US Pressure Washer Market Size, Share, Growth Analysis By Type (Gas-Powered Pressure Washers, Electric Pressure Washers, Battery-Powered Pressure Washers), By Performance (Professional-Grade, Heavy Duty, Light Duty, Medium Duty), By Application (Commercial, Residential/Household), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146198

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

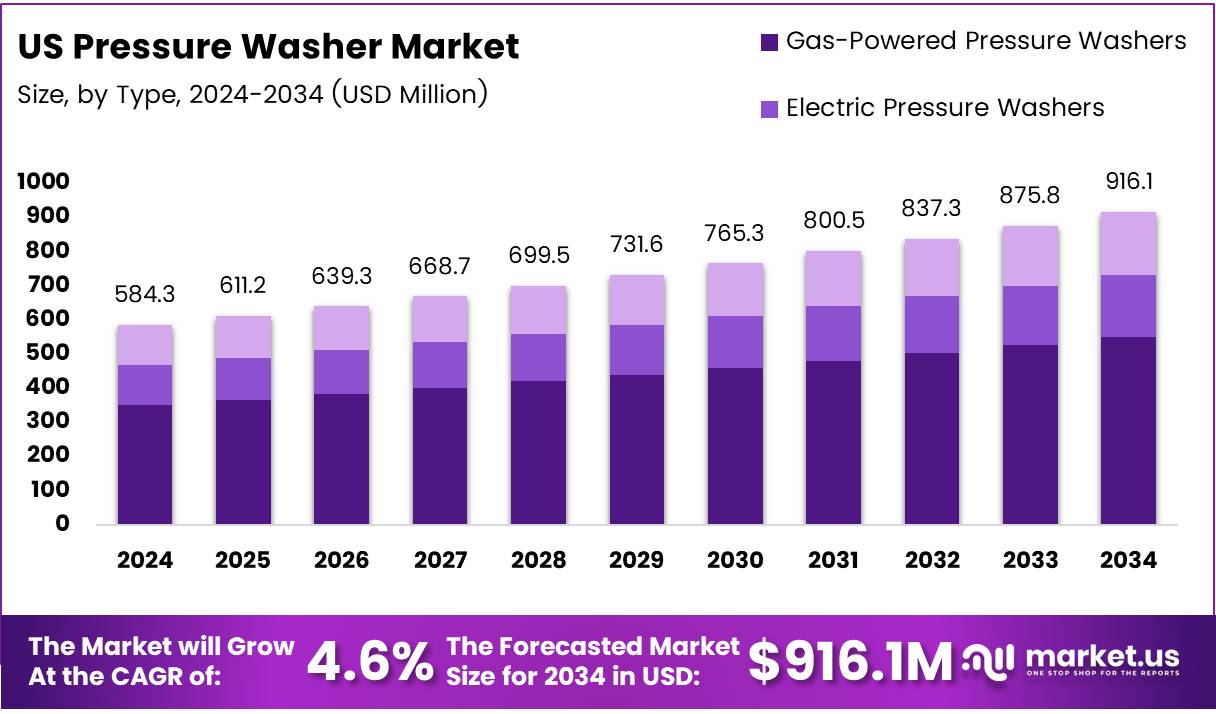

The US Pressure Washer Market size is expected to be worth around USD 916.1 Million by 2034, from USD 584.3 Million in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The US pressure washer market comprises a variety of pressure washing equipment used across residential, commercial, and industrial settings. These devices leverage high-pressure water sprays to remove loose paint, mold, grime, dust, mud, and dirt from surfaces and objects such as buildings, vehicles, and concrete surfaces. According to industry insights, pressure washers are increasingly seen as a tool for enhancing cleaning efficiency while conserving water.

As highlighted by Kärcher, a leading manufacturer, the pressure washer is notably efficient, using 80% less water compared to traditional cleaning methods such as garden hoses, assuming the flow volume of the pressure washer is 40% that of a garden hose and that the cleaning task is completed in half the time. These attributes underscore a growing preference for sustainable and efficient cleaning solutions within the US market.

The growth trajectory of the US pressure washer market is shaped by several key factors, including technological advancements, environmental regulations, and evolving consumer preferences. Electric pressure washers, which are typically more affordable and have a lifespan of three to five years as per insights from Hotsy AB, are gaining traction among cost-conscious consumers, especially in residential settings.

For general home use, Active Products suggests a pressure washer with a PSI (pounds per square inch) range of 1300 to 2400, indicating a strong market for moderately powerful models suitable for everyday cleaning tasks. Furthermore, government investments in infrastructure and maintenance have bolstered the demand for industrial-grade pressure washers, which are essential for large-scale cleaning operations.

Government regulations regarding water usage and environmental conservation significantly impact the pressure washer market. These regulations push manufacturers to develop more efficient models that comply with environmental standards while meeting the cleaning needs of various sectors.

