Urban Rail Transit Market By Rail Type(Metro / Subway, Monorail, Suburban, Tram), By Autonomy(Manual, Semi-autonomous, Fully Autonomous), By Autonomy Level(GoA-0 (On-sight), GoA-1 (Manual), GoA-2 (Semi-automatic Train Operation [STO]), GoA-3 (Driverless Train Operation [DTO]), GoA-4 (Unattended Train Operation [UTO])), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 25594

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

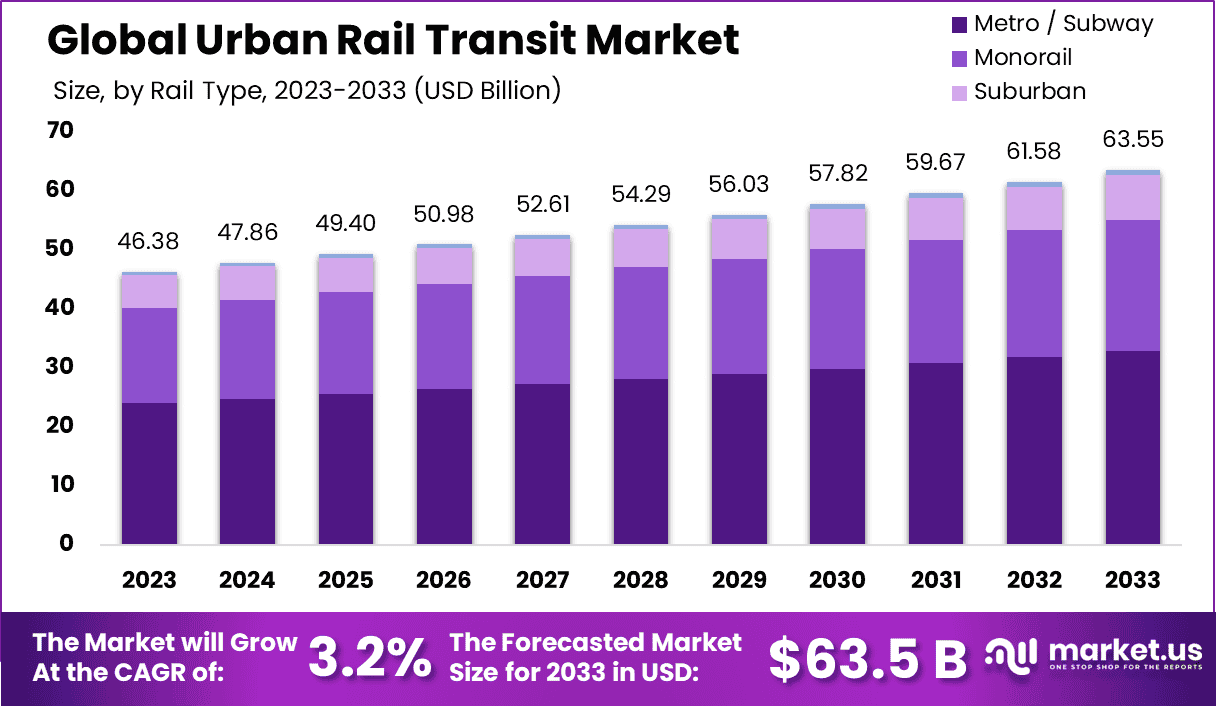

The Global Urban Rail Transit Market size is expected to be worth around USD 46.38 Billion by 2033, From USD 63.5 Billion by 2023, growing at a CAGR of 3.20% during the forecast period from 2024 to 2033.

The Urban Rail Transit Market encompasses the comprehensive infrastructure, technologies, and services integral to urban rail systems, including subways, trams, light rail, and commuter trains. This market is pivotal in addressing the escalating demand for sustainable and efficient urban transportation solutions, driven by increasing urbanization and environmental concerns.

It offers insights into system planning, construction, operation, and maintenance, alongside advancements in digitalization and electrification. For industry leaders such as Product Managers, understanding this market is crucial for strategic decision-making, enabling the development of innovative, user-centric products and services that enhance urban mobility while minimizing environmental impact.

