Global Unified AI Platforms Market Size, Share, Growth Analysis By Component (Platform/Software, Services [Professional Services, Managed Services]), By Deployment Mode (Cloud-based, On-Premises), By Technology (Computer Vision, Natural Language Processing (NLP), Speech Recognition & Generation, Generative AI & Foundation Models, Predictive Analytics & Forecasting, Others), By End-User (IT & Technology Companies, BFSI, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167385

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

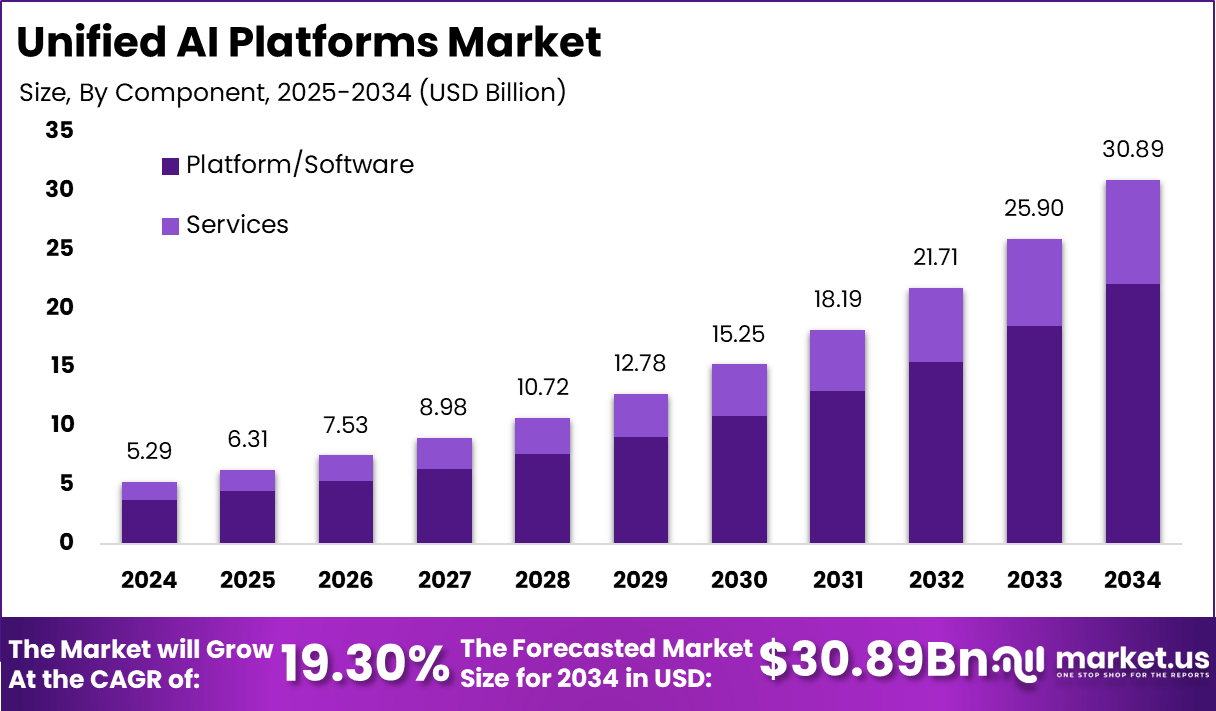

The Unified AI Platforms Market, valued at USD 5.29 billion in 2024, is expected to expand rapidly as enterprises accelerate the integration of AI into core operations. A projected CAGR of 19.30% reflects the rising demand for centralized platforms that unify data pipelines, model development, deployment workflows, and governance under a single ecosystem.

Organizations increasingly prioritize scalable AI stacks capable of supporting automation, predictive analytics, and real-time decision intelligence across diverse business functions. By 2034, the market is anticipated to reach USD 30.89 billion, driven by the adoption of multimodal AI, growth in enterprise-grade foundation models, and expanding regulatory frameworks that require standardized AI governance infrastructure.

