Global Vintage Guitars Market Size, Share, Growth Analysis By Type (Electric Guitars, Acoustic Guitars, Rare Collectibles, Custom Guitars, Classical Guitars), By Application (Musicians, Collectors, Music Schools, Retailers, Hobbyists) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173121

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

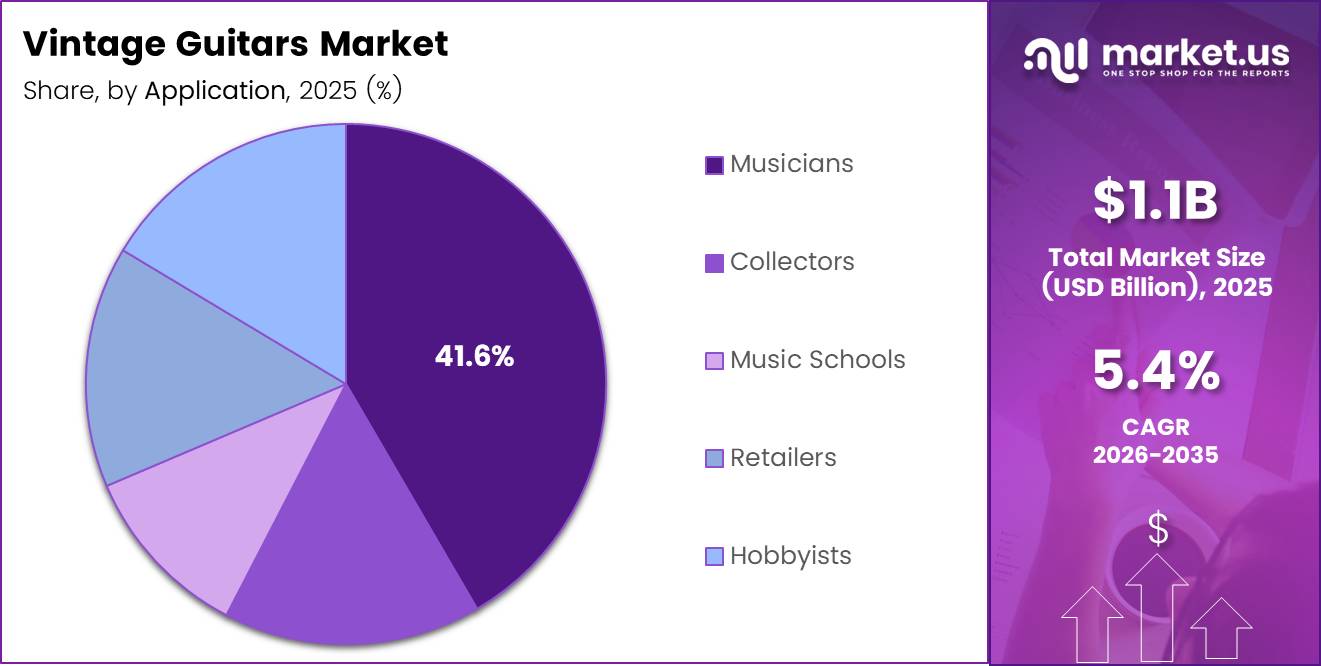

The global Vintage Guitars Market size is expected to reach around USD 1.9 Billion by 2035 from USD 1.1 Billion in 2025, growing at a CAGR of 5.4% during the forecast period 2026 to 2035. This specialized segment represents instruments typically manufactured before 1980, valued for historical significance, craftsmanship quality, and tonal characteristics.

Vintage guitars encompass pre-owned instruments from iconic manufacturers that have gained value through age, rarity, and cultural significance. The market serves diverse stakeholders including professional musicians, high-net-worth collectors, investment funds, and educational institutions. These instruments represent both functional musical tools and appreciating alternative assets.

Market growth stems from multiple converging factors driving sustained demand. The classic rock and blues revival has intensified nostalgia-driven purchases among aging demographics. Meanwhile, professional musicians increasingly seek authentic analog sound qualities that modern production techniques cannot replicate. Investment diversification strategies among wealth managers have positioned vintage instruments as tangible assets with proven appreciation potential.

Supply constraints significantly influence market dynamics and pricing trajectories. Pre-1970 handcrafted instruments from legendary luthiers face inherent scarcity as production volumes were limited. Natural attrition through damage, modification, or loss continuously reduces available inventory. This supply-demand imbalance creates upward price pressure, particularly for iconic models with documented provenance.

