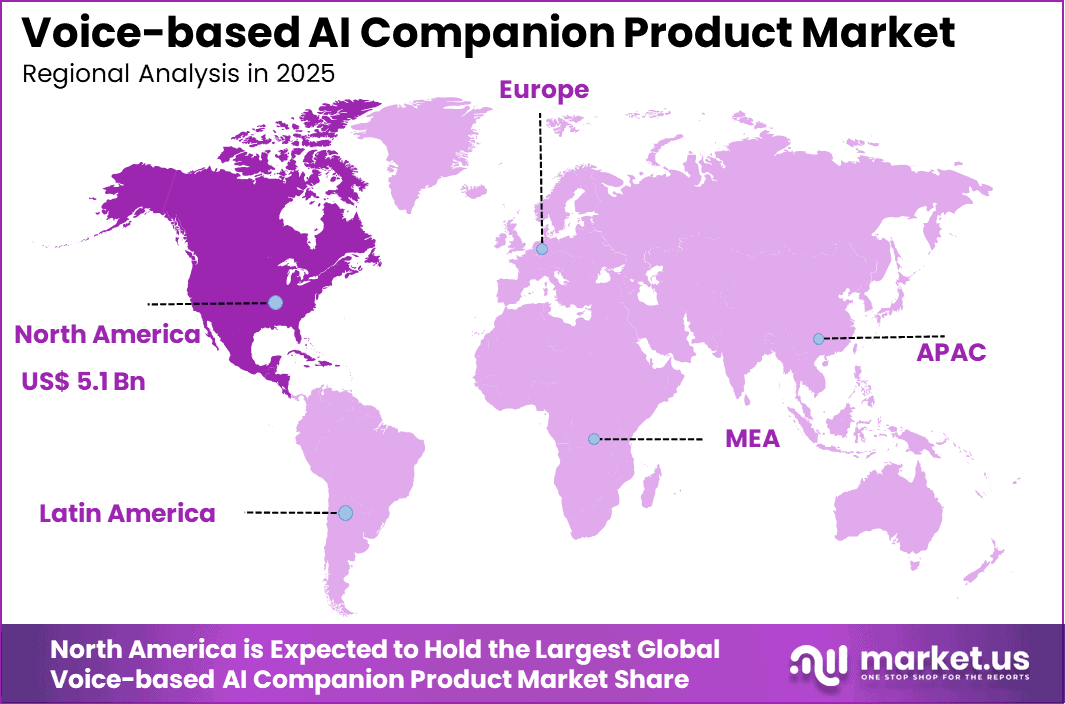

The Global Voice-based AI Companion Product Market presents a compelling consumer-AI investment opportunity, having generated USD 13.2 billion in 2025 and expected to scale to nearly USD 79.7 billion by 2035, expanding at a CAGR of 19.7%. North America’s dominant position, with more than 38.9% market share, reinforces the region’s role as a key growth engine for long-term capital deployment in AI-driven personal technology.

The voice based AI companion product market is defined as devices and applications that use speech input and spoken responses to act as a daily support companion for users. These products typically combine automatic speech recognition, natural language understanding, and text to speech to hold conversations, answer questions, and assist with routines such as reminders and basic guidance.

The market includes voice first companions embedded in consumer devices, as well as dedicated companion form factors designed for continuous interaction and emotional support use cases. Adoption is being supported by steady improvements in speech and conversational quality, with user expectations shifting toward more natural dialogue and better context handling.

One of the principal drivers for the adoption of voice-based AI companions is the rapid integration of smart devices in everyday life. As mobile phones, smart speakers, and connected home systems proliferate, users expect seamless voice interaction for information requests, task execution, and device control. Voice interfaces reduce barriers associated with touch or text inputs, enabling users to interact naturally and efficiently with technology.

For instance, In January 2025, Lucid Motors introduced the Lucid Assistant, a hands free in vehicle voice assistant powered by SoundHound Chat AI. The solution integrates generative AI to support natural and conversational voice interactions. It enables drivers to access real time information and control vehicle functions through voice commands.