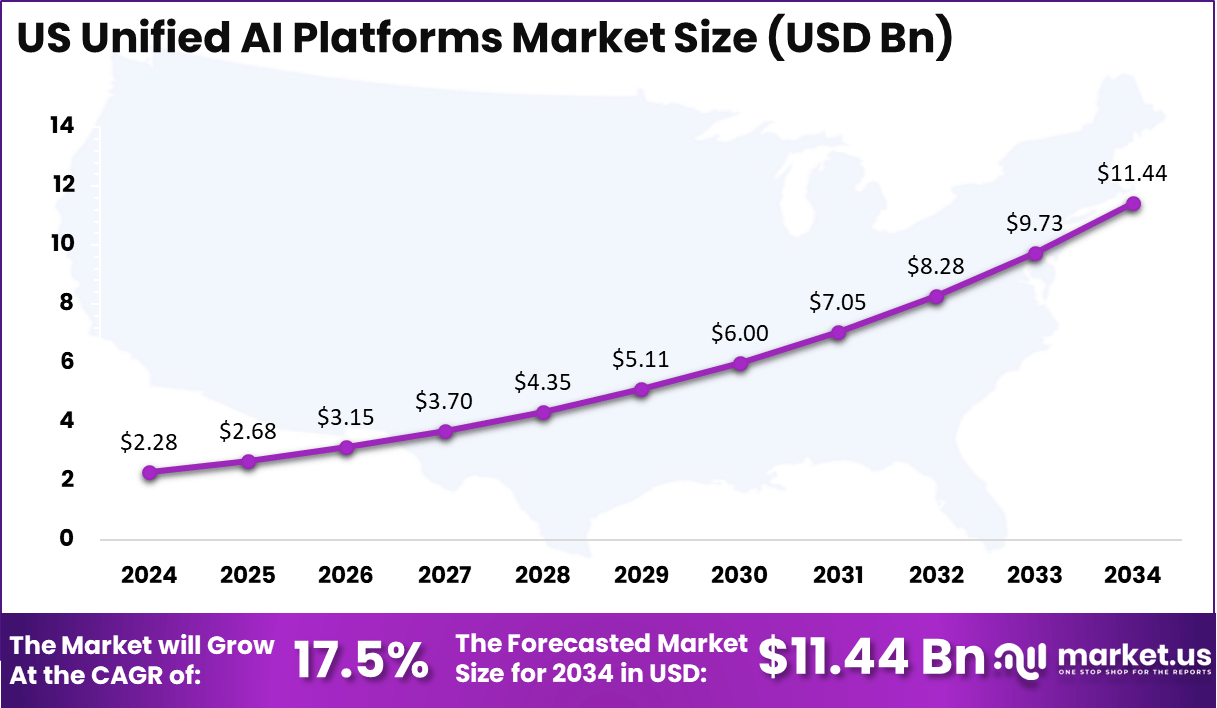

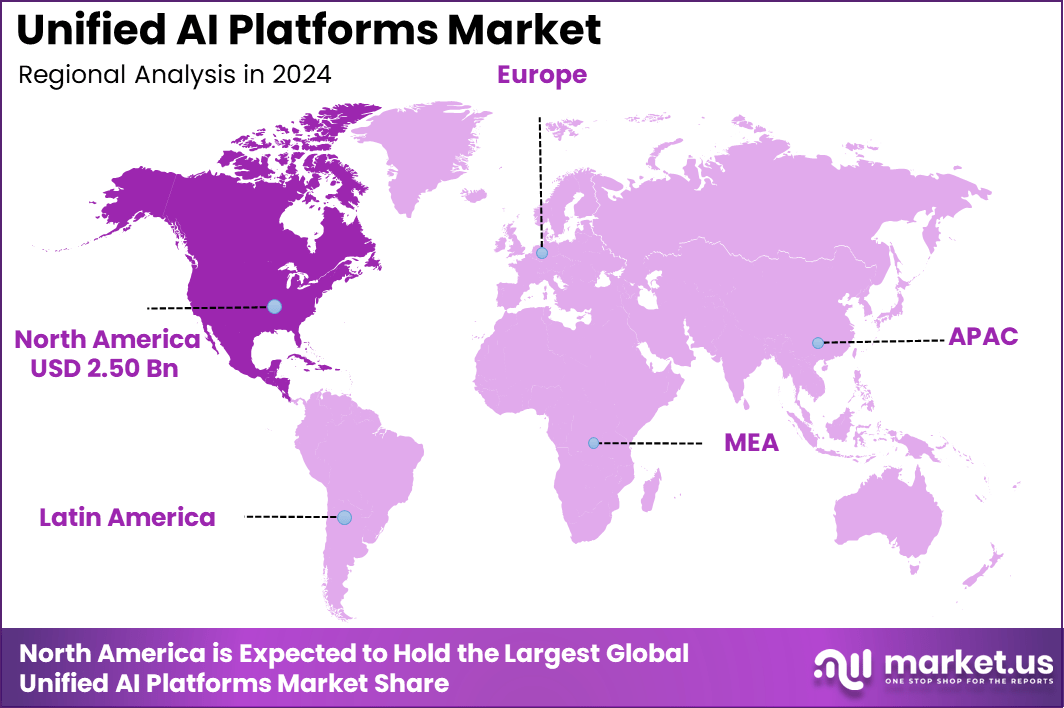

North America accounts for 47.3% of the global market, representing USD 2.50 billion in 2024, supported by advanced cloud infrastructure, high digitalization rates, and strong enterprise investments in AI modernization. The US alone contributed USD 2.28 billion in 2024 and is projected to reach USD 11.44 billion by 2034, expanding at a CAGR of 17.5%. This growth is expected to be shaped by the rapid deployment of AI copilots, enterprise automation platforms, and integrated MLOps environments across technology, banking, healthcare, and manufacturing sectors.

