U.S. Men's Metal Wedding Bands Market Size, Share, Growth Analysis By Material (Gold, Platinum, Diamond, Silver, Titanium, Cobalt, Tungsten, Others), By Composition (100% Precious Metal, 100% Non-precious Metal, Combination of Precious & Non-precious Metals), By Distribution Channel (Independent Brick & Mortar Retail Jewelry Stores, National Retail Chains, Branded E-Commerce Marketers, Non-branded Websites), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176672

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

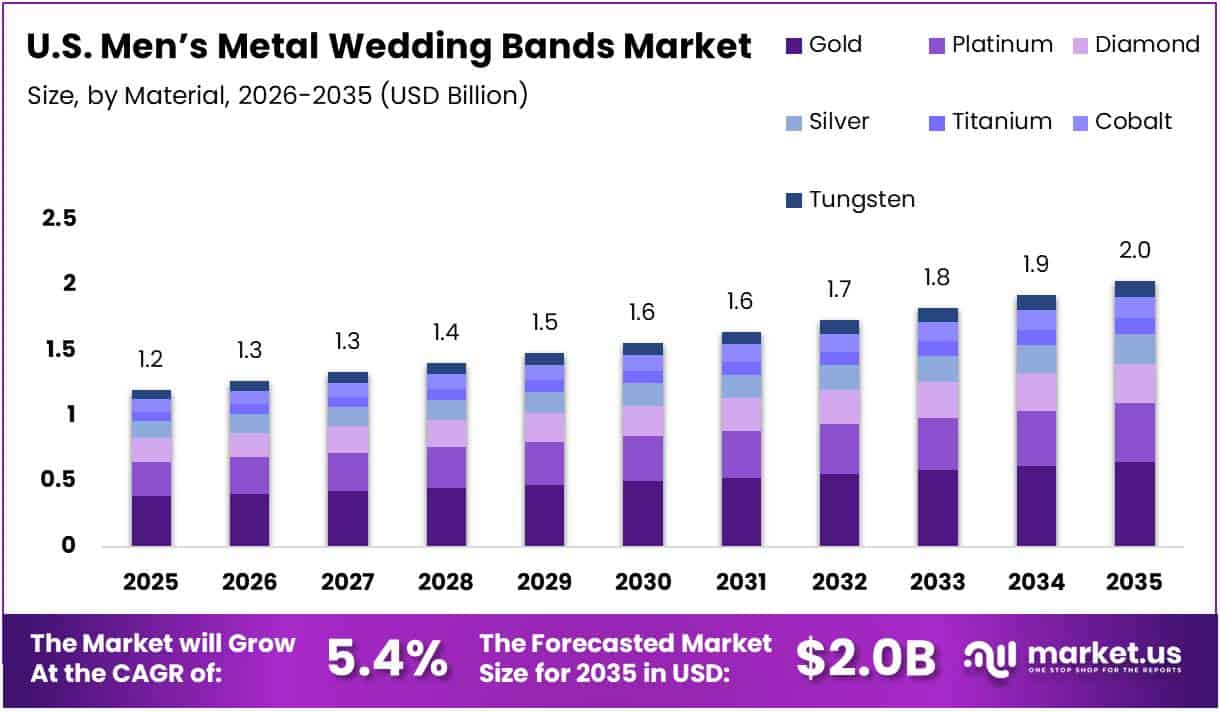

The U.S. Men’s Metal Wedding Bands Market size is expected to be worth around USD 2.0 Billion by 2035 from USD 1.2 Billion in 2025, growing at a CAGR of 5.4% during the forecast period 2026 to 2035.

The U.S. Men’s Metal Wedding Bands Market encompasses the retail sale of wedding rings crafted from various metals specifically designed for male consumers. These bands range from traditional precious metals like gold and platinum to modern alternatives such as titanium, tungsten, and cobalt. The market serves engaged and married men seeking durable, stylish symbols of commitment.

