US Adjustable Bed Frames Market Size, Share, Growth Analysis By Frame Type (Split Frame, Single Frame),By Size (Queen Size, Full Size, King Size, Twin XL Size, Twin Size, Others),By End-Use (Residential, Hospitality),By Distribution Channel (Home Improvement Stores, Specialty Store, Online/E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174785

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

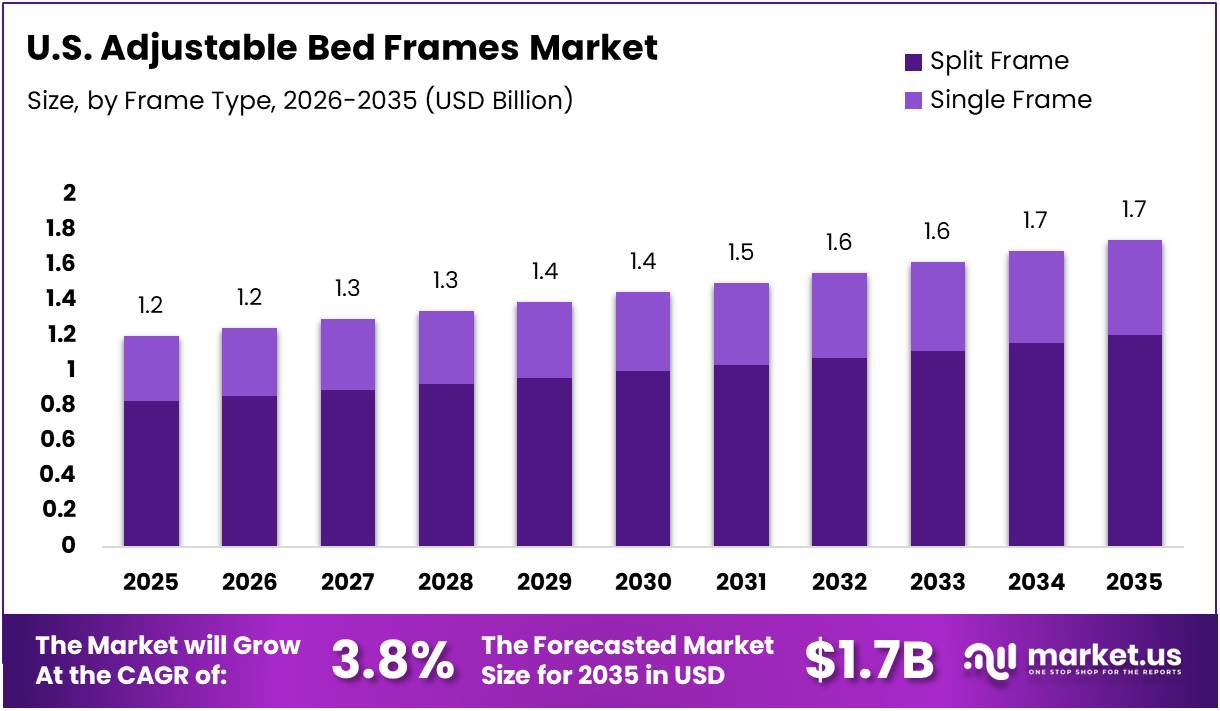

The U.S. Adjustable Bed Frames Market size is expected to be worth around USD 1.7 Billion by 2035, from USD 1.2 Billion in 2025, growing at a CAGR of 3.8% during the forecast period from 2026 to 2035.

The U.S. adjustable bed frames market represents a dynamic segment within the broader sleep solutions industry. These innovative products feature motorized mechanisms enabling users to elevate head and foot sections. Consequently, consumers achieve personalized sleeping positions that enhance comfort and address specific health concerns. The market encompasses various price points, catering to diverse demographic segments seeking improved sleep quality.

Driving substantial growth, the market benefits from America’s aging population and heightened wellness awareness. Healthcare professionals increasingly recommend adjustable bases for managing chronic conditions like sleep apnea and acid reflux. Moreover, younger consumers recognize these frames as lifestyle upgrades rather than medical necessities. This demographic shift expands the total addressable market significantly, creating lucrative opportunities for manufacturers and retailers alike.

