Global Video Conferencing Market By Component (Hardware (Camera, Microphone, Other Components), Software, Services (Professional Services, Managed Services)), By Deployment (On-Premise, Cloud), By Enterprises Size (Large Enterprises, Small and Medium Enterprises), By Application (Consumer, and Enterprises), By End-User (Corporate, Education, Healthcare, Defense, Entertainment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: July 2024

- Report ID: 41119

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

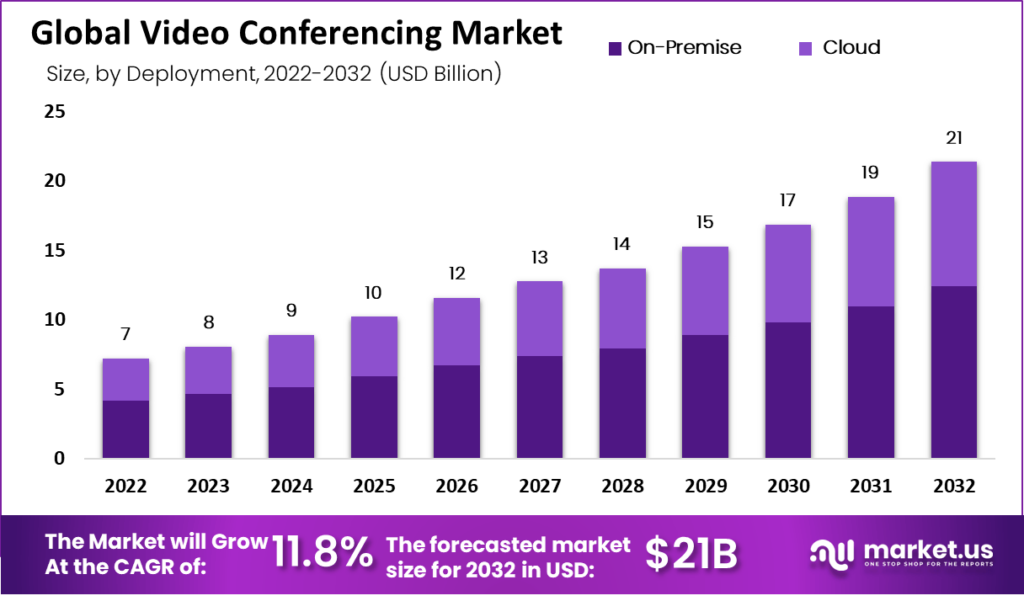

The Global Video Conferencing Market size is expected to be worth around USD 21 billion by 2032 from USD 8.0 billion in 2023, growing at a CAGR of 11.8% during the forecast period 2023 to 2032.

Video conferencing is a technology that enables users to conduct meetings, presentations, and discussions through video and audio connections over the internet. This technology has become essential in various sectors such as business, education, and healthcare due to its ability to facilitate real-time communication among participants from different geographical locations. Key features of video conferencing systems include high-definition video and audio quality, content sharing capabilities, and integration with other collaborative tools and platforms.

The video conferencing market has experienced remarkable growth driven by various factors. The increasing adoption of remote work practices, coupled with the need for efficient virtual communication solutions, has propelled the demand for video conferencing platforms. Businesses and individuals rely on these tools to conduct meetings, interviews, training sessions, and other collaborative activities, regardless of geographical limitations.

Technological advancements have played a significant role in shaping the video conferencing market. Improved internet infrastructure, enhanced video and audio quality, and the development of user-friendly interfaces have made video conferencing more accessible and user-friendly. These advancements have not only expanded the market but also improved the overall user experience, making virtual meetings more engaging and productive.

Despite its growth, the market faces challenges such as concerns over data security and privacy, the need for high-quality internet connectivity, and the integration complexities with existing IT infrastructure. These issues can hinder user experience and adoption rates.

The ongoing technological advancements present substantial opportunities. The integration of artificial intelligence and machine learning can enhance the functionality and efficiency of video conferencing systems. There’s also a growing demand in emerging markets, where businesses are just beginning to adopt modern communication tools, offering a fresh area for expansion.

In the realm of corporate communication, video conferencing software has demonstrated a significant enhancement in productivity, boosting efficiency by 50%. As of January 2022, 78% of American corporations routinely integrated video conferencing tools into their operations, a trend that has maintained its momentum. By July 2022, this adoption expanded, with approximately 90% of businesses investing in video conferencing solutions to facilitate remote collaboration.

