US automotive eCall Market Size, Share, Growth Analysis By Propulsion Type (ICE, Electric Motor), By Trigger Type (Automatically Initiated eCall (AIeC), Manually Initiated eCall (MIeC)), By Vehicle Type (Passenger Cars, Commercial Vehicles) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173681

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

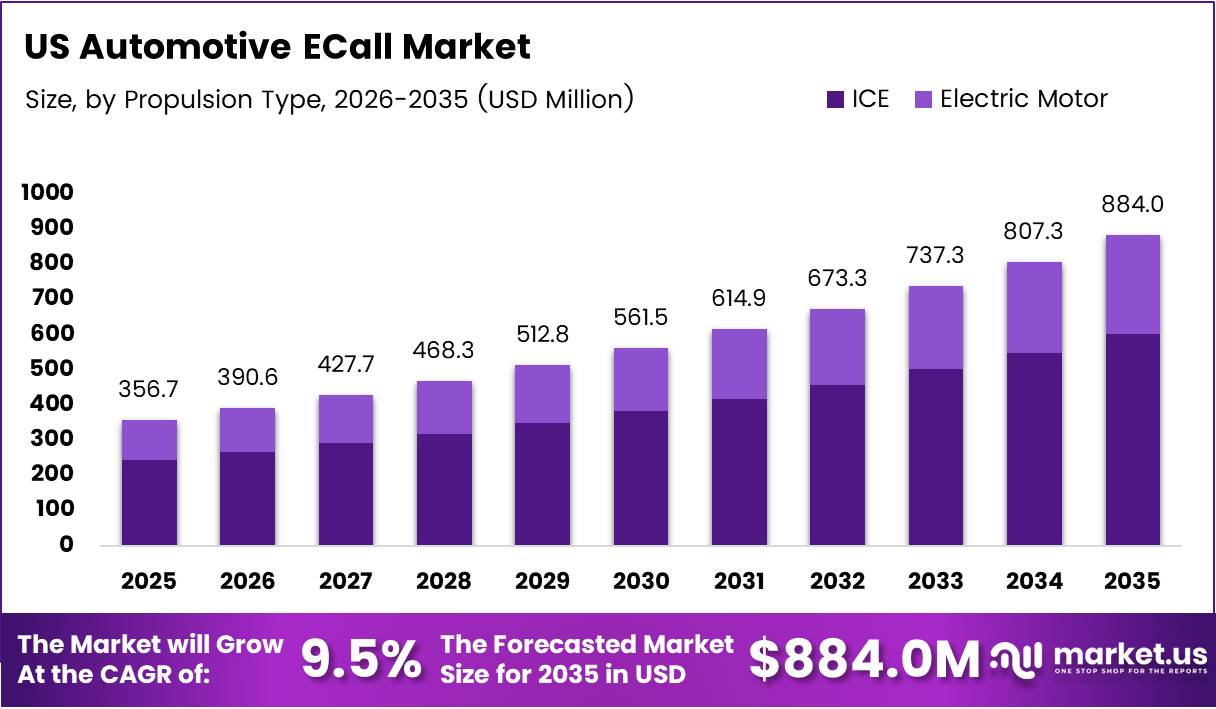

The US automotive eCall market size was valued at approximately USD 356.7 Million in 2025 and is projected to reach USD 884.0 Million by 2035, expanding at a compound annual growth rate of 9.5% during the forecast period from 2026 to 2035.

The market fundamentally revolves around in-vehicle emergency communication systems that automatically or manually transmit collision data and location coordinates to emergency services. These systems leverage cellular networks and GNSS positioning technology to deliver real-time crash notifications. Modern eCall platforms integrate seamlessly with connected car architectures, enabling faster emergency response times and potentially reducing accident fatality rates across American roadways.

Growth momentum stems from multiple converging factors including regulatory advancement, technological innovation, and heightened safety awareness. Federal Motor Vehicle Safety Standard initiatives continue pushing automakers toward enhanced automatic crash notification capabilities.

Meanwhile, insurance providers increasingly recognize eCall-equipped vehicles through premium incentives, further accelerating adoption across passenger and commercial segments. Connected car penetration rates continue rising, creating favorable infrastructure for eCall deployment nationwide.

Commercial fleet operators demonstrate growing interest as eCall systems enhance driver safety protocols and reduce liability exposure. Urban accident density remains elevated, prompting OEMs to prioritize comprehensive safety system upgrades.

According to the National Highway Traffic Safety Administration, an estimated 39,345 people were killed in U.S. motor vehicle traffic crashes in 2024, underscoring urgent demand for life-saving emergency response technologies. This statistical reality reinforces market expansion as stakeholders pursue solutions that minimize response delays during critical post-crash moments.

