Global Polycarbonate Sheets Market By Product Type (Solid Sheets, Multiwall Sheets, Corrugated Sheets, Others), By Category (Clear, Colored), By Application (Building and Construction, Automotive, Electronics, Agriculture, Aerospace and Defense, Advertising, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2033

- Published date: Nov 2024

- Report ID: 133203

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

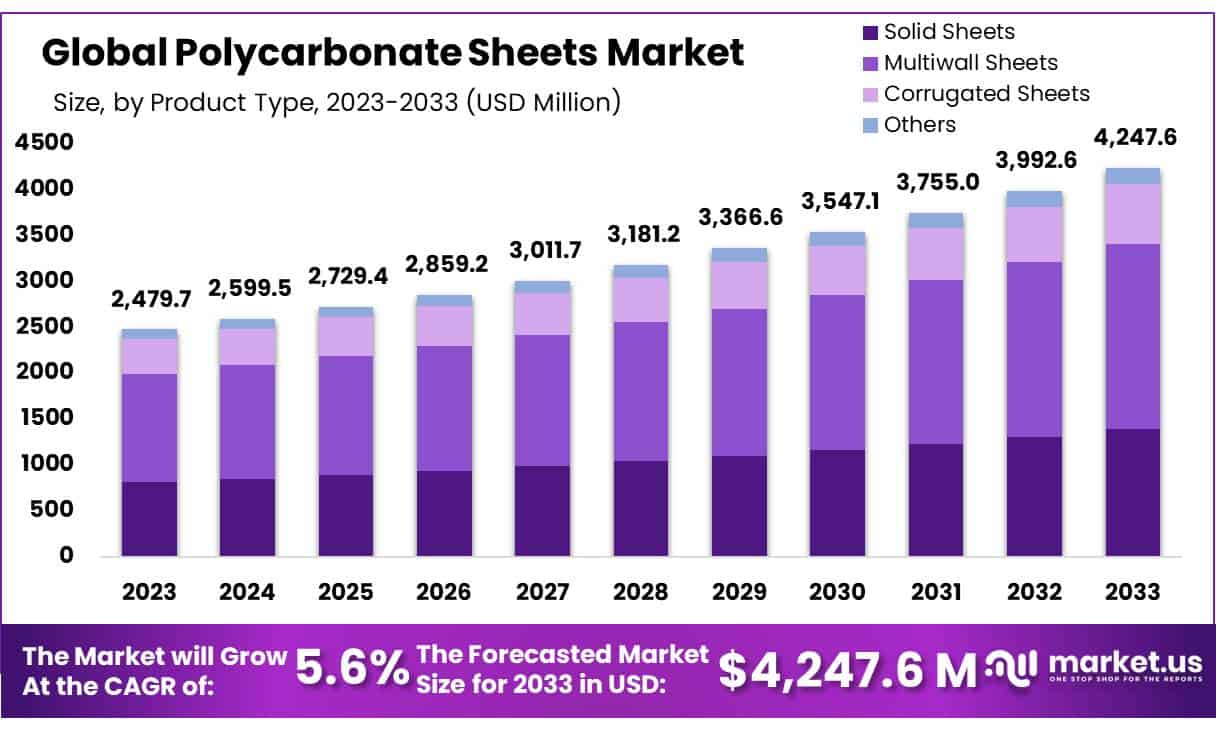

The Global Polycarbonate Sheets Market size is expected to be worth around USD 4,247.6 Mn by 2033, from USD 2,479.7 Mn in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Polycarbonate sheets are a type of thermoplastic material known for their exceptional durability, optical clarity, and high impact resistance. Made from polycarbonate resin, these sheets offer a unique combination of properties such as lightweight, transparency, and resistance to UV radiation and extreme temperatures.

Due to their versatility, polycarbonate sheets are used across various industries, including construction, automotive, electronics, and signage. The polycarbonate sheets market has been experiencing significant growth and transformation in recent years, driven by various factors including technological advancements, increasing demand across multiple sectors, and the rising awareness of the material’s benefits.