Transitioning to investment potential, the sector attracts significant capital from both established furniture manufacturers and emerging direct-to-consumer brands. E-commerce channels facilitate market penetration, enabling companies to reach cost-conscious buyers efficiently. Additionally, technological integration including smartphone connectivity and sleep tracking differentiates premium offerings. These innovations justify higher price points while enhancing consumer value propositions across competitive landscapes.

Regarding regulatory frameworks, the Consumer Product Safety Commission oversees product safety standards for adjustable bed frames. Manufacturers must comply with electrical safety certifications and structural integrity requirements. Furthermore, Medicare provides partial coverage for adjustable bases when prescribed for specific medical conditions. This reimbursement framework validates the therapeutic benefits, subsequently encouraging broader adoption among eligible populations nationwide.

Examining market penetration, 33% of consumers demonstrate familiarity and purchasing interest in adjustable bases, indicating substantial untapped potential. Notably, durability remains advantageous as these products typically last 8 to 15 years, offering compelling long-term value. Most significantly, 75% of older adults experience pain-disrupted sleep, with adjustable beds providing effective joint pain relief. These statistics collectively underscore robust demand fundamentals supporting sustained market expansion through 2030 and beyond.

Key Takeaways

- The U.S. adjustable bed frames market is projected to grow from USD 1.2 Billion in 2025 to USD 1.7 Billion by 2035, registering a 3.8% CAGR.

- Split Frame segment leads by frame type, accounting for 68.9% of the U.S. market due to customizable and independent adjustment features.

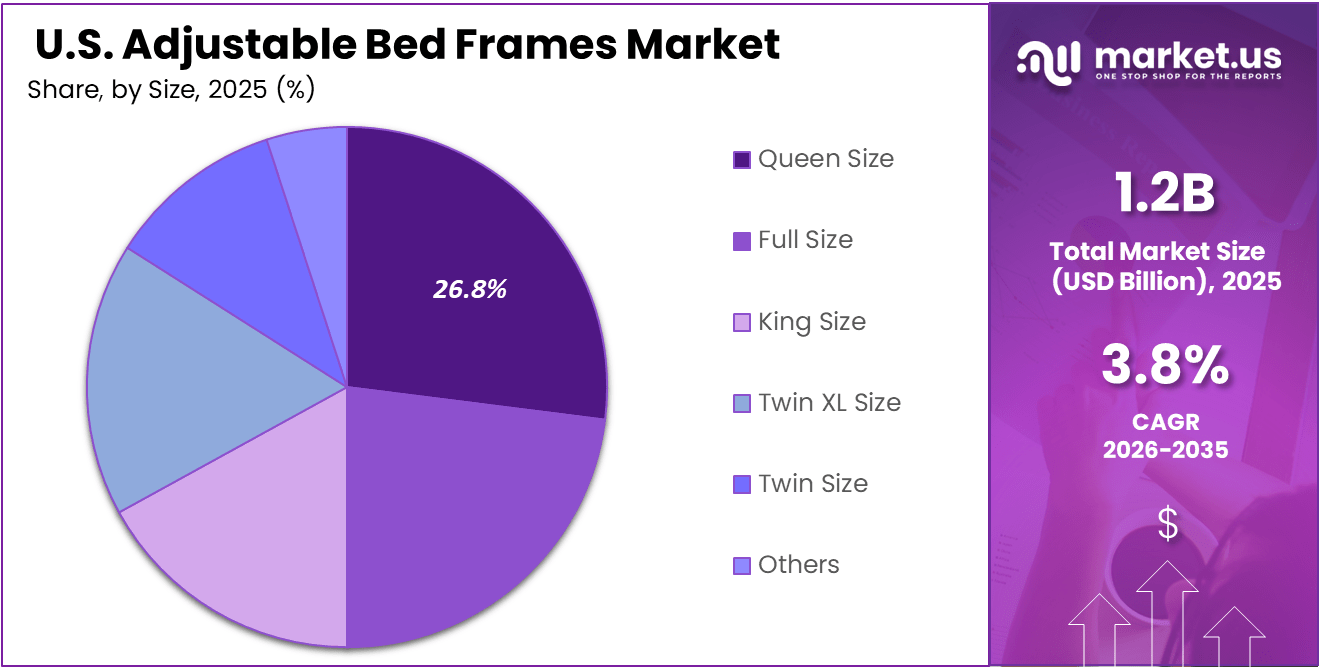

- Queen Size dominates the size segment with a 26.8% share, reflecting strong adoption across standard U.S. households.

