Global UV Absorber Market By Type(Benzotriazole, Triazine, Benzophenone, Others), By Application(Adhesives, Cosmetics, Plastics, Coatings, Others), By End-use(Construction, Personal Care, Agriculture, Automobile, Others), By Distribution Channel(Direct Sales, Indirect Sales), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121296

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

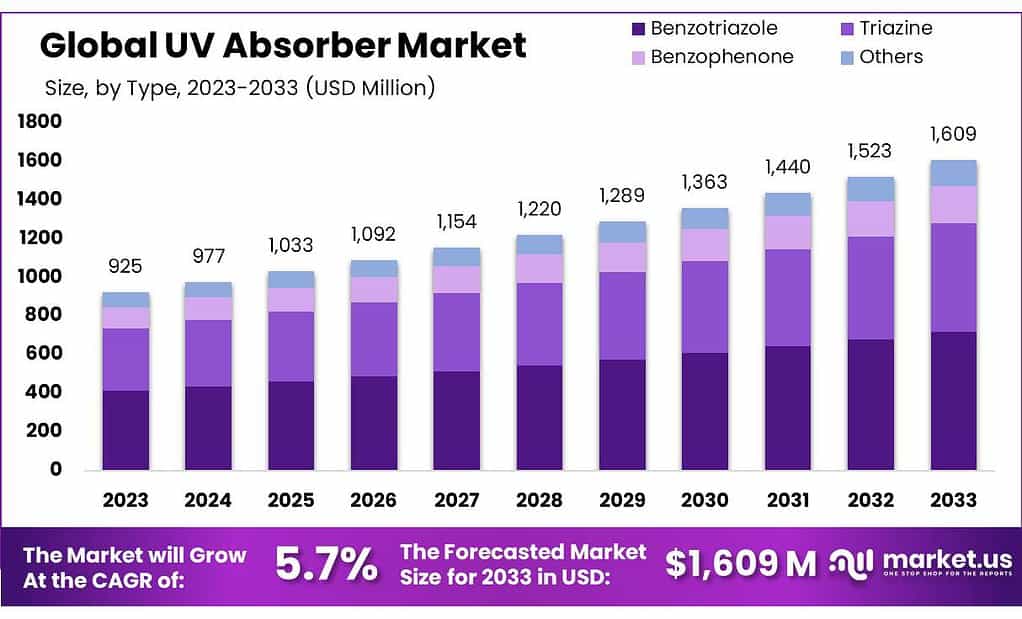

The global UV Absorber Market size is expected to be worth around USD 1609 Million by 2033, from USD 925 Million in 2023, growing at a CAGR of 5.7% during the forecast period from 2023 to 2033.

The UV absorber market refers to the industry that produces and sells chemicals designed to absorb ultraviolet (UV) radiation and protect materials from UV light damage. These chemicals are used in various products to prevent fading, discoloration, or degradation caused by sunlight exposure.

UV absorbers are commonly incorporated into plastics, coatings, cosmetics, and personal care products to extend their lifespan and maintain their quality and appearance under UV light exposure.

In plastics, UV absorbers help in maintaining structural integrity and appearance, preventing the material from becoming brittle or discolored. In the cosmetics industry, they are used in products like sunscreens and moisturizers to protect the skin from harmful UV rays. UV absorbers can also be found in automotive paints and industrial coatings, where they protect surfaces from sun damage, thus preserving color and finish over time.

The demand for UV absorbers is driven by their widespread applications and the growing awareness about the harmful effects of UV radiation on both materials and human health. Additionally, the increasing use of plastics and polymers in various industries, including automotive, construction, and packaging, further boosts the market growth. Innovations in product formulations and the development of more efficient and environmentally friendly UV absorbers will likely provide new opportunities for this market.

Key Takeaways

- UV Absorber Market is poised to reach USD 1,609 million by 2033, with a 5.7% CAGR from USD 925 million in 2023.

- Benzotriazole dominates the UV absorber market with over 44.6% share in 2023, valued at USD 413.05 million.