Particularly within larger corporations, those with over 250 employees, there is a marked preference for these technologies, with 83% having implemented video conferencing systems. Daily usage of these tools is prevalent, with over 58% of companies relying on them to sustain their operational flow.

Conversely, smaller companies, those with fewer than 250 employees, show a lower adoption rate, with 28% routinely using video conferencing. Despite the widespread adoption and positive impacts on communication clarity – 90% of individuals report improved effectiveness in conveying their points via video – the integration of such technology is not without its challenges. For instance, poorly organized meetings contribute to a substantial economic loss, exceeding $399 billion annually.

Remote work facilitated by video conferencing is preferred by 76% of employees, contributing to enhanced performance as 77% of remote workers report increased productivity from home settings. However, this shift also introduces challenges, with 23% of remote employees working significantly longer hours than they would in a traditional office environment.

Key Takeaways

- The Global Video Conferencing Market is projected to experience significant growth over the next decade. From a valuation of USD 8.0 billion in 2023, the market size is anticipated to expand to approximately USD 21 billion by 2032. This growth trajectory represents a compound annual growth rate (CAGR) of 11.8% during the forecast period from 2023 to 203

- The Hardware segment emerged as a key player, capturing a considerable portion of the market share.

- The On-Premise deployment model also showed significant dominance, securing more market share.

- Large Enterprises constituted the majority in user demographics, claiming a substantial market share and indicating a preference for robust video conferencing solutions among larger corporate entities.

- The Corporate segment maintained a strong presence in the market, reflecting the widespread adoption of video conferencing tools in formal business settings.

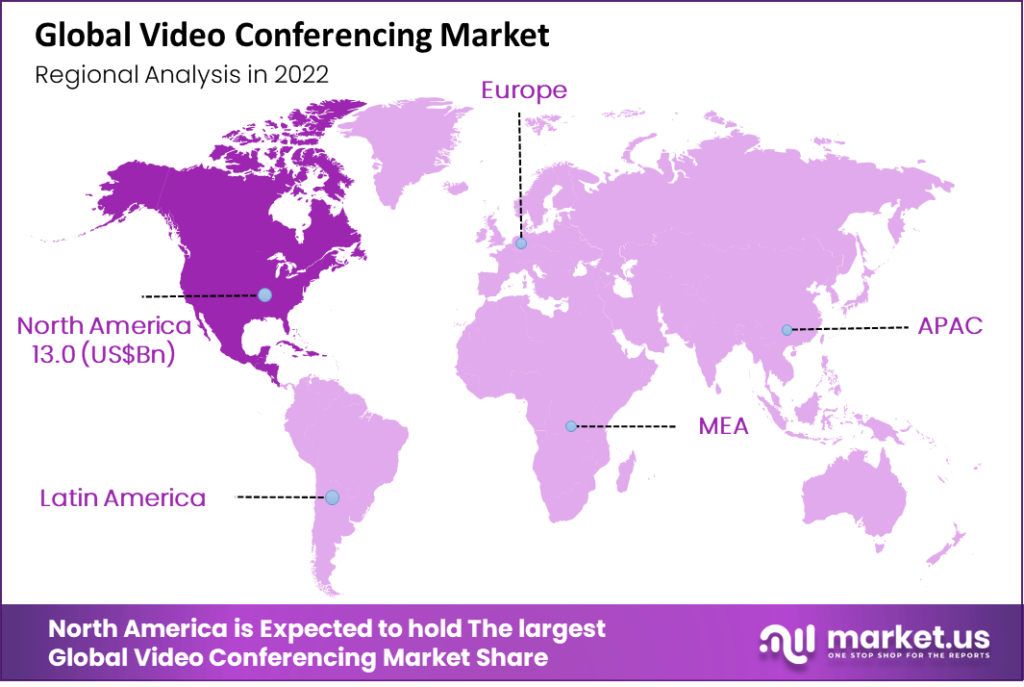

- Geographically, North America led the market, holding over 37.5% of the global market share, with revenues reaching approximately USD 13 billion, underscoring the region’s pivotal role in the technology’s adoption and integration

By Component Analysis

In 2022, the Hardware segment held a dominant market position in the video conferencing industry, capturing more share. This substantial market share reflects the critical role that physical devices – like cameras, microphones, and dedicated conferencing systems – play in ensuring high-quality video communications.

