Global Vinyl Acetate Monomer Market Size, Share, And Business Benefits By Purity (99% and Above, Less Than 99%), By Application (Polyvinyl Alcohol, Polyvinyl Acetate, Ethylene Vinyl Acetate, Others), By End-use (Packaging, Construction, Textile, Adhesives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151907

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

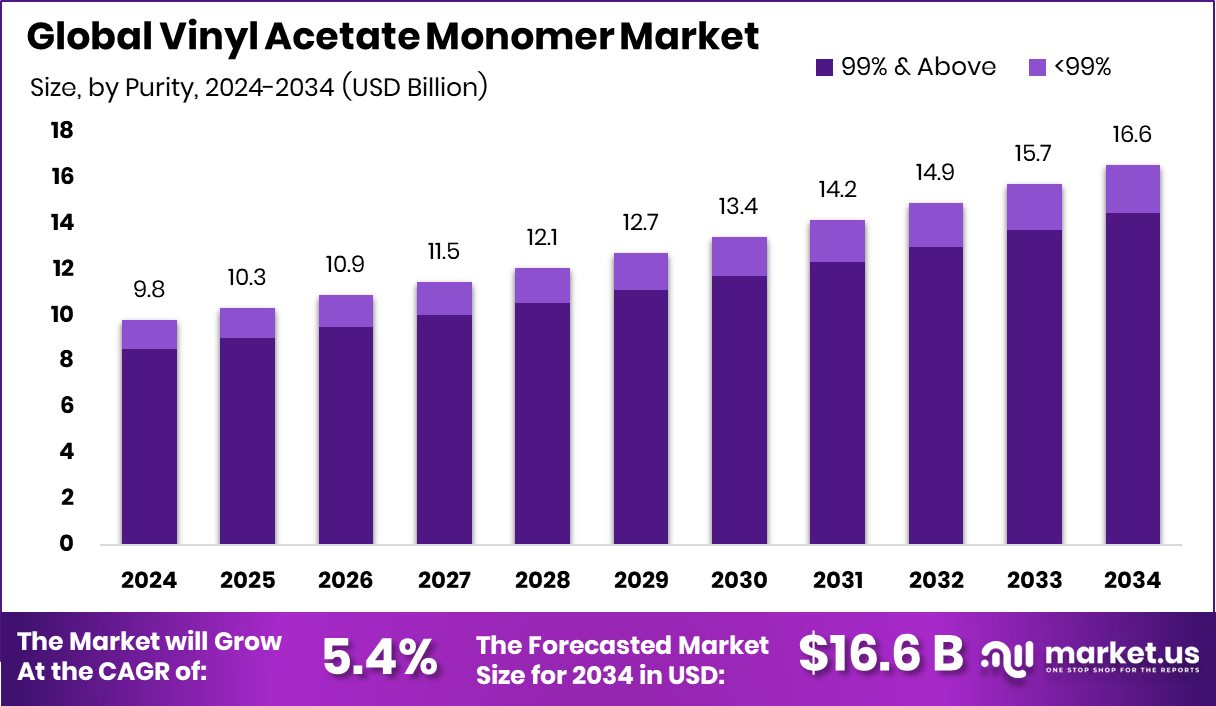

Global Vinyl Acetate Monomer Market is expected to be worth around USD 16.6 billion by 2034, up from USD 9.8 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. Strong industrial demand in North America supported the 38.10% market share growth.

Vinyl Acetate Monomer (VAM) is an industrial chemical compound primarily used as a key intermediate in the production of various polymers and resins. It is synthesized by the reaction of ethylene, acetic acid, and oxygen in the presence of a palladium catalyst. VAM serves as a building block for manufacturing products such as polyvinyl acetate (PVA), polyvinyl alcohol (PVOH), ethylene vinyl acetate (EVA), and vinyl acrylic copolymers. These derivatives are widely used in adhesives, paints, coatings, textiles, packaging films, and construction materials due to their flexibility, strong bonding properties, and moisture resistance.

The Vinyl Acetate Monomer market is gaining momentum, driven by rising demand from downstream industries such as packaging, construction, and textiles. As economies grow and industrial production rises, the consumption of VAM-based adhesives and coatings also increases. Its vital role in improving product performance and durability makes it an essential component in many industrial applications.