Polycarbonate sheets, known for their exceptional durability, lightweight properties, and excellent impact resistance, are being utilized in a diverse range of applications, from construction and automotive to electronics and consumer goods.

Key Takeaways

- The global polycarbonate sheets market was valued at US$ 2,479.7 million in 2023.

- The global polycarbonate sheets market is projected to reach US$ 4,247.6 million by 2033.

- Among product types, the multiwall sheets held the majority of the revenue share at 47.7%.

- Based on category, clear accounted for the largest market share with 61.7%.

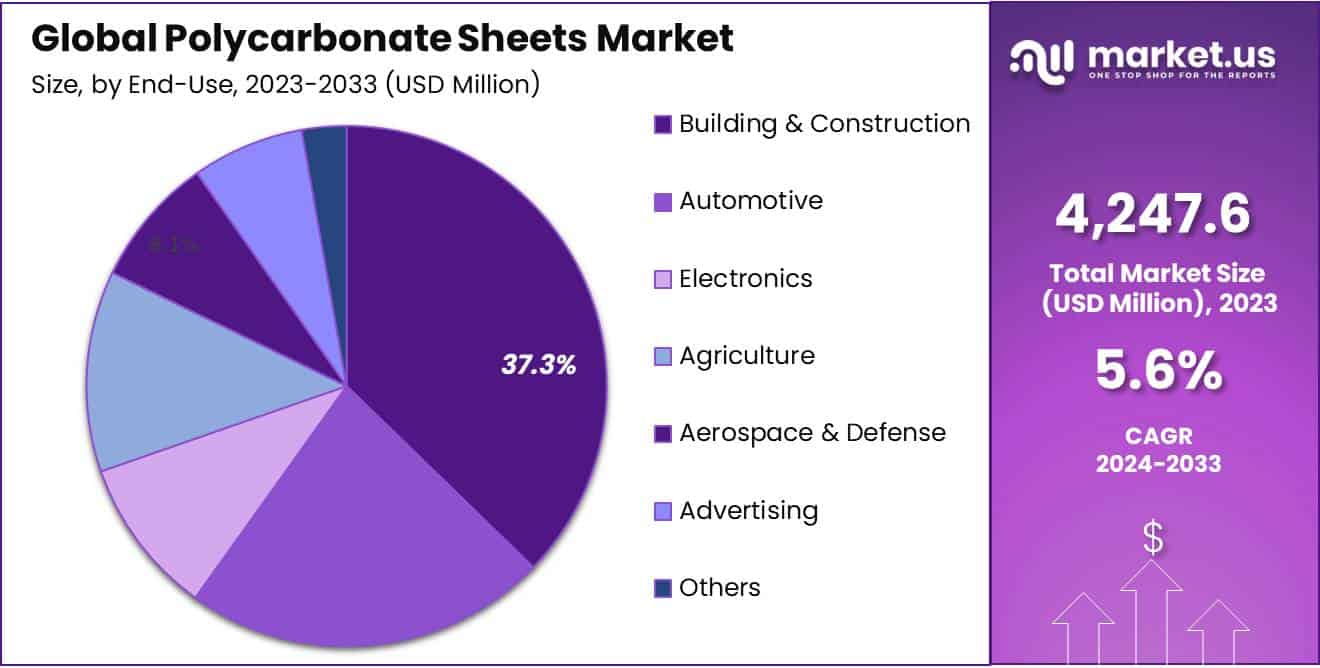

- Among end-use, building & construction sector accounted for the majority of the polycarbonate sheets market share with 37.2%.

- In the first eight months of 2023, U.S. construction spending reached approximately $1.28 trillion, marking a 4.2% increase compared to the previous year.

Product Type Analysis

Offset Structure Type Held the Major Share Owing To Their High-Quality Output

The polycarbonate sheets market is segmented based on product types into solid sheets, multiwall sheets, corrugated sheets, and others. Among these, the multiwall sheets held the majority of revenue share in 2023, with a market share of 47.7% due to their superior thermal insulation properties, lightweight structure, and cost-efficiency.

