US Bearings Market By Product Type (Ball Bearings (Deep Groove Bearings, Others), Roller Bearings, (Split, Tapered, Others), Plain Bearings (Sleeve Bearings, Spherical Plain Bearings, Others), Other Product Types), By Application, (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, and Other Applications), States and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165079

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

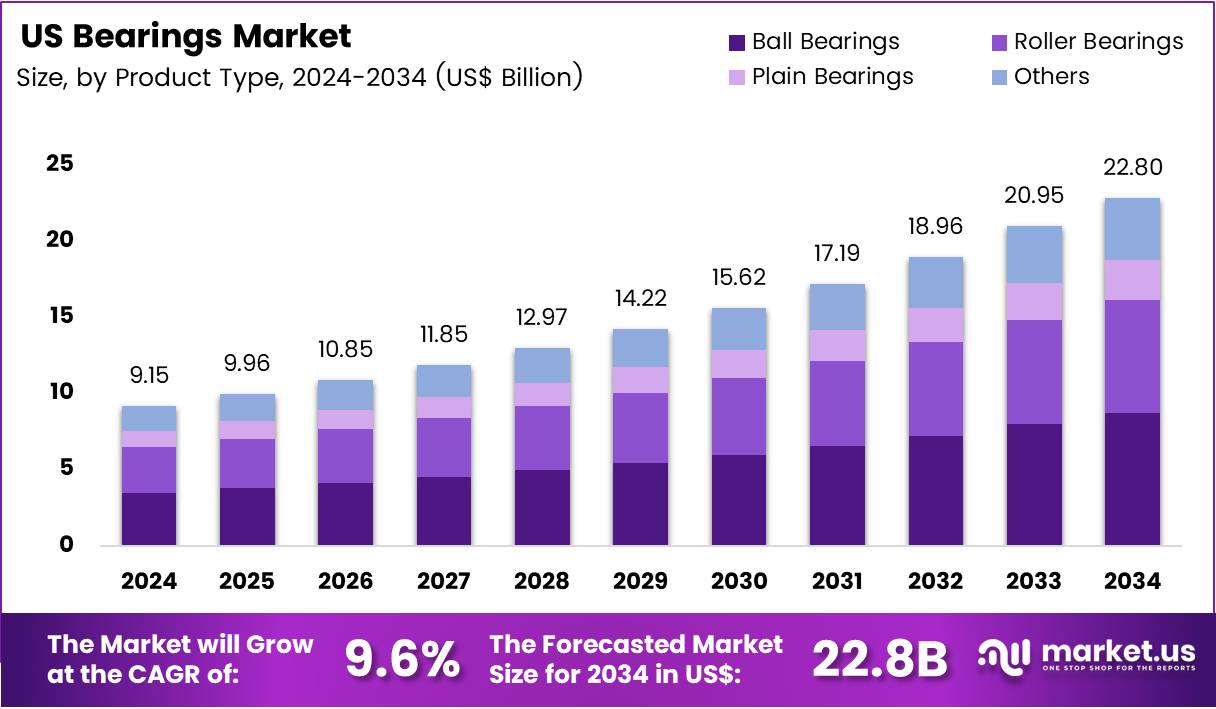

The US Bearings Market size is expected to be worth around US$ 22.79 billion by 2034 from US$ 9.15 billion in 2024, growing at a CAGR of 9.6% during the forecast period 2025 to 2034.

The US bearings market plays a critical role across various industries, including automotive, aerospace, and industrial machinery, underpinning the efficient operation of systems with high precision and reduced friction. This market is characterized by its innovation-driven approach, where technological advancements are central to addressing operational efficiency and environmental sustainability concerns.

US Bearings Market Analysis, 2020-2024 (US$ Billion)

US 2020 2021 2022 2023 2024 CAGR Revenue 5.52 6.70 7.74 8.43 9.15 9.6% The evolution of the market has been influenced by technological advancements, such as the development of lubrication technology and materials science. For instance, the introduction of ceramics and advanced polymers has led to bearings that are lighter, can operate at higher temperatures, and offer lower friction coefficients. The shift towards sustainability has also spurred innovation in the bearings industry, with increased demand for products that contribute to energy efficiency and meet stringent environmental regulations.

