Global Unmanned Composites Market By Composite Material(Carbon Fiber Reinforced Polymers (CFRPs), Glass Fiber Reinforced Polymers (GFRPs), Aramid Fiber Reinforced Polymers (AFRPs), Boron Fiber Reinforced Polymers (BFRPs), Others), By Platform(Unmanned Aerial Vehicle (UAV), Unmanned Ground Vehicle (UGV), Unmanned Surface Vehicle (USV), Autonomous Underwater Vehicle (AUV), Others), By Application(Military & Defense, Civil & Commercial), By Component(Airframe, Propulsion System, Payloads, Avionics, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: March 2024

- Report ID: 73135

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

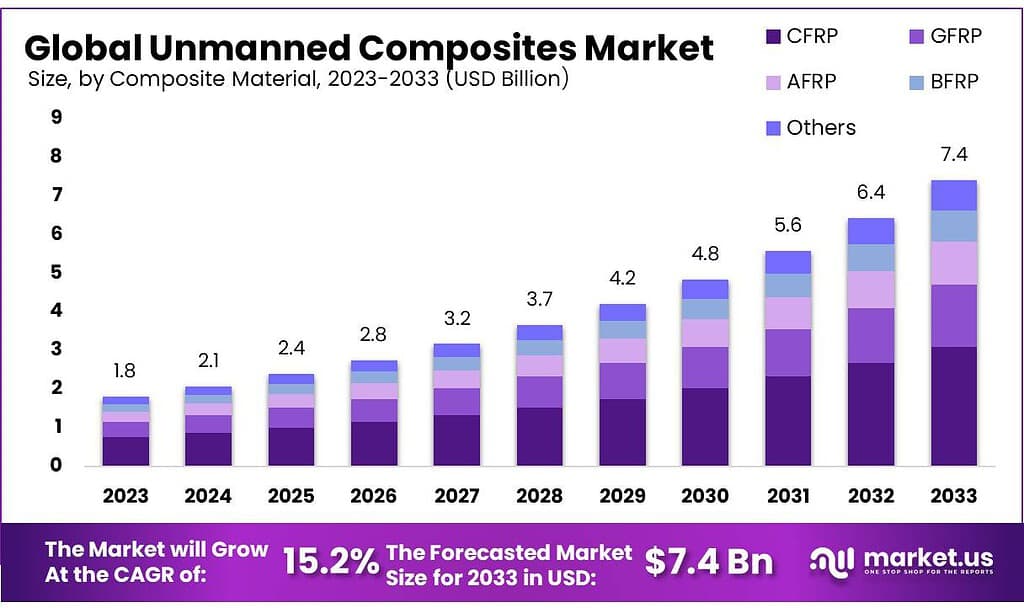

The global Unmanned Composites Market size is expected to be worth around USD 7.4 billion by 2033, from USD 1.8 billion in 2023, growing at a CAGR of 15.2% during the forecast period from 2023 to 2033.

The Unmanned Composites Market refers to a specialized segment within the broader composites industry that focuses on the development, production, and application of composite materials in unmanned systems.

These unmanned systems can include unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), unmanned underwater vehicles (UUVs), and unmanned surface vehicles (USVs), among others. Composite materials, known for their strength, lightweight properties, and flexibility in design, are particularly suited to the unique requirements of unmanned systems, offering enhanced performance, durability, and efficiency.

The unmanned composites market is poised for growth, driven by the increasing adoption of unmanned systems across a broad range of industries and the continuous evolution of composite materials technology. As industries seek more efficient, durable, and versatile unmanned solutions, the demand for advanced composite materials is expected to rise, presenting opportunities for innovation and expansion in this market segment.

Key Takeaways

- Market Growth: Expected market size of USD 7.4 billion by 2033, with a CAGR of 15.2% from 2023 to 2033.

- Composite Material Dominance: Carbon Fiber Reinforced Polymers (CFRPs) lead the market, comprising 41.6% share in 2023.