- Residential end-use holds the largest share at 69.2%, driven by rising focus on home comfort and sleep quality in the U.S.

- Home Improvement Stores represent the leading distribution channel with 36.1% market share, supported by in-store product demonstration advantages.

By Frame Type Analysis

Split Frame dominates with 68.9% due to its customizable comfort and independent adjustment capabilities.

The Split Frame segment commands a substantial 68.9% market share, driven by its ability to offer personalized sleep experiences for couples. These frames allow each side to adjust independently, accommodating different comfort preferences simultaneously. Growing awareness of individualized sleep needs, combined with rising adjustable bed adoption in master bedrooms, fuels this dominance. Split frames address diverse health requirements, enabling partners to find optimal sleeping positions without compromising comfort.

The Single Frame segment caters to individual users and smaller households seeking simplified adjustable solutions. These frames appeal to solo sleepers, guest rooms, and compact living spaces where split functionality isn’t necessary. Single frames offer cost advantages over split configurations, attracting budget-conscious consumers. The segment benefits from growing adoption among younger demographics and urban dwellers prioritizing space efficiency and straightforward operation.

By Size Analysis

Queen Size dominates with 26.8% due to its optimal balance between space efficiency and sleeping comfort.

The Queen Size segment leads with 26.8% market share, representing the most popular mattress dimension in American households. This size perfectly balances spatial requirements with comfortable sleeping area, fitting well in standard master bedrooms while accommodating couples comfortably. Queen-sized adjustable frames align with existing furniture configurations, minimizing additional room modifications needed.

The Full Size segment serves smaller bedrooms, guest rooms, and single sleepers seeking compact adjustable solutions. These frames appeal to apartment dwellers and those transitioning from traditional beds. Full-sized frames offer an entry point for consumers exploring adjustable technology without larger investments, particularly resonating with young professionals within limited spaces.

The King Size segment targets premium consumers seeking maximum sleeping space and luxury comfort. These expansive frames accommodate couples preferring generous personal space and families allowing occasional bed-sharing. King-sized adjustable beds represent aspirational purchases, often featuring advanced technological integrations appealing to homeowners with spacious master suites.

The Twin XL Size segment primarily serves college dormitories, adjustable bed newcomers, and tall individuals requiring extended length. These frames fit standard dorm dimensions while providing adjustability benefits for students. Twin XL beds also appeal to elderly individuals transitioning to assisted living, maintaining niche demand through institutional purchases.

The Twin Size segment addresses children’s rooms, single sleepers, and space-constrained environments. These compact frames introduce younger users to adjustable bed benefits while fitting seamlessly into small bedrooms. Twin adjustable beds serve as practical solutions for individuals recovering from medical procedures, benefiting from parents investing in children’s sleep quality.

The Others segment encompasses specialty sizes including California King, Split King, and custom dimensions catering to unique consumer requirements. These variations address specific architectural constraints and unusual room configurations. The segment serves niche markets willing to invest in bespoke sleeping solutions that standard sizes cannot accommodate.

By End-Use Analysis

Residential dominates with 69.2% due to increasing consumer focus on home comfort and sleep quality improvement.

The Residential segment captures 69.2% market share, reflecting the fundamental shift toward home-centric wellness investments. Homeowners increasingly prioritize sleep quality, recognizing its impact on overall health and daily performance. Residential adoption surged following remote work normalization, as people spend more time at home. The segment benefits from aging populations seeking comfort solutions and health-conscious consumers investing in preventive wellness.

The Hospitality segment encompasses hotels, resorts, healthcare facilities, and senior living communities integrating adjustable beds into their offerings. Premium hospitality establishments differentiate guest experiences by providing adjustable options in luxury suites. Healthcare facilities utilize adjustable frames for patient comfort and recovery optimization, enhancing guest satisfaction and addressing diverse customer needs.

By Distribution Channel Analysis

Home Improvement Stores dominate with 36.1% due to their physical product demonstration capabilities and trusted retail presence.

The Home Improvement Stores segment leads with 36.1% market share, leveraging established consumer trust and hands-on shopping experiences. These retailers offer customers the critical opportunity to physically test adjustable beds before purchasing, addressing concerns about comfort and functionality. Major chains provide knowledgeable staff, comprehensive product comparisons, and immediate availability that online channels cannot replicate.

