Global Vegan Dips Market Size, Share Analysis Report By Type (Hummus, Salsa, Guacamole, Spinach and Artichoke Dip, Baba Ganoush, Others), By Flavors (Classic, Spicy, Herby And Fresh, Others), By Packaging (Bottles, Sachets/Pouches, Containers/Tubs, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173631

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

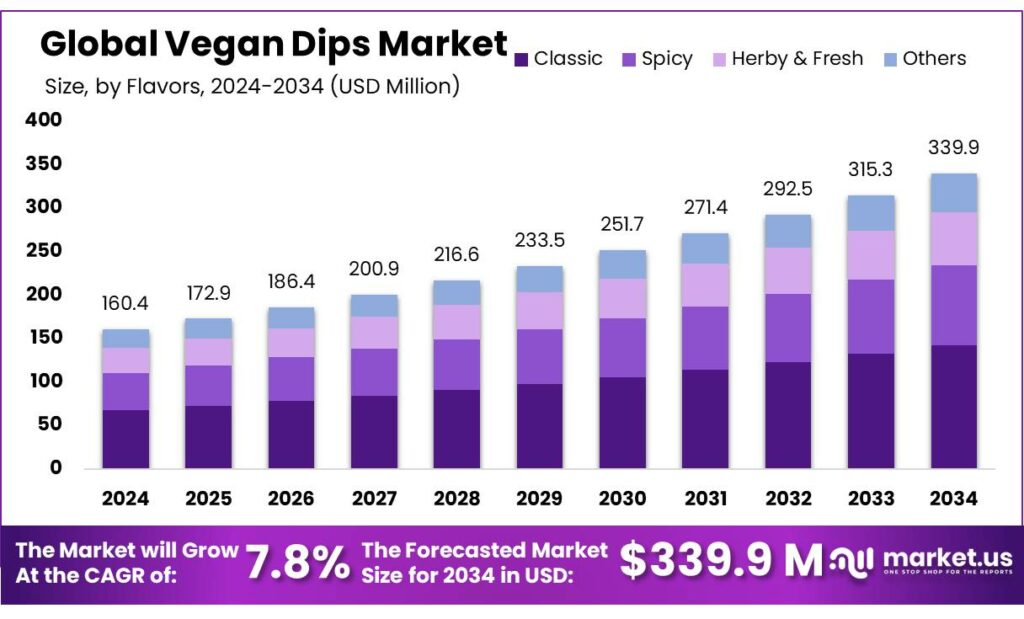

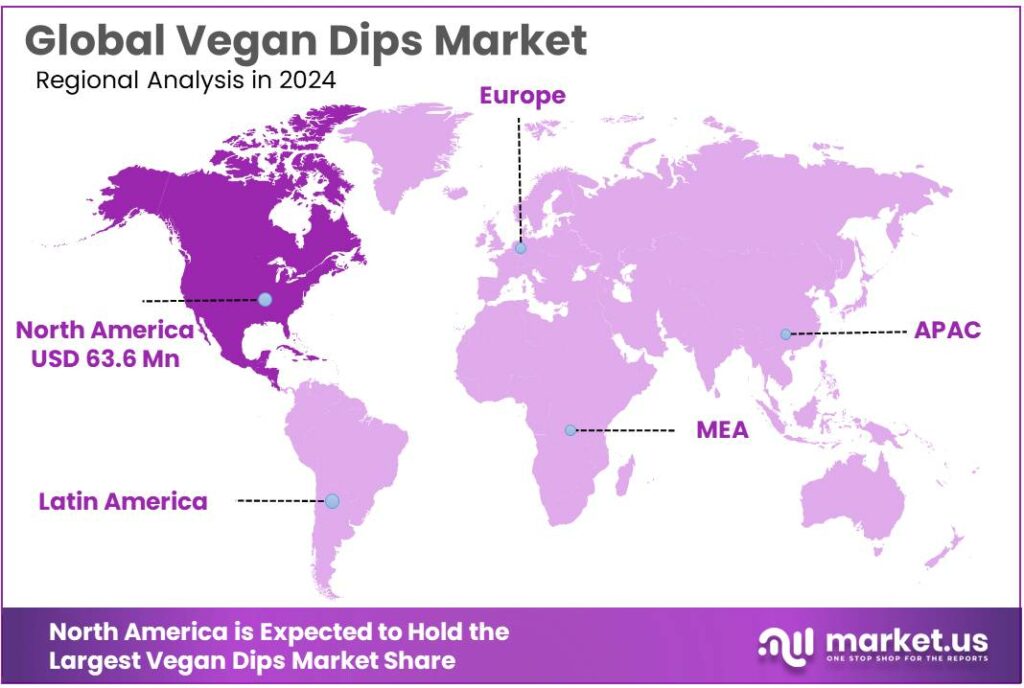

Global Vegan Dips Market size is expected to be worth around USD 339.9 Million by 2034, from USD 160.4 Million in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.3% share, holding USD 0.9 Billion in revenue.

Vegan dips sit at the intersection of convenience snacking, “better-for-you” eating, and the broader plant-based shift in packaged foods. In retail, the momentum is visible in adjacent categories that share the same shopper mission—quick protein, fiber, and flavor without animal ingredients. In the U.S., plant-based foods generated about $8.1 billion in retail dollar sales in 2024, based on sales data commissioned from SPINS and reported by the Good Food Institute and the Plant Based Foods Association.

From an industrial scenario standpoint, vegan dips typically rely on crop-based inputs plus stabilizers, acidulants, and flavor systems that deliver consistent texture and shelf life. The pulse supply chain is increasingly important: global chickpea output was about 17 million tonnes according to FAO reporting. In the United States, USDA’s Economic Research Service highlighted real-world volatility that affects dip manufacturers’ cost planning—by June 2024, chickpea stocks were down 23% year over year, while 2023/24 marketing-year imports through May were down 31%.

- Key demand drivers are practical and measurable. In the U.S., PBFA reports 59% of households purchased plant-based foods in 2024, and 48% of U.S. restaurants feature plant-based foods—both signals that plant-forward eating is mainstream, not niche.

Policy and public programs can indirectly strengthen category tailwinds by pushing fruit-and-vegetable access and local procurement—two areas that naturally pair with dips. The USDA announced an investment of more than $52 million to improve dietary health and access to fruits and vegetables for eligible families. Separately, USDA’s Farm to School Grant program has awarded roughly $100 million across 1,200+ projects since 2013, helping schools and communities expand healthier meal and snack ecosystems that can incorporate plant-forward sides and spreads.