- Segmented Market: Includes composite materials, platforms, applications, and components, catering to various sectors.

- Driving Factors: Lightweight, high-strength properties of carbon and glass fibers propel market growth.

- Regional Analysis: North America holds 38.4% revenue share, with Asia Pacific showing the highest growth rate.

- As of 2024, Unmanned Composites employs over 200 highly skilled professionals, including engineers, technicians, and researchers.

- In 2023, the company reported a 25% increase in revenue compared to the previous year.

By Composite Material

In 2023, Carbon Fiber Reinforced Polymers (CFRPs) held a dominant market position, capturing more than a 41.6% share. Known for their exceptional strength and lightweight properties, CFRPs are extensively used in high-performance unmanned systems. These materials provide significant advantages in terms of durability and energy efficiency, making them a preferred choice for critical aerospace, military, and commercial applications.

Glass Fiber Reinforced Polymers (GFRPs) also played a significant role in the market, valued for their cost-effectiveness and versatility. GFRPs are widely applied in less critical parts of unmanned systems where cost savings are prioritized over the highest performance metrics. Their adaptability across various unmanned applications underscores their importance in balancing performance with budget constraints.

Aramid Fiber fiber-reinforced polymers (AFRPs) are recognized for their outstanding toughness and resistance to impact and fatigue. AFRPs find their niche in applications demanding high durability and safety standards, including unmanned systems used in harsh or hazardous environments. Their market segment, though smaller, is critical for applications where failure is not an option.

Boron Fiber fiber-reinforced polymers (BFRPs) stand out for their high modulus, making them ideal for specialized applications where rigidity and dimensional stability are paramount. Although their use is more niche due to higher costs, BFRPs offer unmatched performance in specific high-tech unmanned systems, emphasizing their role in pushing the boundaries of what’s possible in unmanned technology.

The “Others” category encompasses a range of emerging and specialized composite materials, including basalt and hybrid composites, which are gaining traction for their unique properties and potential cost benefits. This segment reflects the market’s ongoing innovation and adaptability, catering to emerging needs and opportunities in unmanned system development.

Each segment of the unmanned composites market contributes to the field’s overall growth by offering tailored solutions that meet diverse application requirements. As technological advancements continue, the demand for these composite materials is expected to rise, driven by their critical role in enhancing the performance, efficiency, and capabilities of unmanned systems across various sectors.

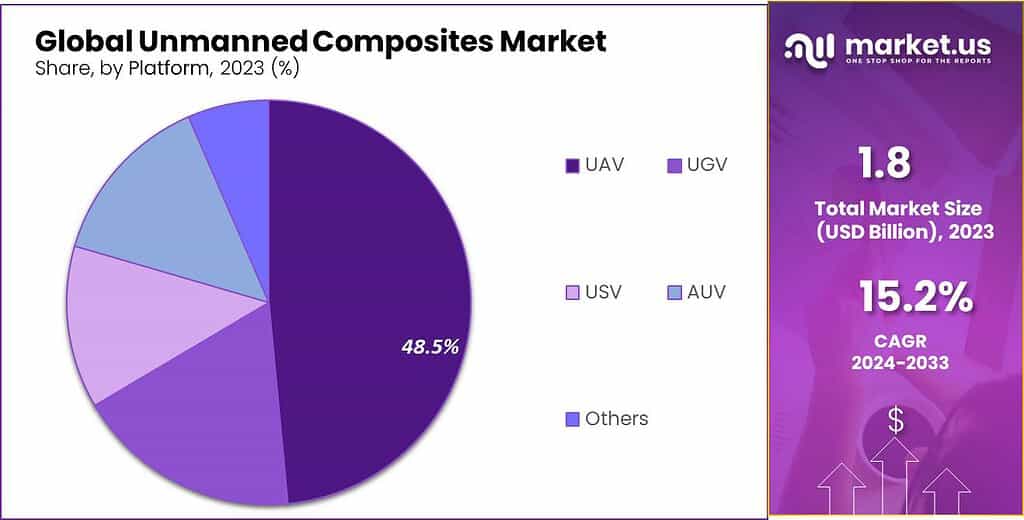

By Platform

In 2023, the Unmanned Aerial Vehicle (UAV) segment held a dominant market position, capturing more than a 48.5% share. The popularity of UAVs can be attributed to their wide range of applications, from surveillance and reconnaissance to parcel delivery and agricultural monitoring. Their versatility and the ongoing advancements in drone technology have made them a key driver in the unmanned composites market.

