Global Underwater Marine IoT & Wireless Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Communication Technology (Acoustic, Optical, Radio Frequency (RF), Hybrid Acoustic-Optical, Magnetic Induction), By Application (Environmental Monitoring, Oil and Gas Operations,Others), By End-User (Government and Research Agencies, Offshore Energy Companies, Aquaculture Producers,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167348

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Performance Statistics

- By Component

- By Communication Technology

- By Application

- By End-User

- Key reasons for adoption

- Benefits

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

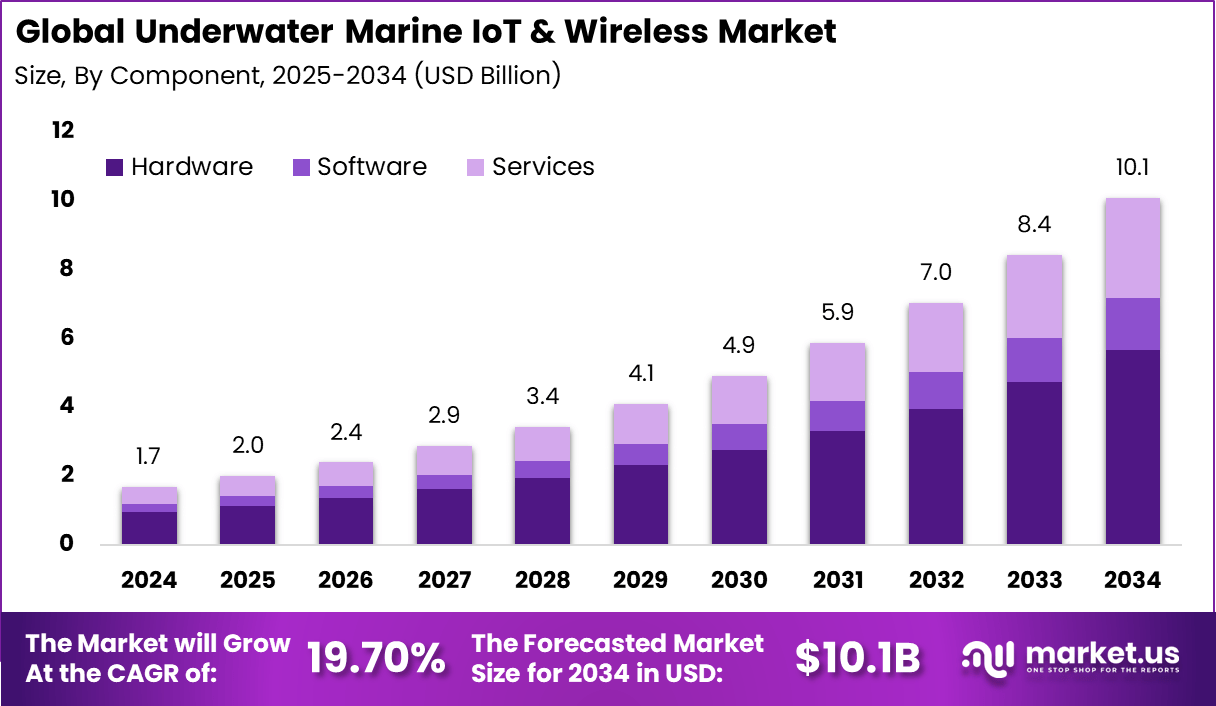

The Global Underwater Marine IoT & Wireless Market generated USD 1.7 billion in 2024 and is predicted to register growth from USD 2.0 billion in 2025 to about USD 10.1 billion by 2034, recording a CAGR of 19.70% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 40.5% share, holding USD 0.67 Billion revenue.

The underwater marine IoT and wireless market has expanded as ocean industries adopt connected sensors, autonomous platforms and wireless communication tools to monitor, map and manage subsea environments. Growth reflects rising interest in real time data collection, operational safety and predictive maintenance for underwater infrastructure. Marine IoT networks are now deployed across offshore energy sites, aquaculture farms, research programs and naval operations.

The growth of the market can be attributed to increasing offshore exploration, rising investment in blue economy projects and stronger need for continuous monitoring of subsea assets. Climate research efforts and stricter environmental regulations require accurate underwater measurements. Advancements in acoustic, optical and electromagnetic communication systems also support wider deployment of underwater IoT architectures.

