U.S. Heritage Tourism Market Size, Share, Growth Analysis By Age Group (51 to 70, 30 and Under, 31 to 50, 71 and Above), By Booking Channel (Direct Booking, Online Travel Agencies (OTAs), Marketplace Booking), By Type (Cultural Heritage, Natural Heritage, Intangible Heritage), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151525

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

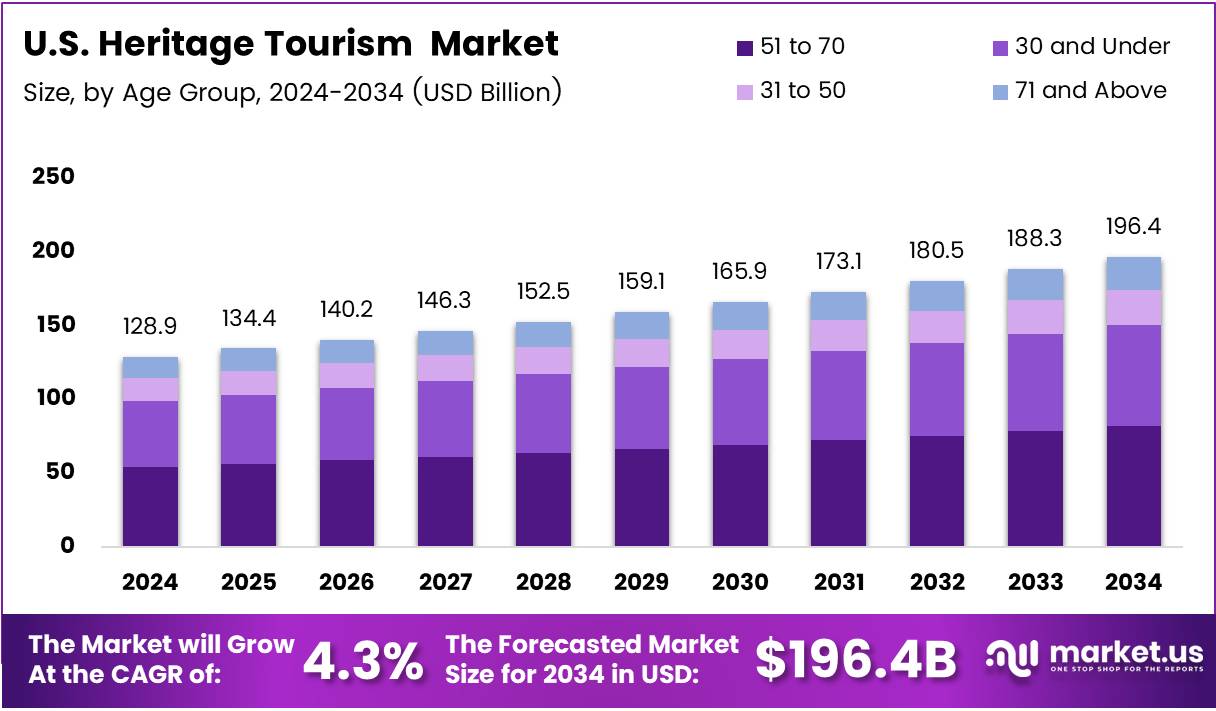

The U.S. Heritage Tourism Market size is expected to be worth around USD 196.4 Billion by 2034, from USD 128.9 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The U.S. Heritage Tourism Market represents a vibrant segment of the travel industry, rooted in the exploration of cultural, historical, and natural assets. This market includes visits to historic landmarks, museums, cultural festivals, and preserved architectural sites. With rising consumer interest in authentic and educational travel experiences, heritage tourism continues to gain momentum across the country.

In recent years, the sector has witnessed significant attention from public and private players alike. Government initiatives to restore heritage infrastructure, along with community-led preservation programs, are fostering sustainable tourism growth. These investments are not only preserving national history but also strengthening regional economies.

According to uwaterloo, 34.5 million American adults are classified as Heritage Tourism Enthusiasts by the Canadian Tourism Commission. This makes them the largest pool of potential U.S. heritage travelers, reflecting a sizable and engaged audience for targeted marketing and tour development. Operators are increasingly tailoring experiences to this segment’s preferences.

Meanwhile, the United States boasts 26 UNESCO World Heritage Sites, as reported by jagranjosh. These globally recognized sites symbolize the country’s rich cultural legacy, environmental stewardship, and historical significance, further elevating the market’s international appeal. This boosts inbound travel interest and drives greater visitation across heritage corridors.

Furthermore, the expansion of digital platforms has enabled heritage destinations to promote virtual storytelling, enhancing accessibility and engagement. This trend not only supports remote learning and exploration but also generates demand for in-person visits once travelers become inspired by these digital previews.