Demand for voice-based AI companions has been supported by shifting user preferences toward more intuitive digital experiences. Many users now prefer speaking over typing to complete tasks such as setting reminders, accessing information, or controlling smart home devices. The hands-free nature of voice interfaces is especially important in use cases such as driving, cooking, or operating machinery, where manual interaction is impractical.

For instance, Voize raised USD 50 million in a Series A funding round to expand its AI voice companion for nurses across Europe and the United States. The solution is designed to automate clinical documentation with 99.2% accuracy and is currently used by more than 75,000 nurses across 1,100 healthcare facilities. The platform supports real time voice based documentation during patient care. B

Investment opportunities in this market are found in technological innovation and platform integration. Companies that develop advanced natural language processing, emotion recognition, and memory-enabled conversational models are positioned to benefit from growing demand. Improving these core technologies enhances user engagement and differentiates products in a competitive market.

Top Market Takeaways

- The global voice based AI companion product market was valued at USD 13.2 billion in 2025 and is growing at a 19.7% CAGR, reflecting strong consumer and enterprise interest in conversational AI solutions.

- By product type, embedded AI companions led with 46.8% share, driven by integration into devices such as smartphones, wearables, smart speakers, and vehicles.

- By end user, individual consumers accounted for 55.5%, supported by rising use of AI companions for daily assistance, reminders, and personal organization.

- By application, productivity and personal assistance held 33.1%, highlighting demand for task management, scheduling, and information retrieval through voice interfaces.

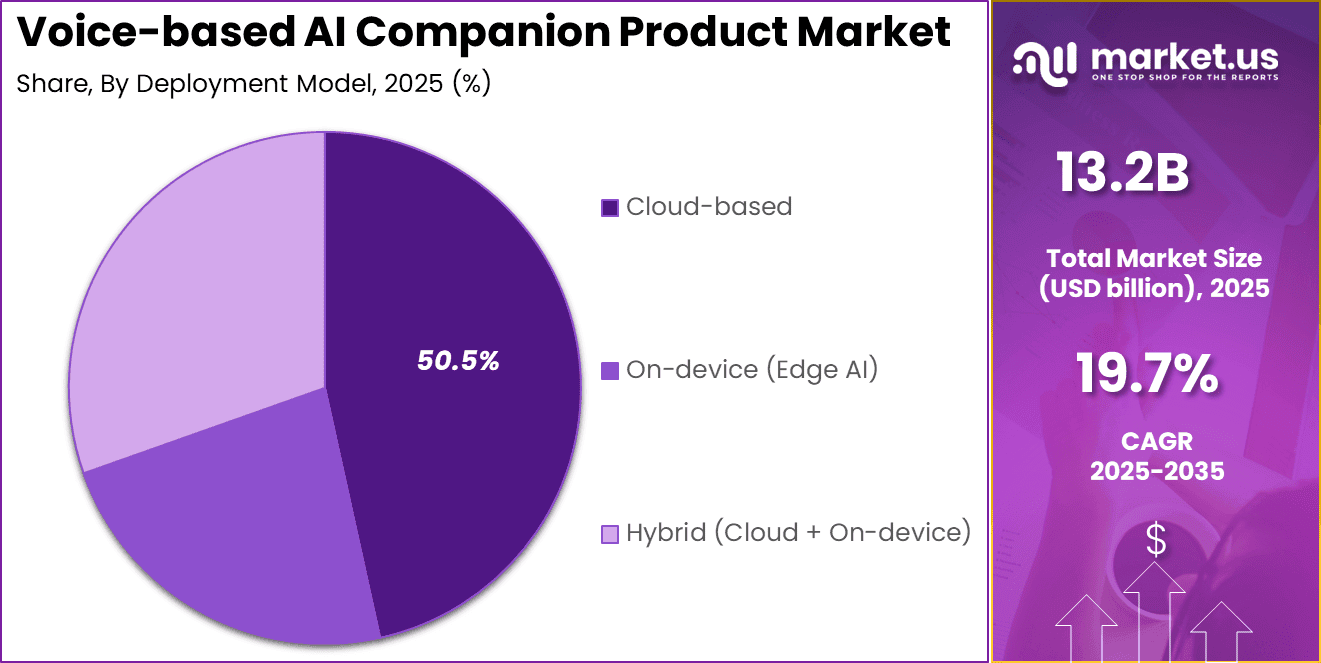

- By deployment model, cloud based solutions captured 50.5%, enabling scalability, continuous updates, and access to advanced AI models.