Investment flows increasingly toward next-generation telematics control units featuring eSIM capabilities and 5G connectivity. Vehicle-to-everything communication integration presents substantial long-term opportunities.

Cloud-based emergency management platforms gain traction alongside AI-powered crash severity detection algorithms. These technological advancements position the US automotive eCall market for sustained double-digit growth through 2035, transforming emergency response capabilities across American transportation networks.

Key Takeaways

- US automotive eCall market valued at USD 356.7 Million in 2025, projected to reach USD 884.0 Million by 2035

- Market expected to grow at a CAGR of 9.5% during the forecast period 2026-2035

- ICE propulsion segment dominates with 79.9% market share

- Automatically Initiated eCall holds 78.5% share in trigger type segment

- Passenger Cars command 86.3% of vehicle type segment

- Federal safety standards and connected car penetration drive market expansion

- 39,345 fatalities reported in 2024 U.S. traffic crashes highlight critical need for eCall systems

- 5G telematics modules and V2X integration represent key growth opportunities

By Propulsion Type

ICE vehicles dominate with 79.9% market share due to extensive installed base and established telematics infrastructure.

In 2025, ICE vehicles held a dominant market position in the By Propulsion Type segment of the US automotive eCall market, with a 79.9% share. Internal combustion engine vehicles continue representing the vast majority of America’s automotive fleet. Consequently, eCall system deployments concentrate heavily within this segment.

Legacy automakers maintain comprehensive ICE production lines with integrated telematics capabilities. Retrofit opportunities further expand as older ICE vehicles receive aftermarket eCall installations. The mature supply chain and standardized integration protocols support cost-effective implementation across diverse ICE platforms.

Electric motor vehicles demonstrate accelerating adoption despite smaller current market presence. Battery electric and plug-in hybrid models increasingly feature native eCall functionality as standard equipment. EV manufacturers prioritize advanced safety features to differentiate their offerings.

Electric vehicle architectures naturally accommodate sophisticated electronics integration, simplifying eCall deployment. Growing EV sales projections suggest this segment will capture expanding market share throughout the forecast period, though ICE vehicles maintain overwhelming dominance presently.

By Trigger Type

Automatically Initiated eCall dominates with 78.5% share driven by regulatory emphasis and superior crash response reliability.

In 2025, Automatically Initiated eCall held a dominant market position in the By Trigger Type segment of the US automotive eCall market, with a 78.5% share. Automatic systems activate instantly upon detecting collision forces through integrated crash sensors. This eliminates human intervention delays during critical post-accident moments.

Regulators strongly favor automatic activation mechanisms for maximum life-saving potential. OEMs increasingly adopt AIeC as standard safety equipment rather than optional features. Insurance providers offer more substantial premium reductions for automatic systems compared to manual alternatives.

Manually Initiated eCall systems serve complementary roles in emergency scenarios beyond collisions. Drivers activate these systems during medical emergencies, vehicle breakdowns, or witnessed accidents. Manual triggers provide valuable functionality for non-crash emergencies requiring immediate assistance.

However, their dependence on conscious driver action limits effectiveness during incapacitating collisions. Market preference clearly trends toward automatic systems that guarantee activation regardless of occupant condition, explaining the substantial dominance gap between trigger type segments.

By Vehicle Type

Passenger Cars command 86.3% market dominance reflecting higher production volumes and regulatory prioritization for consumer vehicles.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of the US automotive eCall market, with an 86.3% share. Private passenger vehicles constitute the overwhelming majority of registered vehicles nationwide. Consequently, eCall deployment concentrates within sedan, SUV, and personal-use vehicle categories.

Automakers prioritize passenger car safety features to meet consumer expectations and regulatory requirements. Connected car technologies penetrate passenger segments more rapidly than commercial categories. Insurance incentives primarily target private vehicle owners, accelerating adoption among passenger car buyers who benefit from reduced premiums.

Commercial vehicles represent growing opportunities as fleet operators recognize operational benefits beyond emergency response. Logistics companies leverage eCall systems for comprehensive fleet management and driver safety monitoring. Delivery vehicles, trucks, and service fleets increasingly adopt telematics platforms incorporating eCall functionality.

However, commercial vehicle volumes remain substantially lower than passenger cars. Additionally, commercial adoption timelines extend longer due to fleet replacement cycles and cost sensitivity. Nevertheless, commercial segment growth rates exceed passenger cars as fleet modernization initiatives gain momentum across transportation and logistics industries.