Full Ceramic Bearings feature ceramic components (inner and outer races, and balls), such as silicon nitride (Si3N4) or zirconia (ZrO2), ideal for extreme environments due to superior corrosion resistance, high temperature tolerance, and low friction.

The competitive landscape is robust, dominated by key players such as SKF, Timken, and Schaeffler, who compete on innovation, product quality, and supply chain capabilities. The market also sees a significant amount of strategic mergers, acquisitions, and collaborations that aim to leverage new market opportunities and technological advancements.

In June 2023, the US Department of Defense (DoD) has recently reached an agreement aimed at enhancing domestic manufacturing of ball bearings, a crucial component for numerous critical systems. Under the $13.8 million agreement, the Timken Company expanded its production of high-precision ball bearings at its facility located in Keene, New Hampshire. These high precision ball bearings manufactured by Timken play a vital role in advanced systems utilized in defense and space-related applications.

Key Takeaways

- The US Bearings market was valued at USD 9.15 billion in 2024 and is anticipated to register substantial growth of USD 22.79 billion by 2034, with 9.6% CAGR.

- Based on Product Type, the market is bifurcated into Ball Bearings, Roller Bearings, Plain Bearings, and Others, with Ball Bearings taking the lead in 2024 with 38.1% market share.

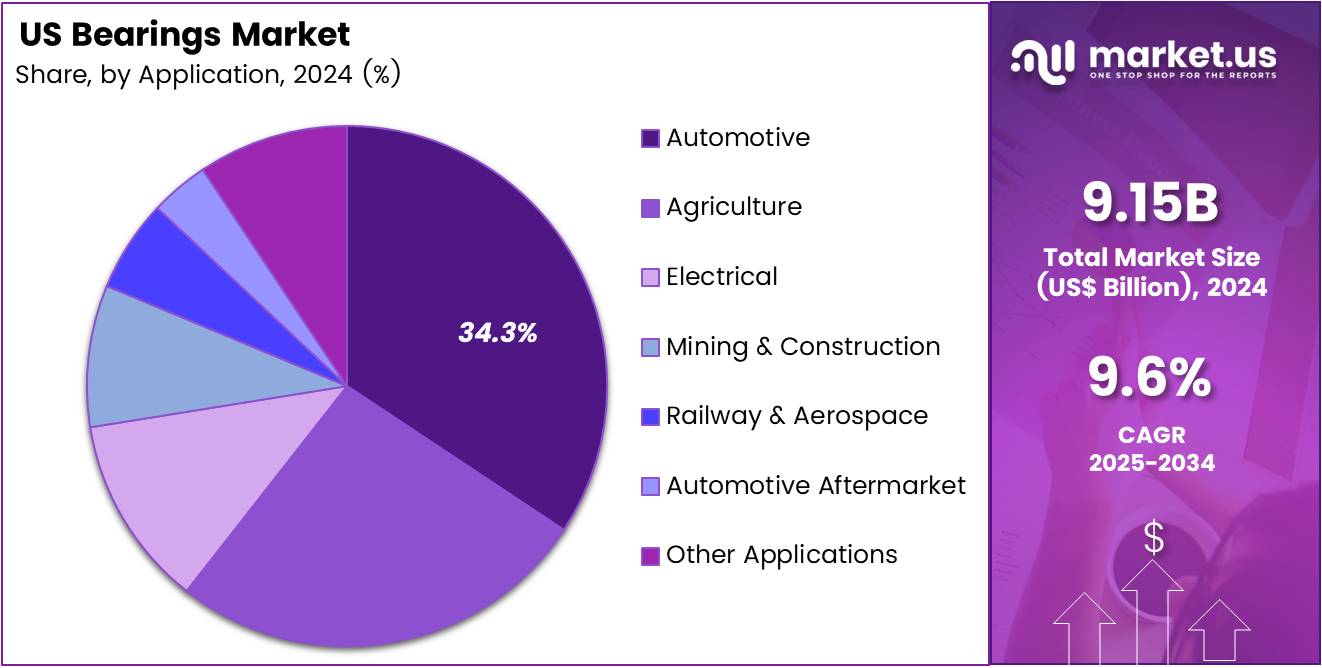

- Based on Application, the market is divided into Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, and Other Applications, with Automotive leading with dominant market share of 34.3% .