The leadership of the Hardware segment can be attributed to several factors. First, the demand for advanced, high-definition video conferencing hardware has surged as businesses strive to enhance the quality of remote communications. High-quality cameras and microphones are essential for delivering clear audio and crisp video, which are vital for effective virtual meetings.

Furthermore, dedicated conferencing systems provide a seamless and integrated experience that general computing devices cannot match, which is particularly important in professional settings like boardrooms and large-scale international meetings.

Additionally, the ongoing innovation in this segment contributes to its growth. Manufacturers are continually developing more sophisticated and user-friendly hardware solutions that incorporate better integration with various software and platforms. These innovations include features like automated camera focus, background noise reduction, and even facial recognition, enhancing the overall user experience.

Moreover, as hybrid work models become more prevalent, organizations are investing in permanent setups for video conferencing in their offices. This trend underscores the need for durable and reliable hardware that can support frequent use and integrate smoothly with an organization’s IT infrastructure.

Overall, the Hardware segment’s dominance in the video conferencing market is a reflection of its pivotal role in providing the essential tools needed for effective virtual communication. As technology evolves and hybrid work environments become standard, this segment is likely to see continued growth and development.

By Deployment Analysis

In 2022, the On-Premise segment held a dominant market position in the video conferencing industry, capturing more share. This leadership can be largely attributed to the high level of control and security that on-premise solutions offer, which are critical factors for many organizations, particularly those in sensitive or heavily regulated industries.

The preference for on-premise video conferencing systems stems from their ability to provide organizations with full control over their communication infrastructure. Companies that manage their own video conferencing servers and networks can tailor the setup to their specific needs, ensuring that capacity, performance, and security align perfectly with their operational requirements. This is particularly appealing to sectors like finance, government, and healthcare, where data protection and compliance with strict regulatory standards are paramount.

Moreover, on-premise solutions tend to offer better reliability and performance consistency compared to cloud-based solutions. Since the data does not traverse the public internet, there are generally fewer issues related to bandwidth, latency, and overall quality of service. Organizations with substantial IT resources find that maintaining on-premise infrastructure provides a predictable and stable environment that cloud services cannot always guarantee, especially in regions with less developed internet infrastructure.

Additionally, many enterprises with existing significant investments in on-premise IT infrastructure find it more cost-effective to extend their capabilities rather than switch to a cloud model. This continuity allows organizations to leverage their current assets and IT expertise, reducing the need for substantial new investments in technology and training.

By Enterprises Size

In 2022, the Large Enterprises segment held a dominant market position in the video conferencing industry, capturing a significant share. This segment’s prominence is driven by the extensive adoption of video conferencing solutions within large organizations, aimed at improving communication, collaboration, and productivity across often global operations.

Large enterprises typically have the financial resources and IT infrastructure to invest in advanced video conferencing systems that offer enhanced security, scalability, and integration capabilities. These organizations frequently operate across multiple locations worldwide, necessitating robust communication tools that can support diverse and geographically dispersed teams.

Video conferencing enables these large firms to facilitate seamless meetings, manage projects, and maintain team cohesion, which is invaluable in supporting their expansive operational frameworks. Furthermore, large enterprises are often at the forefront of adopting new technologies that can streamline operations and foster innovative collaboration methods.

The integration of video conferencing with other enterprise solutions like enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and productivity tools creates a more interconnected and efficient workflow. This holistic approach to digital transformation appeals particularly to large organizations looking to maintain competitive edges.

Security is another critical concern for large enterprises, particularly those handling sensitive information or operating in regulated sectors. On-premise video conferencing solutions, which are more prevalent among larger organizations, offer enhanced control over data security and compliance with regulatory requirements, making them an attractive choice.