Demand is rising across oil and gas operators, offshore wind farms, marine research institutes, aquaculture facilities, national navies and environmental organisations. Operators rely on marine IoT to track equipment condition, pipeline integrity and seabed activity. Researchers use sensor networks for biodiversity studies and climate modelling. Aquaculture farms adopt IoT systems for water quality monitoring, feeding control and livestock health management.

Top Market Takeaways

- By component, hardware leads with 56.3% share, including underwater sensors, acoustic modems, AUVs, ROVs, and underwater cameras essential for IoT data acquisition in marine environments.

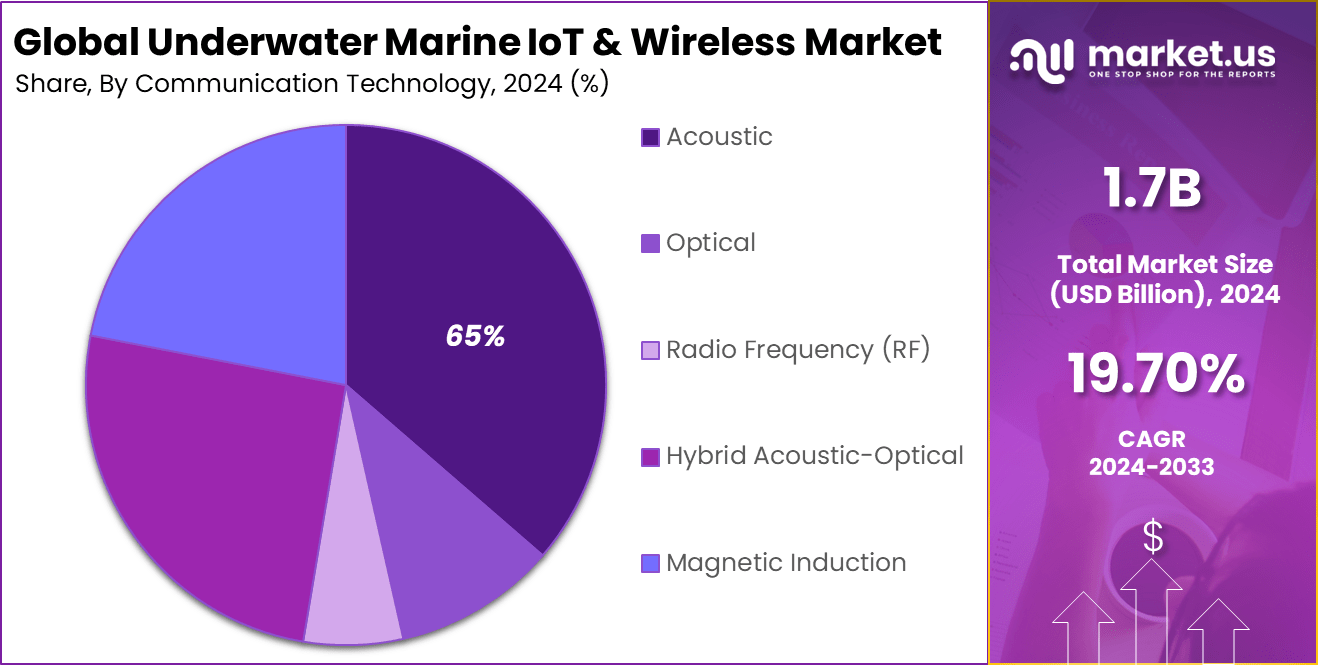

- By communication technology, acoustic communication dominates with 64.8% of the market, favored for its long-range capability and reliability in underwater data transmission, despite bandwidth limitations. Advances in spread-spectrum and directional acoustic arrays extend range and improve resilience to noise.

- By application, environmental monitoring holds 31.5% share, driven by government regulations on marine ecosystem protection, biodiversity assessments, and ocean health monitoring—supported by sensor grids recording chemistry, sound, and eDNA signatures.

- By end-user, government and research agencies lead with 39.7%, funding large-scale sensor networks for climate change studies, pollution tracking, maritime security, and oceanographic research.