Unified AI platforms are becoming essential as enterprises move from isolated AI tools to fully integrated ecosystems that streamline the entire AI lifecycle. These platforms bring data ingestion, model development, deployment, monitoring, and governance into one unified environment, reducing complexity and improving scalability for organizations adopting AI at speed.

As businesses increasingly rely on automation, predictive analytics, and generative AI, unified platforms help ensure consistency, accuracy, and security across all AI-driven processes. They also support interoperability across cloud, on-premise, and edge environments, enabling companies to build and manage AI solutions with greater operational efficiency.

The demand for unified AI platforms is rising as companies recognize the limitations of scattered AI workflows, which often lead to higher costs, longer deployment cycles, and governance challenges. By consolidating capabilities into a single stack, enterprises are able to accelerate innovation, maintain compliance, and gain real-time visibility into model performance.

With the growing use of multimodal applications, large-scale language models, and automated ML pipelines, unified AI platforms are expected to play a central role in enterprise digital transformation. Their ability to support diverse industry needs—from finance and retail to manufacturing and healthcare—positions them as a foundational technology for the next decade of AI-driven growth.

On the product side, Mphasis launched its NeoIP unified AI platform in October 2025, which includes specialized AI agents for code generation, AI governance, incident prediction, and business operations automation. Euryka introduced a unified AI platform targeting marketing and creative teams, integrating over 30 AI tools into one workspace for content creation and brand management.

CoreWeave expanded its AI developer platform through acquisitions such as Marimo, Weights & Biases, and OpenPipe, aiming to accelerate end-to-end AI model development and deployment. Cisco released a Unified Edge platform combining Intel’s Xeon processors with Cisco’s networking capabilities, supporting distributed AI workloads with real-time inference at the edge.

In funding, UnifyApps raised $50 million in Series B funding led by WestBridge Capital, bringing its total funding to $81 million to advance its enterprise AI operating system. xAI secured $10 billion to expand AI infrastructure, while startups like Resistant AI and FurtherAI received $25 million each in Series A and B rounds, focusing respectively on AI for fraud prevention and insurance automation workflows. Modular raised $250 million to develop an AI unified compute layer, a key infrastructure for AI scalability. Bhindi AI secured $4 million pre-seed funding to build a multifunctional AI app for individuals and businesses.

These recent moves underscore an intense focus on integrating AI tools into unified platforms that simplify management, governance, development, and security, backed by strong investor confidence and strategic acquisitions across major tech players. Numeric data, such as $50 million Series B for UnifyApps, $10 billion funding for xAI, and $250 million raised by Modular, illustrate significant financial commitment fueling innovation in unified AI platforms.

Key Takeaways

- The Unified AI Platforms Market reached USD 5.29 Billion in 2024 and is projected to grow to USD 30.89 Billion by 2034 at a 19.30% CAGR.

- North America accounted for 47.3% of the global market, representing USD 2.50 billion in 2024.

- The US contributed USD 2.28 billion in 2024 and is expected to reach USD 11.44 billion by 2034 with a 17.5% CAGR.

- By Component, Platform/Software held 71.4%, making it the dominant offering in the market.