Market growth is driven by evolving consumer preferences toward personalized jewelry and increasing acceptance of men’s accessories as everyday fashion statements. Moreover, the expansion of e-commerce platforms has made specialized men’s wedding bands more accessible to diverse consumer segments. Therefore, retailers are focusing on offering customizable options that reflect individual style and personality.

The industry benefits from technological advancements in metal alloy development, enabling scratch-resistant and hypoallergenic options suitable for active lifestyles. Additionally, design innovations featuring matte, brushed, and hammered finishes appeal to modern consumers seeking distinctive alternatives to traditional polished bands. Consequently, manufacturers are investing in specialized collections that cater specifically to male preferences and requirements.

Government regulations regarding precious metal authenticity and consumer protection standards ensure product quality across the market. However, trade policies affecting metal imports influence pricing strategies and material availability for manufacturers. Therefore, compliance with hallmarking requirements and quality certifications remains essential for market participants operating within the United States.

According to The Knot, the average cost of a men’s wedding band is $600, indicating substantial consumer investment in quality wedding jewelry. Furthermore, according to JCK Online, 34% of U.S. grooms chose white gold for their wedding band, demonstrating continued preference for precious metals. Additionally, according to Professional Jeweller, 55% prefer a plain band design similar to a wedding ring, highlighting demand for classic, timeless styles.

The market demonstrates significant opportunities through custom design platforms and personalized engraving services tailored specifically for male consumers. Moreover, the development of innovative metal combinations and finishes continues to attract younger demographics seeking unique wedding bands. Therefore, market participants are strategically positioned to capitalize on shifting consumer preferences and expanding distribution channels throughout the forecast period.

Key Takeaways

- The U.S. Men’s Metal Wedding Bands Market is projected to reach USD 2.0 Billion by 2035 from USD 1.2 Billion in 2025, at a CAGR of 5.4%