The Urban Rail Transit Market has shown dynamic shifts in passenger behavior and ridership patterns, particularly highlighted by the notable figures from 2023. Specifically, the Long Island Rail Road, with its significant annual ridership of 75,186,900 passengers, leads in the commuter rail segment within the New York area. It is closely followed by the Metro-North Railroad and NJ Transit Rail Operations, boasting 60,569,700 and 57,179,000 passengers, respectively.

These figures underscore the vital role of urban rail transit systems in facilitating daily commutes across major urban corridors. Furthermore, the 2022 Single Summary of Transit Report sheds light on the average passenger trip length, pinpointing commuter rail’s average at 22.5 miles per trip. This metric provides insights into commuter preferences and the substantial reach of urban rail services.

The landscape of urban rail transit has been subject to evolving challenges and opportunities, marked by a 30 percent increase in transit ridership from 1993 to 2014. However, this growth trajectory encountered a downturn post-2014, attributed to the emergence of Transportation Network Companies (TNCs). These platforms have introduced alternative travel options for short trips, prompting a reevaluation of urban transit strategies. The gradual ridership decline signals the need for urban rail systems to adapt and innovate in the face of changing urban mobility patterns and preferences.

Integrating these data points, it becomes evident that urban rail transit remains a cornerstone of metropolitan transportation ecosystems. Nonetheless, the sector is at a critical juncture, necessitating strategic adjustments to reclaim and expand its ridership base. Addressing the competitive pressures from TNCs and enhancing the commuter experience through technological advancements and service optimizations can be pivotal in sustaining the urban rail transit market’s growth and relevance.

Key Takeaways

- Market Growth: The Global Urban Rail Transit Market size is expected to be worth around USD 46.38 Billion by 2033, From USD 63.5 Billion by 2023, growing at a CAGR of 3.20% during the forecast period from 2024 to 2033.

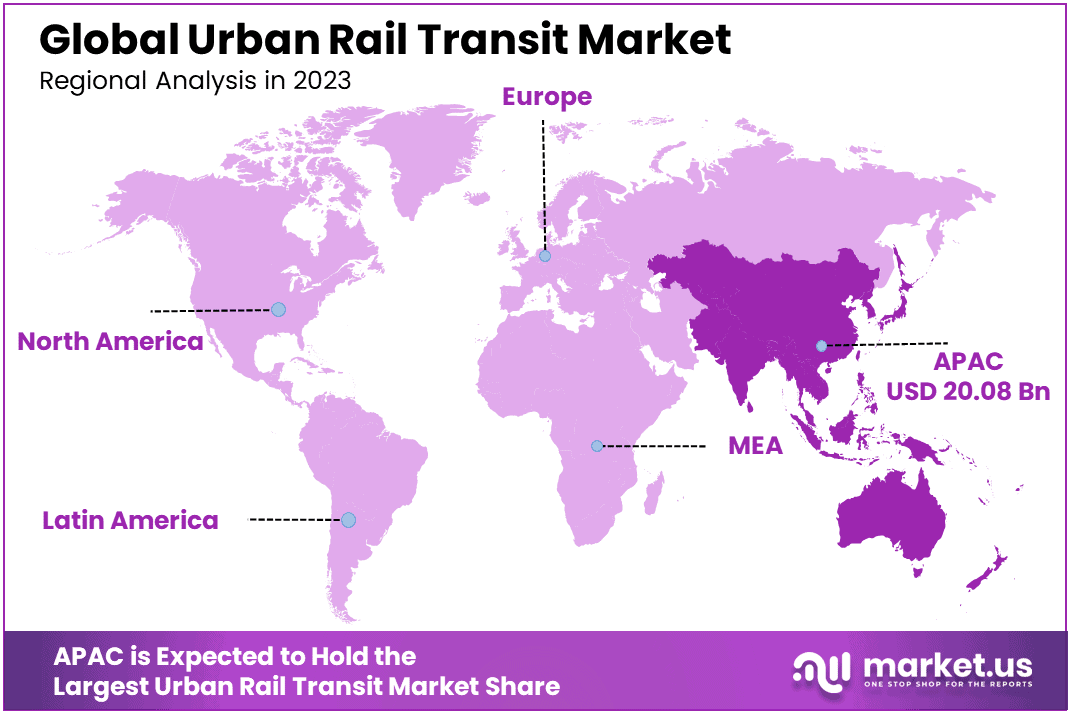

- Regional Dominance: Asia-Pacific dominates, holding 46.2% of the urban rail transit market.