Digital transformation is reshaping authentication and transaction processes across the market. Blockchain-based certification systems now provide immutable provenance records, addressing long-standing counterfeit concerns. Online marketplaces with verification protocols have expanded buyer access beyond traditional auction houses. These technological advances enhance market transparency while reducing information asymmetries between sellers and buyers.

Regulatory frameworks vary significantly across jurisdictions, affecting cross-border transactions and import duties. CITES regulations govern instruments containing protected materials like Brazilian rosewood, requiring proper documentation. Export restrictions from certain countries protect cultural heritage, particularly for historically significant instruments. Insurance requirements and authentication standards continue evolving as market values escalate.

According to GuitarWorld, Kurt Cobain’s 1959 Martin D-18E acoustic guitar sold for over $6,010,000 at auction, demonstrating extraordinary price potential for artist-associated instruments. Meanwhile, Reverb Price Index data indicates used electric guitar prices settled approximately 10% cheaper than pandemic peaks by early 2025, reflecting market normalization after speculation-driven volatility.

Key Takeaways

- Global Vintage Guitars Market projected to grow from USD 1.1 Billion in 2025 to USD 1.9 Billion by 2035 at 5.4% CAGR

- Electric Guitars segment dominates with 44.8% market share in Type analysis

- Musicians application segment leads with 41.6% market share

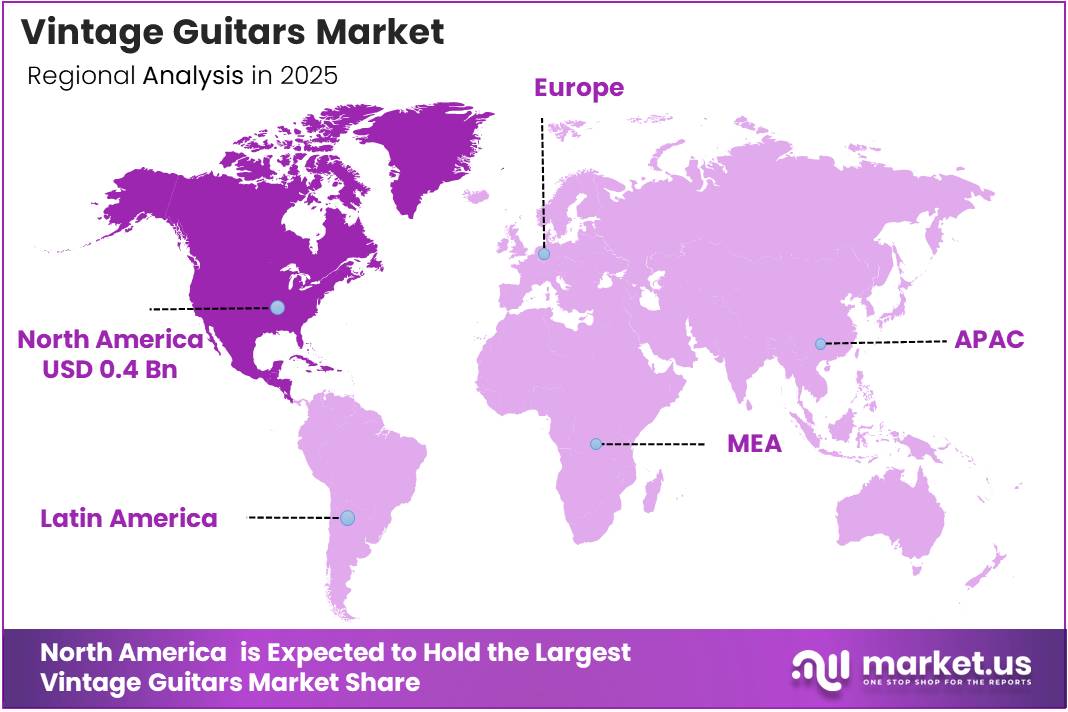

- North America holds dominant regional position with 39.20% share valued at USD 0.4 Billion

- Kurt Cobain’s guitar achieved record $6,010,000 auction price demonstrating investment potential

- Used electric guitar prices declined 10% from pandemic peaks by early 2025

Type Analysis

Electric Guitars dominate with 44.8% due to iconic brand heritage and sustained collector demand.

In 2025, Electric Guitars held a dominant market position in the By Type segment of Vintage Guitars Market, with a 44.8% share. This leadership reflects enduring demand for iconic models from Fender, Gibson, and other legendary manufacturers. Professional guitarists value electric vintage instruments for distinctive tonal qualities that modern equivalents cannot replicate. Investment collectors target limited-production models from the 1950s and 1960s golden era.