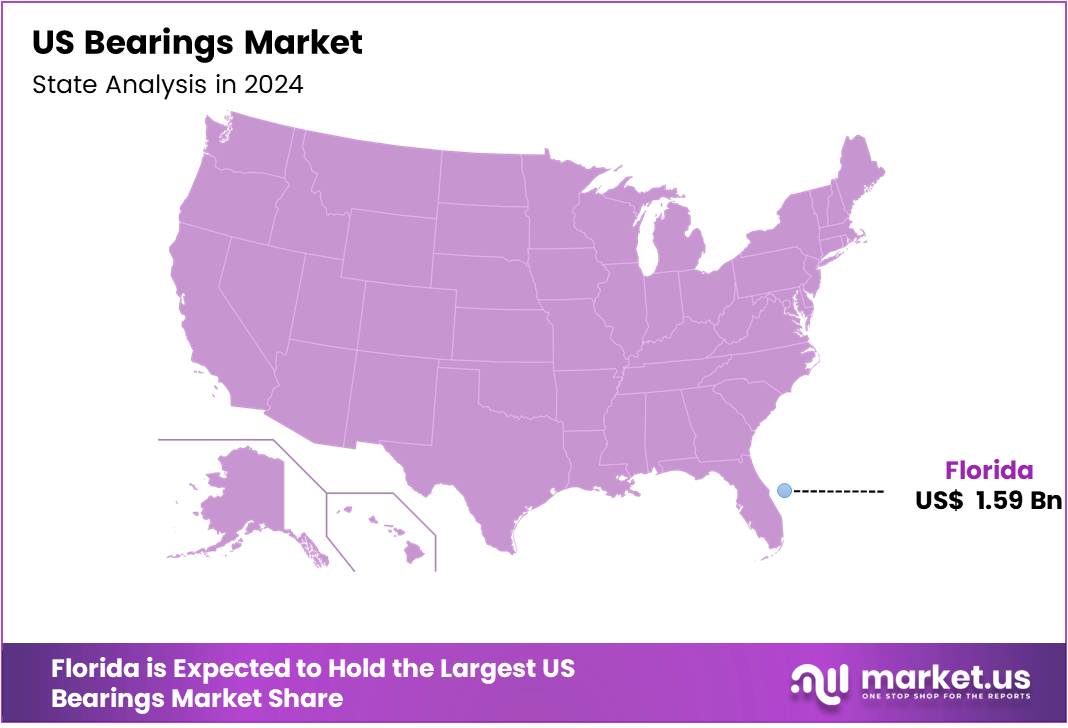

- Florida maintained its leading position in the US market with a share of over 17.4% of the total revenue.

By Product Type

Ball bearings are a fundamental component in mechanical systems which dominated the market with 38.1% market share in 2024, providing low friction and reliable performance across numerous applications.

Among these, deep groove bearings stand out as particularly prevalent due to their design, which incorporates a deep groove on the radial plane of the bearing. This unique structure allows them to accommodate both radial and axial loads simultaneously, making them a versatile choice for a broad array of equipment including electric motors and automotive axles, where they ensure smooth operation under varying load conditions.

Beyond deep groove bearings, the ball bearing category also includes several other specialized types designed for specific applications and challenges. Angular contact bearings, for instance, are engineered to support higher axial loads and are typically utilized in pairs to balance forces effectively. Their ability to handle combined loads makes them ideal for use in complex assemblies such as spindle bearings in precision machinery.

US Bearings Market, Product Type, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 CAGR Ball Bearings 2.10 2.55 2.95 3.21 3.49 9.7% Roller Bearings 1.77 2.16 2.50 2.73 2.97 10.0% Plain Bearings 0.66 0.80 0.92 0.99 1.07 9.1% Others 0.99 1.20 1.38 1.50 1.62 9.3% Total 5.52 6.70 7.74 8.43 9.15 9.6% By Application

Automotive sector dominated the US bearings market with 34.3% market share in 2024. In the automotive sector, bearings play an indispensable role in ensuring the smooth and efficient functioning of various vehicle components. The precision and reliability of bearings are paramount as they directly impact vehicle performance and longevity.

For instance, wheel hub assemblies use tapered roller bearings or deep groove ball bearings, which are essential for maintaining stable vehicle control and handling by accommodating both radial and axial loads effectively. These bearings ensure that the wheel rotates smoothly with minimal friction, which is crucial for optimizing fuel efficiency and reducing wear and tear.