The Specialty Store segment includes dedicated mattress retailers and furniture showrooms offering curated adjustable bed selections with expert consultation. These establishments provide personalized service, detailed product knowledge, and premium brand offerings that mass retailers may not stock. Specialty stores excel in educating consumers about advanced features and long-term value propositions.

The Online/E-commerce segment experiences rapid growth through convenience, competitive pricing, and extensive product variety. Digital platforms enable comprehensive research, customer review access, and direct-to-consumer models eliminating middleman costs. E-commerce appeals to tech-savvy consumers comfortable making significant purchases online, benefiting from generous return policies and doorstep delivery services.

The Others segment encompasses department stores, direct manufacturer sales, and wholesale clubs offering adjustable beds alongside diverse product categories. These channels serve opportunistic shoppers discovering adjustable beds while shopping for unrelated items. The segment includes membership-based retailers providing value pricing and manufacturer showrooms offering factory-direct pricing and customization capabilities.

Key Market Segments

By Frame Type

- Split Frame

- Single Frame

By Size

- Queen Size

- Full Size

- King Size

- Twin XL Size

- Twin Size

- Others

By End-Use

- Residential

- Hospitality

By Distribution Channel

- Home Improvement Stores

- Specialty Store

- Online/E-commerce

- Others

Drivers

Rising Prevalence of Sleep Disorders Among U.S. Adults Drives Market Growth

The U.S. adjustable bed frames market is experiencing significant expansion driven by the growing incidence of sleep disorders and chronic back pain among American adults. Medical professionals increasingly recommend adjustable beds as therapeutic solutions for conditions like sleep apnea, acid reflux, and spinal alignment issues. These beds allow users to elevate their head or legs, reducing pressure points and improving circulation during rest.

The home healthcare sector is witnessing rapid adoption of adjustable beds, particularly in elderly care settings. As the aging population grows, more families are investing in adjustable frames to provide comfort and independence for senior members at home. These beds reduce caregiver burden by enabling easier patient positioning and mobility assistance.

Consumer preferences are shifting toward premium bedroom furniture that enhances comfort and sleep quality. Today’s buyers view adjustable beds as lifestyle upgrades rather than medical equipment. Manufacturers are responding with stylish designs, advanced features, and customizable options that appeal to health-conscious consumers willing to invest in better sleep. This trend toward premiumization continues to fuel market demand across diverse demographic segments.

Restraints

High Average Selling Prices Limiting Adoption in Price-Sensitive Households

The U.S. adjustable bed frames market faces notable challenges that could slow adoption rates. The primary restraint is the high average selling price of quality adjustable frames, which places them beyond reach for many budget-conscious households. While entry-level models exist, frames with desirable features like massage functions, memory presets, and durable motors often cost significantly more than traditional bed frames.

Compatibility concerns present another significant obstacle for potential buyers. Many consumers already own traditional mattresses that may not work optimally with adjustable bases. Memory foam and latex mattresses typically perform well on adjustable frames, but innerspring and hybrid models may experience premature wear or malfunction.

Retailers and manufacturers struggle to clearly communicate compatibility requirements, leading to post-purchase dissatisfaction and returns. These technical limitations, combined with premium pricing, create hesitation among first-time buyers and slow overall market expansion across price-sensitive consumer segments.

Growth Factors

Increasing Demand for Smart Home-Integrated Adjustable Beds Creates Market Opportunities

The U.S. adjustable bed frames market presents substantial growth opportunities for manufacturers willing to innovate. The integration of adjustable beds with smart home ecosystems represents a major expansion avenue. Consumers increasingly expect bedroom furniture to connect seamlessly with their existing smart devices. Beds featuring compatibility with systems like Amazon Alexa, Google Home, and Apple HomeKit appeal to tech-savvy buyers seeking comprehensive home automation.

Significant untapped potential exists within mid-income residential housing segments nationwide. While adjustable beds have gained traction among affluent buyers and seniors, middle-income households remain largely underserved. These consumers desire comfort-enhancing products but need more affordable options and flexible financing solutions. Manufacturers developing value-oriented models without sacrificing essential features can capture this demographic.

Direct-to-consumer sales channels and online marketplaces reduce distribution costs, making premium products more accessible. As awareness grows about health benefits and prices gradually decline through competition and manufacturing efficiencies, mid-income penetration will accelerate, expanding the total addressable market substantially across diverse geographic and demographic segments.