The market is also witnessing a shift towards more eco-friendly models that promise lower water usage and reduced environmental impact, aligning with broader sustainability trends. This regulatory environment creates opportunities for market players to innovate and differentiate their offerings, potentially capturing a larger share of the market through enhanced brand reputation and consumer trust.

Key Takeaways

- US Pressure Washer Market size is projected to reach USD 916.1 Million by 2034, up from USD 584.3 Million in 2024, growing at a CAGR of 4.6%.

- Gas-Powered Pressure Washers held a 47.3% market share in 2024, dominating the By Type segment due to their high-pressure output and suitability for outdoor, heavy-duty use.

- Professional-Grade pressure washers captured 31.2% of the market in 2024, leading the By Performance segment, driven by industrial demand in construction, automotive, and agriculture sectors.

- Commercial applications accounted for 70% of the market in 2024, making it the top By Application segment due to extensive use in industrial and public infrastructure cleaning.

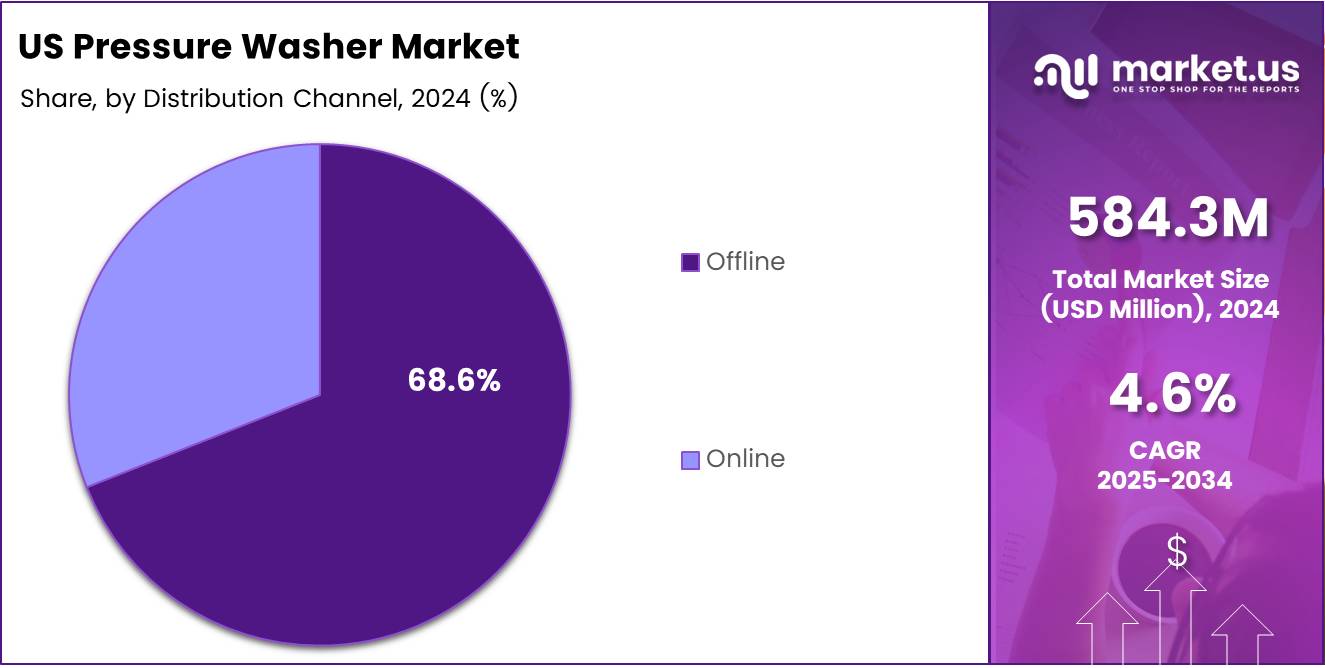

- Offline distribution channels held a 68.6% market share in 2024, dominating the By Distribution Channel segment, as in-store evaluations influence purchase decisions.

Type Analysis

Gas-Powered Pressure Washers lead with 47.3% owing to their superior power and outdoor usability.

In 2024, Gas-Powered Pressure Washers held a dominant market position in the By Type Analysis segment of the US Pressure Washer Market, with a 47.3% share. These models continue to gain preference among users seeking high-pressure outputs for large-scale and heavy-duty applications, particularly in outdoor settings where electrical access is limited.

Electric Pressure Washers are steadily gaining ground due to their affordability, ease of use, and lower maintenance needs. They are increasingly preferred by residential users and small business operators who prioritize convenience over raw power.