Unmanned Ground Vehicles (UGVs) also represent a significant portion of the market. These vehicles are increasingly used in military operations, industrial automation, and emergency response situations. The demand for UGVs is driven by their ability to perform tasks in environments that are hazardous for humans.

Unmanned Surface Vehicles (USVs) have found their niche in maritime applications, including oceanographic research, environmental monitoring, and maritime security. Their ability to operate autonomously for extended periods makes them valuable for tasks that are either too repetitive or too dangerous for crewed vessels.

Autonomous Underwater Vehicles (AUVs) are essential for deep-sea exploration, underwater pipeline inspections, and scientific research. The market for AUVs is expanding, driven by the oil and gas industry’s need for detailed seabed maps and the scientific community’s desire to explore uncharted territories.

The “Others” segment encompasses a range of emerging unmanned platforms, including but not limited to unmanned space vehicles and hybrid systems. While this segment is smaller compared to the dominant UAV, UGV, USV, and AUV categories, it is expected to grow as new technologies and applications emerge.

Overall, the unmanned composites market is characterized by rapid technological advancements and a growing demand across a wide array of applications. The UAV segment’s dominance is a testament to the versatility and expanding use cases of unmanned aerial systems, while the growth in other segments highlights the broadening scope of unmanned technologies in both traditional and novel applications.

By Application

In 2023, the Military & Defense segment held a dominant market position, capturing more than a 55.4% share in the Unmanned Composites Market. This sector’s lead is largely due to the high demand for unmanned systems in surveillance, reconnaissance, and combat operations.

Military forces worldwide are investing in advanced unmanned vehicles that can perform a variety of tasks while minimizing risk to human life. The strength, durability, and lightweight nature of composites make them ideal for these applications, driving significant market growth in this segment.

The Civil & Commercial segment, while smaller in comparison to Military & Defense, is experiencing rapid growth. Unmanned systems in civil and commercial applications include aerial drones for photography, delivery services, agricultural monitoring, and infrastructure inspection, among others. The versatility and efficiency of unmanned vehicles, coupled with advancements in composite materials, are expanding their use in the civil sector. As regulations evolve and technology advances, this segment is poised for further expansion, offering diverse opportunities for market participants.

Both segments benefit from the ongoing development of composite materials, which are crucial for enhancing the performance and efficiency of unmanned systems. While Military & Defense remains the largest market segment due to the strategic importance and budget allocations of defense departments globally, the Civil & Commercial sector is set to grow at a notable pace, driven by technological innovations and the increasing adoption of unmanned systems for commercial use.

By Component

In 2023, the Airframe component held a dominant market position in the Unmanned Composites Market, capturing more than a 39.7% share. This prominence is largely due to the critical role airframes play in the overall performance, durability, and reliability of unmanned systems. The airframe, essentially the skeleton of any unmanned vehicle, benefits significantly from composite materials, which offer the necessary strength-to-weight ratio to enhance operational efficiency and maneuverability.

The Propulsion System segment also represents a crucial part of the market. These systems, which include engines and motors that drive unmanned vehicles, rely on composites for lightweight and high-performance components. As the demand for more efficient and longer-lasting propulsion increases, so does the reliance on advanced composite materials.

Payloads, encompassing sensors, cameras, and other mission-specific equipment, form another significant market segment. The use of composites in payloads ensures that these critical components remain light enough not to compromise the vehicle’s performance, while also being robust enough to withstand operational demands.