- Gold material segment dominates with 32.1% market share in 2025

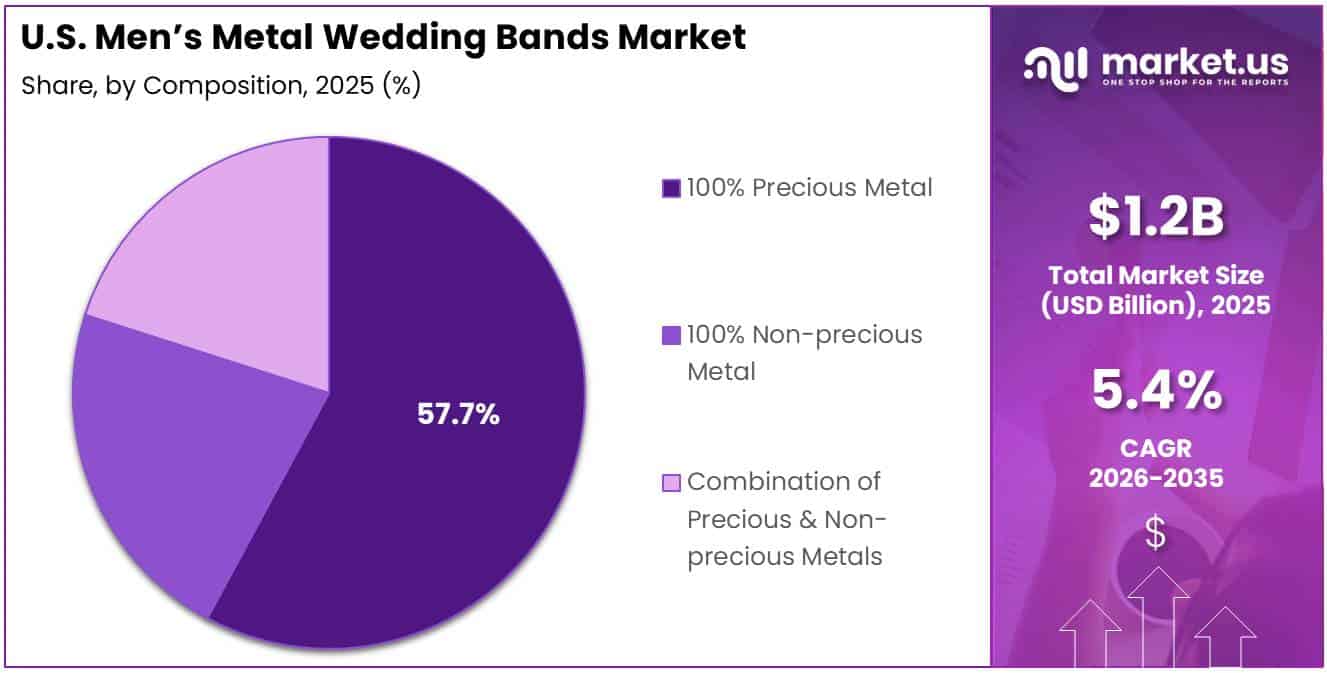

- 100% Precious Metal composition holds 57.7% market share

- Independent Brick & Mortar Retail Jewelry Stores lead distribution channels with 42.4% share

Material Analysis

Gold dominates with 32.1% due to its timeless appeal and traditional significance in wedding ceremonies.

In 2025, Gold held a dominant market position in the By Material segment of U.S. Men’s Metal Wedding Bands Market, with a 32.1% share. This material continues to represent enduring value and cultural significance for wedding ceremonies. Moreover, gold offers versatility through various color options including yellow, white, and rose variations. Therefore, it remains the preferred choice among traditionalists and modern consumers alike.

Platinum appeals to premium segment consumers seeking exceptional durability and hypoallergenic properties for everyday wear. This precious metal maintains its luster without requiring frequent maintenance or refinishing. Additionally, platinum’s natural white color provides elegant aesthetic appeal that complements various personal styles. Consequently, it commands higher price points while attracting quality-conscious buyers seeking investment-grade wedding bands.

Diamond accents and inlays add distinctive luxury elements to men’s wedding bands, creating unique visual appeal beyond traditional plain metal designs. These embellishments cater to consumers seeking statement pieces that reflect personal style. However, diamond-enhanced bands require careful consideration regarding durability for active lifestyles. Therefore, manufacturers incorporate protective settings that secure stones while maintaining masculine design aesthetics.

Silver provides affordable entry points for budget-conscious consumers while maintaining precious metal appeal and traditional wedding band aesthetics. This material offers excellent workability for custom designs and engravings. Moreover, silver bands serve younger demographics and alternative wedding celebrations effectively. Additionally, modern finishing techniques enhance silver’s durability and tarnish resistance for extended wear.

Titanium attracts active lifestyle consumers through exceptional strength-to-weight ratios and superior scratch resistance compared to traditional metals. This modern alternative offers hypoallergenic properties ideal for sensitive skin conditions. Furthermore, titanium enables innovative color treatments and surface finishes unavailable with precious metals. Consequently, it appeals to consumers prioritizing practicality and contemporary design over traditional precious metal symbolism.

Cobalt combines precious metal appearance with enhanced durability and affordable pricing, bridging traditional and modern material preferences. This alloy resists scratching better than gold while maintaining polished finishes longer. Additionally, cobalt provides permanent sizing, eliminating concerns about ring resizing for weight fluctuations. Therefore, it serves consumers seeking maintenance-free options with traditional aesthetic appeal.

Tungsten delivers maximum scratch resistance and extreme durability for consumers in demanding occupations or active recreational pursuits. This ultra-hard material maintains mirror finishes indefinitely without polishing or refinishing requirements. However, tungsten’s brittleness under extreme impact requires consumer education regarding proper care. Moreover, its permanent sizing necessitates accurate measurements during initial purchase.

Others include emerging materials like ceramic, wood inlays, meteorite fragments, and Damascus steel, appealing to consumers seeking truly unique wedding bands. These alternative materials enable distinctive personalization and storytelling elements reflecting individual interests. Additionally, mixed-material designs combine traditional metals with unconventional elements for contemporary aesthetics. Consequently, this segment continues expanding as manufacturers innovate with novel material combinations.

Composition Analysis

100% Precious Metal dominates with 57.7% due to consumer preference for traditional wedding band purity and investment value.