- Segmentation Insights:

- By Rail Type: The metro/subway rail type commands a majority at 51.1%.

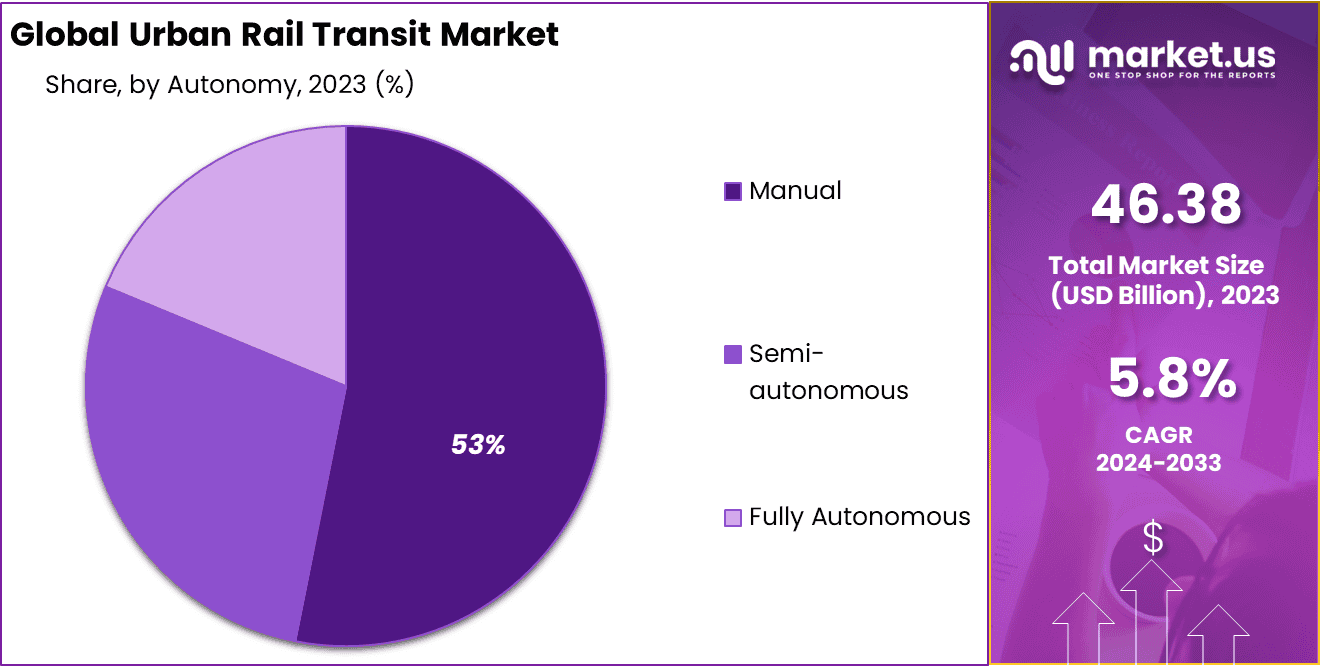

- By Autonomy: Manual operation dominates autonomy in rail transport at 54.3%.

- By Autonomy Level: GoA-0 (On-sight) autonomy level prevails, accounting for 43%.

- Growth Opportunities: In 2023, the global urban rail transit market is transforming through electric trains and AV technology adoption, alongside significant investments in metro rail infrastructure, to meet environmental and urbanization challenges.

Driving Factors

Increasing Urbanization and Population Growth

The expansion of the urban rail transit market is significantly influenced by the global rise in urbanization and population growth. As cities across the world continue to grow at an unprecedented rate, the demand for efficient, reliable, and sustainable public transportation systems has become more pressing. Urban rail transit, encompassing subways, light rail, and trams, offers a viable solution to address the challenges posed by increased urban density. These systems facilitate the movement of large numbers of people, alleviating traffic congestion, reducing travel times, and contributing to the overall reduction of urban air pollution.

According to the United Nations, the proportion of the world’s population living in urban areas is projected to increase, underscoring the need for robust urban rail systems to support the burgeoning urban population. Consequently, governments and private stakeholders are increasingly investing in the development and expansion of urban rail infrastructure, recognizing its critical role in fostering sustainable urban growth and improving the quality of life for city dwellers.