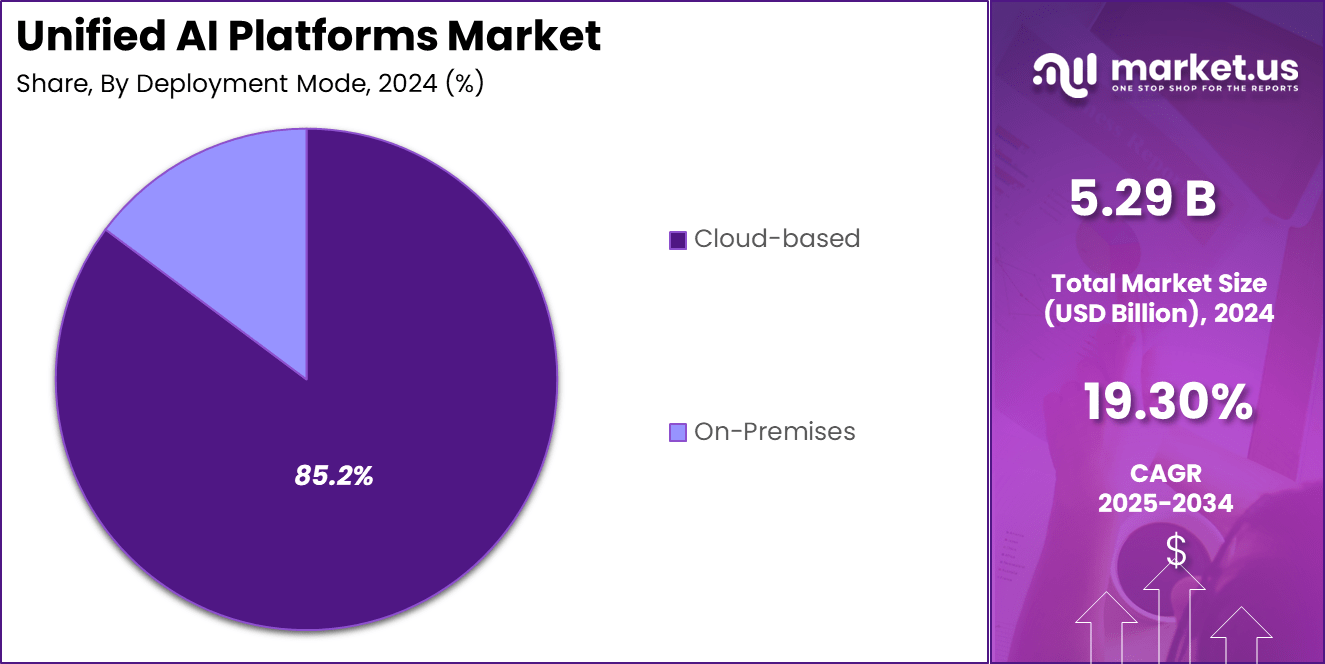

- By Deployment, Cloud-based solutions captured 85.2%, reflecting strong enterprise preference for scalable AI infrastructure.

- By Technology, Generative AI & Foundation Models accounted for 30.4%, driven by rapid enterprise adoption.

- By End-User, IT & Technology Companies led with 35.3%, representing the largest demand base for unified AI platforms.

Role of AI

Artificial intelligence plays a transformative role across global industries by enabling automation, accelerating decision-making, and improving operational efficiency at scale. Its impact is expanding rapidly as organizations deploy AI to enhance productivity, reduce costs, and unlock new revenue opportunities.

Today, more than 70% of enterprises have integrated at least one AI-driven application into their workflows, while AI adoption in business operations has increased by over 250% in the last four years. AI supports real-time analytics, predictive intelligence, and multimodal processing, allowing companies to gain insights from complex datasets that traditional systems cannot interpret effectively.

Generative AI has further amplified AI’s role, with studies showing that over 45% of tasks in areas such as marketing, software development, and customer engagement can now be automated or augmented. In manufacturing, AI-enabled predictive maintenance reduces downtime by up to 30%, while healthcare providers using AI-assisted diagnostics report accuracy improvements of 15% to 20% across several clinical areas.

AI also enhances cybersecurity by detecting threats 60% faster than manual monitoring.

As unified AI platforms and foundation models gain traction, AI’s role is shifting from isolated tools to fully integrated systems that support enterprise-wide transformation. This evolution positions AI as a central driver of digital competitiveness for the coming decade.Industry Adoption