Public-private partnerships are growing in the form of grants, restoration projects, and destination branding. States like Virginia and Massachusetts have successfully leveraged such models to boost heritage tourism revenue and infrastructure, aligning economic development with conservation goals.

Rising interest among younger generations for immersive, culturally conscious travel is also playing a pivotal role. This demographic is more inclined to visit places with historical context, local narratives, and preserved authenticity, presenting operators with fresh programming opportunities.

In addition, changing travel behaviors post-pandemic have pushed more Americans toward domestic travel. This has strengthened the appeal of regional heritage destinations and increased revenue flow to lesser-known cultural sites across rural and suburban communities.

Key Takeaways

- The U.S. Heritage Tourism Market is projected to reach USD 196.4 Billion by 2034, up from USD 128.9 Billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034.

- In 2024, the 51 to 70 age group held the largest market share at 56.2%, driven by retirement freedom and higher disposable income.

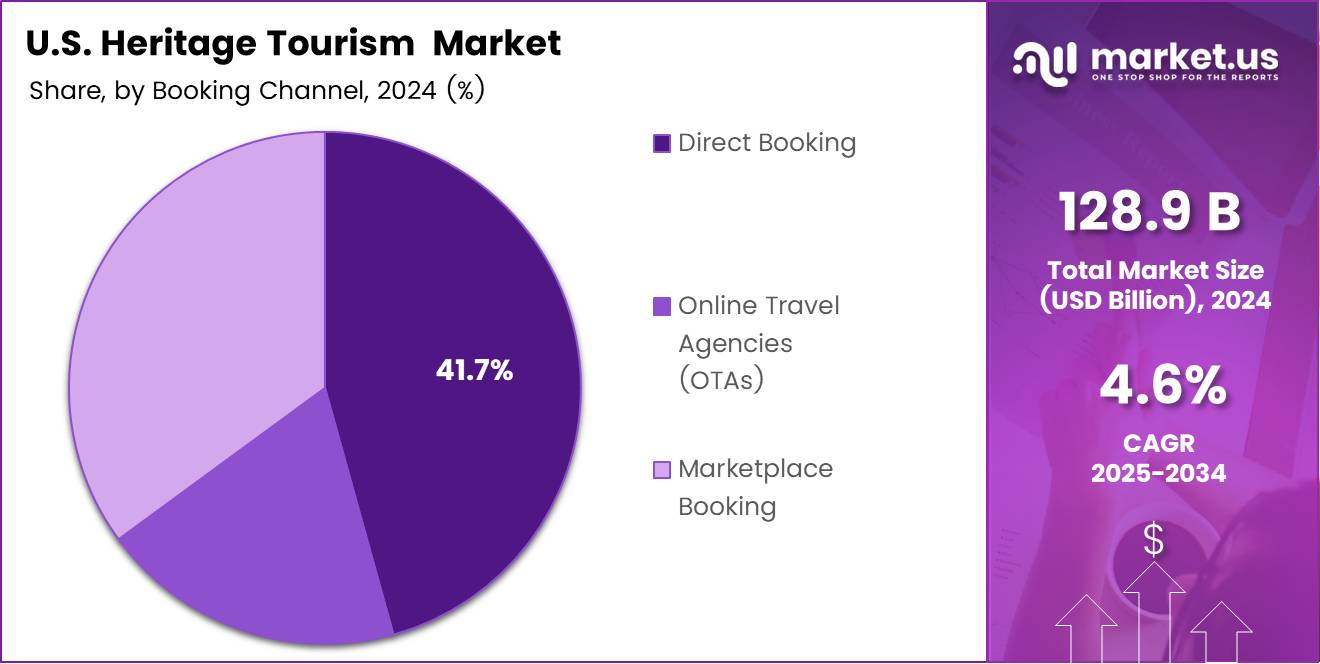

- Direct Booking was the leading channel in 2024 with a 41.7% share, favored for better customization and exclusive direct offers.

- Cultural Heritage was the top segment by type in 2024, accounting for 53.6%, reflecting strong interest in museums, historic sites, and traditional events.

Age Group Analysis

51 to 70 dominates with 56.2% due to high interest in historical exploration and greater spending capacity.

In 2024, 51 to 70 held a dominant market position in By Age Group Analysis segment of U.S. Heritage Tourism Market, with a 56.2% share. This group showed strong interest in cultural and historical destinations, often driven by retirement freedom and higher disposable income. Their travel patterns emphasized in-depth heritage experiences, often involving guided tours and educational programs.

The 30 and Under segment trailed behind, reflecting limited financial independence and different leisure priorities. While younger travelers do engage with heritage tourism, their shorter trips and digital-first approach shape a distinct, less dominant trend.