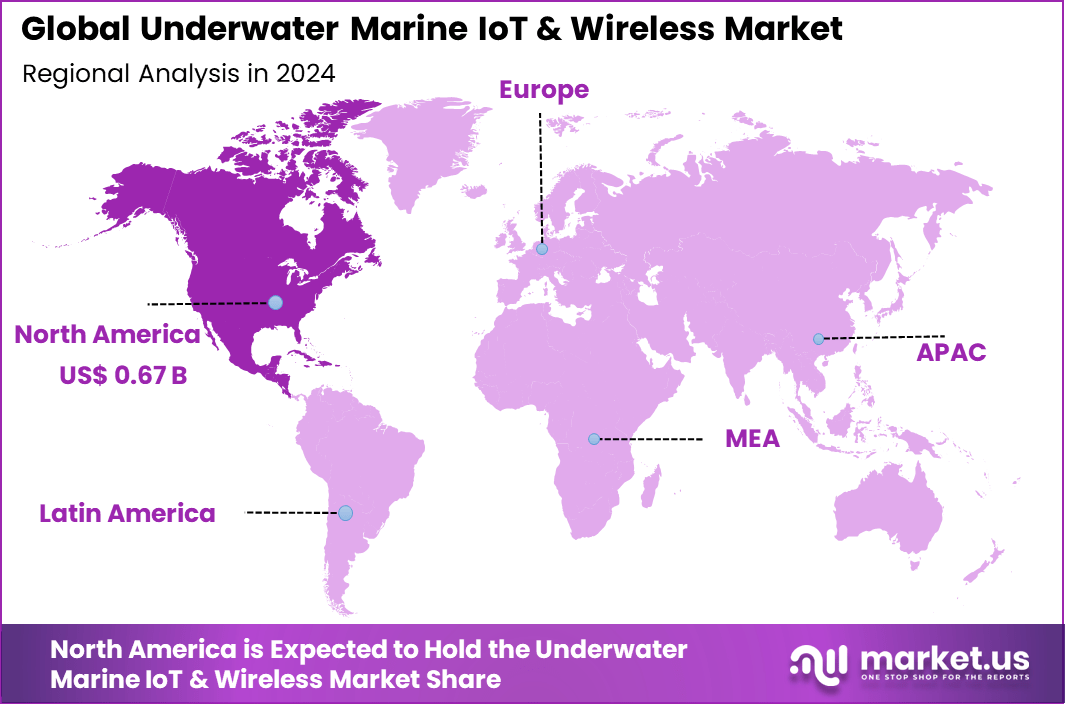

- North America accounts for approximately 40.5% of the market.