Battery-Powered Pressure Washers are emerging as a viable option in the lightweight and portable equipment category. Their cordless operation and environmental friendliness make them attractive for quick jobs and areas where noise restrictions apply. However, their limited power output compared to gas and electric variants restrains wider adoption.

Performance Analysis

Professional-Grade takes the lead with 31.2% as demand grows across industrial and commercial sectors.

In 2024, Professional-Grade held a dominant market position in the By Performance Analysis segment of the US Pressure Washer Market, with a 31.2% share. These high-powered machines are heavily utilized by industries that require deep and frequent cleaning, such as construction, automotive, and agriculture.

Heavy Duty models remain essential for users needing extra force without entering the professional-grade territory. Contractors and maintenance crews prefer these for their balance between performance and affordability.

Light Duty units cater to casual home users for everyday cleaning needs like washing patios, cars, or furniture. While this category is price-sensitive, rising awareness of home upkeep is expanding its base.

Medium Duty pressure washers offer a middle ground, making them ideal for users who need flexibility. Homeowners and small business owners use them for tasks that require moderate pressure and consistent results.

Application Analysis

Commercial dominates with 70% driven by industrial cleaning demands and extended usage.

In 2024, Commercial held a dominant market position in the By Application Analysis segment of the US Pressure Washer Market, with a 70% share. This dominance is largely attributed to the growing use of pressure washers in industrial facilities, fleet maintenance, public infrastructure, and construction sites.

The increased demand for maintaining hygiene standards, equipment longevity, and surface preparation is pushing commercial establishments to invest in high-efficiency cleaning tools.

Residential/Household applications are witnessing increased adoption as consumers seek convenient ways to manage outdoor cleaning. With the rise of DIY culture and cost-conscious maintenance habits, pressure washers are becoming a regular part of home maintenance kits.

Distribution Channel Analysis

Offline channels take the lead with 68.6% due to consumer preference for in-store product trials.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the US Pressure Washer Market, with a 68.6% share. Brick-and-mortar stores benefit from allowing customers to evaluate pressure washer build quality, pressure ratings, and accessories firsthand before purchase.

Retailers also offer after-sales support, demonstrations, and seasonal discounts, further reinforcing consumer trust and loyalty.

Online sales are expanding rapidly due to rising e-commerce penetration and the convenience of home delivery. Many consumers are now turning to digital platforms to compare prices, access a wider product range, and read user reviews before making informed decisions.

However, the lack of physical product evaluation and concerns over shipping damages still limit the complete shift to online platforms, especially for high-ticket industrial-grade machines.

Key Market Segments

By Type

- Gas-Powered Pressure Washers

- Electric Pressure Washers

- Battery-Powered Pressure Washers

By Performance

- Professional-Grade

- Heavy Duty

- Light Duty

- Medium Duty

By Application

- Commercial

- Residential/Household

By Distribution Channel

- Offline

- Online

Drivers

Rising Demand for Outdoor Cleaning Fuels Market Growth

The US pressure washer market is experiencing steady growth, largely driven by the increasing demand for outdoor cleaning solutions. Homeowners and property managers are investing more in maintaining driveways, decks, patios, and vehicles, which in turn fuels the demand for efficient cleaning tools like pressure washers.

This rising trend is also reflected in the growing importance of outdoor aesthetics and hygiene. As more people upgrade their outdoor spaces, the need for high-performance cleaning equipment becomes essential.

Moreover, commercial usage is expanding rapidly. Industries such as automotive services, construction, and agriculture are adopting pressure washers to clean large machinery and work areas. The integration of advanced features—such as cordless operation, electric-powered systems, and high-efficiency pumps—makes pressure washers more convenient and attractive to a wide range of users. All these factors collectively contribute to the strong market momentum in the United States.

Restraints

High Equipment Cost Slows Down Wider Market Adoption

Despite rising demand, the high initial cost of pressure washers—especially industrial-grade models—continues to be a major barrier. For small businesses and residential users, the investment may seem too steep, particularly if the equipment is only needed occasionally.

In addition to the upfront purchase price, ongoing maintenance and repair costs present another challenge. Pressure washers require regular servicing, and replacement parts can be expensive. This added expense may discourage long-term ownership and reduce repeat purchases.

For price-sensitive consumers and budget-conscious small enterprises, these costs can outweigh the benefits, leading many to explore cheaper alternatives or rental options. As a result, market growth is somewhat restrained in segments that cannot afford the high total cost of ownership.

Growth Factors

Growing Demand for Battery-Powered Units Offers New Avenues

The emergence of battery-powered, portable pressure washers presents a significant opportunity in the US market. These models are gaining popularity among residential users due to their ease of use, lightweight design, and freedom from cords and fuel dependency.

As battery technology improves, these washers are becoming more powerful and efficient, meeting the needs of both casual users and small businesses. Additionally, the integration of smart features—like IoT-based monitoring, remote control, and automated performance tracking—adds further appeal, especially for tech-savvy consumers and commercial users looking for intelligent solutions.