The 31 to 50 segment represented a mid-tier share, influenced by family obligations and career constraints. Their participation often involves multi-generational travel, which affects destination and experience choices.

Lastly, the 71 and Above group accounted for a smaller portion, impacted by mobility and health considerations. However, they still contributed to niche travel offerings, especially in accessible heritage tours.

Booking Channel Analysis

Direct Booking dominates with 41.7% as travelers prioritize trust and personalized experiences.

In 2024, Direct Booking held a dominant market position in By Booking Channel Analysis segment of U.S. Heritage Tourism Market, with a 41.7% share. This was largely attributed to travelers seeking direct communication with service providers, better customization, and exclusive offers not available on third-party platforms.

Online Travel Agencies (OTAs) followed closely, offering convenience and comparison-based options. Although widely used, they lacked the depth of personalization desired in heritage tourism.

Marketplace Booking trailed as a growing but niche channel. These platforms appeal to tech-savvy users exploring curated or local experiences, but their reach and trust levels remain limited compared to established direct and OTA options.

Type Analysis

Cultural Heritage dominates with 53.6% owing to travelers’ growing interest in history, arts, and traditions.

In 2024, Cultural Heritage held a dominant market position in By Type Analysis segment of U.S. Heritage Tourism Market, with a 53.6% share. This segment reflects a strong public fascination with museums, historic landmarks, and traditional events, particularly in urban and historically rich regions.

Natural Heritage came in as a significant category, drawing travelers to national parks, geological wonders, and scenic trails. While attractive, it catered more to eco-tourists and seasonal travelers.

Intangible Heritage, such as folklore, culinary arts, and crafts, held the smallest share. However, its experiential nature attracted niche groups seeking immersive and participatory travel, indicating growth potential in curated storytelling and cultural workshops.

Key Market Segments

By Age Group

- 51 to 70

- 30 and Under

- 31 to 50

- 71 and Above

By Booking Channel

- Direct Booking

- Online Travel Agencies (OTAs)

- Marketplace Booking

By Type

- Cultural Heritage

- Natural Heritage

- Intangible Heritage

Drivers

Integration of Augmented Reality for Immersive Historical Experiences Drives Market Growth

The U.S. heritage tourism market is seeing strong growth due to the increasing use of Augmented Reality (AR) in historic sites and museums. Tourists can now enjoy more engaging and immersive experiences, such as digitally reconstructing ancient buildings or interacting with historical figures, which enhances learning and enjoyment.

Another key driver is the revival of Indigenous cultural narratives. Many travelers are becoming more interested in authentic and respectful representations of Native American traditions. Heritage tourism providers are working with Indigenous communities to offer meaningful cultural programs and experiences.

Government-endorsed regional revitalization efforts are also supporting the growth of the heritage tourism sector. Federal and state programs are funding the restoration of historical towns and landmarks, helping to attract more tourists while preserving local heritage.

There is a rising interest in heritage cruises and rail tourism, particularly along historic routes. These forms of slow travel allow visitors to explore American history in comfort and at a leisurely pace. Scenic trains and historic-themed cruises are creating unique travel experiences tied to the nation’s past.

Restraints

Limited Accessibility to Remote or Rural Heritage Sites Restrains Market Potential

One of the main challenges facing the U.S. heritage tourism market is limited access to remote or rural heritage locations. Many important cultural and historical sites are located far from urban centers and lack proper transportation, which discourages visitors from traveling to them.

Another restraint is the inadequate digital infrastructure in many heritage destinations. Poor online presence and outdated websites make it hard for tourists to discover, learn about, and book visits to these places. This digital gap reduces visibility and competitiveness in today’s internet-driven tourism market.

Together, these accessibility and digital issues limit growth by making heritage tourism less convenient and appealing to a wider audience, especially younger, tech-savvy travelers.

Growth Factors

Expansion of Multilingual Guided Heritage Tours Unlocks Market Opportunities

The U.S. heritage tourism market has new growth opportunities through the expansion of multilingual guided tours. By offering services in multiple languages, destinations can attract a more diverse set of international tourists interested in American history.

Another opportunity is the development of heritage-themed hotels and accommodations. Travelers increasingly want lodging that reflects the culture and story of the place they’re visiting. Boutique hotels with historical themes offer memorable experiences and longer stays.

Collaborations with educational institutions are also creating potential. Schools and universities are partnering with heritage sites for field trips, workshops, and research programs. These efforts increase awareness and ensure a steady flow of educational visitors.

A growing niche market is forming around African American and immigrant heritage trails. These culturally significant routes are drawing interest from tourists seeking to understand lesser-known parts of American history, helping to diversify the tourism offering.