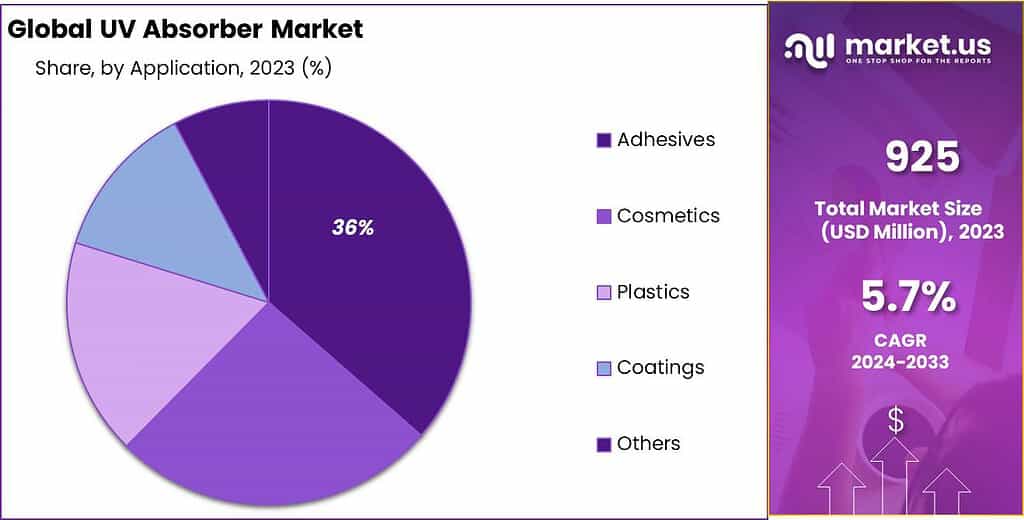

- Adhesives hold the largest market share in 2023, capturing over 35.8%, valued at USD 330.85 million.

- The construction sector leads end-use applications in 2023, with over 35.9% market share, valued at USD 331.98 million.

- Indirect sales dominate distribution channels with over 71.3% market share in 2023, valued at USD 658.88 million.

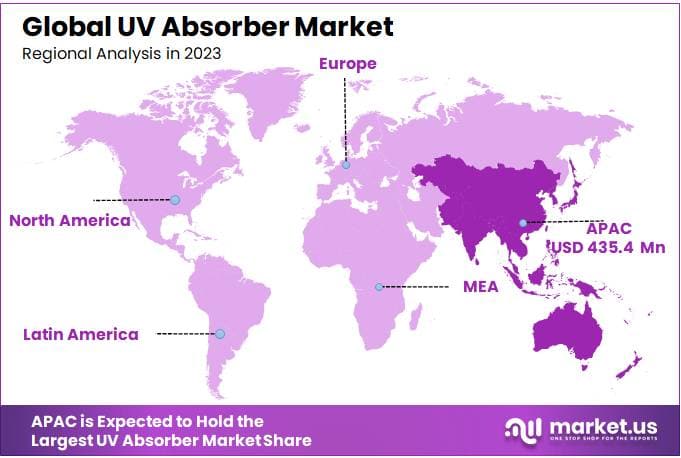

- Asia Pacific emerges as the dominant force in the UV absorber market, securing 37.6% market share in 2023, valued at USD 435.4 million.

By Type

In 2023, Benzotriazole held a dominant market position, capturing more than a 44.6% share. This type of UV absorber is favored for its exceptional performance in protecting polymers from UV degradation, making it ideal for applications in automotive coatings and plastics. Its high stability and ability to absorb lower wavelengths of light efficiently contribute to its widespread use.

Triazine UV absorbers are also significant players in the market. Known for their strong absorbency at higher UV wavelengths, they are particularly valued in sunscreen products and outdoor applications where strong UV protection is crucial. Triazine compounds are appreciated for their long-term stability and minimal color distortion in products.

Benzophenone is used primarily in personal care products like sunscreens and cosmetics, as well as in packaging materials. It acts by absorbing UV radiation and converting it into less harmful infrared radiation, which is then dissipated as heat. However, its use has become controversial due to environmental and health concerns, leading to stricter regulations.

By Application

In 2023, Adhesives held a dominant market position, capturing more than a 35.8% share. This segment extensively utilizes UV absorbers to enhance the durability and performance of adhesives exposed to sunlight, preventing degradation and maintaining bond strength in various applications, from construction to consumer goods.

Cosmetics represent another key application area for UV absorbers. In this sector, UV absorbers play a critical role in protecting products such as sunscreens, moisturizers, and lip balms from UV radiation, thus safeguarding the skin from sun damage and extending the shelf life of the products.