Growth factors include increasing demand for environment-friendly and water-based adhesives and coatings. VAM’s compatibility with low-VOC formulations makes it suitable for sustainable manufacturing, which is becoming a priority for many end-user industries. Additionally, infrastructural projects and urbanization in Asia-Pacific and Latin America are boosting consumption of VAM-based construction products.

Demand is strongly supported by the packaging sector, especially flexible packaging. The food and beverage industry, which relies heavily on safe, lightweight, and protective packaging solutions, continues to generate steady consumption of VAM. The shift from rigid to flexible packaging in consumer goods further accelerates demand growth.

Key Takeaways

- Global Vinyl Acetate Monomer Market is expected to be worth around USD 16.6 billion by 2034, up from USD 9.8 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- In the Vinyl Acetate Monomer market, 99% and above purity accounted for 87.2% share.

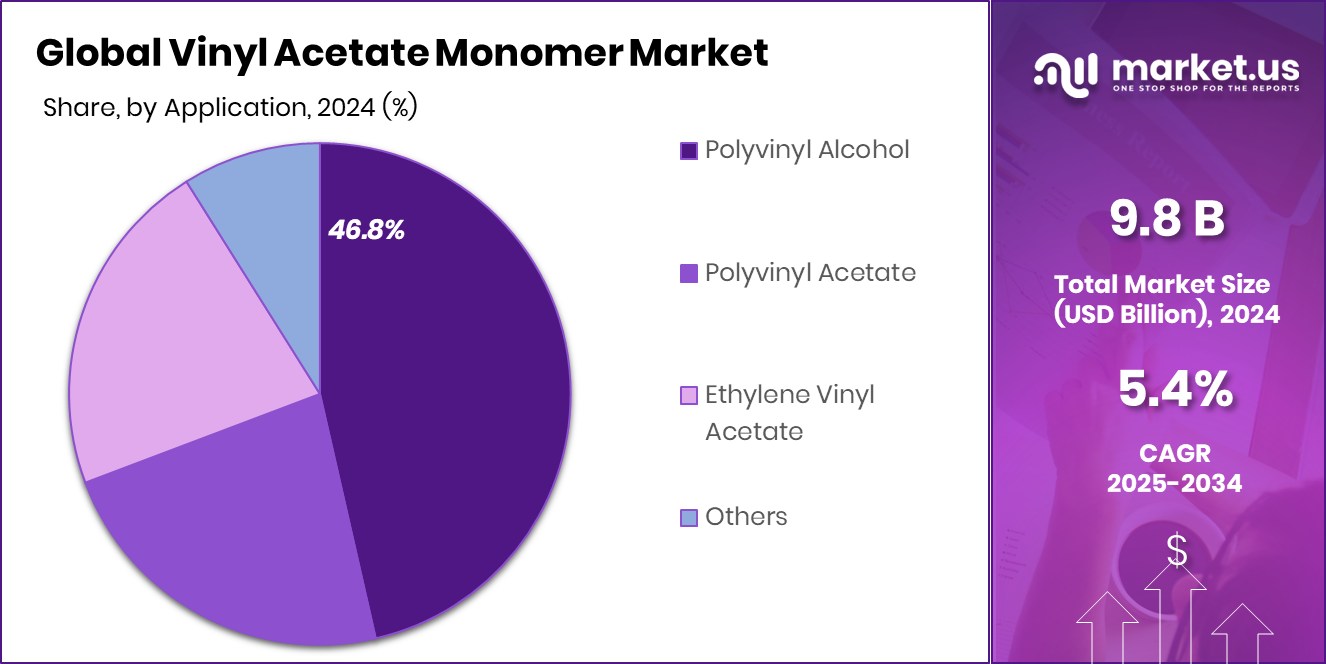

- Polyvinyl alcohol led the application segment in the Vinyl Acetate Monomer market with 46.8% contribution.

- The packaging industry dominated end-use in the Vinyl Acetate Monomer market, holding a 38.7% market share.

