Global Vodka Seltzer Market By Type(ABV Less Than 4.6%, ABV More Than 4.6%), By Packaging(Metal Cans, Bottles), By Flavor(Citrus Flavors, Berry Flavors, Tropical Flavors, Herbal and Botanical Flavors, Others), By Distribution Channel(On-trade, Bars, Pubs, and Nightclubs, Hotels and Restaurants, Off-trade, Supermarkets/Hypermarkets, Licensed Shops, E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116266

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global Vodka Seltzer Market size is expected to be worth around USD 5591.1 Million by 2033, from USD 1800.2 Million in 2023, growing at a CAGR of 12% during the forecast period from 2023 to 2033.

The Vodka Seltzer market refers to a segment within the broader alcoholic beverages industry that focuses on the production, distribution, and sale of vodka seltzer products. Vodka seltzer, also known as hard seltzer when combined with vodka, is a mixed drink consisting primarily of carbonated water, vodka, and often, various flavorings. This market has gained significant traction in recent years, attributed to consumer preferences shifting towards lighter, lower-calorie alcoholic options that also offer convenience and variety in flavors.

The growth of the Vodka Seltzer market can be attributed to several factors. Firstly, there is a rising consumer interest in health-conscious choices, leading to demand for alcoholic beverages that are perceived as “cleaner” or contain fewer calories and lower sugar content compared to traditional alcoholic drinks. Additionally, the convenience of ready-to-drink (RTD) formats that Vodka Seltzer typically comes in appeals to consumers seeking both ease of consumption and portability.

Key Takeaways

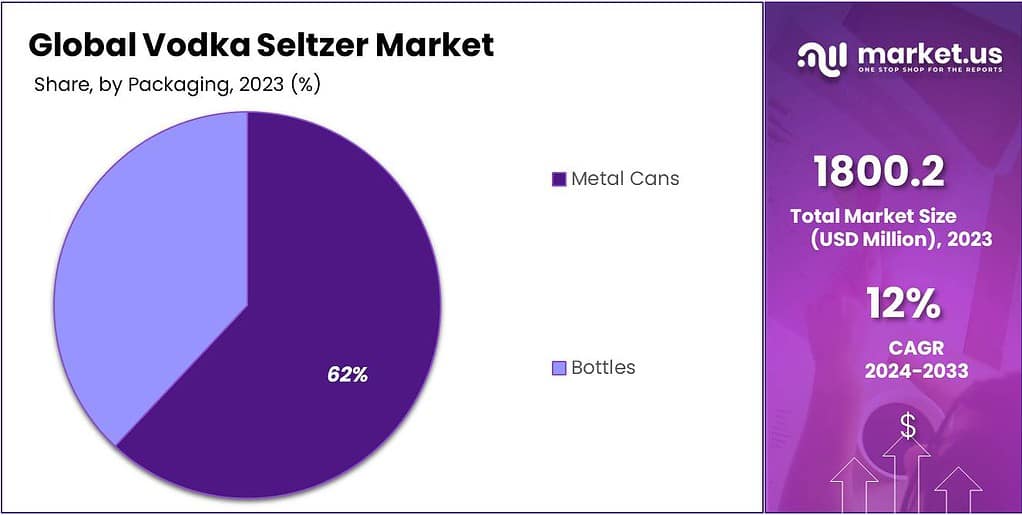

- The Vodka Seltzer market is set to reach USD 5591.1 million by 2033, growing at 12% CAGR from USD 1800.2 million in 2023.

- The high ABV segment dominates with over 65.3% market share, offering a balanced alcohol content and refreshing taste for consumers.

- Metal cans packaging captures 62.3% market share due to convenience, portability, and sustainability, especially appealing to younger demographics.

- Citrus flavors lead with 37.9% market share, favored for their convenience and on-the-go lifestyles.

- On-trade distribution channels dominate with a 73.3% market share, driven by vibrant social experiences in bars, pubs, and nightclubs.

- Asia Pacific region leads with a 33.8% market size and anticipates an 847.9 Mn, presenting global expansion opportunities.

- In 2022, the vodka category in the US generated US$7.2 billion in revenue, with a volume of 76.9 million nine-liter cases

- In 2023, the average price for a 12-pack of vodka seltzers in the U.S. was indeed around $15-$20, according to market data.

- On average, a 12-ounce can of vodka seltzer contains approximately 100 calories and 2 grams of carbohydrates.