In the Plastics industry, UV absorbers are crucial for preventing the photodegradation of plastic products that can lead to discoloration, loss of strength, and brittleness. They are widely used in automotive parts, packaging, and outdoor furniture to maintain material integrity and appearance.

Coatings also benefit significantly from the inclusion of UV absorbers. These chemicals help protect everything from automotive finishes to wood varnishes, enhancing their resistance to sun exposure and improving their lifespan and aesthetic preservation under UV light.

By End-use

In 2023, Construction held a dominant market position, capturing more than a 35.9% share. UV absorbers are crucial in this sector for protecting materials like PVC piping, window frames, and exterior paints from UV degradation, ensuring longevity and structural integrity in building components exposed to sunlight.

In Personal Care, UV absorbers are integral to products such as sunscreens, lotions, and lip balms, protecting skin from harmful UV rays and preventing the premature aging of skin. This segment leverages the ability of UV absorbers to enhance the efficacy and stability of skincare and cosmetic products.

The Agriculture sector uses UV absorbers to protect greenhouse films and agricultural nets, which shield crops from excessive UV exposure. This helps in maintaining crop quality and yield, while also extending the lifespan of the agricultural films used.

In the Automobile industry, UV absorbers are used in automotive paints, interior coatings, and parts to prevent color fading and material degradation caused by UV light. This ensures that vehicles retain their aesthetic appeal and structural strength over time.

By Distribution Channel

In 2023, Indirect Sales held a dominant market position, capturing more than a 71.3% share. This channel includes wholesalers, distributors, and online marketplaces that facilitate the bulk distribution of UV absorbers to manufacturers and end-users. Indirect sales are preferred by many companies for their broad market reach and the logistical convenience they offer, enabling efficient distribution across diverse geographical regions.

Direct Sales involve transactions directly between manufacturers and end-users or large-scale buyers. This channel is utilized by firms aiming to establish closer relationships with their customers, offering tailored services and better control over pricing and supply chain dynamics. While smaller in scale compared to indirect sales, direct sales are crucial for businesses focusing on specific market segments or where high customization is required.

Key Market Segments

By Type

- Benzotriazole

- Triazine

- Benzophenone

- Others

By Application

- Adhesives

- Cosmetics

- Plastics

- Coatings

- Others

By End-use

- Construction

- Personal Care

- Agriculture

- Automobile

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Drivers

Major Driver for UV Absorber Market: Increasing Demand for Durable and Long-lasting Materials

One of the primary drivers propelling the UV absorber market is the increasing demand for durable and long-lasting materials across various industries such as automotive, construction, and textiles. As global economies grow and urbanization increases, there is a heightened need for materials that can withstand harsh environmental conditions, including prolonged exposure to ultraviolet (UV) radiation. UV absorbers play a critical role in enhancing the longevity and durability of products exposed to sunlight, making them essential in numerous applications.

In the automotive industry, UV absorbers are crucial for preventing the degradation of car interiors and exteriors that are constantly exposed to the sun. They are integrated into automotive paints, coatings, and plastics to protect against fading, cracking, and other forms of UV damage that can affect the vehicle’s appearance and structural integrity. As consumer expectations for high-quality, durable vehicles increase, so does the demand for effective UV protection solutions.

Similarly, in the construction sector, UV absorbers are incorporated into building materials such as PVC piping, window frames, and exterior paints. The protective properties of UV absorbers help prevent material degradation, such as discoloration and brittleness, thus extending the life of buildings and reducing maintenance costs. The growing construction activities worldwide, especially in emerging economies, significantly contribute to the demand for UV absorbers.

Additionally, the textile industry benefits from UV absorbers as they are used to protect fabrics from fading and fiber degradation. The demand for UV protection in textiles is not only limited to outdoor applications like awnings and outdoor furniture but is also increasingly prevalent in everyday fashion and sportswear. This trend is driven by a growing consumer awareness of the harmful effects of UV exposure and a rising interest in functional apparel that offers UV protection.

Furthermore, the push towards sustainability and the increasing regulatory requirements for environmentally friendly products encourage manufacturers to innovate and develop new UV absorber formulations that are less harmful to the environment. This innovation opens new markets and applications for UV absorbers, further driving their demand.

