Global Vitamin B Test Market By Product Type (Vitamin B12 Test, Folic Acid (Vitamin B9) Test, and Others), By Application (ELISA, Lateral Flow Assay, and High-performance Liquid Chromatography), By End-user (Hospitals & Clinics, Diagnostic Centers, and Homecare Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170041

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

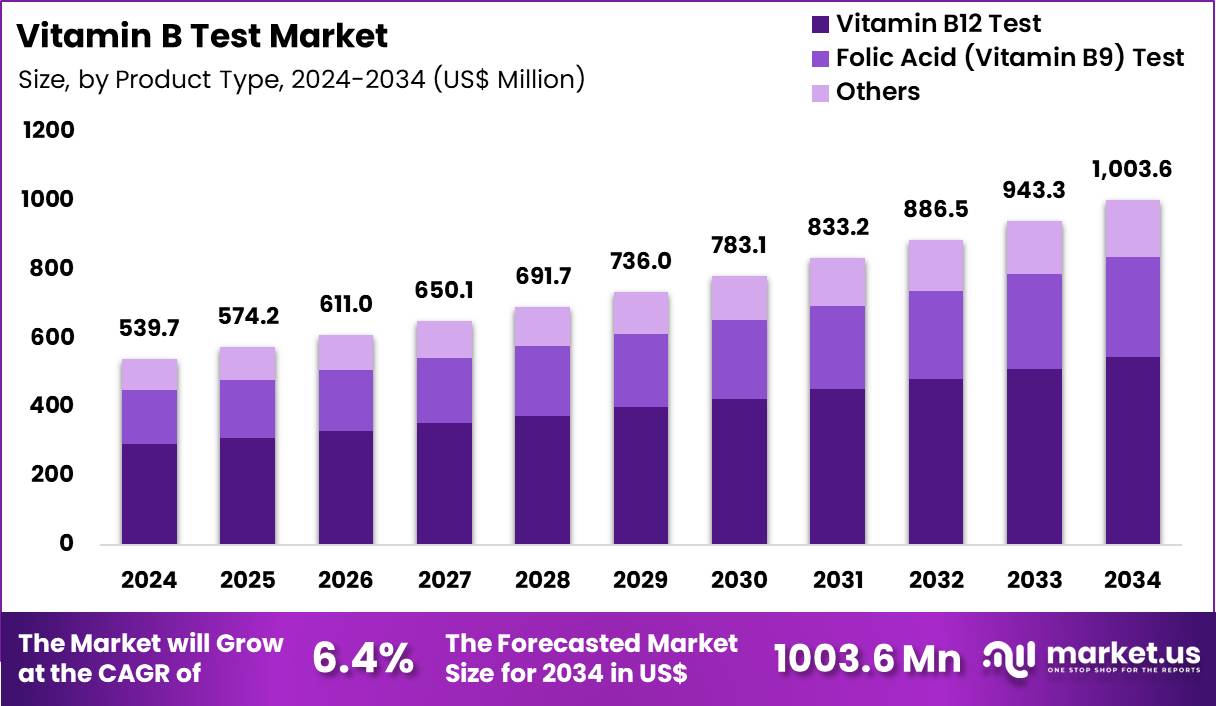

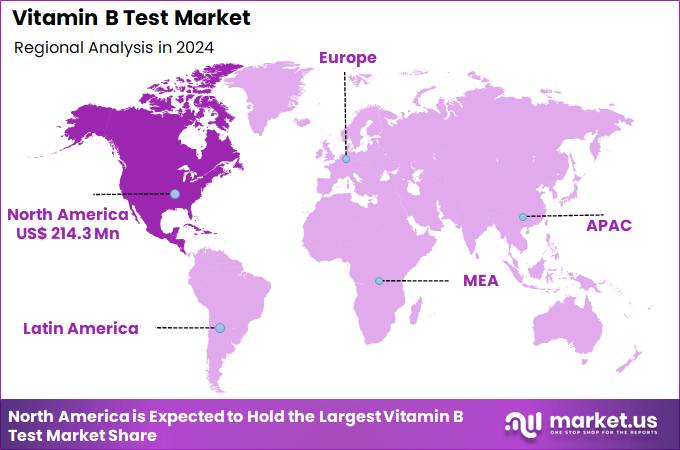

Global Vitamin B Test Market size is expected to be worth around US$ 1003.6 Million by 2034 from US$ 539.7 Million in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 214.3 Million.