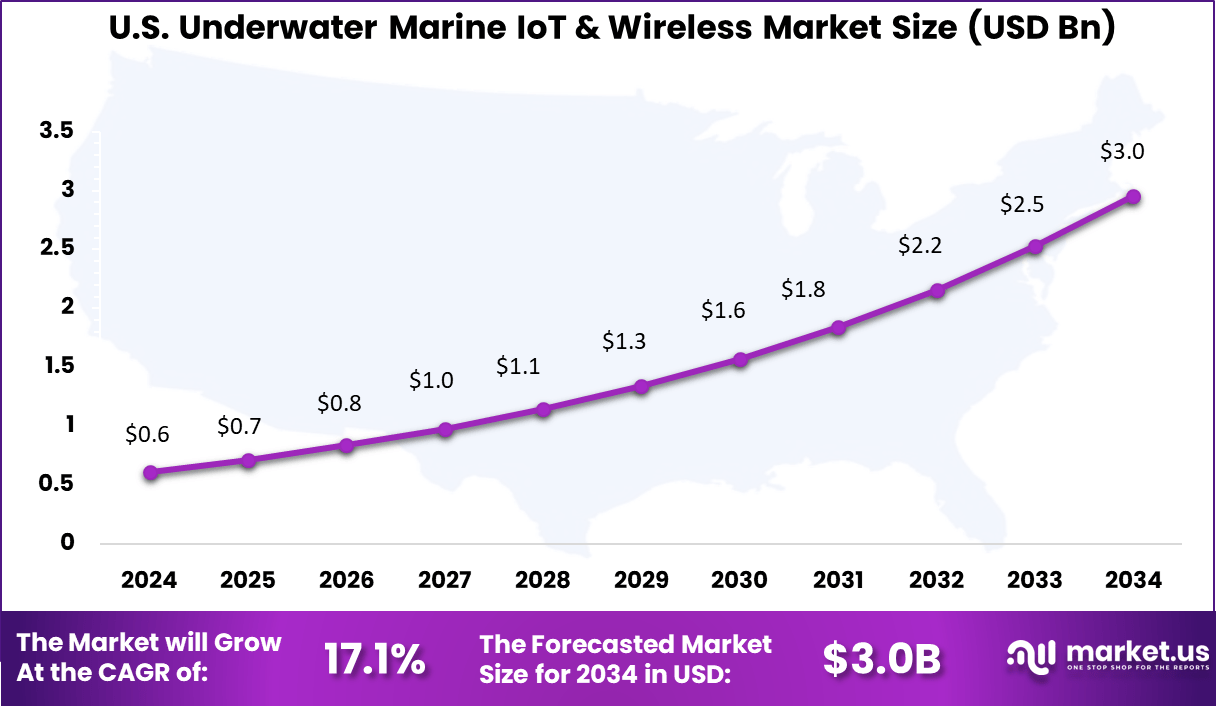

- The U.S. market size is valued at about USD 0.61 billion in 2025.

- The market is expected to grow at a CAGR of approximately 17.1%, accelerated by increasing public and private investment in underwater infrastructure, technological innovation in hybrid acoustic-optical systems, and expansion of IoT-enabled maritime applications.

Performance Statistics

- Range: Prototype underwater systems have demonstrated operational coverage of up to 1.3 km in diameter and 51 m in depth, with ongoing research focused on extending both horizontal and vertical communication ranges.

- Data Rate: Traditional underwater communication technologies provide low throughput, but advancements are improving performance. Acoustic backscatter has achieved data rates of up to 20 kbps at distances of up to 62 meters, representing a significant enhancement over legacy acoustic signaling.

- Power Efficiency: Power remains a primary constraint due to the difficulty of recharging submerged devices. Acoustic backscatter systems operate at extremely low power levels – as little as 100 microwatts, nearly one million times lower than conventional underwater acoustic modems – making them suitable for long-term deployments.

- Accuracy: In water quality monitoring applications (including pH, turbidity, TDS, temperature), IoT-enabled systems demonstrated 95% accuracy, compared to 85% for traditional measurement methods, as reported by ScienceDirect. This illustrates the precision benefits of sensor-driven, real-time monitoring technologies.

By Component

In 2024, The hardware segment holds a commanding 56.3% share of the underwater marine IoT and wireless market. This segment includes ruggedized sensors, acoustic modems, underwater cameras, AUVs, and autonomous devices built to withstand harsh oceanic conditions such as pressure, corrosion, and biofouling.

Hardware reliability ensures continuous data collection, critical for real-time marine monitoring and control systems. As marine operations grow more sophisticated, investing in durable, energy-efficient devices becomes essential to maintain long-term communication networks beneath the waves.

These advanced hardware components form the backbone enabling IoT deployments to gather accurate environmental data, monitor subsea equipment health, and facilitate autonomous underwater navigation, supporting various marine industries including research, energy, and logistics.

By Communication Technology

In 2024, Acoustic communication technology leads with a 65% share in the underwater marine IoT market. Acoustic waves remain the most effective method for underwater data transmission over long distances where radio frequency signals cannot penetrate.

Acoustic systems facilitate stable point-to-point and networked communications for submerged devices, supporting complex sensor grids and mobile platforms like AUVs and ROVs. Innovations improving modulation techniques and noise cancellation enhance data rates and transmission reliability despite challenging underwater environments.

The dominance of acoustic technology reflects its unmatched range and penetrability in marine settings. It forms the communication backbone for crucial applications such as pipeline monitoring, environmental sensor arrays, and oil & gas exploration, enabling seamless underwater connectivity essential for expanding marine IoT ecosystems.

By Application

In 2024, Environmental monitoring constitutes 31.5% of the market application segment, driven by increasing focus on marine ecosystem health, pollution control, and climate change impacts. Underwater IoT networks provide real-time data on water quality, temperature, marine life movements, and chemical composition, empowering governments and research institutions to act proactively.