Technological Advancements and Smart Urban Mobility

Technological advancements have emerged as a pivotal driving factor in the growth of the urban rail transit market. The integration of cutting-edge technologies, including Internet of Things (IoT) devices, artificial intelligence (AI), and big data analytics, has revolutionized urban rail systems, enhancing their efficiency, safety, and passenger experience. Smart urban mobility solutions, such as real-time tracking, predictive maintenance, and contactless payments, are being implemented to streamline operations and improve service reliability.

Furthermore, the advent of autonomous train technology and advanced signaling systems has the potential to significantly increase the capacity and safety of urban rail systems, while reducing operational costs. These technological innovations not only cater to the evolving expectations of urban commuters for faster, safer, and more convenient travel options but also align with the global shift toward sustainable urban development. As cities strive to become smarter and more connected, the adoption of advanced technologies in urban rail transit systems is anticipated to accelerate, driving the market forward.

Restraining Factors

High Capital Investment: A Financial Barrier to Urban Rail Transit Expansion

The construction and maintenance of urban rail transit systems are characterized by high capital investment requirements, acting as a formidable barrier to market entry and expansion. This restraint is particularly pronounced in cities and countries where financial resources are scarce or prioritized for other infrastructure needs. The necessity for substantial upfront investment not only encompasses the physical construction of rail lines and stations but also extends to the procurement of rolling stock, installation of advanced signaling systems, and ongoing maintenance costs.

These financial demands can deter many municipalities from developing or expanding urban rail transit systems, thereby limiting the market’s growth potential. Additionally, the long-term nature of return on investment in urban rail infrastructure may dissuade private sector participation, further constricting market development. The high capital investment requirement, therefore, plays a critical role in shaping the trajectory of the urban rail transit market, influencing not only the pace and scale of new developments but also the technological innovation and sustainability measures that can be integrated into these systems.

Firmness of Route: Limiting Flexibility and Adaptability

The inherent firmness of routes in urban rail transit systems presents a significant challenge to their flexibility and adaptability, impacting market growth. This rigidity restricts the ability of urban rail systems to respond to changing urban landscapes and evolving transportation needs. As cities expand and demographic patterns shift, the fixed routes of rail systems may no longer align with the optimal paths for commuter flow, leading to inefficiencies and a potential decrease in ridership.

Moreover, the fixed nature of rail infrastructure means that any modifications or expansions require substantial planning, investment, and time, often making it impractical to swiftly adapt to immediate urban development needs. This limitation not only affects the capacity of urban rail systems to serve as a dynamic component of urban mobility but also impacts the attractiveness of investing in such infrastructure from both public and private perspectives. Consequently, the firmness of the route not only poses challenges to the operational flexibility of urban rail transit systems but also influences the strategic decisions related to their expansion and integration into broader transportation networks.

By Rail Type Analysis

The market share for metro or subway rail types is estimated at 51.1%, indicating a significant preference among urban transit systems.

In 2023, Metro / Subway held a dominant market position in the “By Rail Type” segment of the Urban Rail Transit Market, capturing more than a 51.1% share. This was followed by Suburban rails, which accounted for a significant portion of the market, Trams, and Monorails, in descending order of market share. The prioritization of Metro / Subway systems can be attributed to their capacity to facilitate rapid, high-volume transit across densely populated urban areas, effectively reducing traffic congestion and contributing to the decarbonization of urban transport.

Monorail systems, while less prevalent, have been recognized for their relatively lower construction costs and shorter development times, making them a viable option for cities looking to expand their urban rail infrastructure efficiently. Suburban rails have continued to play a critical role in the urban transit ecosystem, providing essential connectivity between outlying areas and central urban districts. This segment’s market presence underscores the ongoing need for comprehensive urban to suburban transit solutions, catering to the commuting patterns of the urban workforce.

Trams, often celebrated for their eco-friendly nature and ability to integrate into existing urban landscapes with minimal disruption, have seen varied adoption rates. Their contribution to the Urban Rail Transit Market underscores a growing preference for sustainable and versatile public transport options within city centers and suburban areas alike.