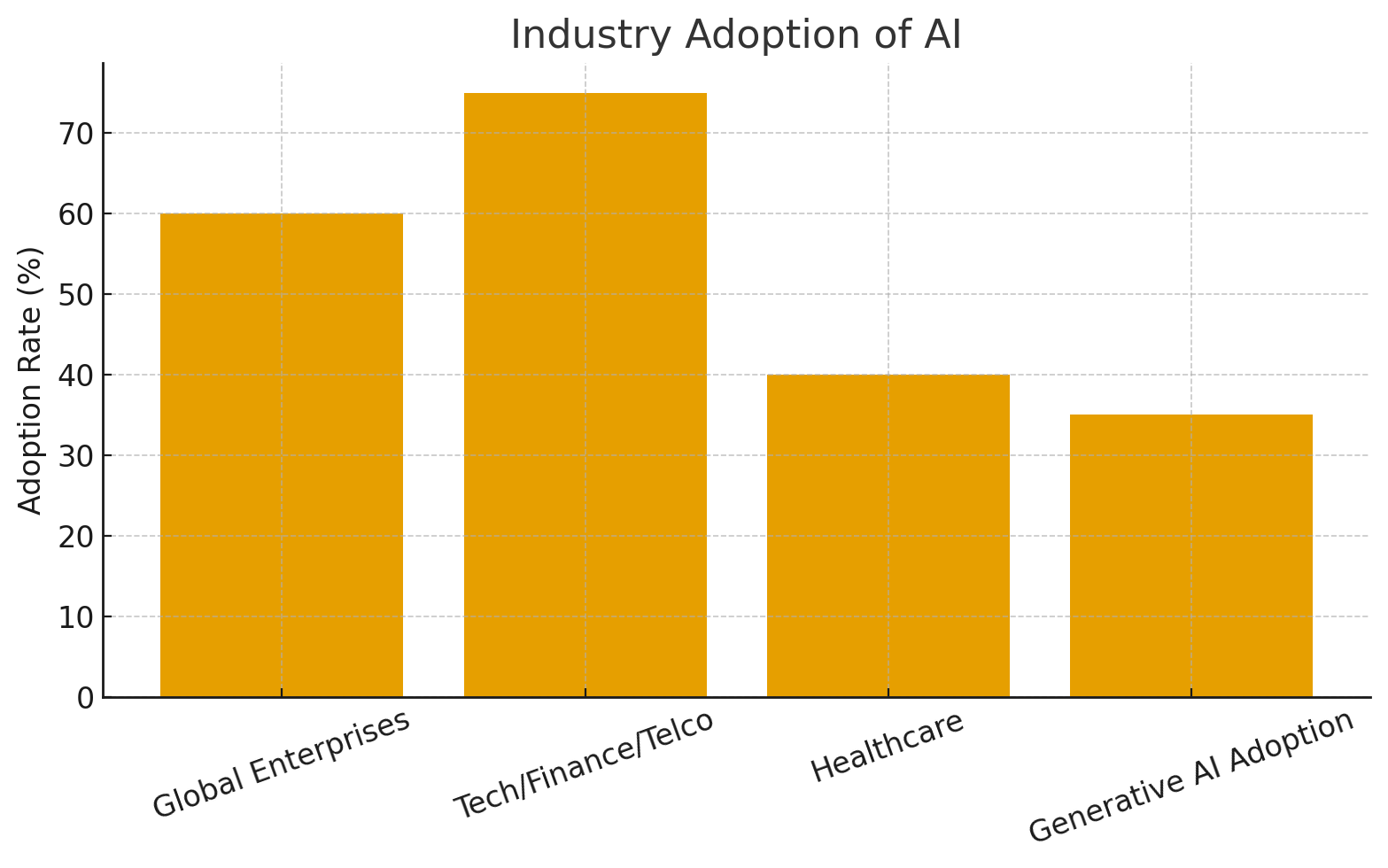

Industry adoption of artificial intelligence is accelerating as organizations recognize its value in improving efficiency, reducing operational costs, and enabling data-driven decision-making. Across sectors, the shift toward digitalization is pushing companies to integrate AI into core processes rather than rely on fragmented or experimental deployments.

Recent industry analyses show that over 60% of global enterprises have adopted AI in at least one functional area, with adoption rates exceeding 75% in technology, finance, and telecommunications. Manufacturing and retail are also seeing rapid uptake, driven by automation, supply-chain optimization, and real-time analytics.

In healthcare, AI adoption has increased by over 40% in the past three years, supported by advancements in diagnostic algorithms and patient-care automation. The banking and financial services industry reports 30% to 50% efficiency gains in fraud detection and risk modeling through AI-enabled systems. Meanwhile, logistics and transportation companies using AI for route optimization have reduced fuel costs by 10% to 15%.

Generative AI is also reshaping adoption patterns, with more than 35% of enterprises experimenting with or deploying generative tools for content automation, coding assistance, and customer interaction. As unified AI platforms streamline deployment and governance, industry adoption is expected to grow even further, strengthening AI’s role as a foundational enabler of enterprise-wide transformation.

Emerging Trends

Emerging trends in artificial intelligence reflect a rapid shift toward more unified, intelligent, and autonomous systems that reshape how industries operate. One of the most significant developments is the rise of multimodal and generative AI, which combines text, images, audio, and video processing within a single model. This capability enables more intuitive applications such as AI copilots, automated content creation, and advanced decision-support tools. Industry surveys show that over 30% of enterprises are already testing multimodal solutions to enhance productivity and reduce manual workloads.

Another major trend is the growing adoption of unified AI platforms that consolidate data management, model development, deployment, and governance. As businesses struggle with fragmented AI environments, unified stacks offer scalability, lower operational costs, and improved regulatory compliance. Meanwhile, edge AI is gaining momentum, with adoption expected to surpass 55% by 2027, as organizations push intelligence closer to devices for faster, real-time processing.

AI safety and governance are also emerging as critical priorities. Nearly 70% of large enterprises are now investing in model monitoring, auditability, and responsible AI frameworks. Additionally, the integration of AI with automation, robotics, and IoT is giving rise to autonomous operations, enabling predictive maintenance, self-optimizing workflows, and smarter infrastructure. Together, these trends signal a decisive move toward enterprise-ready, trustworthy, and highly scalable AI ecosystems.

US Market Size

The US Unified AI Platforms Market is experiencing strong momentum as enterprises accelerate the shift toward integrated AI ecosystems that streamline data workflows, model development, deployment, and governance. In 2024, the US market is valued at USD 2.28 billion, driven by rapid modernization across technology, finance, retail, and healthcare sectors.

As organizations move from isolated AI tools to unified platforms, demand is rising for scalable infrastructures that support multimodal applications, generative AI integration, and enterprise-grade automation. Businesses are increasingly prioritizing platforms that reduce operational complexity, offer end-to-end visibility, and ensure compliance with evolving AI regulations. This shift is further supported by strong cloud adoption, robust digital infrastructure, and high R&D investments from leading US technology providers.