These sheets consist of multiple layers separated by air gaps, which enhance their energy efficiency by reducing heat transfer, making them highly suitable for applications in construction and agriculture. Their widespread use in greenhouses, skylights, roofing, and cladding is driven by the growing emphasis on sustainable building practices and energy conservation.

Additionally, multiwall sheets offer excellent impact resistance and UV protection, ensuring durability and long-term performance, which further boosts their preference in both commercial and residential projects. The versatility of these sheets in various climates and their ability to reduce energy costs have positioned them as a preferred choice, contributing significantly to their dominant market share.

Category Analysis

Plastic Product Types Accounted for a Major Share in the Polycarbonate Sheets Market

Based on product types, the market is segmented into clear and colored. Among these, clear accounted for the majority of the market share, at 61.7% can be attributed to their versatile applications and superior properties. Clear polycarbonate sheets offer excellent transparency, allowing up to 90% light transmission, comparable to glass, while being significantly lighter and more impact-resistant.

These characteristics make them the preferred choice in industries such as construction, automotive, and electronics, where both visibility and durability are crucial. In construction, clear sheets are widely used for skylights, greenhouses, and architectural glazing, as they provide natural light while ensuring safety and thermal insulation.

Similarly, in the automotive sector, they are utilized for windows and windshields, where clarity and shatter resistance are essential. Their widespread adoption across these high-demand applications underpins their substantial market share.

End-Use Analysis

Being an Efficient and Cost Effective, Gloss Varnish is the Best Choice for Packaging Applications.

The polycarbonate sheets market was further categorized based on types such as building and construction, automotive, electronics, agriculture, aerospace and defense, advertising, and others. Among these applications, building and construction accounted for a major market share of 37.3% as of 2023 primarily due to the material’s unique combination of durability, lightweight properties, and superior impact resistance.

Polycarbonate sheets are increasingly preferred in construction applications such as roofing, skylights, wall cladding, and glazing because of their high thermal insulation, UV resistance, and transparency, which allow natural light to penetrate while reducing energy consumption. The growing emphasis on sustainable building practices has further boosted demand, as polycarbonate sheets contribute to energy-efficient designs and green building certifications.

Additionally, their easy installation, cost-effectiveness, and ability to withstand harsh weather conditions make them an ideal choice for both commercial and residential infrastructure projects, especially in regions experiencing rapid urbanization and infrastructure development.

Key Market Segments

By Product Type

- Solid Sheets

- Multiwall Sheets

- Corrugated Sheets

- Others

By Category

- Clear

- Colored

By Application

- Building and Construction

- Automotive

- Electronics

- Agriculture

- Aerospace and Defense

- Advertising

- Others

Drivers

Continuous Growth of the Construction Industry Owing to Rapid Urbanization Is Estimated to Boost the Polycarbonate Sheets Market

The continuous growth of the construction industry globally acts as a pivotal driver for the expansion of the polycarbonate sheet market, owing to the unique attributes of polycarbonate sheets that meet the evolving demands of modern construction practices.

This relationship is underscored by several key dynamics within the construction sector that specifically leverage the advantages of polycarbonate materials, significantly influencing market growth. Primarily, the push towards more sustainable and energy-efficient building practices is a major factor.

Polycarbonate sheets are highly valued in the construction industry for their thermal insulation properties, which contribute to reducing heating and cooling costs in buildings. Their ability to transmit light while blocking harmful UV rays also means that they can replace glass in skylights, windows, and facades, thus allowing natural light to penetrate deeper into buildings and reducing the need for artificial lighting.

This not only saves energy but also enhances the aesthetic appeal and comfort of indoor spaces. Moreover, the trend towards more innovative and aesthetically pleasing architectural designs supports the use of polycarbonate sheets. The flexibility and light weight of polycarbonate make it ideal for creating curved or irregular shapes, which are often challenging with glass or other traditional materials.

Architects and designers are increasingly turning to polycarbonate as a solution that offers both functionality and creative freedom, enabling the realization of bold new designs and the transformation of building envelopes with colorful, translucent, and reflective properties.