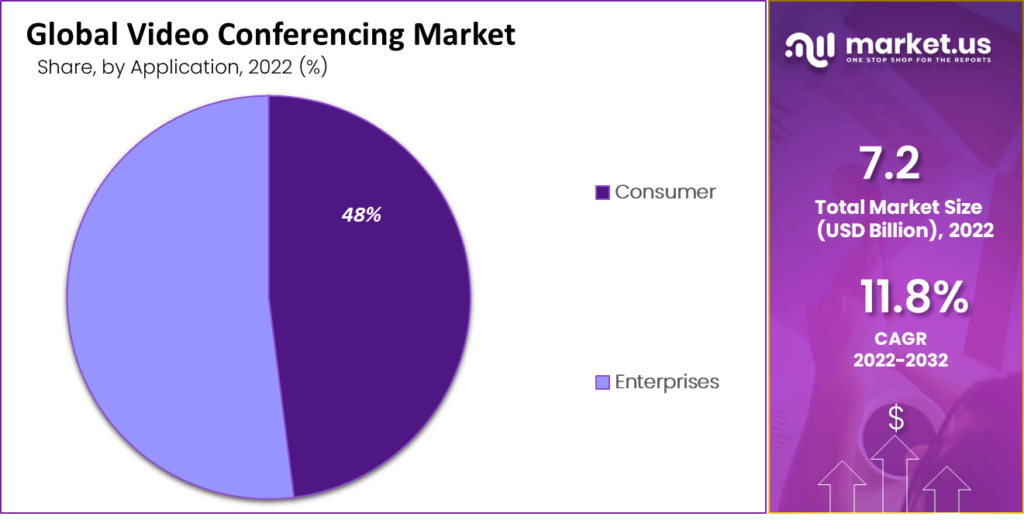

By Application

In 2022, the Enterprises segment held a dominant market position in the video conferencing industry, capturing a substantial share. This segment’s leadership is largely due to the essential role that video conferencing plays in modern business operations, which prioritize communication and collaboration tools to enhance productivity and maintain connectivity across dispersed workforces.

Enterprises across various sectors increasingly rely on video conferencing to conduct daily operations, team meetings, client consultations, and even large-scale conferences. This wide-ranging utility highlights the versatility and indispensability of video conferencing in the business environment. As workplaces have evolved to include more remote and hybrid models, the demand for reliable, high-quality video conferencing systems that can integrate seamlessly with other business applications has surged.

Moreover, enterprises are particularly focused on solutions that offer enhanced security and data protection capabilities, given the sensitive nature of business communications. Video conferencing providers catering to this segment have responded by developing advanced encryption protocols and compliance measures to ensure that these communication platforms meet the stringent security standards required by enterprise users.

The push towards digital transformation within companies also supports the predominant role of the Enterprises segment. Video conferencing is often a central component of digital strategies that seek to optimize operational efficiencies and foster a collaborative culture. By enabling real-time, face-to-face interaction without the limitations of physical location, video conferencing supports enterprises in building a more flexible and responsive business model.

By End-Users Analysis

In 2022, the Corporate segment held a dominant market position in the video conferencing industry, capturing a significant share. This segment’s leading status is driven by the widespread adoption of video conferencing tools within corporate environments, where enhancing communication efficiency and supporting a global workforce are pivotal.

Corporations across the globe utilize video conferencing to streamline internal and external communications. This technology enables businesses to conduct meetings, training sessions, and strategic discussions with participants around the world, thereby eliminating the time and cost associated with travel.

As corporations continue to expand internationally, the need for reliable and effective communication tools like video conferencing becomes even more critical to maintain seamless operations and ensure all team members, regardless of their location, are integrated and engaged. Additionally, the corporate world’s rapid digital transformation accelerates the adoption of video conferencing.

Companies are not only looking to optimize their operational efficiencies but are also striving to adopt sustainable practices. Video conferencing reduces the carbon footprint associated with business travel, aligning with the growing corporate commitment to environmental sustainability.

The Corporate segment also benefits from continuous technological advancements in video conferencing solutions, such as enhanced security features, integration with other business platforms, and improvements in video and audio quality. These enhancements are crucial for corporations that handle sensitive information and require robust, secure communication systems to comply with data protection regulations.

The dominance of the Corporate segment in the video conferencing market is a clear indication of how integral this technology has become in the modern business landscape, where connectivity, efficiency, and sustainability are key drivers of corporate strategy. As businesses continue to evolve and adapt to new challenges, video conferencing remains an essential tool in their operational toolkit.

Key Market Segments

Based on Component

- Hardware

- Camera

- Microphone

- Other Components

- Software

- Services

- Professional Services

- Managed Services

Based on Deployment

- On-Premise

- Cloud

Based on Enterprises Size

- Large Enterprises

- Small and Medium Enterprises

Based on Application

- Consumer

- Enterprises

Based on End-User

- Corporate

- Education

- Healthcare

- Defense

- Entertainment

Driver

Globalization and Remote Work Culture

The expansion of the video conferencing market is significantly driven by globalization and the increasing prevalence of remote work cultures. As businesses continue to operate on a global scale, the demand for robust communication tools that bridge geographical divides is crucial.