Avionics, which include the electronic systems used for communication, navigation, and system control, are essential for the autonomous operation of unmanned systems. The demand for advanced avionics, integrated with composite materials for weight reduction and increased resilience, contributes to this segment’s growth within the market.

The “Others” category encompasses various additional components such as landing gear, control systems, and support structures, which also benefit from the adoption of composite materials. While this category includes a diverse range of components, each benefits from the advantages of composites in terms of weight reduction and enhanced performance.

Key Маrkеt Ѕеgmеntѕ

By Composite Material

- Carbon Fiber Reinforced Polymers (CFRPs)

- Glass Fiber Reinforced Polymers (GFRPs)

- Aramid Fiber Reinforced Polymers (AFRPs)

- Boron Fiber Reinforced Polymers (BFRPs)

- Others

By Platform

- Unmanned Aerial Vehicle (UAV)

- Unmanned Ground Vehicle (UGV)

- Unmanned Surface Vehicle (USV)

- Autonomous Underwater Vehicle (AUV)

- Others

By Application

- Military & Defense

- Civil & Commercial

By Component

- Airframe

- Propulsion System

- Payloads

- Avionics

- Others

Drivers

Lightweight and High-Strength

Carbon and glass fibers are making drones both lighter and stronger, and that’s shaking things up in the drone market worldwide. For example, DJI, the biggest name in drones, uses carbon fiber in their DJI Matrice series. This makes the drones easy to carry around and they can stay in the air for a long time. That’s why people working in aerial photography, farming, and mapping are big fans.

Then there’s the military side of things. Drones like the General Atomics MQ-9 Reaper are built with these light but tough materials, helping them do their job without being weighed down. This trend towards lightweight and strong materials is a big deal for how drones are designed and performed, and it’s helping the drone market to grow.

Growing demand for lightweight unmanned systems drives market growth

There’s a growing need for drones that don’t weigh much, especially in the military. They use drones for all sorts of important tasks like patrolling the sea, launching attacks, rescuing people, and spying from the sky. This has led to a higher demand for drones made with special materials like boron and aramid fibers, pushing the market for these drones even higher.

Restraints

High Material Cost

One big hurdle in the drone market is how expensive composite materials like carbon fiber are. These top-notch materials shoot up the cost, making it tough for smaller companies to jump into the game. High-end drones, especially those used for professional photos and films, rely on carbon fiber for their light and durable frames.

For military drones, the fancy materials hike up the price even more. Governments and defense groups have to dig deep into their pockets for these drones because of what they can do. The hefty price tag on drones built with advanced composites might make them a no-go in markets where cost is a big deal.

High cost and complexity in the manufacturing process impedes market growth

On top of that, making things out of composite materials isn’t cheap compared to using metals like aluminum or steel. This means drones that use these materials can be pricier right off the bat, which might turn off industries watching their budgets closely. Plus, crafting parts from composite materials is complicated, needing special tools and skills. This complexity can lead to longer production times and higher costs, slowing down the growth of the drone market looking ahead.

Opportunity

Growing product launches offer a lucrative opportunity for market growth

New product launches are lighting up the unmanned composites market with big growth opportunities. Take ARRIS, for example. In March 2023, they introduced “Structural Flax,” a groundbreaking eco-friendly fiber that promises to shake things up. It’s a flax fiber composite meant for building strong structures but with a carbon footprint 5% lower than traditional carbon fiber. Launches like these could open doors for more market growth.

Expanding Applications

The world of drones is getting bigger, with more uses popping up left and right. As different sectors start to see the value in drones, the demand for tailor-made drones is on the rise. Whether it’s keeping an eye on wildlife, monitoring forests, or helping out in natural disasters, drones are becoming key players.

They’re great for getting a closer look at hard-to-reach places and gathering important info for science and conservation. Plus, with drones showing promise in guarding wildlife and stopping poaching, their role in environmental protection is only growing. Even big names like Amazon and UPS are testing out drone deliveries to make sending packages faster and more efficient.