Restraints

High Competition from Alternative Materials May Hinder the Growth of the Market for A Certain Extent

High competition from alternative materials presents a significant restraint on the global polycarbonate sheet market. As industries seek cost-effective, environmentally sustainable, and technologically advanced materials, polycarbonate sheets face increasing challenges from substitutes that may offer comparable or superior properties in specific applications.

This competition can limit market growth and shift industry preferences toward these alternative materials. One of the primary competitors to polycarbonate sheets is acrylic (PMMA), which offers similar transparency and is often more cost-effective for certain applications.

Acrylic is lighter and has a higher resistance to UV degradation, making it a preferred choice for outdoor applications where long-term exposure to sunlight is a factor.

This can lead to a preference for acrylic over polycarbonate in signage, display cases, and some glazing contexts, where cost and resistance to weathering are crucial considerations.

Glass is another traditional alternative that competes with polycarbonate in areas requiring high optical clarity and scratch resistance. Despite being heavier and more fragile, glass offers superior scratch resistance and a more premium aesthetic, factors that are highly valued in architectural and automotive applications.

The advancements in safety glass, such as tempered and laminated options, have also enhanced its impact resistance, encroaching on one of polycarbonate’s key advantages.

Opportunity

Growth of Sustainable Eco-friendly Product Will Create More Opportunities for Polycarbonate Sheets Market

The growth of sustainable, eco-friendly products is creating significant opportunities for the polycarbonate sheets market. As global awareness and regulatory pressures towards environmental sustainability increase, industries are seeking materials that align with these values without compromising on quality and efficiency. Polycarbonate sheets are highly effective in thermal insulation, making them an attractive option for eco-friendly building and construction projects.

The material’s ability to reduce heat loss translates into energy savings, aligning with green building standards such as LEED and BREEAM. As the construction industry continues to emphasize energy-efficient solutions, the demand for polycarbonate sheets in applications such as glazing, roofing, and wall cladding is expected to rise. Polycarbonate sheets are recyclable, which supports the circular economy model that is integral to sustainable development.

Manufacturers are increasingly focusing on improving the recyclability of these sheets at the end of their life cycle and optimizing production processes to reduce waste and energy consumption. These advancements enhance the environmental profile of polycarbonate sheets and make them more appealing to eco-conscious consumers and businesses.

The adaptability of polycarbonate sheets to incorporate new technologies also presents opportunities. In the solar energy sector, for example, polycarbonate sheets are used in photovoltaic modules and as components in solar panels. Their high light transmission and strength make them ideal for these applications, promoting the use of renewable energy sources.

Trends

Advancements in Material Technology

Advancements in material technology represent a significant trend in the polycarbonate sheets market, driving innovation and expanding applications across various industries. Polycarbonate sheets are known for their lightweight, high-impact resistance, and transparency, making them a favored material in construction, automotive, and other sectors.

Innovations in polymer chemistry and material science have led to the development of polycarbonate sheets with improved resistance to weathering, UV radiation, and chemical abrasion. These enhancements prolong the lifespan of polycarbonate products, reduce maintenance costs, and make them more suitable for outdoor applications. Advances in material technology have also focused on increasing the thermal insulation properties of polycarbonate sheets.

Multi-wall sheets with improved insulative properties are being developed, which help in energy conservation in building applications by maintaining indoor temperature levels more effectively.

Technological advancements have expanded the customization options available for polycarbonate sheets in terms of colors, textures, and finishes. This adaptability enhances aesthetic appeal and meets specific design requirements, making polycarbonate a more attractive option for architectural applications.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impacted the Growth of the Polycarbonate Sheets Market

The conflict led to immediate disruptions in the supply chains for raw materials essential for polycarbonate production, such as Bisphenol A (BPA) and phosgene, which are derived from petroleum products. Russia, as a major oil producer, faced numerous sanctions from Western countries, disrupting global oil markets and increasing the volatility of prices.

This volatility directly impacted the cost structures for polycarbonate manufacturers, as the production process is energy-intensive and dependent on petrochemicals.