Furthermore, in transmission systems, different types of bearings including cylindrical roller bearings and needle bearings are used to facilitate seamless gear transitions and support the transmission shaft. These bearings must withstand high torque and variable speeds, critical for ensuring that the vehicle operates smoothly without mechanical failures.

The dynamic nature of automotive applications—where components frequently encounter high stress and extreme conditions—necessitates bearings that are not only robust but also capable of maintaining high performance over the vehicle’s lifespan.

As the automotive industry focuses on increasing fuel efficiency, reducing emissions, and enhancing vehicle performance, the demand for high-precision, durable, and efficient bearings grows. Furthermore, the shift towards electric vehicles (EVs) introduces new requirements for bearing designs that can handle different load dynamics and operational speeds. According to the U.S. Bureau of Labor Statistics, from 2011 to 2021, electric car sales in the United States surged from a modest 0.2 percent of total car sales to a notable 4.6 percent.

US Bearings Market, Application, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 CAGR Automotive 1.88 2.29 2.65 2.89 3.14 9.8% Automotive Aftermarket 1.39 1.71 1.99 2.19 2.40 10.6% Railway & Aerospace 0.66 0.80 0.92 1.00 1.09 9.4% Electrical 0.49 0.60 0.69 0.75 0.81 9.2% Mining & Construction 0.33 0.39 0.45 0.49 0.52 8.5% Agriculture 0.22 0.26 0.29 0.31 0.33 7.3% Other Applications 0.54 0.65 0.74 0.80 0.86 8.0% Total 5.52 6.70 7.74 8.43 9.15 9.6% Key Market Segments

By Product Type

- Ball Bearings

- Deep Groove Bearings

- Others

- Roller Bearings

- Split

- Tapered

- Others

- Plain Bearings

- Sleeve Bearings

- Spherical Plain Bearings

- Others

- Other Product Types

By Application

- Automotive

- Agriculture

- Electrical

- Mining & Construction

- Railway & Aerospace

- Automotive Aftermarket

- Other Applications

Drivers

Increasing Adoption of Automation and Robotics

The increasing adoption of automation and robotics across various industries is reshaping the landscape of manufacturing and production, driving significant demand for high-performance bearings. These precision-engineered components play a pivotal role in ensuring the smooth operation and accuracy of machinery and robotic systems, thereby facilitating efficient and reliable automation processes.

In the automotive industry, for instance, the rise of autonomous vehicles and electric propulsion systems has led to the integration of advanced robotics in assembly lines. Bearings are essential components in robotic arms, conveyor systems, and robotic welding machines, where they facilitate precise movement, reduce friction, and enhance overall operational efficiency. As automotive manufacturers strive to optimize production processes and achieve higher levels of automation, the demand for specialized bearings capable of withstanding heavy loads, high speeds, and repetitive motion continues to grow.

Similarly, in the aerospace sector, the deployment of robotic systems for aircraft assembly, maintenance, and inspection tasks has increased significantly. Bearings are critical components in robotic manipulators, aerospace machining centers, and automated guided vehicles used in aircraft manufacturing facilities. These bearings enable precise positioning, smooth rotation, and reliable performance under extreme conditions, ensuring the quality and safety of aerospace components and assemblies.

The North American robotics market demonstrated robust growth in 2022, with total installations in manufacturing increasing by 12% to reach 41,624 units. Leading the adoption of robotics in the region is the automotive industry, with companies in the US, Canada, and Mexico installing 20,391 industrial robots, marking a 30% increase compared to 2021. These preliminary findings were presented by the International Federation of Robotics (IFR).

Restraints

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials, particularly steel and alloys crucial for bearing manufacturing, pose significant challenges for manufacturers and impact their profit margins and pricing strategies. Steel, as a primary material in bearing production, is susceptible to price volatility driven by factors such as changes in US demand, supply chain disruptions, and geopolitical tensions.

For instance, fluctuations in iron ore prices, a key raw material for steel production, can directly influence the cost of steel, thereby affecting the overall manufacturing cost of bearings. Similarly, variations in the prices of alloying elements like chromium, molybdenum, and nickel, which impart specific properties such as hardness, corrosion resistance, and high-temperature performance to bearing steels, contribute to cost uncertainties for manufacturers.