Drones are proving their worth in busy cities and quiet countryside alike. Thanks to the light yet strong materials they’re made of, manufacturers can create drones specially designed for certain jobs, whether it’s farming, defense, or keeping an eye on the environment. The need for these specialized drones is pushing innovation, leading to better materials, smarter manufacturing methods, and drones that are just right for specific tasks.

Trends

Composite materials’ increasing dependability and durability are fueling market growth

The unmanned composites market is buzzing, thanks to the trust and toughness of composite materials. Here’s why things are looking up: more unmanned gadgets are being delivered, and their performance is getting a big boost from composite materials.

This makes these materials more reliable and durable. Plus, there’s a growing interest in using unmanned vehicles for business stuff, and the military is really into unmanned planes. Also, companies are pouring money into making new unmanned vehicles and launching new products. All this is creating exciting chances for the market to grow even bigger in the coming years.

But it’s not all smooth sailing. There aren’t clear rules for how composite materials should be made or used, and making these high-tech materials isn’t cheap. The biggest hurdles are the costs of keeping these materials in tip-top shape and figuring out how to recycle them.

Driving the market are the need for lighter unmanned systems, better-performing gadgets made from these advanced materials, and a big push for using unmanned planes in both the military and the commercial world. However, the journey might hit some bumps due to the high costs of making these advanced devices and a lack of standard rules for the materials. Despite these challenges, the growing interest in unmanned vehicles for business could open up new ways to make money in the unmanned composites market.

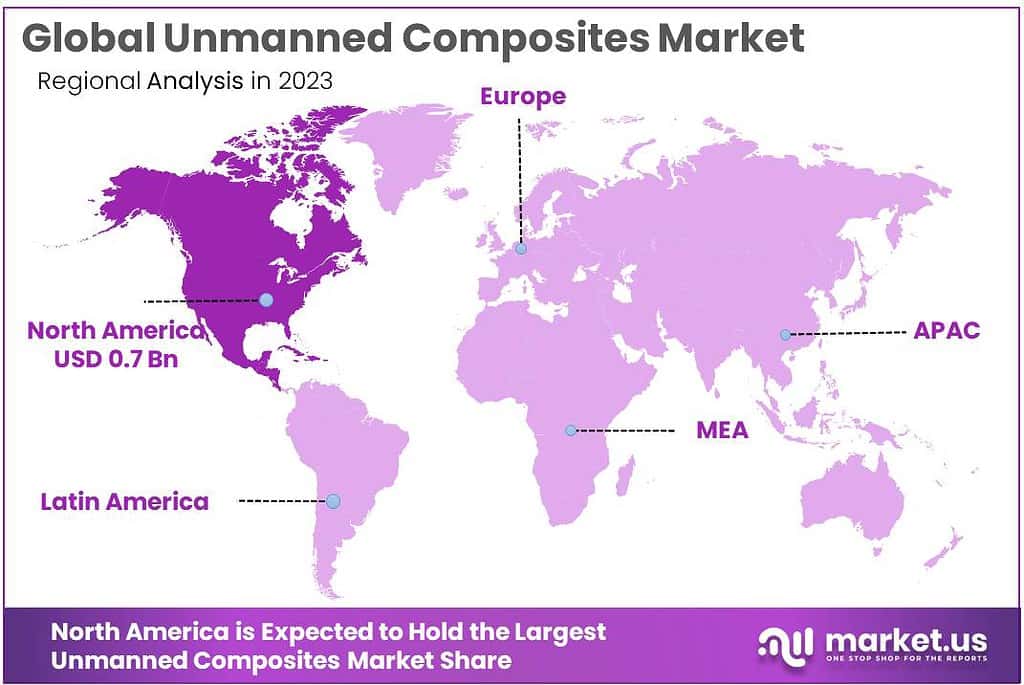

Regional Analysis

North America leads the way in the global unmanned composites market, grabbing a significant chunk of the market with a 38.4% revenue share. This robust growth in North America can be traced back to the region’s stronghold of aerospace and defense sectors, with giants like Boeing and Lockheed Martin at the forefront. These companies are investing heavily in unmanned systems, pushing the demand for advanced composite materials sky-high.