Manufacturers faced increased costs, and in some cases, shortages of raw materials, forcing them to seek alternative suppliers and increase their inventory levels to buffer against further disruptions. Geopolitical instability also influenced the demand for polycarbonate sheets.

In Europe, which is a significant market for polycarbonate sheets and closely tied to the Ukrainian and Russian economies, the construction and automotive industries faced uncertainties due to economic sanctions, reduced consumer spending, and overall economic slowdown.

This uncertainty likely led to delayed or reduced investments in new construction and automotive projects, directly impacting the demand for polycarbonate sheets in these sectors.

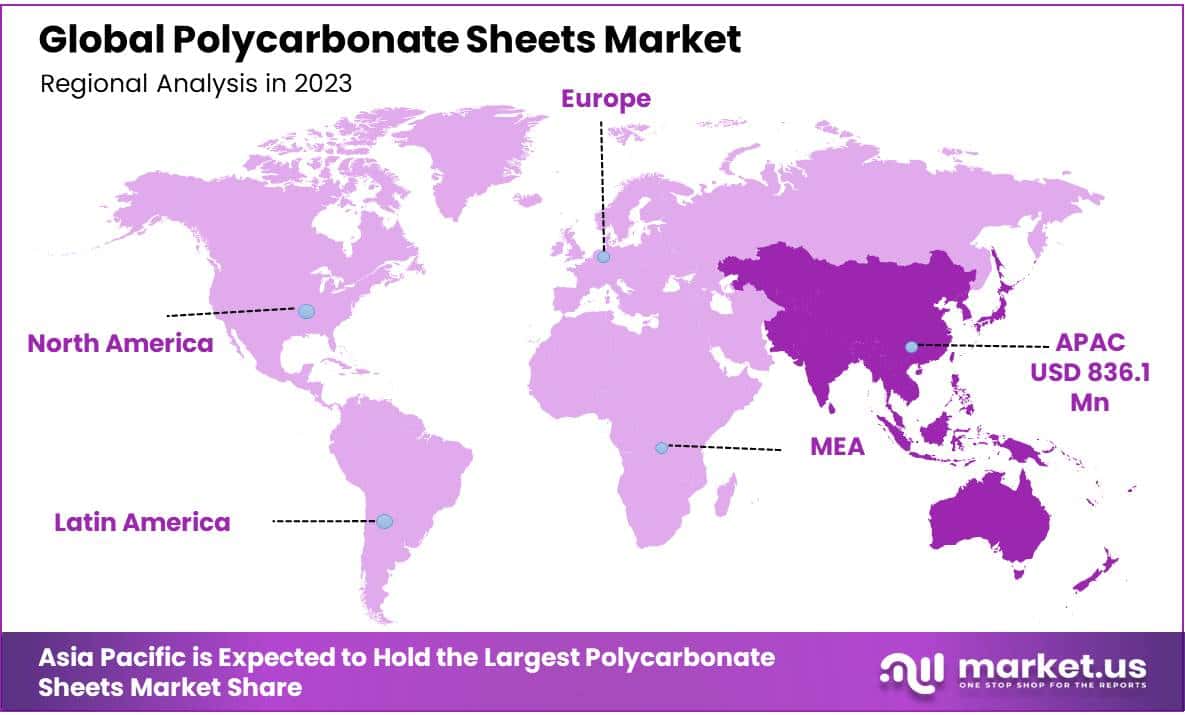

Regional Analysis

The Dominance Of The Asia-Pacific Region In The Polycarbonate Sheets Market Is Also Underpinned By The Rapid Growth Of The Electronics And Automotive Sectors

The Asia-Pacific region dominates the polycarbonate sheets market due to its robust industrial growth, rapid urbanization, and increasing infrastructure development. The region held a market share of 36.1% in 2023. Countries such as China, India, and Japan are key contributors, driven by their booming construction and automotive industries, which are the primary consumers of polycarbonate sheets.