- By business model, subscription based offerings represented 45.1%, reflecting recurring revenue preferences and demand for premium features.

- North America accounted for 38.9% of the global market, supported by high smart device penetration and early adoption of voice driven AI technologies.

Usage and Demographic Insights

- Leading AI companion applications have an estimated 52 million active users worldwide.

- A 2025 survey found that 72% of US teenagers have used AI companions, indicating strong adoption among younger users.

- Nearly 20% of students reported having engaged in, or knowing someone who engaged in, a romantic relationship with an AI companion.

- Around 20% of users in the UK reported seeking relationship advice from AI companions instead of friends or professional counselors.

- Therapeutic AI companions show strong engagement, with a 70% user retention rate after 30 days of use.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising adoption of AI-powered personal assistance in daily life +5.2% North America, Asia Pacific Short to medium term Growth in smart devices and voice-enabled consumer electronics +4.6% Global Medium term Increasing demand for productivity, wellness, and companionship tools +4.1% North America, Europe Medium term Advances in speech recognition and natural language understanding +3.5% Global Medium to long term Higher acceptance of AI interaction among younger demographics +2.3% Asia Pacific, North America Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Privacy and data security concerns around voice data -3.4% Europe, North America Short to medium term High development and maintenance costs for advanced AI models -2.8% Global Medium term Limited personalization accuracy in early-stage products -2.1% Global Short term Dependence on cloud connectivity for real-time interaction -1.9% Emerging Markets Medium term Regulatory uncertainty around AI usage and data handling -1.6% Europe, North America Medium to long term By Product Type

Embedded AI companions account for 46.8%, making them the leading product type in this market. These companions are built directly into devices such as smartphones, smart speakers, and wearables. Embedded deployment enables faster response times and consistent availability. Users benefit from seamless interaction without relying on external systems. Stability and ease of use remain key advantages.

The dominance of embedded AI companions is driven by device-level integration. Manufacturers focus on native AI capabilities to improve user experience. Embedded models reduce latency and dependency on third-party hardware. They also support offline or limited connectivity scenarios. This sustains strong adoption of embedded AI companions.

By End User

Individual consumers represent 55.5%, making them the largest end-user segment. Consumers use voice-based AI companions for everyday activities. Common use cases include reminders, information queries, and entertainment. Hands-free interaction improves convenience. Personalization enhances user engagement.

Growth among individual consumers is driven by lifestyle integration. Voice assistants fit naturally into daily routines. Ease of setup encourages first-time users. Continuous feature updates improve long-term usage. This keeps consumer demand strong.

By Application

Productivity and personal assistance account for 33.1%, making this the leading application area. Voice-based companions help users manage schedules and tasks. Automation reduces the need for manual input. Real-time responses support efficient time management. Accuracy remains critical for user trust.

The prominence of this application is driven by work-life demands. Users seek tools that simplify routine activities. Integration with calendars and apps improves effectiveness. Learning capabilities enhance relevance over time. This sustains adoption in productivity-focused use cases.

By Deployment Model

Cloud-based deployment holds 50.5%, reflecting preference for scalable processing. Cloud platforms support advanced voice recognition and learning. Centralized updates improve performance continuously. Users benefit from new features without device replacement. Flexibility remains a key advantage.

Adoption of cloud-based deployment is driven by data processing needs. Voice AI relies on large datasets. Cloud infrastructure supports continuous improvement. Secure data handling supports confidence. This keeps cloud-based models widely adopted.

By Business Model

Subscription-based models account for 45.1%, making them the leading business model. Subscriptions provide ongoing access to enhanced features. Predictable pricing supports long-term engagement. Regular updates increase perceived value. Customer retention remains important.

The preference for subscriptions is driven by service evolution. Voice-based AI companions improve over time. Subscription revenue supports continued development. Tiered offerings address different user needs. This sustains strong subscription adoption.

By Region

North America accounts for 38.9%, reflecting strong adoption of voice-enabled technologies. Consumers in the region are familiar with AI-driven assistants. High smart device penetration supports usage. Digital infrastructure enables reliable performance. The region remains influential.