Restraints

Major Restraint for UV Absorber Market: Regulatory and Environmental Concerns

One of the significant restraints impacting the UV absorber market is the stringent regulatory and environmental concerns associated with the production and use of chemical UV absorbers. As global awareness about environmental conservation and sustainability grows, regulatory bodies around the world are imposing stricter controls on chemicals that may pose risks to human health and the environment. UV absorbers, particularly certain chemical classes like benzophenones and benzotriazoles, have come under scrutiny due to their potential endocrine-disrupting effects and persistence in the environment.

The use of these chemicals in consumer products such as cosmetics, plastics, and coatings is heavily regulated in regions like Europe and North America. The European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have guidelines and restrictions that limit the use of hazardous substances in products, requiring manufacturers to seek safer, more environmentally friendly alternatives. This has led to increased costs and challenges in product development as companies must comply with these regulations while still ensuring the effectiveness and durability of their products.

Moreover, the public and NGOs are increasingly vocal about the potential environmental impact of synthetic UV absorbers, which can accumulate in water bodies and affect aquatic life. Reports of coral bleaching linked to sunscreen ingredients, including UV filters, have led to bans on certain substances in regions with vulnerable ecosystems, such as Hawaii and Palau. These environmental concerns necessitate the development of new, biodegradable UV absorbers that offer less risk to the environment.

Additionally, the market for UV absorbers is also affected by the volatility in raw material prices, which can fluctuate due to geopolitical tensions, trade policies, and economic instability. This volatility can restrain market growth by increasing the unpredictability of costs for manufacturers of UV absorbers.

Opportunity

Major Opportunity for UV Absorber Market: Expansion into Biodegradable and Eco-Friendly Products

A significant opportunity within the UV absorber market is the increasing demand for biodegradable and eco-friendly products. This trend is driven by the growing global consciousness regarding environmental sustainability and the harmful impacts of non-degradable substances on ecosystems, particularly aquatic life. As consumers become more environmentally conscious, industries are pressured to adopt greener practices and materials, including in sectors like cosmetics, textiles, and packaging, where UV protection is crucial.

The shift towards eco-friendly UV absorbers opens up new markets and opportunities for innovation. For instance, the development of UV absorbers that are not only effective in blocking harmful UV rays but also capable of degrading safely in the environment without leaving harmful residues could revolutionize the market. These products would appeal to environmentally conscious consumers and comply with stringent environmental regulations, giving manufacturers a competitive edge.

Moreover, the introduction of stringent regulations regarding the use of traditional UV absorbers, due to concerns about their potential endocrine-disrupting effects and environmental persistence, has created a gap in the market. There is a pressing need for alternative UV protective solutions that do not compromise on performance while ensuring environmental safety. This need provides a fertile ground for research and development, encouraging companies to invest in new technologies and materials.

Additionally, the use of natural and organic UV-blocking ingredients, such as those derived from plants or other natural sources, is gaining traction. These natural alternatives not only meet the demand for safer products but also enhance the product’s appeal to a broader audience looking for “clean label” solutions. The development and commercialization of such innovations could significantly expand market reach and consumer base.

Trends

Major Trend in the UV Absorber Market: Shift Towards Multi-functional UV Absorbers

A prominent trend in the UV absorber market is the development and increasing adoption of multi-functional UV absorbers. These advanced materials not only protect against UV radiation but also offer additional properties such as anti-aging, anti-pollution, or light-stabilizing effects. This trend is particularly pronounced in the cosmetics and personal care industry, where there is a growing consumer demand for products that provide comprehensive protection and skin care benefits.

Multi-functional UV absorbers are appealing because they simplify product formulations by reducing the need for multiple ingredients, thereby streamlining manufacturing processes and potentially reducing costs. For consumers, these products offer greater convenience and enhanced effectiveness, contributing to their growing popularity. These absorbers are designed to absorb harmful UV rays while also addressing other skin concerns like moisture retention, pollution defense, and improving the longevity of the product on the skin.

Additionally, the integration of UV absorbers with antioxidants is another facet of this trend. Antioxidants help to combat the free radicals generated by UV exposure, providing an added layer of skin protection and enhancing the efficacy of sunscreen formulations. This synergy between UV filters and antioxidants is increasingly being leveraged in products to deliver superior protection against photoaging and other UV-induced skin damage.

The push towards multi-functional UV absorbers is also driven by innovation in material science and chemistry, which allows for the development of more sophisticated and effective compounds. These innovations are supported by advancements in technology and an increase in R&D investments by major companies looking to meet evolving consumer demands and regulatory standards.