Increasing awareness of nutritional deficiencies among healthcare professionals drives the Vitamin B Test market, as clinicians routinely order assays to identify B12 and folate shortfalls that contribute to anemia and fatigue in at-risk populations. Laboratories employ high-performance liquid chromatography and immunoassay kits that deliver precise measurements of serum homocysteine and methylmalonic acid as indirect markers of B-vitamin status.

These tests find applications in prenatal care to monitor folate levels and prevent neural tube defects, geriatric assessments to detect malabsorption-related B12 deficiencies causing cognitive decline, and vegan diet evaluations to address potential B-complex gaps leading to neurological symptoms. Pharmaceutical firms capitalize on this trend by developing multiplex panels that simultaneously quantify multiple B vitamins, enhancing diagnostic efficiency. Clinicians integrate these results into personalized nutrition plans that mitigate risks of peripheral neuropathy from B6 imbalances. This proactive approach strengthens patient outcomes and sustains market momentum through expanded clinical utility.

Growing demand for point-of-care diagnostics accelerates the Vitamin B Test market, as patients and providers favor rapid, on-site results to expedite interventions for conditions like megaloblastic anemia. Diagnostic developers innovate with portable electrochemical sensors and lateral flow devices that analyze whole blood samples for B1, B3, and B7 levels without requiring specialized lab equipment.

Applications extend to gastrointestinal disorder management where tests reveal B-vitamin malabsorption in celiac disease patients, alcohol dependency programs to correct thiamine deficiencies preventing Wernicke’s encephalopathy, and athletic performance optimization by tracking B-complex utilization during intense training. Emerging opportunities arise from collaborations with telemedicine platforms that enable remote interpretation of home-collected samples. Biotechnology companies explore saliva-based assays as non-invasive alternatives for routine B12 monitoring in chronic kidney disease. Such advancements position the market for broader accessibility and foster innovation in user-friendly testing formats.

Rising adoption of artificial intelligence in result analysis invigorates the Vitamin B Test market, as algorithms process complex data sets to predict deficiency risks based on integrated health metrics. Technology providers embed AI into automated analyzers that correlate B-vitamin profiles with electronic health records for holistic insights. These systems support oncology follow-ups where tests monitor B9 depletion from chemotherapy side effects, mental health evaluations linking B6 shortages to depression symptoms, and autoimmune disease tracking to adjust treatments for B-vitamin impacts on immune function.

Recent trends highlight the shift toward sustainable, reagent-free optical detection methods that reduce environmental waste. Research institutions validate these tools against gold-standard mass spectrometry for enhanced accuracy in epidemiological studies. This intelligent evolution drives the market toward predictive healthcare models and amplifies diagnostic precision across diverse therapeutic areas.

Key Takeaways

- In 2024, the market generated a revenue of US$ 539.7 Million, with a CAGR of 6.4%, and is expected to reach US$ 1003.6 Million by the year 2034.

- The product type segment is divided into vitamin b12 test, folic acid (vitamin b9) test; others, with vitamin b12 test taking the lead in 2024 with a market share of 54.3%.