Emerging Trends

Increased Demand for Genealogy-Based Travel Experiences Shapes Market Trends

A major trend in U.S. heritage tourism is the growing demand for genealogy-based travel. Many Americans are using DNA testing and family history research to explore their roots. This has led to increased visits to ancestral towns and archives, giving travelers personal connections to history.

Volunteer tourism is another rising trend. Tourists are now looking to contribute to the restoration of historical buildings or participate in archaeological digs. This hands-on involvement offers meaningful experiences while supporting heritage preservation.

Heritage-inspired culinary tourism is gaining popularity as well. Visitors want to taste history by enjoying traditional dishes, often linked to regional or ethnic heritage. Food festivals and cooking tours are being used to celebrate local history through flavors.

AI is also influencing tourism trends. Smart applications use traveler interests to create personalized heritage itineraries and storytelling, making each trip unique. This tech-driven trend helps modernize the heritage experience and attract younger audiences.

Key U.S. Heritage Tourism Company Insights

In 2024, the U.S. heritage tourism market continues to gain momentum, driven by a renewed interest in cultural and historical exploration. Among the leading players, several companies stand out for their strategic offerings and immersive travel experiences.

American Classic Tours, Inc. has maintained its reputation for delivering highly curated domestic heritage experiences. With a focus on senior travel and educational narratives, the company capitalizes on group loyalty and detailed itineraries that highlight Americana and historic landmarks.

Gate 1 Travel LTD has leveraged its global infrastructure to offer budget-conscious heritage packages across the U.S. The company’s strength lies in competitive pricing and a wide array of culturally rich destinations, making it attractive to value-seeking travelers.

Mayflower Cruises & Tours has expanded its river cruise portfolio and land tour combinations, emphasizing historical storytelling throughout the Mississippi and East Coast regions. Their consistent integration of expert guides enhances the educational value of each trip.

Tauck, Inc. (Tauck World Discovery) continues to set the bar for luxury heritage travel. The company’s partnerships with national parks and historic estates provide exclusive access to sites, reinforcing its brand as a premium operator in the cultural travel space.

These key players, through distinct strategies ranging from affordability to exclusivity, contribute significantly to the dynamic growth and diversity of the U.S. heritage tourism market in 2024. Their continued innovation in storytelling, local engagement, and experiential design supports a broader trend of travelers seeking meaningful, educational, and culturally enriching journeys.

Top Key Players in the Market

- American Classic Tours, Inc.

- Gate 1 Travel LTD

- Mayflower Cruises & Tours

- Tauck, Inc. (Tauck World Discovery)

- G Adventures Inc.

- National Geographic Expeditions

- Globus Family of Brands (including Globus and Cosmos)

- Historic Tours of America, Inc.

- Trafalgar Tours

- Intrepid Travel, Inc.

Recent Developments

- In Jan 2025, national parks, scenic road trips, and rural destinations saw a surge in popularity. This trend aligned with the administration’s push to celebrate U.S. heritage and natural beauty.

- In Apr 2025, Tourism Economics projected a 9.4% year-over-year decline in international arrivals to the U.S. for 2025. This was a major revision from December’s 8.8% growth forecast, with the sharpest drop coming from Canadian travelers at -20.2%.

- In Apr 2025, Canada, a vital market for inbound U.S. tourism, was forecasted to cut travel to the U.S. by 20% in 2025. This decline significantly contributed to the broader reduction in international tourism to the United States.

- In Jun 2025, analysts had previously anticipated that 79 million foreign visitors would come to the U.S. in 2025. These expectations were set before Trump’s return to office, aiming to reach near pre-pandemic tourism levels.

Report Scope

Report Features Description Market Value (2024) USD 128.9 Billion Forecast Revenue (2034) USD 196.4 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Age Group (51 to 70, 30 and Under, 31 to 50, 71 and Above), By Booking Channel (Direct Booking, Online Travel Agencies (OTAs), Marketplace Booking), By Type (Cultural Heritage, Natural Heritage, Intangible Heritage) Competitive Landscape American Classic Tours, Inc., Gate 1 Travel LTD, Mayflower Cruises & Tours, Tauck, Inc. (Tauck World Discovery), G Adventures Inc., National Geographic Expeditions, Globus Family of Brands (including Globus and Cosmos), Historic Tours of America, Inc., Trafalgar Tours, Intrepid Travel, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Heritage Tourism MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Heritage Tourism MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- American Classic Tours, Inc.

- Gate 1 Travel LTD

- Mayflower Cruises & Tours

- Tauck, Inc. (Tauck World Discovery)

- G Adventures Inc.

- National Geographic Expeditions

- Globus Family of Brands (including Globus and Cosmos)

- Historic Tours of America, Inc.

- Trafalgar Tours

- Intrepid Travel, Inc.