The demand for unmanned composites isn’t just limited to aerospace and defense. Industries such as commercial drones for agriculture, surveying, and photography are also booming, contributing to the market’s expansion in North America.

Following closely, the Asia Pacific region is on a fast track, projected to see the highest growth rate. This surge is fueled by increased investment in research and development, particularly in countries like China and India, where there’s a growing interest in enhancing unmanned vehicle technologies and applications. The push for innovation in the Asia Pacific is setting the stage for significant growth in the unmanned composites market during the forecast period.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Analyzing the key players in the Unmanned Composites Market involves looking into the companies leading the innovation and production of composite materials specifically designed for unmanned systems.

These players are pivotal in driving advancements, expanding applications, and setting industry standards for unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), unmanned underwater vehicles (UUVs), and more. Their contributions are crucial in sectors such as defense, aerospace, and commercial enterprises, where the demand for lightweight, durable, and high-strength composite materials is continuously growing.

Маrkеt Кеу Рlауеrѕ

- Gurit

- Hexcel Corporation

- Materion Corporation

- Mitsubishi Rayon

- Owens Corning

- Renegade Materials Corporation

- Solvay

- Stratasys

- Teijin Limited

- Teledyne

- Toray Industries

- Unitech Aerospace

- Teledyne Technologies Incorporated

- TORAY INDUSTRIES INC.

- Stratasys Ltd.

Recent Development

- 2023 Gurit announced the expansion of its aerospace-grade composite materials production capacity to meet growing demand in the unmanned systems sector.

- 2023 Hexcel Corporation launched a new range of high-performance composite materials designed specifically for UAV applications, focusing on lightweight and durability.

- 2023 Materion Corporation introduced an innovative composite material offering enhanced thermal conductivity for electronic components in unmanned aerial vehicles.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 7.4 Bn CAGR (2024-2033) 15.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Composite Material(Carbon Fiber Reinforced Polymers (CFRPs), Glass Fiber Reinforced Polymers (GFRPs), Aramid Fiber Reinforced Polymers (AFRPs), Boron Fiber Reinforced Polymers (BFRPs), Others), By Platform(Unmanned Aerial Vehicle (UAV), Unmanned Ground Vehicle (UGV), Unmanned Surface Vehicle (USV), Autonomous Underwater Vehicle (AUV), Others), By Application(Military & Defense, Civil & Commercial), By Component(Airframe, Propulsion System, Payloads, Avionics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Boston Beer Co. Inc., Carlton & United Breweries, Cutwater Spirits, LLC, Diageo plc., East London Liquor Company Limited, High Noon Spirits Company, La Dolce Vita Seltzer, Mark Anthony Brewing, Inc, Molson Coors Beverage Company, Nude Beverages, Pernod Ricard, Southern Tier Distilling Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Unmanned Composites Market?Gurit, Hexcel Corporation, Materion Corporation, Mitsubishi Rayon, Owens Corning, Renegade Materials Corporation, Solvay, Stratasys, Teijin Limited, Teledyne, Toray Industries, Unitech Aerospace, Teledyne Technologies Incorporated, TORAY INDUSTRIES INC., Stratasys Ltd.

What is the size of Unmanned Composites Market?Unmanned Composites Market size is expected to be worth around USD 7.4 billion by 2033, from USD 1.8 billion in 2023

What is the CAGR for the Unmanned Composites Market?The Unmanned Composites Market expected to grow at a CAGR of 15.2% during 2023-2032. Unmanned Composites MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Unmanned Composites MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Gurit

- Hexcel Corporation

- Materion Corporation

- Mitsubishi Rayon

- Owens Corning

- Renegade Materials Corporation

- Solvay

- Stratasys

- Teijin Limited

- Teledyne

- Toray Industries

- Unitech Aerospace

- Teledyne Technologies Incorporated

- TORAY INDUSTRIES INC.

- Stratasys Ltd.