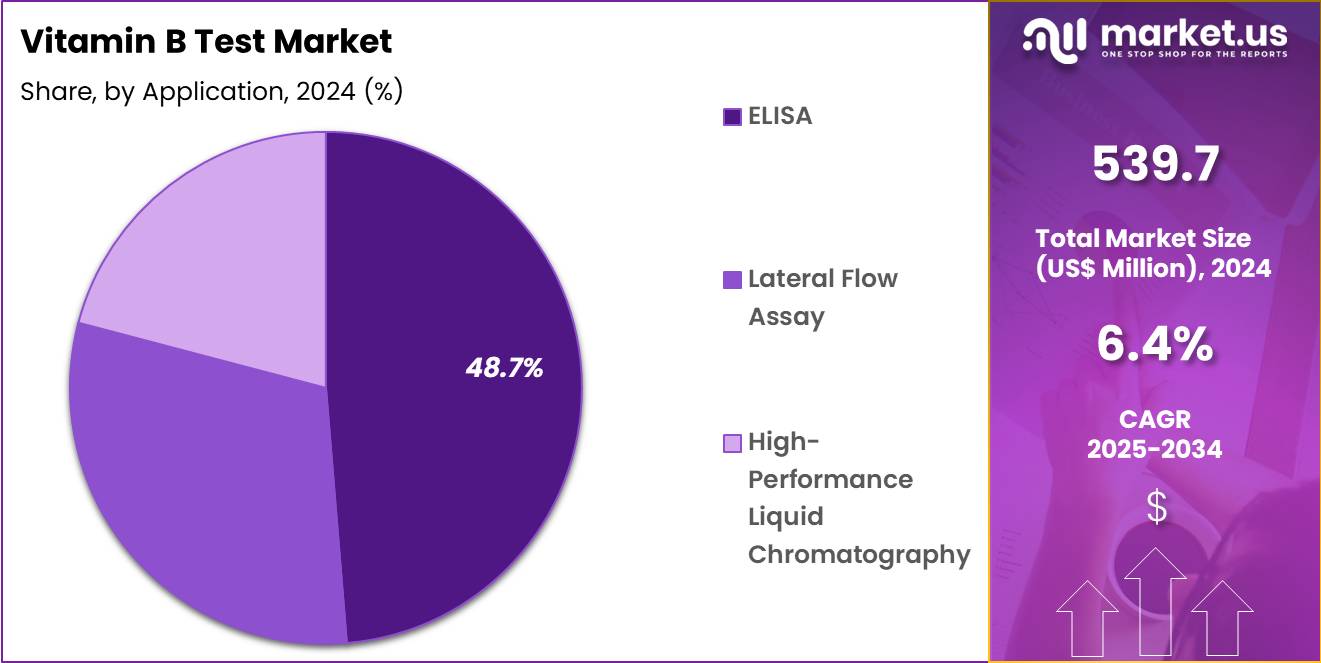

- Considering application, the market is divided into ELISA, lateral flow assay; high-performance liquid chromatography. Among these, ELISA held a significant share of 48.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostic centers; homecare settings. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 52.1% in the market.

- North America led the market by securing a market share of 39.7% in 2024.

Product Type Analysis

Vitamin B12 Test, holding 54.3%, is expected to dominate due to its critical role in diagnosing vitamin B12 deficiency, which is linked to neurological issues, anemia, and cognitive decline. As awareness of the importance of B12 for health increases, particularly in older populations and those with dietary restrictions, the demand for B12 testing continues to rise. Vitamin B12 deficiency is commonly associated with conditions like pernicious anemia, which has prompted healthcare professionals to regularly incorporate B12 testing into routine check-ups.

With growing health concerns around diet-related deficiencies, more patients and healthcare providers are prioritizing B12 testing. Additionally, technological advancements in diagnostic methods are making B12 testing more accessible, affordable, and accurate, further strengthening its demand. These drivers keep Vitamin B12 testing projected to remain the most influential product type in the market.

Application Analysis

ELISA, holding 48.7%, is anticipated to dominate due to its well-established use for high-throughput, sensitive testing in both clinical and research settings. As a reliable method for detecting vitamin B12 and other biomarkers, ELISA supports the high demand for rapid, accurate testing in hospitals, clinics, and diagnostic centers. Its ability to handle large sample volumes with minimal effort and provide reproducible results makes it a preferred choice for diagnostic applications.