This need has been further emphasized by the shift towards remote and hybrid working models, spurred initially by the COVID-19 pandemic and sustained by the ongoing demand for flexible work arrangements. These factors contribute to the growth of video conferencing technologies as they provide essential platforms for collaboration, productivity, and maintaining connectivity across dispersed workforces.

Restraint

Data Security Concerns

A major restraint in the video conferencing market is the ongoing concern regarding data security and privacy. As the use of video conferencing increases, so does the volume of sensitive data being transmitted, raising potential risks of data breaches and cyberattacks.

This concern is particularly pronounced in industries dealing with highly confidential information, such as healthcare, finance, and government. Companies and users are increasingly cautious about the platforms they adopt, seeking assurances that their communication tools are secure and compliant with stringent data protection laws.

Opportunity

Technological Advancements and Integration

There is a significant opportunity in the integration of emerging technologies with video conferencing systems. Advances in artificial intelligence, machine learning, and augmented reality can enhance the functionality of video conferencing tools, making them more interactive and efficient.

For example, AI can be used for real-time language translation and participant tracking, while AR features can be integrated to provide more immersive meeting experiences. These innovations not only improve user engagement but also open up new applications in education, healthcare, and other sectors, driving further adoption of video conferencing technologies.

Challenge

Technological Fragmentation and Integration Issues

A considerable challenge facing the video conferencing market is the technological fragmentation and the difficulties associated with integrating these systems with existing IT infrastructure. Many organizations struggle with compatibility issues between different video conferencing platforms and their in-house systems.

This can hinder the seamless communication essential for effective collaboration. Moreover, as companies often use a variety of software tools, ensuring that video conferencing solutions work well within the broader tech ecosystem remains a complex and costly challenge.

Regional Analysis

In 2022, North America held a dominant market position in the video conferencing market, capturing more than a 37.5% share with revenues reaching approximately USD 13 billion. This leadership can be attributed to several key factors. First, the region boasts a high concentration of major corporations and tech giants that have consistently prioritized and integrated advanced communication technologies. The widespread adoption of remote work models, especially in response to the COVID-19 pandemic, has further propelled the demand for reliable and scalable video conferencing solutions.

Moreover, North America is home to a robust startup ecosystem that contributes to continuous innovations in the tech sector. This has led to the emergence of numerous video conferencing startups and the rapid adoption of their services. The region’s strong infrastructure, with widespread internet connectivity and the early deployment of high-speed networks, also supports the seamless use of high-definition video conferencing technologies.

Educational and governmental institutions in North America have increasingly turned to video conferencing to maintain operations and services, adding to the growth of the market. The presence of a tech-savvy population and the tendency of industries toward digitization are driving further adoption. As companies continue to embrace hybrid work models, the demand for video conferencing in North America is expected to maintain its momentum, potentially increasing the market share in the forthcoming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The video conferencing market has witnessed significant developments from its top players, as companies strive to expand their offerings and market reach through strategic acquisitions, mergers, and new product launches.

Cisco Systems, Inc. has been proactive with acquisitions to strengthen its video conferencing solutions, notably acquiring BroadSoft to enhance its cloud collaboration suite. Microsoft Corporation has also expanded its capabilities in this sector with the acquisition of Skype, integrating it seamlessly into its suite of productivity tools to enhance Microsoft Teams.

Logitech International S.A. has launched innovative products to adapt to the growing demands for quality video conferencing equipment, including high-definition webcams and headsets designed for business environments. Similarly, Polycom, Inc. (now part of HP after being acquired by them) continues to innovate in audio and video technology, launching products that integrate seamlessly with a variety of cloud-based platforms for video conferencing.

Fuze, Inc., another key player, has merged its way to expansion, joining forces with ThinkingPhones. This merger aimed to create a unified cloud-based communication platform that enhances user experience in video conferences.

Huawei Technologies Co., Ltd. has launched new video conferencing systems aimed at offering high-definition and secure communication solutions. These products are designed to be scalable, meeting the needs of large enterprises and SMEs alike.

Top Key Players in Video Conferencing Systems Market

- Adobe Systems Incorporated.

- Atlassian Corporation Plc.

- Cisco Systems, Inc.

- Fuze, Inc.

- Huawei Technologies Co., Ltd.

- JOYCE CR, S.R.O.

- Logitech International S.A.

- LogMeIn, Inc.