Emerging Trends

Rising Popularity of Zero-Gravity Features Shapes Market Trends

The U.S. adjustable bed frames market is evolving as consumers seek advanced comfort and health-focused features. Zero-gravity and anti-snore functions are gaining popularity among health-conscious buyers. The zero-gravity position elevates the head and feet to reduce spinal pressure, improve circulation, and support better sleep quality, driving strong consumer interest.

Anti-snore features automatically detect snoring patterns and gently elevate the head to open airways without waking the sleeper. These health-focused innovations differentiate premium products in a competitive marketplace and justify higher price points for consumers prioritizing wellness.

Technology integration is increasing, with app-controlled and voice-activated bed frames gaining traction. Younger consumers value the convenience of adjusting bed positions via smartphones or smart speakers. Programmable presets for reading, watching TV, and sleeping improve comfort and usability. Manufacturers offering connectivity, sleep-tracking features, and personalized settings are well positioned as the market moves toward smarter, consumer-centric solutions.

Key U.S. Adjustable Bed Frames Company Insights

Tempur Sealy International maintains its leadership position in the U.S. adjustable bed frames market through its premium brand portfolio and extensive distribution network. The company’s integration of advanced sleep technology with its mattress offerings creates a compelling value proposition for consumers seeking comprehensive sleep solutions. Their strategic focus on innovation and brand recognition continues to drive market share growth in 2025.

Sleep Number Corporation differentiates itself through its smart bed technology and personalized sleep experiences, offering adjustable bases that seamlessly integrate with their proprietary sleep tracking systems. The company’s direct-to-consumer model and emphasis on health and wellness positioning have resonated strongly with tech-savvy consumers.

Reverie has carved out a significant niche as a specialized manufacturer of adjustable bed bases, serving both retail partners and direct consumers. The company’s focus on customization options and competitive pricing strategies has enabled it to capture market share across multiple price points. Their partnerships with major mattress brands have expanded distribution channels and enhanced market penetration.

Serta Simmons Bedding leverages its established mattress brand equity to cross-sell adjustable bases, creating bundled solutions that appeal to traditional retail customers. The company’s extensive dealer network and brand recognition provide competitive advantages in reaching consumers who prefer in-store shopping experiences. Their product range spans multiple price tiers, addressing diverse consumer segments from budget-conscious buyers to luxury seekers.

Top Key Players in the Market

- Tempur Sealy International

- Sleep Number Corporation

- Reverie

- Serta Simmons Bedding

- Leggett & Platt

- Ergomotion

- Nectar

- Electropedic

- Rize Home

- Denver Mattress

Recent Developments

- In February 2025, Tempur Sealy successfully completed the acquisition of Mattress Firm, strengthening its direct-to-consumer reach and expanding control across manufacturing, retail, and distribution within the U.S. bedding market.

- In January 2025, Tempur-Pedic and Calm enhanced the multisensory experience of TEMPUR-Ergo® Smart Bases, integrating sound and relaxation content to help users fall asleep faster and improve overall sleep quality.

- In April 2024, Graham-Field expanded its adjustable bed portfolio through the acquisition of Transfer Master Products, Inc., a Hi-Low adjustable bed manufacturer, reinforcing its position in the healthcare and homecare bedding segment.

Report Scope

Report Features Description Market Value (2025) USD 1.2 Billion Forecast Revenue (2035) USD 1.7 Billion CAGR (2026-2035) 3.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Frame Type (Split Frame, Single Frame),By Size (Queen Size, Full Size, King Size, Twin XL Size, Twin Size, Others),By End-Use (Residential, Hospitality),By Distribution Channel (Home Improvement Stores, Specialty Store, Online/E-commerce, Others) Competitive Landscape Tempur Sealy International, Sleep Number Corporation, Reverie, Serta Simmons Bedding, Leggett & Platt, Ergomotion, Nectar, Electropedic, Rize Home, Denver Mattress Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Adjustable Bed Frames MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

US Adjustable Bed Frames MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Tempur Sealy International

- Sleep Number Corporation

- Reverie

- Serta Simmons Bedding

- Leggett & Platt

- Ergomotion

- Nectar

- Electropedic

- Rize Home

- Denver Mattress