The growing adoption of automated ELISA platforms in hospitals and diagnostic labs, along with the increasing prevalence of vitamin deficiencies, fuels the demand for this testing method. Moreover, its cost-effectiveness and adaptability for multiple biomarkers drive its widespread use. These factors keep ELISA anticipated to remain the leading application for vitamin B testing.

End-User Analysis

Hospitals & Clinics, holding 52.1%, are expected to remain the dominant end-user segment due to their central role in diagnosing and managing vitamin B deficiencies, particularly in vulnerable populations. Hospitals conduct a high volume of diagnostic tests, including vitamin B12 and folic acid assays, as part of routine check-ups, especially for patients presenting with neurological symptoms, anemia, or other deficiency-related conditions.

The increasing recognition of the importance of early diagnosis in preventing long-term complications associated with vitamin B deficiencies, such as neurological damage, strengthens the demand for these tests in clinical settings. Furthermore, hospitals have the infrastructure to support advanced diagnostic technologies and high-throughput testing, which boosts the adoption of vitamin B testing. With a growing focus on preventive healthcare and wellness, hospitals are projected to remain the leading end-users in the vitamin B test market.

Key Market Segments

By Product Type

- Vitamin B12 Test

- Folic Acid (Vitamin B9) Test

- Others

By Application

- ELISA

- Lateral Flow Assay

- High-performance Liquid Chromatography

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Homecare Settings

Drivers

The Growing Awareness of Vitamin B12 Deficiency in At-Risk Populations Is Driving the Market

The growing awareness of vitamin B12 deficiency in at-risk populations has emerged as a major driver for the vitamin B test market, as healthcare providers prioritize early detection to prevent neurological and hematological complications. This heightened focus stems from educational campaigns highlighting symptoms like fatigue and cognitive impairment, prompting more routine screenings in primary care. Older adults, pregnant women, and those with gastrointestinal disorders represent key groups where deficiency risks are elevated, leading to increased test orders.

The National Institutes of Health reports that, based on NHANES data from 2017–March 2020, 11% of women had vitamin B12 intakes from food and beverages below the Estimated Average Requirement of 2 mcg daily, underscoring dietary gaps that fuel demand for confirmatory diagnostics. Such statistics encourage integration of B12 assays into wellness panels, expanding market reach beyond symptomatic cases.

Pharmaceutical companies like Roche Diagnostics are capitalizing by developing user-friendly kits compatible with automated analyzers. Public health initiatives, including those from the CDC, emphasize the role of testing in managing chronic conditions like diabetes, where metformin use correlates with lower B12 levels. This driver also stimulates research into multiplex assays that simultaneously evaluate multiple B vitamins, enhancing efficiency. As telemedicine platforms incorporate virtual lab requisitions, accessibility improves, further accelerating adoption. Overall, this awareness transforms vitamin B testing from reactive to preventive, solidifying its market foundation.

Restraints

Limited Reimbursement for Routine Vitamin B Screening Is Restraining the Market

Limited reimbursement for routine vitamin B screening continues to restrain the vitamin B test market by discouraging widespread implementation in asymptomatic individuals. Payers often restrict coverage to cases with documented symptoms or high-risk indicators, leaving preventive testing underutilized despite potential long-term savings. This policy gap disproportionately affects low-income groups reliant on public insurance, where out-of-pocket expenses deter participation.

Medicare Part B covers vitamin B12 testing only when medically necessary, such as for pernicious anemia diagnosis, but excludes broad population screening. The Centers for Medicare & Medicaid Services’ fee schedule for 2023 lists the clinical laboratory fee for vitamin B12 assay at approximately $11.50, yet copays and deductibles add barriers for beneficiaries. Such constraints slow innovation in low-cost formats, as developers prioritize reimbursed applications.

