Global Veterinary Dietary Supplements Market Size, Share, And Industry Analysis Report By Animal (Companion Animals, Livestock Animals), By Type (Multivitamins and Minerals, Protein and Peptides, Omega-3 Fatty Acids, CBD), By Form (Gummies and Chewables, Tablets and Capsules, Powders, Liquids), By Application (Digestive Health, Nutritional Support, Immunity Support, Skin and Coat Health), By Distribution Channel (Pet Specialty Stores and Retails, Veterinary Hospital and Clinic Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170611

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

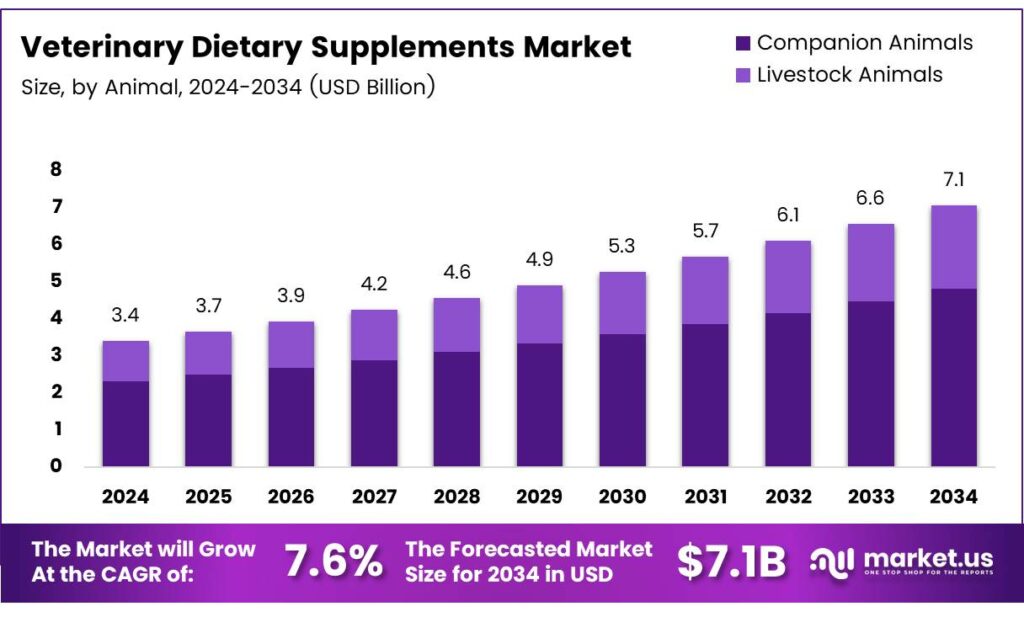

The Global Veterinary Dietary Supplements Market size is expected to be worth around USD 7.1 billion by 2034, from USD 3.4 billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The Veterinary Dietary Supplements Market refers to nutritional products formulated to support animal health beyond regular feed intake. These supplements address immunity, digestion, joint mobility, skin health, and stress management. They are commonly used across companion animals and livestock, aligning preventive care with everyday veterinary nutrition practices.

Veterinary dietary supplements are transitioning from optional add-ons to routine wellness solutions. Pet humanization, rising veterinary awareness, and preventive healthcare thinking continue driving demand. As a result, supplements are increasingly positioned as long-term health investments rather than short-term therapeutic products within veterinary nutrition systems.

- The American Pet Products Association, American pet owners spend over 1 billion annually on dietary supplements. The same source reports usage among 31% of dog owners and 22% of cat owners, highlighting broad but still developing market penetration. APPA survey updates, 53% of dog owners now provide vitamins or supplements, reflecting a 6% increase and a 56% long-term rise. Similarly, 34% of cat owners supplement diets, showing a 6% annual and 70% cumulative increase.

The market is regulated through animal health regulations, feed additive approvals, and labeling compliance. Regulatory agencies emphasize safety, dosage transparency, and ingredient traceability. These frameworks encourage standardized manufacturing and create entry barriers that favor quality-driven suppliers, reinforcing credibility and long-term market stability in veterinary supplements.

