Global Turf Protection Market Size, Share, Growth Analysis By Product (Fungicides, Herbicides, Insecticides, Plant Growth Regulators, Biostimulants and Bio-fertilizers), By Mode of Application (Foliar, Seed, Soil), By Formulation (Liquid, Powder), By Solution (Biological, Chemical, Mechanical), By Application (Landscaping, Golf Courses, Sports Fields, Sod Farms, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157121

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

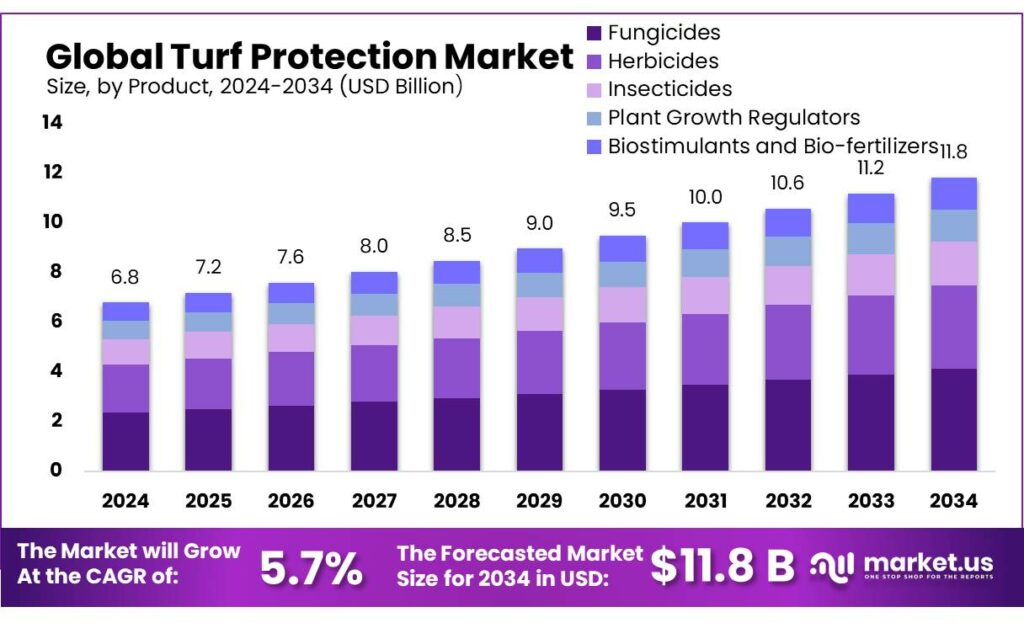

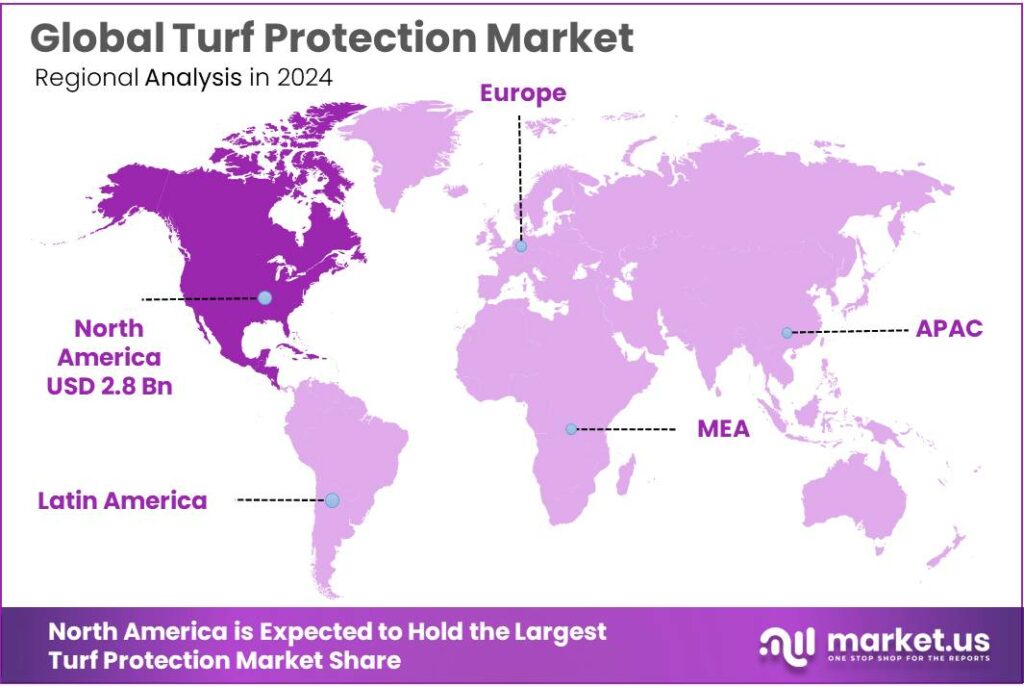

The Global Turf Protection Market size is expected to be worth around USD 11.8 Billion by 2034, from USD 6.8 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 41.6% share, holding USD 2.8 Billion in revenue.