In 2025, 100% Precious Metal held a dominant market position in the By Composition segment of U.S. Men’s Metal Wedding Bands Market, with a 57.7% share. This composition appeals to traditionalists valuing metal purity and authenticity in wedding jewelry. Moreover, these bands maintain resale value and represent tangible investments beyond symbolic significance. Therefore, consumers prioritize precious metal content when selecting enduring symbols of marital commitment.

100% Non-precious Metal serves budget-conscious consumers and those prioritizing durability over traditional precious metal content in wedding bands. These compositions include titanium, tungsten, and cobalt options offering superior scratch resistance. Additionally, non-precious metals accommodate active lifestyles without concerns about damaging expensive precious metals. Consequently, this segment attracts younger demographics and non-traditional wedding participants seeking practical alternatives.

Combination of Precious & Non-precious Metals provides versatility through innovative designs blending traditional precious metal aesthetics with modern durability enhancements. These hybrid compositions often feature precious metal inlays, edges, or accents within non-precious metal bases. Furthermore, combinations enable distinctive two-tone appearances and customization options appealing to style-conscious consumers. Therefore, manufacturers leverage mixed-metal technologies to create differentiated products balancing tradition and innovation.

Distribution Channel Analysis

Independent Brick & Mortar Retail Jewelry Stores dominate with 42.4% due to personalized service and physical try-on experiences.

In 2025, Independent Brick & Mortar Retail Jewelry Stores held a dominant market position in the By Distribution Channel segment of U.S. Men’s Metal Wedding Bands Market, with a 42.4% share. These retailers provide personalized consultation services and expert guidance for first-time wedding band purchasers. Moreover, physical stores enable customers to evaluate sizing, comfort, and visual appeal before purchase. Therefore, independent jewelers maintain competitive advantages through customized customer experiences and local market relationships.

National Retail Chains offer standardized selection and competitive pricing through economies of scale and established brand recognition nationwide. These retailers provide convenient locations and consistent product quality across multiple markets. Additionally, national chains leverage marketing resources and promotional campaigns effectively. Consequently, they attract value-conscious consumers seeking reliable brands and straightforward purchasing processes.

Branded E-Commerce Marketers specialize in online jewelry sales, providing extensive product ranges and detailed customization options through digital platforms. These marketers utilize virtual try-on technologies and comprehensive sizing guides to overcome physical examination limitations. Furthermore, e-commerce enables competitive pricing through reduced overhead costs. Therefore, branded online retailers capture tech-savvy consumers comfortable with digital purchasing experiences.

Non-branded Websites include marketplace platforms and aggregator sites connecting consumers with multiple jewelry vendors through consolidated online interfaces. These channels provide price comparison capabilities and diverse product selections from various sellers. However, quality consistency and customer service vary significantly across non-branded platforms. Additionally, authentication concerns require consumer diligence when purchasing precious metal products. Consequently, this channel serves price-focused buyers willing to navigate varied seller reputations.

Key Market Segments

By Material

- Gold

- Platinum

- Diamond

- Silver

- Titanium

- Cobalt

- Tungsten

- Others

By Composition

- 100% Precious Metal

- 100% Non-precious Metal

- Combination of Precious & Non-precious Metals

By Distribution Channel

- Independent Brick & Mortar Retail Jewelry Stores

- National Retail Chains

- Branded E-Commerce Marketers

- Non-branded Websites

Drivers

Rising Preference for Personalized and Engraved Men’s Wedding Bands Drives Market Growth

Personalization has emerged as a critical differentiator in the men’s wedding band market, with consumers increasingly seeking custom engravings and unique designs. Modern manufacturing technologies enable intricate customization options that reflect individual stories and relationships. Moreover, personalized bands create emotional connections beyond standard retail offerings. Therefore, retailers investing in customization capabilities capture growing consumer demand for distinctive wedding jewelry.

E-commerce platforms specializing in men’s jewelry collections have expanded market accessibility significantly, removing geographic limitations for specialized product discovery. These digital channels provide extensive product comparisons and detailed specifications that physical stores cannot match. Additionally, online retailers offer competitive pricing through reduced operational overhead. Consequently, internet-based distribution continues reshaping traditional jewelry retail dynamics and consumer purchasing behaviors.