By Autonomy Analysis

Manual operation modes retain a majority of 53%, highlighting the ongoing reliance on human oversight in rail transportation.

In 2023, Manual operations held a dominant market position in the “By Autonomy” segment of the Urban Rail Transit Market, capturing more than a 53% share. This was followed by Semi-autonomous and Fully Autonomous systems, in descending order of market share. The enduring preference for manual operations within the urban rail transit sector can be primarily attributed to established safety protocols, existing infrastructure compatibility, and regulatory environments that have been slow to adapt to fully autonomous technologies.

Semi-autonomous systems have gained traction as a middle ground, offering enhancements in operational efficiency and safety while still requiring some level of human oversight. This approach has allowed transit authorities to incrementally introduce autonomy into their networks, leveraging advanced technologies to improve service reliability and capacity without fully relinquishing control.

Fully Autonomous rail systems, though holding the smallest market share, represent a forward-looking investment into the future of urban mobility. These systems promise significant advancements in safety, efficiency, and operational costs by eliminating human errors and optimizing traffic management. However, their adoption has been gradual, influenced by technological, regulatory, and societal factors that necessitate comprehensive validation and acceptance processes.

By Autonomy Level Analysis

The Grade of Automation level GoA-0 (On-sight) commands a 43% share, underscoring the substantial portion of rail systems operating without automation.

In 2023, GoA-0 (On-sight) held a dominant market position in the “By Autonomy Level” segment of the Urban Rail Transit Market, capturing more than a 43% share. This segment was closely followed by GoA-1 (Manual), GoA-2 (Semi-automatic Train Operation [STO]), GoA-3 (Driverless Train Operation [DTO]), and GoA-4 (Unattended Train Operation [UTO]), respectively. The prominence of GoA-0 in the market can be attributed to its widespread application in urban rail systems where direct visual operation is required, especially in regions with stringent safety standards and where complex urban environments necessitate human oversight.

GoA-1 (Manual) operations, while offering more control than GoA-0, still rely heavily on human drivers for operational decisions, reflecting a cautious approach to autonomy in urban rail systems. This level of operation emphasizes the critical role of human intervention in ensuring safety and reliability, even as technology advances.

The adoption of GoA-2 (STO) marks the beginning of automation in the sector, with trains operated semi-automatically but with the presence of drivers or operators on board to oversee operations. This transition reflects a growing confidence in automation technologies, balancing efficiency gains with safety considerations.

Moving up the autonomy scale, GoA-3 (DTO) and GoA-4 (UTO) represent more advanced implementations of automated technology, eliminating the need for onboard staff. These levels, particularly GoA-4, underline a transformative shift towards fully automated, high-efficiency urban rail systems, offering the potential for significant operational improvements and cost savings.

Key Market Segments

By Rail Type

- Metro / Subway

- Monorail

- Suburban

- Tram

By Autonomy

- Manual

- Semi-autonomous

- Fully Autonomous

By Autonomy Level

- GoA-0 (On-sight)

- GoA-1 (Manual)

- GoA-2 (Semi-automatic Train Operation [STO])

- GoA-3 (Driverless Train Operation [DTO])

- GoA-4 (Unattended Train Operation [UTO])

Growth Opportunities

Electric Trains and AV Technology

The global urban rail transit market is witnessing a significant transformation, primarily driven by the increasing adoption of electric trains and Automated Vehicle (AV) technology. This shift is primarily attributed to the growing environmental concerns and the urgent need for sustainable transportation solutions. The incorporation of electric trains within urban rail systems marks a pivotal step towards reducing greenhouse gas emissions, leveraging the benefits of cleaner energy sources.

Furthermore, the integration of AV technology into the urban rail infrastructure is poised to enhance operational efficiency, improve safety standards, and potentially reduce operational costs over the long term. The adoption of these technologies not only supports the environmental sustainability goals but also aligns with the evolving expectations of urban populations for smarter, more reliable transportation options.

Investment in Metro Rail Infrastructure

The demand for efficient, eco-friendly, and cost-effective transportation solutions is catalyzing substantial investments in metro rail infrastructure, especially in emerging economies. These investments are seen as vital for addressing the challenges posed by urbanization, such as traffic congestion and air pollution, while also promoting economic development through improved connectivity. The expansion of metro rail systems is envisaged to facilitate seamless urban mobility, thereby enhancing the quality of life for city dwellers.