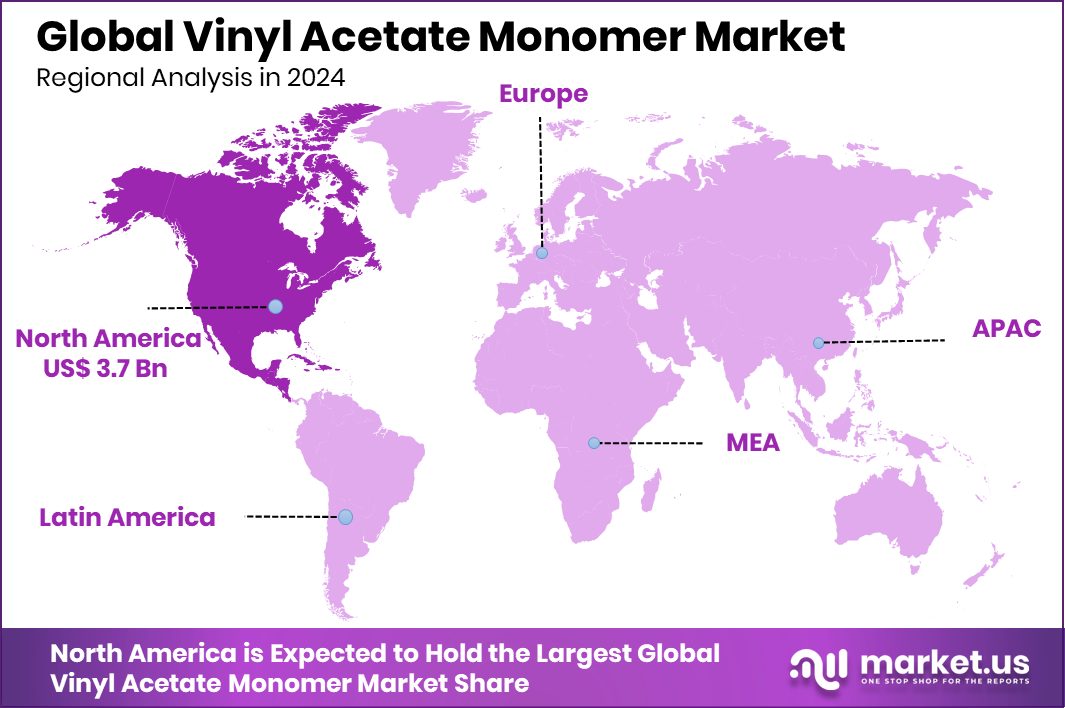

- The North American market value reached approximately USD 3.7 billion during the same year.

By Purity Analysis

Vinyl Acetate Monomer with 99% purity dominates, holding 87.2% market share.

In 2024, 99% and Above held a dominant market position in the By Purity segment of the Vinyl Acetate Monomer (VAM) Market, accounting for an impressive 87.2% share. This high-purity grade is widely preferred across end-use industries due to its superior quality, reliability, and consistent performance in polymer production.

The dominance of this segment is primarily driven by the increasing industrial demand for premium-grade monomers used in critical applications such as adhesives, coatings, and high-performance films. Industries focusing on precise formulation standards and product consistency continue to choose 99% and above purity VAM to ensure minimal impurities and stable chemical behavior during polymerization processes.

Moreover, manufacturers of water-based adhesives and environmentally friendly emulsions favor high-purity VAM to meet regulatory and quality benchmarks. The continued shift toward advanced material development, especially in packaging and construction sectors, reinforces the preference for this grade, ensuring high bonding strength, improved durability, and enhanced end-product performance.

With growing quality requirements across industries, the 99% and above purity category is expected to maintain its stronghold in the market. The segment’s overwhelming share highlights its essential role in meeting stringent product specifications, particularly in fast-growing applications where product uniformity and purity are non-negotiable.

By Application Analysis

Polyvinyl alcohol leads application usage, accounting for 46.8% in global demand.

In 2024, Polyvinyl Alcohol held a dominant market position in the By Application segment of the Vinyl Acetate Monomer (VAM) Market, capturing a substantial 46.8% share. This strong position can be attributed to the extensive use of polyvinyl alcohol in various end-use sectors such as adhesives, textiles, packaging, and paper processing. As a key downstream product of vinyl acetate monomer, polyvinyl alcohol is known for its excellent film-forming, emulsifying, and adhesive properties, along with its high water solubility and biodegradability.

The segment’s dominance is further reinforced by the rising preference for sustainable and water-based materials, particularly in packaging and construction applications, where polyvinyl alcohol contributes to environmental compliance and product performance. Its utility in producing specialty films, emulsions, and coatings also supports this leadership position. The increased demand for biodegradable and low-toxicity polymers aligns well with the characteristics of polyvinyl alcohol, driving its widespread adoption in both industrial and consumer goods manufacturing.