Growing acceptance of men’s jewelry as everyday fashion has normalized wedding band wearing beyond ceremonial contexts alone. Contemporary men increasingly view wedding bands as style accessories complementing personal aesthetics and professional appearances. Furthermore, celebrity endorsements and social media influence have elevated men’s jewelry visibility. Therefore, wedding bands now represent both symbolic commitment and fashion statements, expanding market appeal across demographic segments.

Restraints

Limited Physical Try-On Experience in Online-Only Purchase Journeys Restrains Market Adoption

Online purchasing eliminates tactile evaluation opportunities essential for assessing wedding band comfort, weight, and visual appeal in person. Despite virtual try-on technologies, consumers cannot fully experience how bands feel during extended wear. Moreover, sizing accuracy remains challenging without professional measurement and fitting services. Therefore, hesitancy regarding online-only purchases continues limiting e-commerce channel penetration, particularly among first-time wedding band buyers.

Traditional preferences for classic gold bands among older consumer segments resist market diversification toward alternative materials and contemporary designs. This demographic maintains strong associations between precious metals and wedding symbolism, viewing alternatives as inappropriate. Additionally, generational purchasing patterns favor established retail relationships over online channels. Consequently, market growth faces constraints from conservative consumer attitudes prioritizing tradition over innovation.

Return and exchange complications for online jewelry purchases create additional friction in digital sales channels compared to physical retail experiences. Sizing errors require shipping delays and restocking fees that discourage online experimentation. Furthermore, authentication concerns regarding precious metal content persist without physical verification. Therefore, trust barriers continue restraining full market transition toward predominantly digital distribution models.

Growth Factors

Custom Design Platforms Tailored Specifically for Men Accelerate Market Expansion

Custom design platforms enable consumers to create unique wedding bands reflecting personal interests, hobbies, and relationship stories through intuitive digital interfaces. These technologies democratize custom jewelry design previously requiring expensive jeweler consultations. Moreover, visualization tools allow real-time design modifications and material comparisons. Therefore, customization platforms attract younger demographics seeking personalized alternatives to mass-produced wedding bands.

Development of scratch-resistant and hypoallergenic metal alloys addresses practical concerns for active lifestyle consumers requiring durable everyday wear. Advanced metallurgy creates materials combining traditional precious metal aesthetics with enhanced performance characteristics. Additionally, hypoallergenic formulations eliminate skin sensitivity issues affecting significant consumer populations. Consequently, material innovations expand market accessibility across diverse consumer needs and preferences.

Increasing demand for wedding bands suitable for active lifestyles drives innovation in durable materials and comfort-focused designs. Consumers in physically demanding occupations or recreational activities require bands withstanding harsh conditions. Furthermore, modern lifestyles prioritize maintenance-free options over precious metals requiring regular care. Therefore, manufacturers developing activity-appropriate designs capture growing segments previously underserved by traditional wedding band offerings.

Emerging Trends

Rising Popularity of Matte, Brushed, and Hammered Metal Finishes Reshapes Market Aesthetics

Matte and brushed finishes have gained significant traction as alternatives to traditional polished wedding bands, offering contemporary masculine aesthetics. These surface treatments reduce visible wear and scratches while providing distinctive visual textures. Moreover, non-reflective finishes complement modern fashion sensibilities and professional environments. Therefore, manufacturers increasingly incorporate varied finishing options across product lines to meet evolving style preferences.

Increased demand for wedding bands with hidden interior engravings enables private personalization invisible to external observation. These concealed messages provide intimate meaning without affecting external band appearance or professional appropriateness. Additionally, interior engraving technologies support detailed text and graphics previously impossible. Consequently, hidden personalization features appeal to consumers seeking meaningful customization within conservative design frameworks.