Another growing opportunity is in the rental segment. Many users prefer to rent rather than purchase, particularly for one-off or seasonal tasks. This opens doors for rental companies and equipment dealers to grow their service offerings and reach a broader customer base.

Together, these trends are creating exciting growth avenues for manufacturers and service providers alike.

Emerging Trends

Shift Toward Cordless and Compact Models Drives Market Trends

The market is witnessing a clear shift toward cordless, compact, and lightweight pressure washers. Homeowners and casual users increasingly prefer these models for their convenience, ease of storage, and user-friendly design.

Electric pressure washers are also gaining traction as they offer quieter operation, lower maintenance needs, and eco-friendly performance compared to gas-powered variants. This transition aligns with the broader shift toward sustainability and noise reduction, especially in residential neighborhoods.

Another trend shaping the market is the development of high-pressure technologies that deliver strong cleaning results while using less water. This helps meet environmental standards while enhancing performance, making these models attractive to both individual and commercial users.

Overall, the market is becoming more innovation-driven, with a strong focus on user convenience, environmental responsibility, and smart performance.

Key Players Analysis

The U.S. pressure washer market in 2024 is witnessing significant activity among key players, each leveraging their unique strengths to capture market share in a steadily growing industry.

Sun Joe (Shop Joe/Joe Brands) and Greenworks North America LLC are leading contenders in the residential electric pressure washer segment. Their focus on eco-friendly, affordable, and user-friendly equipment resonates with the increasing popularity of DIY home improvement solutions. Their growing online presence and retail partnerships have helped expand market access and brand visibility.

DEWALT and Stanley Black & Decker, Inc. continue to command attention with their powerful brand equity and diverse portfolios. DEWALT is favored by professionals for its performance and ruggedness, while Stanley Black & Decker benefits from cross-category brand strength and ongoing product innovation. Both are well-positioned in the mid-to-premium segments.

CRAFTSMAN and RYOBI Limited are also gaining traction, especially among consumers seeking reliable, feature-rich machines at competitive prices. RYOBI’s advancements in battery-powered pressure washers cater to the increasing demand for cordless and portable solutions, adding a layer of convenience for users.

Alfred Kärcher SE & Co. KG remains a global leader and maintains a strong foothold in the U.S. through its robust product lineup and consistent innovation across residential, commercial, and industrial categories.

AR North America stands out with its specialization in high-performance pumps, catering primarily to OEMs and professionals who value durability and technical precision.

Simpson & Company Limited and Deere & Company cater to more heavy-duty applications. Simpson focuses on contractors with rugged designs, while Deere integrates pressure washers into its wider equipment range, offering additional value to commercial users.

Top Key Players in the Market

- Sun Joe (Shop Joe/Joe Brands)

- Greenworks North America LLC

- DEWALT

- Stanley Black & Decker, Inc.

- CRAFTSMAN

- RYOBI Limited

- Alfred Kärcher SE & Co. KG

- AR North America

- Simpson & Company Limited

- Deere & Company

Recent Developments

- In March 2025, Greenworks unveiled its most powerful hybrid electric pressure washer to date, combining cutting-edge performance with eco-friendly technology. This model is designed for unmatched portability, making it ideal for both residential and commercial cleaning tasks.

- In July 2024, Yard Force® launched a new line of pressure washers powered by the reliable Honda-Gas GX200 series engines. These models offer enhanced durability and high-pressure performance, targeting demanding outdoor cleaning jobs.

- In February 2025, RF acquired S&K Building Services, a strategic move aimed at strengthening its portfolio of essential services. The acquisition expands RF’s capabilities in facility maintenance and infrastructure support across key markets.

Report Scope

Report Features Description Market Value (2024) USD 584.3 Million Forecast Revenue (2034) USD 916.1 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gas-Powered Pressure Washers, Electric Pressure Washers, Battery-Powered Pressure Washers), By Performance (Professional-Grade, Heavy Duty, Light Duty, Medium Duty), By Application (Commercial, Residential/Household), By Distribution Channel (Offline, Online) Competitive Landscape Sun Joe, Greenworks North America LLC, DEWALT, Stanley Black & Decker, Inc., CRAFTSMAN, RYOBI Limited, Alfred Kärcher SE & Co. KG, AR North America, Simpson & Company Limited, Deere & Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Pressure Washer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

US Pressure Washer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sun Joe (Shop Joe/Joe Brands)

- Greenworks North America LLC

- DEWALT

- Stanley Black & Decker, Inc.

- CRAFTSMAN

- RYOBI Limited

- Alfred Kärcher SE & Co. KG

- AR North America

- Simpson & Company Limited

- Deere & Company