With its high-performance profile and versatile functionality, the Polyvinyl Alcohol application segment continues to play a central role in the vinyl acetate monomer value chain. The 46.8% market share in 2024 reflects its critical importance and expanding use across industries requiring reliable, efficient, and eco-friendly polymer solutions.

By End-use Analysis

The packaging sector drives end-use demand, capturing 38.7% share in consumption.

In 2024, Packaging held a dominant market position in the by-end-use segment of the Vinyl Acetate Monomer (VAM) Market, with a notable 38.7% share. This leadership is primarily supported by the growing demand for flexible and durable packaging solutions across industries such as food and beverage, pharmaceuticals, and personal care. Vinyl acetate monomer plays a crucial role in producing packaging films and adhesives that offer strength, flexibility, and excellent sealing properties—attributes essential for maintaining product integrity and extending shelf life.

The prominence of the packaging segment is further driven by consumer preferences shifting toward lightweight, protective, and environmentally conscious materials. VAM-based polymers, such as polyvinyl alcohol and ethylene-vinyl acetate, are extensively used in packaging applications due to their clarity, barrier performance, and compatibility with food-grade standards. With the global emphasis on hygiene, shelf-life stability, and convenience, the demand for innovative packaging formats continues to rise, positioning VAM as a key raw material.

The 38.7% share underscores the critical role of packaging in driving vinyl acetate monomer consumption. As packaging requirements become more advanced and sustainability-focused, VAM’s relevance in producing high-performance packaging materials ensures its continued importance in this dominant end-use segment.

Key Market Segments

By Purity

- 99% and Above

- <99%

By Application

- Polyvinyl Alcohol

- Polyvinyl Acetate

- Ethylene Vinyl Acetate

- Others

By End-use

- Packaging

- Construction

- Textile

- Adhesives

- Others

Driving Factors

Growing Demand for Water-Based Adhesives and Coatings

One of the main driving factors for the Vinyl Acetate Monomer (VAM) market is the rising demand for water-based adhesives and coatings. These products are widely used in packaging, construction, textiles, and automotive industries due to their strong bonding strength, low toxicity, and eco-friendly properties. Vinyl acetate monomer is a key ingredient in making such adhesives and coatings, especially polyvinyl acetate and its derivatives.

As industries move away from solvent-based solutions to comply with environmental regulations, water-based systems are becoming the preferred choice. This shift is creating steady demand for VAM. Moreover, increasing awareness about indoor air quality and sustainability is pushing manufacturers to adopt safer, low-VOC products, further supporting market growth for VAM-based formulations.

Restraining Factors

Fluctuating Raw Material Prices Impact Production Costs

A key restraining factor in the Vinyl Acetate Monomer (VAM) market is the fluctuating prices of raw materials such as ethylene and acetic acid. These materials are essential in the production of VAM, and any instability in their supply or pricing can directly affect manufacturing costs. Since ethylene is derived from crude oil, global oil price volatility often leads to uncertainty in VAM production expenses.

Additionally, geopolitical tensions, supply chain disruptions, and inflation can further increase raw material costs. This makes it difficult for producers to maintain stable pricing and profitability. As a result, manufacturers may face pressure on margins, and end-users could see higher product costs, reducing demand in price-sensitive industries and slowing overall market growth.

Growth Opportunity

Rising Focus on Sustainable Packaging Materials Worldwide

A major growth opportunity in the Vinyl Acetate Monomer (VAM) market lies in the increasing global demand for sustainable packaging solutions. With governments and industries pushing for eco-friendly alternatives to traditional plastics, VAM-based polymers like polyvinyl alcohol and ethylene-vinyl acetate are gaining attention for their biodegradable and recyclable properties.

These materials are ideal for producing flexible films, adhesives, and coatings that meet modern environmental standards. As consumers and companies prioritize green packaging to reduce plastic waste and carbon footprints, the need for high-performance, sustainable polymers is expected to rise. This trend opens new doors for VAM applications in packaging, especially in food, healthcare, and personal care sectors, where safety, durability, and sustainability are essential.

Latest Trends

Shift Toward Bio-Based Vinyl Acetate Production

One of the latest trends in the Vinyl Acetate Monomer (VAM) market is the shift toward bio-based production methods. With growing environmental concerns and stricter regulations on emissions, manufacturers are exploring renewable raw materials to produce VAM more sustainably. Instead of relying only on petroleum-based sources like ethylene, companies are developing technologies that use bio-ethanol and bio-acetic acid as feedstocks.