High regulatory standards and global biodiversity treaties further incentivize extensive deployment of sensor networks and automated monitoring systems to meet conservation goals. Environmental monitoring offers a clear window into oceanic health, facilitating sustainable resource management and early detection of ecological threats.

By End-User

Government and research agencies represent 39.7% of end users in the underwater marine IoT market, leveraging these technologies for marine science, national security, resource management, and disaster response. These agencies deploy extensive sensor arrays and autonomous monitoring platforms to gather environmental data, manage marine protected areas, and support search and rescue operations.

Investments focus on scalable, interoperable systems compatible with long-term ocean observation initiatives. The strategic importance of marine domains and increasing emphasis on sustainable ocean exploitation drive sustained funding and innovation. Collaboration between governments, academia, and industry enhances capabilities, creating robust frameworks for oceanographic research and environmental policy enforcement.

Key reasons for adoption

- Real-time monitoring: Enables continuous, real-time tracking of underwater assets, environmental conditions, and vessel performance for better decision-making and operational control.

- Automation and efficiency: Supports autonomous vessels and smart ports by integrating sensor networks that reduce human error and improve operational workflow.

- Wireless connectivity: Eliminates the need for expensive and fragile cables, enabling easier deployment and flexibility in underwater communications.

- Advanced data handling: Combines 5G, satellite links, and edge computing to handle high-volume data transmission and real-time processing at the edge, enhancing responsiveness.

- Environmental compliance: Facilitates monitoring of water quality, pollution, and marine ecosystems to meet increasing regulatory requirements.

- Asset protection: Supports inspection and maintenance of critical offshore infrastructure like oil rigs, underwater cables, and wind farms with early warning capabilities.

- Scalability: Wireless marine IoT networks can be scaled across fleets, ports, and vast underwater areas, providing comprehensive coverage and integration.

Benefits

- Higher situational awareness: By adding accurate direction and intensity information, AVS give operators a clearer picture of what is happening in the water or around a critical asset, which improves tactical and operational decisions.

- Fewer sensors for the same job: Because a single vector sensor can replace multiple traditional pressure sensors, system designers can simplify arrays and cut hardware count without losing performance.

- Lower deployment and integration burden: Small size, low weight, and reduced cabling make installation faster and cheaper on ships, platforms, vehicles, and fixed sites.

- Better performance per unit cost: Improved detection, tracking, and classification quality means each deployed channel delivers more useful information over its life, which strengthens the business case even when unit prices are higher.

- Enhanced safety and asset protection: Earlier and more reliable detection of threats, leaks, or abnormal acoustic signatures helps protect people, infrastructure, and high‑value equipment.

- Readiness for advanced analytics and AI: Clean, directional acoustic data from AVS feeds directly into modern signal‑processing and AI pipelines, enabling smarter automation and new analytics services.

- Flexibility across programs: The same core sensor concept can be reused across defense, offshore energy, research, and industrial noise monitoring, spreading development and integration costs across multiple programs.

Emerging Trends

Key Trends Description Hybrid Acoustic-Optical Communication Combining long-range acoustic with high-bandwidth optical links for data-intensive subsea applications. AI-enabled Network Management Artificial intelligence optimizing underwater IoT node communication, power use, and data routing. Expansion of Autonomous Underwater Vehicles Increasing deployment of AUVs integrated with IoT for exploration, monitoring, and data collection. Development of Low-Power, Miniaturized Sensors Sensors with enhanced power efficiency and smaller form factors enabling longer deployments and diverse use cases. Integration with Satellite and 5G Networks Seamless handoff between underwater and terrestrial communication networks for continuous connectivity. Growth Factors

Key Factor Description Increasing Investment in Marine Research Growing government and private sector funding for ocean monitoring and resource exploration accelerating market. Rising Offshore Energy Projects Expansion of offshore wind and oil & gas infrastructure requiring robust underwater IoT monitoring systems. Environmental Monitoring and Conservation Regulatory emphasis on marine ecosystem protection increasing demand for real-time underwater data collection. Technological Advancements and Innovations Continuous improvements in sensor technology, underwater wireless protocols, and data analytics foster growth. Regional Growth in Asia-Pacific and North America Rapid industrialization and infrastructure expansion in key regions driving adoption and market penetration. Key Market Segments