Acoustic Guitars represent the second-largest segment, attracting folk, country, and fingerstyle musicians seeking warm, resonant tones. Pre-war Martin and Gibson acoustics command premium prices due to superior tonewood quality and craftsmanship. This segment benefits from crossover appeal among both players and collectors. Authentication is generally simpler than electric guitars due to fewer electronic components.

Rare Collectibles encompass limited-edition models, prototypes, and historically significant instruments with documented provenance. These pieces often appear at major auction houses rather than retail channels. Buyers include museums, private collectors, and investment funds seeking trophy assets. Price appreciation in this subsegment significantly outpaces standard vintage instruments.

Custom Guitars feature unique specifications, artist signatures, or bespoke modifications that enhance desirability. Stage-played instruments from legendary performers command substantial premiums over standard models. Verification of authenticity and usage history critically impacts valuation. This segment attracts serious collectors willing to pay for documented celebrity connections.

Classical Guitars appeal to niche audiences including flamenco specialists and formal classical musicians. Handcrafted Spanish instruments from renowned luthiers hold strong value retention. This segment experiences steadier demand patterns with less speculative volatility compared to electric guitars. Market participation includes conservatories, professional performers, and dedicated classical guitar enthusiasts.

Application Analysis

Musicians dominate with 41.6% as professional players prioritize authentic vintage tone and playability.

In 2025, Musicians held a dominant market position in the By Application segment of Vintage Guitars Market, with a 41.6% share. Professional and touring artists actively purchase vintage instruments for recording and performance purposes. These buyers prioritize playability, tonal characteristics, and stage presence over investment returns. Established musicians often maintain diverse collections spanning multiple eras and manufacturers.

Collectors represent sophisticated buyers focused primarily on appreciation potential and portfolio diversification. This segment includes high-net-worth individuals, family offices, and specialized investment funds. Authentication, provenance documentation, and condition assessment drive purchasing decisions. Collectors typically maintain climate-controlled storage and rarely play acquired instruments.

Music Schools acquire vintage instruments for educational purposes, providing students access to historically significant examples. Institutions value these guitars as teaching tools demonstrating evolution of design and sound. Budget constraints limit purchases to mid-tier vintage pieces rather than premium collectibles. Educational buyers prioritize playable condition over pristine originality.

Retailers operate as intermediaries connecting sellers with end buyers through consignment arrangements or direct purchases. Specialized dealers provide authentication services, restoration recommendations, and market expertise. This segment benefits from growing online marketplace penetration alongside traditional brick-and-mortar operations. Retailer margins vary significantly based on instrument rarity and condition.

Hobbyists comprise amateur players and casual collectors with moderate budgets seeking affordable entry points. This segment gravitates toward 1970s and 1980s instruments offering vintage character without premium pricing. Hobbyists often purchase for personal enjoyment rather than investment strategy. Online marketplaces have democratized access for this buyer category.

Key Market Segments

By Type

- Electric Guitars

- Acoustic Guitars

- Rare Collectibles

- Custom Guitars

- Classical Guitars

By Application

- Musicians

- Collectors

- Music Schools

- Retailers

- Hobbyists

Drivers

Rising Investment Demand for Tangible Alternative Assets Among High-Net-Worth Collectors

Wealth managers increasingly recommend vintage guitars as portfolio diversification tools offering low correlation with traditional financial markets. High-net-worth individuals seek tangible assets combining aesthetic appreciation with capital preservation. Vintage instruments demonstrate consistent value appreciation over multi-decade holding periods. Unlike stocks or bonds, these physical assets provide enjoyment through display or occasional playing.

Family offices allocate significant capital toward alternative investments including rare musical instruments. This institutional participation elevates market professionalism through standardized authentication and valuation protocols. Investment-grade vintage guitars offer liquidity advantages over other collectibles like fine art. Market transparency improvements through digital platforms facilitate informed purchasing decisions.

Growing recognition of guitars as legitimate investment vehicles drives sustained demand growth. Auction house results provide publicly available pricing benchmarks for portfolio valuation. Insurance companies now offer specialized coverage recognizing vintage instruments as appreciating assets. This mainstream acceptance attracts new capital from traditional investment channels into the vintage guitar market.

Restraints

High Authentication Risks and Prevalence of Counterfeit or Modified Instruments

Counterfeit vintage guitars flood secondary markets as sophisticated reproductions become increasingly difficult to detect. Unscrupulous sellers artificially age modern instruments using distressing techniques that deceive inexperienced buyers. Component replacements and modifications often occur without documentation, compromising authenticity and value. Expert authentication requires specialized knowledge beyond typical buyer capabilities.