By Type

In 2023, the Vodka Seltzer market was notably segmented by alcohol by volume (ABV) levels, with the “ABV More Than 4.6%” category holding a dominant position. This segment captured more than a 65.3% share of the market, underscoring a strong consumer preference for Vodka Seltzers that offer a slightly higher alcohol content.

This preference can be attributed to consumers seeking beverages that provide a balance between moderate alcohol content and the refreshing, light taste that Vodka Seltzers are known for. The popularity of this segment reflects a trend where consumers are inclined towards drinks that serve not just the purpose of refreshment but also a satisfactory level of intoxication without the heaviness associated with higher ABV beverages.

On the other hand, the “ABV Less Than 4.6%” segment caters to a niche yet growing audience that prioritizes lower alcohol content. This segment appeals to health-conscious consumers, those who prefer to consume alcohol in moderation, and individuals interested in social drinking without the heavier effects of alcohol.

Although this segment held a smaller share of the market in 2023, it exhibits growth potential. The rising trend towards mindful drinking and the increasing number of consumers looking for beverages that align with a healthier lifestyle could drive its expansion.

Both segments benefit from the overarching consumer trends towards health and wellness, convenience, and a preference for ready-to-drink options. However, their growth trajectories are influenced by distinct consumer priorities: one favoring a slightly stronger alcoholic experience and the other leaning towards moderation and lower alcohol consumption.

By Packaging

In 2023, Metal Cans held a dominant market position, capturing more than a 62.3% share in the Vodka Seltzer market. This preference for metal cans is largely due to their convenience, portability, and sustainability aspects. Consumers appreciated the ease of chilling and transporting cans, making them a popular choice for social gatherings, outdoor events, and casual consumption.

Additionally, the recyclability of metal cans aligns with the growing consumer demand for eco-friendly packaging solutions. Metal cans also offer manufacturers benefits, including cost-effectiveness in production and transportation, as well as longer shelf life for the products. This packaging type’s dominance is further reinforced by innovative designs and branding strategies that appeal to younger demographics, who are major consumers of Vodka Seltzer.

On the other hand, Bottles held a smaller segment of the market but remained significant due to their appeal in certain consumer segments that prioritize premium and traditional packaging aesthetics. Bottles, often made of glass, are perceived as offering a higher quality experience and are preferred for more upscale occasions.

Despite their lower market share, bottles play a crucial role in the Vodka Seltzer market, catering to a niche audience looking for premiumization and distinctiveness in their beverage choices. The bottle segment’s presence underscores the market’s diversity, highlighting the importance of offering multiple packaging options to meet varying consumer preferences and occasions.

By Flavor

In 2023, Citrus Flavors asserted its dominance in the Vodka Seltzer market, securing a robust 37.9% share. This sturdy position can be attributed to the convenience and portability that metal cans offer to consumers. The sleek packaging of metal cans not only enhances the product’s aesthetic appeal but also aligns with the on-the-go lifestyle favored by many.

Bottles, while holding a respectable market presence, trailed behind with a market share of 37.7%. Despite the slightly lower share, bottles maintained their significance by catering to consumers who prioritize a more traditional and reusable packaging option. The enduring popularity of bottles underscores the diverse preferences within the Vodka Seltzer market.

This segmentation highlights the dynamic nature of consumer choices, with metal cans emerging as the preferred choice for a majority, while bottles continue to appeal to those who prioritize sustainability and a classic drinking experience. As the market evolves, understanding and catering to these distinct preferences will be pivotal for companies seeking to navigate the competitive landscape and capture the hearts – and taste buds – of their target audience.

By Distribution Channel

In 2023, the On-trade segment flexed its market muscle, securing an impressive 73.3% share in the Vodka Seltzer landscape. This commanding position can be attributed to the vibrant atmosphere and social experiences that bars, pubs, and nightclubs offer, making them favored destinations for consumers seeking a lively and dynamic setting to enjoy their beverages.

Off-trade channels, comprising supermarkets/hypermarkets, licensed shops, and e-commerce, played a significant role but held a collective market share of 26.7%. The convenience of purchasing Vodka Seltzers from the shelves of supermarkets, and licensed shops, and the ease of online ordering contributed to the steady presence of the Off-trade segment.