The region’s expanding middle class and rising disposable incomes have fueled demand for durable and aesthetically appealing building materials in residential and commercial projects. Additionally, Asia-Pacific is home to some of the largest polycarbonate manufacturers and exporters, benefiting from lower production costs, abundant raw materials, and government initiatives supporting industrialization and foreign investments. This combination of factors positions the region as a global leader in the polycarbonate sheets market.

Additionally, favorable government policies and infrastructure development initiatives in emerging economies like India, Vietnam, and Indonesia have significantly boosted the construction industry.

Programs such as Smart Cities Mission in India aim to enhance urban infrastructure, increasing the adoption of energy-efficient materials like polycarbonate sheets for applications such as skylights, facades, and soundproof barriers. These materials are valued for their superior thermal insulation, UV protection, and lightweight properties, which align with sustainable building practices.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Market Players In The Polycarbonate Sheets Industry Are Evolving Through Various Strategies To Maintain and Reinforce The Dominance Of Industry Leaders.

Market players in the polycarbonate sheets industry are employing a range of strategies to adapt to evolving market demands and maintain competitive advantage. Companies are investing in research and development to create advanced polycarbonate sheets with enhanced properties such as improved UV resistance, higher impact strength, and better thermal insulation.

These innovations cater to specific applications in sectors such as construction, automotive, and electronics, meeting the growing demand for high-performance materials. Collaborations, mergers, and acquisitions are being pursued to strengthen market position and diversify product offerings. By partnering with or acquiring other firms, companies can leverage new technologies, access different markets, and enhance their competitive edge.

Manufacturers are offering tailored polycarbonate sheet solutions to meet the unique requirements of various industries. This customization addresses specific needs in applications like roofing, glazing, and signage, providing added value to customers and fostering long-term relationships.

Market Key Players

- Covestro AG

- 3A Composites

- Teijin Limited

- Mitsubishi Chemical Corporation

- ROHM GmbH

- Excelite

- Plaskolite

- Arla Plast AB

- Palram Industries Ltd.

- DS Smith Plc

- Brett Martin Ltd.

- Gallina s.r.l.

- Spartech

- Polyvalley Technology (Tianjin) Co., Ltd.

- Other Key Players

Recent Development

- On September 29, 2023, Recently Mitsubishi Chemical Corporation announced its development of a plant-derived polycarbonate thermoplastic elastomer. This cutting-edge development by the company boasts polycarbonate impressive biomass content and remarkable heat resistance.

- On January 25, 2024, Recently Covestro introduced their high-performance polymer APEC-2045 was specially developed for medical equipment including respiratory masks and other medical devices requiring seal moulding. These developments from Covestro will boost productivity in silicone over-molding applications.

Report Scope

Report Features Description Market Value (2023) US$ 2,479.7 Mn Market Volume (2023) XX Forecast Revenue (2033) US$ 4,247.6 Mn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Global Polycarbonate Sheets Market By Structure Type (Mesoscopic , and Planar), By Product Type (Rigid, and Flexible), By Type (Single Junction, and Multi Junction) By Technology (Solution Method, Vapor-Assisted Solution Method, and Vapor-Deposition Method) By Application (Smart Glass, Building-Integrated Photovoltaics, Solar Panel, and Others), By End-Use (Residential, Commercial, Industrial, and Utility) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Covestro AG, 3A Composites, Teijin Limited, Mitsubishi Chemical Corporation, ROHM GmbH, Excelite, Plaskolite, Arla Plast AB, Palram Industries Ltd., DS Smith Plc, Brett Martin Ltd., Dott.Gallina s.r.l., Spartech, Polyvalley Technology (Tianjin) Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Polycarbonate Sheets MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Polycarbonate Sheets MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Covestro AG

- 3A Composites

- Teijin Limited

- Mitsubishi Chemical Corporation

- ROHM GmbH

- Excelite

- Plaskolite

- Arla Plast AB

- Palram Industries Ltd.

- DS Smith Plc

- Brett Martin Ltd.

- Gallina s.r.l.

- Spartech

- Polyvalley Technology (Tianjin) Co., Ltd.

- Other Key Players