- Microsoft Corporation

- Orange Business Services

- Polycom, Inc.

- Vidyo, Inc.

- Visual Systems Group, Inc. (VSGi)

- West Corporation

- ZTE Corporation.

- Other Key Players.

Recent Developments

- In June 2024, Adobe launched new features for its Adobe Connect platform, focusing on enhanced user experience and integration with other Adobe products to streamline workflows for remote teams. This update includes advanced AI-driven analytics to improve meeting efficiency.

- In April 2024, Microsoft released new AI-powered features for Microsoft Teams, including advanced noise suppression and enhanced video quality in low-bandwidth conditions. These updates aim to improve the user experience for remote workers.

- In February 2024, Huawei launched its CloudLink Board, an all-in-one video conferencing device that integrates AI-powered facial recognition and gesture control, aimed at improving user interaction and meeting productivity.

- In January 2024, Logitech announced the release of the Logitech Rally Bar, a modular video conferencing system designed for medium to large meeting rooms, offering advanced audio and video capabilities with AI enhancements.

- In April 2024, Zoom introduced Zoom IQ, an AI-powered tool that provides meeting summaries, action item suggestions, and real-time feedback to enhance productivity and user engagement during virtual meetings.

Report Scope

Report Features Description Market Value (2023) USD 8 Bn Forecast Revenue (2032) USD 21 Bn CAGR (2023-2032) 11.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware (Camera, Microphone, Other Components), Software, Services (Professional Services, Managed Services)), By Deployment (On-Premise, Cloud), By Enterprises Size (Large Enterprises, Small and Medium Enterprises), By Application (Consumer, and Enterprises), By End-User (Corporate, Education, Healthcare, Defense, Entertainment) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Systems Incorporated.,Atlassian Corporation Plc, Cisco Systems In, Fuze Inc, Huawei Technologies Co. Ltd, JOYCE CR S.R.O, Logitech International S.A, LogMeIn Inc, Microsoft Corporation, Orange Business Services, Polycom Inc, Vidyo Inc, Visual Systems Group Inc(VSGi), West Corporation. ZTE Corporation, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the Video Conferencing Systems Market?The Video Conferencing Systems Market refers to the industry involved in the development, manufacturing, and distribution of hardware and software solutions that enable remote communication through video and audio channels.

How big is Video Conferencing Market?The Global Video Conferencing Market size is expected to be worth around USD 21 billion by 2032 from USD 7.2 billion in 2022, growing at a CAGR of 11.8% during the forecast period 2023 to 2032.

What are the key factors driving the growth of the Video Conferencing Systems Market?Key factors include the increasing need for remote work solutions, advancements in video conferencing technology, the demand for real-time communication and collaboration, growing adoption of cloud-based solutions, and the rising importance of reducing travel expenses for businesses.

What are the current trends and advancements in the Video Conferencing Systems Market?Current trends include the integration of AI for enhanced user experience, the rise of hybrid work models, advancements in video quality and security features, the adoption of virtual and augmented reality for immersive meetings, and the increasing use of video conferencing in telehealth and education.

What are the major challenges and opportunities in the Video Conferencing Systems Market?Major challenges include concerns over data privacy and security, the need for high-speed internet connectivity, interoperability issues with different systems, and managing meeting fatigue. Opportunities lie in improving user interfaces, expanding applications in various sectors, leveraging AI for automation and insights, and enhancing security measures.

Who are the leading players in the Video Conferencing Systems Market?Leading players include Adobe Systems Incorporated.,Atlassian Corporation Plc, Cisco Systems In, Fuze Inc, Huawei Technologies Co. Ltd, JOYCE CR S.R.O, Logitech International S.A, LogMeIn Inc, Microsoft Corporation, Orange Business Services, Polycom Inc, Vidyo Inc, Visual Systems Group Inc(VSGi), West Corporation. ZTE Corporation, and Other Key Players.

Video Conferencing Systems MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Video Conferencing Systems MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Systems Incorporated.

- Atlassian Corporation Plc.

- Cisco Systems, Inc.

- Fuze, Inc.

- Huawei Technologies Co., Ltd.

- JOYCE CR, S.R.O.

- Logitech International S.A.

- LogMeIn, Inc.

- Microsoft Corporation

- Orange Business Services

- Polycom, Inc.

- Vidyo, Inc.

- Visual Systems Group, Inc. (VSGi)

- West Corporation

- ZTE Corporation.

- Other Key Players.