Key Market Segments

By Propulsion Type

- ICE

- Electric Motor

By Trigger Type

- Automatically Initiated eCall (AIeC)

- Manually Initiated eCall (MIeC)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Federal Safety Standards and Connected Car Penetration Drive Rapid Market Expansion

Federal Motor Vehicle Safety Standard initiatives increasingly emphasize advanced automatic crash notification integration. Regulatory bodies recognize eCall systems as essential components for reducing traffic fatality rates. Consequently, automakers face mounting pressure to incorporate these technologies across production lines. This regulatory momentum accelerates standardization and drives down implementation costs through economies of scale.

Rising penetration of connected car platforms across passenger and light commercial vehicles creates favorable infrastructure conditions. Modern vehicles increasingly feature cellular connectivity and telematics control units as baseline equipment. This existing connectivity foundation simplifies eCall integration without requiring extensive hardware modifications. Connected car adoption rates continue climbing, establishing ideal conditions for widespread eCall deployment.

Growing insurance incentives for vehicles equipped with emergency telematics systems provide compelling financial motivation. Insurance providers offer premium discounts recognizing reduced accident severity and faster emergency response capabilities. These cost savings influence purchasing decisions and accelerate adoption among budget-conscious consumers. Additionally, increasing urban accident density drives OEM-level safety system upgrades as manufacturers respond to elevated collision risks in metropolitan areas.

Restraints

High Retrofit Costs and Privacy Concerns Limit Market Penetration

High telematics hardware and cellular connectivity retrofit costs in legacy vehicle fleets present substantial barriers. Older vehicles require extensive modifications to accommodate eCall systems including crash sensors, GPS modules, and cellular modems. Installation complexity increases labor expenses while hardware components carry significant price tags. Many vehicle owners, particularly those operating aging cars, find retrofit economics unfavorable compared to vehicle replacement.

These elevated costs particularly impact lower-income demographics and rural populations operating older vehicle fleets. Aftermarket installation providers face challenges delivering cost-effective solutions that compete with factory-integrated systems. Consequently, substantial portions of America’s existing vehicle population remain without eCall capabilities despite demonstrated safety benefits.

Consumer privacy concerns related to continuous vehicle location and data tracking generate resistance among privacy-conscious demographics. eCall systems require persistent connectivity and location monitoring to function effectively during emergencies. However, many consumers express discomfort with constant vehicle tracking and potential data sharing with manufacturers, insurers, and government agencies. These privacy apprehensions slow adoption rates despite safety advantages, particularly among individuals prioritizing personal data protection over incremental safety improvements.

Growth Factors

V2X Integration and Subscription Services Create Substantial Growth Opportunities

Integration of eCall systems with vehicle-to-everything communication infrastructure represents transformative growth potential. V2X networks enable vehicles to communicate with surrounding infrastructure, other vehicles, and emergency services. This connectivity amplifies eCall effectiveness by providing richer contextual data during emergency situations. Infrastructure investments in V2X technology create synergistic opportunities for advanced eCall implementations featuring enhanced situational awareness capabilities.

Expansion of subscription-based emergency assistance services by U.S. automakers generates recurring revenue streams. Manufacturers increasingly offer tiered service packages combining eCall functionality with roadside assistance, stolen vehicle recovery, and concierge services. These subscription models improve customer retention while generating predictable revenue beyond initial vehicle sales. Premium tiers featuring enhanced emergency services attract safety-conscious consumers willing to pay for comprehensive protection.

Growing demand for eCall deployment in commercial fleet and logistics vehicles opens substantial B2B opportunities. Fleet operators recognize operational benefits including reduced accident liability, faster incident response, and improved driver safety metrics. Additionally, adoption of next-generation eSIM-enabled telematics control units simplifies global deployment and carrier management. eSIM technology eliminates physical SIM card limitations while enabling remote provisioning and multi-carrier redundancy for maximum reliability.

Emerging Trends

Cloud Platforms and AI Analytics Transform Emergency Response Capabilities

Shift toward cloud-based emergency response management platforms modernizes infrastructure and improves scalability. Cloud architectures enable centralized data processing, real-time coordination between emergency services, and seamless integration with hospital systems. This transformation reduces response times while improving resource allocation during mass casualty incidents. Cloud platforms also facilitate continuous system updates and feature enhancements without hardware modifications.

AI-enabled crash severity detection and automated dispatch analytics represent significant technological advancements. Machine learning algorithms analyze accelerometer data, airbag deployment patterns, and vehicle telemetry to assess collision severity instantly. This intelligent triage enables emergency services to prioritize responses and dispatch appropriate resources. Automated analytics reduce human error while accelerating decision-making during critical moments following accidents.