Moreover, the focus on developing metro rail infrastructure underscores the commitment of governments and private entities to foster sustainable urban growth. In 2023, the strategic allocation of funds toward the modernization of existing rail networks and the construction of new lines is expected to unlock significant growth opportunities within the global urban rail transit market.

Latest Trends

Government Investment

The year 2023 is marked by a substantial increase in government investment aimed at decongesting urban traffic, a pivotal trend fueling the expansion of the global urban rail transit market. This surge in public funding is a direct response to the escalating challenges of urbanization, including traffic congestion and environmental degradation. Governments worldwide are recognizing the critical role of efficient and sustainable urban rail systems in improving city living conditions.

Investments are being channeled into the expansion and enhancement of rail networks, signaling a strong commitment to transforming urban mobility landscapes. This financial backing is crucial for the development of more extensive and efficient urban rail systems, capable of meeting the growing demand for sustainable transportation solutions. The initiative not only aims to alleviate traffic congestion but also to contribute to the reduction of carbon emissions, aligning with broader environmental sustainability goals.

Autonomous Rail Technology

The introduction of autonomous rail technology stands out as a groundbreaking trend, presenting significant opportunities for vendors in the urban rail transit market. This innovation heralds a new era in urban transportation, characterized by enhanced safety, efficiency, and reliability. Autonomous rail systems, equipped with advanced smart sensors and AI algorithms, promise to revolutionize urban mobility by offering high-capacity services that can adapt in real-time to varying passenger demands.

The shift towards automation is expected to streamline operations, minimize human error, and optimize energy consumption, thereby elevating the urban transit experience and operational sustainability. As vendors and stakeholders invest in and pilot autonomous rail projects, the potential for scalable, intelligent urban rail solutions becomes increasingly tangible, positioning the global urban rail transit market on the cusp of a major technological leap forward.

Regional Analysis

The Asia-Pacific region dominates the urban rail transit market, holding a substantial 46.2% share.

In North America, the urban rail transit sector is experiencing a resurgence, with significant investments aimed at expanding existing networks and introducing new lines to cater to the growing urban populations. The United States and Canada are leading this growth, focusing on sustainability and reducing urban congestion.

Europe’s urban rail transit market is marked by a strong emphasis on sustainability and efficient public transportation systems. With an extensive existing infrastructure, European countries are now focusing on the modernization and interoperability of cross-border rail services. The adoption of advanced technologies for improved passenger experience and operational efficiency is a key trend in this region.

Asia-Pacific, dominating the global urban rail transit market with a share of 46.2%, is witnessing rapid expansion due to burgeoning urbanization and the need for sustainable transport solutions. Countries like China, India, and Japan are at the forefront, investing heavily in metro and light rail projects to support economic growth and enhance urban mobility.

The Middle East & Africa region is increasingly recognizing urban rail transit as a critical component of urban development. With economic diversification efforts and urban population growth, investments in rail infrastructure are on the rise, particularly in the Gulf Cooperation Council (GCC) countries, where mega-projects are under development.

Latin America’s urban rail transit market is evolving, with countries like Brazil, Mexico, and Argentina investing in expanding and upgrading their urban rail systems. The focus is on improving connectivity and reducing travel time, amidst challenges such as financial constraints and political uncertainty.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Urban Rail Transit Market in 2023, numerous key players vie for prominence, each contributing to the industry’s growth and innovation. Among these, several companies stand out as pivotal influencers, shaping the trajectory of urban rail transit systems worldwide.

One such key player is Siemens, a renowned multinational conglomerate synonymous with engineering excellence and technological innovation. With a rich history spanning over a century, Siemens has entrenched itself as a stalwart in the field of transportation infrastructure. Leveraging its extensive expertise and cutting-edge solutions, Siemens continues to revolutionize urban rail transit with state-of-the-art technologies and sustainable mobility solutions.

Siemens’ comprehensive portfolio encompasses a diverse range of offerings, including rolling stock, signaling systems, electrification solutions, and digitalization platforms. Through strategic partnerships and collaborative ventures, Siemens remains at the forefront of driving urban rail transit advancements, catering to the evolving needs of modern cities.