Gender-neutral and unisex metal band designs reflect evolving social attitudes toward traditional wedding jewelry conventions and marriage symbolism. These designs eliminate distinctly masculine or feminine aesthetic elements, enabling interchangeable wearing or matching couple’s bands. Furthermore, unisex styling accommodates non-traditional relationships and modern partnership dynamics. Therefore, gender-neutral designs represent significant growth opportunities as societal norms continue evolving beyond conventional wedding traditions.

Key Company Insights

Frederick Goldman, Inc. establishes market leadership through extensive precious metal wedding band collections emphasizing traditional craftsmanship and quality materials. The company offers diverse customization options including engraving services and unique finishing techniques. Moreover, Frederick Goldman maintains strong relationships with independent retailers nationwide, ensuring broad market distribution. Therefore, the company’s reputation for reliability and artisanal quality supports premium pricing and customer loyalty across demographic segments.

Moses Jewelers differentiates through specialized focus on men’s wedding jewelry, providing expert consultation and personalized customer service experiences. The retailer combines traditional precious metals with contemporary design aesthetics appealing to modern consumers. Additionally, Moses Jewelers leverages both physical showrooms and digital platforms for comprehensive market coverage. Consequently, the company captures diverse consumer segments seeking specialized men’s wedding band expertise and tailored purchasing experiences.

Novell Design Studio innovates through distinctive design approaches incorporating mixed metals, unique textures, and contemporary masculine aesthetics in wedding bands. The studio emphasizes artistic expression and individual style over conventional wedding jewelry traditions. Furthermore, Novell collaborates with independent retailers to distribute exclusive collections nationwide. Therefore, the company attracts style-conscious consumers seeking designer wedding bands reflecting personal identity and modern relationships.

Benchmark Rings leads in alternative metal wedding bands, specializing in titanium, tungsten, and cobalt compositions for active lifestyle consumers. The company develops proprietary alloy formulations and finishing techniques unavailable from competitors. Moreover, Benchmark emphasizes durability and comfort through ergonomic design principles and quality manufacturing. Consequently, the brand captures growing market segments prioritizing performance characteristics over traditional precious metal symbolism in wedding jewelry.

Key players

- Frederick Goldman, Inc.

- Moses Jewelers

- Novell Design Studio

- Benchmark Rings

- Guertin Brothers

- Avant Garde Jewelers

- Absolute Titanium Designs

- Jewelry by Johan

- STAGHEAD DESIGNS

Recent Developments

- November 2025 – Thorum Launches “Legacy in Metal” Collection, introducing a new era of storytelling through men’s wedding bands featuring innovative design elements and personalized customization options. The collection emphasizes narrative-driven jewelry that reflects individual relationship stories and personal heritage through distinctive metal combinations and engraving techniques.

- May 2025 – Brand Talks Platinum Love Bands Unveils “The Wedding Edition” Collection, expanding premium platinum wedding band offerings with contemporary designs targeting modern grooms. The collection features 100% precious metal compositions with innovative finishing techniques and customization capabilities addressing evolving consumer preferences for luxury men’s wedding jewelry.

Report Scope

Report Features Description Market Value (2025) USD 1.2 Billion Forecast Revenue (2035) USD 2.0 Billion CAGR (2026-2035) 5.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Gold, Platinum, Diamond, Silver, Titanium, Cobalt, Tungsten, Others), By Composition (100% Precious Metal, 100% Non-precious Metal, Combination of Precious & Non-precious Metals), By Distribution Channel (Independent Brick & Mortar Retail Jewelry Stores, National Retail Chains, Branded E-Commerce Marketers, Non-branded Websites) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Frederick Goldman, Inc., Moses Jewelers, Novell Design Studio, Benchmark Rings, Guertin Brothers, Avant Garde Jewelers, Absolute Titanium Designs, Jewelry by Johan, STAGHEAD DESIGNS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Men’s Metal Wedding Bands MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

US Men’s Metal Wedding Bands MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Frederick Goldman, Inc.

- Moses Jewelers

- Novell Design Studio

- Benchmark Rings

- Guertin Brothers

- Avant Garde Jewelers

- Absolute Titanium Designs

- Jewelry by Johan

- STAGHEAD DESIGNS