Key Takeaways

- The Global Veterinary Dietary Supplements Market is projected to grow from USD 3.4 billion in 2024 to USD 7.1 billion by 2034, registering a CAGR of 7.6% during 2025–2034.

- Companion Animals dominate the market with a share of 67.3%, driven by rising pet humanization and preventive healthcare adoption.

- Multivitamins and Minerals lead the By Type segment, accounting for 29.7% of the total market due to broad daily nutritional use.

- Gummies and Chewables are the preferred formulation, holding a market share of 34.9% based on ease of administration and compliance.

- Nutritional Support is the largest application segment with a share of 26.6%, supported by routine wellness supplementation.

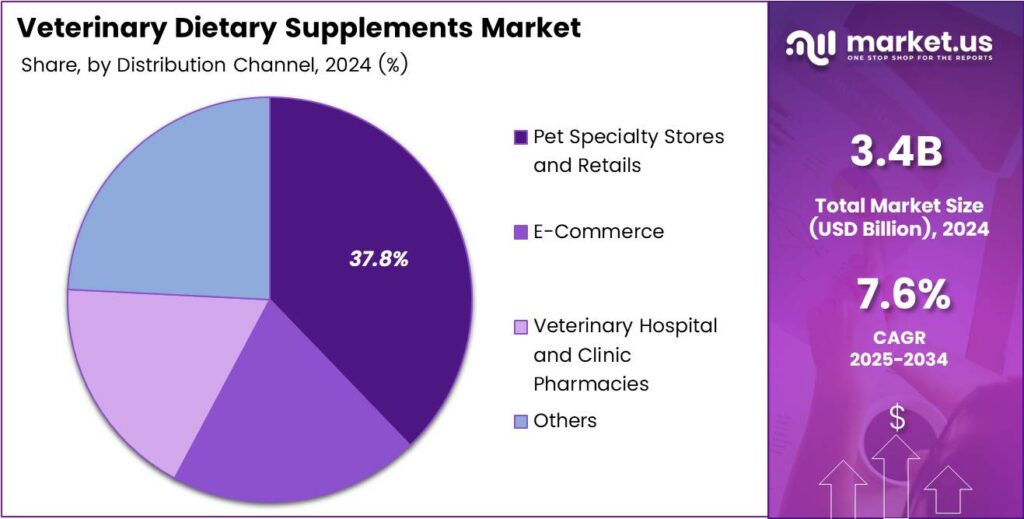

- Pet Specialty Stores and Retailers dominate distribution channels with a share of 37.8%, reflecting trust-based purchasing behavior.