Adoption in North America is driven by consumer readiness. Users value convenience and automation. Enterprises also encourage AI usage in daily tools. Ongoing innovation supports expansion. Market participation remains steady.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Consumer AI product companies Very High High North America, Asia Pacific Strong upside from mass adoption Platform and ecosystem investors High Medium Global Scalable revenue via subscriptions Hardware and smart device investors Medium Medium Asia Pacific Synergy with device sales Private equity firms Medium Medium North America, Europe Expansion and product bundling plays Venture capital investors Very High Very High North America Best suited for early-stage innovation Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Advanced natural language processing and contextual AI +5.1% Human-like interaction Global Short to medium term Cloud-based AI inference and scalable compute +4.3% Real-time responsiveness Global Medium term Multilingual voice recognition and localization +3.8% Wider user reach Asia Pacific, Europe Medium term Emotion and sentiment detection technologies +3.1% Personalized engagement North America Medium to long term On-device AI processing for privacy protection +2.4% Reduced data exposure Europe, North America Long term Emerging Trend Analysis

A significant emerging trend in the Voice-based AI Companion Product market is the move toward more natural and emotionally aware conversational interfaces that enhance user engagement beyond simple command recognition. Voice AI solutions are increasingly designed to understand context, infer intent, and adjust responses in ways that feel more human like, not just transactional.

This trend supports deeper interaction patterns where users engage with voice companions for social, informational, and task oriented purposes, bridging gaps between utility and personal connection. Such advancements are being enabled by improvements in natural language understanding and context retention frameworks.

Another aspect of this trend involves the integration of voice companions into a wider range of smart environments and devices. Voice AI is no longer confined to smartphones and speakers but is being embedded into televisions, vehicles, wearables, and home automation systems, expanding how and where users interact with AI companions.

This expansion increases accessibility and continuous presence of AI companions in daily routines, making them more integral to tasks such as entertainment, navigation, and household management. The proliferation of interconnected ecosystems further amplifies the role of voice based companions across personal and professional settings.

Opportunity

A significant opportunity in the Voice-based AI Companion Product market exists in developing voice companions for specialised use cases such as elderly care, healthcare support, education, and mental wellness. Voice AI that provides companionship, reminders, and conversational support for aging populations or individuals with special needs can address unmet societal and caregiving demands.

Integrating emotional intelligence and empathetic response mechanisms can make companions more effective in these roles, presenting product differentiation opportunities. This expansion into niche user groups can broaden the appeal and impact of voice based AI solutions.

Growth potential also lies in multilingual and culturally adaptive voice companions that serve diverse global markets. As voice technology expands beyond English speaking regions, demand increases for AI companions capable of understanding and conversing in local languages and dialects. Localised models can support accessibility and wider adoption, particularly in regions with multiple language communities.

Challenge

A major challenge for the Voice-based AI Companion Product market is balancing the sophistication of conversational abilities with ethical considerations and user wellbeing. As AI companions become more immersive and emotionally engaging, there is debate about the psychological impacts of extended human-machine interaction.

Industry voices have raised concerns that highly personalised AI companions could influence user behaviour or emotional states in unintended ways, particularly among vulnerable populations such as teens or social isolates. Addressing these ethical dimensions is critical for sustainable product acceptance. Another challenge involves ensuring reliable performance across diverse acoustic environments and accents.

Voice companions must function effectively despite background noise, speech variances, and inconsistent input quality, which requires advanced signal processing and adaptive models. Achieving this level of robustness across global user populations remains complex, and failures in recognition can reduce user trust. Overcoming these challenges requires continuous refinement of audio processing and conversational algorithms.

Competitive Analysis

Leading conversational AI and voice technology providers such as PolyAI Ltd., SoundHound AI Inc., and Witlingo focus on natural voice interaction and context-aware conversations. Their solutions are designed to deliver human-like responses across customer support, personal assistance, and daily engagement use cases. Advanced speech recognition and natural language understanding improve interaction quality.