By 2034, the US market is projected to reach USD 11.44 billion, expanding at a 17.5% CAGR. This growth is expected to be fueled by increasing deployment of AI copilots, MLOps automation, and unified lifecycle management tools across enterprise environments.

The rise of large-scale foundation models and domain-specific AI solutions is also accelerating adoption, with companies integrating unified platforms to gain better control over governance, data lineage, and security. As AI becomes a core operational engine, the US market will continue to lead global adoption, shaping innovation and establishing foundational standards for unified AI architectures.

By Component

Platform and software components account for 71.4% of the Unified AI Platforms Market, reflecting the industry’s strong shift toward integrated, end-to-end ecosystems that centralize the entire AI lifecycle. As enterprises expand their use of multimodal models, generative applications, and automated machine learning, demand for unified platforms that combine data management, model building, deployment, and governance continues to rise.

Companies increasingly prioritize scalable AI stacks that reduce tool fragmentation, accelerate workflows, and support both on-premise and cloud environments. This higher preference for platform-centric architectures is also driven by regulatory pressure for structured AI governance, model transparency, and policy-aligned monitoring systems, making software the core foundation of enterprise AI strategy.

Services form the second key component category, covering professional services and managed services. Professional services support organizations during deployment, customization, integration, model optimization, and regulatory alignment, especially for enterprises modernizing legacy systems. As unified platforms become more sophisticated, businesses rely on technical experts to configure pipelines, create governance structures, and ensure interoperability with existing data ecosystems.

Managed services continue to gain traction as companies outsource ongoing monitoring, model tuning, security updates, and infrastructure support. This segment is growing steadily as enterprises seek lower operational costs, predictable maintenance, and access to specialized expertise without expanding internal teams, reinforcing the long-term value of service-driven support models.

By Deployment Mode

Cloud-based deployment holds 85.2% of the Unified AI Platforms Market, underscoring the dominant shift toward scalable, flexible, and cost-efficient AI infrastructure. Organizations increasingly rely on cloud environments to support high-performance computing needs required for training and deploying large language models, multimodal systems, and automated ML pipelines.

The cloud enables seamless integration of data lakes, MLOps tools, governance workflows, and real-time analytics, making it the preferred option for enterprises accelerating AI adoption. Its ability to scale on demand, reduce hardware investments, and provide instant access to updates and security enhancements strengthens its appeal.

As AI workloads grow more complex, cloud-native architectures are becoming essential for supporting distributed processing, generative AI applications, and continuous model optimization across global teams.

On-premises deployment remains relevant in industries that require stringent control over sensitive data, such as banking, healthcare, defense, and critical infrastructure. These organizations prioritize secure environments with strict regulatory or compliance mandates that limit cloud usage. On-premises systems offer complete data ownership, customizable configurations, and enhanced isolation for mission-critical workloads.

Although smaller in share compared to cloud-based deployment, this segment continues to benefit from hybrid AI strategies, GPU-accelerated servers, and private-cloud extensions that balance security with performance. Overall, both deployment models play a role, but cloud-based platforms continue to define the market’s growth trajectory.

By TechnologyGenerative AI and foundation models represent 30.4% of the Unified AI Platforms Market, reflecting their rapidly expanding role in enterprise transformation. These technologies enable advanced capabilities such as content generation, autonomous decision-support, multimodal understanding, and automated workflows across diverse business functions.

Their adoption is accelerating as enterprises shift toward scalable AI architectures that unify text, image, audio, and structured data processing within a single model. With growing interest in enterprise-grade copilots, domain-specific LLMs, and automated knowledge engines, foundation models are becoming central to AI-driven productivity. Organizations benefit from reduced development timelines, improved model accuracy, and enhanced adaptability, positioning generative AI as a key driver of next-generation enterprise automation.

Computer vision continues to advance applications in surveillance, quality inspection, autonomous systems, and medical imaging, supported by improvements in GPU processing and edge AI. Natural language processing (NLP) remains essential for enterprise search, chatbots, document intelligence, and customer analytics, expanding significantly as multimodal language models mature.

Speech recognition and generation technologies are reshaping call centers, smart devices, and real-time transcription with higher accuracy. Predictive analytics and forecasting tools further support demand planning, risk modeling, and maintenance operations across industries. The “Others” category covers emerging fields such as reinforcement learning, knowledge graphs, and emotion AI, demonstrating the broadening spectrum of AI capabilities within unified platforms.

By End-User

IT and technology companies hold 35.3% of the Unified AI Platforms Market, making them the largest end-user segment due to their early adoption of advanced AI ecosystems, strong digital infrastructure, and continuous investment in automation and innovation. These organizations rely heavily on unified platforms to streamline data pipelines, accelerate model development, and deploy large-scale generative and multimodal applications.