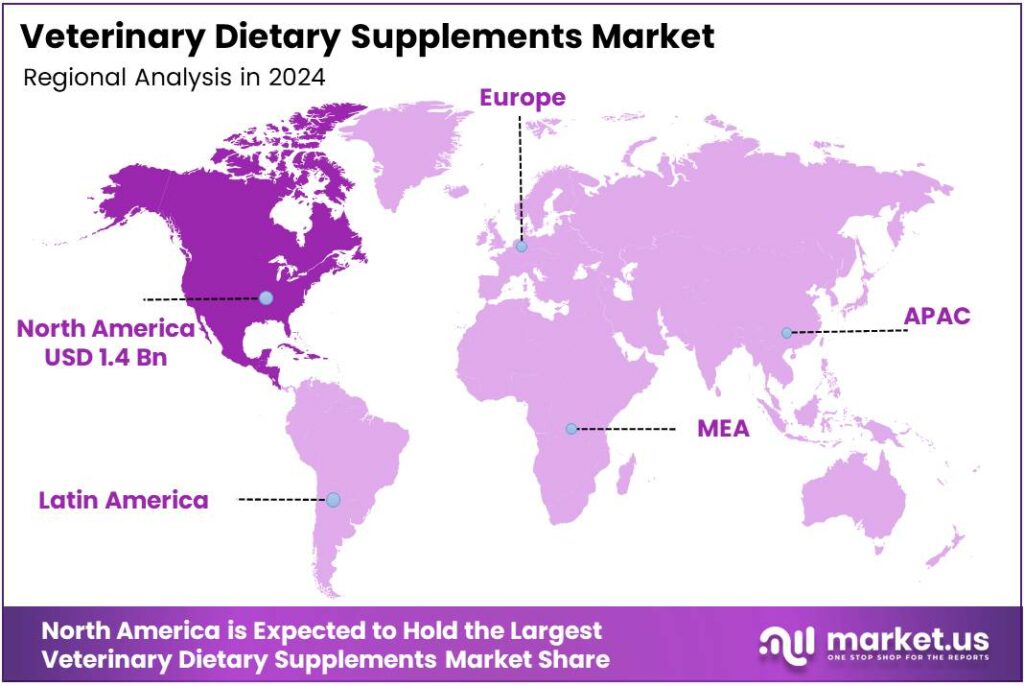

- North America leads the global market with a dominant share of 43.9%, valued at USD 1.4 billion, supported by high preventive care spending.

By Animal Analysis

Companion Animals dominate with 67.3% due to rising pet humanization and preventive care.

Companion Animals held a dominant market position in the By Animal Analysis segment of the Veterinary Dietary Supplements Market, with a 67.3% share. Growth is supported by higher spending on pet wellness, routine supplementation, and increasing awareness of long-term health management among urban pet owners.

Livestock Animals represent a steady demand base, driven by productivity improvement, herd health management, and nutritional balance. Supplements in this segment are commonly linked to immunity, digestion, and stress resistance, supporting consistent usage across dairy, poultry, and meat-producing animals.

By Type Analysis

Multivitamins and Minerals dominate with 29.7% due to broad nutritional coverage.

Multivitamins and Minerals held a dominant market position in the By Type Analysis segment of the Veterinary Dietary Supplements Market, with a 29.7% share. These products address common nutrient gaps and are widely recommended for daily wellness across animal categories.

Probiotic and Prebiotic supplements support gut balance and digestion. Their adoption is increasing as digestive health gains importance, especially for animals exposed to diet changes, antibiotics, or environmental stress. Protein and Peptides focus on muscle maintenance, recovery, and growth.

Omega-3 Fatty Acids are valued for joint, skin, and cardiovascular support. Usage continues to expand alongside awareness of inflammation management and coat health benefits. CBD supplements remain niche but visible, mainly for calming and discomfort support. Adoption is cautious due to regulatory clarity and veterinarian guidance requirements.

By Form Analysis

Gummies and Chewables dominate with 34.9% due to ease of administration.

Gummies and Chewables held a dominant market position in the By Form Analysis segment of the Veterinary Dietary Supplements Market, with a 34.9% share. Palatability and convenience strongly influence repeat purchases and compliance.

Tablets and Capsules remain widely used, especially for precise dosing. They are commonly preferred in veterinary-prescribed regimens and multi-nutrient formulations. Powders offer flexible mixing with food and water. This form is popular for digestive and protein supplements used in both pets and livestock.

Liquids support faster absorption and ease for young or aging animals. They are often selected for immunity and metabolic support applications. Others include pastes and gels, addressing specific administration needs and niche therapeutic use cases.

By Application Analysis

Nutritional Support dominates with 26.6% due to daily wellness usage.

Nutritional Support held a dominant market position in the By Application Analysis segment of the Veterinary Dietary Supplements Market, with a 26.6% share. Daily supplementation drives consistent demand across age groups and animal types.

Joint Health Support addresses mobility concerns and aging-related stiffness. Usage is rising as pet lifespans increase and owners prioritize active living. Calming Stress Anxiety supplements support behavioral balance. Demand is linked to lifestyle changes, travel stress, and noise sensitivity.

Digestive Health applications focus on gut stability and nutrient absorption, especially during dietary transitions or medication use. Immunity Support targets seasonal risks and recovery phases, reinforcing resistance against common infections. Skin and Coat Health supplements enhance appearance and comfort, supporting shedding control and dermatological wellness.

By Distribution Channel Analysis

Pet Specialty Stores and Retail dominate with 37.8% due to trust-based purchasing.

Pet Specialty Stores and Retailers held a dominant market position in the By Distribution Channel Analysis segment of the Veterinary Dietary Supplements Market, with a 37.8% share. Personalized guidance and product variety strengthen buyer confidence.