Verification costs add significant transaction expenses particularly for mid-tier vintage instruments. Authentication services may charge thousands of dollars for detailed analysis and certification. Non-destructive testing methods cannot always definitively confirm originality of finishes, electronics, or structural components. Disputes over authenticity frequently arise years after purchase when resale attempts reveal discrepancies.

Limited liquidity characterizes the vintage guitar market due to narrow buyer pools for high-value instruments. Sellers often wait months or years finding qualified buyers willing to pay expected prices. Forced liquidation scenarios typically result in substantial discounts from estimated values. Regional market variations create pricing inconsistencies complicating accurate valuation. Transaction costs including authentication, shipping, and insurance reduce net returns for short-term holders.

Growth Factors

Expansion of Online High-Value Instrument Marketplaces With Verified Provenance

Digital platforms revolutionize vintage guitar transactions by connecting global buyers with authenticated inventory. Online marketplaces implement rigorous verification protocols reducing counterfeit risks for purchasers. Virtual inspection tools including high-resolution photography and video demonstrations enhance remote purchasing confidence. These platforms aggregate supply from worldwide sources increasing selection breadth beyond local dealers.

Blockchain technology enables immutable provenance tracking from original manufacture through subsequent ownership transfers. Digital certificates of authenticity provide tamper-proof documentation accessible to future buyers. Smart contracts facilitate secure escrow arrangements protecting both parties during high-value transactions. This technological infrastructure attracts institutional investors requiring audit-compliant documentation.

Emerging market collectors in Asia-Pacific and Middle East regions demonstrate accelerating acquisition activity. Rising wealth concentration in these geographies creates new demand pools for Western cultural artifacts. Local auction houses establish vintage instrument departments serving regional buyers. Cross-border shipping improvements and customs simplification facilitate international transactions. Museum exhibitions and private vault displays elevate vintage guitars as prestige assets comparable to fine art, driving visibility and desirability among affluent collectors worldwide.

Emerging Trends

Surge in Digitally Certified Provenance and Blockchain-Based Authentication

Blockchain authentication systems provide unforgeable digital records tracking instrument history from manufacture through ownership chains. These platforms integrate expert certifications, repair documentation, and photographic evidence into permanent ledgers. Buyers access complete provenance instantly rather than relying on paper certificates or seller representations. Major dealers adopt blockchain standards as competitive differentiation and fraud prevention measures.

Artist-owned and stage-played vintage guitars generate extraordinary premiums reflecting celebrity provenance value. Documented performance history at iconic concerts or recording sessions multiplies base instrument valuations. Auction houses aggressively market these pieces to crossover buyers from entertainment memorabilia markets. Video documentation and witness attestations strengthen authentication for celebrity-associated instruments.

Luxury asset investors without musical backgrounds increasingly participate in vintage guitar markets. These buyers apply traditional alternative investment analysis frameworks to instrument acquisitions. Professional advisory services emerge specializing in guitar portfolio construction and management.

Original-condition instruments command growing premiums over restored examples as collectors prioritize authenticity. According to US guitar sales statistics, the 18-24 age group recorded the highest guitar purchases at 17.5%, followed by the 25-34 age group at 10.6%, indicating younger demographic engagement potentially influencing future collector trends.

Regional Analysis

North America Dominates the Vintage Guitars Market with a Market Share of 39.20%, Valued at USD 0.4 Billion

North America maintains market leadership with 39.20% share valued at USD 0.4 Billion, driven by concentration of major manufacturers, auction houses, and affluent collectors. The United States hosts iconic brands including Fender, Gibson, and Martin, creating strong domestic heritage connections. Established dealer networks and authentication experts support robust secondary market infrastructure. High disposable incomes and cultural attachment to rock music sustain consistent demand across buyer segments.

Europe Vintage Guitars Market Trends

Europe represents a mature market with sophisticated collectors concentrating in United Kingdom, Germany, and France. British blues and rock heritage drives strong demand for vintage electric guitars from the 1960s. European dealers specialize in rare continental brands alongside American imports. Regulatory frameworks governing CITES-listed materials create compliance complexities for cross-border transactions within the region.