With rapid growth in AI copilots, automated coding tools, predictive IT operations, and cloud-native architectures, the technology sector remains at the forefront of platform modernization. Their need for scalable, secure, and flexible AI frameworks drives higher demand for unified platforms that support experimentation, governance, and enterprise-wide integration.

The BFSI sector is also expanding its adoption as banks and insurers deploy AI for fraud detection, underwriting automation, risk scoring, and customer analytics. Healthcare and life sciences organizations leverage unified platforms to support diagnostics, clinical decision support, drug discovery, and digital health workflows, especially as multimodal and predictive systems improve accuracy.

Retail and e-commerce companies use AI for personalization, demand forecasting, inventory optimization, and customer engagement. Manufacturing continues to adopt unified platforms for predictive maintenance, quality inspection, and autonomous operations. The “Others” segment covers industries such as energy, logistics, education, and public sector services, all gradually integrating AI platforms to modernize operations and improve service efficiency.

Key Market Segments

By Component

- Platform/Software

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-Premises

By Technology

- Computer Vision

- Natural Language Processing (NLP)

- Speech Recognition & Generation

- Generative AI & Foundation Models

- Predictive Analytics & Forecasting

- Others

By End-User

- IT & Technology Companies

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Others

Regional Analysis

North America accounts for 47.3% of the Unified AI Platforms Market, reflecting its position as the most mature and innovation-driven region in enterprise AI adoption. In 2024, the regional market reached USD 2.50 billion, supported by strong investments in cloud computing, high-performance infrastructure, and large-scale deployment of generative and multimodal AI systems.

The presence of leading technology companies, hyperscalers, and AI research institutions continues to accelerate platform development, enabling enterprises to adopt unified ecosystems that integrate data management, model training, deployment, and governance. North American organizations are early adopters of AI copilots, automated MLOps pipelines, and foundation model fine-tuning, driving rapid modernization across multiple industries.

The region benefits from a highly digitalized enterprise landscape, particularly in the US, where demand for unified AI stacks is strong across technology, banking, healthcare, retail, and manufacturing sectors. Adoption is further supported by favorable funding environments, mature AI talent pools, and regulatory discussions focused on responsible AI and transparency.

North American enterprises increasingly seek platforms that offer scalability, security, and end-to-end lifecycle optimization, reducing fragmentation in AI workflows. As multimodal applications expand and AI governance becomes more critical, North America is expected to maintain its leadership trajectory, setting global benchmarks for unified AI architecture and enterprise-grade deployment.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The growth of unified AI platforms is driven by rising enterprise adoption of multimodal and generative AI, which requires centralized, scalable environments to manage diverse data workflows and advanced model architectures. With more than 70% of enterprises now integrating AI into core operations, demand is increasing for unified platforms that streamline data ingestion, model training, deployment, and governance under one system.

Cloud adoption also plays a significant role, with over 85% of AI workloads running on cloud-based infrastructure, accelerating platform scalability. Additionally, growing regulatory focus on transparency and responsible AI is pushing organizations to adopt solutions with built-in governance, monitoring, and auditability.

The rapid expansion of AI copilots, automation tools, and predictive systems across industries further strengthens platform demand. As enterprises aim to reduce operational complexity and accelerate innovation cycles, unified AI platforms are becoming essential for supporting end-to-end lifecycle management and high-performance AI environments.

Restraint Factors

Despite strong growth, several factors restrain the widespread adoption of unified AI platforms. High implementation costs remain a challenge, particularly for mid-sized organizations that lack advanced cloud infrastructure or AI-ready data environments. Setting up unified platforms often requires significant investments in integration, customization, security frameworks, and ongoing maintenance.

Data privacy and regulatory compliance also pose barriers, as nearly 40% of enterprises report concerns related to data sovereignty, model explainability, and compliance with evolving AI regulations. Skill shortages further hinder adoption, with demand for AI engineers, data scientists, and MLOps specialists exceeding supply by over 30%.

Integration with legacy systems adds complexity, especially in industries reliant on outdated infrastructures. Additionally, organizations face difficulties in consolidating fragmented AI tools into a cohesive platform, slowing down transformation efforts. These restraints collectively impact scalability, increasing the time and resources required for full deployment of unified AI platforms.

Growth Opportunities

Unified AI platforms present strong growth opportunities as enterprises shift from isolated tools to integrated systems that support end-to-end AI workflows. One of the largest opportunities lies in the rapid adoption of generative AI, with over 35% of enterprises actively deploying or piloting generative models. This trend creates demand for platforms capable of model fine-tuning, governance, and multimodal processing at scale.

Industry-specific AI models also offer new potential, especially in healthcare, BFSI, retail, and manufacturing, where specialized platforms can optimize diagnostics, fraud detection, personalization, and predictive maintenance. Another major opportunity is the expansion of edge AI, expected to achieve over 55% adoption by 2027, enabling real-time, low-latency AI applications.