Key Takeaways

- Vegan Dips Market size is expected to be worth around USD 339.9 Million by 2034, from USD 160.4 Million in 2024, growing at a CAGR of 7.8%.

- Hummus held a dominant market position, capturing more than a 37.5% share.

- Classic held a dominant market position, capturing more than a 42.7% share.

- Containers/Tubs held a dominant market position, capturing more than a 38.2% share.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.4% share.

- North America emerged as the dominating region in the global vegan dips market, capturing approximately 39.8% of total market share and registering an estimated value of USD 63.68 million.

By Type Analysis

Hummus leads the vegan dips market with a 37.5% share, supported by its everyday use and clean ingredient profile

In 2024, Hummus held a dominant market position, capturing more than a 37.5% share, as it remained the most familiar and widely consumed vegan dip across global markets. Its strong demand was driven by simple ingredients such as chickpeas, tahini, and olive oil, which align well with plant-based, clean-label, and high-protein food trends. Hummus was commonly used as a dip, spread, and meal accompaniment, supporting frequent household consumption rather than occasional use.

In 2025, the segment continued to show steady growth, supported by rising vegan and flexitarian diets, along with increased availability of flavored and fortified hummus variants. Improved cold-chain distribution and wider shelf placement in retail stores further supported volume sales. Overall, hummus maintained its leading position due to high consumer trust, nutritional value, and its ability to fit easily into daily meals and snacking habits.

By Flavors Analysis

Classic flavor dominates vegan dips with a 42.7% share, driven by familiarity and broad consumer appeal

In 2024, Classic held a dominant market position, capturing more than a 42.7% share, as consumers continued to prefer familiar and well-balanced flavors over bold or experimental options. The classic profile offered a neutral taste that paired easily with vegetables, snacks, and prepared foods, making it suitable for daily consumption across households. Its wide acceptance among both vegan and non-vegan consumers supported higher repeat purchases and consistent sales volumes.