By Component

- Hardware

- Software

- Services

By Communication Technology

- Acoustic

- Optical

- Radio Frequency (RF)

- Hybrid Acoustic-Optical

- Magnetic Induction

By Application

- Environmental Monitoring

- Oil and Gas Operations

- Defense and Security

- Aquaculture and Fisheries

- Underwater Research and Exploration

- Offshore Renewable Energy

- Smart Ports and Shipping

- Disaster Monitoring and Early Warning

- Others

By End-User

- Government and Research Agencies

- Offshore Energy Companies

- Aquaculture Producers

- Shipping and Maritime Logistics Firms

- Defense / Naval Forces

- Environmental NGOs and Conservation Organizations

- Others

Regional Analysis

North America held a dominant position in the underwater marine IoT and wireless market, capturing approximately 40.5% of the global share. The region’s growth is driven by extensive investments in offshore energy exploration, maritime security, and oceanographic research. Technological advancements in underwater sensors, communication modules, and edge computing contribute to the robustness and scalability of marine IoT solutions.

Strong public and private sector funding supports the deployment of underwater sensor networks that withstand harsh marine environments, enabling efficient real-time monitoring and data collection for environmental and industrial applications. Continuous innovation in AI-driven data analytics and sustainable marine operations further fuels market expansion in North America.

The United States represents a key market segment valued at about USD 0.61 billion in 2024, exhibiting a high growth rate with a CAGR of 17.1%. The U.S. marine IoT market benefits from active governmental programs such as NOAA’s Integrated Ocean Observing System and significant naval unmanned system deployments. Energy companies in the Gulf of Mexico maintain extensive subsea pipeline monitoring networks, further pushing demand.

Additionally, the country’s strong technology ecosystem advances the development of reliable acoustic and optical communication systems, mesh networking capabilities, and smart power management. These developments enhance operational efficiency, safety, and environmental monitoring, positioning the U.S. as a global leader in underwater marine IoT and wireless communication technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Advanced Defense and Surveillance Systems

The acoustic vector sensor market is propelled by growing demand for precise and reliable underwater surveillance and sonar applications, especially in defense sectors. These sensors provide enhanced detection and localization capabilities by capturing sound intensity and direction, critical for anti-submarine warfare and naval defense operations.

Increasing global defense expenditures and modernization programs to counter underwater threats fuel this growth. Additionally, marine research and environmental monitoring require accurate acoustic sensing for data collection and ecosystem analysis. This diversified use across defense and civil sectors widens market demand for advanced sensor technologies with real-time processing capabilities.

Restraint

High Manufacturing Costs and Calibration Complexities

Despite strong growth prospects, the market faces challenges due to high manufacturing costs of acoustic vector sensors. Producing high-sensitivity, multi-axis sensors with low noise levels involves sophisticated technology and precision engineering, which increases the price barrier for widespread adoption.

Calibration is another complexity affecting market growth. Ensuring accurate directional measurements demands extensive calibration and maintenance, especially when operating in varying environmental conditions like temperature and pressure fluctuations. These factors restrict use in cost-sensitive applications and markets with limited technical capabilities.

Opportunity

Integration with Autonomous Underwater Vehicles and AI

The integration of acoustic vector sensors with autonomous underwater vehicles (AUVs) and AI-driven data analytics presents significant growth opportunities. AUVs used in subsea exploration and inspection benefit immensely from precise acoustic localization, enabling safer, more efficient missions in deep and challenging underwater environments.

AI enhances signal processing by filtering noise and improving detection accuracy, enabling real-time decision-making. This combination opens new possibilities in marine biology, offshore energy, and infrastructure monitoring where autonomous systems require robust sensing capabilities.

Challenge

Environmental Factors and Cybersecurity Risks

Environmental factors like water salinity, temperature, and ocean currents introduce noise and signal distortion, posing challenges to acoustic vector sensor accuracy and reliability. Adapting sensors and algorithms to these dynamic conditions requires ongoing R&D efforts.

Furthermore, the cybersecurity aspect of underwater sensor networks is emerging as a critical concern. Unauthorized data access or interference could compromise mission-critical operations in defense and commercial applications. Ensuring secure communication protocols and data integrity is essential to maintain trust and operational continuity.