Small and mid-sized enterprises represent an emerging market as cloud-native unified platforms make AI more accessible. Additionally, rising global investments in responsible AI frameworks open new pathways for platforms offering compliance automation, monitoring, and lifecycle governance.

Trending Factors

Several key trends are shaping the evolution of unified AI platforms. Multimodal AI is becoming mainstream as organizations adopt models capable of processing text, images, audio, and video simultaneously, with adoption expected to exceed 30% within the next two years. The rise of AI copilots for software development, content creation, and business workflows is accelerating platform integration across industries.

Another major trend is the shift toward hybrid and multi-cloud architectures, as over 60% of enterprises now rely on multi-cloud ecosystems to support scalable AI deployments. AI governance is also gaining prominence, driven by increasing regulatory requirements; nearly 70% of large enterprises now prioritize responsible AI tools for transparency, bias detection, and model monitoring.

Finally, the integration of AI with automation technologies—including RPA, IoT, and autonomous systems—is creating demand for unified platforms that support self-learning workflows and real-time optimization, paving the way for autonomous enterprise operations.

Competitive Analysis

The competitive landscape of the Unified AI Platforms Market is defined by a concentrated group of technology leaders, cloud hyperscalers, and emerging AI-native companies that are accelerating innovation in end-to-end AI ecosystem management. Major players such as Microsoft, Google, Amazon Web Services, IBM, and Oracle dominate the market through their deep cloud infrastructure, extensive AI model libraries, and strong enterprise relationships.

These companies leverage advanced foundation models, integrated MLOps pipelines, and multimodal AI capabilities to provide highly scalable unified platforms. Their competitive strength is further reinforced by significant R&D spending, with hyperscalers investing over USD 50 billion annually in AI and cloud advancements.

Specialized AI platform companies such as Databricks, Snowflake, DataRobot, H2O.ai, and OpenAI are also gaining traction by offering flexible architectures, industry-specific models, and streamlined governance features tailored to enterprise needs. These firms compete by focusing on data unification, automated machine learning, and interoperability across multi-cloud environments. Startups developing domain-specific generative AI and verticalized AI platforms are intensifying competition, particularly in healthcare, finance, and cybersecurity.

Competitive differentiation increasingly revolves around multimodal integration, low-code AI development, security and governance automation, and cost-efficient scalability. As enterprises prioritize unified AI stacks over fragmented tools, vendors that provide seamless orchestration, lifecycle transparency, and compliance-ready frameworks are expected to strengthen their market position over the next decade.

Top Key Players in the Market

- Microsoft

- AWS

- IBM

- Databricks

- DataRobot

- H2O.ai

- C3.ai

- SAS

- Palantir

- NVIDIA

- Cloudera

- OpenAI

- Anaconda

- Graphcore

- Abacus.ai

- Domino Data Lab

- Run:AI

- CognitiveScale

- Others

Recent Developments

- November 18, 2025: Microsoft expanded its Azure AI Studio with unified multimodal orchestration layers, enabling enterprises to build, fine-tune, and deploy text-image-audio foundation models through a single interface, reducing development time for AI applications by more than 40% across pilot customers.

- November 12, 2025: Google unveiled Vertex AI HyperModels, a new suite of enterprise-optimized foundation models designed for high-accuracy retrieval-augmented generation (RAG), multilingual search automation, and predictive decisioning, offering deeper integration with BigQuery and Duet AI workflows.

- November 5, 2025: Amazon Web Services introduced SageMaker Fusion, combining model lifecycle automation, feature governance, and distributed training capabilities to support multimodal and generative workloads at scale for financial services, retail, and industrial clients.

Report Scope

Report Features Description Market Value (2024) USD 5.29 Billion Forecast Revenue (2034) USD 30.89 Billion CAGR(2025-2034) 19.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Platform/Software, Services [Professional Services, Managed Services]), By Deployment Mode (Cloud-based, On-Premises), By Technology (Computer Vision, Natural Language Processing (NLP), Speech Recognition & Generation, Generative AI & Foundation Models, Predictive Analytics & Forecasting, Others), By End-User (IT & Technology Companies, BFSI, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google, Microsoft, AWS, IBM, Databricks, DataRobot, H2O.ai, C3.ai, SAS, Palantir, NVIDIA, Cloudera, OpenAI, Anaconda, Graphcore, Abacus.ai, Domino Data Lab, Run:AI, CognitiveScale, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Unified AI Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Unified AI Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- AWS

- IBM

- Databricks

- DataRobot

- H2O.ai

- C3.ai

- SAS

- Palantir

- NVIDIA

- Cloudera

- OpenAI

- Anaconda

- Graphcore

- Abacus.ai

- Domino Data Lab

- Run:AI

- CognitiveScale

- Others