The turf protection industry, a specialized segment within the broader chemical and crop‑protection sectors, focuses on safeguarding grass surfaces—such as in golf courses, sports fields, municipal lawns, and landscaped residential and commercial spaces—from pests, diseases, environmental stress, and weeds.

Protective products include insecticides, fungicides, herbicides, growth regulators, and seed‑ or soil‑applied treatments. While publicly available governmental sources seldom provide turf‑specific figures, several government‑backed chemical and agriculture industry datasets offer valuable insights that align closely with turf protection trends.

India’s agrochemical industry, encompassing turf protection, is experiencing significant growth. In the fiscal year 2022–23, agrochemical exports from India reached USD 5.4 billion (₹43,223 crores), up from USD 4.9 billion (₹36,521 crores) in the previous fiscal year. This upward trajectory underscores the sector’s expanding global footprint. The government has identified agrochemicals as one of the 12 champion sectors poised for global leadership, aiming to bolster domestic manufacturing and reduce reliance on imports.

Government initiatives play a pivotal role in the development of the turf protection industry. In Uttar Pradesh, the state government is implementing a comprehensive seed purification campaign to protect crops from damage caused by insects, diseases, weeds, and rodents.

This initiative includes a large-scale public awareness campaign and provides farmers with a 75% subsidy on seed treatment chemicals through the ‘Ecological Resources Scheme Pest/Disease Control Scheme. Such policies not only enhance agricultural productivity but also contribute to the overall health of turfgrass in agricultural settings.

Key Takeaways

- Turf Protection Market size is expected to be worth around USD 11.8 Billion by 2034, from USD 6.8 Billion in 2024, growing at a CAGR of 5.7%.

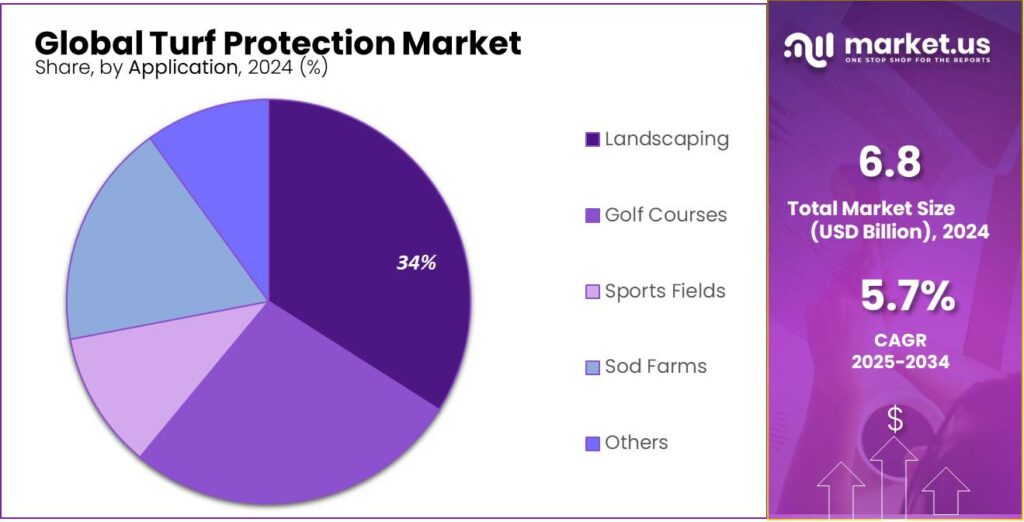

- Fungicides held a dominant market position, capturing more than a 34.8% share of the turf protection market.

- Foliar held a dominant market position, capturing more than a 48.2% share of the turf protection market.

- Liquid held a dominant market position, capturing more than a 71.7% share of the turf protection market.

- Chemical held a dominant market position, capturing more than a 59.6% share of the turf protection market.