Asia Pacific Vintage Guitars Market Trends

Asia Pacific demonstrates fastest growth rates as emerging wealth in China, Japan, and Southeast Asia fuels collecting activity. Japanese buyers historically dominated vintage guitar imports, establishing premium pricing for Japanese domestic market instruments. Chinese collectors increasingly participate in international auctions seeking trophy pieces. Regional authentication challenges persist due to limited local expertise and counterfeit prevalence.

Middle East and Africa Vintage Guitars Market Trends

Middle East luxury consumers diversify collections beyond traditional assets into musical instruments with investment potential. UAE-based auction houses facilitate regional access to international vintage guitar markets. Limited local musical heritage reduces emotional connections compared to Western buyers. African market remains nascent with isolated high-net-worth collectors primarily in South Africa.

Latin America Vintage Guitars Market Trends

Latin America exhibits modest participation concentrated among Brazilian and Argentine collectors with connections to local music traditions. Economic volatility limits sustained high-value acquisitions in most markets. Import duties and currency fluctuations create pricing disadvantages versus North American or European purchases. Regional players focus on mid-tier vintage instruments rather than premium collectibles.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Vintage Guitars Company Insights

Fender dominates the vintage electric guitar market through iconic models including Stratocaster and Telecaster designs produced since the 1950s. The company’s instruments from the pre-CBS era command extraordinary premiums among collectors and professional musicians. Fender’s vintage reissue programs attempt to capture characteristics of original instruments while generating revenue from heritage. The brand maintains strong authentication services supporting secondary market integrity and value preservation for genuine vintage pieces.

Gibson represents the pinnacle of vintage guitar desirability through legendary Les Paul, SG, and ES models from the golden era. Pre-1960 Les Paul Standards rank among the most valuable vintage guitars worldwide due to limited production and exceptional tonal qualities. Gibson’s historical manufacturing variations create complex authentication challenges requiring expert analysis. The company’s bankruptcy and ownership changes have not diminished vintage instrument values, which continue appreciating independently of current corporate performance.

C.F. Martin & Company produces acoustic guitars that define vintage instrument excellence, particularly pre-war dreadnoughts from the 1930s and 1940s. Martin’s consistent quality and documentation facilitate authentication compared to many competitors. The company maintains detailed shipping records enabling provenance verification for vintage instruments. Brazilian rosewood models face CITES restrictions affecting international transactions but command premium prices reflecting scarcity and tonal superiority over modern alternatives.

Gretsch occupies a specialized niche in the vintage market through distinctive hollow-body electric guitars favored by rockabilly and country musicians. The brand’s instruments from the 1950s and 1960s demonstrate unique aesthetic designs and FilterTron pickup technology. Gretsch guitars associated with Chet Atkins and other endorsers carry additional provenance value. The company’s various ownership transitions complicate vintage production dating and authentication processes for collectors and dealers.

Key Market Players

- Fender

- Gibson

- C.F. Martin & Company

- Gretsch

- Rickenbacker

- Guild

- Ibanez

- Yamaha

- Höfner

Recent Developments

- January 2024 – Vista Musical Instruments acquired all associated trademarks of legendary Manhattan music store Manny’s from Sam Ash Music Corporation, preserving iconic retail heritage. This transaction reflects consolidation trends as traditional music retailers face market pressures. The Manny’s brand carries historical significance among vintage guitar collectors and professional musicians.

- 2024 – Kurt Cobain’s 1959 Martin D-18E acoustic guitar from Nirvana’s MTV Unplugged concert sold for over $6,010,000 at auction, establishing new benchmark pricing. This record-breaking sale demonstrates extraordinary premium potential for celebrity-associated vintage instruments. The transaction attracted significant media attention elevating mainstream awareness of vintage guitars as investment assets.

- Early 2025 – Reverb Price Index data revealed used electric guitar prices settled approximately 10% lower than pandemic-era peaks, indicating market normalization. This correction reflects reduced speculative buying as economic conditions stabilized. The adjustment creates favorable entry opportunities for collectors who avoided inflated pricing during pandemic volatility.

Report Scope

Report Features Description Market Value (2025) USD 1.1 Billion Forecast Revenue (2035) USD 1.9 Billion CAGR (2026-2035) 5.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electric Guitars, Acoustic Guitars, Rare Collectibles, Custom Guitars, Classical Guitars), By Application (Musicians, Collectors, Music Schools, Retailers, Hobbyists) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fender, Gibson, C.F. Martin & Company, Gretsch, Rickenbacker, Guild, Ibanez, Yamaha, Höfner Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fender

- Gibson

- C.F. Martin & Company

- Gretsch

- Rickenbacker

- Guild

- Ibanez

- Yamaha

- Höfner