The dominance of On-trade signifies the enduring appeal of the social aspect of consuming Vodka Seltzers, with consumers valuing the shared experiences facilitated by bars, pubs, and nightclubs. However, the Off-trade channels underline the importance of accessibility and convenience in catering to a broader audience. Recognizing and balancing these preferences is pivotal for market players looking to tap into the diverse consumer landscape and maintain a competitive edge in this effervescent market.

Market Key Segments

By Type

- ABV Less Than 4.6%

- ABV More Than 4.6%

By Packaging

- Metal Cans

- Bottles

By Flavor

- Citrus Flavors

- Berry Flavors

- Tropical Flavors

- Herbal and Botanical Flavors

- Others

By Distribution Channel

- On-trade

- Bars, Pubs, and Nightclubs

- Hotels and Restaurants

- Off-trade

- Supermarkets/Hypermarkets

- Licensed Shops

- E-commerce

Drivers

Changing Consumer Preferences

The Vodka Seltzer market is experiencing a robust surge driven by changing consumer preferences. With a growing focus on healthier lifestyle choices, consumers are increasingly drawn toward lighter and lower-calorie alcoholic beverages.

Vodka Seltzers, with their refreshing taste and relatively lower calorie content compared to traditional cocktails and beers, have become a preferred choice for many health-conscious individuals. This shift in consumer behavior is a key driver propelling the market’s growth, as manufacturers respond to the demand for lighter and more refreshing options.

Convenience and Portability

Another significant driver for the Vodka Seltzer market is the convenience and portability offered by the product. The rise in on-the-go lifestyles and socializing preferences has fueled the demand for ready-to-drink options that can be easily carried and enjoyed in various settings.

Metal cans, in particular, have gained popularity due to their lightweight and durable nature, making them a convenient choice for outdoor activities, parties, and events. This emphasis on convenience aligns with the modern consumer’s desire for hassle-free, portable beverages, contributing substantially to the market’s growth.

Restraints

Stringent Regulations: One of the significant restraints affecting the Vodka Seltzer market is the stringent regulatory landscape governing the production, distribution, and marketing of alcoholic beverages. Compliance with varying regulations across different regions poses challenges for market players, requiring them to navigate a complex web of legal requirements.

This can result in increased costs, delays, and restrictions on certain marketing strategies. Adhering to and understanding the regulatory framework is crucial for companies operating in the market, as failure to do so can hinder their market entry and expansion efforts.

Competition from Alternative Beverages:

The Vodka Seltzer market faces competition from an array of alternative alcoholic beverages, including craft beers, flavored spirits, and ready-to-drink cocktails. The diverse choices available to consumers can pose a restraint on the growth of the Vodka Seltzer market, as individuals may opt for other trendy and innovative options.

Market players must continuously innovate, differentiate their offerings, and effectively communicate the unique selling points of Vodka Seltzers to stay competitive in an environment where consumers have a plethora of beverage options.

Opportunities

Global Market Expansion

An exciting opportunity for the Vodka Seltzer market lies in global expansion. As consumer preferences for lighter and healthier alcoholic beverages become more universal, there is a growing potential to introduce Vodka Seltzers to new markets.

Exploring untapped regions and adapting marketing strategies to resonate with diverse cultural preferences present avenues for market players to broaden their reach and capitalize on the untapped potential of the global market.

Collaborations and Partnerships

Collaborations and partnerships within the beverage industry present an opportunity for market players to enhance their offerings and reach a wider audience. Collaborating with popular bars, restaurants, or even influencers can help create brand awareness and build credibility.

Additionally, partnerships with other beverage companies or flavor specialists can lead to the development of unique and innovative products, providing a competitive edge in the market. Exploring and leveraging strategic alliances can open doors to new opportunities and drive growth in the Vodka Seltzer market.

Trends

Flavor Innovation

A prominent trend shaping the Vodka Seltzer market is the continuous innovation in flavors. Manufacturers are keenly aware of the importance of offering a diverse range of flavors to cater to evolving consumer tastes. From classic citrus and berry blends to exotic and unique flavor combinations, the market is witnessing a proliferation of options.

This trend not only adds excitement to the consumer experience but also allows brands to differentiate themselves in a competitive landscape. The ability to provide a variety of appealing flavors is becoming a crucial factor in attracting and retaining consumers in the Vodka Seltzer market.