Furthermore, Siemens’ unwavering commitment to sustainability underscores its pivotal role in shaping the future of urban mobility. Embracing eco-friendly practices and energy-efficient solutions, Siemens actively contributes to reducing carbon footprints and enhancing the overall sustainability quotient of urban rail networks.

Market Key Players

- ABB

- Alstom S.A.

- Beijing Traffic Control Technology Co., Ltd.

- Bharat Forge limited

- Bombardier

- BYD Auto Co., Ltd.

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- FTD Fahrzeugtechnik Bahnen Dessau GmbH

- General Electric

- GHH-BONATRANS

- Hitachi Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kinki Sharyo Co., Ltd.

- Knorr-Bremse AG

- Larsen & Toubro Limited

- Mitsubishi Electric

- Samvardhana Motherson

- Niigata Transys Co., Ltd.

- Robert Bosch GmbH

- Siemens

- Skoda Transportation AS

- Thales Group

- The Greenbrier Companies Inc.

- Wabtec Corporation

Recent Development

- In March 2024, The U.S. Department of Transportation’s SMART grant program awarded $54 million to 34 projects nationwide, including rail-related initiatives by LA Metro, Bay Area Rapid Transit, and Southern California Regional Rail Authority (Metrolink), enhancing safety and efficiency.

- In March 2024, CRRC Changchun Railway Vehicles Co., Ltd. in China successfully tests its first domestically developed hydrogen-powered urban train, achieving speeds of 160 kph and a range of over 1,000 km.

- In March 2024, The Guangzhou Municipal Transportation Bureau releases draft regulations for urban rail transit passenger conduct, detailing prohibited actions and luggage restrictions. Violations will be handled according to law.

Report Scope

Report Features Description Market Value (2023) USD 46.38 Billion Forecast Revenue (2033) USD 63.5 Billion CAGR (2024-2033) 3.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rail Type(Metro / Subway, Monorail, Suburban, Tram), By Autonomy(Manual, Semi-autonomous, Fully Autonomous), By Autonomy Level(GoA-0 (On-sight), GoA-1 (Manual), GoA-2 (Semi-automatic Train Operation [STO]), GoA-3 (Driverless Train Operation [DTO]), GoA-4 (Unattended Train Operation [UTO])) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB, Alstom S.A., Beijing Traffic Control Technology Co., Ltd., Bharat Forge Limited, Bombardier, BYD Auto Co., Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, FTD Fahrzeugtechnik Bahnen Dessau GmbH, General Electric, GHH-BONATRANS, Hitachi Ltd., Kawasaki Heavy Industries, Ltd., Kinki Sharyo Co., Ltd., Knorr-Bremse AG, Larsen & Toubro Limited, Mitsubishi Electric, Samvardhana Motherson, Niigata Transys Co., Ltd., Robert Bosch GmbH, Siemens, Skoda Transportation AS, Thales Group, The Greenbrier Companies Inc., Wabtec Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Urban Rail Transit Market Size in the Year 2023?The Global Urban Rail Transit Market size was USD 63.5 Billion by 2023, growing at a CAGR of 3.20%.

What is the Urban Rail Transit Market Estimated CAGR During the Forecast Period?The Global Urban Rail Transit Market is expected to grow at a CAGR of 3.20% during the forecast period from 2024 to 2033.

What is the Estimated Urban Rail Transit Market Size During the Forecast Period?The Global Urban Rail Transit Market size is expected to be worth around USD 46.38 Billion during the forecast period from 2024 to 2033.

Urban Rail Transit MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Urban Rail Transit MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Alstom S.A.

- Beijing Traffic Control Technology Co., Ltd.

- Bharat Forge limited

- Bombardier

- BYD Auto Co., Ltd.

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- FTD Fahrzeugtechnik Bahnen Dessau GmbH

- General Electric

- GHH-BONATRANS

- Hitachi Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kinki Sharyo Co., Ltd.

- Knorr-Bremse AG

- Larsen & Toubro Limited

- Mitsubishi Electric

- Samvardhana Motherson

- Niigata Transys Co., Ltd.

- Robert Bosch GmbH

- Siemens

- Skoda Transportation AS

- Thales Group

- The Greenbrier Companies Inc.

- Wabtec Corporation