This approach helps reduce the carbon footprint and supports circular economy goals. Bio-based VAM also appeals to industries looking to make their supply chains more eco-friendly. As demand rises for green chemicals and cleaner processes, this trend is gaining momentum and could play a key role in shaping the future of VAM manufacturing and global adoption.

Regional Analysis

In 2024, North America dominated the market with a 38.10% share overall.

In 2024, North America emerged as the leading region in the Vinyl Acetate Monomer (VAM) market, accounting for the highest 38.10% share and reaching a market value of USD 3.7 billion. The region’s dominance is supported by well-established end-use industries such as packaging, construction, and adhesives, along with strong demand for water-based polymers and resins. North America’s focus on environmentally friendly materials and technological advancements in polymer processing continues to drive VAM consumption across the region.

Europe, Asia Pacific, the Middle East & Africa, and Latin America also contribute to the global VAM market, supported by infrastructure development, increasing industrial output, and rising demand for flexible packaging and coatings. While specific values for these regions are not provided, they remain vital to the overall market structure.

Asia Pacific, in particular, shows promising potential due to growing urbanization and manufacturing capacity. Europe continues to adopt eco-compliant materials, while the Middle East & Africa and Latin America experience gradual growth driven by local production and consumer goods expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arkema maintained its position through advanced technology integration in VAM production. The company’s investment in process optimization and catalyst development resulted in improved yield efficiency and cost control. This technological edge enabled Arkema to serve high-end applications in coatings and adhesives, sustaining its competitive advantage.

Celanese Corporation, with its robust global manufacturing footprint, delivered a stable supply to key regional markets. Its strategic alignment with the packaging and construction sectors allowed Celanese to capitalize on continuous polymer demand. The company’s operational flexibility in feedstock sourcing helped mitigate raw material volatility, ensuring price competitiveness.

Chang Chun Group showed strong performance in the Asia Pacific region. Leveraging its local production capacity, the company captured regional growth driven by urbanization and industrial expansion. Chang Chun’s integrated approach—linking VAM output to downstream polyvinyl alcohol and EVA production—enhanced value chain control and increased product differentiation in specialty segments.

DCC, while smaller in scale compared to other players, focused on niche markets and specialized distribution channels. The company’s agility allowed it to address specific customer segments with tailored VAM-grade solutions. This approach supported its steady growth and positioned DCC as a reliable regional supplier, especially in markets seeking alternative sourcing options.

Top Key Players in the Market

- Arkema

- Celanese Corporation

- Chang Chun Group

- DCC

- Dow Chemical

- Exxon Mobil Corporation

- Innospec

- Japan VAM & Poval Co Ltd

- Kuraray Co Ltd

- LyondellBasell Industries N.V.

- Sinopec China Petrochemical Corporation

- Sipchem

- Solventis

- Wacker Chemie AG

Recent Developments

- In March 2025, Arkema announced the first phase of a large-scale project at its Carling site in France—a €130 million investment to add a purification unit (initially for acrylic acid) that will improve energy efficiency by 25% and reduce carbon intensity by 20%.

- In June 2024, Celanese lifted the force majeure previously declared on acetic acid and vinyl acetate monomer in the Western Hemisphere. The company had initially declared the force majeure earlier in the year after disruptions at feedstock suppliers. Resumption of normal VAM supply helped stabilize deliveries to key customers.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Billion Forecast Revenue (2034) USD 16.6 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (99% and Above, <99%), By Application (Polyvinyl Alcohol, Polyvinyl Acetate, Ethylene Vinyl Acetate, Others), By End-use (Packaging, Construction, Textile, Adhesives, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Celanese Corporation, Chang Chun Group, DCC, Dow Chemical, Exxon Mobil Corporation, Innospec, Japan VAM & Poval Co Ltd, Kuraray Co Ltd, LyondellBasell Industries N.V., Sinopec China Petrochemical Corporation, Sipchem, Solventis, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vinyl Acetate Monomer MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Vinyl Acetate Monomer MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema

- Celanese Corporation

- Chang Chun Group

- DCC

- Dow Chemical

- Exxon Mobil Corporation

- Innospec

- Japan VAM & Poval Co Ltd

- Kuraray Co Ltd

- LyondellBasell Industries N.V.

- Sinopec China Petrochemical Corporation

- Sipchem

- Solventis

- Wacker Chemie AG