- Landscaping held a dominant market position, capturing more than a 34.9% share of the turf protection market.

- North America accounted for 41.6% of the global turf protection market, equivalent to approximately USD 2.8 billion.

By Product Analysis

Fungicides lead with 34.8% share, protecting turf against disease

In 2024, Fungicides held a dominant market position, capturing more than a 34.8% share of the turf protection market. This strong position reflects how crucial these products are in defending lawns, sports fields, and golf courses from fungal diseases that can quickly damage turf quality and appearance. Turf managers lean on fungicides to maintain lush, green grass by targeting persistent threats like dollar spot, brown patch, and anthracnose.

Beyond the immediate effect of disease control, the popularity of fungicides stems from their reliability and the deep expertise behind their development. Manufacturers offer a wide range of formulations—liquid concentrates, systemic sprays, and seed treatments—so turf professionals can choose the right tool for different climates, grass types, and usage scenarios. At the same time, a growing awareness of environmental impact is encouraging the adoption of lower-risk biological alternatives, though fungicides remain a cornerstone in turf health maintenance thanks to their proven efficacy and ease of use.

By Mode of Application Analysis

Foliar dominates with 48.2% share, offering precise turf protection with ease

In 2024, Foliar held a dominant market position, capturing more than a 48.2% share of the turf protection market. Grassland caretakers—whether for golf courses, sports fields, or residential lawns—favor foliar application because it lets them spray treatments directly onto leaf surfaces, ensuring fast-acting, targeted results with minimal waste. This method shines especially when conditions call for an immediate response to pests or stress, and it beautifully aligns with modern precision tools like handheld sprayers or drone delivery.

Beyond its effectiveness, foliar application is popular because it’s flexible and intuitive. Turf managers can easily tune application rates to canopy density, weather shifts, and disease hotspots. In a world leaning toward both green lawns and greener practices, foliar application continues delivering on both performance and practicality.

By Formulation Analysis

Liquid leads with 71.7% share, offering fast and flexible turf care

In 2024, Liquid held a dominant market position, capturing more than a 71.7% share of the turf protection market. This commanding lead underlines how liquid formulations—like sprays and concentrated solutions—are favored by turf professionals for their speed, uniform application, and easy integration into modern equipment like boom sprayers and GPS-guided systems.

Liquid products shine when quick absorption is essential—think on-the-spot applications for pest outbreaks or stress-relief treatments during hot weather. They also let users adjust concentrations on the fly depending on canopy density or grass type, making them adaptable for golf greens, sports fields, and manicured lawns alike.

By Solution Analysis

Chemical solutions rule with 59.6% share, thanks to their reliability and versatility

In 2024, Chemical held a dominant market position, capturing more than a 59.6% share of the turf protection market. This strong dominance speaks volumes about the confidence turf managers have in chemical treatments—whether it’s herbicides, insecticides, or fungicides—to deliver consistent, visible results. Chemical solutions are prized for their ability to quickly control pests, diseases, and weeds across different turf types, from sports fields to ornamental lawns, while offering a range of action modes and residual protection.

What sets chemical treatments apart is their predictability: turf professionals know exactly what to expect in terms of dosage, application timing, and recovery period. This reliability is crucial during high-stakes maintenance cycles, such as tournaments or peak season care. While greener alternatives are gaining attention, chemical options remain the backbone of turf health management, offering fast-acting and cost-effective control when turf looks and performance matter most.

By Application Analysis

Landscaping leads with 34.9% share, nurturing green spaces with care

In 2024, Landscaping held a dominant market position, capturing more than a 34.9% share of the turf protection market. This reflects a growing appreciation for well‑kept gardens, commercial green areas, and public parks—places where turf health isn’t just practical but also a statement of beauty and environmental stewardship. Property owners and maintenance teams usually rely on a mix of weed control, disease-prevention sprays, and stress-relieving treatments suited for varied turf types and high-visibility areas.

The success of landscaping as an application segment lies in its dual role: preserving curb appeal and adding real functional value to outdoor spaces. Whether it’s a business campus or a community greenway, consistent turf condition signals care and contributes to lasting impressions. Innovation in eco-friendly formulations and tailored treatments for varied climates and usage intensities adds to its momentum, making landscaping a quietly powerful—and increasingly sustainable—cornerstone of the turf protection market.