E-Commerce is expanding rapidly, supported by convenience, subscription models, and wider brand access for repeat supplement purchases. Veterinary Hospital and Clinic Pharmacies remain influential for condition-specific recommendations. Professional advice supports credibility and targeted usage.

Key Market Segments

By Animal

- Companion Animals

- Livestock Animals

By Type

- Multivitamins and Minerals

- Probiotic and Prebiotic

- Protein and Peptides

- Omega-3 Fatty Acids

- CBD

- Others

By Form

- Gummies and Chewables

- Tablets and Capsules

- Powders

- Liquids

- Others

By Application

- Joint Health Support

- Calming/Stress/Anxiety

- Digestive Health

- Nutritional Support

- Immunity Support

- Skin and Coat Health

- Others

By Distribution Channel

- Pet Specialty Stores and Retail

- E-Commerce

- Veterinary Hospital and Clinic Pharmacies

- Others

Emerging Trends

Shift Toward Natural, Clean-Label, and Customized Supplements Shapes Trends

A key trend in the veterinary dietary supplements market is the shift toward natural and clean-label products. Pet owners increasingly prefer supplements made with herbal extracts, probiotics, and omega-based ingredients. Customization is another growing trend.

- Breed-specific, age-based, and condition-focused formulations help deliver better outcomes. The American Pet Products Association (APPA), an estimated 94 million U.S. households owned at least one pet in 2025, including 68 million dog-owning homes and 49 million cat-owning homes.

Personalized nutrition plans are gaining popularity through veterinary clinics. Innovative product formats such as soft chews, flavored liquids, and gummies are also trending. These improve compliance and ease of feeding, making supplements a regular part of animal care routines.

Drivers

Rising Pet Humanization and Preventive Care Awareness Drives Market Growth

The veterinary dietary supplements market is strongly driven by the growing humanization of pets. Pet owners increasingly treat dogs and cats as family members and focus on long-term health rather than only treatment. This mindset boosts demand for daily vitamins, joint care, digestive aids, and immunity supplements.

Rising awareness about preventive animal healthcare also supports market growth. Veterinarians now recommend supplements to manage early-stage issues such as arthritis, skin problems, and gut imbalance. This reduces future medical costs and improves animal well-being.

Urban lifestyles and nuclear families further increase supplement usage. Busy owners prefer easy-to-administer chewables and liquids that support overall nutrition. Growth in pet adoption, especially among millennials, continues to expand the consumer base for veterinary dietary supplements.

Restraints

Lack of Standardized Regulations Limits Market Expansion

One major restraint in the veterinary dietary supplements market is the lack of uniform regulations. In many regions, supplements are not regulated as strictly as veterinary medicines. This creates confusion about product quality, safety, and effectiveness.

- Limited clinical validation also affects buyer trust. Some supplements lack strong scientific backing, making veterinarians cautious about recommending them. This slows adoption, especially in professional veterinary channels. The APPA’s recent national survey also shows that around 53% of dog owners and 34% of cat owners now give vitamins or supplements to their pets, with both numbers rising each year.

Price sensitivity is another challenge. Premium supplements can be costly, which restricts use among livestock owners and budget-conscious pet owners. In developing markets, limited awareness and lower spending power further reduce market penetration.

Growth Factors

Expansion of E-Commerce and Veterinary Clinics Creates New Opportunities

The growing presence of e-commerce platforms presents a major growth opportunity for veterinary dietary supplements. Online channels make products easily accessible and offer a wide variety of choices. Convenience, discounts, and subscription models encourage regular purchases.

Rising investments in veterinary clinics and pet care centers also support market expansion. Modern clinics increasingly offer supplements alongside treatments, creating bundled care solutions. This improves product visibility and trust among consumers.

Product innovation offers another strong opportunity. Companies are developing breed-specific, age-specific, and condition-focused supplements. These targeted solutions address precise health needs, increasing customer satisfaction and market value.

Regional Analysis

North America Dominates the Veterinary Dietary Supplements Market with a Market Share of 43.9%, Valued at USD 1.4 Billion

North America leads the veterinary dietary supplements market, supported by strong pet humanization trends and high preventive healthcare spending. In this region, the market held a dominant share of 43.9%, reaching a value of USD 1.4 billion, reflecting mature adoption across companion animals. High awareness among pet owners, regular veterinary consultations, and premium nutrition preferences continue to drive steady demand growth.