Competitive Analysis

The underwater wireless modem and communication devices market is highly competitive, featuring leading companies such as Kongsberg Gruppen, L3Harris Technologies, Inmarsat, Xylem, Sonardyne, Saab, Teledyne Marine, Ultra, EvoLogics, Alcatel Submarine Networks, AXYS Technologies, MetOcean Telematics, InnovaSea Systems, and AKVA Group.

These players compete by developing advanced acoustic, optical, and hybrid communication technologies that enable reliable, high-speed data transfer in challenging subsea environments. Innovation focuses on enhancing signal processing, AI-integrated network management, and device durability to cater to offshore energy, defense, marine research, and aquaculture sectors.

Strategic partnerships, investments in R&D, and geographic expansion are pivotal in strengthening market positions, with Asia-Pacific emerging as a fast-growing region due to increasing offshore exploration and maritime security initiatives. Regulatory compliance and environmental considerations also influence product design and deployment strategies.

Overall, the competitive dynamics center around technological superiority, integrated solution offerings, and global service capabilities to meet the growing demand for advanced underwater communication and telemetry systems.

Top Key Players in the Market

- Kongsberg Gruppen ASA

- Teledyne Technologies Inc.

- Inmarsat Global Limited

- Xylem Inc.

- Sonardyne Ltd.

- Saab AB

- L3Harris Technologies, Inc.

- WSENSE S.r.l.

- EvoLogics GmbH

- Alcatel Submarine Networks SAS

- AXYS Technologies Inc.

- MetOcean Telematics Ltd.

- InnovaSea Systems Inc.

- AKVA Group ASA

- Others

Future Outlook

The underwater marine IoT and wireless market is set for significant growth driven by advances in sensor technologies, underwater wireless communication systems, and integration with AI for real-time monitoring. This growth is fueled by increasing demand across marine environmental monitoring, offshore energy, defense, and aquaculture sectors. Innovations that improve data transmission reliability and range underwater, combined with rising regulatory emphasis on marine conservation, will further accelerate market expansion.

Future Opportunities Description Environmental Monitoring Real-time water quality, pollution, and marine ecosystem data collection for regulatory compliance. Offshore Infrastructure Wireless monitoring of subsea assets such as wind turbines, oil platforms, and underwater cables. Autonomous Underwater Vehicles Enhanced communication networks to support AUV operations for inspection and exploration. Aquaculture and Fisheries IoT deployment for tracking, monitoring, and optimizing farmed seafood production and health. Recent Developments

- October, 2025, Kongsberg Gruppen ASA proposed listing its maritime business independently on the Oslo Stock Exchange by mid-2026, intending to sharpen focus on defense operations while enabling maritime technology growth

- September, 2025, Inmarsat expanded its partnership with Pulsar International to deploy NexusWave maritime communication solutions on 300+ vessels, enhancing digital connectivity and operational management offshore

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 10.1 Bn CAGR(2025-2034) 19.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Communication Technology (Acoustic, Optical, Radio Frequency (RF), Hybrid Acoustic-Optical, Magnetic Induction), By Application (Environmental Monitoring, Oil and Gas Operations,Others), By End-User (Government and Research Agencies, Offshore Energy Companies, Aquaculture Producers,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Inmarsat Global Limited, Xylem Inc., Sonardyne Ltd., Saab AB, Teledyne Technologies Inc., Ultra, WSENSE S.r.l., EvoLogics GmbH, Alcatel Submarine Networks SAS, AXYS Technologies Inc., MetOcean Telematics Ltd., InnovaSea Systems Inc., AKVA Group ASA, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Underwater Marine IoT & Wireless MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Underwater Marine IoT & Wireless MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kongsberg Gruppen ASA

- Teledyne Technologies Inc.

- Inmarsat Global Limited

- Xylem Inc.

- Sonardyne Ltd.

- Saab AB

- L3Harris Technologies, Inc.

- WSENSE S.r.l.

- EvoLogics GmbH

- Alcatel Submarine Networks SAS

- AXYS Technologies Inc.

- MetOcean Telematics Ltd.

- InnovaSea Systems Inc.

- AKVA Group ASA

- Others