Key Market Segments

By Product

- Fungicides

- Herbicides

- Insecticides

- Plant Growth Regulators

- Biostimulants and Bio-fertilizers

By Mode of Application

- Foliar

- Seed

- Soil

By Formulation

- Liquid

- Powder

By Solution

- Biological

- Chemical

- Mechanical

By Application

- Landscaping

- Golf Courses

- Sports Fields

- Sod Farms

- Others

Emerging Trends

Advancements in Turf Protection Technology

One notable advancement is the development of high-performance infill materials. Traditional rubber infills are being replaced with more durable and environmentally friendly alternatives, such as silica sand and organic infills. These materials not only improve the longevity of the turf but also enhance player safety by providing better shock absorption and reducing the risk of injuries.

Additionally, smart turf systems are being introduced, incorporating sensors that monitor various parameters like temperature, humidity, and usage intensity. This data allows for predictive maintenance, enabling facility managers to address wear and tear proactively, thereby extending the lifespan of the turf and ensuring optimal playing conditions.

The Indian government’s commitment to improving sports infrastructure further supports the adoption of these advanced technologies. Under the Khelo India Scheme, the government has approved over 300 new sports infrastructure projects worth ₹3,000 crore, focusing on the development of world-class facilities across the country. These initiatives create a conducive environment for the implementation of cutting-edge turf protection technologies.

Moreover, states like Uttar Pradesh are actively promoting sports development through various programs. On National Sports Day, Chief Minister Yogi Adityanath announced the establishment of sports colleges in each commissionerate, recruitment of former Olympians as coaches, and the distribution of sports kits. These efforts underscore the state’s commitment to enhancing sports infrastructure and fostering a culture of sportsmanship.

Drivers

Government Initiatives Promoting Turf Protection in India

A notable example is the Khelo India initiative, which aims to revive the sports culture at the grassroots level by building a strong framework for all sports played in the country. Under this scheme, the government provides financial assistance for the development of sports infrastructure, including the installation of synthetic turfs for football and hockey fields. This initiative has led to the establishment of numerous artificial turf fields across various states, promoting both recreational and professional sports.

Additionally, the Urban Sports Infrastructure Scheme (USIS) is another government program that supports the creation of sports infrastructure in urban areas. This scheme offers financial assistance for the development of sports facilities, including synthetic turf fields, in cities with a population of over one lakh. The aim is to provide quality sports facilities to urban populations, thereby encouraging sports participation and talent development.

- State governments have also been proactive in promoting turf protection. For instance, the Tamil Nadu Sports Development Authority has announced plans to establish futsal and box cricket turfs in all 38 districts of the state. Each facility, costing ₹60 lakh, will feature fully enclosed nets, centralized lighting, and late-night operational hours, making sports accessible to a broader audience.

These government initiatives not only enhance the quality of sports infrastructure but also contribute to the growth of the turf protection industry. The demand for synthetic turf fields has increased, leading to advancements in turf technology and maintenance practices. Moreover, the focus on sustainable and low-maintenance solutions aligns with the industry’s objectives, fostering a conducive environment for growth and innovation.

Restraints

High Initial Investment and Maintenance Costs

While artificial turf offers numerous benefits, one of the significant challenges hindering its widespread adoption in India is the substantial initial investment required for installation and the ongoing maintenance costs. These financial considerations can be a deterrent for many institutions, especially in regions with limited budgets.

The cost of installing artificial turf varies based on several factors, including the quality of materials, field size, and additional infrastructure requirements. On average, the installation cost ranges between ₹260 to ₹570 per square foot.

- For instance, constructing a 5-a-side football turf in Chennai (approximately 45×75 feet) can cost around ₹14.5 lakh, while a rooftop pickleball court in Coimbatore (30×60 feet) may cost about ₹8 lakh.

Beyond installation, artificial turf requires regular maintenance to ensure its longevity and performance. This includes periodic cleaning, brushing, and infill replenishment. The maintenance costs can add up over time, making it a significant financial commitment for sports facilities and institutions.

Opportunity

Government Support for Turf Protection: A Growth Opportunity

One of the most promising growth opportunities for the turf protection industry in India lies in the government’s proactive support for sports infrastructure development. Recognizing the pivotal role of sports in fostering community engagement, health, and national pride, various government initiatives have been launched to enhance sports facilities across the country.

A notable example is the Khelo India Scheme, which aims to develop sports infrastructure at the grassroots level. Under this scheme, the government provides financial assistance for the creation and upgradation of sports facilities, including synthetic turf football grounds, hockey fields, and multipurpose halls.