Disparities in access exacerbate health inequities, with rural clinics less likely to stock advanced testing due to uncertain recovery. Educational efforts to advocate for expanded coverage face resistance amid rising healthcare costs. Consequently, market growth lags in non-acute settings, limiting scalability. Bridging this restraint requires policy reforms to recognize screening’s value in averting costly complications.

Opportunities

Advancements in Point-of-Care Vitamin B12 Assays Are Creating Growth Opportunities

Advancements in point-of-care vitamin B12 assays are creating robust growth opportunities by enabling rapid, on-site diagnostics that streamline patient management in diverse settings. These portable platforms reduce reliance on centralized labs, minimizing delays in treatment initiation for deficiency-related disorders.

Integration of chemiluminescent immunoassay technology allows for high-sensitivity detection using minimal sample volumes, ideal for ambulatory and remote care. Developers like bioMérieux have introduced the VIDAS Vitamin B12 Total assay, receiving CE-marking in 2024 for enhanced accuracy in total cobalamin measurement. This innovation supports same-day results, improving compliance in chronic disease monitoring programs. Opportunities extend to partnerships with telehealth providers, where POC results can inform immediate supplementation advice.

Emerging economies benefit from cost-effective cartridges that align with global health equity goals. Validation studies confirm correlation coefficients exceeding 0.95 with reference methods, bolstering clinician trust. As regulatory approvals proliferate, scalability in pharmacies and community health centers rises. These developments position POC assays as pivotal for expanding access and driving market diversification.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and expanding healthcare budgets energize the vitamin B test market, as consumers and clinics prioritize quick diagnostics for deficiencies tied to diet, stress, and chronic conditions in bustling urban areas. Inflation, however, spikes prices for specialized enzymes and substrates, which forces manufacturers to pass on higher costs and curbs uptake among budget-strapped patients in rural settings.

Geopolitical strains, notably U.S.-China trade clashes, sever supply lines for critical reagents from Asia, which prolongs testing delays and swells operational burdens for international distributors. These strains, in a silver lining, galvanize Europe and Southeast Asia to ramp up domestic biotech hubs, which unleashes collaborative innovations and fortifies against global bottlenecks.

Current U.S. tariffs, with a 10% universal levy on imports and up to 54% on Chinese diagnostic kits since April 2025, burden smaller labs with elevated expenses and squeeze margins for U.S.-based providers. Yet, these tariffs spur American companies to localize assembly and R&D, which generates jobs and shields the supply chain from overseas turbulence. Despite such pressures, heightened wellness trends and streamlined point-of-care technologies drive the vitamin B test market toward steady advancement and broader preventive health benefits.

Latest Trends

The CE-Marking of the VIDAS Vitamin B12 Total Assay in 2024 Is a Recent Trend

The CE-marking of the VIDAS Vitamin B12 Total assay by bioMérieux in 2024 marks a notable recent trend toward automated, high-throughput vitamin B testing solutions. This approval validates the assay’s performance for quantitative determination of total vitamin B12 in human serum or plasma, facilitating efficient laboratory workflows. The system delivers results in under 45 minutes, addressing bottlenecks in high-volume diagnostics.

Commercial rollout commenced in select European markets by late 2024, with U.S. expansion planned for early 2025 pending FDA review. This trend reflects broader industry shifts toward consolidated platforms that minimize manual intervention and error risks. Key features include a broad measuring range of 50–2000 pg/mL, ensuring versatility across deficiency severities. Early adopters report improved turnaround times, enhancing patient throughput in outpatient settings.

The assay’s alignment with international standards supports global harmonization of B12 reference intervals. As similar technologies emerge, competition intensifies, spurring further refinements in precision and integration with lab information systems. In summary, this 2024 milestone underscores the pivot to streamlined, reliable testing amid rising deficiency concerns.