Rising E-commerce Sales

The increasing prevalence of e-commerce channels is emerging as a notable trend in the Vodka Seltzer market. With the convenience of online shopping gaining traction, consumers are exploring and purchasing alcoholic beverages through digital platforms. E-commerce offers a wide selection, easy comparison, and doorstep delivery, enhancing the overall consumer experience.

This trend is particularly relevant for the off-trade segment, including supermarkets/hypermarkets and licensed shops, as online platforms provide an additional avenue for reaching a broader customer base. Embracing and optimizing e-commerce channels has become a strategic move for brands seeking to tap into this evolving market trend.

Regional Analysis

The Vodka Seltzer market showcases a predominant presence in the Asia Pacific region, securing the largest market size at 47.6% and anticipating a substantial Compound Annual Growth Rate (CAGR) of 8.1% over the forecast period. The reported demand for Vodka Seltzer in the Asia Pacific region, reaching a value of 847.9 million in 2023, signals a robust market presence and consumer interest. This substantial figure underscores the increasing popularity of Vodka Seltzer in the region.

Key players contributing to the market’s growth include China, India, and Southeast Asian nations such as Korea, Thailand, Malaysia, and Vietnam, where an escalation in polymer production is expected to be the primary impetus behind market expansion throughout the forecast duration.

North America is positioned for economic growth, particularly in the automotive, polymer, and manufacturing sectors, signaling an uptick in demand for Vodka Seltzer products. The region is poised to experience a surge in market demand. Meanwhile, Europe is anticipated to witness substantial growth in the Vodka Seltzer market, driven by robust demand within the textile industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Vodka Seltzer market features several key players who play a pivotal role in shaping and influencing the industry. These companies contribute to market dynamics through product innovation, strategic partnerships, and effective marketing strategies. Here’s a brief analysis of some key players in the Vodka Seltzer market

Market Key Players

- Boston Beer Co. Inc.

- Carlton & United Breweries

- Cutwater Spirits, LLC

- Diageo plc.

- East London Liquor Company Limited

- High Noon Spirits Company

- La Dolce Vita Seltzer

- Mark Anthony Brewing, Inc

- Molson Coors Beverage Company

- Nude Beverages

- Pernod Ricard

- Southern Tier Distilling Company

Report Scope

Report Features Description Market Value (2023) USD 1800.2 Mn Forecast Revenue (2033) USD 5591.1 Mn CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(ABV Less Than 4.6%, ABV More Than 4.6%), By Packaging(Metal Cans, Bottles), By Flavor(Citrus Flavors, Berry Flavors, Tropical Flavors, Herbal and Botanical Flavors, Others), By Distribution Channel(On-trade, Bars, Pubs, and Nightclubs, Hotels and Restaurants, Off-trade, Supermarkets/Hypermarkets, Licensed Shops, E-commerce) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Boston Beer Co. Inc., Carlton & United Breweries, Cutwater Spirits, LLC, Diageo plc., East London Liquor Company Limited, High Noon Spirits Company, La Dolce Vita Seltzer, Mark Anthony Brewing, Inc, Molson Coors Beverage Company, Nude Beverages, Pernod Ricard, Southern Tier Distilling Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Vodka Seltzer Market?Vodka Seltzer Market size is expected to be worth around USD 5591.1 Million by 2033, from USD 1800.2 Million in 2023

Which region dominated the Vodka Seltzer market in 2023?Vodka Seltzer market showcases a predominant presence in the Asia Pacific region, securing the largest market size at 47.6%

What is the CAGR for the vodka seltzer market?The vodka seltzer market expected to grow at a CAGR of 12.0% during 2023-2032.

Who are the key players in the Vodka Seltzer Market?Boston Beer Co. Inc., Carlton & United Breweries, Cutwater Spirits, LLC, Diageo plc., East London Liquor Company Limited, High Noon Spirits Company, La Dolce Vita Seltzer, Mark Anthony Brewing, Inc, Molson Coors Beverage Company, Nude Beverages, Pernod Ricard, Southern Tier Distilling Company

-

-

- Boston Beer Co. Inc.

- Carlton & United Breweries

- Cutwater Spirits, LLC

- Diageo plc.

- East London Liquor Company Limited

- High Noon Spirits Company

- La Dolce Vita Seltzer

- Mark Anthony Brewing, Inc

- Molson Coors Beverage Company

- Nude Beverages

- Pernod Ricard

- Southern Tier Distilling Company