In 2025, demand for classic vegan dips remained strong, supported by clean-label expectations and minimal seasoning preferences among health-focused buyers. Retailers also favored classic variants due to lower risk and steady turnover. Overall, the classic flavor segment maintained its leadership position by meeting everyday taste preferences while aligning with simple, natural, and plant-based food choices.

By Packaging Analysis

Containers and tubs lead vegan dips packaging with a 38.2% share, supported by convenience and easy storage

In 2024, Containers/Tubs held a dominant market position, capturing more than a 38.2% share, as they remained the most practical and consumer-friendly packaging format for vegan dips. This packaging type allowed easy scooping, resealing, and refrigeration, which supported repeated use and reduced food waste at the household level. Containers and tubs were widely preferred for both single-serve and family-size packs, making them suitable for everyday consumption and social occasions.

In 2025, demand for this packaging format continued to remain stable, supported by lightweight materials, improved recyclability, and clearer labeling that enhanced shelf appeal. Retailers also favored containers and tubs due to efficient stacking and display benefits. Overall, this segment maintained its leading position due to its strong convenience value, storage efficiency, and alignment with consumer usage habits.

By Distribution Channel Analysis

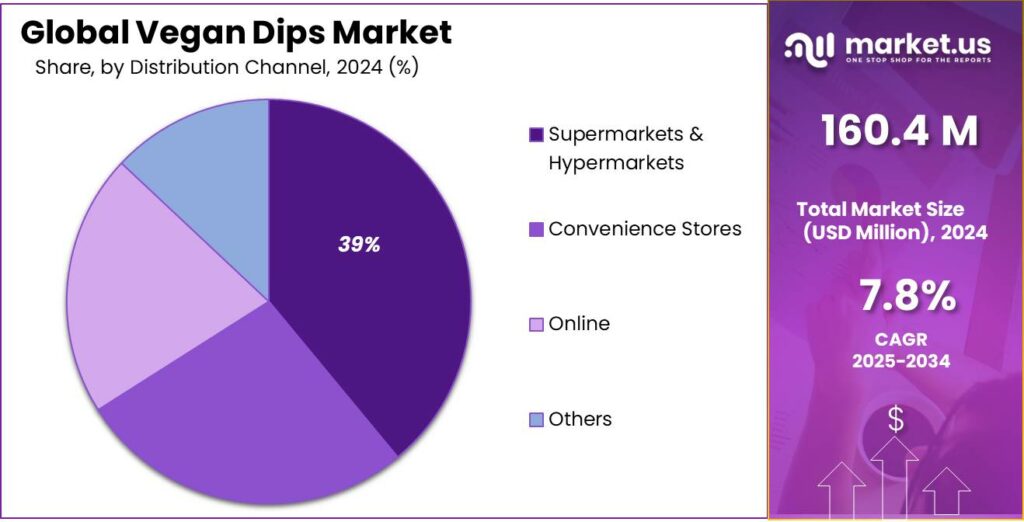

Supermarkets and hypermarkets lead vegan dips sales with a 39.4% share, driven by strong shelf presence and routine shopping

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 39.4% share, as they remained the primary purchasing channel for vegan dips. These outlets offered wide product visibility, multiple brand choices, and competitive pricing, which supported higher consumer trust and frequent purchases. Placement in chilled and health food sections further increased product awareness among both vegan and non-vegan shoppers.

In 2025, this channel continued to perform strongly, supported by expanded plant-based food sections and growing foot traffic from health-conscious consumers. Regular promotions and in-store sampling also helped improve trial rates. Overall, supermarkets and hypermarkets maintained their leading role due to convenience, scale, and their strong influence on everyday food buying decisions.

Key Market Segments

By Type

- Hummus

- Salsa

- Guacamole

- Spinach and Artichoke Dip

- Baba Ganoush

- Others

By Flavors

- Classic

- Spicy

- Herby & Fresh

- Others

By Packaging

- Bottles

- Sachets/Pouches

- Containers/Tubs

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Snackification Is Turning Vegan Dips Into Mini-Meal Staples

A clear latest trend in vegan dips is that they are being used less as a “party extra” and more as an everyday mini-meal solution. People are changing how they eat during the day, leaning into smaller, flexible eating moments instead of sitting down for three full meals. In the 2024 IFIC Food & Health Survey, 56% of Americans said they replace traditional meals by snacking or eating smaller meals.