These fluctuations in raw material prices create challenges for bearing manufacturers in managing production costs and maintaining competitive pricing in the market. When raw material prices increase, manufacturers may face pressure to absorb higher production costs or pass them onto customers through price adjustments. However, in price-sensitive markets or during periods of economic downturn, raising prices may not be feasible and could lead to loss of market share or reduced profitability.

As per the reports, Steel prices experienced a significant downturn from May to early July. The Russian invasion of Ukraine initially prompted prices to surge by $500 per ton in both Europe and the United States. However, by mid-July, prices had dropped by $600 or more, returning to previous levels.

Growth Factors

Ongoing Transition Towards Industry 4.0 technologies

The ongoing transition towards Industry 4.0 technologies, characterized by the integration of digitalization, automation, and data analytics in manufacturing processes, presents significant opportunities for bearings equipped with sensors and condition monitoring capabilities. In the context of smart factories and connected machinery, bearings play a crucial role as integral components in rotating equipment, and the integration of sensors enables real-time monitoring of their performance, health, and operating conditions.

For instance, in industrial machinery and equipment, bearings equipped with vibration sensors can detect early signs of wear, misalignment, or lubrication issues, allowing for timely intervention and preventive maintenance to avoid costly downtime and equipment failures. By continuously monitoring vibration levels, temperature, and other performance parameters, predictive maintenance algorithms can analyze data patterns, predict potential failures, and schedule maintenance activities proactively, optimizing equipment uptime and reliability.

In August 2022, Motion plastics expert Igus has introduced a service life calculator tool tailored for their WJRM series of hybrid rolling bearings. This specialized product line integrates drylin linear bearing technology with ball bearings, resulting in reduced friction, thereby making them particularly suitable for manual adjustments.

Impact of Macroeconomic / Geopolitical Factors

The US bearings market has been significantly influenced by macroeconomic and geopolitical factors shaping demand, production costs, and trade dynamics. The slowdown in US industrial output in 2024, coupled with tighter monetary policies by the Federal Reserve, impacted capital spending across automotive, aerospace, and manufacturing sectors, restraining short-term growth in bearing consumption.

High interest rates also dampened new equipment investments, particularly in heavy machinery and construction segments. However, the gradual easing of inflationary pressures and industrial recovery in 2025 are expected to improve order volumes, especially in precision and energy-efficient bearing systems.

Geopolitical tensions, such as the ongoing US-China trade restrictions and the Russia-Ukraine conflict, have disrupted global and US steel and alloy supply chains—key raw materials for bearing manufacturing. For instance, the sanctions on Russian steel exports and logistics disruptions in Eastern Europe led to higher input costs and longer lead times for US manufacturers like Timken and RBC Bearings. In response, several US-based producers are localizing supply chains and expanding domestic forging and heat-treatment facilities to reduce import dependence.

Additionally, the US Infrastructure Investment and Jobs Act has stimulated domestic demand for industrial machinery and rail bearings, offsetting some of the trade-related headwinds.

Latest Trends

Digitalization and Connectivity

The integration of digital technologies, notably IoT (Internet of Things) and cloud computing, into bearing systems represents a significant advancement in the manufacturing industry. By embedding sensors and connectivity capabilities into bearings, manufacturers can enable remote monitoring, predictive maintenance, and real-time data analytics of industrial equipment.

This trend facilitates the offering of value-added services such as condition monitoring, performance optimization, and predictive maintenance solutions, thereby enhancing overall equipment efficiency and reducing downtime for end-users.

Through IoT-enabled sensors embedded within bearings, manufacturers can collect real-time data on various parameters such as temperature, vibration, and lubrication levels. This data is transmitted to cloud-based platforms where advanced analytics algorithms process and analyze it to assess the health and performance of the equipment.

By continuously monitoring the condition of bearings and other critical components, manufacturers can detect early signs of wear, misalignment, or potential failures, allowing for proactive maintenance interventions before issues escalate into costly downtime or equipment damage.

Country Analysis

Florida is leading state in the US Bearings Market

Florida held a majority revenue share of 17.3% in 2024 during the forecast period. In Florida, the bearings market is primarily driven by the state’s robust manufacturing sector, which encompasses industries such as aerospace, automotive, marine, and industrial machinery.