- For instance, the cost for constructing a synthetic turf football ground is sanctioned at ₹5 crore, while a synthetic hockey field is supported with ₹5.50 crore.

Additionally, the Urban Sports Infrastructure Scheme (USIS) focuses on enhancing sports facilities in urban areas with populations exceeding one lakh. This scheme offers financial support of up to ₹2 crore for the development of indoor halls, turf fields, swimming pools, and lighting installations.

These initiatives have led to the establishment of numerous sports complexes equipped with artificial turf fields. For example, the Dwarka Centre for Excellence in Delhi boasts multiple synthetic turf courts for tennis, badminton, basketball, and pickleball . Similarly, the Sardar Vallabhbhai Patel Sports Enclave in Ahmedabad is being developed to include various sports facilities, with a focus on hosting international events.

Regional Insights

North America leads with 41.6% share, delivering roughly USD 2.8 billion in turf protection revenue

In 2024, North America accounted for 41.6% of the global turf protection market, equivalent to approximately USD 2.8 billion in annual revenue. This is no surprise: the region hosts a dense mix of professional sports venues, golf courses, residential landscapes, and public green spaces—all demanding resilient, high‑quality turf care products.

The strength of this market flows from both infrastructure and innovation. Well‑developed distribution networks ensure fast access to specialized formulations, while turf care professionals benefit from advanced agronomic tools such as GPS‑guided sprayers, drone‑based monitoring, and data‑driven scheduling. Institutions like turf associations and extension services also reinforce best‑practice use and stewardship, keeping turf healthy and safe across seasons.

Moreover, North America’s investment in research partnerships between universities, manufacturers, and end‑users helps bring new, more sustainable options—like reduced‑risk chemistries and novel biopesticides—into practical use.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF is a heavyweight in turf protection, known for precision-engineered solutions like Aramax Intrinsic, a dual‑active fungicide launched in 2024 for golf course fairways and high‑traffic turfs. In 2024, its Agricultural Solutions segment—covering crop and turf protection—generated €9,798 million in sales, underscoring its broad scale and influence. From a market perspective, BASF brings deep R&D, trusted brands, and practical innovation—helping turf professionals deliver consistently resilient and healthy greens.

Founded in 1998, BioSafe Systems is celebrated for its sustainable, reduced‑risk chemistries—especially peroxide‑based solutions—for turf, horticulture, and sanitation . While their 2024 financials aren’t publicly disclosed, their standing is built on environmental trust, ISO-certified manufacturing practices, and focus on biodegradable alternatives. As a market analyst, I’d say BioSafe brings principled innovation—making turf protection that’s both effective and kind to ecosystems, which resonates deeply with modern stewardship values.

UPL, ranked as the world’s fifth‑largest generic agrochemical company, reported over US$ 6 billion in sales and 14,000+ product registrations across nearly 140 countries in FY 2025. Though not turf‑specific, its broad agrochemical and biosolutions platform gives it strong footing in turf markets globally. From a research standpoint, UPL’s scale, integrated R&D, and global reach position it as a potent force—able to deliver turf protection products across diverse geographies with consistent supply and innovation.

Top Key Players Outlook

- BASF SE

- Atticus, LLC

- SIGMA ORGANICS, INC.

- BioSafe Systems, LLC.

- UPL

- Koppert

- Syngenta Crop Protection AG

- Corteva

- Nufarm

- Bayer AG

Recent Industry Developments

In 2024, BASF’s Agricultural Solutions segment—which includes turf protection products like fungicides—recorded €9,798 million in sales and an EBITDA (before special items) of €1,938 million.

In 2024, Atticus, LLC reported estimated revenues between USD 10 million and USD 50 million, according to market intelligence sources.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 11.8 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fungicides, Herbicides, Insecticides, Plant Growth Regulators, Biostimulants and Bio-fertilizers), By Mode of Application (Foliar, Seed, Soil), By Formulation (Liquid, Powder), By Solution (Biological, Chemical, Mechanical), By Application (Landscaping, Golf Courses, Sports Fields, Sod Farms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Atticus, LLC, SIGMA ORGANICS, INC., BioSafe Systems, LLC., UPL, Koppert, Syngenta Crop Protection AG, Corteva, Nufarm, Bayer AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Atticus, LLC

- SIGMA ORGANICS, INC.

- BioSafe Systems, LLC.

- UPL

- Koppert

- Syngenta Crop Protection AG

- Corteva

- Nufarm

- Bayer AG