Europe represents a well-established market driven by strict animal welfare standards and an increasing focus on preventive pet healthcare. Growing demand for natural, functional, and condition-specific supplements supports consistent market expansion. The region also benefits from strong regulatory frameworks that improve product quality and consumer trust.

Asia Pacific is emerging as a high-growth region due to rising pet ownership, urbanization, and increasing disposable incomes. Awareness of animal nutrition is improving rapidly, especially in developing economies. Expanding veterinary infrastructure and digital pet-care platforms are further accelerating market penetration across the region.

The U.S. plays a critical role within the global market due to advanced pet healthcare practices and strong consumer spending on animal wellness. High acceptance of daily nutritional supplements and preventive care routines supports consistent demand. Innovation in formulations and targeted health solutions continues to shape market evolution.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Boehringer Ingelheim continues to shape the 2024 veterinary dietary supplements space by linking supplements with everyday preventive care in companion animals. Its scale in animal health helps it support consistent quality, science-led claims, and wider veterinary acceptance across markets. This positions the company well as pet parents increasingly look for “clinic-trusted” supplement options.

Virbac benefits from a strong veterinary-channel focus, which supports credibility in supplements that target skin, digestion, and general wellness needs. Its brand strength in pet care helps it compete on trust and formulation expertise rather than price alone. This strategy can improve repeat purchase rates where vets influence buying decisions.

AMORVET stands out as a fast-moving player that can adapt product formats and claims to local demand patterns, especially in value-driven markets. It gains traction by offering accessible supplement choices while still emphasizing everyday pet wellness. Its growth outlook is tied to expanding distribution and strengthening practitioner confidence.

Elanco leverages its established animal health footprint to support supplement portfolios that align with long-term pet health and compliance-friendly positioning. In 2024, its advantage comes from broad market reach and the ability to integrate supplements into wider health management conversations. This makes Elanco well placed to capture premium segments where owners prioritize preventive outcomes.

Top Key Players in the Market

- Boehringer Ingelheim

- Virbac

- AMORVET

- Elanco

- Vetoquinol

- Ark Naturals

- Biovencer Healthcare Private Limited

- Nutramax Laboratories Veterinary Sciences, Inc

- Zesty Paws

Recent Developments

- In 2025, Boehringer Ingelheim continues to advance animal health innovation through partnering efforts, with a 2025 outlook emphasizing R&D investments in new medicines and preventive solutions. Their animal health portfolio focuses on advanced products, though specific veterinary dietary supplement launches remain tied to broader therapeutic advancements.

- In 2025, Virbac launched Veterinary HPM, a revamped physiological food range for pets rolling out in Europe, featuring eco-responsible 100% recyclable packaging, enriched formulas with ingredients like Ascophyllum nodosum for oral hygiene, hyaluronic acid for joint support, and highly digestible rice. This update extends shelf life to 18 months while maintaining a science-based nutrition approach for veterinarians and pet owners.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Animal (Companion Animals, Livestock Animals), By Type (Multivitamins and Minerals, Probiotic and Prebiotic, Protein and Peptides, Omega-3 Fatty Acids, CBD, Others), By Form (Gummies and Chewables, Tablets and Capsules, Powders, Liquids, Others), By Application (Joint Health Support, Calming Stress Anxiety, Digestive Health, Nutritional Support, Immunity Support, Skin and Coat Health, Others), By Distribution Channel (Pet Specialty Stores and Retails, E-Commerce, Veterinary Hospital and Clinic Pharmacies, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Boehringer Ingelheim, Virbac, AMORVET, Elanco, Vetoquinol, Ark Naturals, Biovencer Healthcare Private Limited, Nutramax Laboratories Veterinary Sciences, Inc., Zesty Paws Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Veterinary Dietary Supplements MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Dietary Supplements MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Boehringer Ingelheim

- Virbac

- AMORVET

- Elanco

- Vetoquinol

- Ark Naturals

- Biovencer Healthcare Private Limited

- Nutramax Laboratories Veterinary Sciences, Inc

- Zesty Paws