Regional Analysis

North America is leading the Vitamin B Test Market

North America accounted for 39.7% of the overall market in 2024, and the region saw significant growth as the prevalence of vitamin B deficiencies in high-risk populations, such as the elderly, pregnant women, and those with chronic illnesses, increased. Healthcare providers expanded screening for deficiencies in vitamin B12 and folate to address rising concerns related to neurological health, fatigue, anemia, and cognitive function.

The growing adoption of personalized medicine encouraged clinicians to test vitamin B levels as part of comprehensive metabolic health assessments. The Centers for Disease Control and Prevention (CDC) estimated that 6 million people in the U.S. suffer from vitamin B12 deficiency, contributing to a significant demand for diagnostic tests in 2022 (CDC – “Vitamin B12 Deficiency: Data and Trends 2022”).

Increased awareness about the impact of vitamin B deficiencies on overall well-being also drove consumer demand for at-home testing kits. As clinical practices embraced more efficient testing methods, these factors collectively supported robust growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as healthcare systems increase focus on vitamin B deficiencies, particularly in countries with high rates of malnutrition, vegetarian populations, and increased consumption of processed foods. Hospitals and clinics expand testing services for vitamin B12 and folate levels to address rising cases of anemia, fatigue, and cognitive decline. Public health programs emphasize early detection and treatment to combat neurological disorders linked to vitamin B deficiencies.

The World Health Organization (WHO) reported that more than 1 billion people in Asia-Pacific are at risk for vitamin B12 deficiency due to dietary factors and absorption issues in 2023 (WHO – “Global Nutritional Deficiencies Report 2023”), highlighting the urgent need for better diagnostic coverage. Increased health awareness and access to testing facilities will likely propel market expansion in the region. These efforts contribute to the anticipated growth in the vitamin B test market across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms in the vitamin‑B diagnostics space pursue growth by expanding test panels to cover multiple B‑vitamins (such as B12, B9, B6), offering both single‑vitamin assays and comprehensive B‑complex screens to meet varied clinical and preventive‑health needs. They enhance lab efficiency by developing high‑throughput immunoassays and automated analyzers that deliver faster turnaround and consistent result quality.

They push geographic expansion by partnering with diagnostic labs and distributors in emerging regions and tailoring service offerings to local dietary patterns and deficiency risks. They invest in consumer awareness and preventive‑health campaigns to educate physicians and individuals about risks of vitamin‑B deficiencies, thereby increasing demand for screening services. They broaden access by offering direct‑to‑consumer or home‑sample‑collection options alongside standard clinical lab testing to attract non‑hospital segments.

One major player, Quest Diagnostics Incorporated, operates a large network of laboratories across the Americas, provides broad vitamin‑diagnostic services including full B‑vitamin panels, and leverages its infrastructure and brand recognition to deliver reliable and widely accessible vitamin‑status testing services.

Top Key Players

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

- Bio‑Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Beckman Coulter, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- In August 2024, LycoRed released a new range of Vitamin B12 products that use an advanced tablet process in which the vitamin is chemically attached to an ion-exchange resin. This approach helps shield B12 from breaking down, improving its stability throughout storage and use.

- In February 2024, Lupin Limited introduced its FDA-approved Cyanocobalamin Nasal Spray (500 mcg) to the U.S. market. Although the product is therapeutic, its use depends on prior B12 level assessment, reflecting the broader trend toward easier access to vitamin-based treatments and diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 539.7 Million Forecast Revenue (2034) US$ 1003.6 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamin B12 Test, Folic Acid (Vitamin B9) Test, and Others), By Application (ELISA, Lateral Flow Assay, and High-performance Liquid Chromatography), By End-user (Hospitals & Clinics, Diagnostic Centers, and Homecare Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Inc., Bio‑Rad Laboratories, Inc., DiaSorin S.p.A., Beckman Coulter, Inc., Ortho Clinical Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

- Bio‑Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Beckman Coulter, Inc.

- Ortho Clinical Diagnostics