For instance, in the aerospace industry, bearings play a crucial role in aircraft engines, landing gear systems, and flight control mechanisms. Major aerospace companies with operations in Florida, such as Lockheed Martin and Northrop Grumman, contribute to the demand for high-quality bearings.

According to Space Florida’s 2023 report, Florida’s aerospace industry has experienced significant growth over the past year. This growth underscores the ongoing shift from a primarily government-led sector to a dynamic commercial market.

Moreover, Florida’s position as a major hub for international trade and logistics further boosts the bearings market, as bearings are essential components in port equipment, conveyor systems, and material handling machinery used in shipping and logistics operations. Additionally, the state’s construction and infrastructure development projects drive demand for bearings in heavy equipment such as cranes, excavators, and earthmoving machinery.

Key US Bearings Company Insights

Key players in the Bearings market includes Harbin Bearing Manufacturing Co., Ltd., Fersa Bearings, Schaeffler Group USA Inc., SKF Corporation, NBI Bearings Europe, JTEKT Corporation, NSK Global, Regal Rexnord Corporation, NTN Corporation, The Timken Company, RBC Bearings Incorporated, and Other Key Players.

Schaeffler Group USA Inc.: The company is the United States arm of a global industrial and automotive supplier, based in Fort Mill, South Carolina, offering rolling and plain bearings, linear and direct-drive technologies, maintenance services and monitoring systems for a wide range of industrial applications.

SKF Corporation is the US subsidiary of a global leader in rolling bearings and associated technologies, the company supplies bearings, units, seals, lubrication systems and services across industrial and automotive sectors, with manufacturing in the US and worldwide distribution.

NSK Ltd. Is a Japan-based bearing manufacturer founded in 1916, operating globally (including US facilities), providing ball and roller bearings, linear motion products and automotive components with a strong reputation for high precision and engineering excellence.

Top Key Players in the Market

- Harbin Bearing Manufacturing Co., Ltd.

- Fersa Bearings

- Schaeffler Group USA Inc.

- SKF Corporation

- NBI Bearings Europe

- JTEKT Corporation

- NSK Global

- Regal Rexnord Corporation

- NTN Corporation

- The Timken Company

- RBC Bearings Incorporated

- Other Key Players

Recent Developments

- In April, 2024, NSK Ltd. has introduced a novel gas turbine generator bearing tailored for eVTOLs, encompassing large drones, with the anticipation of enhancing the flight durability of drones.

- In March, 2024, NSK Ltd. developed a high-performance bearing with low particle emission levels, enhancing the stable operation of industrial machinery like industrial robots.

- In May 2023, NTN Corporation developed a specialized bearing, known as the “Bearing with Insulating Coating,” designed to resist electrical pitting in e-Axles utilized in electric vehicles (EVs) and hybrid electric vehicles (HEVs). By applying an insulating coating to the outer diameter and width of the bearing, the bearing effectively mitigates electric current flow. With an insulation performance rating of 100V or higher, it facilitates the utilization of high-voltage batteries.

- In February 2023, Regal Rexnord Corporation introduced the latest addition to its product line: the Sealmaster Stainless Steel (SS) Gold bearings. Engineered with a focus on durability and longevity, these new bearings are designed to withstand corrosive conditions and rigorous washdown protocols, making them ideal for applications in the food and beverage, pharmaceutical, and chemical processing sectors.

Report Scope

Report Features Description Market Value (2024) USD 9.15 Billion Forecast Revenue (2034) USD 22.79 Billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ball Bearings (Deep Groove Bearings, Others), Roller Bearings, (Split, Tapered, Others), Plain Bearings (Sleeve Bearings, Spherical Plain Bearings, Others), Other Product Types), By Application, (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, and Other Applications) Competitive Landscape Harbin Bearing Manufacturing Co., Ltd., Fersa Bearings, Schaeffler Group USA Inc., SKF Corporation, NBI Bearings Europe, JTEKT Corporation, NSK Global, Regal Rexnord Corporation, NTN Corporation, The Timken Company, RBC Bearings Incorporated, Other Key Players Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Harbin Bearing Manufacturing Co., Ltd.

- Fersa Bearings

- Schaeffler Group USA Inc.

- SKF Corporation

- NBI Bearings Europe

- JTEKT Corporation

- NSK Global

- Regal Rexnord Corporation

- NTN Corporation

- The Timken Company

- RBC Bearings Incorporated

- Other Key Players