Emotion and wellbeing-focused players such as Hume AI Inc., Meela, Inc., and Earkick emphasize empathetic voice responses and emotional intelligence. Their platforms use voice tone and sentiment analysis to adapt conversations. Intuition Robotics Inc. and Miko.ai combine voice AI with physical devices for companionship and learning.

Large technology platforms such as Amazon, Inc. and Google LLC strengthen the market through scalable voice ecosystems. Their AI companions integrate with smart home devices and cloud services. Consumer-focused apps such as Luka, Inc. and Chai Research Corp target personalized companionship and social interaction. Other emerging vendors expand innovation and niche use cases.

Top Key Players in the Market

- PolyAI Ltd. (U.K.)

- Witlingo (U.S.)

- SoundHound AI Inc. (U.S.)

- Hume AI Inc (U.S.)

- Meela, Inc. (U.S.)

- Miko.ai (India)

- Intuition Robotics Inc. (Israel)

- Amazon, Inc. (U.S.)

- Google LLC (U.S.)

- Luka, Inc. (U.S.)

- Chai Research Corp (U.S.)

- Earkick (U.S.)

- Others

Recent Developments

- February 2025, Amazon unveiled Alexa+, a next‑generation, generative‑AI version of Alexa that makes the assistant more conversational, context‑aware, and able to handle complex, multi‑step voice requests, positioning it closer to an always‑on AI companion in the home.

- March 2025, Alexa+ began rolling out to millions of users as a tiered service, with advanced AI companion‑like features (personalized routines, voice recognition, proactive suggestions) available via a paid subscription while the classic Alexa experience remained free.

- March 2025, Google announced plans to “upgrade” Google Assistant on most mobile devices to Gemini, signalling a shift from a classic voice assistant toward a unified, multimodal AI agent that can act as a cross‑device digital companion.

Key Market Segments

By Product Type

- Standalone AI Companion Apps

- Embedded AI Companions (smartphones, wearables, smart speakers)

- Dedicated Companion Devices/Robots

By End User

- Individual Consumers

- Enterprises/Organizations

- Healthcare & Care Providers

- Education Institutions

By Application

- Companionship & Social Interaction

- Mental Health & Emotional Support

- Productivity & Personal Assistance

- Learning & Tutoring

- Elderly Care & Assisted Living

By Deployment Model

- Cloud-based

- On-device (Edge AI)

- Hybrid (Cloud + On-device)

By Business Model

- Subscription-based

- Freemium with In-app Purchases

- Enterprise Licensing/Contracts

- Advertising/Sponsored Models

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 13.2 Bn Forecast Revenue (2035) USD 79.7 Bn CAGR(2026-2035) 19.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Standalone AI Companion Apps, Embedded AI Companions (smartphones, wearables, smart speakers), Dedicated Companion Devices/Robots) By End User (Individual Consumers, Enterprises/Organizations, Healthcare & Care Providers, Education Institutions), By Application (Companionship & Social Interaction, Mental Health & Emotional Support, Productivity & Personal Assistance, Learning & Tutoring, Elderly Care & Assisted Living), By Deployment Model (Cloud-based, On-device (Edge AI), Hybrid (Cloud + On-device)), By Business Model (Subscription-based, Freemium with In-app Purchases, Enterprise Licensing/Contracts, Advertising/Sponsored Models) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PolyAI Ltd. (U.K.), Witlingo (U.S.), SoundHound AI Inc. (U.S.), Hume AI Inc. (U.S.), Meela, Inc. (U.S.), Miko.ai (India), Intuition Robotics Inc. (Israel), Amazon, Inc. (U.S.), Google LLC (U.S.), Luka, Inc. (U.S.), Chai Research Corp (U.S.), Earkick (U.S.), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Voice-based AI Companion Product MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Voice-based AI Companion Product MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- PolyAI Ltd. (U.K.)

- Witlingo (U.S.)

- SoundHound AI Inc. (U.S.)

- Hume AI Inc (U.S.)

- Meela, Inc. (U.S.)

- Miko.ai (India)

- Intuition Robotics Inc. (Israel)

- Amazon, Inc. (U.S.)

- Google LLC (U.S.)

- Luka, Inc. (U.S.)

- Chai Research Corp (U.S.)

- Earkick (U.S.)

- Others