This snack-meal behavior is also pushing vegan dips closer to produce, which changes both merchandising and product design. When someone snacks to replace a meal, they often want something that feels filling and balanced. Dips pair well with carrots, cucumbers, peppers, and other fresh items, making them a practical bridge between convenience and healthier eating. Government programs are supporting the same direction by strengthening fruit-and-vegetable access.

- For example, the USDA announced an investment of more than $52 million to improve dietary health and access to fresh fruits and vegetables for eligible families. Another USDA announcement highlighted an investment of more than $46 million aimed at food and nutrition security, including efforts that support healthy diets and access to fruits and vegetables for eligible families.

Digital buying is accelerating this trend by making vegan dips easier to discover and reorder. PBFA’s State of the Marketplace reporting notes that e-commerce sales of plant-based foods reached $394 million in 2023, growing 16.4% over three years, and capturing 6.8% online market share versus 3.8% in retail stores.

Drivers

Mainstream Plant-Based Eating Makes Vegan Dips an Easy “Everyday” Buy

One of the biggest drivers for vegan dips is that plant-based eating is no longer a niche habit—it has become a normal shopping behavior in many households. When more people feel comfortable buying plant-based items, dips benefit because they are a low-risk trial: a shopper can try one tub at a party, with lunch, or as a quick snack, without changing their whole diet.

- Industry reporting from the Good Food Institute (GFI), using retail-sales tracking shared with the Plant Based Foods Association (PBFA), notes the U.S. retail plant-based food market was worth $8.1 billion in 2024.

Repeat buying behavior is another reason this driver is so powerful. People often discover vegan dips through one occasion—game night, office snacks, kids’ lunchboxes—and then keep buying because it solves the daily “what can I eat quickly?” question. In GFI’s plant-based industry reporting, 81% of U.S. households that purchased plant-based foods in 2023 bought them more than once during the year.

This mainstreaming effect becomes even stronger when paired with digital buying. PBFA’s State of the Marketplace reporting highlights that plant-based food e-commerce sales reached $394 million in 2023, and grew about 16.4% over three years; it also reports an online market share of 6.8% compared with 3.8% in retail stores.

Government nutrition programs also reinforce the same demand direction—more produce and healthier snacking occasions—where dips fit naturally. The USDA announced an investment of more than $52 million to improve dietary health and access to fresh fruits and vegetables for eligible families.

Restraints

Higher Shelf Prices and Food Inflation Limit Repeat Buying

The broader plant-based market shows how price pressure can translate into fewer units sold, even when interest remains. The Good Food Institute (GFI) reports that in 2024 U.S. plant-based food dollar sales increased 2%, while unit sales declined 1%—an improvement compared with the 8% unit decline seen in 2023, but still a sign that shoppers are buying fewer packs even as prices hold up the dollar value.

The “units down, dollars not as strong” pattern was even clearer in the tougher inflation environment. In GFI’s 2023 state-of-industry reporting, the U.S. retail plant-based food market was valued at $8.1 billion in 2023, but plant-based unit sales were down 9% versus 2022, while dollar sales were down 2%.

Food inflation itself adds to the restraint because it narrows how much room people have for trial and premium choices. USDA’s Economic Research Service forecast (September 2025) anticipates overall food prices rising about 3.0% in 2025, with food-at-home prices projected to increase 2.4%.

There is also a “price gap expectation” issue inside plant-based categories. GFI analysis for plant-based meat and seafood notes the average plant-based meat product price is about 35% higher than its conventional counterpart, and that price differences can cause large drop-offs in consumer interest when the gap widens.

Opportunity

Foodservice and Public Nutrition Channels Can Unlock the Next Wave

The school meal ecosystem is one of the biggest volume opportunities where dips can fit as a side, snack, or component in wrap-and-bowl meals. The School Nutrition Association, citing preliminary USDA FY 2024 figures, notes the National School Lunch Program reaches about 29.7 million students each day across 95,000+ schools and institutions, and serves about 4.9 billion lunches annually.

Local procurement and farm-to-school efforts make this channel even more attractive. The Patrick Leahy Farm to School Grant Program has awarded $100 million since 2013 across 1,275 projects, supporting nutrition education, school gardens, and local food procurement. In parallel, USDA announced that for FY 2026 it will invest up to $18 million in Farm to School grants to strengthen connections between farmers and child nutrition programs.