Multi-constellation GNSS positioning integration delivers higher location accuracy essential for rapid emergency response. Modern eCall systems leverage GPS, GLONASS, Galileo, and BeiDou satellite networks simultaneously. This multi-constellation approach ensures reliable positioning even in challenging urban environments with signal obstructions. Furthermore, embedded 5G telematics modules enable faster emergency data transmission including high-resolution crash video and comprehensive vehicle diagnostics, providing first responders with unprecedented situational awareness before arrival.

Regional Analysis

United States Leads Automotive eCall Adoption Through Regulatory Support and Technology Infrastructure

The United States dominates the North American automotive eCall landscape through substantial federal safety initiatives and extensive connected vehicle infrastructure. American automakers invest heavily in telematics platforms as competitive differentiators.

Major metropolitan areas demonstrate highest adoption rates correlating with elevated accident density. The established cellular network coverage across urban and suburban regions supports reliable eCall functionality. Insurance industry engagement through premium incentive programs accelerates consumer adoption nationwide.

Regulatory momentum continues building as federal agencies evaluate mandatory eCall requirements similar to European eCall mandates. The National Highway Traffic Safety Administration actively researches emergency communication technologies following alarming traffic fatality statistics. California and other progressive states may implement regional requirements ahead of federal mandates.

Commercial fleet concentration in logistics hubs drives B2B segment growth. Technology companies collaborate with automakers to develop next-generation emergency response platforms leveraging artificial intelligence and cloud infrastructure.

Key US Automotive eCall Company Insights

HARMAN International maintains strong positioning within the US automotive eCall market through comprehensive connected car platforms. The company leverages extensive OEM relationships established through infotainment system deployments. HARMAN’s telematics solutions integrate eCall functionality within broader connected vehicle architectures. Their cloud-based emergency services platform enables scalable deployments across multiple automaker partners.

Continental AG delivers advanced telematics control units featuring integrated eCall capabilities for North American markets. The company’s extensive automotive electronics portfolio positions them advantageously for comprehensive safety system integration. Continental emphasizes next-generation eSIM technology and 5G connectivity within their eCall solutions. Their strong relationships with major U.S. automakers facilitate widespread adoption.

OnStar operates one of North America’s most established vehicle emergency services platforms. General Motors’ subsidiary provides subscription-based eCall services across millions of vehicles. OnStar’s extensive operational experience and nationwide emergency response network create substantial competitive advantages. The platform combines automatic crash notification with human advisor assistance for comprehensive emergency support.

DENSO CORPORATION supplies critical telematics components supporting eCall implementations across major automotive manufacturers. The company’s advanced sensor technologies enable accurate crash detection and severity assessment. DENSO emphasizes integration efficiency and cost optimization for mass-market adoption. Their global supply chain capabilities ensure reliable component availability for North American production.

Key Players

- HARMAN International

- Continental AG

- OnStar

- DENSO CORPORATION

- Robert Bosch GmbH

- Aptiv

- Telit Cinterion

- Visteon Corporation

- Infineon Technologies AG

- STMicroelectronics

Recent Developments

- July 2025: Rohde & Schwarz successfully verified Next Generation eCall compliance for the EN 17240:2024 Standard. This milestone advances technical standardization and ensures interoperability across European and North American emergency communication networks, facilitating seamless cross-border emergency response capabilities.

- February 2025: Bosch acquired U.S. company Roadside Protect, Inc., expanding its emergency assistance service portfolio. This strategic acquisition strengthens Bosch’s position within the North American automotive eCall market and enhances its comprehensive roadside assistance and emergency response offerings for connected vehicles.

Report Scope

Report Features Description Market Value (2025) USD 356.7 Million Forecast Revenue (2035) USD 884.0 Million CAGR (2026-2035) 9.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (ICE, Electric Motor), By Trigger Type (Automatically Initiated eCall (AIeC), Manually Initiated eCall (MIeC)), By Vehicle Type (Passenger Cars, Commercial Vehicles) Competitive Landscape HARMAN International, Continental AG, OnStar, DENSO CORPORATION, Robert Bosch GmbH, Aptiv, Telit Cinterion, Visteon Corporation, Infineon Technologies AG, STMicroelectronics Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HARMAN International

- Continental AG

- OnStar

- DENSO CORPORATION

- Robert Bosch GmbH

- Aptiv

- Telit Cinterion

- Visteon Corporation

- Infineon Technologies AG

- STMicroelectronics