Regional Analysis

In the UV absorber market, the Asia Pacific region emerges as a dominant force, securing a significant market share of 37.6%. Projections indicate a valuation of USD 435.4 Million by the end of the forecast period. This growth is propelled by strong adoption across critical sectors such as coatings, plastics, and personal care products.

Key economies in the region, including China, India, Japan, and South Korea, are spearheading this growth trajectory. These nations showcase a notable surge in UV absorber consumption, reflecting the increasing demand for UV protection in various industries, including automotive, construction, and cosmetics. Furthermore, the region’s commitment to innovative manufacturing practices and export-driven strategies further reinforces its position in the global UV absorber market.

In North America, the UV absorber market is witnessing steady expansion. This upward trend is driven by growing demand from industries utilizing UV absorbers in coatings, plastics, and personal care products. The region’s robust manufacturing infrastructure and technological advancements in chemical processes contribute significantly to the adoption of UV absorber-based solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the UV absorber market, several key players drive innovation and shape industry dynamics. Companies such as BASF SE, Clariant AG, Songwon Industrial Co., Ltd., Solvay SA, and Huntsman Corporation stand out as prominent entities in this sector.

Market Key Players

- Addivant

- Adeka Corporation

- Amfine Chemical Corporation

- Anhui Best Progress Imp & Exp Co.,Ltd

- BASF SE

- Clariant AG

- Everlight Chemical Industrial Co.

- Greenchemicals SpA

- Hangzhou Disheng Import&Export Co., Ltd.

- Hunan Chemical BV

- Huntsman Corporation

- Milliken Chemical

- Mayzo

- NYACOL Nano Technologies Inc

- Partners in Chemicals

- Rianlon Corporation

- SABO S.p.A.

- Suqian Liansheng Technology Co., Ltd.

Recent Developments

In August 2023, Addivant expanded its research and development efforts, focusing on eco-friendly UV absorbers to align with growing sustainability trends.

By April 2023, Adeka Corporation had expanded its market presence, with its UV absorber solutions gaining recognition for their effectiveness and reliability.

Report Scope

Report Features Description Market Value (2023) US$ 925 Mn Forecast Revenue (2033) US$ 1609 Mn CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Benzotriazole, Triazine, Benzophenone, Others), By Application(Adhesives, Cosmetics, Plastics, Coatings, Others), By End-use(Construction, Personal Care, Agriculture, Automobile, Others), By Distribution Channel(Direct Sales, Indirect Sales) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Addivant, Adeka Corporation, Amfine Chemical Corporation, Anhui Best Progress Imp & Exp Co.,Ltd, BASF SE, Clariant AG, Everlight Chemical Industrial Co., Green chemicals SpA, Hangzhou Disheng Import&Export Co., Ltd., Hunan Chemical BV, Huntsman Corporation, Milliken Chemical, Mayzo, NYACOL Nano Technologies Inc, Partners in Chemicals, Rianlon Corporation, SABO S.p.A., Suqian Liansheng Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of UV Absorber Market?UV Absorber Market size is expected to be worth around USD 1609 Million by 2033, from USD 925 Million in 2023

What is the CAGR for the UV Absorber Market?The UV Absorber Market is expected to grow at a CAGR of 5.7% during 2024-2033.Name the major industry players in the UV Absorber Market?Addivant , Adeka Corporation , Amfine Chemical Corporation, Anhui Best Progress Imp & Exp Co.,Ltd , BASF SE , Clariant AG , Everlight Chemical Industrial Co. , Greenchemicals SpA, Hangzhou Disheng Import&Export Co., Ltd. , Hunan Chemical BV , Huntsman Corporation , Milliken Chemical , Mayzo , NYACOL Nano Technologies Inc, Partners in Chemicals, Rianlon Corporation, SABO S.p.A., Suqian Liansheng Technology Co., Ltd.

-

-

- Addivant

- Adeka Corporation

- Amfine Chemical Corporation

- Anhui Best Progress Imp & Exp Co.,Ltd

- BASF SE

- Clariant AG

- Everlight Chemical Industrial Co.

- Greenchemicals SpA

- Hangzhou Disheng Import&Export Co., Ltd.

- Hunan Chemical BV

- Huntsman Corporation

- Milliken Chemical

- Mayzo

- NYACOL Nano Technologies Inc

- Partners in Chemicals

- Rianlon Corporation

- SABO S.p.A.

- Suqian Liansheng Technology Co., Ltd.