Produce-access initiatives also support demand for dip-and-produce occasions at home. USDA-backed efforts aimed at improving dietary health and fruit-and-vegetable access can increase the amount of fresh produce households bring in, which naturally raises the value of easy, flavorful pairings like vegan dips. For example, USDA has announced investments of more than $46 million in projects focused on fruit and vegetable access.

Another scalable opportunity is aligning vegan dips with incentives that push produce purchasing. USDA’s Gus Schumacher Nutrition Incentive Program (GusNIP) reports that from 2019 to 2024 it provided over $330 million in funding to over 250 projects across the U.S., spanning nutrition incentives and produce prescription initiatives.

Regional Insights

North America leads the vegan dips market with a 39.8% share, reaching USD 63.68 million in 2024

North America emerged as the dominating region in the global vegan dips market, capturing approximately 39.8% of total market share and registering an estimated value of USD 63.68 million in 2024. The region’s leadership was supported by strong consumer interest in plant-based foods, rising health awareness, and the growing trend of flexitarian and vegan diets across the United States and Canada.

In 2024, higher demand was observed for familiar formats such as hummus, guacamole, and classic flavored dips, driven by their perceived health benefits, clean-label ingredients, and compatibility with everyday snacking and meal occasions. Retail channels such as supermarkets, hypermarkets, and health food stores played a significant role in shaping regional performance, with strategic product placement and promotional activities enhancing visibility and accessibility of vegan dip offerings.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Kraft Heinz Company is a major global food and beverage company headquartered in Chicago/Pittsburgh, producing a range of sauces, snacks and dips, including plant-based and vegan formulations under diverse brands. In 2024, the company reported revenue of USD 25,846 million and continued innovation in vegan dips to leverage its distribution strength across supermarkets and online channels. Kraft Heinz employs approximately 36,000 people worldwide.

Kite Hill is a U.S. plant-based food producer known for its artisanal almond-based dairy alternatives, including vegan dips and spreads that target clean-label consumers. Founded in 2013, the company employs around 150 people and generated about USD 60 million in revenue in 2023, with continued expansion expected in dips and spreads in 2025 as consumer demand for dairy-free and vegan options grows.

SABRA DIPPING CO. LLC, based in the U.S., is a leading hummus and plant dip producer with around 700 employees and a 36 % share of U.S. hummus sales in 2024. The company offers a broad range of vegan-friendly dips like hummus and guacamole, supported by strong retail distribution across North America.

Top Key Players Outlook

- The Kraft Heinz Company

- Kite Hills

- Good Foods Group

- Wingreen World

- SABRA DIPPING CO. LLC

- DAIYA FOODS INC.

- Frito-Lay North America Inc.

- Bolthouse Farms Inc.

- Siete

Recent Industry Developments

In 2024, Wingreens World’s consolidated revenue was approximately ₹260.55 crore (USD ~ 31 million), reflecting expanded distribution in over 1,300 modern trade stores and 9,000 general trade outlets nationwide, with fresh dips such as classic hummus and basil pesto leading category visibility.

n 2024, Good Foods Group’s estimated annual revenue was approximately USD 101.9 million with a workforce of over 300 employees, underscoring its mid-tier scale and capacity to serve national retail channels such as Costco, Target and Publix.

Report Scope

Report Features Description Market Value (2024) USD 160.4 Mn Forecast Revenue (2034) USD 339.9 Mn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hummus, Salsa, Guacamole, Spinach and Artichoke Dip, Baba Ganoush, Others), By Flavors (Classic, Spicy, Herby And Fresh, Others), By Packaging (Bottles, Sachets/Pouches, Containers/Tubs, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Kraft Heinz Company, Kite Hills, Good Foods Group, Wingreen World, SABRA DIPPING CO. LLC, DAIYA FOODS INC., Frito-Lay North America Inc., Bolthouse Farms Inc., Siete Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Kraft Heinz Company

- Kite Hills

- Good Foods Group

- Wingreen World

- SABRA DIPPING CO. LLC

- DAIYA FOODS INC.

- Frito-Lay North America Inc.

- Bolthouse Farms Inc.

- Siete